I know that CMA Fresher Salary is likely the first thing on your mind when you look at this professional certification in finance. It is a practical question because the pressures of rent, family support, and education loans are very real. I also understand that one would naturally want to see a return on one’s hard work. Before we talk about the numbers, I feel it helps to first understand what kind of work this qualification actually prepares you for.

Think about a company that sells across many cities. Sales look strong, but profits are uneven. One region earns well. Another barely breaks even.

The CMA certification builds the ability to connect numbers with real business outcomes. Even at the fresher level, companies see potential in someone who can grow into planning, forecasting, and performance roles. A fresher who understands cost behaviour, budgeting logic, and financial analysis enters the workforce differently from someone who only knows bookkeeping basics. Recruiters recognise this. That recognition often shows up in the CMA Fresher Salary offered at the start of a career.

So when the blog discusses salary ranges, city differences, and growth paths, it all ties back to this foundation. Understanding this helps explain why companies are willing to invest more in entry-level professionals who bring financial thinking, not just accounting execution.

Did You Know?

Companies that hire for financial planning roles often list salaries up to 25% higher than basic accounting roles. This directly affects the average salary of CMA fresher in India.

Why is the CMA Fresher Salary higher?

Before we go deeper into salary numbers, it helps to clearly understand what is CMA and why companies are willing to pay strong entry packages to qualified candidates.

CMA stands for Certified Management Accountant. It is a professional qualification focused on management accounting, financial planning, cost control, and business decision support. Unlike traditional accounting roles that focus mainly on recording numbers, CMA professionals help businesses use numbers to make better decisions.

A CMA-trained professional can dig into numbers and show where distribution costs are high, where pricing needs revision, or where spending is out of control. That insight helps leaders act faster and smarter. Now imagine being the person in the room who can explain why profits changed, not just report that they changed. That is the skill set built into CMA training. It combines financial accounting knowledge with analysis and business understanding.

This is why the CMA certification matters before looking at salary charts. And this is exactly why the CMA Fresher Salary often starts higher than many general finance roles.

What a CMA Is Trained to Do

A CMA professional is trained to work at the intersection of finance and business strategy. Here is a simple breakdown:

| Skill Area | What It Means in Real Work |

| Cost Management | Tracking and reducing business expenses |

| Financial Planning | Preparing budgets and future projections |

| Performance Analysis | Studying profits, losses, and trends |

| Decision Support | Helping managers choose better strategies |

| Risk Assessment | Identifying financial risks early |

These skills directly impact profits. When a professional helps a company save money or improve planning, the company sees clear value. That value reflects in the CMA salary for freshers.

What You Study in CMA

The CMA syllabus builds both accounting depth and business thinking.

| Core Area | How It Helps in Jobs |

| Financial Reporting | Understanding company financial statements |

| Costing Techniques | Calculating product and service costs |

| Budgeting | Planning business spending |

| Internal Controls | Preventing financial errors |

| Data Analysis | Interpreting numbers for decisions |

Because the CMA course subjects focus on practical finance, employers often consider CMA holders ready for analytical roles from day one. That is one reason the CMA salary in India for freshers tends to be higher than basic accounting jobs.

Imagine a small restaurant owner who does not know which dish makes a profit. A CMA-trained professional can analyse costs and sales data and show which items bring the most margin. That insight helps the owner earn more.

Businesses operate the same way, just on a larger scale. This ability to improve decisions is what influences the average salary of a CMA fresher in India.

Types of CMA Paths

There are two common CMA exam routes students explore.

| Type | Focus Area | Career Impact |

| Indian CMA | Cost and management accounting in India | Strong in manufacturing and corporate roles |

| US CMA | Global management accounting standards | Strong in multinational and analytics roles |

Both paths prepare professionals for roles that influence planning and profitability. That is why searches for CMA USA fresher salary in India often show higher figures in multinational companies.

Many students exploring global accounting careers often wonder whether the US CMA journey is tough to manage alongside studies, work, or other commitments. A clear breakdown of what makes the qualification challenging, and where most candidates actually struggle, helps set realistic expectations and build a smarter study plan.

Where CMAs Usually Work

CMAs are not limited to cost and management accounting departments. Their skills are useful across many industries. Common Workplaces for CMAs include:

- Corporate finance teams

- Consulting firms

- Manufacturing companies

- IT and tech companies

- Banking and financial services

Because these industries rely on financial planning and performance management, they offer structured growth. This directly connects to long-term growth beyond the CMA Fresher Salary stage.

