Dubai attracts finance professionals for many reasons, but salary remains the loudest signal. When people search for ACCA Salary in Dubai, they are rarely looking for a single number. They want to understand whether the move makes sense, how pay evolves, and what kind of professional life sits behind the figures.

Some see Dubai as a fast lane to a higher income. Others view it as a competitive market where only the right profiles succeed. Both views exist because salary outcomes here are shaped by far more than qualification names. Role clarity, industry exposure, and how closely someone works with decision makers quietly influence earnings.

Dubai is not a single market. It is a collection of hiring zones. Multinational audit firms, regional headquarters, free zone entities, family offices, and fast-growing SMEs all sit side by side. Each of these employers compensates finance talent differently.

Large firms and global audit networks usually follow structured salary bands. Mid-sized companies often negotiate aggressively based on skills. Small firms sometimes offer lower fixed pay but faster exposure. This mix has a direct impact on the salary outcomes of the ACCA certification.

Another factor is tax structure. Since personal income tax does not apply, employers focus on gross monthly pay instead of complex compensation packages. This is why the ACCA salary in Dubai per month is discussed more openly than in many other countries.

Did you know? Dubai ranks among the top global cities for expatriate finance professionals due to its tax-free income model and strong demand for accounting talent.

Understanding ACCA

Before diving deeper into ACCA Salary in Dubai, it helps to pause and understand the qualification that sits at the centre of this discussion. Salary numbers make more sense once the structure, scope, and global relevance of ACCA are clear.

If you are new to the qualification, what is ACCA often comes up as the first question. ACCA stands for the Association of Chartered Certified Accountants. It is a globally recognised professional qualification designed for careers in accounting, audit, finance, and business management. Unlike country-specific credentials, ACCA follows international standards, which is one of the reasons it holds strong value in global job markets like Dubai.

What ACCA Covers at a Practical Level

ACCA is not limited to bookkeeping or exam theory. The qualification is built around real business functions that companies rely on daily.

- Financial accounting and reporting under IFRS

- Audit and assurance practices

- Performance management and budgeting

- Financial management and decision making

- Business law, taxation, and ethics

This broad coverage is why ACCA professionals fit into multiple finance roles rather than a single job function.

How the ACCA Structure Supports Global Careers

The ACCA subject list is divided into progressive levels that align with career growth.

| ACCA Level | Focus Area |

| Applied Knowledge | Accounting basics and business fundamentals |

| Applied Skills | Reporting, audit, taxation, and financial management |

| Strategic Professional | Leadership, strategy, and advanced decision making |

Each stage builds skills that employers in Dubai actively look for when hiring finance professionals.

Why ACCA Has Strong Relevance in Dubai

Dubai’s business environment is international by design. Most companies operate under IFRS, deal with cross-border transactions, and report to global stakeholders. ACCA is aligned with this environment.

Key reasons ACCA fits well in Dubai include:

- IFRS-focused curriculum

- Recognition across audit firms and multinational companies

- Flexibility to work across industries

- Acceptance in both auditing and corporate finance roles

These factors directly influence ACCA in Dubai salary outcomes across career stages.

How ACCA Links Directly to Salary Progression

Employers in Dubai do not view ACCA as a one-time credential. They associate it with ongoing professional development and applied knowledge. As candidates move from part-qualified to member status, they are trusted with higher responsibility.

This is why ACCA Salary in Dubai usually follows a step-based pattern rather than a flat curve. Each stage of qualification unlocks access to broader roles, which then reflect in monthly pay.

The ACCA framework itself explains many of the salary patterns seen in Dubai. The way subjects progress from core accounting to reporting, audit, and strategic decision making mirrors how roles and pay evolve in real organisations. This video breaks down ACCA in that same sequence, helping place the qualification in context before the discussion moves deeper into roles and responsibilities.

