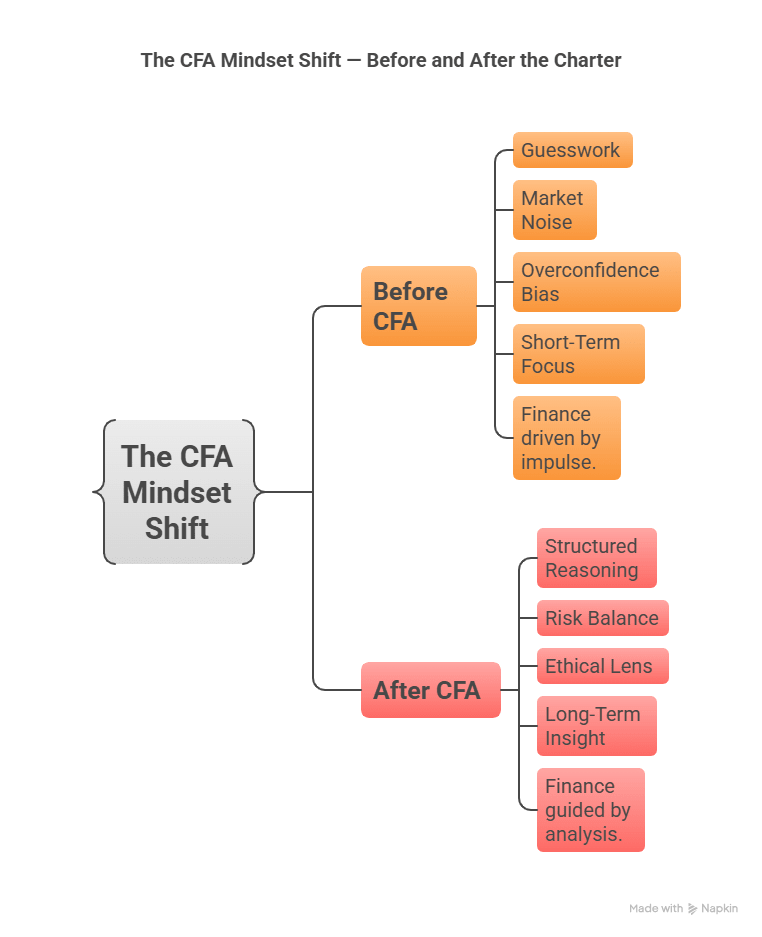

If you have ever tried to understand the finance world from the outside, it can feel like watching a match without knowing the rules. You can see people making decisions, you can sense that money is moving, but the logic behind it looks distant. The CFA Program was built to close that distance. It gives you the rulebook, the tools, and the judgment you need to understand how professionals read companies, value assets, and manage money.

Finance works the same way.

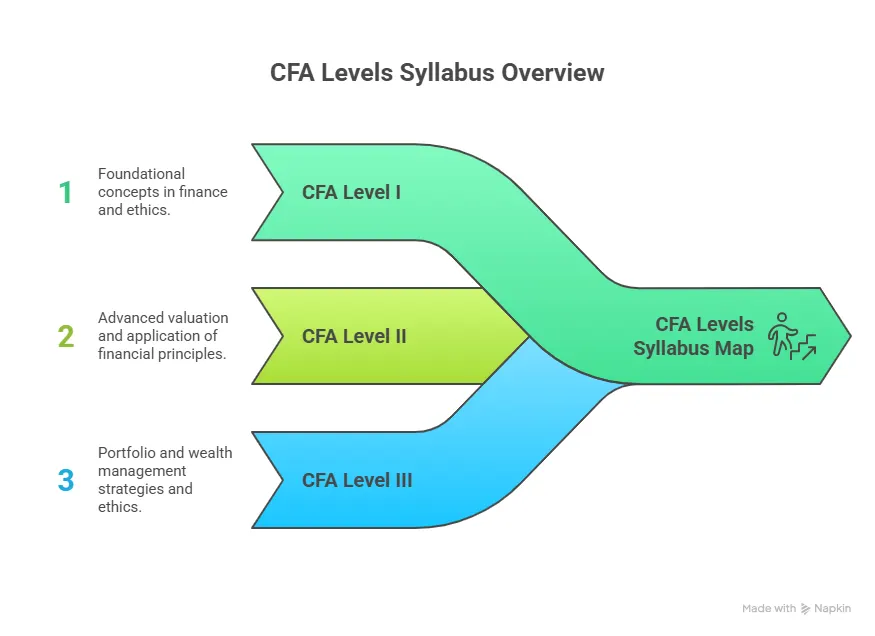

The CFA Program doesn’t drop you into portfolio theory on day one. Instead, it guides you one level at a time, helping you build a foundation you can actually use.

Here’s the simple beauty of the journey:

→ Level I teaches you to see the financial world clearly.

→ Level II teaches you to analyse that world with precision.

→ Level III teaches you to make decisions in that world with confidence.

This progression is why the CFA charter has such credibility in the industry. It doesn’t promise shortcuts or memorised formulas. It builds thinking. It builds discipline. It builds judgment. These are the traits that employers value because they translate directly to real investment work, whether you are analysing a stock, evaluating a bond, or advising a client.

You don’t need to come from a finance family, have insider knowledge or be a mathematical genius. What you need is curiosity, consistency, and the willingness to grow through the CFA levels one step at a time.

