If you’re stuck between CPA vs CFA, let me say this upfront – You’re not confused because the internet lacks information. You’re confused because:

Everyone talks about salary.

Nobody talks about day-to-day work.

And almost no one explains what life looks like 5 to 10 years after choosing one.

So let’s change that. This isn’t about which exam is tougher on paper. It’s about which career you won’t regret committing years of your life to.

Some say that the CPA certification is easier than the CFA. Others argue that CFA is more respected globally. And then there’s the classic that Should I do CPA, CFA, or both? The truth is, both are elite qualifications, but they solve very different career problems.

In this guide, I won’t rank CPA vs CFA academically. Instead, I’ll answer:

CPA vs CFA – which is harder?

Who earns more?

What really works in India?

Which pays better abroad?

Should you do CPA and CFA together?

So instead of rushing to a verdict, let’s slow this down and understand what each path actually offers.

Understanding CPA and CFA

Before comparing salaries and pass rates, it’s important to understand what each qualification is designed to do. One of the biggest reasons students struggle with CFA vs CPA is that both are prestigious, global certifications – but they exist for very different reasons.

Certified Public Accountant (CPA)

Students often ask me what is a CPA, to which I simply say that – CPA is a professional accounting and compliance qualification regulated by the US state boards. The CPA qualification is built around accuracy, accountability, and compliance. CPAs make sure that financial information is correct, transparent, aligned with regulations, and trusted by stakeholders. CPA tells companies how money should be reported. It focuses on:

- Auditing

- Financial Reporting (US GAAP & IFRS)

- Taxation

- Regulation & Compliance

- Internal Controls

- Business Laws

CPA dominates careers in:

- Audit firms (Big 4).

- Accounting & advisory roles.

- Taxation and compliance.

- CFO-track corporate finance roles.

Chartered Financial Analyst (CFA)

When someone asks me what is CFA, I tell them that CFA is an investment-focused qualification awarded by the CFA Institute (USA). The CFA charter, on the other hand, is designed for professionals who analyse money rather than report it. CFA tells investors how money should be invested. It focuses on:

- Equity & Fixed Income Analysis

- Portfolio & Risk Management

- Financial Modeling

- Economics

- Ethics

- Valuation

- Allocating Capital Efficiently

CFAs answer questions like: Is this company worth investing in? How should a portfolio be structured? What risks could impact returns?

CFA dominates careers in:

- Investment banking

- Asset management

- Portfolio management

- Equity research

- Hedge funds

- Private wealth management

Before pass rates, before online debates, before salary screenshots – ask yourself:

Do I want to work with rules, or with risk?

That single question quietly decides CPA vs CFA for most people.

- If you enjoy structure, accuracy, compliance, and financial clarity → CPA

- If you enjoy markets, uncertainty, valuation, and decision-making under risk → CFA

Most people skip this step. That’s why they burn out.

CPA vs CFA: What Your Daily Work Actually Looks Like

Most of the comparison revolves around the syllabus, not reality.

A Realistic View of a Day in a CPA’s Life

As a CPA, your work usually involves:

- Reviewing financial statements

- Ensuring compliance with accounting standards

- Working with audits, controls, and reporting

- Coordinating with regulators, tax authorities, and management

- It’s process-driven, deadline-focused, and critical to business survival.

- You don’t chase market movements – you protect companies from financial and legal mistakes.

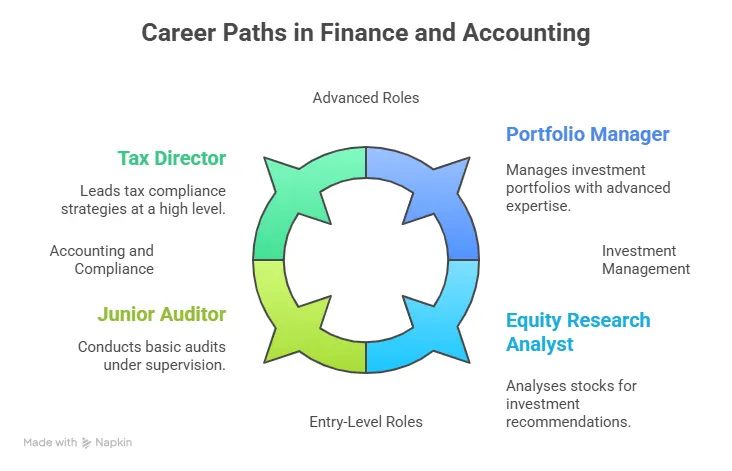

This is why CPAs become audit managers, controllers, finance heads, and CFOs.

