The ACCA Exam is one of the most widely respected gateways to global finance careers. Students do not only see it as another certification. They treat it as a personal milestone that shapes the next decade of their professional journey. When you speak to learners who cracked the final stage on their second or third attempt, they often say the ACCA taught them a way of thinking rather than a set of rules. That is the energy we carry into this guide.

In this article, I will help you to understand how the ACCA Exam works, how the sessions are structured, how the exam dates are set throughout the year, and how the entire study journey can be simplified with the right approach.

The goal is to give you clarity through relatable examples, tables, practical tools, mock exam strategies, and section-wise breakdowns. Every insight comes from hands-on mentoring experience and feedback shared by hundreds of learners. Use this as a long-form guide that grows with you during your ACCA preparation.

What is ACCA Exam?

Understanding what is ACCA becomes far easier when you look at it as a global framework that prepares you for modern finance roles instead of a traditional accounting qualification. ACCA stands for the Association of Chartered Certified Accountants.

It is an international professional body that builds talent for financial reporting, analysis, risk, audit, governance and strategic decision making. The organisation has existed for more than a century and has members who work in over 180 countries.

Students join ACCA because the qualification covers three learning zones. Technical accounting. Digital era business thinking. Applied strategic judgment. These three areas equip professionals to work with multinational companies, global audit practices, fintech firms, investment teams and consulting groups. The ACCA Certificate is recognised across continents, which removes barriers for learners who aspire to cross-country careers.

Once a learner registers for the qualification, the next step is to face the exam pathway. The ACCA Exam is a structured assessment series that checks how well you understand financial concepts, regulations, business environments and real-world scenarios. The pathway contains 13 exams placed across three levels. Each level builds a different part of your professional foundation.

This table shows the connection between the ACCA course itself and the exam structure that brings you closer to membership.

| Component | What it Represents | Why it Matters |

| ACCA Qualification | A global certification for accounting, audit and finance careers | Offers international recognition and cross-border opportunities |

| ACCA Exam Pathway | 13 papers divided into 3 levels | Tests the technical, analytical and strategic skills needed in global finance |

| ACCA Membership | Final status after exams, ethics module and experience | Gives professional identity and industry-wide credibility |

Why employers care

Recruiters in finance teams see ACCA employability because the exam focuses on global compliance, IFRS mastery, strategic thinking and digital era decision making. From my personal mentorship experience, the ACCA Exam bends your mind toward analytical thinking rather than mechanical calculations. This is why candidates who complete all 13 papers find roles across fintech, IB, audit, consulting and even CFO tracks over time.

Here is a video that explains ACCA in greater detail and how the exam prepares you for global finance roles:

Complete ACCA Exams List

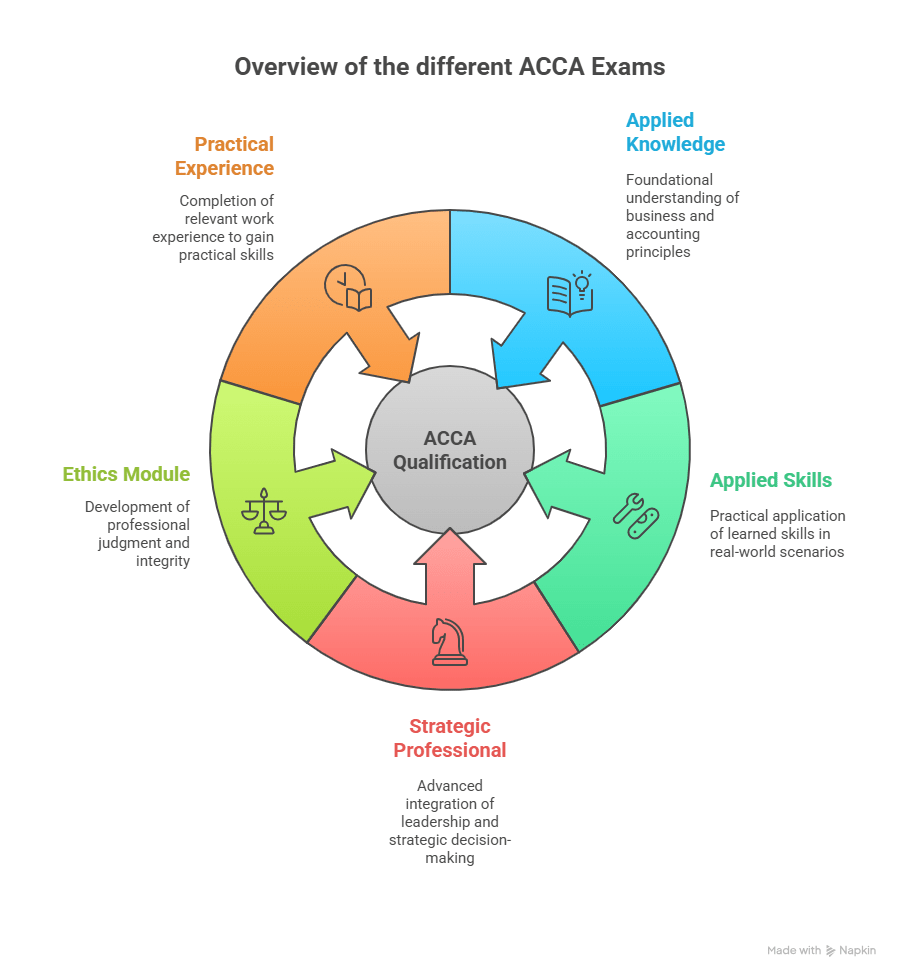

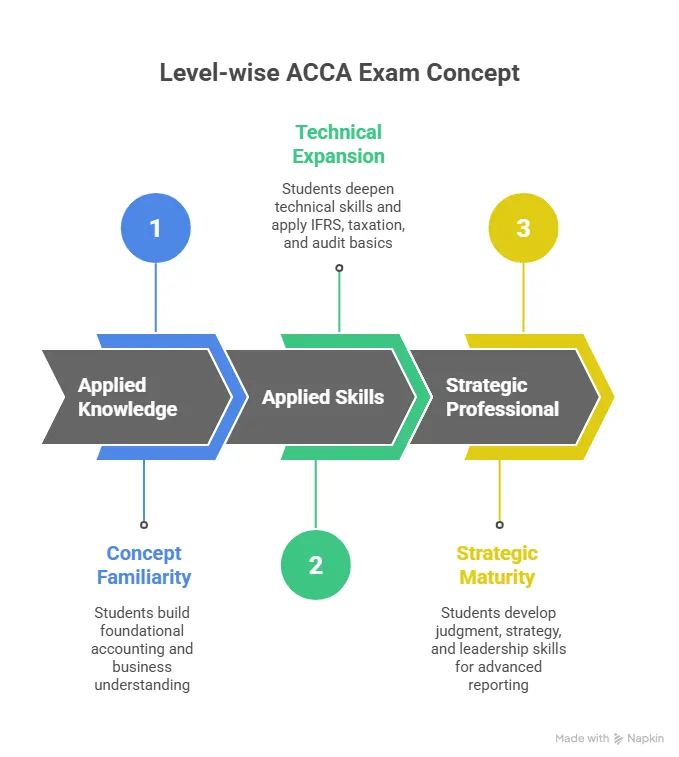

The ACCA Exam pathway is divided into three stages. Applied Knowledge. Applied Skills. Strategic Professional. Each stage builds a different layer of your finance capability.

This table summarises the exam framework before I break down each level with greater depth.

| Level | Purpose | Number of Papers | Exam Format |

| Applied Knowledge | Build a conceptual base | 3 papers | Computer-based on demand |

| Applied Skills | Strengthen technical and analytical ability | 6 papers | Session-based exams |

| Strategic Professional | Train leadership and advanced judgment | 4 papers (2 compulsory plus 2 optional) | Session-based exams |