In this blog, I’ll walk you through every part of that journey: what the CFA Program includes, how each level works, what the syllabus looks like, how difficult each level is, how much the CFA Program costs, and how you can plan your full learning roadmap.

By the end, you’ll know exactly what the CFA path looks like and whether it fits your goals. And if it does, you’ll have a much clearer plan of how to begin.

What Is the CFA Certification?

Before diving deeper into the CFA levels and how they work, it helps to understand what the CFA course actually represents. The Chartered Financial Analyst credential is one of the most recognised qualifications in global finance, known for its depth, rigour, and the real-world decision-making skills it builds.

If someone asks you what is CFA, think of it as a long-term training program that shapes you into a professional who can analyse markets, value companies, assess risk and manage investment portfolios. As a mentor, I often explain it using everyday examples because finance becomes easier when we break it down to things we already understand.

Imagine you are learning to drive.

- First, you learn the rules, the basics, and how the car works.

- Next, you practise driving in different environments: crowded streets, highways, and slopes.

- Finally, you learn judgment: when to slow down, when to accelerate, and how to make safe choices.

The CFA certification works the same way through its three structured CFA levels.

Just like driving, you do not become confident overnight. You grow through repetition, better understanding and practice. The curriculum helps you build this confidence step by step.

Here is a summary table showing what each level tests and how it differs:

| CFA Level | Focus / What You Learn | Exam Format | Outcome of Clearing |

| Level I | Fundamental tools: quantitative methods, basic valuations, financial reporting & analysis, ethics, etc. | Multiple-choice questions (MCQs) | Foundational understanding; eligible to attempt Level II |

| Level II | Deeper analysis, asset valuation across equities, fixed income, derivatives; advanced application of concepts | Item-set questions (vignettes + multiple-choice) | Skill in analysing real-life financial situations; eligible for Level III |

| Level III | Portfolio management, wealth planning, integration of all prior learning, and real-world portfolio decisions | Mix of item-sets + constructed-response (essay / short answer) questions | Readiness to be a CFA charterholder (after work-experience requirement) |

So when people ask “how many levels are there in CFA” or “what are CFA levels,” I give them this simple answer: there are three. And each level is more advanced than the previous one.

How the CFA Certification Builds Your Finance Skills

The program, also revered as the gold standard of finance certification, teaches you how to see the world the way investment professionals do. It starts simple and becomes deeper and more practical.

Here’s what the program helps you develop:

- The ability to read and interpret real company financial statements

- Skills to value stocks, bonds, derivatives and alternative assets

- Understanding of global economic movements

- Judgement to manage portfolios and make investment decisions

- Ethical thinking is needed in real finance roles

Every concept connects to what you actually use on the job.

For instance, think about how we decide whether to buy a phone.

We check:

- Price

- Features

- Brand reputation

- Long-term value

In finance, the same habit becomes valuation. Instead of buying a phone, you’re analysing a stock or bond. The CFA certification trains you to make decisions with data rather than guesswork.

CFA Certification at a Glance

To make this clearer, here’s a simplified table that introduces the CFA qualification in a scan-friendly way:

| Aspect | What It Means |

| Credential Name | Chartered Financial Analyst (CFA) |

| Governing Body | CFA Institute, USA |

| Structure | Three CFA levels (Level I, II, III) |

| Focus Areas | Valuation, analysis, portfolio management, ethics |

| Who It’s For | Analysts, finance aspirants, portfolio professionals, career switchers |

| Global Recognition | Highly recognised across investment, banking, and asset management |

Watch this video that explains very practically how the CFA has become one of the best finance moves for your career today:

Why the CFA Program Is Designed as Three Levels

The reason behind having the CFA course details in three levels is rooted in the philosophy of building depth over time. Not many finance credentials adopt such a structured progressive path.

- At Level I, the focus is on building a strong foundation, such as financial statement analysis, basic quantitative tools, ethics, economics, etc. This ensures everyone has a common base.

- At Level II, you apply that base to valuation, asset pricing, and more complex instruments. You learn how to evaluate real-world assets.

- At Level III, the emphasis is on synthesis and application, no longer standalone tools or formulas, but actual decision-making in a portfolio and wealth management context.

This design ensures a gradual ramp-up in complexity, making the CFA Program realistic for both students and working professionals.

Because of this structure, I believe that a single blog that explains all CFA levels, their syllabus, difficulty, fees, and progression, offers the most value to a prospective candidate.

What Is the Full CFA Levels Syllabus

To understand what you are signing up for, you need clarity on what topics each level covers. The syllabus evolves from basic to advanced, that you get in the CFA exam overview.

Here is a simplified high-level breakdown (topic areas that run across levels). Some of these topics are common across levels (with increasing depth).

| Topic Area | Importance Across Levels | How It Evolves |

| Ethics & Professional Standards | High throughout all levels | Basics at Level I; deeper application & real-world ethics dilemmas at Level II & III |

| Quantitative Methods | Strong at Level I; still relevant later | Basics (statistics, time value) at Level I; used for valuations, modelling at Levels II & III |

| Economics | Foundational at Level I; applied later | Macro and micro fundamentals; later applied to market valuations & asset pricing |

| Financial Reporting & Analysis (FRA) | Important at Level I; critical at Level II | Understand company financials → Deep valuations, equity/fixed income analysis |

| Corporate Finance | Fundamental at Level I; applied later | Basics → Capital budgeting, corporate actions, leverage, etc. |

| Equity / Fixed Income / Derivatives / Alternative Investments | Introduced broadly at Level I; expanded and deepened later | Valuation + analysis under different market conditions, instruments, and risk |

| Portfolio Management & Wealth Planning | Introduced lightly early; central at Level III | From basics to full portfolio construction, optimisation, and wealth planning strategies |

This progressive layering makes the CFA curriculum robust.

