As the finance industry has continued to evolve at a rapid pace, so has the investment banking career path; financial services, particularly investment banking, are quickly adapting to the changing influence of both data and technology. One report suggested that by 2030, nearly 89% of roles in investment banking will require some level of proficiency with technology and data. The implications of this are considerable—this fact arguably indicates a complete rethinking of banking, as the role of data analytics and ‘technology savvy-ness’ will be critical to the future world of investment banking. With the inevitable rise of investment banking data and technology, the question then becomes how do current and future investment banking professionals prepare themselves to start acquiring the necessary skills to remain relevant? This blog post will touch on these points and other useful information to prepare for the changing and evolving investment banking world. For both new job seekers and experienced professionals, now it is time to accept the inevitable intersection of both investment banking, data and technology. So, let’s discuss the future and how to prepare for it.

Future of Career Landscape in investment banking

As technology and its adoption continue to be refined, the finance industry has not been left untouched. More specifically, we are certainly seeing a shift in job trends within investment banking careers. From a recent predictive report about data roles in the finance industry, it predicted that by 2030, roughly 89% of roles in investment banking will require technical and data skills.

The factors that influence this are multiple:

- Increasing reliance on data analytics: Investment banks now have to use data analytics regarding investments, thus banks have significantly more reliance on data in their decision-making process, which leads to a need for professionals who have usable knowledge of data and how to analyse it.

- Technological skills are becoming critical with the rise of fintech: Fintech has radically altered the traditional banking roles, making technical skills crucial in investment banking.

- Streamlining operations has led to greater automation of rote tasks: The push for greater efficiencies has led to new automated ways of completing many processes which require employees to have technical skills to operate and troubleshoot.

To remain competitive, individuals interested in an investment banking role have to be the first to adapt. Focusing on developing and honing your data and technology skills will be key to maintaining a successful career. You must prepare whether you have been in the sector for five years or are just beginning your career.

Investment banking is a fast-changing career, and being able to predict and adapt to these roles can be the differentiator in achieving success in the industry. Without changing, those who stand still will be left behind as the sector evolves. Staying informed on the latest trends and growing your skills are key to a successful investment banking career in the future.

An Evolution in Investment Banking Careers

The finance sector, and particularly investment banking, is about to see a significant transformation; financial services firms are now looking to new technologies to establish a new norm, which recognises data proficiency as a critical skill set. This shift not only impacts investment banking careers, but it will establish a new threshold for the profession. Analysts expect that by 2030, an astonishing 89% of positions in investment banking will require data and tech skills. Let’s now take a look at this more closely:

- A solid understanding of data analysis tools and techniques helps identify market trends, making informed decisions, and achieving profitability.

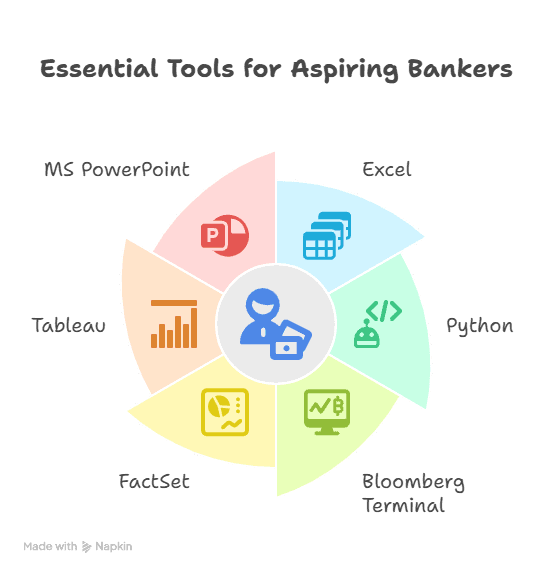

- An understanding of programming languages: Languages such as Python, R, and SQL are increasingly becoming the universal language of the finance industry. In working with data for manipulation and statistical analysis, programming languages help streamline outputs.

- Knowledge of Artificial Intelligence (AI) and Machine Learning (ML): These capabilities are transforming financial decision-making and are critical tools in the investment banking toolbox.

- An understanding of Big Data platforms: Platforms such as Hadoop and Spark are used in big data situations, which happen daily in the data-oriented finance sector.

In this evolving world, it is essential to understand that these data/tech skills are not just an extra, but rather, a requirement for those pursuing an investment banking career. Data/tech skills are necessary to keep competitive, relevant, and at the edge of the industry. If you plan to pursue investment banking, you must equip yourself with these skills to establish an effective and sustainable career.

The Transformation of Investment Banking: A Look Ahead

The world of investment banking is about to undergo a significant transformation over the next ten years. Given the rapid evolution of technology and digital advancements, the traditional career in investment banking is set to change considerably.

