Have you ever placed a trade and thought, “What happens next?” Most people focus on buying or selling. But the real finish line comes after the trade settlement. And that’s where things can go wrong.

What if your shares don’t arrive? What if money gets delayed?

In a world where trading happens in seconds, the trade settlement process is what ensures everything is final, legal, and clean. But many don’t understand how it works or why it’s critical. So, if you’re trading without knowing the trading and settlement procedure, you’re leaving your investments to chance.

Why Trade Settlement Matters More

The primary goal of trade settlement is to transfer ownership of securities and money safely and fully. It makes your trade real.

If this process is slow or fails, confidence in the market drops. That’s why regulators worldwide, including in India, focus heavily on clearing and settlement rules.

For example, settlements have moved from T+5 (five days after trade) to T+1 in India. That’s faster execution, better liquidity, and reduced counterparty risk.

But faster doesn’t mean safer unless you understand the machinery behind it.

What Is Trade Settlement?

In finance, trade means exchanging securities such as stocks, bonds, commodities, currencies, derivatives, or any other financial instrument for cash. This transaction usually takes place on an exchange, like a stock, commodity, or futures exchange.

Trade settlement is the final step of a trade. It’s when the buyer receives the security, and the seller gets the money. Simple, right? Not quite.

Between executing a trade and completing it, several things happen:

- The trade gets confirmed by both parties.

- The trade goes through a clearing house.

- The exchange ensures money and securities are available.

- Instructions are sent to banks and depositories.

So, when people ask, “What is trade settlement?” the short answer is it’s the formal process of exchange. But the real answer includes the system, timing, risks, and participants behind it.

Stages of the Trade Settlement Process

India’s headline CPI inflation dropped to a seven-month low of 3.6% in February 2025, mainly due to falling food prices.

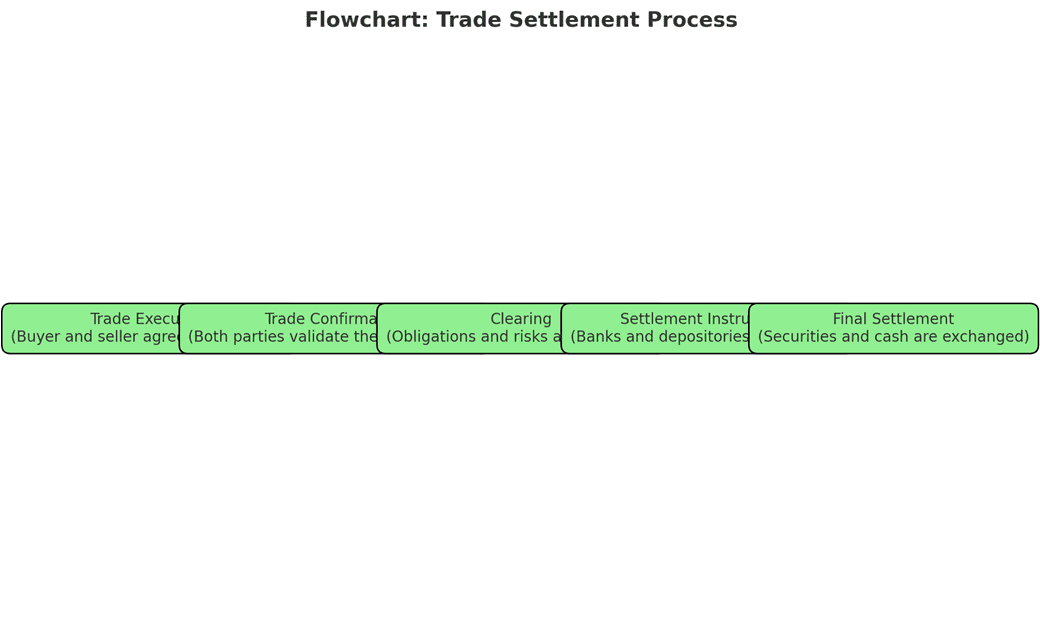

Let’s break down the trade settlement process in a way that’s simple:

- Trade Execution – The buyer & seller agree on price and quantity via the exchange.

- Trade Confirmation – Both parties validate the trade details.

- Clearing – This stage ensures the availability of money and securities.

- Instruction – Settlement instructions are sent to the depository and bank.

- Final Settlement – Securities move to the buyer, and money gets transferred to the seller.

This flow matters not only for retail investors but also for institutions handling thousands of trades a day. One mistake can cost millions.

| Participant | Function in Settlement |

| Buyer & Seller | Place trade and confirm a transaction |

| Broker | Acts as intermediary; submits orders. |

| Clearing Corporation | Calculates obligations and manages risk |

| Depository | Transfers securities electronically |

| Bank | Handles money transfer |

Each party has a set job. If anyone fails, the trade settlement process breaks down. That’s why the ecosystem needs to function with near perfection.

What Can Delay or Fail a Trade Settlement?

Trade settlements don’t always go as planned.

Here are the common reasons:

- Incorrect account details

- Mismatched trade confirmation

- Lack of funds or securities

- Software errors at the broker end

- Timing issues (especially with international trade)

This is where knowing the trading and settlement procedure helps. You can ask the right questions, follow up with your broker, and track the flow.

For those dealing with cross-border transactions or large trade volumes, even one missed detail can delay settlement.

Why the Trade Settlement Process Is Getting Faster

Regulatory bodies are pushing for faster settlements. India recently adopted the T+1 system. The faster the cycle, the lower the risk.

When trades take fewer days to settle:

- Capital releases quickly

- There’s less chance of market volatility hurting a trade

- Confidence in systems improves

But here’s the catch: speed must not ignore accuracy. Many in the industry are now exploring blockchain to bring real-time clearing and settlement.

Even students in an investment banking course learn why speed and control both matters in post-trade services. Every time you place a trade, don’t stop at execution. Know what happens after. Follow your trade settlement path. Ask your broker questions. Track delays. Be proactive.

If you’re looking to learn how the trading and settlement procedure works in large banks, consider enrolling in a trusted investment banking course. It could be your edge in a competitive world.

Build Your Career with the CIBOP Investment Banking Course

Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) course gives you practical training in securities settlement, risk management, AML, and asset operations. Tailored for finance graduates with 0–3 years of experience, this programme promises a job-assured path into top investment banks.

It’s not just theory. You’ll solve real-world case studies, practice with live simulations, and gain soft skills to clear interviews confidently. Whether it’s wealth management or global settlements, you’ll work with tools used in the real banking world.

By joining the CIBOP investment banking course, you’re not just getting certified; you’re preparing to become job-ready in the fastest-growing back-end finance roles.

Apply for the CIBOP programme today and unlock placement support, expert mentoring, and industry-relevant learning.

FAQs

1. What is trade settlement?

It’s the final step where the buyer gets the stock, and the seller gets the money.

2. Why is trade settlement important?

It confirms the deal and legally transfers ownership between the buyer and seller.

3. How long does trade settlement take?

It usually follows a T+1 or T+2 cycle, depending on the market rules.

4. What is the trading and settlement procedure?

It includes trade execution, confirmation, clearing, and actual transfer of money and securities.

5. Can trade settlement fail?

Yes. Reasons include incorrect account details, lack of funds, or technical errors.

6. Which entities are basically involved in trade settlement?

Buyers, sellers, brokers, clearing houses, depositories, and banks.

7. What’s the link between investment banking and trade settlement?

Back-end investment banking roles handle the clearing, settlement, and compliance of trades.

8. Which investment banking course covers trade settlement?

The CIBOP™ course by Imarticus Learning covers the trade settlement process and operational functions in detail.