Most candidates need to dedicate significant time to each level. A self-paced approach often works best, especially for working professionals.

Did you know? The CFA Program began in 1963 with only 284 charterholders, and today there are more than 190,000 charterholders globally.

How Long to Complete All CFA Levels & What It Costs

When I discuss CFA total levels, one natural question is: How much time and money should I expect to spend to complete all three levels? Below, I have explained the CFA duration required to go through the various levels.

Time Commitment

- Recommended study time per level is around 300 hours.

- Most people take three to four years to complete all levels, especially if they are working alongside.

That means realistically, you should plan for a multi-year commitment, with regular study intervals.

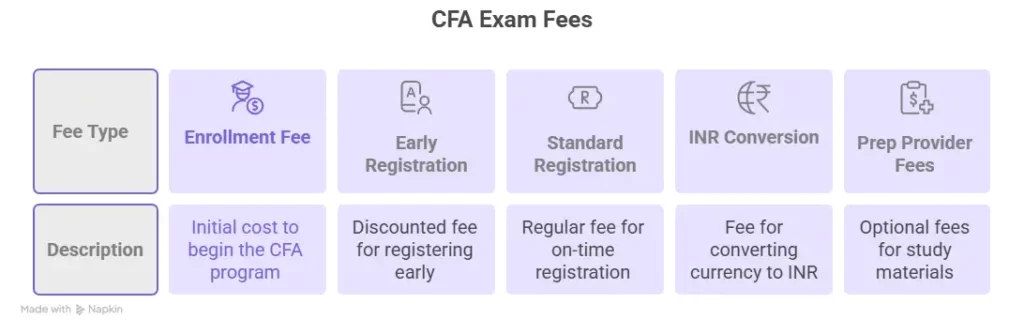

Fees & Costs

Here is a breakdown of typical costs and CFA course fees associated with the program:

| Cost Component | Typical Amount | Notes |

| One-time Enrollment Fee (when first registering) | $350 | Paid only once, at Level I registration |

| Registration Fee per Level (2025 fee structure) | Level I / II: $990 (early) / $1,290 (standard); Level III: $1,090 / $1,390 | Varies depending on when you register |

| Total Cost for All Three Levels (exam + registration) | $3,520 – $4,600 (as per 2026 fee schedule) | Excludes supplementary costs (study materials, etc.) |

Beyond official exam fees, many candidates also invest in study materials, prep classes, mock tests, and sometimes retake costs or rescheduling. All these add up, which makes it important to budget wisely from the start.

From my experience mentoring students, I often advise them to treat the CFA Program as not just an academic journey but a financial as well as temporal investment.

Understanding the CFA Difficulty Level: Why Every Level Feels Tough

From the outside, the CFA Program might just look like “three exams.” But once you start, you realise the challenge is multidimensional: content volume, conceptual depth, application-based questions, and long-term discipline.

Here are some reasons the difficulty is real:

- Breadth and Depth: The syllabus spans accounting, economics, ethics, quantitative methods, fixed income, equity, derivatives, alternative investments, and portfolio management; a lot of ground to cover.

- Progressive Complexity: Concepts introduced at Level I reappear at Level II and Level III in much more complex forms (valuation models, real-world scenarios, portfolio optimisation).

- Rigorous Exam Formats: From simple MCQs at Level I to vignette-based item sets at Level II, and essay + item sets at Level III. That requires both memory and analytical thinking.

- Low Pass Rates: Historically, pass rates have remained low. Recent data shows the Level I pass rate is around 43–45%. Level II often below 50% and Level III has pass rates slightly higher but still challenging. (CFA Institute)

Because of this, when I mentor candidates, I always stress that clearing all CFA levels isn’t just about hard work; it’s about smart work, discipline, time management, and realistic planning.

A Deeper Look at the CFA All Levels Syllabus

I spend a lot of time guiding candidates on how to approach the curriculum. The CFA Institute updates the curriculum often, and here you should also know the CFA Program Policies, so I prefer to think of the CFA all levels syllabus as a learning map rather than a list. Each topic returns in a new form as you progress through the CFA levels, which helps you learn through repetition and context.

Below is a level-wise overview that gives you a clean understanding.

