According to Glassdoor, “The estimated total pay for an Investment Banker is ₹29.5 LPA, with an average salary of ₹11,00,000 per year.” In today’s competitive financial landscape, the scope of investment banking is expanding rapidly. As technology is redesigning the processes and markets worldwide are changing, finance professionals today are being confronted with a fresh set of challenges. The article examines the investment banking of the future, new trends in investment banking, and identifies niche courses in investment banking that are remolding career opportunities,

The last few decades have witnessed unprecedented disruption in the financial services industry. The conventional banking operations have evolved into hybrid operations integrating finance, technology, risk, and sustainability. As all the operations have online websites, the future of investment banking will be for individuals who possess the capability to innovate and transform. The following blog examines some of the aspects of the investment banking industry on the basis of core facts and trend-based data to try and give a clear picture of what lies ahead.

The Scope of Investment Banking

Investment banking is no longer just mergers & acquisitions and underwriting. Its reach has widened to encompass:

- Financial Advisory and Capital Raising:

Providing strategic investment, mergers, and acquisition guidance to companies

- Asset and Wealth Management:

Portfolio management of institutional and high net worth individuals

- Risk Management and Compliance:

Regulatory change management and effective risk management controls

- Securities Trading and Market Analysis:

Using analytics in market forecasting and trading

All such varied functions make the investment banking career broad and expansive, where space is given for all financial disciplines to flourish.

Technology convergence powers banking these days. Advanced analytics, artificial intelligence, and blockchain are the new digital technologies rationalizing everything to make quicker, better choices. In addition, evolving demands on compliance and rising emphasis on sustainability have generated fresh opportunities for professionals. Today’s bankers need to reconcile quantitative strengths with strategic sensibilities, and the role is demanding yet rewarding.

The Future of Investment Banking

Investment banking is in the future being re-shaped by some of those who are more connected drivers. Technology expansion, changed demands within markets, and new arising global economies are all destined to bring a business situation change.

Technology and Innovation

Contemporary investment banks are coming on board digitization slowly in large steps. The core innovation initiatives entail:

- Artificial Intelligence and Machine Learning:

To develop forecasting analysis better, automated trading platforms, and reducing the operational risk

Security of transactions and financial transactions becoming more transparent

Enabling more informed decision-making by analysing huge volumes of financial data

All these technologies are not only streamlining operations but also creating new job opportunities with a mix of finance and technology.

Emphasis on Sustainability

Worldwide focus on environmental, social, and governance (ESG) considerations is transforming investment strategy. Banks and other financial institutions are becoming increasingly interested in:

Investing in socially responsible projects

Investment in green projects as well as renewable energy projects

- Long-Term Value Creation:

Long-term expansion at the expense of short-term profits

Therefore, sustainable finance and ESG standard specialists are in great demand.

Globalisation and Market Integration

Financial market global connectivity nowadays makes investment banking increasingly global in character. Cross-border operations and foreign alliances have become the future trend, forcing specialists to:

- Adapt to diverse regulatory environments.

- Understand global market dynamics.

- Communicate effectively across cultures.

This global orientation is perhaps the most notable aspect of the future of investment banking with career prospects globally.

Trends in Investment Banking

The trends in investment banking are transforming the business. Let us discuss some of these trends:

Data-Driven Decision Making

Investment banks employ more data analytics. Some of the most important trends are:

Using historical data to forecast market trends

Providing minute-by-minute information to inform trading and risk management decisions

- Customised Investment Solutions:

Product customisation through utilising client data mined from data

These are the trends reflecting the growing use of analytical expertise in investment banking.

Digital Platforms and Fintech Integration

Digitalisation is revolutionising the delivery of financial services. Trends are:

Online Trading Platforms:

Dispensing institutions and retail investors to markets

Mobile Banking Solutions:

Providing customer experience through easy, on-the-go propositions

Fintech Collaborations:

Merging fintech with traditional banking to create innovative products

Digital platforms are the means of establishing such a revolution, leading to improved and customer-centric banking.

Regulatory Reforms and Compliance

Regulatory standards have intensified with global economic crises. Trends moving in such directions are as follows:

Activating detailed reporting and rigorous compliance processes

- Sophisticated Risk Management:

Implementing technology for risk monitoring and effective risk management

Applying technology to automate compliance

These reforms offer stability in the financial markets and the creation of new risk management and compliance roles.

