Last Updated on 2 months ago by Imarticus Learning

Most people type CMA Salary in USA into a search bar, expecting a number to settle the question in their head. What they usually find instead is a range so wide that it raises more doubts than it clears. Sixty thousand. One hundred thousand. One hundred and fifty thousand. All of them are correct. None of them is helpful on their own.

Salary, especially in the USA, does not work like a fixed price tag. It behaves more like a signal. It reacts to how close you are to decisions, how early you see problems, and how clearly you can explain what should happen next. The CMA certification sits right in the middle of that system, which is why the numbers around it often feel confusing when seen without context.

Here is a simple way to think about it. Two people can work in the same company. One prepares reports that explain what already happened. The other uses those reports to influence what happens next. The difference between those two roles is where the CMA Salary in USA begins to stretch, not because of the title, but because of the weight of responsibility attached to the work.

Another question worth pausing on is this.

→ Why does the same CMA earn very differently in different cities, even within the same country?

→ Why does a fresher in New York sometimes earn more than someone with five years of experience elsewhere?

→ Why does monthly pay matter more to some professionals than annual figures?

These are not anomalies. They are clues. When people talk about the CMA in USA salary, they are often asking a deeper question without realising it. What kind of finance professional does the market reward long-term? One who follows processes. Or one who helps redesign them when they stop working.

This blog is written for readers who want that clarity before committing years of effort. Not to impress. Not to chase inflated promises. But to understand how the numbers move, why they move, and what kind of preparation actually aligns with where the salary curve bends upward.

Salary only makes sense when it fits into daily life. So I will start there.

Before the Numbers: What is CMA in the USA

In the USA, companies do not pay finance professionals for knowing accounting rules alone. They pay for judgment. For the ability to look at numbers and explain what they mean for the next decision. This is the space where the CMA role lives, and this is why the CMA Salary in USA behaves the way it does across industries and experience levels.

A CMA works inside the business, not around it. The work revolves around financial planning, control, and performance. Budgets are not prepared to complete a task. They are built to test whether a plan is realistic. Costs are not analysed to report variances. They are studied to understand where money is being quietly lost or poorly used.

This is where the idea of what is CMA has become relevant. The qualification is designed around internal finance. It trains professionals to support decisions that affect pricing, capacity, investment, and risk. That focus naturally places CMAs closer to leadership conversations, which is also where compensation tends to move upward.

In practical terms, a CMA’s day often includes questions like these. Should the company continue with an underperforming product? Can margins improve without raising prices? Which department is consuming more resources than it should? These are not academic questions. They directly affect profit and cash flow.

Because of this, US employers treat the CMA skill set differently from traditional accounting roles. Financial Reporting accuracy is expected. Insight is rewarded. Over time, this difference becomes visible in how salaries progress.

The CMA exam curriculum reflects this expectation clearly.

What CMA Focuses On in Day-to-Day Work

- Budgeting and forecasting for future periods

- Cost analysis to improve margins

- Performance evaluation across departments

- Supporting cost and management accounting decisions with financial insight

This focus is important because the CMA Salary in the USA rises fastest in roles where finance supports direction rather than documentation.

How CMA Is Structured

The certification is awarded by the Institute of Management Accountants, and the CMA syllabus is built around two exam parts.

| CMA Exam Part | Core Focus Areas |

| Part 1 | Financial planning, performance, and analytics |

| Part 2 | Strategic financial management and decision-making |

This structure explains why CMA professionals are often trusted with planning and control roles early in their careers. The skill set is designed for internal leadership rather than external reporting.

Also Read: Choose the Best CMA Review Course for Your Preparation

Why CMA Aligns Strongly with the USA Job Market

US companies place a high value on roles that can connect finance with operations. Manufacturing firms rely on cost control. Tech companies rely on forecasting. Healthcare organisations rely on budgeting discipline. CMA skills fit naturally into all three. This alignment is one of the main reasons the CMA Salary in the USA remains competitive across industries and continues to scale with experience.

CMA Compared to General Accounting Roles

To keep this simple, think of general accounting, with respect to CMA vs CA, as documenting what happened, while CMA work focuses on shaping what happens next. That shift affects responsibility levels, exposure to leadership, and long-term growth.

It also explains why the CMA Salary in the USA varies widely based on how close a role sits to planning and decision-making.

