I meet many learners who want a clear view of the ACCA salary in UK because it guides their choices. The most practical way to understand this topic is to look at fresh data, live job patterns, location impact and long-term salary movement. When people have the right salary picture, they can plan their exams, city preferences, roles and even their work style in a better way.

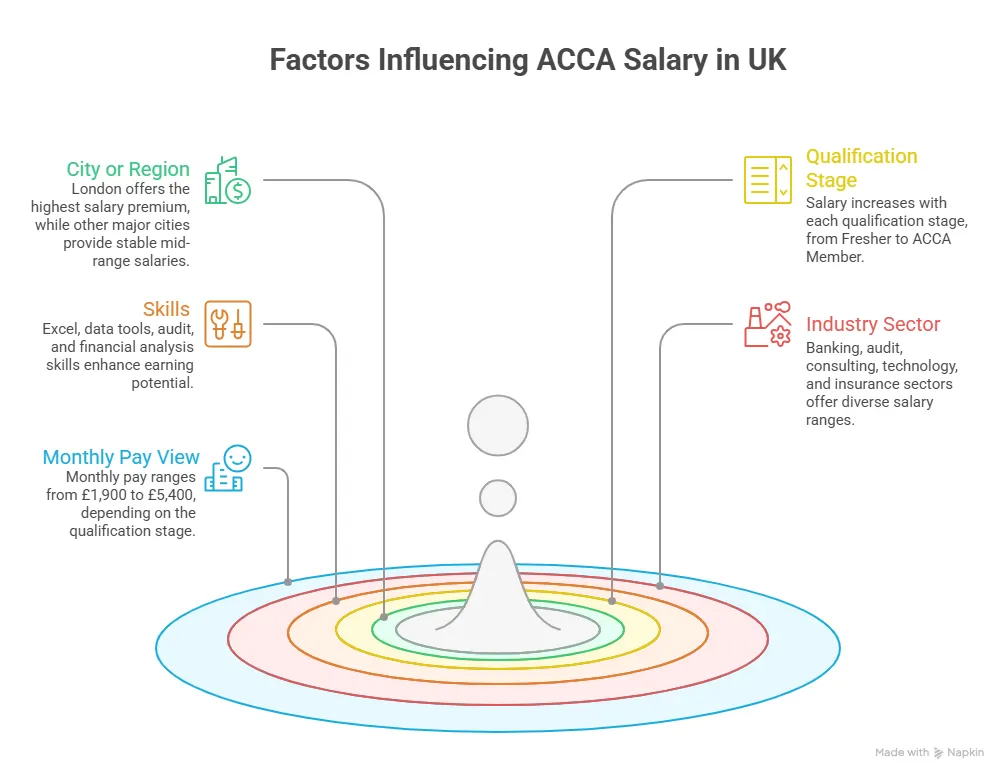

The ACCA salary in UK is shaped by skills, job demand and the way the financial industry evolves. When firms hire, they check your progress in the qualification, the way you use digital tools and the clarity you bring to financial judgment.

If someone wants to understand the average salary of ACCA in UK, I start by showing the range for freshers and then build it up to the level of an ACCA member. The moment you see the journey as a ladder, the numbers make sense. Monthly pay also plays a big role in planning. So the salary for the ACCA certification is not a minor detail. It affects housing, travel, savings and even the way people schedule their exams.

I will break down these details step by step in this blog and take you deeper into city salaries, monthly pay tables, ACCA qualified salary in UK, and more advanced pathways that shape your growth.

Why the ACCA Qualification Matters When Discussing Pay

To make sense of the ACCA salary in the UK, you first need a simple picture of what is ACCA and why it holds so much importance in finance roles. ACCA trains you in accounting, audit, tax and financial insight. These skills match the work that UK companies expect from their teams. As you move through the qualification, your understanding becomes deeper, and this affects your role and salary. This link between learning and earning is why the ACCA makes such a strong impact on pay growth across the UK. Here is an overview of the ACCA framework and the kind of skills it builds over time.