First, we can see the growing importance of data analytics and artificial intelligence. Future investment bankers will be as adept at using data analysis and data visualisation tools as they are at reading balance sheets. It is expected that by 2030, 89% of jobs in the investment banking industry will require a level of data and technology acumen, with the industry shifting to accommodate new skillset requirements.

- Data Analytics: The ability to analyse vast amounts of data and present findings in an actionable manner will be invaluable.

- Artificial Intelligence: Familiarity with application tools that aid in predictive analyses and risk assessments will be required.

- Cybersecurity: With the growing trend toward digital transactions, the fundamentals of cybersecurity will become increasingly important.

Secondly, we have the rise of FinTech firms, which continue to innovate and disrupt traditional investment banking. These companies are leveraging technology and introducing innovative solutions to deliver customer-centric products and services faster, more transparently, and at lower costs.

To prepare for these challenges, individuals contemplating an investment banking career will need to commit to learning and developing their skills in data and technology. This may involve enrolling in courses, attending industry seminars and gaining experience.

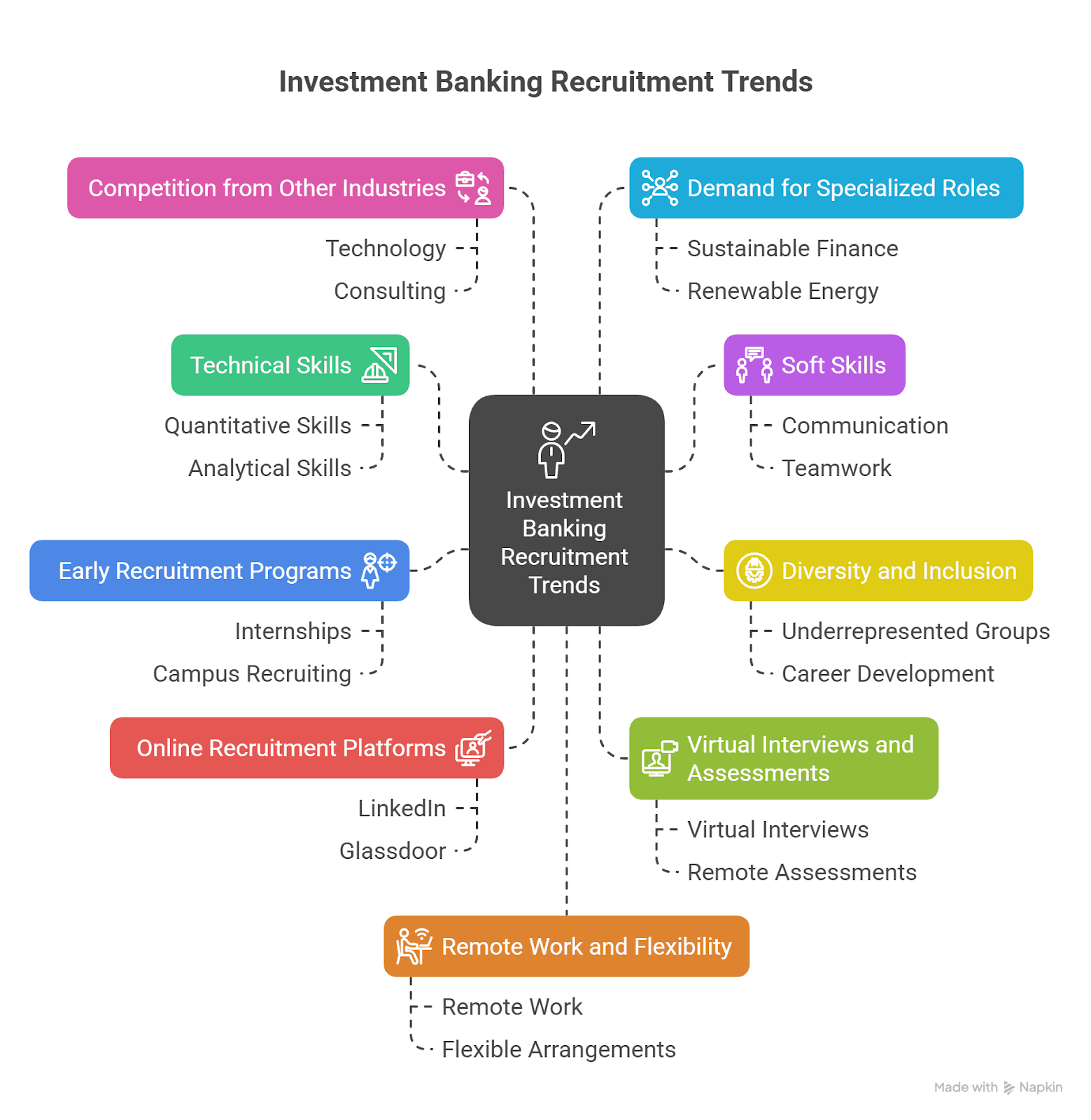

Also, the investment banking industry will have to change the way it recruits talent. Firms are likely to start hiring individuals with an understanding of technology, data analytics and quantitative skills, along with the traditional skillset of investment banking.