Deciding whether to pursue a professional certification often comes down to understanding the real value it brings to career growth. When you look at the skills, opportunities, and responsibilities associated with a qualification, it becomes easier to assess how it aligns with your long-term goals and whether it supports the kind of professional life you envision.

CMA Salary in USA and What the Numbers Really Mean

The CMA Salary in USA sits higher than many finance roles because of how the role is designed. CMAs do not only record numbers. They explain them. They guide decisions. That shift changes pay. According to the IMA Global Salary Survey, the average salary of a CMA in USA ranges between $90,000 and $120,000 per year, depending on experience and role.

Think of it like:

A CMA is closer to the person who decides whether a factory should expand or pause. That role carries responsibility. Responsibility carries compensation.

This is why the CMA average salary in USA stays consistently higher than general accounting roles.

What Is the Average Salary for CMA in USA by Career Stage

Salary grows in layers. It does not jump overnight. It grows as your exposure grows. Before looking at the table, it helps to understand one thing. US companies pay for clarity. When you reduce uncertainty in decisions, your value increases.

Experience-wise salary overview

| Experience Level | Annual Salary Range |

| Entry level 0 to 2 years | $60,000 to $75,000 |

| Mid-level 3 to 6 years | $80,000 to $110,000 |

| Senior 7 to 10 years | $120,000 to $150,000 |

| Leadership 10+ years | $150,000 to $200,000+ |

This explains why people search for a CMA accountant 10 years experience salary in USA so often. After a decade, the role becomes strategic. Budgets are larger. Teams are bigger. Decisions carry weight. At that stage, professionals often cross into the highest CMA salary in USA bracket.

Also Read: Essential Project Selection Methods for CMA Professionals

CMA Salary in USA Per Month Explained Simply

When people talk about the CMA Salary in USA, annual numbers often dominate the discussion. In daily life, income is experienced month by month. Rent is paid monthly. Savings are built monthly. Expenses show up every few weeks, not once a year. Looking at the CMA salary in USA per month makes the earning potential easier to relate to and more practical to plan around.

It helps clarify what a fresher can realistically manage in the first job, how income improves with experience, and why monthly pay becomes more comfortable as CMA roles move closer to planning and decision support. A monthly salary helps people plan better. It answers real questions.

→ Can I pay rent without stress?

→ Can I save monthly?

→ Can I travel once a year?

Here is a clear monthly view.

| Career Stage | Monthly Salary Range |

| Fresher | $5,000 to $6,200 |

| Mid level | $6,800 to $9,100 |

| Senior | $10,000 to $12,500 |

| Leadership | $13,000 to $16,500 |

This explains why people search for CMA accountant in USA salary per month instead of annual figures. Monthly clarity feels real.

Salary expectations often shift when career opportunities are viewed across geographies. The comparison between CMA salary in India vs USA is about how roles are structured, the scale of businesses involved, and the level of responsibility assigned. Looking at both markets side by side helps put earning potential into context and highlights how experience, exposure, and decision-making scope influence compensation over time.

CMA Fresher Salary in USA and Early Career Growth

The CMA fresher salary in USA depends heavily on industry. Manufacturing. Tech. Healthcare. Financial services. Tech and healthcare tend to pay higher. Manufacturing offers steadier growth. The first two years shape learning. This phase builds exposure. Exposure builds value. This is also why US CMA salary in USA grows faster after the first role change.

CMA USA Fresher Salary in New York

New York deserves a separate mention. The CMA USA fresher salary in New York usually starts higher. Entry roles often begin at $70,000 to $80,000. Living costs are higher. Rent is higher. Transport is faster. Work exposure is deeper. The salary reflects that environment.

CMA Salary in USA in Rupees and Why Conversion Matters

Many readers think in rupees. That is natural. The CMA salary in USA in rupees helps visualise long-term impact.

Using an average exchange rate of USD 1 = INR 83:

| Annual Salary USD | Annual Salary INR |

| $70,000 | ₹58 Lakhs |

| $100,000 | ₹83 Lakhs |

| $150,000 | ₹1.24 crore |

This table also answers searches like CMA salary in USA in India rupees convert and CMA US salary in USA in India. It explains why global exposure changes financial planning.

When salary discussions move ahead, experience alone does not explain everything. Two people with the same years can earn very different amounts. The reason usually lies in role design, industry choice, and how close the work is to decision-making.