Snapshot of Current Salary Trends for ACCA Jobs in the UK

I’ll start with a quick set of data points that show how strong the demand looks right now. These include figures reported by the UK Office for National Statistics and major salary guides like the ones from Reed and Hays.

| Aspect | Current Trend in the UK Job Market | What This Means for ACCA Candidates |

| Finance Job Openings | Over 180,000 new finance roles added in the past year | Strong and sustained hiring demand across accounting and finance |

| Entry-Level Hiring | Consistent rise in junior and trainee finance roles | Positive impact on ACCA fresher salary in UK and role availability |

| Role Design | Increase in hybrid roles combining reporting, analysis and tech tools | Faster skill development and quicker salary progression |

| Skill Demand | High demand for financial modelling, audit analytics and compliance automation | ACCA candidates with these skills see better salary movement |

| Qualification Value | Employers link ACCA progress with responsibility and pay bands | Clear salary growth as exam stages are completed |

| Salary Movement | Steady upward trend across entry and mid-level roles | More predictable growth in the average salary for ACCA in UK |

The numbers show a stable rise in entry roles, which will help you establish how ACCA can propel your career. This affects the ACCA fresher salary in UK in a positive way. Freshers are not locked into one type of job. Many firms open hybrid roles that mix reporting, analysis and tech-enabled finance tasks. These roles are simple to grow in, and the pay scales move faster as your exam progress improves.

The average salary for ACCA in UK rises even more once people pick up skills in financial modelling, audit analytics and compliance automation. These skills sound very technical, but most ACCA students get trained in them as part of their progress. When you combine these skills with the ACCA papers, the salary outcomes change.

Salary Stages Across the ACCA Journey

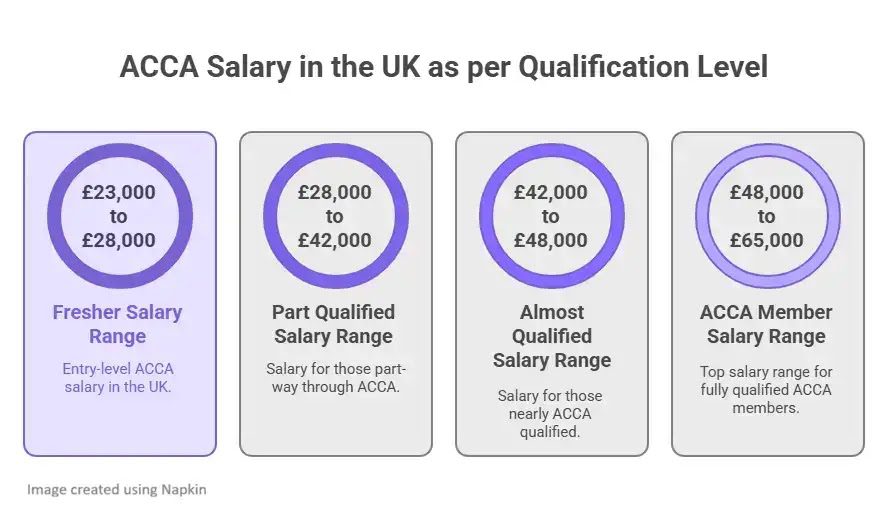

When firms hire ACAs or ACCAs, they use a stage-wise salary idea. They classify you as a fresher, part-qualified or fully qualified. These stages decide the early years of your career. I have always felt that the early stage breakdown gives the clearest idea of the ACCA starting salary in UK and the later earning potential.

The table below shows the way UK employers usually map the journey to ACCA salary ranges. These ranges change by city, sector and your exam progress, but this table gives you a solid benchmark. All figures are annual before tax.

ACCA Salary Progression Table

| Stage | Typical Role | Annual Salary Range | Notes |

| Fresher | Junior Accounts Assistant | £23,000 to £28,000 | Ideal for someone starting with 0 to 1 year of experience. |

| Early-Part Qualified | Finance Assistant or Audit Trainee | £28,000 to £34,000 | Range rises as you clear 2 to 5 papers. |

| Mid-Part Qualified | Assistant Accountant or Analyst | £34,000 to £42,000 | Firms raise the range once you cross the halfway mark of the papers. |

| Almost Qualified | Senior Analyst or Audit Senior | £42,000 to £48,000 | This is when employers see you as a strong contributor. |

| Fully Qualified | ACCA Member | £48,000 to £65,000 | The sector plays a big role at this stage. |

| Post Qualification 3 to 5 Years | Finance Manager or Senior Auditor | £65,000 to £80,000 | Growth is influenced by technical skills and team responsibility. |

| Experienced Member | Senior Finance Manager or Controller | £80,000 to £110,000 | Stable level for long-term roles. |

(Source: Robert Half, Morgan McKinley)

The above ranges help you understand how, after the ACCA training, a qualified salary in UK takes shape. When the stages are shown clearly, the Salary of an ACCA in UK gives a much clearer idea.