Key Factors That Decide ACCA Salary in Dubai

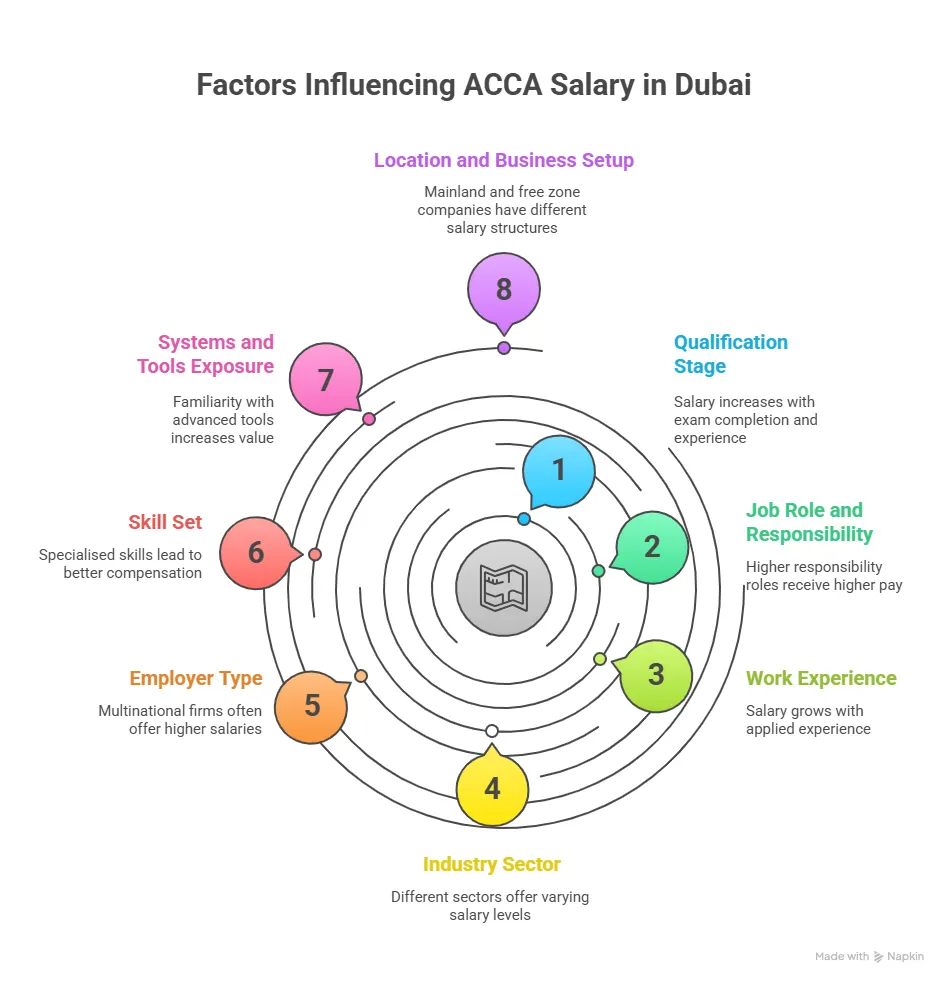

Salary outcomes are never random. I see the same patterns repeat across roles and employers. Before sharing salary tables, it helps to understand what employers actually pay for.

- Qualification stage: ACCA part-qualified salary in Dubai sits lower because firms still invest in training. Once exams are cleared, compensation moves faster.

- Role type: The ACCA accountant salary in Dubai varies widely between audit, reporting, internal control, and finance operations.

- Industry: Banking, consulting, and real estate often pay more than trading or small services firms.

- Employer size: Large firms offer stable growth. Smaller firms may offer higher short-term pay.

- Experience: An Experienced ACCA salary in Dubai reflects applied skills rather than years alone.

These factors explain why two ACCA professionals can earn very different salaries in the same city.

Average Salary of ACCA in Dubai Across Career Stages

This section explains how salary ranges usually progress over time. Since ACCA opens doors to high-paying global finance jobs, they are observed market bands reported by recruitment firms and hiring portals. Before reading the table, it helps to note that salaries are quoted in AED per month. Annual packages vary depending on bonuses and benefits.

| Career Stage | Monthly Salary Range |

| Entry-level or trainee | AED 4,000 to 6,000 |

| ACCA part-qualified | AED 6,000 to 9,000 |

| ACCA qualified | AED 10,000 to 15,000 |

| ACCA member with experience | AED 15,000 to 25,000 |

These figures form the base for understanding the average salary of ACCA in Dubai. Real outcomes depend on role and sector. Several practical elements come together to shape ACCA salary in Dubai, with pay levels reflecting qualification stage, role responsibility, industry exposure, and the skills applied on the job, rather than any single factor in isolation:

ACCA Salary in Dubai Per Month and What It Means in Real Terms

Many people focus only on the headline number. I always translate a monthly salary into lifestyle reality.

