First things first, let’s understand what cloud computing is. Think of it as a vast virtual space. Here you can store and access data over the internet, instead of relying on a physical hard drive. It’s like having a massive, invisible filing cabinet. You can reach it from anywhere, anytime!

Transforming Business Operations: The Power of Cloud Computing

Cloud computing isn’t just about storage. It’s a powerful tool that’s revolutionising business operations. It’s making businesses more efficient, more flexible, and more scalable. From sharing documents with a team member on the other side of the world to using sophisticated software without installing it on your computer, cloud computing is changing the way we work.

1. Cost Efficiency: Maximising Profits with Cloud Computing

One major advantage of cloud computing is cost efficiency. By moving to the cloud, businesses can reduce the cost of managing and maintaining their IT systems. They no longer need to invest heavily in hardware, upgrades, or in-house IT staff. Plus, the pay-as-you-go approach of most cloud services means companies only pay for what they use.

2. Data Security and Recovery: Protecting Business with Cloud Computing

In the digital age, data security is a top concern for businesses. Cloud computing provides robust security features. These ensure sensitive data is securely stored and handled. Moreover, it makes data recovery a breeze. Information stored in the cloud can be accessed or retrieved from anywhere.

3. Scalability and Flexibility: Growing with Cloud Computing

Another transformative aspect of cloud computing is its scalability. Businesses can easily scale up or down their storage needs based on demand. Thus, it turns out to be a flexible solution for businesses of all sizes. This flexibility also extends to working practices. As a result, it allows employees to work remotely and collaborate efficiently.