Monthly ACCA Salary in UK

Salary planning feels more real when we break yearly pay into monthly figures. The ACCA salary in UK per month makes the cost of living calculations simple. Housing, travel cards, utilities and food budgets all become more predictable with monthly pay.

The table below helps you see what monthly pay looks like for different ACCA stages, which can serve as a cornerstone for unlocking your career potential with ACCA. I have used approximate annual salary data to help you visualise how much reaches your bank before tax.

Monthly Salary View

| Stage | Annual Salary | Monthly Pay Estimate |

| Fresher | £23,000 to £28,000 | £1,900 to £2,330 |

| Early-Part Qualified | £28,000 to £34,000 | £2,330 to £2,830 |

| Mid-Part Qualified | £34,000 to £42,000 | £2,830 to £3,500 |

| Almost Qualified | £42,000 to £48,000 | £3,500 to £4,000 |

| Fully Qualified | £48,000 to £65,000 | £4,000 to £5,400 |

These numbers make the ACCA average salary in UK easier to understand for people planning visas or budgeting their early life in the country.

Converting the ACCA Salary in UK into Rupees

I notice many learners find assurance in converting salaries to INR. It helps them visualise the value. If you take an average ACCA salary in UK of about £45,000 and use a simple conversion rate of 1 GBP to ₹105, you get an approximate yearly value close to ₹47 lakh.

Did you know?

If someone earns £50,000 in London, the INR value can cross 52 lakh INR depending on the exchange rates. This is why the ACCA salary in UK in Rupees is one of the most searched terms among Indian students.

Now, imagine two people.

One person starts as a Junior Accounts Assistant in Manchester. This person earns around £24,000. The work involves posting entries, supporting month end and checking invoices. It is simple work, and most people learn quickly.

Another person starts as an Audit Trainee in Birmingham with a salary of about £30,000. This role needs field visits, support for audit files and simple testing of financial data. It is a busy job, but it builds confidence fast.

Both roles show how the ACCA salary in UK takes shape at the very start of a career. Even though the cities, pay levels and daily tasks are different, each role offers a solid entry point into finance. As the ACCA exam progresses and experience grows, these early starting points begin to converge into stronger roles, wider options and higher earning potential across the UK finance landscape.

Exploring the ACCA Salary in London

London has always been a special case. The variety of accounting and finance roles is larger than in any other UK city. New roles open daily in audit, tax, FP&A, treasury, internal controls and ESG reporting. These roles push the ACCA Salary in London into higher brackets when compared to many other cities.

In the table below, I show typical salary observations for some common ACCA-linked roles in London.

London Salary Table

| Role | Typical Range | Notes |

| Junior Accountant | £28,000 to £33,000 | Strong entry bracket due to higher job density. |

| Audit Associate | £32,000 to £40,000 | Fast growth for good performers. |

| Assistant Management Accountant | £35,000 to £45,000 | Firms expect solid Excel and reporting skills. |

| Financial Analyst | £40,000 to £52,000 | Salaries rise with system knowledge and modelling skills. |

| ACCA Member Roles | £52,000 to £75,000 | Banks and consulting firms increase the upper range. |

These ranges make it easier to understand why many people choose London, even if the living costs are higher. The talent exposure is large, and the chance to gain experience in complex work is high. For someone focused on a long career, this exposure often balances the expenses. A visual snapshot showing how the ACCA salary in UK progresses as candidates move through different qualification levels.

