If you’ve been exploring careers in finance – investment banking, equity research, portfolio management – chances are you’ve heard people talk about the CFA program. And usually, it comes up with a lot of curiosity and a lot of confusion. And if you’re serious about pursuing it, one of the first things you’ll want clarity on is CFA eligibility.

Every year, thousands of students plan to start the CFA Certification – but most delay it simply because they’re unsure about eligibility. The surprising part? Many of them were eligible already.

This is where many students and working professionals get confused.

Can you start CFA after graduation?

Can non-commerce students apply?

Is there an age limit?

Do you need work experience?

The truth is – CFA eligibility is simpler than most people think, but understanding it clearly can save you time, money, and unnecessary confusion.

In this detailed guide, I’ll break down everything you need to know about CFA course eligibility, level-wise criteria, exam requirements, scholarships, and what your eligibility actually means for your career in finance.

Did you know?

The CFA eligibility criteria include a bachelor’s degree (or final-year student), or relevant work experience, a valid international passport, and agreement to professional conduct standards set by the CFA Institute.

What Is CFA and Why Eligibility Matters

If you’re wondering: What is CFA? The Chartered Financial Analyst (CFA) is a globally recognised finance certification offered by the CFA Institute, focused on investment analysis, portfolio management, and financial decision-making.

Over the years, CFA has earned a reputation as one of the most respected qualifications in finance. Investment banks, asset management firms, consulting companies, and large corporations across the world value the kind of knowledge and analytical skills CFA candidates bring. For many finance professionals, it’s not just another certification – it’s a career-defining step.

That’s why more and more students and working professionals today are considering CFA. And this interest isn’t limited to the US or Europe anymore. In India, too, awareness around the program has grown a lot. Students want global opportunities, and professionals want to move into specialised, better-paying finance roles.

But before you start thinking about preparation or CFA careers, there’s one thing you need to be clear about first – your CFA eligibility. This is usually where doubts begin.

| Feature | Benefits of Understanding CFA Eligibility Early | Ignore Eligibility |

| Start CFA at the right time | ✅ | ❌ |

| Smooth exam registration | ✅ | ❌ |

| Better exam planning with college/work | ✅ | ❌ |

| Documents ready (passport, ID) | ✅ | ❌ |

| Clear career alignment with finance goals | ✅ | ❌ |

| Saves time and avoids extra costs | ✅ | ❌ |

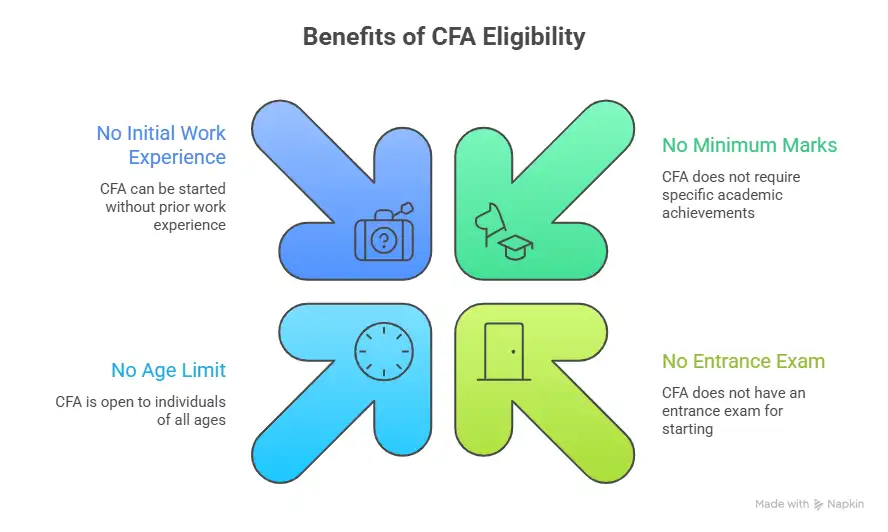

Some people assume CFA is only for commerce or finance students. Others think they need years of work experience before they can even apply. Many believe there’s an age limit or strict academic requirements.