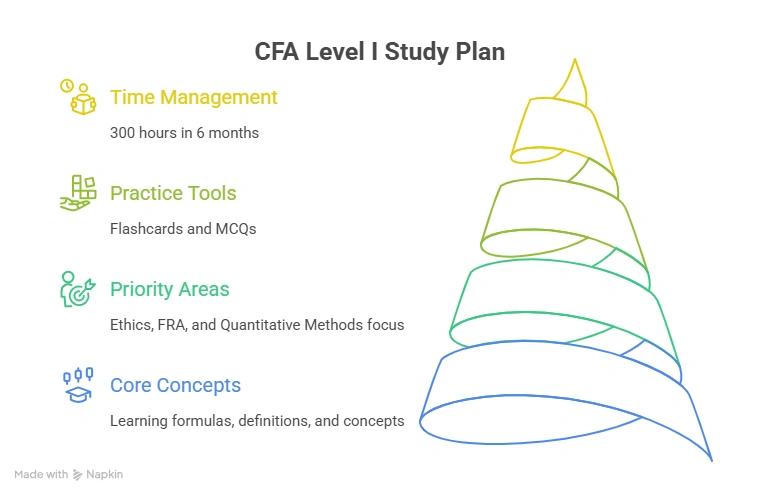

Level I Syllabus in Simple Language

CFA Level I tests the foundation you need for investment work. Almost every topic is tested. Your job here is to build comfort with the tools.

Key themes you meet at Level I:

- Time value of money, statistics and probability

- How to read and compare company financial statements

- Intro to equity, fixed income, derivatives and alternatives

- Understanding risk, return and basic portfolio terms

- Using ethical standards in decision-making

Each topic here forms a brick. Later levels use these bricks to build larger structures.

Because this level has the widest spread of topics, I advise candidates to spend time learning the concepts slowly and to revise them often. It helps to use practice questions every day.

Watch this video that explains certain in-depth practical strategies that can help you clear the CFA Level 1 with ease, and this is the perfect guide that explains it in brief:

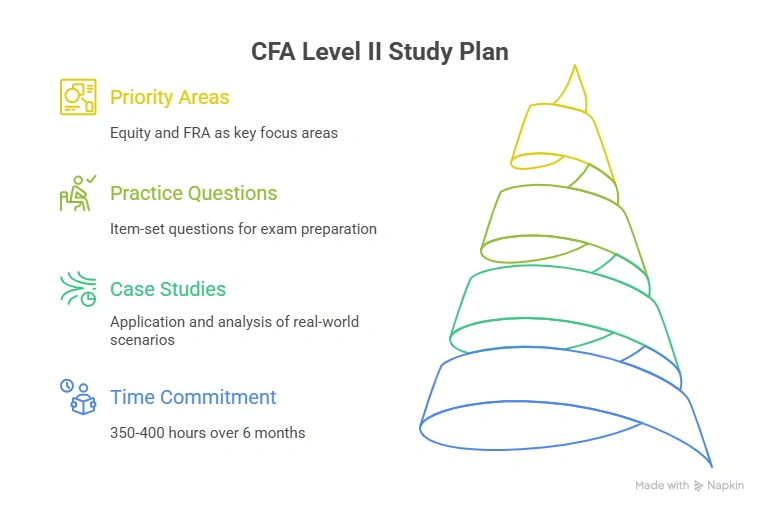

Level II Syllabus in Simple Language

CFA Level II takes the bricks from Level I and turns them into real structures. The entire level is built on practical interpretation. You do not get short MCQs here. Instead, you answer item-set questions. These are long caselets with three or four MCQs attached.

You need to read carefully, understand the story and pick answers that match the scenario.

How the topics evolve at Level II:

- Equity and fixed income now rely on valuation models

- FRA becomes deeper, especially with leases, pensions and intercorporate investments

- Derivatives move to valuation, Greeks, and strategy building

- Portfolio concepts grow from simple return calculations to full factor models

Students sometimes underestimate how much detail Level II requires. My advice is to use real examples from listed companies and global market developments. If you can link a concept to what you see in the news, you remember it better.