An ACCA monthly salary in Dubai between AED 8,000 and AED 10,000 allows shared accommodation and basic savings. Salaries above AED 15,000 provide independent housing and comfortable living. Once monthly income crosses AED 20,000, professionals usually begin long-term savings and investments.

This context helps explain why the ACCA salary in Dubai per month is often considered attractive even at mid-career levels.

ACCA Salary in Dubai in Rupees for Indian Professionals

For Indian candidates, in addition to knowing ACCA salary in India, conversion to INR helps assess return on investment for the ACCA certification. Based on recent exchange rates published by the Reserve Bank of India and XE, 1 AED equals approximately ₹24.39.

Using this rate:

| Monthly Salary in Dubai | Approx Salary in INR |

| AED 6,000 | ₹1.46 lakh |

| AED 10,000 | ₹2.43 lakh |

| AED 15,000 | ₹3.65 lakh |

| AED 20,000 | ₹4.87 lakh |

This is why ACCA salary in Dubai per month in rupees often looks significantly higher than Indian packages, even at similar experience levels.

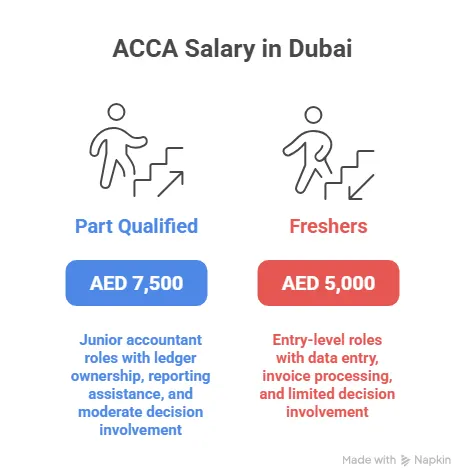

ACCA Starting Salary in Dubai for Freshers and Part-Qualified

Freshers usually enter through junior accounting, audit assistant, or finance executive roles. ACCA starting salary in Dubai commonly ranges between AED 4,000 and AED 6,000 per month.

ACCA jobs in Dubai without experience, the salary depends heavily on internship exposure and communication skills. Candidates with Excel, reporting exposure, and basic ERP knowledge tend to start at the higher end of the range.

ACCA Starting Salary in Dubai for Freshers

The table below outlines how entry-level roles typically differ in responsibility and starting pay for freshers entering the Dubai job market.

| Entry-Level Role | Typical Monthly Salary | Key Responsibilities | What Improves Starting Pay |

| Junior Accountant | AED 4,000 to 6,000 | Basic accounting entries, reconciliations, and invoice processing | Strong Excel skills, internship exposure |

| Audit Assistant | AED 4,500 to 6,000 | Audit support, documentation, and data verification | Communication skills, audit exposure |

| Finance Executive | AED 5,000 to 6,000 | Reporting support, MIS preparation, and coordination tasks | ERP familiarity, reporting exposure |

Employers often increase pay within the first year once performance is proven.

ACCA Part-Qualified Salary in Dubai and Transition Phase

This stage is critical and often misunderstood. ACCA part-qualified salary in Dubai usually ranges from AED 6,000 to 9,000 per month. Employers expect candidates to contribute independently while still completing exams.

At this stage:

- Pay increases come from role expansion

- Employers support exam completion indirectly

- Job switches become more common

This phase sets the base for long-term ACCA in Dubai salary growth.

ACCA Jobs in Dubai Salary by Role Type

Let’s look at how ACCA jobs in Dubai salary changes based on the type of role and your ACCA skills, rather than the qualification alone. Even at similar experience levels, pay varies because each role carries a different level of responsibility, reporting exposure, and business impact. Understanding these role-based differences helps make sense of why salaries are not uniform across accounting, audit, and finance positions, and why career direction plays a strong role in long-term earnings.