The reality is much simpler than all of this.

The eligibility criteria for CFA certification are actually quite flexible. Think of CFA as a long-term professional journey. And like any journey, the first step is simply checking if you’re eligible to begin. Once that’s clear, everything else – from study plans to career planning – becomes much easier to figure out.

If you’re still wondering whether CFA is worth the effort, this video explains how the qualification can open doors to global finance roles, higher earning potential, and long-term career growth in investment banking and portfolio management.

Overview of CFA Eligibility

Let’s start with a quick overview of CFA course eligibility criteria.

The CFA Institute has designed the program to be accessible globally, so that students, graduates, and professionals from different backgrounds can pursue it.

| Requirement | Details |

| Education | Bachelor’s degree or final-year student |

| Work experience | 4,000 hours of work experience (alternative pathway) |

| Passport | Mandatory valid passport |

| Age limit | No official minimum or maximum |

| Entrance exam | No separate entrance exam |

| English proficiency | Required (exam is in English) |

Whether you are looking at CFA eligibility in India, the USA, or globally, the core requirements remain the same.

Also Read: Complete guide to the CFA course in Delhi, coaching options, and career scope.

Who Can Pursue CFA

The CFA course syllabus is designed to build strong fundamentals in finance, investment analysis, portfolio management, and financial decision-making, making it accessible even for those without a finance background. One of the biggest advantages of the CFA program is its flexibility. The CFA course eligibility is not limited to commerce or finance students. Even engineers, economists, and working professionals from different industries pursue it.

You can pursue CFA if you are:

- A final-year undergraduate student

- A graduate (any stream)

- A CA or MBA student

- A working professional

- Planning a finance career switch

This flexibility is why CFA eligibility for Indian students has made the program increasingly popular across India.

CFA Eligibility After Graduation

If you’ve completed your bachelor’s degree, you fully meet CFA eligibility after graduation. The CFA Institute accepts candidates with a bachelor’s degree in commerce, engineering, arts, science, or management.

Graduates from the following fields commonly pursue CFA:

- BCom

- BBA

- BA Economics

- BSc Finance

- Engineering

- MBA

Even if your degree isn’t finance-related, you can still apply. You just need dedication and interest in finance concepts.

CFA Eligibility for CA, MBA & Finance Professionals

Many professionals pursue CFA alongside or after other qualifications.

- CA students – The CFA eligibility for CA students is straightforward. Chartered Accountants often pursue CFA to move into investment banking, equity research, or global finance roles.

- MBA students – MBA finance students use CFA to strengthen technical investment knowledge.

- Working professionals – If you’re already working in finance, CFA can significantly boost career growth and global opportunities.

Did you know?

You can register for CFA Level 1 even in your final year of graduation.

CFA Level 1 Eligibility Criteria

The first step in the CFA journey is Level 1. Understanding CFA Level 1 eligibility criteria is crucial before registration. Once you understand the requirements, planning becomes much easier – you can choose the right exam window, prepare your documents in advance, and start your preparation with confidence instead of second-guessing whether you’re eligible.

| Requirement | Details |

| Education | Final-year graduation or completed degree |

| Work experience | 4,000 hours combined work/study option |

| Passport | Mandatory |

| English | Basic proficiency required |

If you’re wondering about eligibility for CFA Level 1 India, the same global rules apply.

You don’t need:

- Minimum marks

- Commerce background

- Finance degree

If you’re preparing for CFA Level 1, this video walks you through a practical step-by-step strategy to prepare for CFA Level 1, manage the vast syllabus, and stay consistent throughout your preparation. I

CFA Level 2 Eligibility Criteria

Once you clear Level 1, you can move to Level 2. CFA Level 2 eligibility requires candidates to pass Level 1 of the CFA exam and register with the CFA Institute while meeting professional conduct requirements.

CFA Level 2 eligibility requirements:

- Must pass the CFA Level 1 Exam

- Valid passport

- Registration with CFA Institute

- Adherence to the ethics declaration

There are no separate academic requirements after Level 1.

Also Read: Explore how to choose the best CFA coaching and preparation strategy for your exam journey.

