Colleges are starting, and you’re thinking about applying for jobs. One of the first things employers will ask for is a resume, which can be intimidating if you don’t have any work experience to list. But what if I told you that it’s possible to build your resume with online certificate courses?

In this blog post, we’ll discuss how taking just a few courses from top universities worldwide can provide an excellent foundation to show future employers that you are serious about advancing in your current position! This blog post will outline the best online MBA courses.

MBA IN FINTECH PROGRAM:

- The interactive FinTech learning experience allows students to apply what they have learned to real-world business challenges and circumstances.

- This rigorous JAIN(Deemed-to-be-University) online MBA program comprehensively examines the paradigms of New Age FinTech, providing the student with a high-quality learning experience.

- Hands-on training from industry experts, real-business case studies, tech-enabled projects based on Blockchain, Cloud Computing, and other prominent New Age tech tools, as well as valuable interactions with FinTech industry leaders and entrepreneurs, will empower their professional FinTech knowledge like never before.

MBA IN INVESTMENT BANKING & EQUITY RESEARCH:

- Banking and finance are varying at a breakneck pace, primarily fueled by cutting-edge transformational technologies.

- As a result, New Age Investment Banking’s complexity has evolved to mirror these shifts.

- The widespread use of financial technology has dramatically transformed the global economy’s dynamics, leading to a surge in demand for tech-savvy New Age Investment Banking Professionals.

- This comprehensive Online MBA program delves deeply into the many paradigms of New Age Investment Banking, providing a student with a high-quality learning experience.

PROGRAM FOR DUAL BANKING AND FINANCE MANAGEMENT

- This dual Banking and Finance Management program is excellent for individuals wanting to advance their BFSI professions thanks to its innovative curriculum and two parallel study pathways.

- This unique approach to professional education redefines students’ industry knowledge and successfully enhances their vocational talents throughout their learning journey.

- NMIMS Global Access MBA (Distance) in Banking and Finance Management is a comprehensive, 24-month unique combination of two industry-endorsed Finance and Banking courses specially designed to upgrade existing careers in the booming Banking and Finance industry.

- Suppose students are searching for all of the advantages of a traditional Masters in Banking and Finance. In that case, Masters in Quantitative Finance, Masters in Banking and Financial Economics, or Masters in Financial Management, this globally renowned PGP in New Age Banking Program is the answer.

Explore JAIN MBA Program with Imarticus Learning:

This JAIN MBA includes hands-on instruction from industry professionals and covers every vital area of course. Students may apply what they learn in the immersive tech-enabled learning experience to real-world business settings and challenges.

Some course USP:

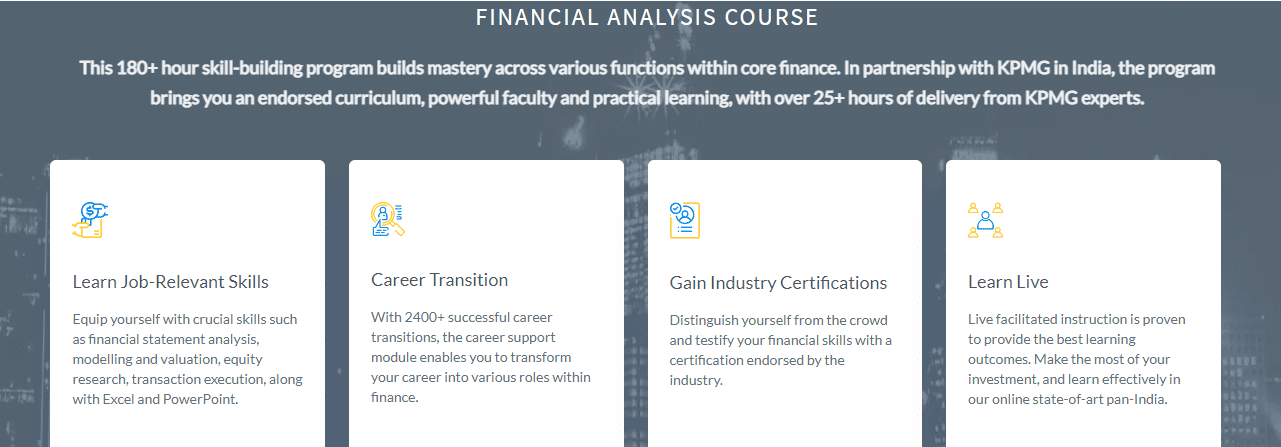

- This online certificate course for MBA students is with placement assurance aid the students to learn job-relevant skills.

- Impress employers & showcase skills with the best online MBA courses endorsed by India’s most prestigious academic collaborations.

World-Class Academic Professors to learn from through live online sessions and discussions.

A lot of institutions offer a solid

A lot of institutions offer a solid  Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Here, we are going to talk about what

Here, we are going to talk about what