Investment Banking Courses and the CIBOP Programme

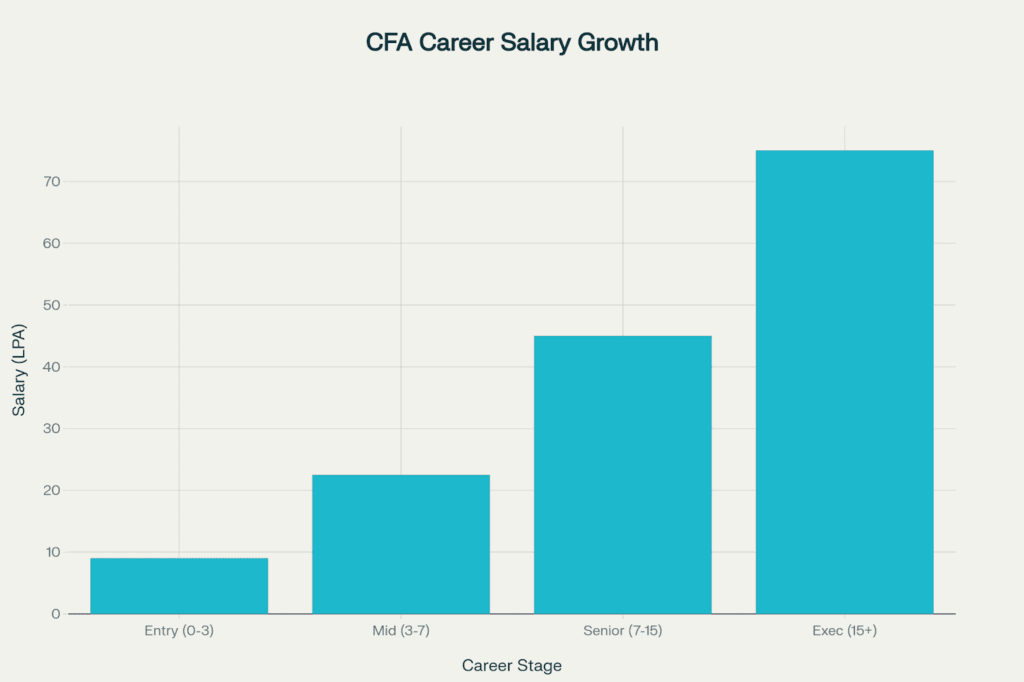

Investment banking courses in niche specialization is the future in a competitive job market. The perfect example of one such course is Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) programme. The programme is tailored for finance graduates with 0-3 years of experience and is highly popular for its life-changing experience.

Key Features of the CIBOP Programme

Hand-picked candidates guaranteed placements.

Available in 3-month and 6-month duration.

- Excellent Placement Rate:

85% placement rate, first salary hike up to 9 LPA.

Best Education Provider in Finance award at 30th Elets Worlds Education Summit 2024.

- Comprehensive Curriculum:

Including securities operations, wealth management, risk management, and AML processes.

With over 1200 batches placed and 50,000+ students, the program has strong industry links with over 1000 hiring partners

Benefits of Specialised Investment Banking Courses

Investment banking training programs like CIBOP transfer experts with:

Practical skills in the form of simulation, case studies, and live projects

Industry advantages and experienced faculty

Tailored curriculum for enhanced decision-making and analytical capabilities, getting them ready to tackle the dynamic market

Continuous learning cannot be an option in the constantly changing, dynamic world of finance. Investment banking courses, being such special courses, are a necessity to being in line with current trends in investment banking and geared up for future of investment banking.

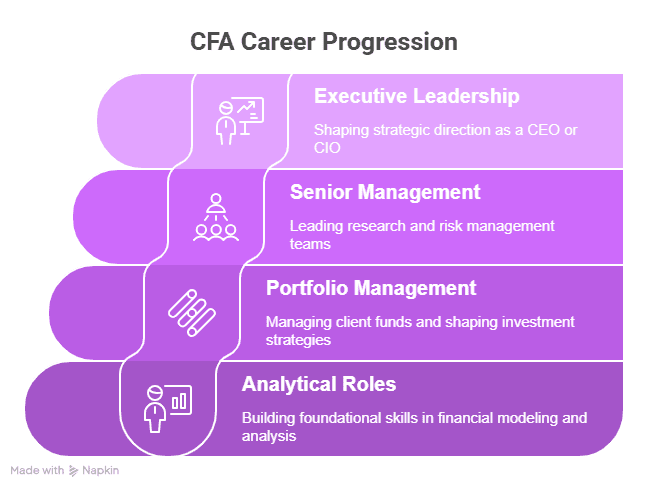

Career Prospects in Investment Banking

The broad range of the scope of investment banking has many career options. These are some of the career paths open to career professionals in the field of finance:

Financial Analyst:

Conducting extensive market analysis and making investment suggestions.