A Realistic View of a Day in a CFA’s Life

As a CFA professional, your day looks very different:

- Analysing companies and industries

- Building valuation models

- Tracking markets and macro trends

- Making recommendations that involve risk

You live in probabilities, not certainties. Some days you’re right. Some days, the market humbles you – and that’s exactly the reality of CFA jobs like equity research, portfolio management, investment analysis, and risk management, where decisions are made under uncertainty every single day.

That’s why CFA careers reward deep thinking, long-term perspective, and emotional control. This is why CFAs end up in asset management, equity research, investment banking, and portfolio management.

CPA vs CFA: Quick Overview

If you want a quick snapshot before diving into the details, this table sums up how CPA and CFA differ at a glance. It’s not about which is better – it’s about which one fits your way of thinking and the kind of career you’re aiming for.

| Criteria | CPA | CFA |

| Focus on accounting, audit & compliance | ✅ | ❌ |

| Focus on investments & financial markets | ❌ | ✅ |

| Strong fit for Big 4 & accounting firms | ✅ | ❌ |

| Strong fit for asset management & IB | ❌ | ✅ |

| Rule-based, structured work | ✅ | ❌ |

| Judgment-based, analytical decision-making | ❌ | ✅ |

| Stable, predictable career growth | ✅ | ❌ |

| Ideal for finance/investment-oriented minds | ❌ | ✅ |

CPA vs CFA Syllabus

When most students start comparing the CPA vs CFA syllabus, what they’re really asking is not – What are the subject names? But what will I be doing every day while I study? And will this keep me motivated for months or years?

That’s the part that matters – because both programmes are big commitments, and you want to know you’ll enjoy most in which of the journey.

What the CPA Syllabus Feels Like

If you picture yourself as the person who knows the rules inside and out, a CPA fits that mental model. The syllabus is practical, structured and profession-focused – you learn the tools that accountants and auditors actually use every day. With CPA subjects, you prepare for four core papers:

- AUD (Auditing & Attestation)

- FAR (Financial Accounting & Reporting)

- REG (Regulation)

- Discipline Paper (BAR/ISC/TCP)

The CPA syllabus constantly brings you back to real-life situations: If you were in this scenario at work, what would you do?

If you like clear frameworks, rules that make sense, and learning by application, the CPA syllabus usually feels logical and familiar – especially if you loved accounting in your undergrad.

What the CFA Syllabus Feels Like

The CFA course syllabus is a different experience. It’s broader, more analytical and deeply focused on financial markets and investment decision-making. Across three levels, you’ll study:

- Ethics & Professional Standards

- Financial Reporting & Analysis

- Economics & Quantitative Methods

- Corporate Finance

- Equity, Fixed Income & Derivatives

- Portfolio Management & Wealth Planning

Instead of asking What rule applies here?, CFA constantly asks Why is this happening? And how would an analyst or investor think about this?

In Level 1, you build the foundation. In CFA Level 2, you go deeper into valuation and analysis. In CFA Level 3, you focus on strategic portfolio decisions and wealth planning. It’s less about memorising rules and more about developing financial judgment and insight.

Here’s the truth: most candidates realise once they’re a few weeks into prep:

- CPA trains you to report, verify and comply.

- CFA trains you to analyse, value and invest.

Neither is easier – they just train different muscles. CPA feels more precise and rule-based. CFA feels more strategic and judgment-based.

Ask yourself this:

Do you enjoy accounting logic, clear rules, audits and structured problem-solving?

→ The CPA syllabus will feel natural to you.