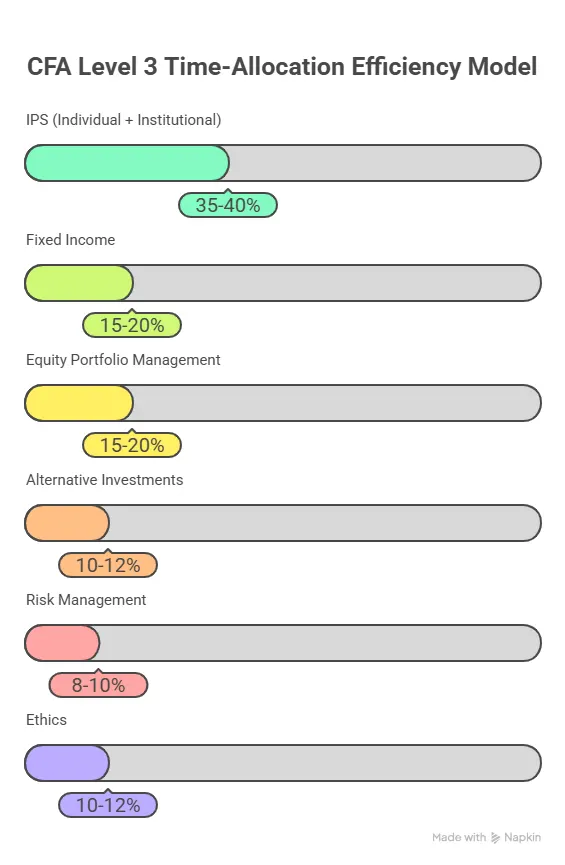

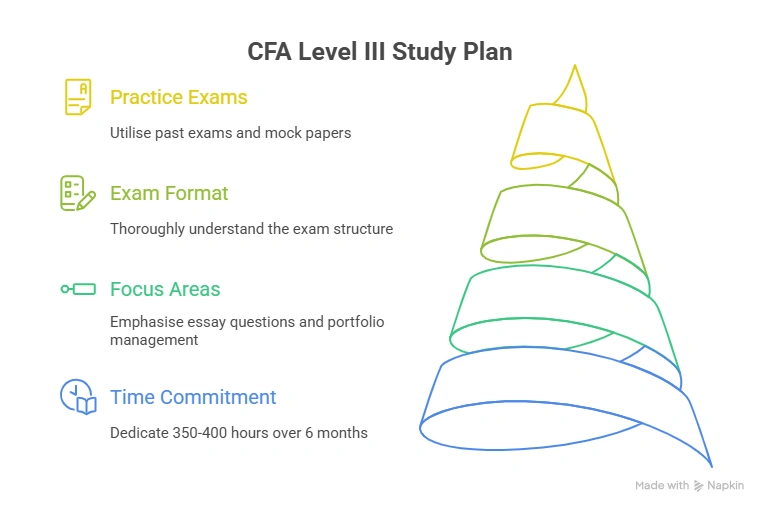

Level III Syllabus in Simple Language

CFA Level III brings everything to portfolio management. This is where you apply everything you learned across the CFA levels to real investment decisions.

You write constructed-response answers along with item sets. That means your thought process must be very clear.

What Level III focuses on:

- Private wealth management

- Institutional investor management

- Behavioural finance

- Fixed-income portfolio strategies

- Equity portfolio strategies

- Risk management at the portfolio level

- Asset allocation

- Performance evaluation

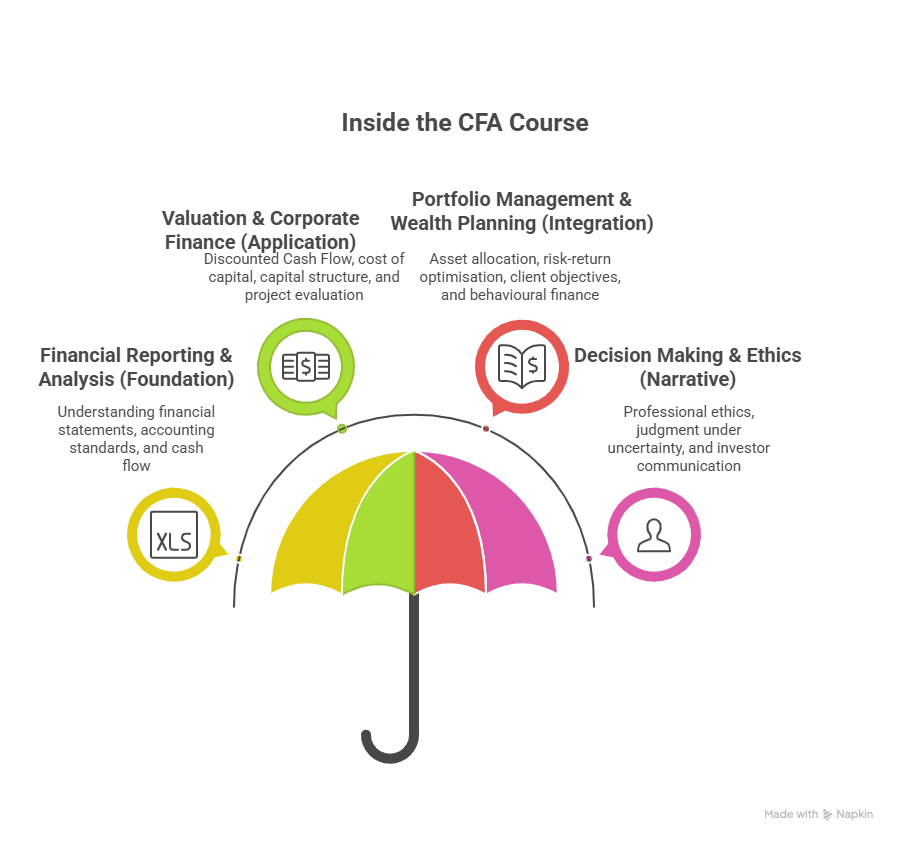

I always tell candidates to practise writing short, structured answers every day. Most students struggle at first because it feels unusual, but it gets easier with practice. You do not need long paragraphs. You need clarity. The infographic below highlights the CFA levels syllabus at a glance. You can discover what various levels consist of on a broader lens:

Did you know? Time value of money calculations, introduced at Level I, reappear in advanced forms in CFA Level II and CFA Level III.

