Blockchain Technology in Finance

Blockchain technology has emerged as a transformative force within the financial industry, revolutionising traditional business models and practices. The Ethereum blockchain, in particular, has paved the way for more open, secure, and inclusive financial networks.

With digital securities being issued faster and at lower costs, customised to meet investor demands, the financial landscape is experiencing a profound shift. Moreover, the sector’s increasing investment and positive outlook on blockchain’s future impact, as evidenced by a 2022 study from FTI Consulting, underscore its growing significance.

Projections from Global Industry Analysts indicate a soaring market worth, from $1.4 billion in 2022 to an estimated $43.1 billion by 2030, reflecting the expanding role of blockchain in supporting existing financial services and driving innovation in the industry.

Consequently, this presents an excellent opportunity for those considering a career in fintech, as the growing demand for expertise in blockchain and financial technology makes it an increasingly lucrative field for professionals seeking to shape the future of finance. This article delves into the multifaceted impact of blockchain technology in financial services, elucidating its potential to reshape the sector.

What is Blockchain in Finance?

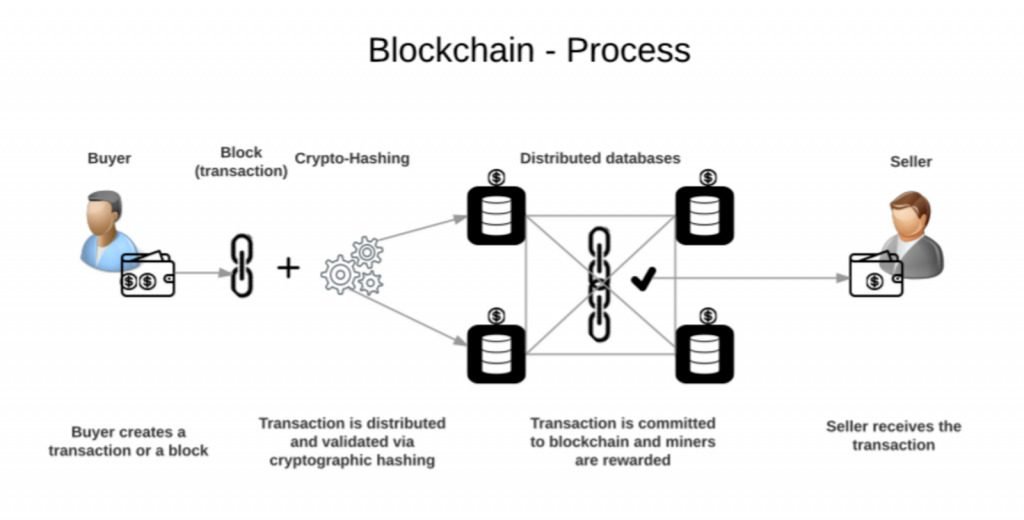

Blockchain technology is at the core of modern finance. It’s a decentralised, distributed, and public ledger used to record transactions across a network of computers. This design brings a range of valuable properties to the financial industry, including enhanced security, transparency, and immutability.

Distribution: A shared ledger

One of the foundational aspects of blockchain in finance is distribution. In this system, numerous copies of the ledger exist throughout the network. When a new transaction or block is added, every participant within the network receives an identical copy.

What’s unique is that no single entity controls the ledger; instead, it’s designed to provide all participants with the same information. This creates a level of transparency and security that traditional financial systems struggle to match.

Immutability: A tamper-proof record

Blockchain provides an immutable, chronological history of transactions. Since every participant in the network possesses a copy of this ledger, altering or erasing transactions, or adding unverified information, becomes exceptionally challenging.

Successful tampering would necessitate a coordinated attack on hundreds or even hundreds of thousands of computers simultaneously, a feat that’s highly improbable.

In the financial sphere, these features of blockchain technology offer a significant advantage. They lay the foundation for secure, transparent, and tamper-proof financial transactions, revolutionising the way businesses and institutions conduct their operations.

How Digitising Financial Instruments Has Revolutionised the Financial Landscape

The digitisation of financial instruments has brought about a sweeping change in the financial world. This transformation involves creating digital assets, smart contracts, and programmable money, all powered by blockchain technology.

Let’s explore how this shift has revolutionised finance:-

Boosting trust and accuracy: Digitisation ensures that financial data remains accurate and secure. It creates an unchangeable record of an asset’s history, making it easy to track where it came from and its full transaction story.

This level of transparency is essential in an age where data integrity is paramount.

Programmable assets: What makes digital financial instruments unique is their programmable nature. Code can be embedded within these assets to handle governance, compliance, data privacy, and even identity verification.