Are you drawn to financial markets, investment analysis, and strategy?

→ The CFA syllabus will keep you engaged over the long haul.

The choice isn’t about which one is objectively better – it’s about which one aligns with the kind of work you want to do, and the way you like to think and learn.

CPA vs CFA Eligibility

When students compare CPA vs CFA eligibility, they’re really asking: Can I get started with this now? And what do I need on paper before I even register? Let’s break that down in simple terms.

CPA eligibility

For CPA eligibility, most candidates need a recognised bachelor’s degree plus around 120-150 semester hours of accounting and business-related coursework – that usually means your normal degree plus a little extra or a post-grad qualification to hit the credit requirement. Some US states also expect you to have 1-2 years of relevant work experience under a licensed CPA before you can finalise your license.

In short,

CPA: Degree + specific credit hours in accounting/business + some supervised work experience

CFA eligibility

On the CFA side, the basic entry point is holding a bachelor’s degree (in any field) or being in the final year of your undergraduate programme when you register for CFA Level 1. Alternatively, you can qualify with a combination of professional work experience and education that totals about three years / 4,000 hours. Then, once you’ve passed all three levels and completed the required experience, you qualify for the CFA charter.

In short,

CFA: Degree or final-year student or relevant work experience pathway, and then pass three exams

To sum it up, CPA requires more formal classroom credits up front, whereas CFA certification gives you a little more flexibility on how you meet the eligibility requirements, as long as you have the degree or work experience combined.

CPA vs CFA: Which One Is Harder?

I’ve been asked this question multiple times, and I’ve seen this question appear everywhere – CPA vs CFA difficulty, CFA vs CPA, which is harder, and even entire Reddit threads debating it.

But difficulty depends on what kind of effort you find challenging.

Why CFA Is Considered Academically Tougher

CFA Level 1 exams are all about building your foundation – you’re introduced to core finance concepts, ethics, and market basics that set the tone for the entire CFA journey.

- The syllabus is vast and interconnected.

- Concepts are layered across three levels.

- You need strong analytical and conceptual depth.

- Progression takes years, not months.

- CFA tests how deeply you understand finance and markets.

CFA exam pass rates are indeed generally lower than CPA exam pass rates. This often creates the impression that the CFA is more elite, more valuable, or automatically better. But that conclusion is misleading if you look only at percentages.

Why CPA Feels Practically Demanding

- Precision matters – small errors have consequences.

- You’re expected to apply standards correctly.

- The pace of work can be intense.

- Regulatory updates require continuous learning.

- CPA tests how reliably you can apply knowledge in real-world scenarios.

So while CFA is often harder to clear, CPA is harder to sustain over a long career. Many professionals choose the CFA charter for its long-term career value, and the CFA benefits extend well beyond exams to include global recognition, strong investment judgment, and access to front-office finance roles.

CPA vs CFA Course Fees

One of the first things students want to know is: Okay, so how much do these courses cost in real money?

Let’s break it down in a way that feels real – no big blocks of numbers buried in textbooks.

CPA Course Fees

Talking about the CPA fees, there are a few parts to consider:

1. Exam fees

The CPA exam has four parts, and each exam section typically costs around $250–$390 when taken in the U.S. system, which adds up to roughly $1,050–$1,500 for all four sections if you pass them the first time.

2. Application & state fees

You’ll also pay some one-time application and registration fees (varies by state) that can add a few hundred dollars.

3. Review materials & prep

Most serious candidates take a review course. These can range from a few hundred to a few thousand dollars, depending on how in-depth you want your prep to be.

4. Total ballpark

If you’re doing this from India (or anywhere outside the U.S.), exam registration + coaching can total roughly ₹3-4 lakh all-in – including fees, prep, and admin costs.

In simple terms: CPA isn’t just about the exam fees – it’s about prep and admin costs too. But most students who plan can finish their CPA journey somewhere in the mid-range of those totals.