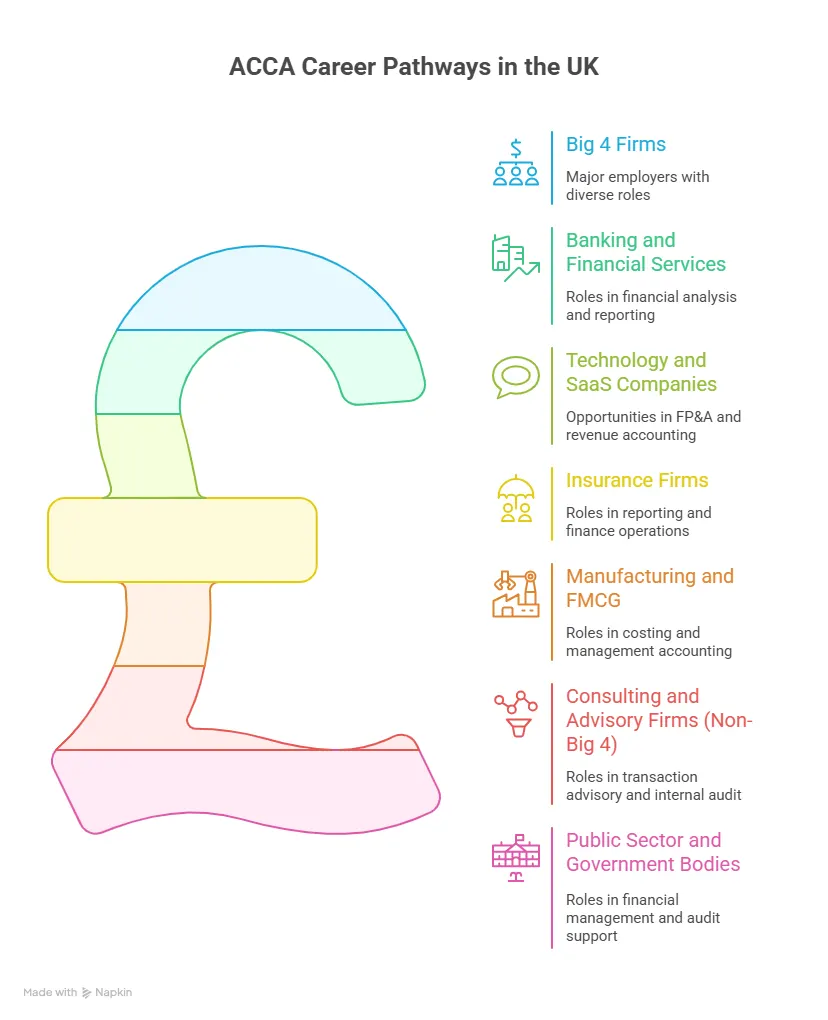

Industry Segments That Influence the ACCA Salary in UK

Across the UK, industry sectors shape salary ranges for finance roles. Some sectors pay for speed and analysis. Others pay for precision and control. When I break down the Salary of an ACCA in UK across sectors, I see clear patterns. The list below shows how different sectors behave in terms of salary and ACCA jobs growth.

Overview of Sectors

- Banking: Banks offer high exposure to reporting, credit review and regulatory work. Salaries for part-qualified professionals rise fast when they gain experience with financial regulations.

- Consulting and Advisory: These firms value both analysis skills and communication. Salaries rise with client handling experience.

- Audit and Assurance: Audit firms value progress in exam papers. Salaries increase with each stage of completion and project responsibility.

- Technology and SaaS: Tech firms hire ACCA-trained professionals for FP&A and revenue accounting. Salaries depend on system knowledge.

- Insurance: Insurance companies offer stable growth. Roles involve reporting, actuarial support and compliance tasks.

- Manufacturing and Retail: These roles bring broad exposure to budgeting, costing and supply chain finance. Salaries increase with operational insight.

When you compare these sectors, you understand how the average salary for ACCA in UK and ACCA career journeys take shape across roles. Every sector has its own pace of salary growth, so your choice depends on long-term comfort with the work style.

How ACCA Salary in UK Ties To Skills That Employers Seek

Salary is not only about job titles. It rises with your ACCA skills that support financial judgment. When I look at the ACCA in UK salary pattern, I notice that employers reward skills linked to digital finance and structured thinking.The list below shows skills that influence salaries across stages.