The future of investment banking is going to be an exciting one. It will combine traditional financial skills, data-driven financial insights, and cutting-edge technology skills. Embracing those changes and adapting accordingly will be the key to a prosperous future in investment banking.

Adapting to the Technology Changes in Investment Bank Careers

Like many areas of society, technology is evolving the way investment banking operations jobs function. Data and artificial intelligence (AI) are changing the way banking traditionally operates, and therefore, technological competence is now a critical skill in the investment banking career landscape.

- Temple for Tech: In traditional investment banking operations jobs, there was not necessarily a strong emphasis on technology. As investment strategy has evolved, it now requires skilled workers who can use software programs, AI, and data analytics. By 2030, a survey found that nearly 89% of jobs in this sector will require these types of skills.

- Data Analysis Skills: In this age of investment banking careers, professionals with a strong understanding of data analysis are considered desirable. Investment bankers can now make well-informed decisions, analyse trends, and predict potential investment opportunities using big data tools.

- Tech Reports: As the banking industry grows increasingly digital, workers skilled in the use of banking software and also an understanding on blockchain principles and fintech innovations will become highly sought after.

- Upskill for Future Roles: If you are considering a career in investment banking operations or want to secure your career future, it’s crucial to develop competence in data analytics and other emerging technologies. Many online courses and certifications exist and will prepare workers for the future.

Regardless of the investment banking sector you want to pursue, adapting to change is paramount. The future is digital, and those who can optimise technology and gain an upper hand through it will lead in the investment banking world.

A Look at the Pros of Pursuing a Potential Career in Investment Banking

A career in investment banking offers numerous advantages that are vast and worth pursuing. The rewards include a variety of factors, ranging from financial benefits to opportunities for personal development, thus investing banking a highly desirable career path for many driven and ambitious individuals.

Financial Benefits:

Investment banking positions are very lucrative, and one of the main advantages of a career in investment banking is the financial compensation. Not only do investment bankers earn a lucrative salary, but they also receive generous year-end bonuses, which offer a huge incentive and reward for a career in investment banking.

- Competitive Base salary

- Significant bonuses for performance

Professional Development:

A career in investment banking has numerous professional development opportunities. The intense learning curve in a career of investment banking provides professionals the ability to learn a considerable amount of information about finance, investment, and market knowledge in a short amount of time.

- Quick, intense skill development and learning

- Exposure to industry-leading investment strategies

Networking:

A career in investment banking offers a unique opportunity to network with professionals. Investment banking professionals often work with high-profile clients and industry leaders, creating numerous opportunities to build meaningful relationships that will further their careers for many years to come.

- Work with industry leaders.

- Create valuable networks

Personal Development:

A career in investment banking involves professionals in various high-stakes situations, making important decisions quickly, and developing resilience along with a strong work ethic based on demanding conditions.

- Development of problem-solving abilities

- Development of resiliency

Overall, a career in investment banking provides you with many valuable advantages. The combination of monetary rewards, professional and personal improvement and extensive networking opportunities makes it excellent for the individual who wants to make their mark in the financial industry.

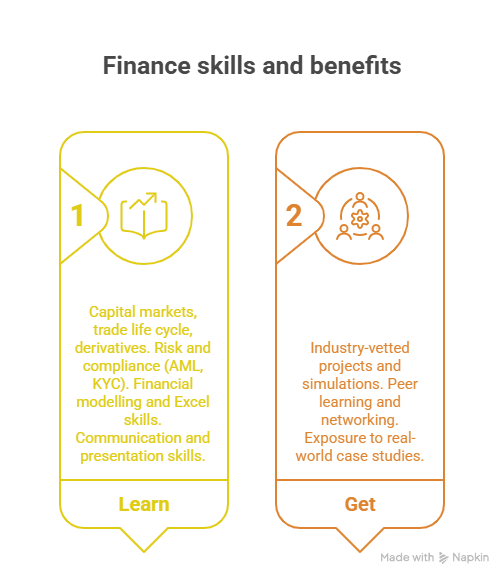

Imarticus Learning offers a carefully planned investment banking course to help you establish yourself in the fast-paced world of finance. This extensive course provides an excellent path for those interested in starting their investment banking career because it allows for a solid foundation. The course curriculum adheres to global standards and covers everything about investment banking operations, providing best-practice insights into working in investment banking.

