In the age of technology, financial institutions are looking for employees with knowledge in financial technology. They need people who can help them keep up with the competition and stay ahead of the curve. That’s why more and more universities are starting to offer financial technology courses.

The best Fintech course will train tomorrow’s tech leaders in everything from blockchain to big data analytics. If you’re interested in the finance profession, you should consider enrolling in one of these courses!

In this blog post, we will discuss:

- The benefits of financial technology courses

- How financial technology will impact the future of business and finance

- The career opportunities available in the field of financial technology

The Benefits of Financial Technology Courses

In the coming years, financial technology courses will become more and more important as businesses look to train the next generation of leaders. Here are the advantages of taking these courses in 2022:

- You’ll learn how to use new technologies to solve financial problems.

- You’ll gain an understanding of how economic systems work.

- You’ll develop the skills you need to create innovative financial products.

- You’ll be able to work in various industries, including finance, banking, and insurance.

How will financial technology impact the future of business and finance?

Financial Technology courses are popping up all over the place and for a good reason. Professionals who understand FinTech will be in high demand as businesses of all sizes seek to adopt new technologies to streamline their operations and stay competitive.

Here are just a few examples of how FinTech is changing the game:

- Digital currencies such as Bitcoin are disrupting traditional banking and payment systems

- Artificial intelligence and machine learning create predictive analytics that can help businesses make better financial decisions

- The blockchain is altering the way we do business by facilitating secure, transparent transactions without the need for a third party

The career opportunities available in the field of financial technology

Colleges and universities are beginning to offer financial technology courses as part of their curriculum to meet the needs of this expanding technology. These classes provide students with the skills to work in many different roles within the financial technology field.

The demand for skilled workers in financial technology will only grow in the coming years. That’s why students must begin their training and start preparing themselves for a career in this exciting field. The future of finance is waiting for you!

Discover Career in FinTech with Imarticus Learning

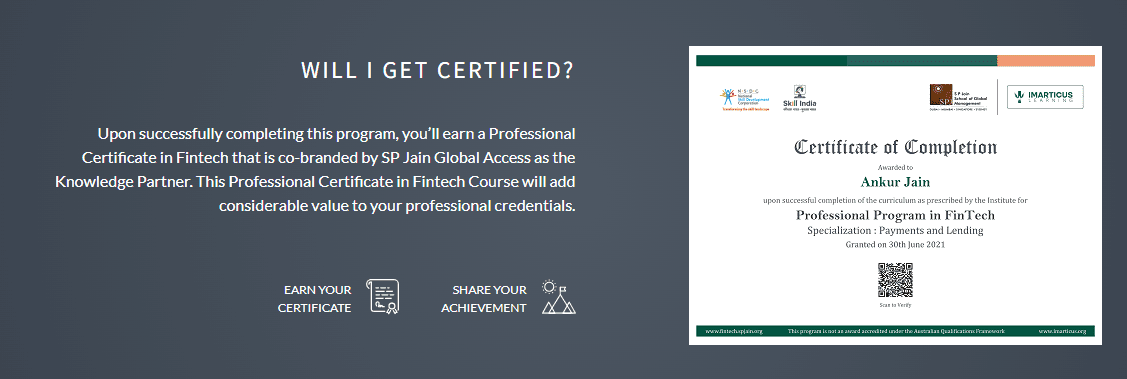

The FinTech online training will give students real-world experience and networking to land their dream job in this competitive industry. Students will learn how financial technologies are changing our society, which is why it’s become so popular as an emerging profession – but don’t stop there!

There’s still time for students who want a future with theory knowledge AND practical application skills; take advantage now before these opportunities fly off the shelves.

Course Benefits For Learners:

- Students will be prepared with the knowledge to lead in this exciting industry. From machine learning algorithms, blockchain tech, and more – our Fintech certification course has it all!

- Fintech students can keep up-to-date with the latest developments in their field by attending Fintech networking events, job boards, and webinars.

- This innovative, cutting-edge program gives the student a premium learning experience in the field of New Age FinTech.

If you wonder

If you wonder

This one-of-a-kind

This one-of-a-kind

This also implies that the demand for specialists in Fintech is increasing.

This also implies that the demand for specialists in Fintech is increasing.

If you want to know more about cryptocurrency and finance, enroll in one of our

If you want to know more about cryptocurrency and finance, enroll in one of our

Imarticus Learning offers

Imarticus Learning offers  Technology: If you are opt-in for

Technology: If you are opt-in for  The Fintech industry has been one of the most disruptive and transformative industries that the 21st century has seen. However, this is just the start. The industry has a long way to go. Fintech will find use in industries that are currently untouched.

The Fintech industry has been one of the most disruptive and transformative industries that the 21st century has seen. However, this is just the start. The industry has a long way to go. Fintech will find use in industries that are currently untouched.

From healthcare to finance, companies in nearly every industry are looking to apply blockchain and get ahead of their peers.

From healthcare to finance, companies in nearly every industry are looking to apply blockchain and get ahead of their peers. There’s a bright scope for blockchain developers in India. If you’re interested in becoming a blockchain developer and want to learn what is blockchain, check out this

There’s a bright scope for blockchain developers in India. If you’re interested in becoming a blockchain developer and want to learn what is blockchain, check out this

If you’re a FinTech enthusiast, you don’t want to be caught napping while competitors gain an edge through up-skilling. To be a professional, well-versed in fintech, you need to look for

If you’re a FinTech enthusiast, you don’t want to be caught napping while competitors gain an edge through up-skilling. To be a professional, well-versed in fintech, you need to look for