Why Companies Value CMA at Entry Level

Even at the fresher level, a CMA can support these functions. That is why recruiters are willing to offer competitive starting packages.

| Reason | Business Benefit |

| Better cost control | Higher profits |

| Accurate planning | Smarter budgets |

| Clear reporting | Better management decisions |

| Performance tracking | Early problem detection |

Did You Know?

Global salary surveys consistently show that management accounting professionals earn nearly 21% more than non-certified peers over time. This trend begins early and shapes the fresher CMA salary in India and abroad.

Understanding CMA Fresher Salary in India

When you search specifically for CMA fresher salary in India, the numbers fluctuate because India is a large and diverse economy. Salaries in metro cities tend to be higher than in smaller towns. Here is a location snapshot:

CMA Salaries Across Indian Cities

| City | Typical Entry Level Salary |

| Mumbai | ₹5 – ₹9 LPA |

| Delhi / NCR | ₹4.5 – ₹9 LPA |

| Chennai (CMA fresher salary in Chennai) | ₹4 – ₹8 LPA |

| Kolkata (CMA fresher salary in Kolkata) | ₹3 – ₹7 LPA |

These numbers reflect domestic CMA career roles, which may include cost accountant, financial analyst, junior finance associate, or management accountant roles in mid-sized companies.

Here’s a practical example:

If you live in Mumbai and receive an offer of ₹9 lakh per year as a CMA fresher, it might feel strong because Mumbai usually has higher living costs. But in Chennai or Kolkata, earning ₹7 lakh might stretch further because your monthly rent and daily expenses could be lower. This is why location impacts how far that salary goes in real life.

Also Read:Choose the Best CMA Review Course for Your Preparation

What About US CMA Freshers Salary in India?

Let’s clarify a term many readers search for: CMA USA fresher salary in India. This is slightly different from the domestic CMA salary. Many companies value the US CMA certification more because it signals international standards and knowledge.

Here is what average numbers look like:

- A US CMA fresher in India typically earns around ₹6 lakh to ₹10 lakh per year when they begin.

- Mid-career US CMAs (3 to 5 years of experience) rise to ₹12 lakh or more.

- Some senior professionals can earn over ₹20 lakh annually.

These figures show a clear progression when you hold the US CMA credential. To make sense of this in simple terms: the certification opens doors to roles that value strategic finance skills, such as financial planning and analysis or cost control, which are often rewarded better.

Imagine two friends, Ravi and Aisha, starting their careers. Both graduated at the same time. Ravi enters an accounting role with only a bachelor’s degree. Aisha completes her CMA.

After a year:

- Ravi earns around ₹3 lakh per year

- Aisha earns around ₹6 lakh per year

After three years, if Aisha continues to grow her skills, her salary could easily reach ₹10 lakh or more, especially in sectors like consulting or finance analytics. This is why people ask about CMA salary for freshers in India, not as an abstract number but a real-life opportunity for advancement.

Did You Know?

Many finance professionals double their salary within the first five years if they switch companies at the right time. This trend is common in roles linked to planning and analysis, which impacts the CMA salary for freshers’ growth path.

How Job Roles and Industries Change CMA Fresher Salary

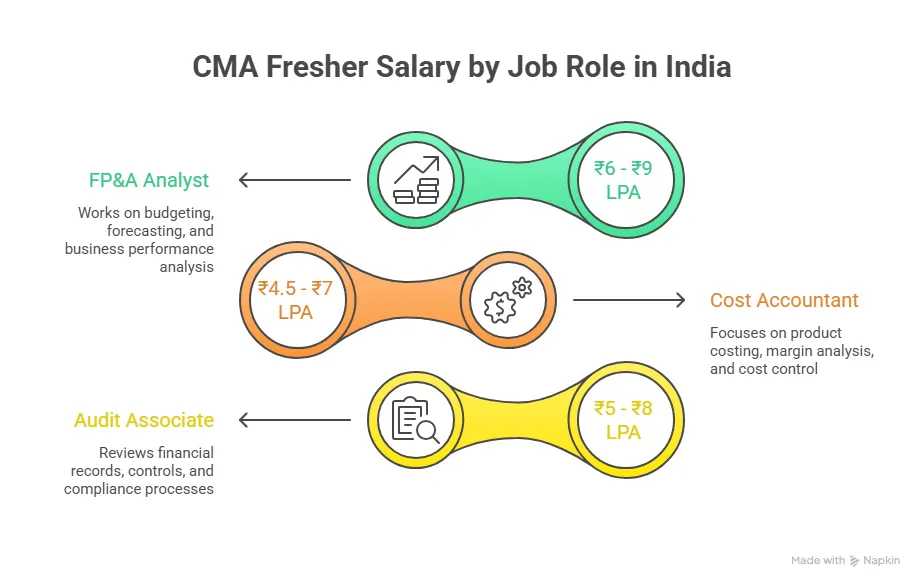

The job title on your offer letter plays a big role in deciding your CMA Fresher Salary. The same qualification can lead to very different pay depending on what kind of work you do every day.