Before listing salaries, it helps to understand role expectations. Audit roles focus on compliance and reporting. Accounting roles manage books and closures. Analyst roles combine data with finance logic.

| Job Role | Monthly Salary Range |

| Junior Accountant | AED 4,500 to 6,500 |

| Audit Associate | AED 5,000 to 7,000 |

| Financial Analyst | AED 7,000 to 10,000 |

| Senior Accountant | AED 10,000 to 14,000 |

(Source: Bayt, NakuriGulf)

These figures reflect common ACCA jobs in Dubai salary bands across industries. ACCA salary in Dubai varies across roles based on the level of responsibility, reporting ownership, and decision support involved, which explains why similar experience levels can lead to very different pay outcomes:

How Roles, Industries, and Experience Shape ACCA Salary in Dubai

Once the foundation is clear, the next layer that matters is how your ACCA salary changes based on what a professional actually does inside an organisation. ACCA Salary in Dubai rises and falls with role depth, sector exposure, and how closely a professional sits to decision-making.

How Job Roles Influence ACCA Salary in Dubai

Every finance role solves a different business problem. Employers pay according to the risk and responsibility attached to that problem.

Before looking at numbers, it helps to understand that titles in Dubai often sound similar but carry different expectations.

- Accounting roles focus on accuracy, closures, and compliance

- Audit roles focus on assurance, controls, and regulatory reporting

- Finance roles focus on analysis, forecasting, and business support

This distinction explains why ACCA jobs in Dubai salary vary even at the same experience level.

| Role Type | Typical Monthly Salary |

| Junior Accountant | AED 4,500 to 6,500 |

| ACCA Accountant | AED 7,000 to 11,000 |

| Audit Executive | AED 8,000 to 12,000 |

| Financial Analyst | AED 9,000 to 14,000 |

| Finance Manager | AED 15,000 to 25,000 |

(Source: Glassdoor, Hays)

The ACCA accountant salary in Dubai usually sits in the middle of this range. It grows faster when reporting responsibility increases.

Industry-Wise Salary Differences for ACCA Professionals

With the benefits and career opportunities of ACCA, industry choice quietly shapes long-term earnings. Some sectors pay more because errors are costly or regulations are strict. Before the table below, it helps to note that salaries reflect both workload and accountability.

| Industry | Monthly Salary Range |

| Audit and Consulting | AED 8,000 to 18,000 |

| Banking and Financial Services | AED 10,000 to 22,000 |

| Real Estate and Construction | AED 7,000 to 16,000 |

| FMCG and Trading | AED 6,000 to 14,000 |

| Technology and Startups | AED 7,000 to 15,000 |

This is why the average salary of ACCA in Dubai looks higher in finance-heavy sectors, even when experience is similar.

After completing BCom, many career paths open up, but long-term growth and earning potential depend on how well a qualification aligns with industry demand. Professional certifications like ACCA, FRM, CFA, and CMA lead to very different roles across accounting, finance, risk management, and investment domains.

Understanding how these options translate into job profiles, skill requirements, and salary outcomes in 2025 helps make a more informed decision about which path offers the strongest return on effort and time.

ACCA Salary in Dubai Per Month Across Experience Levels

Experience in Dubai is valued for outcomes rather than tenure. Employers care about what problems someone can solve on day one.

Before reading the ranges, it helps to understand that promotions often happen through job switches rather than internal cycles.

| Experience Level | Monthly Salary |

| 0 to 1 year | AED 4,000 to 6,000 |

| 2 to 4 years | AED 7,000 to 12,000 |

| 5 to 8 years | AED 13,000 to 20,000 |

| 8 plus years | AED 20,000 to 30,000 |

Experienced ACCA salary in Dubai reflects exposure to audits, budgeting cycles, and stakeholder communication rather than just exam completion.

ACCA Jobs in Dubai Without Experience Salary Reality

Fresh graduates often worry about placement without local exposure. ACCA jobs in Dubai without experience salary usually fall on the lower end, but progression can be fast.

Entry roles include:

- Accounts assistant

- Audit trainee

- Finance executive

Monthly salaries often range between AED 4,000 and 5,500 initially. Employers raise pay once candidates demonstrate reliability and system knowledge. Candidates who bring internship exposure or strong Excel skills often secure better offers.

ACCA Member Salary in Dubai and Career Acceleration

Once membership is achieved, salary discussions shift from survival to strategy.