Investment Banker:

Creating mergers, acquisitions, and raising capital.

Risk Manager:

Risk management and analysis in a high-risk market.

Portfolio Manager:

Client investment management and optimization of asset allocation.

Data Analyst:

Investment decision-making based on big data and investment decisions.

Compliance Specialist:

Regulatory compliance and risk management of operations.

Sustainable Finance Expert:

ESG and ethical investment solution specialist expertise.

Following the economic revolution that has been caused by digitalization, new hybrid careers are emerging consisting of traditional financial expertise combined with technological skills. The union of data analysis and digital technology is creating a scenario where experts have the potential of high-rewarding, high-reward professional opportunities.

Real-World Insights and Case Studies

Real-life instances prove real-life application of recent investment banking trends. Observe the following-discussed case studies:

Case Study 1: AI-powered Trading Systems

The major banks have developed AI algorithms that in real time scan gigantic volumes of data. The systems possess more advanced trading notions with successful trades being made at a rapid pace, reducing human emotions-driven mistakes, and the risks being managed optimally.

Case Study 2: Sustainable Funds

They have established funds for green purposes alone, and they focus on green technology and green energy. They attracted a generation of moral and green-oriented investors.

Case Study 3: Digital Platform Innovation

Major banks have devised elaborate digital platforms with web-based services of unprecedented fluidity, from market studies to virtual advisory meeting sessions. The platforms advance the level of customer engagement and nurture long-term customer relationships.

Key Takeaways:

- Investment banking is transforming with technological and regulatory change

- Sustainability and environmental, social, and governance investing are redefining financial practice

- Programmes such as the CIBOP programme, including specialist material, are critical to professional success

- Real-life breakthroughs provide the model for industry trends to follow

These are examples that contemporary investment banking practice is not just theoretical, since they are being used in practice to efficiency and innovation in the practice.

The Role of Digital Transformation

Digital transformation is revolutionising investment banking by embracing cutting-edge technology to all its financial operations.

Benefits of Digitalisation

Efficiency Improvements:

Human mistakes are avoided and processes are reduced with automation

Improved Data Analysis:

Better and faster decision-making is facilitated by advanced analytics

Customer-centric Solutions:

Digitalised platforms enable personalised financial services, raising the level of customer satisfaction

Global Connectivity:

Digital platforms enable global payments and global connections

Investment banking is more and more a virtual company. Finance professionals with computer skills are in a better position to take advantage of future opportunities and innovate their companies. Digital technology well integrated into business not only makes them more efficient but also reveals new career opportunities for technology professionals with financially savvy skills.

Building a Resilient Career

A successful career in investment banking requires technical expertise and adaptability to match evolving market trends. Experts require:

Continue Learning:

Be current with current trends in investment banking by pursuing specialized training programs and professional workshops.

Cross-Functional Skills Development:

Alternate finance skills with technology knowledge and knowledge of regulatory procedures.

Active Networking:

Establish connections with business managers, attend seminars, and engage in workshops in an effort to generate business opportunities.

Adapt to Change:

Stay current with technology innovation and business practice to remain viable in today’s day-to-day finance reality.

Professional development and continuous learning is the key. Custom-designed training programs, such as the CIBOP program, help practitioners develop answers to investment banking conundrums of today and establish a firm, stable career.

Adapting to Regulatory Changes

Regulatory reforms have had a significant effect on the investment banking industry. Banks are now under stricter compliance rules, and this has opened up new career paths.

Regulatory Impact

Increased Transparency:

Greater reporting has placed transparency at the top of the agenda.

Risk Mitigation:

Adopting advanced risk management methods to satisfy regulation needs.

Compliance Roles:

Greater demand for regulatory compliance and risk management experts.