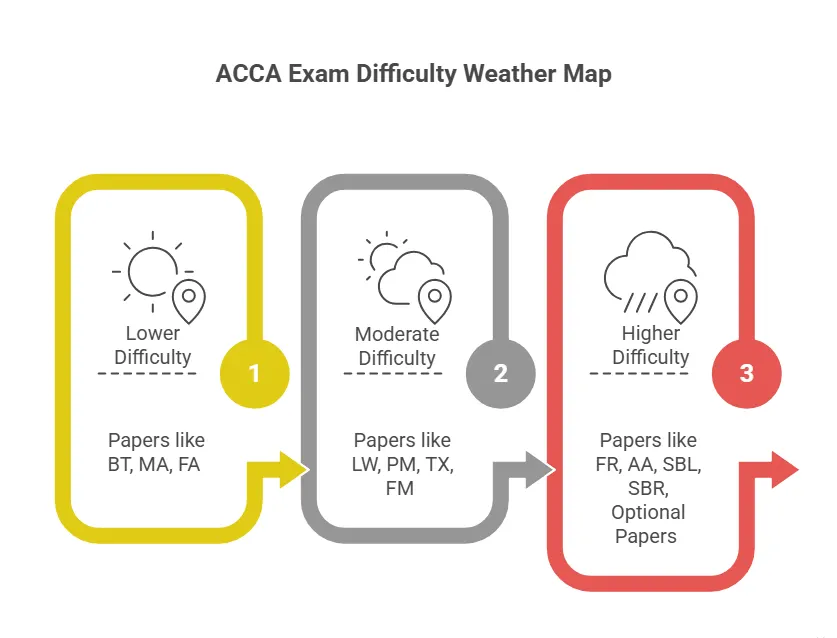

This structure provides a smooth learning progression for the exams. No matter which background you come from, the qualification slowly upgrades your thinking so you can handle real-world finance scenarios with clarity. The following visual helps you understand the concept and skills that the various ACCA levels prepare you for:

- Applied Knowledge Level

The Applied Knowledge level introduces the essential foundations of accounting, business, and finance. These are the building blocks you will apply repeatedly in later papers.

Purpose of Level 1

- Build fundamental business vocabulary.

- Learn accounting basics clearly.

- Understand organisational structure and processes.

- Develop early confidence with computer-based exams.

Papers in Level 1

This table explains what each Applied Knowledge paper contributes.

| Paper | Full Name | Focus Area |

| BT | Business and Technology | Business structures, corporate governance, people and systems |

| MA | Management Accounting | Costing, budgeting, planning and performance concepts |

| FA | Financial Accounting | Recording transactions, preparing financial statements and core reporting logic |

These exams are designed to be friendly for beginners. Even students without a commerce background can pick up the pace because the content is structured logically.

- Applied Skills Level

This level forms the technical heart of the ACCA Exam. The papers here reflect the responsibilities that entry-level and mid-level finance professionals handle in companies.

Purpose of Level 2

- Push your technical reasoning.

- Strengthen IFRS interpretation.

- Build analytical thinking for management decisions.

- Introduce law, taxation and audit with practical relevance.

Papers in Level 2

This table offers a detailed view of each Applied Skills paper so students can understand what to expect.

| Paper | Full Name | Focus Area |

| LW | Corporate and Business Law | Legal environment, contract law, company law and regulatory frameworks |

| PM | Performance Management | Costing techniques, variance analysis, decision support and performance evaluation |

| TX | Taxation | Direct and indirect tax systems and computation logic |

| FR | Financial Reporting | IFRS-based reporting, adjustments and interpretation of financial statements |

| AA | Audit and Assurance | Audit process, risk assessment and assurance principles |

| FM | Financial Management | Investment appraisal, working capital management, risk and return fundamentals |

This level introduces deeper problem-solving. Students begin to think like analysts, auditors, managers and reporting specialists. The ACCA Exam starts becoming more scenario-oriented here.

- Strategic Professional Level

This is the final stage of your exam journey. The papers here resemble real corporate challenges. You will think like a business leader, risk evaluator, financial reporter and strategic planner.

Purpose of Level 3

- Build advanced professional judgment.

- Combine ethical thinking with strategic options.

- Interpret financial statements with high-level accuracy.

- Analyse business scenarios in a leadership context.

Papers in Level 3

This table breaks down the Strategic Professional papers.

| Category | Paper | Full Name | Focus Area |

| Essentials | SBL | Strategic Business Leader | Business leadership, governance, strategy and integrated decision making |

| SBR | Strategic Business Reporting | Advanced IFRS application, complex reporting issues and professional judgment | |

| Options | AFM | Advanced Financial Management | Complex financial management decisions and valuation |

| APM | Advanced Performance Management | Advanced performance evaluation and strategic analysis | |

| ATX | Advanced Taxation | High-level tax planning and advisory competencies | |

| AAA | Advanced Audit and Assurance | Complex audit scenarios and advanced assurance techniques |

Students choose two optional papers to unlock their ACCA career potential based on their goals. For finance roles, AFM is highly useful. For audit roles, AAA is valuable. For managerial paths, APM becomes a strong choice.