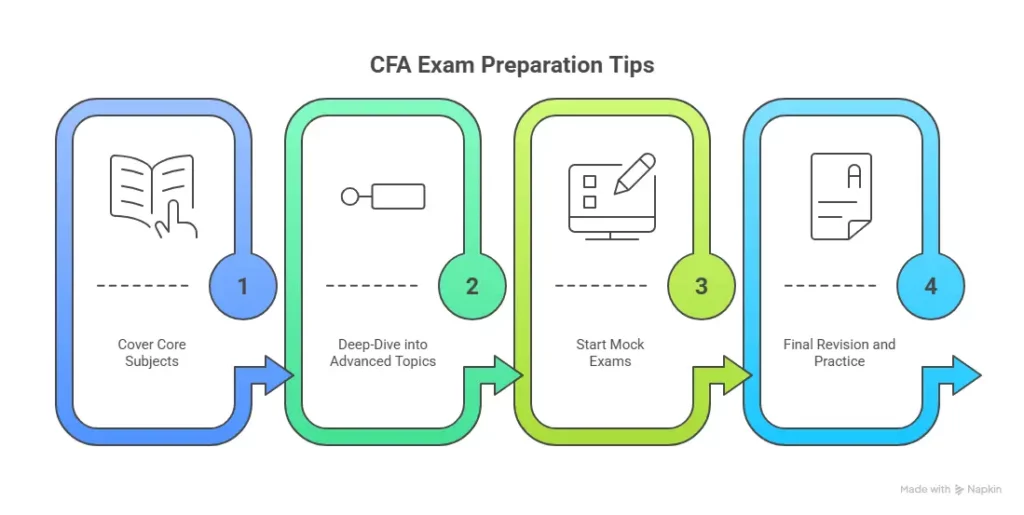

Realistic Study Strategy for All CFA Levels

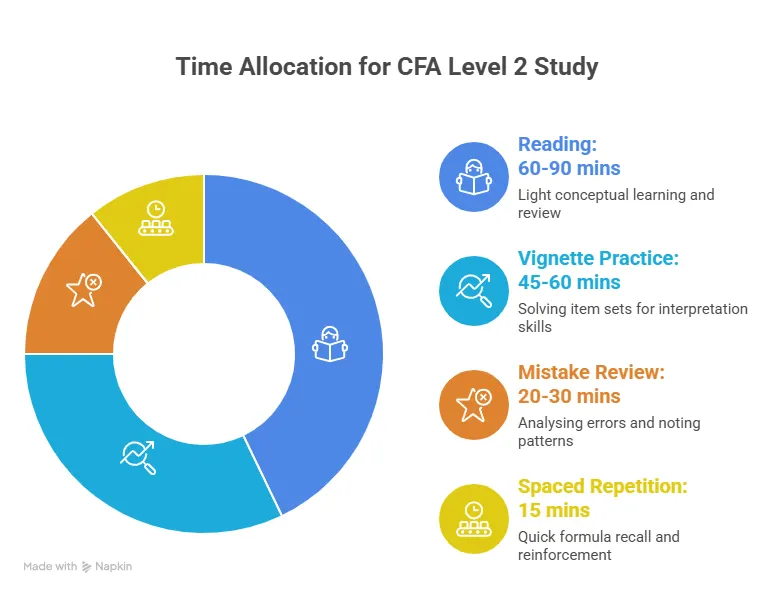

After mentoring candidates for many years, I follow a simple rule: small steps taken every day are more powerful than long study sessions taken once a week. The syllabus is wide, and if you skip a day, you feel it.

Below is a pattern that works for most working professionals.

1. Start with reading, but never end with reading

Reading builds familiarity. But exams test your ability to apply. So a typical weekly plan may look like this:

- Read 5 days a week

- Practice questions 4 days a week

- Revise 2 days a week

- Attempt a full mock every 2 weeks during the last month

You can adjust this, but I find this rhythm easy to sustain for months.

2. Create small learning packets

Some candidates try to study an entire reading in one sitting. That often leads to burnout. Instead, break concepts into small packets. For example:

- Discounted cash flow

- Dividend discount valuation

- FCFF and FCFE

- Residual income models

Each of these packets can be done in a single evening. Smaller packets improve recall.

3. Use early morning study windows

Most candidates tell me they are too tired in the evening. I have seen better consistency when students study early in the morning. Even 60 minutes is enough if you do it every day.

4. Always use a formula notebook

The CFA Program uses many formulas. Some people try to memorise them at the end. That creates unnecessary stress. Instead, maintain a small formula notebook from the start. Add formulas as you learn them. By the time revision starts, your notebook and the CFA books become your most valuable resources.

5. Take 3 mock exams per level (minimum)

Mocks help you understand the exam. They also teach you:

- How to manage time

- How to recover from a tough section

- How to stay calm when you don’t know the answer

Mocks also highlight weak areas quickly. I always ask candidates to analyse each mock carefully. This is where improvement happens.

How Working Professionals Should Approach CFA Prep

Many of my students come from full-time roles in banking, accounting, audit, fintech, equity research or consulting. They face the toughest schedule. Here are habits that help:

- Use 60- to 90-minute study blocks

- Keep weekends for revision and question practice

- Avoid long breaks in study rhythm

- Keep digital distractions away during study time

- Use spaced repetition for memory-heavy areas like ethics and FRA

A steady pace wins this race. I have seen students with busy audit seasons or long banking hours clear levels because they kept a very small but daily commitment.