An ACCA member salary in Dubai often starts around AED 12,000 to 15,000 per month and grows with leadership responsibility. Members who handle reporting, audits, and team supervision move faster into higher bands. This stage separates operational roles from decision support roles.

ACCA vs CA Salary in Dubai From a Market View

Salary comparisons appear frequently in search data, so this section focuses on employer behaviour rather than opinion.

ACCA vs CA salary in Dubai depends on role alignment. ACCA professionals dominate audit, IFRS reporting, and multinational finance roles. CAs often perform well in tax and regional accounting roles. In multinational firms, ACCA in Dubai salary often matches or exceed CA pay due to international recognition. In smaller firms, salaries may converge for the CA vs ACCA comparison.

Choosing between CA and ACCA often comes down to where someone wants to build their career and how they want their skills to be used. Both qualifications are respected, but they serve different professional paths. One is deeply rooted in domestic practice and regulatory work, while the other is designed for global reporting, audit, and multinational finance roles.

Understanding how each qualification aligns with job roles, mobility, and long-term earning potential helps clarify which path fits better for working in international markets such as Dubai.

Why Salary Growth Accelerates After the First Few Years

The early years focus on proving reliability. After that, salary growth becomes skill-driven.

Professionals who handle:

- Month-end closures

- Audit coordination

- Management reporting

tend to see consistent pay jumps.

This explains why the salary of an ACCA in Dubai often grows unevenly at first and rapidly later.

Skills That Directly Increase ACCA Salary in Dubai

Before listing skills, it helps to understand how employers think because this might have a direct impact on your ACCA employability. They do not pay more for certificates alone. They pay for reliability, clarity, and problem-solving.

The skills below consistently influence ACCA in Dubai salary growth.

- Financial reporting under IFRS

- Advanced Excel and spreadsheet modelling

- ERP exposure, such as SAP or Oracle

- Budgeting and forecasting

- Audit coordination and compliance handling

- Communication with auditors and management

Professionals who combine technical accuracy with clear communication tend to move into higher-paying roles faster.

Did You Know? Dubai hosts over 30,000 international companies operating under IFRS standards, increasing demand for ACCA qualified professionals.

Long-Term Salary Trajectory for ACCA Professionals in Dubai

Salary growth in Dubai follows stages rather than straight lines.

In the first two years, pay focuses on learning and adjustment. Between years three and five, an ACCA qualified salary in Dubai usually increases as professionals handle independent responsibilities. Beyond this stage, salary depends on leadership exposure.

Senior professionals often move into:

- Finance manager roles

- Internal audit leadership

- Regional reporting positions

These roles define the upper range of experienced ACCA salary in Dubai.

Why Employers Continue to Hire ACCA Professionals in Dubai

Dubai continues to attract global businesses that require structured financial reporting. IFRS compliance, audits, and internal controls remain essential.

This sustained demand supports stable ACCA jobs in the UAE and supports salary trends even during slower economic cycles.

Why Choose Imarticus for Your ACCA Journey

When you invest your time and effort into a qualification that influences your ACCA Salary in Dubai, the quality of your preparation can make a meaningful difference. Choosing a training partner that aligns with global standards and job market expectations helps you build not just exam success but practical competence that employers value.

The ACCA Course prep with Imarticus Learning stands out in several ways that support both learning and career readiness:

- Gold-level ACCA Approval: Imarticus is a Gold Approved Learning Partner of ACCA UK, meaning the training you receive meets ACCA’s global standards for content quality and delivery. This alignment ensures you are preparing with materials and methodologies recognised across the finance industry.

- Kaplan-Powered Study Resources: The course uses ACCA-approved Kaplan content, giving you access to curated books, question banks, practice papers, flashcards, videos, live classes, and on-demand sessions. These resources help strengthen both conceptual understanding and practical application.

- Structured, Industry-Aligned Learning: Training at Imarticus includes live interactive classes, expert faculty guidance, and a clear study roadmap throughout your ACCA journey. This structure helps you tackle complex papers confidently and stay on track, which is critical for performance and progression.

- Placement and Internship Support: After completing the early levels of ACCA, Imarticus offers a placement or internship guarantee for selected batches. This support includes pre-placement bootcamps and interview preparation, helping bridge the gap between exam success and real job opportunities.