Skills With Strong Impact

- Data interpretation skills

- Ability to link numbers to business actions

- Command over Excel, Power BI or Tableau

- Financial modelling awareness

- Understanding of audit workflows

- Clear reporting style

- Focus on accuracy and timely delivery

- Ability to work across departments

These skills help you reach higher salary tiers at every stage. They also help you move into specialist or managerial roles earlier. A quick look at how you can translate your technical skills into clear answers during Big 4 interview conversations:

How Salary Growth Feels Over a Five-Year Cycle

Many people ask me how salary growth feels when seen over a longer time frame. I find that a five-year view gives a fair picture. The table below shows a simple example of how someone might grow in five years. These numbers represent typical ranges based on patterns from job portals and salary guides.

Five-Year Growth View

| Year | Typical Stage | Annual Salary |

| Year 1 | Fresher | £24,000 to £27,000 |

| Year 2 | Early Part Qualified | £28,000 to £34,000 |

| Year 3 | Mid Part Qualified | £35,000 to £42,000 |

| Year 4 | Almost Qualified | £42,000 to £48,000 |

| Year 5 | ACCA Member | £50,000 to £65,000 |

This pattern helps explain the ACCA salary in UK in a realistic way. Every year brings a visible gain when skills and exam progress move together.

How Future Trends Shape the ACCA Salary in UK

Salary patterns do not stay still. They evolve with technology, new rules, global events and the speed of business activity. When I study projections for the ACCA salary in UK, I look at how firms invest in digital systems, how reporting standards change and how global market conditions shift. These elements shape long-term salary growth for finance roles.

Every year, automation speeds up many tasks, which increases the value of professionals who can interpret numbers, analyse trends and support decisions. This is one reason ACCA roles hold strong footing in many companies.

The growing focus on sustainability reporting also affects salary ranges. Firms now ask for professionals who understand ESG data and can link it with finance. This new space gives many ACCA learners a chance to enter roles that did not even exist a few years ago. In the next few years, I expect more firms to widen their audit and compliance teams. This will strengthen the ACCA fresher salary in UK because hiring pools will expand.

How Technology Roles Boost Salary Potential

Technology is at the core of modern finance jobs. Tools like Power BI, Python basics, cloud accounting platforms and business intelligence systems influence salary ranges at every stage. When these skills combine with ACCA training, your prospect for salary growth increases because employers value people who can explain both numbers and patterns.

This is true even for early roles. A fresher who understands data visualisation can stand out in interviews. A part-qualified candidate who knows how to automate simple checks in Excel or Google Sheets can move ahead faster. These small skill gains help build confidence and raise your earning potential.

I often tell learners to focus on clear thinking. When your thought process is structured, your tools support you better. When thinking is organised, work becomes easier to follow for others, and this is one of the signals employers rely on when setting the starting salary of ACCA in UK hires and trusting them with core tasks. A simple walkthrough of ACCA study resources that help learners organise their preparation and strengthen core concepts.

How International Mobility Connects To Salary Growth

One unique advantage of the ACCA route is the ability to work in 180+ countries. The UK often acts as a gateway for global mobility. Once someone gains a few years of UK experience, many firms open roles in Europe, the Middle East and Asia. This global mobility expands your reach and makes your profile stronger. It also increases your earning potential because international exposure builds confidence and depth of judgement.

What Makes the ACCA Journey Easier to Navigate With Imarticus Learning

For students planning to build an international finance career, especially those looking toward roles that influence the ACCA salary in UK, the way the ACCA course is taught and supported matters just as much as the qualification itself. Imarticus Learning brings together a few elements that many overseas learners find reassuring and practical.

- ACCA-approved learning structure with Kaplan study resources, including textbooks, question banks, mock exams and practice support, so learners prepare using material aligned with global ACCA standards rather than fragmented sources.

- Case-based learning was developed with KPMG, helping students understand how accounting concepts are applied in real business and audit environments, which is especially useful for those unfamiliar with UK-style professional settings.

- Opportunity for internship exposure with KPMG in India for eligible learners, offering early insight into how global firms operate and how professional expectations are set in large accounting networks.

- Live webinars and sessions led by industry professionals, allowing learners to stay connected with current finance and accounting practices, even when studying from outside the UK.

- Structured exam preparation approach, designed to help students manage ACCA papers alongside academic schedules or work commitments, which is often a concern for international candidates.