This programming also extends to system incentives and stakeholder participation, allowing for easy integration of voting and other rights directly within the assets. This automation streamlines operations and builds trust within the financial ecosystem.

Efficiency through automation: Digitisation brings automation, which leads to greater operational efficiency. It enables real-time settlement, auditing, and reporting, all while reducing the time it takes to process transactions and minimising the chances of errors.

This streamlined approach makes financial processes more cost-effective.

Economic advantages: Efficient, automated processes mean cost savings. As the financial sector continues to digitise, we can expect lower infrastructure, operational, and transaction costs.

This shift towards cost-efficiency makes financial institutions more competitive in the digital age.

Meeting market demands: Digital securities are highly customisable, allowing issuers to respond quickly to market needs. They can create digital financial instruments tailored to the specific needs of investors.

This adaptability keeps the financial landscape relevant in rapidly evolving markets.

Fostering innovation and expansion: Digitising financial instruments opens the door to innovation. It introduces secure and scalable asset transfers, fractional ownership of real-world assets, and more.

As financial instruments evolve, new products and markets emerge, expanding the possibilities in financial services.

Benefits of Leveraging The Power of Blockchain Technology in Finance

Blockchain technology is a transformative force in the world of finance, offering a wide array of benefits for businesses and institutions. By embracing this innovative technology, the financial industry can experience significant improvements in various aspects of its operations. Here are some key benefits of leveraging the power of blockchain technology in finance:

Transparency: The transparent nature of blockchain ensures that all participants in a transaction have access to the same information. This transparency fosters trust and reduces the potential for disputes, making financial processes more straightforward and efficient.

Immutability: Immutability means that once data is on a blockchain, it’s almost impossible to change or remove. This feature guarantees the accuracy of financial records and transaction history, minimizing the chances of mistakes or tampering.

Efficiency: Blockchain’s automation capabilities lead to increased operational efficiency. Real-time settlement and auditing, as well as the reduction of manual processes, enhance the speed and accuracy of financial transactions.

Global reach: Blockchain enables cross-border transactions and international operations with ease. It eliminates the complexities of dealing with multiple currencies and financial systems, making it simpler for businesses to engage in global finance.

Accessibility: Blockchain technology is accessible to a wide range of institutions and individuals. It opens up financial services to the unbanked or underbanked populations, promoting financial inclusion.

Innovation: The blockchain ecosystem fosters innovation by providing a platform for the development of new financial products and services. This encourages competition and drives the evolution of the financial industry.

Risk reduction: Through smart contracts and transparent ledgers, blockchain reduces the risk of errors and disputes. It also enhances the tracking and management of assets, decreasing the potential for losses.

Real-time auditing: The real-time auditing capabilities of blockchain make it easier for regulatory authorities and financial institutions to monitor transactions, reducing the risk of non-compliance going unnoticed.

Trust and confidence: Blockchain instils trust and confidence in financial transactions. The technology’s security features and transparency promote a sense of security among all stakeholders.

Blockchain Applications in Financial Services

Blockchain technology has proven to be a game-changer in the financial services industry, ushering in a realm of possibilities across various financial sectors. It extends far beyond cryptocurrencies; the distributed ledger system of blockchain finds application in numerous crucial domains, elevating security, efficiency, and transparency.

Let’s delve into how blockchain is reshaping the landscape of financial services across diverse sectors.

Capital Markets

One sector that has particularly benefited from the innovative capabilities of blockchain is the capital markets. Blockchain’s decentralised and secure ledger system has ushered in a new era of efficiency and transparency, revolutionising various facets of capital markets operations.

Issuance: Blockchain streamlines the issuance of financial instruments, facilitating the creation and management of digital assets with enhanced efficiency and security.

Sales and trading: The technology is utilised for trade execution, enabling faster and more transparent transactions within capital markets.

Clearing and settlement: Blockchain simplifies the processes of clearing and settlement, reducing the time and costs associated with these critical stages.

Post-trade services and Infrastructure: Post-trade services, encompassing record-keeping and reconciliation, benefit from the incorruptible ledger offered by blockchain.

Asset servicing: Blockchain plays a pivotal role in asset servicing, ensuring the precision of asset records and transaction histories.

Custody: The security of digital asset custody, a fundamental aspect of contemporary finance, is further reinforced by blockchain technology.

Asset management

Asset management is a critical domain within the financial sector, tasked with overseeing and optimising investments on behalf of clients. In this complex landscape, efficiency, transparency, and security are paramount. Blockchain technology has emerged as a powerful ally, streamlining various processes and enhancing the overall management of assets.

Fund launch: Blockchain expedites the launch of investment funds, simplifying the creation and management of fund shares.

Cap table management: In the domain of asset management, the maintenance of an accurate cap table becomes more straightforward, thanks to blockchain’s transparency and security.