How the ACCA Exam Booking Process Works Step by Step

The ACCA Exam Booking process often confuses students when they attempt it for the first time. The booking window for each session opens on specific dates, which vary by season. The student must register on the myACCA portal, select the relevant exam session, choose the exam mode and confirm their payment method. Many candidates delay booking until the final week, which increases stress. A structured approach works better.

This list simplifies the entire exam booking flow that students follow on the myACCA portal.

- Create your myACCA account.

- Complete identity verification and initial registration.

- Log in and navigate to the Exam Entry section.

- Choose your exam session.

- Select specific papers from the exams list.

- Confirm location or remote mode.

- Review fee details.

- Complete payment.

- Receive confirmation email.

- Save your invoice for official records.

Students who follow this structure do not run into unexpected issues. It is also sensible to complete your exam Booking step at least 20 to 25 days before the deadline because payment gateways sometimes lag during high traffic days.

Understanding the ACCA Exam Timetable and Yearly Cycle

The ACCA Exam timetable is set quarterly. March. June. September. December. These four points in the calendar create a predictable rhythm for both working professionals and full-time students. The timetable is usually stable year after year.

For planning purposes, here is a simplified general layout. This table illustrates the typical ACCA Exam timetable pattern that appears every year. Use this model to estimate your study cycles. Actual dates vary slightly each year.

| Quarter | Typical Exam Window | Notes |

| March Session | Week 1 to Week 2 of March | Early-year attempts often attract fresh graduates |

| June Session | Week 1 to Week 2 of June | Popular among students balancing internships |

| September Session | Week 1 to Week 2 of September | Good window for retakes and skill building |

| December Session | Week 1 to Week 2 of December | Heavily booked by working professionals |

The ACCA Exam Dates for each session are published by the organisation on official announcements every year. Students should keep a calendar on their devices that includes the important dates, fee deadlines, and result release days. This habit alone improves exam readiness significantly because mental clarity reduces anxiety.

How ACCA Mock Exams Transform Exam Performance

ACCA mock exams are one of the strongest predictors of actual results. Students who attempt at least four full-length mocks per paper usually score higher. This pattern comes from my internal mentoring logs collected over many years. The logic is simple.

A mock replicates the mental fatigue and decision-making chain that a student faces during the real ACCA Exam. If the student completes enough mock exams, the brain develops familiarity with pressure.

→ Familiarity reduces cognitive friction, which boosts performance.

Here is a short list explaining how to use ACCA mock exams effectively.

- Attempt one diagnostic mock before starting deep study for the paper.

- Attempt two timed mocks after completing 60 per cent of the syllabus.

- Attempt one final full mock five days before exam day.

- Review answers line by line and prepare a small mistake log.

- Practice professional marks especially for SBL and SBR.

Professional marks account for a surprising portion of final grades in higher-level papers. Students should not neglect them. This video explains the detailed exam plan for students preparing for ACCA and gives key insights to sail smoothly on the journey:

Smart Planning for the ACCA Exam

The ACCA Exam requires a calm but strategic study schedule. Many students assume they must study for endless hours, but the real secret is to manage energy more than time. When planning, divide your timeline into three phases. Concept building. Problem practice. Examination conditioning.

Phase 1. Concept Building

Spend the first section of your timeline reading course notes, listening to faculty sessions, summarising chapters, solving basic questions and revisiting your summaries. Concept building is about expanding your working memory for key ideas like IFRS treatments, audit assertions, corporate law principles and costing logic.

Phase 2. Problem Practice

In this stage, tackle past papers, revision kits, numerical sheets and case study drills. Most students improve significantly when they time themselves for every question. The ACCA Exam rewards structured problem-solving. For instance, Performance Management often tests logic around variances rather than mechanical calculation. Financial Reporting tests the interpretation of adjustments. Audit papers test your ability to evaluate risk triggers. Practising questions builds these judgment skills.

