The finance industry is famous for compensating high performers handsomely, and no career is more representative of this than investment banking. As you consider a career in finance, you ought to know the prevailing investment banker salary trends so that you can make an informed decision. Along the way, we’ll cover everything from starting salaries to seven-figure executive deals and what’s driving them—so you can chart a successful finance career with intention and accuracy.

Understanding the Investment Banker Salary Landscape

The banking sector does not have too many positions as desirable as high-paid as an investment banker. The compensation of the investment banker sets a benchmark for the maximum earning potential in the corporate sector. Investment banker compensation varies based on various factors like career, experience, location of the bank office, and global professional reputation of the bank.

What Influences Investment Banker Salary Packages?

The components of an investment banker pay typically consist of base compensation, bonuses based on performance, and sometimes stock options. The following factors typically play a significant role in overall compensation:

- Level of experience: Analysts are significantly lower-compensated compared to Managing Directors.

- Location: Global financial hubs such as London, New York, and Hong Kong compensate more handsomely.

- Firm size and performance: More prestigious banks tend to provide higher packages.

- Specialisation: Specialisation in areas like M&A or equity capital markets can have more satisfying remunerations.

Entry-level Salaries: A Strong Start

A fresh investment banking analyst in India can expect an initial salary of ₹7–8 LPA, the total compensation reaching as high as ₹10–12 LPA when bonuses are factored in. Overseas, it could reach as much as USD 150,000 in global financial hubs.

Mid-Career Compensation: Scaling the Ladder

When you are promoted to the level of being an associate or a VP, your investment banker’s salary gets doubled or tripled. Indian associates receive ₹12–20 LPA, while the counterpart in London or New York receives up to nearly USD 300,000 per year.

Senior Roles: The Big League

Managing Directors and Partners in international banks typically earn more than USD 1 million a year. Such roles are, however, under enormous performance pressure and are very stressful.

Key Skills That Justify High Investment Banker Salaries

A finance undergraduate degree alone cannot command high-paying investment banker remuneration. High-profile firms are looking for a whole package of skills for an investment banker, including:

- Financial modelling

- Deal structuring

- Communication and negotiation

- Regulatory knowledge

- Market analysis and valuation

Professional certification such as attaining the best investment banking certification can be used to hone these abilities.

Regional Trends in Investment Banker Salary

India

As certified experts in India are needed, extra pay has been implemented. Especially in major cities of Mumbai and Bangalore, finance investment banking course students receive a higher starting pay and faster promotion.

United Kingdom

London remains one of the better-paying markets. Salaries will start at £60,000 per annum, rising to six figures in five years. Bonuses are bound to equate to or even surpass basic pay.

United States

Wall Street remains the best for investment banking compensation. The average analyst is paid USD 120,000–150,000 per annum, and total compensation often tops USD 200,000 in top firms.

Middle East & Asia-pacific

Increasingly, the financial hubs of Dubai and Singapore are close on their heels, too. Aggressive compensation levels to attract are used to entice talent in the expanding markets.