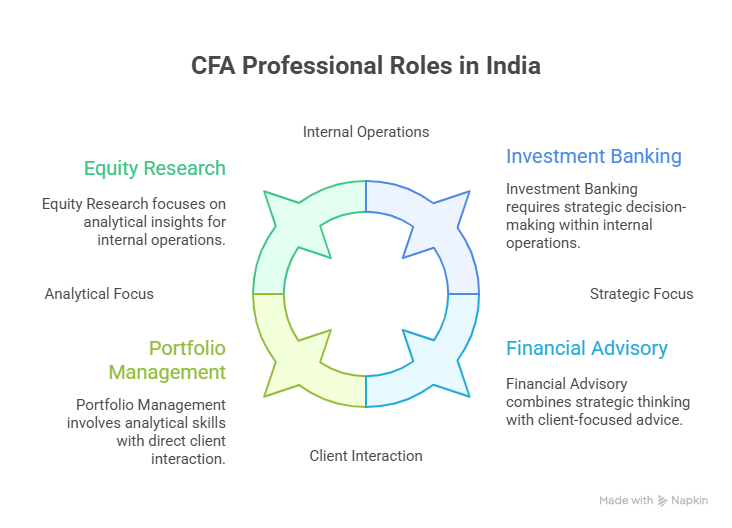

Career Paths After Clearing the CFA Levels

When candidates ask me what they can do after clearing all CFA levels, I often tell them to think of the CFA benefits as a way to sharpen the skills that markets demand. Many roles in finance rely on analytical thinking, valuation ability, financial modelling, portfolio understanding and ethical judgment. The CFA Program has all these in one place.

Here are some common roles that open up for people who complete the CFA levels and then build experience:

- Equity research analyst

- Portfolio analyst

- Fixed-income analyst

- Investment banking roles related to valuation

- Wealth management and private banking

- Risk analysis roles

- Alternative investment roles in funds

- ESG research roles

- Corporate finance and strategy positions

Many roles do not require the charter as a strict rule, but having the CFA levels completed gives you a strong advantage during interviews. You show discipline and mastery of concepts. Employers value that because it reduces training time.

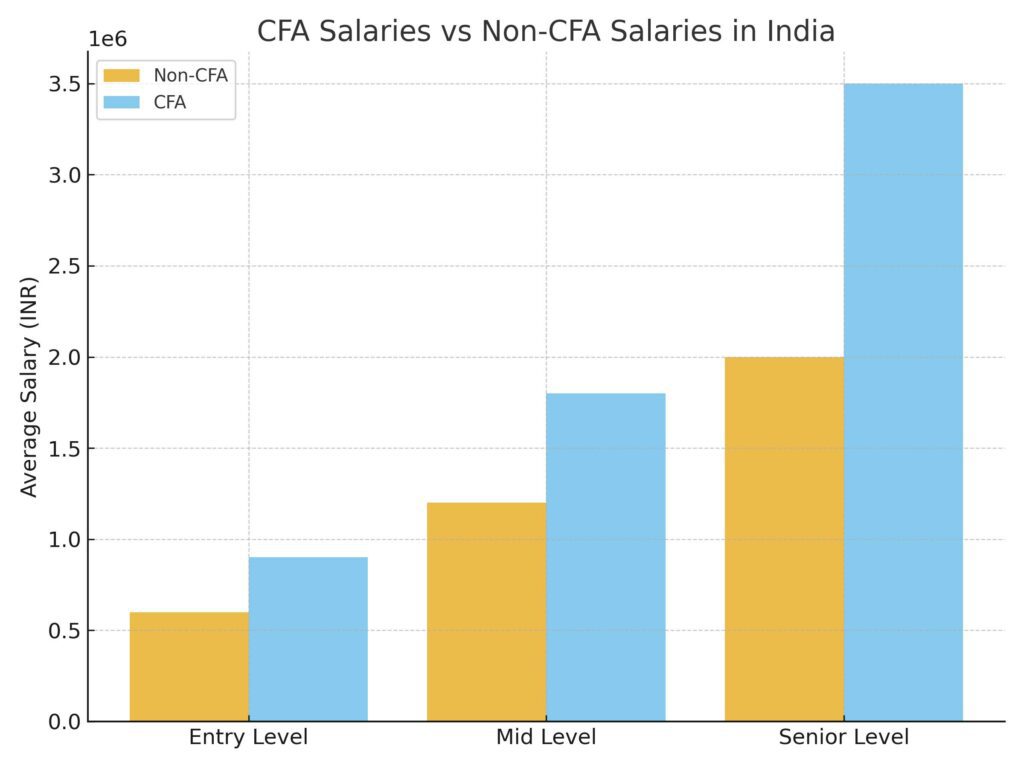

People who understand career options after CFA also find the CFA Program useful. I have seen engineers, statisticians, accountants, lawyers, computer science majors and even psychology majors complete the CFA levels and reshape their careers. What matters is curiosity and a willingness to learn finance in a structured way. The roles often get the most sought after when you consider the CFA salary outcomes that having the credential commands.

The visual below also encapsulates how various CFA levels translate to high-earning job roles across the globe. These are the most talked about and hot roles today in the finance job market:

Why Imarticus Learning Makes a Strong Case for CFA Candidates

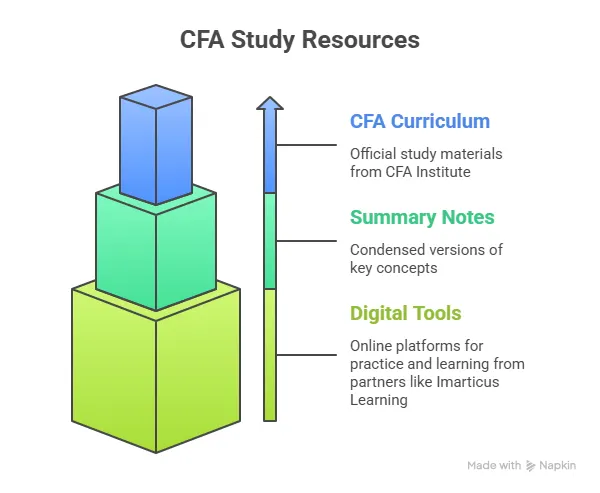

When you choose Imarticus for your CFA course prep, you get advantages that go beyond just “reading and testing.” These are real differentiators that can make the difference between a struggle and a successful CFA completion:

- Industry-Aligned Programme in Collaboration with a Big 4 Firm: Their CFA certification is delivered in collaboration with KPMG in India. This means the curriculum and case studies reflect actual market and corporate realities, not just textbook theory.

