There is a lot to consider when it comes to forecasting, and that’s why financial analysts spend a significant time determining what data sets are most impactful in their forecasts. Financial analysts often look at stock prices, economic indicators such as GDP growth rates, the unemployment rate, and consumer sentiment index before making predictions about future events. They also compare current conditions against past trends for clues about where things might head next.

Forecasting is an art and science.

Taking accurate measurements and inputting this data in a forecasting model is crucial to producing an accurate forecast. It, however, does not always provide correct estimates because they can sometimes be too broad or too narrow. The input data can also be inaccurate or outdated, which can alter the entire forecast.

There are three standard views of what makes a forecast:

1) A forecast is a statement made at the time “T” about an event that will occur at a time “T+n.”

2) A forecast is a statement about the value of a variable in the future.

3) A forecast is just one possible outcome, given the information currently available.

Typically, Financial Analysts use forecasts as part of their valuation process to help assess what values are reasonable for key variables used in their analysis.

Factors to consider while generating forecast:

1) What is Forecasting?

Typically, forecasts are about revenue, earnings per share (EPS), future dividends, or cash flows.

2) How Frequently is the Forecast being Made?

Most forecasts utilize regularly. One example would be financial analysts who use quarterly sales estimates for each firm within their coverage universe to make buy/sell recommendations to their clients.

3) Who makes the forecast?

The individual who generates the forecast can (and should) affect its reliability. A seasoned financial analyst will often generate more reliable estimates than a novice analyst.

4) Is there a Methodology Used to arrive at the forecast?

There should always be a rational methodology behind any forecast used in valuation:

- A correlation between two variables

- The expected future growth in a variable (i.e., revenue or EPS)

- A regression analysis of historical data that plots the predictor against the predicted

5) How are Data Being Collected?

Many analysts use forecasts based upon past performance, which can be unreliable if used for an extended period. An example would be new management instituting changes that reduce costs or increase revenues, improving future cash flows.

6) What is the Liquidity of the Asset?

It would be best if you considered the liquidity of an asset:

- How easy is it to sell at market value?

- Are there restrictions on its sale?

Explore and learn with Imarticus Learning

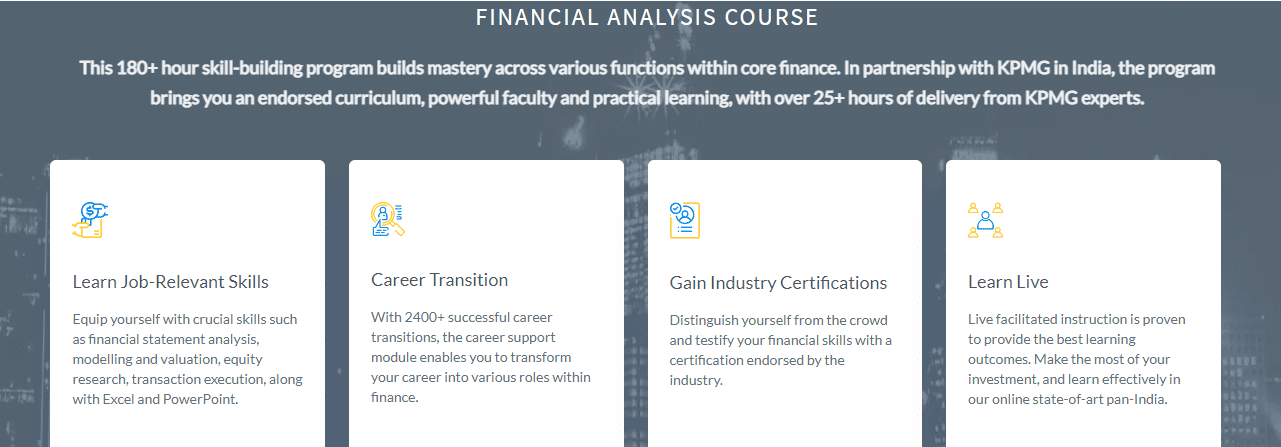

This financial analyst certification includes hands-on training with leading technologies, including APIs, Blockchain, Cloud Computing, AI, Machine Learning, RPA, IoT, and Big Data.

Some course USP:

- This financial analyst course aid the students to learn job-relevant skills that prepare them for a career.

- Impress employers & showcase skills with the best online finance courses endorsed by India’s most prestigious academic collaborations.

- World-Class Academic Professors to learn from through live online sessions and discussions. It will help students understand the 360-degree practical learning implementation with assignments.

Contact us through the live chat support system or schedule a visit to Mumbai, Thane, Pune, Chennai, Bengaluru, Delhi, Gurgaon training centers.

A lot of institutions offer a solid

A lot of institutions offer a solid  Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Here, we are going to talk about what

Here, we are going to talk about what

The best option is to go for an online course to learn and become a chartered financial analyst. Imarticus Learning offers reliable

The best option is to go for an online course to learn and become a chartered financial analyst. Imarticus Learning offers reliable

The sheer ability of financial analytics to address critical business problems has led to an acute demand for skilled Financial Analysts and

The sheer ability of financial analytics to address critical business problems has led to an acute demand for skilled Financial Analysts and  When you

When you  Are you looking for a

Are you looking for a