Before we look at numbers, think of this like choosing a lane in traffic. Some lanes move slowly. Some move fast. Your role is that lane.

Entry Roles and What They Pay

Each role uses CMA knowledge in a different way. Some focus on cost control. Some focus on planning future profits. The business impact changes the pay.

| Role | Work Focus | Typical CMA Fresher Salary in India |

| Junior Financial Analyst | Budget reports and expense tracking | ₹4.5 – ₹8 LPA |

| Cost Accountant Trainee | Product costing and margin checks | ₹4 – ₹7 LPA |

| FP and A Analyst | Forecasting and planning | ₹5 – ₹9 LPA |

| Internal Audit Associate | Checking controls and compliance | ₹4 – ₹8 LPA |

| Business Finance Executive | Supporting strategy decisions | ₹5 – ₹10 LPA |

A role linked to decision-making usually offers a higher CMA salary for freshers than a role focused only on data entry.

Also Read: How Much Can CMA Professionals Earn Globally?

Industry Impact on Salary

Industry choice can quietly shape the direction of your early earnings. In sectors like consulting, technology, and financial services, decisions move quickly, and financial data plays a direct role in strategy. Companies in these spaces rely heavily on financial forecasting, budgeting, and performance analysis, which are core strengths developed through CMA training.

In contrast, industries with tighter cost structures, such as traditional manufacturing or small-scale trading businesses, may offer more stability but slower salary movement at the start. Finance roles in these environments often focus more on cost management & control and reporting rather than forward-looking analysis. The work still builds solid experience, but the pace of salary growth can differ because the financial function has a more operational role than a strategic one.

| Industry | Why Salary Differs | CMA salary in India for freshers |

| IT and Tech | High growth and global exposure | ₹5 – ₹10 LPA |

| Consulting | Client advisory and analysis | ₹6 – ₹11 LPA |

| Manufacturing | Cost control-driven | ₹4 – ₹8 LPA |

| Banking and Finance | Regulated and data-heavy | ₹5 – ₹9 LPA |

| E commerce | Fast scaling businesses | ₹5 – ₹10 LPA |

This explains why the fresher CMA salary in India can look different from one report to another. Different industries are included.

Interesting Insight→ Finance professionals in consulting firms often receive performance bonuses even in early roles. This can increase the effective starting salary of CMA fresher by 10 to 20% annually.

City Differences Inside India

Where you begin your career can influence both your paycheck and your monthly budget. Large metro cities such as Mumbai, Bangalore, and Delhi usually offer higher starting salaries because more multinational companies and large finance teams are based there. These cities handle bigger business volumes, which creates demand for analytical and planning roles often linked with CMA skills.

At the same time, living costs in these cities are also higher. Rent, travel, and daily expenses can take up a larger share of your income compared to smaller cities. In places like Chennai, Pune, or Kolkata, the starting salary might be slightly lower, but the cost of living is often more manageable. This balance between income and expenses is important when evaluating the real value of a CMA fresher’s first job offer.

| City | CMA Fresher Salary Range | Cost of Living Level |

| Mumbai | ₹5 – ₹9 LPA | High |

| Bangalore | ₹5 – ₹9 LPA | High |

| Chennai | ₹4 – ₹8 LPA | Medium |

| Kolkata | ₹3 – ₹7 LPA | Medium |

| Pune | ₹4.5 – ₹8 LPA | Medium |

This explains why many search specifically for CMA fresher salary in Chennai or CMA fresher salary in Kolkata.