- Global-Standard Study Material: They provide content from Kaplan Schweser, a globally trusted prep provider. That ensures you study from internationally benchmarked and up-to-date resources.

- Dual-Teacher Model with Personalised Mentorship: Students get both live classes from chartered faculty and 24×7 support for doubts and clarifications. That kind of mentorship especially helps when you’re juggling CFA studies with a job or other commitments.

- Money-Back / Partial Refund Guarantee: If you follow the prescribed schedule and still don’t pass, Imarticus offers a refund of 50% of your course fee. This reflects their confidence in the quality of training and reduces the financial risk for you.

- Structured Learning with Real-World Case Studies and Internship Option: The programme includes business-case simulations, curated resources, and in some cases, internship opportunities (for top performers) with real organisations. This gives you practical exposure, not just exam prep, but a taste of real finance work.

FAQs on CFA Levels

Below are the most frequently asked questions about CFA levels. Each answer includes the primary keyword naturally and offers clear guidance.

How many levels of CFA are there?

There are three CFA levels in the CFA Program. Each level focuses on a different set of skills that build your finance knowledge step by step. You learn the tools at Level I, the applications at Level II, and portfolio management at Level III. These stages prepare you not only for the exam but also for real work in investment roles. If you train with Imarticus Learning, you receive guided support at every level, which helps you manage your study plan and stay consistent.

Is CFA Level II harder than Level I?

Most candidates feel that Level II is harder than Level I because the questions become longer and require deeper application. Level I introduces the concepts. Level II expects you to use those concepts in realistic valuation cases. This creates a natural jump in the CFA difficulty level. Many students join coaching support from Imarticus Learning during this level because the training keeps the pace steady.

Is 60 percent enough to pass CFA Level I?

There is no fixed passing score published by the CFA Institute. They use a process called the Minimum Passing Score, which changes after every exam cycle. Most candidates believe that scoring around 60 to 70 percent in mocks gives a reasonable chance to clear Level I.

Is CFA Level II possible in three months?

It is possible to prepare for Level II in three months, but it requires full commitment, longer daily study hours and strong foundations from Level I. The CFA difficulty level at Level II feels higher because the questions need interpretation. If you can study two to three hours every day and go through many item-set questions, three months can work. Candidates who train with Imarticus Learning follow a structured schedule that helps them complete the core syllabus efficiently.

Can I clear CFA in one month?

Clearing a CFA level in one month is rare because the syllabus is large and requires a deep understanding. Most candidates need several months to study comfortably. The CFA levels are designed to be progressive, and each level requires practice, revision and mock exams. One month is too short for most students, especially if they have work commitments.

Is 400 hours enough for CFA Level II?

Yes, 400 hours can be enough for Level II if you use those hours wisely. The CFA Institute recommends about 300 hours per level. Many students spend between 350 and 450 hours on Level II because the content feels heavier. What matters is how consistently you study. The CFA levels demand both understanding and stamina. You build both when you study regularly.

How many times can you fail CFA Level II?

There is no limit on how many times you can attempt Level II. You can take it as many times as you need. The CFA Program gives you freedom because the journey is different for everyone. Clearing all CFA levels is a long-term goal, not a short-term race. Support from Imarticus Learning also helps because structured guidance improves confidence.

Is CFA Level III tough?

Many candidates find Level III tough because of the essay-style questions. This format requires clarity in writing and comfort with portfolio management. The CFA difficulty level peaks here because you need to pull together everything from Levels I and II. If you practise writing short, structured answers, Level III becomes manageable. The key is to understand portfolio situations instead of memorising facts.

Is the CFA exam MCQ-based?

Level I of the CFA Program is fully MCQ-based. Level II uses item-set questions, which are long caselets followed by MCQs. Level III is a mix of item sets and constructed-response questions. You start with direct questions, then move to applied questions, and finish with essay-style decision-based questions. This structure helps you learn how investment professionals think.

Your Path Forward in the CFA Journey

Completing all three CFA levels is a long journey, but it is also one of the most rewarding paths in finance. If you approach the syllabus with care, stay consistent and give yourself enough time, you build strong knowledge that stays with you for life. I have seen students with different backgrounds succeed. The ones who do well focus on understanding rather than rushing. If you take that approach, your learning becomes meaningful, and you grow both as a student and as a future professional.

Every year, students who come in are unsure of where to begin and eventually grow into confident analysts. That transformation is possible for anyone who approaches the CFA Course with patience and purpose. If you feel ready to take the first step, this is the right time to start shaping your future in finance. And if you want guided learning along the way, Imarticus Learning can support your journey with structure and direction.