Investment banking courses nowadays include comprehensive modules on regimes of regulation to enable professionals to tackle compliance issues in an efficient way. All of this involves keeping pace and staying adaptable in financially more regulated environments.

Global Perspectives in Investment Banking

Globalisation now has resulted in the investment banking arena much broader than the local markets. Globalisation opened a window for a demand for individuals with more sensitivity towards world finance.

Global Trends

Cross-border Transactions:

More cross-border mergers, acquisitions, and raisings of capital

Cultural Flexibility:

It is in highest demand so that one may work in multicultural, diversified environments

International Markets:

Offshore financial centers and new markets all over the globe are becoming opportunities

investment banking degrees contain international finance streams to endow the students with the ability to address international problems. A global mindset is most needed to excel in the finance sector of today because it provides avenues for innovation and growth.

Embracing Innovation and Sustainability

Innovation and sustainability will be the way of the future in the new financial world. They will determine the path in career development as the future is pursued in investment banking.

Key Focus Areas

Innovative Financial Products:

Adopting cutting-edge technologies like AI and blockchain to create tailor-made financial products

Sustainable Investment:

Including ESG factors in investment planning, making them ethical investors

Green Finance:

Financing green ecological initiatives and green energy initiatives

Investment banking schools are integrating more information about green practice and new finance. This is to make sure that the students learn not only the traditional banking practices but also get an opportunity to assist in delivering a greener and visionary business.

Preparing for a Digital Future

As digitalisation takes over the finance sector more and more, the need for finance-technology specialists is growing. Future of investment banking is technologically oriented, and its embracers will thrive.

Digital Skills for the Future

Data Analytics:

The capability of handling big data sets for making investment decisions

Tech-savvy Mindset:

Adopting technology and platforms that deliver efficiency and customer happiness

Cybersecurity Awareness:

Adopting the necessity to protect digital payments and data

By investing in digital literacy and a short investment banking course training, it is very much possible to be at the forefront of any revolution. Ongoing upgradation in digital technology will give the competitive edge in a rapidly changing situation.

Conclusion

The scope of investment banking is vast and growing. In a future full of sustainability, digitalisation, and globalisation, the industry is more expansive than ever. Adopting modern trends in investment banking and promoting adherence to professional investment banking courses such as the CIBOP programme will enable money professionals to map lucrative career trajectories.

As the economy changes, so does the kind of skill required to thrive. One needs to learn, be flexible, and have a progressive attitude towards technological revolution in order to stay ahead in this ruthless business. For those who are passionate about finance and hungry to innovate, the future of investment banking is full of challenge but also promise.

Start with confidence, leverage your experience, and be prepared to lead a career as demanding as it is fulfilling. The secret to a rewarding investment banking career lies plain in front of you—invest in education, get flexible, and observe the opportunities unfold.

FAQs

Q1: What is the scope of investment banking?

Investment banking is a generic activity with business transactions of a multi-dimensional character involving everything from advice and asset management to risk analysis to securities dealing to compliance.

It’s evolving rapidly with reform in regulation and technology revolution.

Q2: What does the future of investment banking hold?

The prospects of investment banking are good due to digitalisation, sustainable investing, and globalisation. The trends are data-driven decision making, digital platforms, usage of AI integration, and sustainable finance. The trends are re-defining work and establishing new jobs in the industry.

Q3: What are the investment banking trends?

The trends are digital platforms, data-driven decision making, AI integration, and sustainable finance. These trends are changing jobs and creating new jobs in the sector.

Q4: Why would I need investment banking courses?

Investment banking courses offer specialized training which connects theoretical knowledge with practical capability. They impart professionals with the capability to address modern-day challenges from risk management to digital transformation for professional success.

Q5: Why is CIBOP course unique?

Certified Investment Banking Operations Professional course has 100% job guarantee, best placement, hands-on practice, and backed by best industry awards. It provides training in key areas such as securities operations, risk management, and AML practices.

Q6: What are the career functions one can pursue in investment banking?

Investment banker, risk manager, portfolio manager, financial analyst, data analyst, and compliance specialist are just a few examples. Digitalisation has also created hybrid jobs which are a blend of finance and technology.

Q7: Why is digitalisation so crucial in investment banking?

It is important. It makes it more efficient, allows real-time decision-making, and creates new career prospects. Digital-compliance professionals are required as the investment banking landscape keeps changing.