Also Read: The Future of CMA Certification: Emerging Trends and Developments

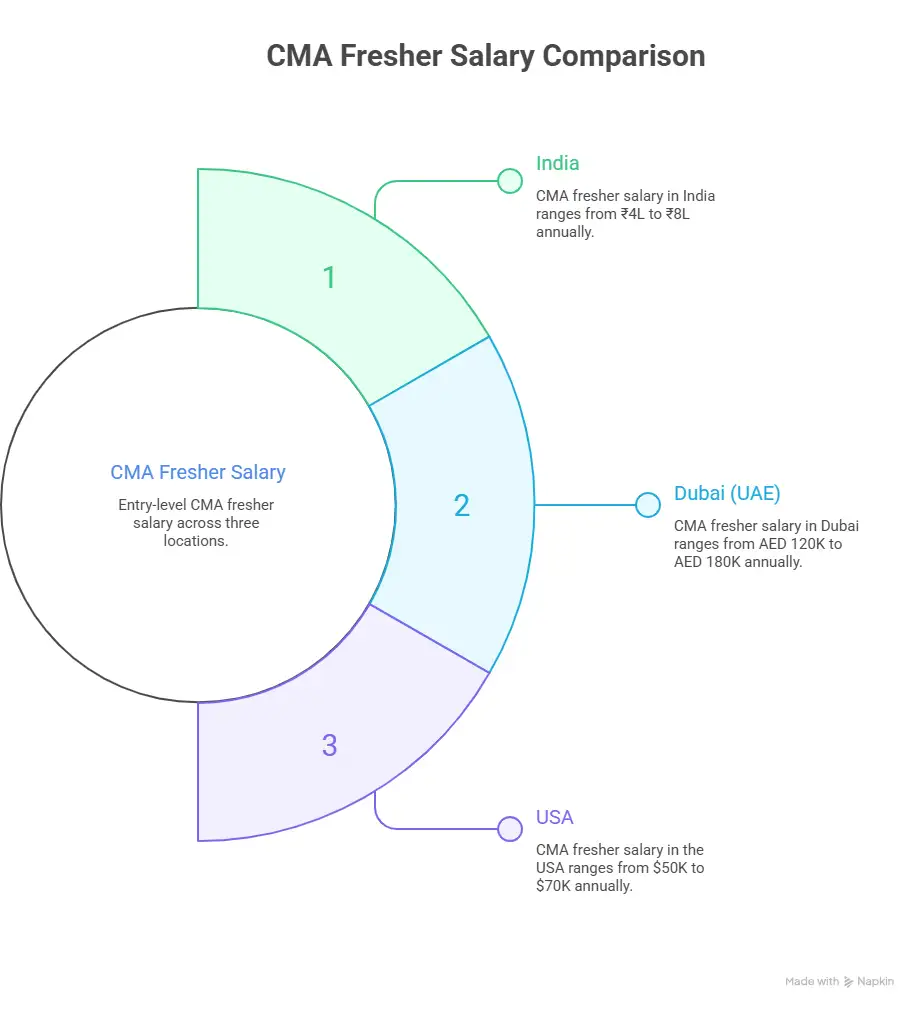

CMA Fresher Salary in USA

Now let’s talk about the other end of the spectrum: CMA fresher salary in USA figures. These are based on survey data from the Institute of Management Accountants and industry salary guides:

Typical CMA salaries in the United States at the entry level start around $50,000 to $70,000 per year.

Convert this to Indian rupees (assuming an exchange rate around ₹83 per $1), and you see similar figures:

- $50,000 equals roughly ₹41 lakh per year

- $70,000 equals roughly ₹58 lakh per year

These are rough conversions, but they offer a sense of relative earning power. When people talk about CMA fresher salary in USA compared with Indian salaries, the difference is large, mainly due to economic conditions and cost of living differences.

If you earn ₹6 lakh per year as a CMA fresher, that is roughly ₹50,000 per month before tax. After taxes and deductions, it could be around ₹40,000 to ₹45,000 monthly.

In real-life terms, this pay:

- Covers rent in a decent shared apartment

- Leaves room for savings

- Allows some lifestyle choices, like travel or fitness memberships

That is significant for someone just starting their professional journey.

When comparing career outcomes, many aspirants are curious about how earning potential differs between countries. Looking at salary ranges in India and the United States helps put global opportunities into perspective, especially when factors like cost of living, job roles, and employer expectations come into play:

CMA Fresher Salary in Dubai

Dubai has become a popular destination for finance professionals because many multinational companies operate regional offices there. These firms often look for candidates who understand cost control, financial reporting, and performance analysis, which aligns well with CMA training. As a result, entry-level roles in corporate finance and accounting can offer higher salary packages compared to many starting roles in India.

| Role | Salary per Year | Approx in INR |

| Entry Finance Analyst | AED 120,000 to 180,000 | ₹27 lakh to ₹40 lakh |

| Cost Analyst | AED 100,000 to 160,000 | ₹22 lakh to ₹36 lakh |

These figures relate to searches like CMA fresher salary in Dubai and CMA USA fresher salary in Dubai.