Also Read: Cost Management Strategies: A Core Skill in the US CMA Course

Did You Know? According to IMA, CMAs in the USA earn up to 21% more than non-certified peers in similar roles. That difference compounds over the years. It shapes how much you can save, how comfortably you plan for retirement, and the lifestyle you can afford.

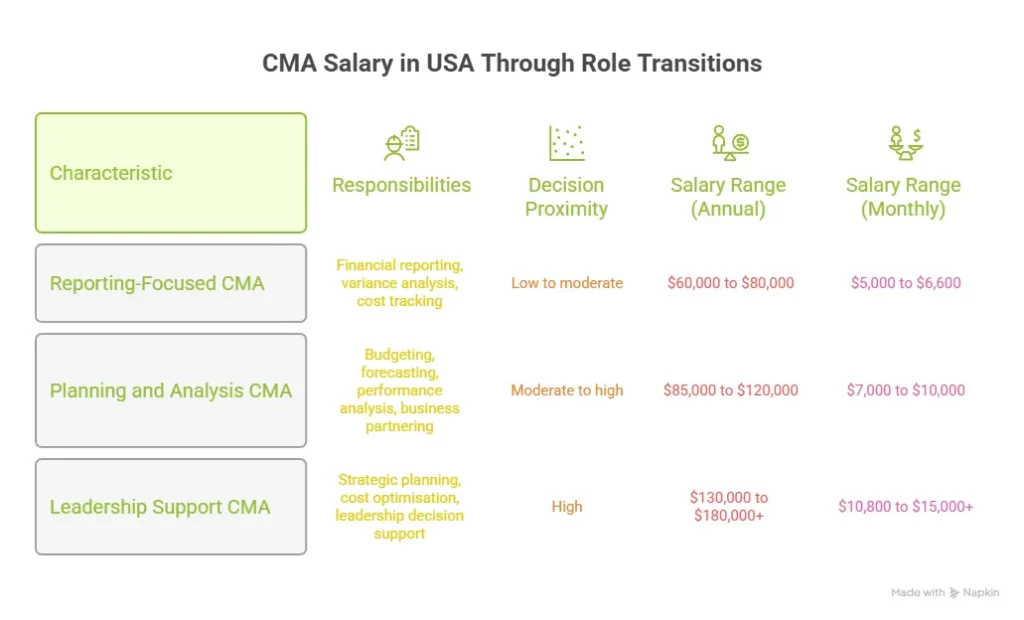

How Job Roles Shape CMA Salary in USA

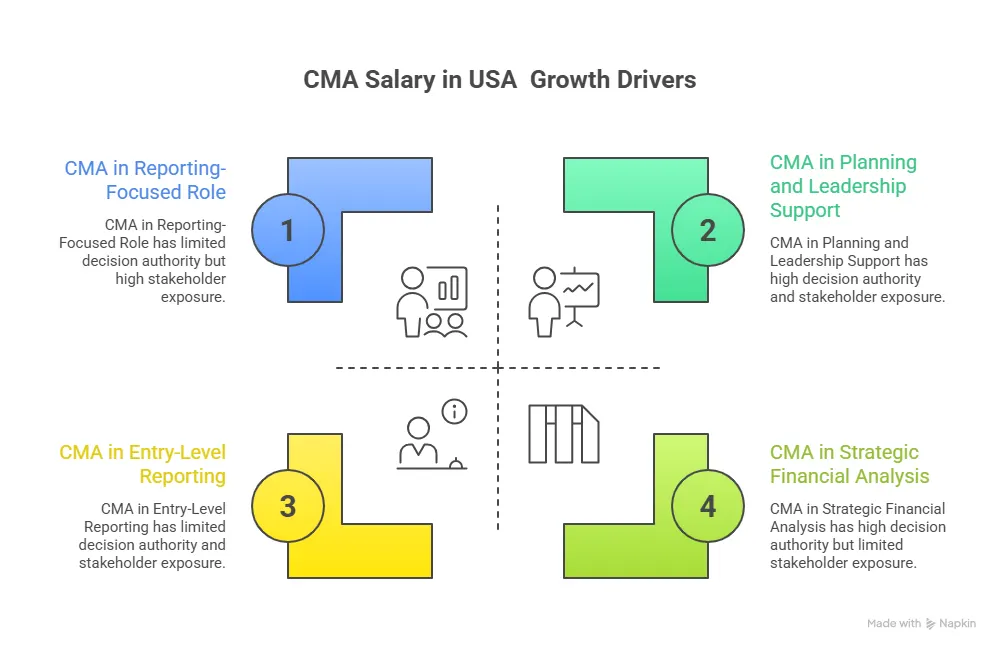

The CMA Salary in USA changes sharply based on what a professional actually does every day. Titles look similar on paper. Daily tasks differ a lot.