CFA Course Fees

The CFA course fees typically range between ₹3 lakh and ₹3.6 lakh for all three levels combined, depending on when you register and whether you opt for additional coaching or study support. The CFA fees structure is a little different because you’re looking at three exam levels:

1. Exam registration fees

Each CFA levels have a registration fee, and if you register early, it’s cheaper (roughly $900 early / $1,200 standard per level).

2. One-time enrollment fee

There’s also a one-time programme registration fee when you join, which adds a bit upfront.

3. Total CFA cost

All three levels – registration + exams + tools – generally add up to around $2,500 to $3,500 for the whole CFA journey.

4. In Indian rupees

That translates to roughly ₹3 lakh to ₹3.6 lakh if you count the exam registration, standard fees, and optional coaching/study resources.

So unlike CPA, the CFA cost is spread out over three levels, and you pay as you go. There’s flexibility – you don’t pay the full thing upfront, but you do need to budget year by year.

| Cost Component | CPA | CFA |

| Number of exams | 4 | 3 |

| Typical exam fee only | ~$1,050-$1,500 | ~$2,500-$3,500 (for all 3 levels) |

| Prep & coaching (optional) | ₹1-2+ lakh | ₹1.2-2+ lakh |

| Ballpark total (India) | ~₹3-4 lakh | ~₹3-4 lakh |

Note – Numbers are approximate and vary based on registration timing, study resources, and coaching choices.

Even though the fees are high for CFA, what sets the CFA course apart is its global recognition and the depth of financial judgment it builds over time.

If you’re wondering how a CPA career can evolve beyond traditional accounting roles, the video shows how CPAs transition from compliance-focused work into financial leadership, strategic decision-making, and executive roles and what skills and experience make that progression possible.

CPA vs CFA Course Duration

When students compare CPA vs CFA course duration, they’re usually asking a practical question: How many years of my life will this realistically take? The answer depends less on the brochure timeline and more on how the courses are structured and how people actually progress.

| Qualification | Typical Duration | How It Plays Out in Real Life |

| CPA (US CPA) | 12-18 months | Many candidates complete all four papers within 1-1.5 years, especially if they plan well and study consistently. |

| CFA (Chartered Financial Analyst) | 2.5-4 years | Even though exams are offered more frequently now, most candidates take multiple years to clear all three levels. |

Why CPA Is Usually Faster

The CPA course duration is shorter because:

- It has 4 exams, and you can choose the order.

- Once you pass your first paper, you get an 18 to 30-month rolling window (varies by jurisdiction) to finish the rest.

- The syllabus is application-focused, making it easier to combine with full-time work if you’re disciplined.

- Many working professionals clear the CPA while working full-time, especially those from accounting or commerce backgrounds.

- CPA books are rule-based and application-driven. They’re designed to help you pass the exam and perform at work.

Why CFA Takes Longer

The CFA course duration is longer because:

- It has 3 sequential levels – you must pass one level to move to the next.

- Each level demands 300-400 hours of study, often more.

- Even motivated candidates usually space exams to avoid burnout.

- That’s why, in practice, CFA becomes a multi-year commitment, not a quick credential.

- CFA books are theory-heavy and analytical, especially in the early levels. The official CFA Institute curriculum runs into thousands of pages.

The Real Question Isn’t Speed

A shorter or longer duration doesn’t make one qualification better. If you want faster qualification + structured finance roles, a CPA often fits better. If you’re comfortable with a long-term, theory-heavy journey into investments and portfolio management, CFA makes sense.

So instead of asking: Which course finishes sooner?

Ask: Am I ready for an intense 12 to 18 months or a steady 3 to 4-year marathon?

Your answer to that will matter far more than the duration.

When comparing CPA vs CFA, reviewing the CFA course details helps you see how investment-focused the program really is.

This video breaks down US CPA career opportunities and salary expectations, helping you understand what roles CPAs actually move into and how the qualification translates into real-world growth.

CFA vs CPA Salary

When students search for CPA vs CFA salary, they usually want a realistic picture of what they can earn in India and globally. While both qualifications can lead to strong pay, the salary structure, growth pattern, and risk profile are very different.