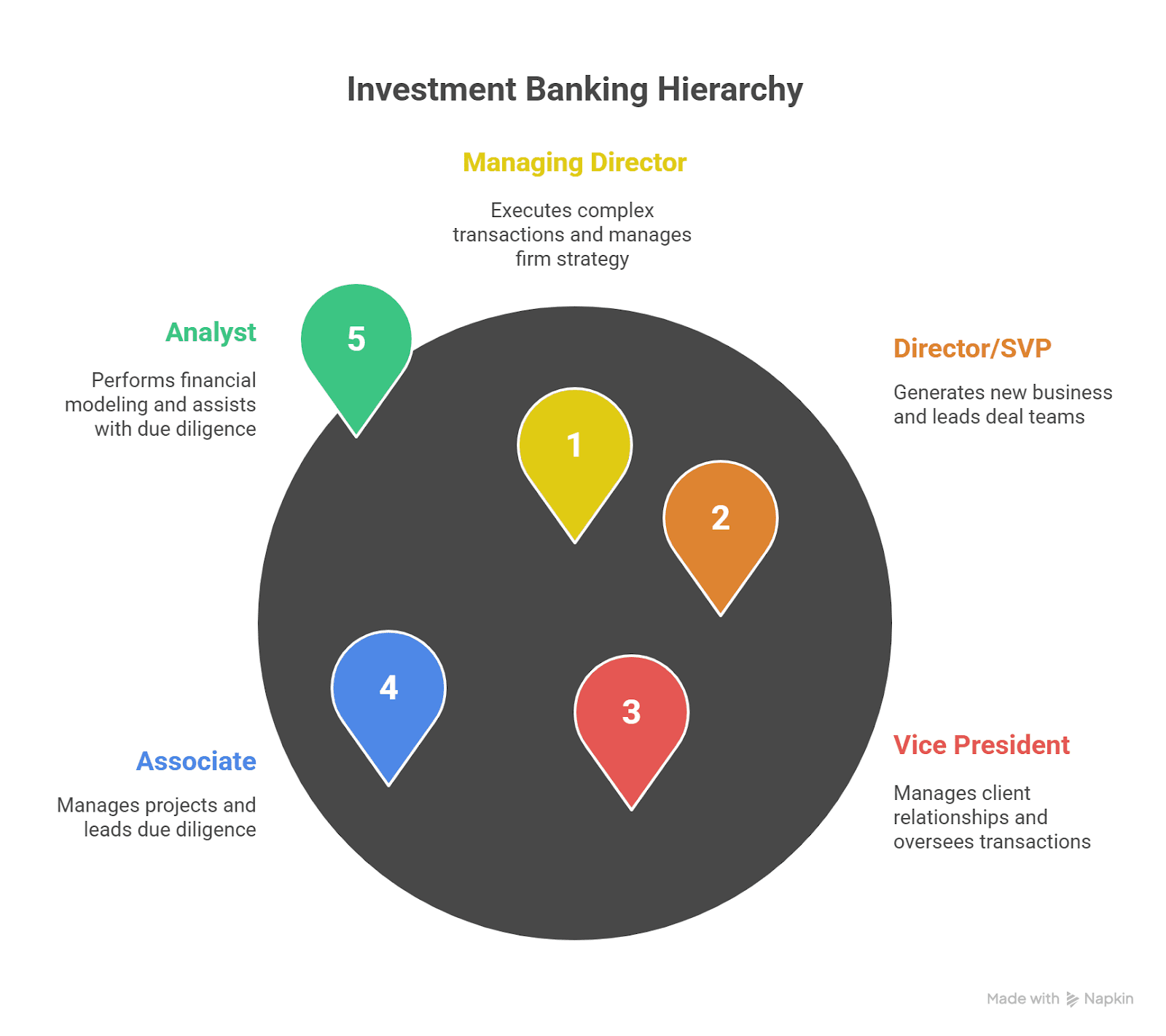

Career Roadmap: From Entry to Executive

Developing a successful investment banking career route is a step-by-step approach with ongoing learning:

- Analyst (0–2 years): Gain fundamentals, support senior bankers.

- Associate (3–5 years): Begin contributing to client accounts.

- VP/Director (6–10 years): Execute transactions and manage teams.

- Managing Director (10+ years): Build and create business portfolios.

Each step is marked by transparent progress in compensation and responsibility.

Finance Career Growth: Why Timing and Strategy Matter?

Career direction by the comp trends in investment banking allows for more knowledgeable monetary decision-making. Career change, the building of skills, and firm selection are all essential engines behind compensation streams. Staying ahead of the curve on industry progress cycles is crucial so that one does not end up on a sideways career track.

Boosting Your Salary Potential with Certification

You are in mid-career or a fresher; certifications are one of the most valuable investments to climb. Selecting the best investment banking certification not only enhance your profile but can even raise your salary instantly.

FAQs

1. What is the average investment banker salary in India?

Investment bankers in India are typically offered approximately ₹7–8 LPA as base, reaching ₹20’30 LPA for mid-level roles.

2. How does the investment banker salary compare across regions?

Salaries vary geographically—India (₹8–20 LPA), UK (£60,000+), and US (USD 150,000+). Bonuses can noticeably affect total compensation.

3. Do certifications affect investment banker salary?

Yes, certifications like the CIBOP™ by Imarticus Learning can enhance salary opportunities by enhancing value to your skill set and employability.

4. What skills are required for high-paying investment banking jobs?

Financial modelling, M&A planning, regulatory know-how, and communications are some investment banking competencies.

5. What are the highest paying finance jobs today?

The best-paying finance careers in the world are hedge fund management, private equity, and investment banking.

6. How can I start a finance career in investment banking?

Start with quality education, have an investment banking career plan, and have a certification like CIBOP.

7. What is the role of bonuses in investment banker salary?

Bonuses will be on or above base salary, especially in high-performing teams or supporting market conditions.

Conclusion: Planning Your Future in Investment Banking

Investment banking is not just a lucrative profession but also one that involves thinking. Knowledge of dominant trends in investment banker compensation allows you to have a better chance of charting your career and making final points of professional achievement.

One of the most effective methods to take your career forward is by becoming a part of the Certified Investment Banking Operations Professional (CIBOP™) program of Imarticus Learning. With over 50,000 learners and 1,000+ hiring clients, CIBOP is designed specifically to place finance graduates.

With 7 guaranteed interviews, 100% employment guarantee, and live projects, CIBOP is the safest bet for a candidate wanting to begin a serious career in investment banking. Being an investment banking operations-focused course with a focus on risk management and financial compliance, CIBOP gets the students job-ready from day one.

With two versatile tenure plans (3-month and 6-month) and an average salary of 4 LPA (with scope for rise by as much as 60%), this course is your golden key to professional triumph. Start now from boardroom to classroom with Imarticus Learning.