Before looking at numbers, think of a simple example. One person prepares reports. Another person explains what those reports mean for the next quarter. The second role influences action. That influence reflects in pay.

Common CMA roles and salary ranges

| Role | Annual Salary Range |

| Cost Accountant | $70,000 to $95,000 |

| FP&A Analyst | $85,000 to $120,000 |

| Finance Manager | $110,000 to $150,000 |

| Controller | $130,000 to $180,000 |

| Strategy Finance Lead | $150,000 to $200,000+ |

Roles tied to planning and forecasting push the CMA USA salary in USA higher. These roles connect finance to business decisions.

Also Read: What do you need to do to pass the US Certified Management Accountant course?

Industry Impact on CMA Salary in USA

Industry choice matters more than people expect. A CMA in healthcare budgeting faces different problems than one in a manufacturing plant. Both use the same skills. The scale differs.

Here is how industries usually stack up.

| Industry | Salary Trend |

| Technology | High |

| Healthcare | High |

| Financial Services | High |

| Manufacturing | Medium to High |

| Retail | Medium |

This explains why the US CMA salary in US often rises faster in tech-heavy cities.

Also Read: Why Choose CMA USA? State 5 Key Benefits of the Certification

CMA Salary in USA for Indian Professionals

Many students ask me about the CMA salary in India in USA. The answer depends on more than nationality. Work authorisation. Communication clarity. Industry exposure. These matter more.

On average, Indian CMAs in the USA earn between $85,000 and $120,000 annually after initial adjustment. Once settled, the gap narrows. In senior roles, it often disappears. This is why the CMA US salary in USA in India comparisons look impressive but also realistic when career stages are understood.

| Career Stage | Typical Role Scope | Annual Salary (INR) | Monthly Salary (INR) |

| Entry Level (0-2 years) | Reporting, cost analysis, and budgeting support | ₹49.8 ₹62.3 LPA | ₹4.15 – ₹5.19 Lakhs |

| Early Mid-Level (3-5 years) | Budgeting, forecasting, performance analysis | ₹66.4 – ₹83 LPA | ₹5.48 – ₹6.89 Lakhs |

| Mid to Senior Level (6-9 years) | Business partnering, financial planning | ₹87.2 – ₹1.07 Cr per annum | ₹7.26 – ₹8.96 Lakhs |

| Senior / Leadership (10+ years) | Strategic finance, leadership advisory | ₹1.12 Cr – ₹1.5cr+ per annum | ₹9.34 – ₹12.45+ Lakhs |

For Indian professionals working in the USA, salary progression closely mirrors that of local professionals once role exposure and decision responsibility stabilise. Early differences, when they exist, are usually linked to industry, location, and role scope rather than nationality.

CMA Salary in USA in Rupees Over Time

Currency conversion makes sense when seen over the years. The CMA salary in USA in India rupees compounds faster because raises apply on a higher base. A 5% raise on $120,000 feels very different from the same raise on a lower base. This long-term compounding explains why professionals track the CMA salary in USA in rupees closely.

Big 4 and CMA Salary in USA

Big 4 firms attract attention for a reason. In Big 4 roles, CMAs usually work in advisory, internal finance, or performance improvement. The salary range typically starts around $75,000 and can cross $140,000 with experience. The learning curve is steep. Work pace is fast. Exposure is broad. This environment often accelerates future CMA average salary in USA even after moving out.

Also Read: The Future of CMA Certification: Emerging Trends and Developments

Did You Know? According to IMA data, CMAs working in planning roles earn up to 20% more than those in pure reporting roles. This explains why job design influences the average salary of a CMA in USA so strongly.