- Practical Case Exposure: The programme includes industry-relevant case studies and real-world examples designed in collaboration with finance practitioners. This exposure helps you apply ACCA knowledge meaningfully in workplace scenarios, which often reflects in stronger performance on the job.

Together, these features help you build a deeper foundation, not just pass exams but also walk into roles with confidence. When the focus shifts from qualification to job performance, this preparation can contribute to stronger early career outcomes and a more strategic salary trajectory in markets like Dubai.

FAQs on ACCA Salary in Dubai

This section addresses the most frequently asked questions around ACCA Salary in Dubai, focusing on pay expectations, career opportunities, and how salary changes with experience and roles. These FAQs help clarify practical doubts that often arise when evaluating ACCA as a career choice in the Dubai job market.

Is Dubai good for ACCA?

Dubai is considered a strong destination because the ACCA Salary in Dubai benefits from tax-free income, international exposure, and steady demand for accounting and reporting roles. The city hosts multinational firms, regional headquarters, and audit networks that rely heavily on IFRS reporting. This environment allows ACCA professionals to build both income and global experience. Imarticus Learning prepares candidates for this market by aligning training with international accounting standards and role expectations.

Which country pays the ACCA’s highest salary?

Several countries offer high compensation, but the ACCA Salary in Dubai remains competitive due to tax-free earnings. While markets like the UK or Singapore may show higher gross figures, net take-home pay in Dubai often compares favourably. This balance of salary, lifestyle, and savings potential makes Dubai a preferred choice for many ACCA professionals.

Is AED 25000 a good salary in Dubai?

A monthly income of AED 25,000 is considered strong by Dubai standards. At this level, ACCA Salary in Dubai supports independent living, savings, and long-term financial planning. Such pay is usually linked to senior or managerial roles and reflects significant experience and responsibility within finance teams.

What is the salary of an ACCA per month?

The ACCA salary in Dubai per month typically ranges from AED 4,000 at the entry level to over AED 25,000 at senior levels. ACCA monthly salary in Dubai depends on qualification stage, experience, and job role. As responsibilities grow, salary progression tends to accelerate rather than move slowly.

Who earns more, CA or ACCA in Dubai?

ACCA vs CA salary in Dubai depends on role alignment rather than qualification alone. ACCA professionals often earn more in multinational firms, audit roles, and IFRS-focused environments. CAs may perform well in regional accounting and tax-driven roles. Employers value relevance to business needs more than labels.

Can I get a job in Dubai after ACCA?

Yes, many professionals secure roles after completing ACCA. ACCA Salary in Dubai for freshers starts lower, but opportunities exist in audit firms, accounting roles, and finance teams. Structured training offered through Imarticus Learning improves job readiness by focusing on practical application and industry-aligned skills.

What is the salary of an ACCA fresher in Dubai?

ACCA starting salary in Dubai for freshers generally ranges between AED 4,000 to AED 6,000 per month. ACCA jobs in Dubai without experience salary depending on internships, skill exposure, and communication ability. Early performance often leads to salary increases within the first year.

What skills boost ACCA salary in Dubai?

Skills that directly improve ACCA Salary in Dubai include IFRS reporting, audit handling, advanced Excel, ERP systems, and financial analysis. Professionals who build these skills early often move into higher-paying roles faster. Imarticus Learning focus on bridging academic knowledge with workplace expectations, which supports long-term salary growth.

Where This Salary Journey Leads

ACCA Salary in Dubai becomes clearer once all the moving parts are seen together. Pay is not driven by a single exam result or job title. It grows through steady skill building, exposure to real financial work, and the ability to support business decisions with accuracy and confidence. Freshers start by learning systems and processes. Qualified professionals move into roles that demand judgment and accountability. Senior roles reward those who understand reporting, controls, and how numbers influence strategy.

Dubai continues to value finance professionals who can work across cultures, standards, and fast-paced environments. For anyone planning this path, preparation that goes beyond theory matters. Structured learning, practical exposure, and role-focused training often shape how smoothly this journey unfolds. Many learners choose to align their ACCA Course preparation with Imarticus Learning because the focus stays close to industry expectations rather than exams alone.

With the right approach, ACCA in Dubai salary growth becomes less about chance and more about informed career choices made at each stage.