CFA Level 3 Eligibility Criteria

CFA Level 3 is the final exam stage before becoming a charterholder. CFA Level 3 eligibility requires candidates to pass Level 2 of the CFA exam and remain enrolled in the CFA program under CFA Institute guidelines.

CFA Level 3 eligibility:

- Must pass Level 2

- Continue program registration

- Meet professional conduct standards.

After clearing all CFA levels, you need to get work experience to earn the CFA charter.

Curious about the CFA salary after each level? This video breaks down the earning potential after clearing Level 1, Level 2, and Level 3, and explains how salaries typically grow as your skills and experience increase in the finance industry.

CFA Exam Eligibility Requirements

Apart from academic requirements, there are some important CFA exam eligibility requirements.

Key requirements:

- Valid international passport.

- Payment of CFA course fees and exam fees.

- Professional conduct declaration.

- English proficiency.

- Agreement to CFA Institute policies.

These apply globally, including CFA exam eligibility in India.

Also Read: Everything you need to know about the CFA course in Bangalore, coaching options, and career scope.

CFA Scholarship Eligibility

The CFA Institute offers scholarships to reduce exam fees.

| Scholarship | Benefit |

| Access scholarship | Reduced registration fee |

| Student scholarship | For affiliated colleges |

| Women scholarship | Encourages female candidates |

Eligibility depends on financial need and application approval.

Did you know?

Students and professionals with financial need or those enrolled in affiliated institutions may apply for CFA scholarships offered by the CFA Institute to reduce exam fees.

Common Myths About CFA Eligibility

When it comes to CFA eligibility, there’s a lot of confusion floating around. Many students and even working professionals delay starting the CFA program simply because they’re unsure whether they qualify. Some assume the course is only for commerce students, others believe they need years of work experience, and a few think there’s an age limit to even begin.

The table below shows some common myths and the reality about CFA eligibility:

| Myth | What People Think | Reality |

| Only commerce students can do CFA | CFA is only for BCom or finance background students | Any graduate can pursue CFA. Students from engineering, arts, science, or management backgrounds are equally eligible. |

| You need strong maths expertise | Advanced mathematics is required to clear the CFA | Basic maths and analytical skills are enough. The focus is more on finance concepts and interpretation than on complex calculations. |

| There is an age limit for CFA | You must be within a certain age to apply | There is no official CFA eligibility age restriction. Candidates usually start during or after graduation, but professionals can start anytime. |

| Work experience is compulsory before starting | You must work in finance before registering | You can start in your final year of graduation. Work experience is required only later to become a CFA charterholder, not to begin exams. |

You can start in your final year of graduation. Work experience is required only later to become a CFA charterholder, not to begin exams.

As you progress in the field, the qualification can open doors to high-growth roles and understanding the CFA salary in India across experience levels can give you a clearer picture of the long-term career potential.

There are plenty of misconceptions around the CFA exam – from difficulty level to eligibility and career outcomes. This quick video breaks down some of the most common myths and gives a clearer picture of what pursuing CFA actually looks like.

CFA Eligibility vs Other Finance Courses

Understanding how CFA eligibility and CFA course duration compare with other finance courses can help you choose the path that fits your timeline, career goals, and current qualifications. One of the biggest deciding factors is always eligibility – when you can start and what requirements you need to meet.

Compared to many other finance qualifications, the CFA program is known for being relatively flexible.

| Course | When Can You Start | Eligibility | Focus | Duration |

| CFA | Final year of graduation or after | Graduation (any stream) /final year | Investment banking, portfolio management and financial analysis | 2-4 years |

| CA | After class 12 | Commerce preferred (any stream allowed) + multiple exam levels | Accounting, taxation and audit | 4-5 years |

| MBA Finance | After graduation | Bachelor’s degree + entrance exams (CAT/XAT, etc.) | Management & corporate finance | 2 years |

| FRM | After graduation (or during) | No strict stream requirement | Risk management and banking risk roles | 1-2 years |

Also Read: CFA benefits and career advantages every finance aspirant should know.