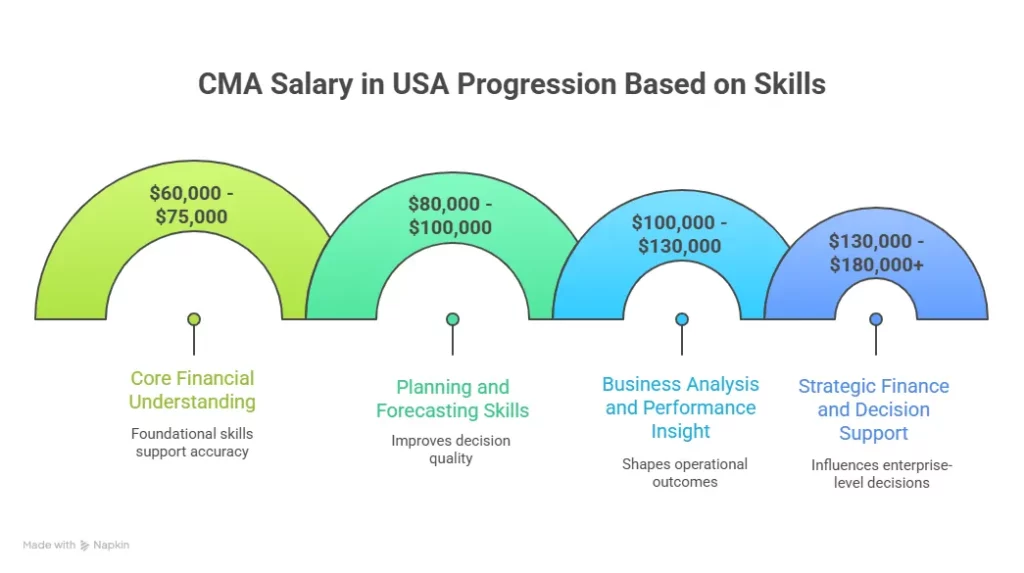

How Skills Translate Into Higher CMA Salary in USA

Certain skills consistently push pay upward. This is supported by the CMA eligibility profile.

- Forecasting and budgeting

- Business partnering

- Data analysis and visualisation

- ERP system expertise

These skills shorten decision time. Companies value that speed.

Also Read: Is the CMA Certification Truly Globally Recognised?

Why CMA Salary Growth Accelerates After Year Five

The first five years build foundation. After that, CMAs start influencing direction. This is where CMA accountant 10 years experience salary in USA jumps significantly. The professional stops answering questions. They start framing them. That shift changes compensation discussions.

Many learners reach a point where they have to choose between deepening their expertise in finance or broadening their exposure across management functions. The discussion around CMA vs MBA often comes down to the kind of work one wants to do in the long run. One path focuses on financial decision-making, planning, and performance control inside organisations. The other builds a wider management perspective across functions and industries.

How CMA Salary in USA Evolves After Senior Levels

At senior stages, compensation often splits into fixed pay and variable pay. Bonuses. Performance incentives. Stock-based rewards. This structure explains why the CMA USA average salary in USA looks different on paper versus the actual take-home value. A senior CMA may earn USD 140,000 fixed pay. With incentives, total earnings can cross $170,000. This model rewards consistency. Decision quality matters more than hours logged.

What Drives the Highest CMA Salary in USA

The highest CMA salary in USA usually appears in roles connected to long-range planning.

These roles include:

- Corporate finance leadership

- Strategic cost transformation

- Enterprise performance management

Such positions sit close to the executive table. Information flows directly. Decisions move fast. That proximity explains compensation growth.

CMA Salary in USA and Career Longevity

CMA roles age well. Skills stay relevant. Strategy. Cost control. Forecasting never goes out of demand. This longevity supports steady income growth even in slower economies. It also explains why the US CMA salary in USA remains resilient across cycles.

Also Read: Expert Guide for Top CMA Study Materials: Books, PDFs, & Prep Tips

Interesting Insight → According to IMA, CMAs report higher job stability scores compared to many finance roles. Stability supports long-term income planning.

Why Choose Imarticus Learning for Your CMA Journey

A strong foundation and smart preparation strategy can help you move into higher-impact roles that command better CMA Salary in USA. When learning goes beyond theory and mirrors how finance teams actually work, it becomes easier to grow into responsibilities that influence pay and progression. The CMA Course prep offered by Imarticus Learning are designed with this transition in mind, helping learners build practical skills alongside exam readiness:

- Gold Learning Partner of IMA USA with formal approval for US CMA prep, reflecting recognised quality and industry alignment.

- Industry-led curriculum co-created with KPMG in India, bringing real-world case studies and practical insights that mirror global finance roles.

- Globally relevant US CMA curriculum across two parts, teaching financial planning, performance management, strategic decision-making, and analytics, the exact skills that drive higher salaries.