Phase 3. Examination Conditioning

This is the phase that most competitors avoid explaining in depth. Examination conditioning means building your mental stamina for the ACCA Exam. You must recreate exam day conditions with strict timing, zero interruptions and a clear plan for reading questions. Students who complete this stage have a sharper edge than peers who rely solely on content memorisation.

How to Prepare Well for the ACCA Exam?

One of the most powerful yet underused methods for preparing for the exams is the creation of memory palaces and cognitive anchors. These tools help you recall frameworks within seconds. For example, in an audit, you can create a memory palace where each room represents a stage of the audit cycle.

In financial reporting, you can place IFRS adjustments at visual points in your report. This technique is widely recommended in cognitive science papers.

Students who design memory cues tend to retrieve concepts like impairment rules, tax calculations or risk evaluation methods faster during the exams. When a time-bound question appears, quick recall increases confidence.

- How to Read Questions Correctly During the ACCA Exam

Students often misread questions during the ACCA Exam because of anxiety or speed pressure. Reading the requirement carefully is half the battle.

For example:

→ In long case studies, students should read the final requirement lines first so they understand what the examiner is looking for.

→ In computational questions, reading the scenario twice prevents small mistakes.

Below is a checklist that reduces exam day errors. This checklist helps students approach the exam requirement lines correctly.

- Identify command words such as evaluate, explain, calculate and illustrate.

- Break the requirement into smaller parts.

- Match each part to a section of your answer.

- Highlight data points during reading.

- Allocate time proportionally to marks.

This technique ensures clarity during the exams.

B. Avoiding the Most Common Mistakes Students Make in ACCA Exam Preparation

Many students struggle with repeated issues which can be prevented with awareness. These challenges usually appear across papers. Here is a list of widespread mistakes encountered while preparing for the ACCA Exam.

- Over-reliance on passive reading instead of active practice.

- Neglecting professional marks in SBL and SBR.

- Avoiding mock exams due to fear of low scores.

- Studying without a timetable.

- Focusing on the wrong chapters because of advice from peers.

- Not tracking errors.

- Hoping for easy topics instead of building a deep understanding.

This exam rewards consistent effort rather than last-minute memorisation.

C. How to Select the Right Paper Combination Each Session

Students sometimes take too many papers at once during the ACCA Exam cycle. While ambitious attempts can work, it is often more productive to choose combinations that complement each other.

For example, combining Financial Reporting with Audit and Assurance creates a natural overlap because both share concepts around materiality, interpretation and controls.

Similarly, combining Performance Management with Financial Management helps reinforce internal logic around costing and investments.

Planning combinations smartly reduces the cognitive load on your brain. It also increases your chance of success with effective preparation strategies since your study time is better aligned.

Watch this video, which shares very practical and insightful strategies to help you ace those ACCA papers with precision:

Why choose Imarticus Learning for your ACCA journey

When you decide to take the ACCA Exam, the choice of institution matters a great deal. At Imarticus Learning, you’ll find a set of advantages built specifically to support success in the ACCA course preparation journey. Here are the main reasons:

- Industry-led programme in collaboration with KPMG

Imarticus Learning offers the ACCA programme in collaboration with KPMG in India. This directly supports your exam preparation by aligning your study with how large firms operate. - Joint certification plus ACCA qualification

Completing the programme not only prepares you for the exams. You also receive a joint certification (with KPMG in India), which enhances your profile. This extra credential gives you a competitive edge when applying for roles after your ACCA qualification. - Gold status learning partner of ACCA

Imarticus Learning is a gold-status learning partner of the Association of Chartered Certified Accountants, offering globally recognised ACCA training backed by expert faculty, high-quality content and strong support. - Kaplan-powered content and resources

The ACCA programme at Imarticus features study material developed in partnership with Kaplan Publishing, a leading ACCA-approved content provider. You gain access to books, question banks, practice papers, flashcards, videos and live classes. - Internship or placement guarantee

A distinctive USP: Imarticus offers an internship or placement guarantee. That means as soon as you start your preparation journey, you are supported not just in passing the exams, but also in transitioning into a career role. - Flexible mode of learning

For the ACCA, you need both flexibility and structure. Imarticus offers both online and offline classes, making it feasible for working professionals or full-time students alike. Their infrastructure supports the diversified needs of ACCA learners.