4. Stepping into the Future: Cloud Computing Courses

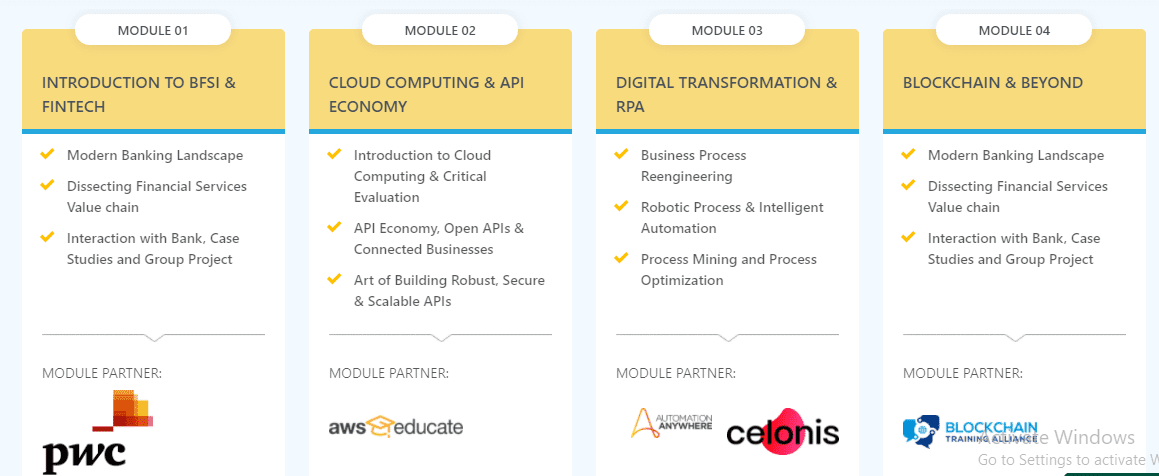

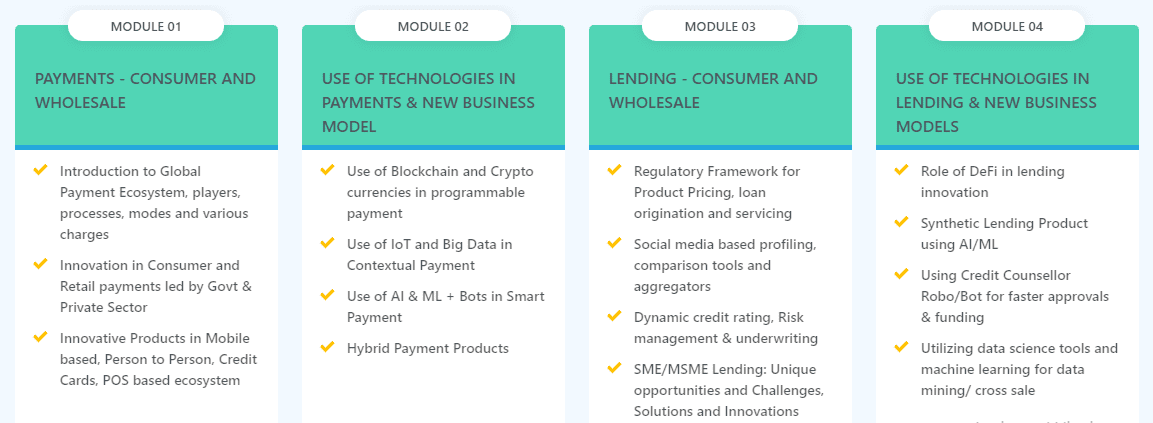

To fully harness the power of cloud computing, one must possess the right knowledge and skills. This is where Cloud Computing Courses come into play. These cloud computing courses are designed to equip you with an understanding and technical expertise. Thus, you can easily navigate the world of cloud computing.

5. Improved Collaboration: Teamwork in the Cloud

Cloud computing is redefining teamwork in businesses. It allows for seamless collaboration among team members. You do not have to worry about their location. Multiple individuals can work on the same project simultaneously, with real-time updates and sharing capabilities. This increased collaboration leads to efficiency and improved productivity. In turn, it makes the business more competitive.

6. Sustainability: A Greener Approach with Cloud Computing

Did you know cloud computing is also environmentally friendly? By using virtual services instead of physical products and systems, businesses can reduce their carbon footprint. Plus, the scalability of cloud computing means that businesses only use the energy they need, leading to less waste. This shift towards sustainable practices is a significant step in the fight against climate change.

7. Innovation and Competitiveness: Staying Ahead with Cloud Computing

Cloud computing has the necessary agility and flexibility. So, businesses can bring products and services to market more quickly. This capability to innovate rapidly gives companies a competitive edge in today’s fast-paced business environment. With cloud computing, even small businesses can disrupt the market. Moreover, they can compete with larger, established companies.

8. Insight and Decision Making: Smart Business with Cloud Computing

Cloud computing also provides businesses with valuable insights for decision-making. With sophisticated data analysis tools available in the cloud, businesses can collect and analyse large amounts of data. This analysis can inform business decisions and strategies. This leads to better outcomes and increased profitability.

9. Automating Business Processes: Efficiency through Cloud Computing

Cloud computing enables businesses to automate many routine tasks. This comprises sending out automatic updates to manage customer relationships. Indeed, automation can significantly increase efficiency. Also, it can free up staff time to focus on more strategic tasks. This shift not only improves productivity but also enhances job satisfaction. That’s because employees can focus on the more engaging aspects of their roles.

Conclusion

Cloud computing is more than a technological innovation. Certainly, you can call it a business revolution. It’s redefining how businesses operate. It makes them more efficient, secure, and adaptable to change.

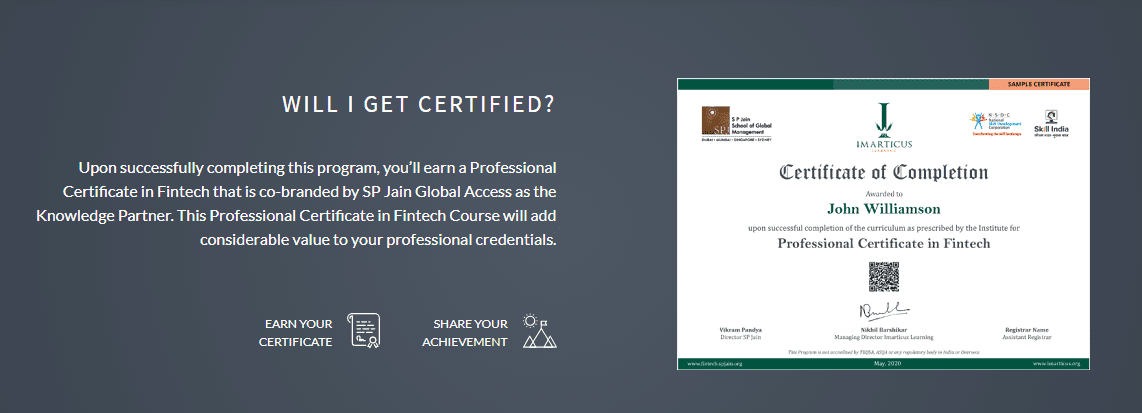

Are you ready to be part of this transformative era? Cloud Computing Courses are your ticket to joining this revolution. Are you a fresh graduate? Or are you a young professional? Looking for structured technical proficiency development courses on the internet?

Start your journey with the Professional Certificate Course in FinTech from Imarticus. Visit Imarticus today for amazing cloud computing courses. Take the first step towards a promising career in cloud computing. The future is in the cloud. Are you ready to soar?