- Access to curated, exam-focused study materials and resources, including comprehensive content tailored for CMA exam success and role readiness.

- Monthly live sessions and webinars by industry practitioners, keeping candidates informed of current trends and practical applications in finance.

- Hands-on case studies from top global finance frameworks that help bridge the gap between exam preparation and workplace impact.

- Internship opportunities with KPMG in India for top performers, offering valuable exposure that supports stronger on-the-job performance and compensation potential.

- AI-driven study support with 24×7 tutor access and mock question banks, enabling continuous practice and targeted learning when it matters most.

- Pre-placement bootcamp and soft skills training, ensuring candidates not only know the concepts but can present themselves confidently during interviews.

- Money-back guarantee designed to provide confidence in preparation outcomes, demonstrating commitment to your success.

FAQs on CMA Salary in USA

Questions around CMA Salary in USA often go beyond the numbers. Learners want to understand demand, growth over time, work pressure, exam attempts, and long-term value before committing to the path. So let’s look at some of the most frequently asked questions that come up when students and professionals try to make sense of earning potential in real terms.

Which country pays the highest salary to CMA USA?

The CMA Salary in USA remains among the highest globally due to the scale of businesses and decision-driven finance roles. While countries like Canada and Australia offer strong compensation, the USA leads in senior-level pay and incentive structures. Professionals trained through programs at Imarticus Learning often find it easier to align their skills with high-value US roles.

Is CMA in demand in the USA?

Yes, the CMA Salary in USA reflects consistent demand. Companies seek professionals who can link numbers to strategy. Demand remains steady across industries like healthcare, technology, and manufacturing. This demand keeps salary growth stable and predictable.

Which CMA is better, the US or Indian?

Both serve different markets. The CMA Salary in USA benefits from global recognition and access to larger organisations. Indian CMA roles remain strong domestically. Professionals aiming for global mobility often prefer the US CMA pathway for broader salary potential.

Is CMA a stressful job?

Stress exists during reporting cycles. Overall, the CMA Salary in USA aligns with roles that offer structured workloads and planning-driven responsibilities. Many professionals report balanced routines once systems and teams are in place.

Is CMA USA easy to pass?

The exam requires discipline. It tests the application, not memory. Preparation support from Imarticus Learning helps candidates understand the business context, which directly supports both exam success and future CMA Salary in USA outcomes.

What is the salary of CMA freshers in USA?

The CMA Salary in the USA for freshers usually ranges from $60,000 to $75,000 annually. Monthly income offers a comfortable living in many cities. Growth accelerates within the first three years.

What is the salary of a CMA in Big 4?

In Big 4 firms, the CMA Salary in USA often starts around $75,000 and grows beyond $130,000 with experience. The exposure gained often boosts future salary negotiations outside these firms as well.

How many attempts for CMA USA?

Candidates have multiple attempts within the exam window. Clearing exams efficiently helps professionals enter the workforce faster and begin earning the CMA Salary in USA sooner. Structured preparation with Imarticus Learning reduces repeat attempts and saves time.

Where the CMA Salary in USA Can Take You Next

When people look up the CMA Salary in USA, they often think they are searching for certainty. A number that confirms the effort is worth it. What usually happens instead is something quieter. The salary data begins to act like a mirror.

It shows which skills are rewarded. It shows where finance stops being transactional and starts influencing outcomes. It shows that compensation rises fastest when the role moves closer to decisions that affect cost, risk, and direction. That pattern repeats across industries, cities, and experience levels.

This is why the CMA USA salary should be read less like a destination and more like a signal. It signals what the market values over time. It also signals what kind of professional the system is built to reward. Someone who can explain why a margin moved. Someone who can sit in a meeting and translate numbers into choices.

Preparation plays a role here that often goes unnoticed. Exam success alone does not unlock higher compensation. Role readiness does. The CMA Program preparation offered by Imarticus Learning trains candidates to think in business terms and tends to shorten the distance between certification and meaningful responsibility. That distance is where most salary gaps appear.

The CMA Salary in USA does not reward speed. It rewards alignment. When skills, exposure, and decision-making grow together, the numbers tend to follow without forcing them. Understanding that sequence is often the most valuable takeaway.

At this stage, the question is no longer about whether the salary makes sense. It is about whether the next step you take moves you closer to the kind of work that consistently earns it.