Another major factor is the tax structure. The UAE does not levy personal income tax on salaries, which means a larger portion of earnings stays with the employee. Even though rent and lifestyle expenses can be higher, the overall take-home value of a CMA fresher’s pay in Dubai often feels more substantial, especially for those working in established global organisations.

Did You Know? The UAE has zero personal income tax on salary. So the take-home from a CMA fresher’s salary in Dubai often feels much higher than a similar cost-to-company figure in India.

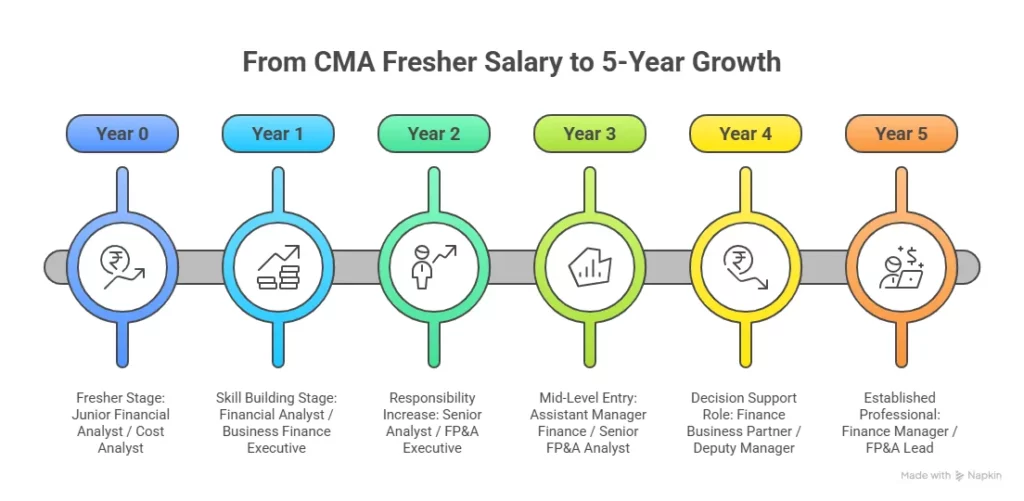

How Salaries Grow After the Fresher Stage

The first role after qualifying often acts as the foundation for everything that follows. Employers use early performance to decide how quickly responsibilities increase and how much salary can grow. Strong problem-solving, reliability, and the ability to handle financial analysis tasks can lead to faster appraisals and role upgrades within the first few years.

Skill-building during this phase plays an equally important role. As professionals move beyond basic reporting and start contributing to budgeting, forecasting, and decision support, their value inside the company rises. This transition is what usually drives steady jumps beyond the initial CMA fresher pay level.

| Experience Level | Typical Salary in India |

| Fresher | ₹4 – ₹8 LPA |

| 2 to 3 years | ₹6 – ₹12 LPA |

| 4 to 6 years | ₹10 – ₹20 LPA |

| 7 plus years | ₹18 – ₹35 LPA |

These jumps explain why the starting salary of CMA fresher is only one part of the long term picture.

Key factors that influence salary growth early on:

- Taking on analytical tasks instead of only routine reporting

- Learning tools like advanced Excel, Power BI, or ERP systems

- Moving into planning and performance-focused roles

- Switching to companies that offer wider business exposure

- Building strong communication skills for stakeholder interaction

Salary Growth in the First Few Years

Your first job sets the base. Growth comes with performance and skill-building.

| Experience | Salary Range in India |

| Fresher | ₹4 – ₹8 LPA |

| 2 Years | ₹6 – ₹12 LPA |

| 3 to 4 Years | ₹8 – ₹18 LPA |

This shows how the CMA Fresher Salary stage is just the starting point of a strong upward path.

Preparing for interviews is often the step where many qualified candidates feel unsure, especially when applying for roles linked to global finance credentials. Getting familiar with real interview scenarios helps candidates move from theoretical preparation to job-ready communication.

Why Choosing Your CMA Preparation With Imarticus Learning Makes a Difference

Before choosing where to prepare for a global qualification like CMA, it helps to look beyond just classes and study material. The right training partner should connect exam success with real career outcomes, practical skills, and industry readiness. A CMA program that combines strong academic support with job-focused preparation can make a meaningful difference in how confidently you step into the professional world after certification.