Why Choose Imarticus Learning for Your CFA Journey

Meeting the CFA eligibility criteria is one thing. Actually, clearing all three levels of the CFA program is where things get real. The syllabus feels bigger than expected. This is exactly where many CFA aspirants start feeling stuck.

Some lose consistency after the initial motivation fades. Others keep studying, but without a clear strategy, unsure if they’re even preparing the right way. Many realise later that passing CFA isn’t just about putting in long hours – it’s about studying with the right approach and guidance.

That’s where the right support system can genuinely change the experience. What makes Imarticus stand out:

- Structured CFA preparation roadmap – Clear weekly study plan so you always know what to study next.

- Complex concepts explained simply – Some finance topics can feel dense at first. Good faculty break them down patiently, connect them to real examples, and make sure you actually understand what you’re studying – not just memorise it.

- Industry-aligned teaching – Mock tests and regular assessments help you see where you stand. Over time, this builds confidence and reduces exam-day stress because you know what to expect.

- Experienced finance faculty – You’re learning from mentors who understand both the CFA exam and the finance industry.

- Doubt-solving support – Everyone gets stuck sometimes. Having someone to ask, clarify concepts with, and guide you forward makes preparation feel far less overwhelming – and much less lonely.

- Placement assistance – Students receive guidance not only for exams but also for building strong finance careers after the CFA.

Clearing CFA is important, but what comes after matters just as much. Students also get direction on finance roles and career paths once they complete the program. For many students, having a clear plan and expert support is what turns CFA from something overwhelming into something achievable.

FAQs on CFA Eligibility

Here are some of the most frequently asked questions about CFA eligibility that can help you decide when and how to begin. Whether you’re a student, graduate, or working professional, understanding these basics can help you plan your next step with more clarity and confidence.

What are the eligibility criteria for CFA?

To pursue CFA, you need to be either in the final year of your graduation, a graduate, or have relevant work experience. You’ll also need to hold a valid international passport and must agree to the CFA Institute’s professional conduct guidelines.

Can I do CFA after graduation?

Yes, absolutely. In fact, many students start CFA right after graduation. Whether your degree is in commerce, engineering, arts, or management, you can pursue CFA if you’re interested in building a finance career.

Can final-year students apply for CFA?

Yes. Final-year undergraduate students can register for CFA Level 1 and begin their preparation even before completing graduation. Many students manage their college and CFA preparation by enrolling in top institutes like Imarticus Learning.

Is there an age limit for CFA?

There is no official minimum or maximum age limit for CFA eligibility. Most candidates start during or after graduation, but working professionals can begin at any stage of their career.

Do I need work experience to start CFA?

Work experience is not required to start the CFA program. You can begin as a student or graduate. Many engineers, economists, and MBA graduates pursue CFA to move into finance roles. However, work experience will be needed later to obtain the CFA charter after clearing all levels.

Can CA or MBA students pursue CFA?

Yes. Many CA and MBA students pursue CFA to move beyond traditional accounting or management roles into specialised, high-growth areas of finance and build careers in investment banking, equity research, portfolio management, and global finance roles.

How long does it take to complete CFA?

On average, students take about 2.5 to 4 years to complete all three levels, depending on their preparation pace and exam schedule.

When is the best time to start CFA?

The best time to start CFA is during your final year of graduation or soon after completing your degree. Starting early helps you complete the program sooner and move ahead faster in your finance career.

Here’s What Your CFA Eligibility Means for Your Career

Understanding your CFA eligibility is just the starting point. If you’re eligible, you’re already closer to a global finance career than you think.

The CFA program opens doors to investment banking, equity research, portfolio management, corporate finance, and global finance roles. But eligibility alone doesn’t build a career. Consistent preparation, right guidance, and a clear plan definitely do.

If you meet the CFA eligibility criteria, the smartest move is simple: start early, stay consistent, and build expertise step by step.

If you’re eligible today, the best time to start CFA isn’t next year. It’s now. Because in finance careers, the earlier you start, the faster you grow. Take your first step and enrol in the CFA Course to kickstart your career.