CPA vs CFA Salary in India (INR)

| Experience Level | CPA Salary (India) | CFA Salary (India) |

| Entry-Level (0-3 yrs) | ₹6-9 LPA | ₹7-12 LPA |

| Mid-Level (4-7 yrs) | ₹12-22 LPA | ₹15-30 LPA |

| Senior Level (8-12 yrs) | ₹25-45 LPA | ₹30-60 LPA |

| Leadership (15+ yrs) | ₹45-55 LPA+ | ₹60-70 LPA+ |

What Drives CPA Salary in India?

The CPA salary in India is stable and predictable, largely driven by:

- Demand from Big 4, global accounting firms, and MNCs.

- Roles in audit, taxation, financial reporting, and compliance.

- Strong offshore and shared services demand from US companies.

- Clear progression from analyst → manager → controller roles.

CPA compensation tends to grow steadily with experience, even without switching jobs frequently.

What Drives CFA Salary in India?

The CFA salary in India is more variable because they depend on:

- Role type (equity research, portfolio management, IB, FP&A).

- Firm performance and market cycles.

- Individual performance and deal exposure.

- Locations like Mumbai, Bangalore, and Gurgaon typically pay more.

Top CFA professionals in front-office investment roles earn significantly more, but outcomes vary widely.

Choose CPA if you value income stability, consistent growth, and global back-office to mid-office roles.

Choose CFA if you’re comfortable with performance-driven pay and competitive investment roles.

Higher salary potential doesn’t always mean better career satisfaction. The best-paying qualification is the one you can stick with and grow in the long term.

Why Imarticus for CPA Preparation?

One of the first questions students ask isn’t just How much should I study? or What do I study? – it’s where should I study this so I actually succeed? That’s exactly where Imarticus comes in.

Choosing the right learning partner matters because the CPA course and CFA aren’t weekend courses – they’re investments in your future. Imarticus is about giving you the clarity, structure, and support you need to get results.

Here’s what sets Imarticus apart:

- Straight-forward guidance from day one – Right from orientation to exam strategy, you get help that makes sense – no confusion, just clear steps that align with what the exam bodies actually expect.

- Expert faculty with real experience – You’re learning from professionals who’ve been there – CPAs, CFAs, and finance practitioners who blend exam insight with real market perspective. That makes your prep more relevant and less theoretical.

- Structured study plans that fit your life – CPA and CFA require disciplined prep. Imarticus gives you practical study timelines and checkpoints, so you can balance learning with work or college without burning out.

- Premium study resources built for results – You get access to curated learning kits, practice questions, mock exams, and exam-aligned content – all framed to help you understand concepts and apply them effectively.

- Support that goes beyond content – It’s not just classroom time. You also get mentorship, doubt-clearing sessions, performance feedback, and strategies to improve continually – so you stay on track.

- Career support to help you transition – Once you’re ready with the certification, Imarticus helps you take the next step with interview prep, resume feedback, and industry insights – because earning a certificate is just one part of the journey.

At the end of the day, the difference isn’t just what you learn – it’s how well you’re prepared to use it. Imarticus focuses on helping you not only clear the exam, but move forward in your career with confidence.

FAQs About CPA vs CFA

Choosing between CPA and CFA naturally raises a lot of questions. These frequently asked questions address the most common doubts around difficulty, salary, career scope, and long-term value.

CFA vs CPA – which is better?

There’s no universal winner in CFA vs CPA. CPA is better if you want a structured career in accounting, audit, tax, and compliance. CFA is better if you want to work in investments, markets, valuation, and portfolio management. The better option is the one that fits the kind of work you want to do every day.

CFA vs CPA – which is harder?

This depends on what you find difficult. CFA vs CPA difficulty debates miss this point. CFA is academically heavier, spread across three levels, and requires deep conceptual understanding. CPA is more practical and detail-driven, where accuracy and correct application of rules matter. CFA is harder to clear; CPA is harder to sustain over a long career.

CFA vs CPA vs CMA – how do I choose?

In CFA vs CPA vs CMA, think of it this way:

CPA → Accounting, audit, tax, compliance.