- A money-back assurance linked to exam outcomes, providing an added layer of confidence for students investing in long-term professional education away from home.

- Support ecosystem built for globally mobile learners, making it easier for students to transition from study to professional roles without feeling disconnected from industry expectations.

For many foreign students, this combination of structured learning, practical exposure and exam-aligned resources reduces uncertainty and helps them stay focused on building a career that can eventually align with opportunities in markets like the UK.

FAQs About the ACCA Salary in UK

This section answers the most frequently asked questions people have about the ACCA salary in UK, covering earning potential at different stages, job demand, global opportunities and how the qualification fits into long-term career planning.

Which country pays the ACCA’s highest salary?

The ACCA salary in UK is strong, but the highest pay for ACCA professionals often comes from regions where financial and advisory services grow at a rapid pace. Countries in the Middle East, such as the UAE and Qatar, report high earning potential due to tax-free income and large project-based roles. Singapore also offers high packages for finance specialists.

What is the salary of an ACCA in the USA?

The ACCA salary in UK is structured in stages, but the USA uses a slightly different pattern due to local licensing rules. Even so, ACCA professionals working in roles such as audit support, reporting analysis or FP&A in the USA can earn competitive ranges that start near $55,000 and rise above $90,000 as experience grows.

Is ACCA in demand in the UK?

The ACCA salary in UK continues to rise because demand stays strong across audit, compliance, reporting, banking and tech finance roles. The UK has a consistent hiring cycle for ACCA-trained professionals because companies need people who understand reporting frameworks and can support digital finance tasks. Many learners also join Imarticus Learning because structured training increases their confidence before entering the job market.

What is the first salary of ACCA?

The first part of the ACCA salary in UK usually sits between £23,000 and £28,000 for freshers. This range applies to roles such as Junior Accounts Assistant or Audit Trainee. The exact number changes by city and skill set. When freshers show strong Excel skills or a clear understanding of accounting basics, the salary often moves toward the upper end of the range.

Can I finish ACCA in 2 years?

Many learners want to complete the qualification quickly because the ACCA salary in UK increases with exam progress. It is possible to complete the papers within two years if you follow a structured learning plan, stay consistent and prepare for each session with focus. Candidates also choose training support from Imarticus Learning to build steady study rhythms.

Is ACCA a government job?

The ACCA salary in UK applies to private, public and non-profit sectors, but ACCA is not a government job in itself. It is a professional qualification that prepares you for finance roles in many types of organisations. Some government departments in the UK do hire ACCA professionals for budgeting, reporting or audit-related work. These roles follow public sector pay structures.

What is the salary of an ACCA in the UK in Indian rupees?

Many learners check the ACCA salary in UK in Rupees to understand the real-world value. If someone earns around £45,000 a year, the conversion at an exchange rate of 1 GBP to ₹105 creates a value close to ₹47 lakh. If the salary rises to £55,000 in cities like London, the value goes beyond ₹57 lakh. These conversions help students and working professionals plan their future before moving to the UK.

Which country is best for a job after ACCA?

Many people begin their journey wth ACCA because the UK offers a clear structure and steady growth. After gaining experience there, professionals often explore roles in the Middle East, Singapore, Canada or Australia. These countries offer strong finance ecosystems and value international exposure. The best country depends on your long-term goals and the type of work you enjoy.

Shaping Your Next Step With Confidence

As you look at the many parts that shape the ACCA salary in UK, one thing becomes clear. Every stage of this path gives you something valuable. Your early steps build confidence. Your mid stages build skill. Your qualified stages build perspective and open doors. The numbers show steady progress, but the real change lies in how you grow as a professional with each passing year.

The UK job market has space for people who think with clarity and work with focus. That is why ACCA training feels like a strong foundation. When you understand how salaries move across cities, industries and experience levels, you can plan your next step with ease. You also get a clearer sense of how your work fits into the larger world of finance.

If you are preparing for the ACCA journey, a structured path can help you stay consistent. With guided support from Imarticus Learning for your ACCA course prep, you get steady preparation that builds confidence for each exam stage.

Your ACCA path can take many directions. No matter which one you choose, a clear plan and a calm pace can take you where you want to go.