Transfer agency in asset management: Blockchain simplifies the functions of transfer agencies, making it more convenient to manage investor records and transactions.

Fund administration: Administrative aspects of asset management are automated and streamlined for greater efficiency with blockchain.

Payments and remittances

Payments and remittances are the lifeblood of the global economy with efficiency, security, and cost-effectiveness being the pillars of this essential sector. Blockchain technology has offered innovative solutions that revolutionise how payments and remittances are handled.

Domestic retail payments: Blockchain provides a secure and efficient means to process domestic retail payments.

Domestic wholesale and securities settlement: It simplifies and accelerates the settlement of domestic wholesale and securities transactions.

Cross-border payments: Blockchain transforms cross-border transactions, making them swifter and more cost-effective for remittances.

Tokenised fiat, stablecoins, and cryptocurrency: The issuance and management of tokenised fiat currencies, stablecoins, and cryptocurrencies reap the benefits of blockchain’s security and transparency.

Banking and lending

When it comes to banking and lending, accuracy and security in credit assessment, loan processing, and asset collateralisation are of paramount importance. Blockchain technology has emerged as a disruptive force, offering innovative solutions that streamline these critical functions.

Credit prediction and credit scoring: Blockchain enhances credit prediction and scoring by offering a comprehensive record of an individual’s financial history.

Loan syndication, underwriting, and disbursement: These processes become more efficient and secure through the application of blockchain.

Asset collateralisation: Blockchain enables secure and transparent asset collateralisation, thereby enhancing lending practices.

Trade finance

Trade finance is the backbone of global commerce, ensuring the smooth flow of goods and payments across borders. To efficiently navigate the intricate web of international transactions, efficiency, transparency, and security are essential.

Blockchain technology has emerged as a powerful tool, offering innovative solutions that streamline trade finance operations.

Letters of credit and bill of lading: Blockchain simplifies the management of letters of credit and bills of lading, reducing fraud and errors.

Financing structures: Complex financing structures within trade finance are made more manageable through blockchain technology.

Insurance

Efficiency and transparency are crucial to the insurance sector and can make all the difference for policyholders. Blockchain technology has emerged as a transformative force, offering innovative solutions that streamline claims processing and enhance the overall efficiency of insurance operations.

Claims processing and disbursement: Blockchain streamlines the claims process, rendering it faster and more transparent.

Parametrised contracts: These automated insurance processes benefit from blockchain’s efficiency.

Reinsurance markets: Blockchain enhances transparency and efficiency within reinsurance markets.

Blockchain and Regulatory Compliance

Blockchain technology, with its unique governance and compliance attributes, streamlined processes, and real-time auditing capabilities, is a powerful tool for ensuring regulatory compliance.

It not only assists financial institutions in meeting their obligations but also offers a proactive approach to compliance through incentivised governance structures. In a world where regulatory complexity continues to grow, blockchain simplifies and strengthens compliance efforts in the commerce and finance space.

Unique governance and compliance attributes

One of the core strengths of blockchain technology lies in its ability to programme unique governance and compliance attributes directly into digital assets. By embedding rules and regulations into the blockchain, these digital assets automatically adhere to the prescribed standards.

This ensures that all transactions involving these assets comply with the relevant regulations, reducing the risk of non-compliance.

Streamlined compliance processes

Blockchain introduces streamlined processes that significantly aid compliance efforts. It automates data verification and reporting, a critical aspect of ensuring regulatory adherence. This automation facilitates real-time regulatory oversight, reducing operational friction and eliminating errors often associated with manual auditing and other activities.

These processes are rendered more efficient, making it easier for institutions to meet their regulatory obligations.

Real-time auditing

One of the most powerful features of blockchain in facilitating compliance is real-time auditing. Every transaction on the blockchain is recorded in an unalterable ledger, ensuring transparency and traceability.

This feature enables regulators and institutions to perform real-time audits, reducing the chances of non-compliance going unnoticed. It enhances accountability and helps financial institutions proactively address any compliance issues.

Incentive structures for governance

Blockchain technology is not just about compliance; it also plays a role in the creation and enforcement of incentive structures that improve network governance. By aligning the interests of network participants with compliance objectives, blockchain can encourage stakeholders to follow the rules.

This mechanism promotes self-regulation within the blockchain network, further strengthening compliance.

Cross-border compliance

For firms operating in multiple jurisdictions, blockchain’s cross-border capabilities offer a significant advantage. It can ensure that compliance is consistent across different regulatory regimes.

Transactions and digital assets that adhere to regulations in one country can seamlessly maintain their compliance when moving across borders, simplifying the complexity associated with international operations.