The course has been designed to align with our blog, allowing readers to reflect on the blog’s content sections and apply their primary skills. The investment banking course can prepare you against the odds to help you differentiate yourself from the many job seekers. You will develop key skills from industry practitioners, receive globally recognised certifications, and be provided with the opportunity to enter the respected field of investment banking. If you are looking to develop your career, this is the course for you.

Frequently Asked Questions

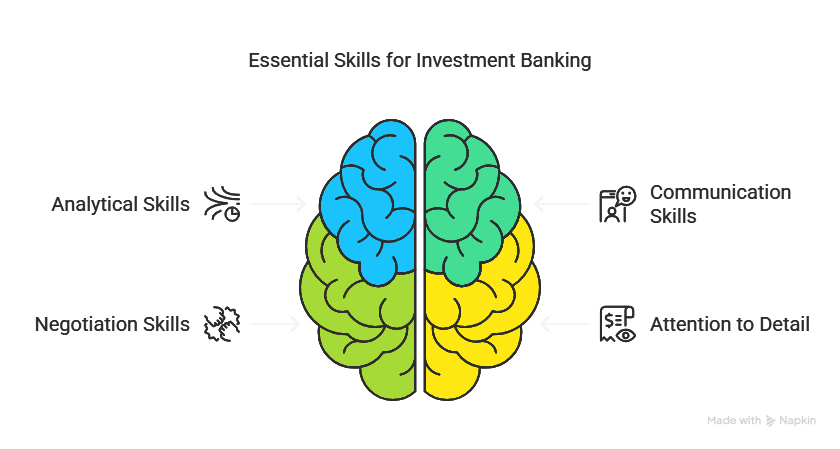

What are the essential skills to develop to be prepared for an investment banking profession in the future?

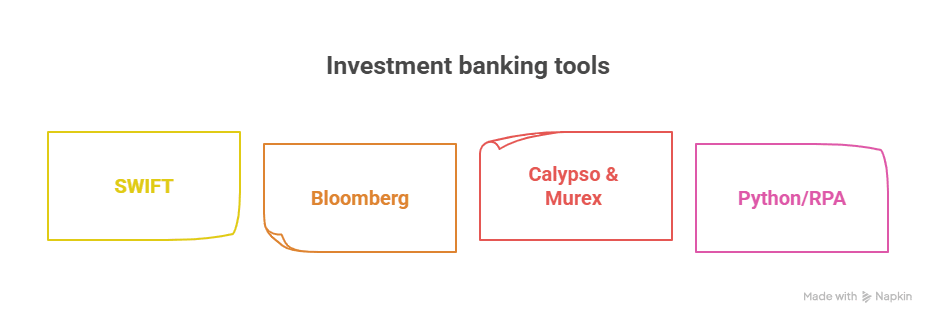

Based on new trends, it is anticipated that by 2030, 89% of investment banking sector roles will require good knowledge of data and technology. This indicates that to be a successful investment banker, you will need broad data analysis, coding, artificial intelligence, and blockchain skills. Knowledge of software such as Python, R, and SQL, as well as the ability to parse and interpret complex datasets, will be very useful.

Why are data and technology skills becoming more important in investment banking?

There is a clear transition occurring in the investment banking sphere, as it embraces the rapid developments in technology and the increasing value of data. As technology develops, banks are using data analytics to assess large amounts of information to make informed decisions, reduce risk, and maintain day-to-day efficiencies. Technologies such as artificial intelligence and blockchain are already impacting the finances of many corporations and will continue to do so. As a result, data and tech skills will become a requirement for a career in investment banking.

What is the best way to acquire data and technology skills for an investment banking career?

There a few avenues to obtain necessary skillsets, for a career in investment banking. In universities and colleges, there are several courses that recognise this evolution and are focused on data science and technology. There are also online platforms that offer a plethora of courses covering a wide range of value-adding data and tech skills. Finally, perhaps the most traditional method is to gain experience and hone skills through internships or part-time roles.

How will data and technology skills change the role of an investment banker by 2030?

The role of an investment banker is predicted to change significantly by the year 2030, as 89% of roles require data and technology skills. Hence, investment bankers will have to possess advanced data analysis and technology strategy skills. For example, it could be commonplace for an investment banker to develop algorithms to inform trading, develop financial models via data platforms, or introduce novel blockchain solutions.

How can an investment banker stay relevant with evolving data and technology skills?

It is vital to remain relevant for a successful investment banking career, as it relates to data and technology skills. Attending conferences and industry-associated workshops, as well as online courses regularly, are good ways to remain abreast. Additionally, participating in professional networks and leveraging social media to stay updated on the latest technology and data skills trends is vital.

Does the shift to data and technology skills mean traditional banking skills will be less relevant?

Rather than simply being an ‘evolution’ of project-based, traditional banking skills will still be extremely valuable. This investment banking shift will likely require an eclectic mix of multiple talents and technical abilities.