- Gold Learning Partner of IMA, USA: Imarticus Learning is officially recognised as a Gold Learning Partner of the Institute of Management Accountants, USA, giving you globally approved prep for the US CMA qualification.

- Industry-Led Program with KPMG in India Collaboration: The CMA course features industry insights and case studies curated with KPMG in India, helping you build real-world skills that employers look for.

- Structured Live Mentorship and Faculty Support: Learning includes guided classes and expert mentorship designed to improve understanding, retention, and exam performance from day one.

- Practical Case Studies and Internships: The curriculum includes practical business case studies, and top performers receive opportunities like internships with leading firms, building work readiness beyond theory.

- Pre-Placement Bootcamp and Career Support: Pre-placement training includes resume guidance, interview preparation, and placement bootcamp support to help you convert learning into job offers.

- Money-Back Guarantee on Exam Success: The program offers a partial refund guarantee if you are unable to clear all exams under specified conditions, showing confidence in the training quality.

FAQs About CMA Fresher Salary

When people research CMA fresher salary, they usually have very specific, practical questions in mind. How much can I really earn? How fast can my pay grow? What do top companies offer at the entry level? This section answers the most frequently asked questions with clear, realistic numbers and straightforward explanations so you know exactly what to expect as you begin your CMA career journey.

What is the starting salary of a CMA?

The CMA Fresher Salary at the starting level in India usually falls between ₹4 lakh and ₹8 lakh per year. This depends on the city, company, and role type. Freshers joining planning or analyst roles often start higher than those in routine accounting positions.

Can CMA earn 1 lakh per month?

Yes, reaching ₹1 lakh per month is realistic within a few years. The CMA Fresher Salary begins lower, but with 3 to 5 years of experience, many professionals cross ₹12 lakh per year, especially in multinational firms and consulting roles.

What is the salary of a CMA fresher in Deloitte?

Large consulting firms offer competitive packages. A CMA Fresher Salary in such firms often ranges between ₹6 lakh and ₹10 lakh annually, depending on role and location. Bonuses may add extra earnings.

Is CMA earning more than CA?

Both qualifications have strong earning power. The CMA Fresher Salary is often similar to entry CA roles in corporate finance. Over time, growth depends more on role, industry, and performance than on qualifications alone.

What salary can a CMA expect as a fresher?

A realistic CMA Fresher Salary expectation in India is ₹4 lakh to ₹8 lakh per year. US CMA holders in multinational firms may start slightly higher.

Does CMA increase salary?

Yes, the qualification improves earning potential. The CMA Fresher Salary is typically higher than non-certified entry roles, and growth is faster in finance planning and analysis paths.

What is the salary of a CMA at JP Morgan?

Large global banks pay competitive salaries. A CMA Fresher Salary in such firms may fall in the ₹7 lakh to ₹12 lakh range, depending on the function and city.

Can CMA get a job easily?

Yes, demand for finance analysts and cost professionals remains strong. Imarticus Learning helps students prepare for roles aligned with CMA Fresher Salary career paths through placement support and skill training.

Can I pass the CMA with a job?

Many candidates prepare while working. Good time planning helps. Earning the certification can significantly raise the CMA Fresher Salary potential once you switch into a CMA-aligned role.

Your Next Step Toward a Higher CMA Fresher Salary

The numbers around the CMA Fresher Salary tell an encouraging story. Entry pay may look like a starting step, yet the growth path ahead is wide. Location, role, industry, and skills all shape how fast that salary rises. What matters most is how you use the qualification once you step into your first job.

A fresher role is where learning meets earning. The early years build confidence with real business problems. Each report prepared, each forecast built, and each cost analysis reviewed adds weight to your profile. Over time, this steady growth turns an entry package into a high professional income.

I always see the first offer as a base camp, not the peak. The climb happens through skill upgrades, smarter job moves, and exposure to better projects. Whether someone begins with a domestic role or a global profile, the CMA Fresher Salary stage is only the launchpad for much higher earning potential.

Preparation plays a quiet but powerful role here. Strong conceptual clarity and practical skills help candidates step into better roles from day one. Structured training environments, industry exposure, and placement-focused learning can make that transition smoother. The CMA Course prep offered by Imarticus Learning is, for this reason, as guided preparation often bridges the gap between passing exams and securing the right job opportunity.

If you are planning your path, focus on learning deeply, building real skills, and choosing roles that stretch your thinking. The financial rewards tend to follow consistent effort. The journey from CMA salary fresher to senior finance leadership is built step by step, and every step counts.