CMA → Corporate finance, FP&A, internal decision-making.

CFA → Investments, markets, portfolio management.

They’re not competitors – they solve different career problems. That’s where Imarticus Learning adds value. By offering guided preparation for CPA, CMA, and CFA paths, Imarticus helps you understand not just the syllabus but the career reality behind each option, so you choose the qualification that fits your strengths, interests, and long-term goals, not just what sounds impressive.

CFA vs CPA pass rate – does a lower pass rate mean CFA is better?

Not necessarily. CFA vs CPA pass rate differences reflect exam design, not career quality. CFA pass rates are lower because the syllabus is broader and more analytical. CPA pass rates are higher because it’s application-focused. A lower pass rate doesn’t automatically mean better career outcomes.

CPA vs CFA salary – who earns more?

In CPA vs CFA salary, CFA professionals can earn more in front-office investment roles, but outcomes vary widely. CPA salaries are usually more stable and predictable, especially in audit, tax, and reporting roles. CFA salaries are higher at the top – but more performance-dependent.

CPA vs CFA salary in India – what’s the realistic earning potential?

For CPA vs CFA salary in India, CPAs typically earn ₹6-9 LPA at the entry level, with steady growth over time. CFAs may start slightly higher in finance roles, but salary growth depends heavily on role, firm, and market conditions. Stability vs upside is the real trade-off.

CPA vs CFA salary in Canada – which pays better?

In CPA vs CFA Canada comparisons, CPA dominates accounting, audit, and controller roles with strong demand. CFA holders earn more in asset management and investment roles, but these positions are fewer and more competitive. Both are valuable, but for different career tracks.

CPA vs CFA exam – how are they different?

The CPA vs CFA exam experience feels very different. CPA exams test whether you can apply accounting standards correctly under time pressure. CFA exams test whether you can analyse, evaluate, and make judgment-based decisions across markets. One tests precision; the other tests reasoning.

This difference is why structured preparation helps. With Imarticus Learning, CPA candidates get exam-focused training that mirrors real accounting applications, while CFA candidates receive concept-driven guidance that connects theory to market decision-making, so you prepare not just to pass, but to think the way each profession demands.

CMA vs CPA vs CFA salary – who earns the most?

In CMA vs CPA vs CFA salary comparisons, CFA professionals can earn the most at senior investment roles, CMA professionals do very well in corporate leadership and FP&A, and CPAs earn steadily with predictable growth. Risk and reward increase as you move from CPA → CMA → CFA.

ACCA vs CPA vs CFA – which is best globally?

In ACCA vs CPA vs CFA, ACCA is widely recognised for accounting roles globally, CPA is strongest for US-linked accounting and compliance roles, and CFA is unmatched in investment careers. The best option depends on geography and role, not prestige.

Should I do CPA and CFA together?

You can, but it’s demanding. CPA + CFA together make sense if you want leadership roles that combine accounting depth with investment decision-making. For most people, it’s smarter to complete one first, work for a few years, then decide.

Take Your Time, Then Take the Right Step

If you’ve read this far, you’re probably not just comparing CPA vs CFA out of curiosity. You’re trying to make a real decision about your future, and that’s not something to rush.

Both CPA and CFA are strong choices. Neither is better in general. They’re just built for different kinds of people and different kinds of careers. The right one is the one you can see yourself studying for, staying consistent with, and actually enjoying along the way.

What usually trips students up isn’t ability – it’s uncertainty. Not knowing what to study next. Wondering if you’re on the right track. Feeling stuck when preparation gets heavy. That’s where the right guidance quietly makes all the difference.

Choosing a professional qualification like the CPA course is a big step. Doing it with confidence makes it a lot easier. With Imarticus, you don’t have to figure everything out on your own. You get a clear plan, experienced mentors who understand these exams inside out, and steady support that helps you move forward without feeling overwhelmed. You focus on learning – not second-guessing.

If you’re still weighing your options or ready to get started, have a conversation with an Imarticus advisor.

No pressure, no confusion – just clarity on which path suits you and how to prepare the smart way.