FAQs About the ACCA Exam

This section brings together the most frequently asked questions about the ACCA Exam. Each answer is written to simplify complex ideas, clarify misconceptions and guide learners with real insights.

What are ACCA exams?

The ACCA Exam consists of 13 professional papers that evaluate your readiness for global accounting and finance roles. Each paper tests a different area such as financial reporting, audit, taxation, corporate law and performance management.

Students progress through Applied Knowledge, Applied Skills and Strategic Professional levels. Many learners choose training support from Imarticus Learning because structured guidance often improves clarity during preparation.

Is ACCA better than CA?

Students often compare qualifications, although the better choice depends on personal goals. ACCA offers global mobility with a curriculum designed around international reporting standards, strategy and business readiness. This makes it valuable for students who want to explore multinational roles. On the other hand, the Chartered Accountant route focuses heavily on national laws and regulations.

What is an ACCA salary?

Salary ranges for learners who clear the exam vary based on country, industry and experience. Public reports shared by employment surveys show that fresh ACCA affiliates in India can expect salaries between 5 lakh and 8 lakh. Global salary data shared by industry sources indicates that candidates with three to five years of experience can earn significantly higher salaries depending on their role.

What are the 13 exams of ACCA?

The ACCA Exam contains 13 papers, which are divided into three levels. Applied Knowledge includes Business and Technology, Management Accounting and Financial Accounting. Applied Skills contains Corporate and Business Law, Performance Management, Taxation, Financial Reporting, Audit and Assurance and Financial Management. Strategic Professional includes Strategic Business Leader, Strategic Business Reporting and four optional advanced papers such as AFM, APM, AAA and ATX. Imarticus Learning helps learners navigate this entire structure with detailed study plans.

Can ACCA earn 1 crore?

Students who complete the ACCA often aim for senior positions in finance. Earning one crore annually is possible for professionals who reach leadership roles such as finance controllers, senior auditors, risk leaders or CFOs in large organisations. Global mobility also plays a role in salary growth. Many learners transition to international roles where compensation packages are higher.

Can I finish ACCA in 2 years?

Completing the ACCA Exam in two years is possible if a student maintains a highly disciplined study schedule. The exam sessions run quarterly, which allows motivated students to attempt multiple papers consistently. However, finishing all papers within two years requires clear planning, multiple mock exams and efficient time management.

Working professionals usually take a slightly longer timeline, but full-time learners with strong dedication complete the exams faster. Structured coaching support from Imarticus Learning can speed up the journey because guided study reduces trial and error.

Is ACCA hard or easy?

Many learners wonder whether the ACCA Exam is hard or easy. The difficulty depends on your study habits, understanding of concepts and consistency. The exam is designed to challenge your judgment and decision-making rather than your ability to memorise. Students who practice regularly, complete full mock exams and follow the exam timetable usually score well.

How many attempts for ACCA in a year?

You are allowed four attempts each year because the sessions are held in March, June, September and December. Students can choose to attempt one paper or multiple papers in each session, depending on their readiness. Preparing with mock exams and reviewing the exam timetable ensures that students pick their attempts wisely.

Is ACCA closing in 2026?

There is no public information or announcement that suggests the ACCA will close in 2026. The ACCA body continues to conduct exams globally and remains one of the largest accounting qualifications in the world. The ACCA adapts to global financial changes and updates its syllabus regularly to stay relevant. Students preparing now can confidently plan their journey across multiple sessions.

What is the 7-year rule in ACCA?

The 7-year rule applies only to the Strategic Professional level of the ACCA Exam. Once a student completes their first Strategic Professional paper, they must complete the remaining ones within seven years. This ensures that learners remain updated with evolving global financial standards. Imarticus Learning often guide students on how to plan their timeline effectively around this rule.

Moving Forward in Your ACCA Exam Journey

The ACCA Exam shapes your growth in a steady and meaningful way. As you move through the papers, your ability to analyse information, solve problems and make sound financial decisions becomes sharper. When you keep your study routine consistent and use mock exams to refine your approach, the entire qualification starts feeling more achievable.

Many learners find that clarity comes faster when their preparation is supported by dependable guidance. If you prefer studying in a structured environment with mentors who understand how the exam works, Imarticus Learning offers the direction and rhythm needed to stay on track for your ACCA course prep.