Conclusion

The integration of blockchain technology into the financial industry is reshaping the way business is conducted, offering unprecedented opportunities for growth and innovation. As more financial institutions invest in blockchain and fintech, the demand for skilled professionals in this field is on the rise.

Embracing a career in fintech is not only financially promising but also a chance to be a part of the ongoing revolution in the financial sector. To prepare for this journey, we recommend considering the Professional Certificate In Fintech from Imarticus Learning, a comprehensive fintech Certification course that covers essential topics, including AI and Machine Learning in finance, blockchain technology, financial data analysis, and fintech regulations.

This course will equip you with the knowledge and skills needed to excel in the dynamic world of financial technology. Seize this opportunity to be at the forefront of the fintech revolution and play a pivotal role in shaping the industry’s future.

Enrol today!

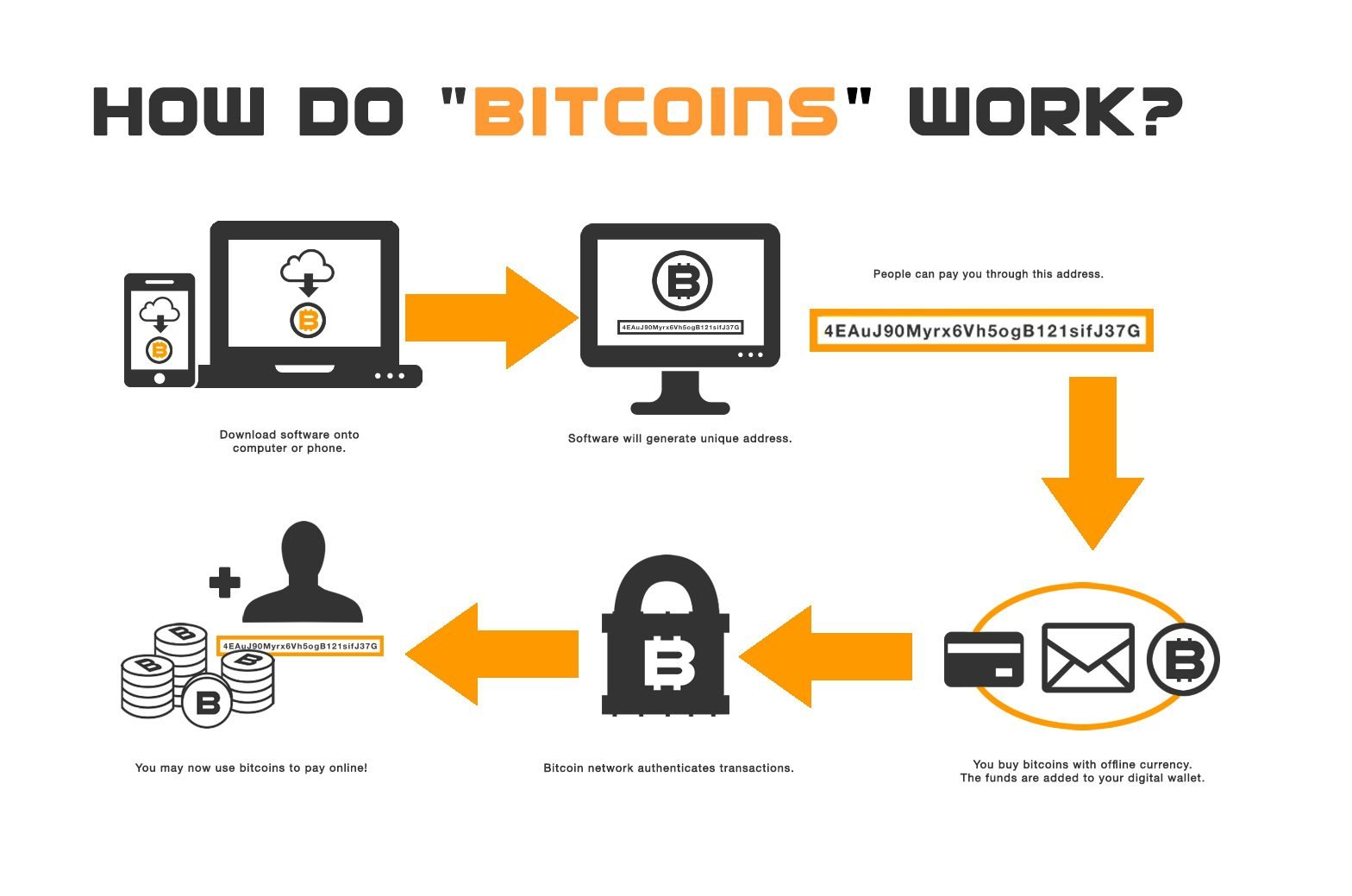

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for  Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.