Starting an ACCA career is often seen as an adventure in the vast world of the Big 4 accounting firms; however, the career opportunities available are far broader than just these four firms, with many opportunities that remain unknown to us. This blog will explore the various career paths ACCA professionals can take, which may be outside of the standard Big Four perspective. We will review the often off-the-beaten-path track in the ACCA career universe, with roles in all manner of industries, from finance to education and everything in between! We intend to introduce you to the fantastic opportunities that a non-traditional career as an ACCA could present to you, and give you the intrigue to skip over the familiar highway to travel on your unique road towards your professional career path. With that in mind, whether you are an aspiring ACCA, a recent graduate, or a professional willing to make a change, we hope this blog will encourage thinking outside the box and present you with fresh ideas for a career with your ACCA. Sit back and enjoy the adventure as we take you on the ACCA career path tour.

Exploring the many roads of ACCA Career options (Outside the Big 4)

While many ACCA professionals aspire to work in one of the Big 4 accounting firms, there are numerous opportunities beyond these traditional paths. An ACCA (Association of Chartered Certified Accountants) career opens up all types of job roles in many markets, not just the Big 4.

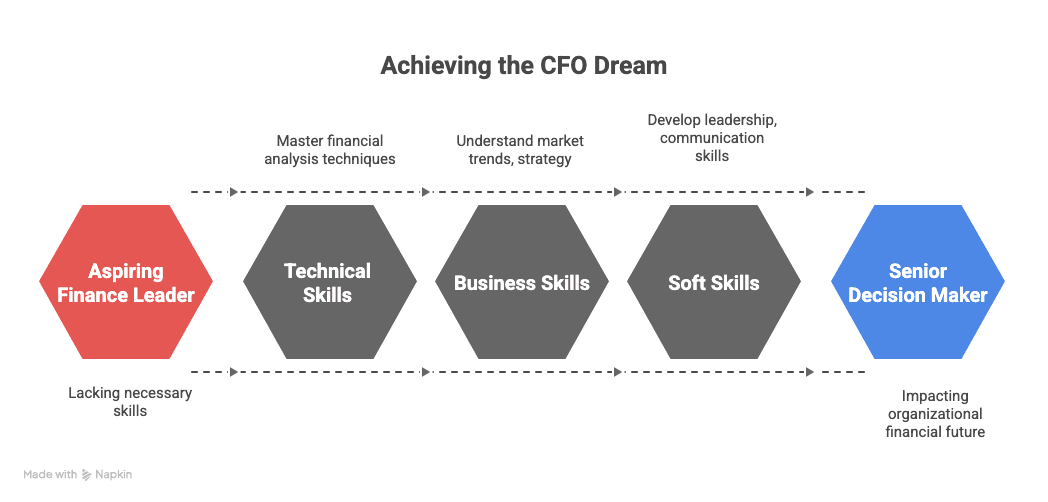

- Corporate: ACCA professionals are also popular across the corporate sector. From controllers to CFOs, ACCA qualifications are designed for people who want to pursue high-level financial management roles.

- Public Sector: ACCA careers can also be in government entities and public sector organisations. These careers may involve supervision of financial management, auditing, and budgeting.

- Not-for-Profit Organisations: Not-for-profit entities often seek ACCA professionals to oversee finances, allocate resources, and ensure financial transparency.

- Educational Institutions: ACCA professionals can also find careers in education, either lecturing or developing financial and accounting curricula.

- Consultancy: If you prefer a dynamic environment, career opportunities abound in consultancy. ACCA professionals can consult on financial management, risk management, and strategic planning for many businesses.

As you can see, ACCA careers are not limited to traditional pathways. The career opportunities within ACCA are vast, and ACCA professionals can determine their career paths. As long as you have the appropriate skills and mindset, there are many opportunities in various sectors for an ACCA professional.

Consider your Options: Diverse Opportunities with an ACCA Qualification

It is a common belief that you only get to work at one of the ‘Big 4’ accounting firms with an ACCA qualification. However, that is not true – an ACCA qualification enables you to find many alternative careers with many more benefits and drawbacks.

For example, ACCA qualified people can work in:

- Financial Consultancy: ACCA careers closely align with principles of finance to provide advice to businesses to help them maximise income and reduce expenses. The work involved as a consultant typically requires, in addition to financial expertise, a focus on economic strategy, risk, and financial forecasting.

- Teaching or Academia: If you love to teach, as an ACCA, you could have a great career in academia. You can continue working in your ACCA field, whether as a lecturer or researcher, or any combination of them, to assist the next generation of financial professionals.

- Non-Government organisations (NGO’s): NGO’s frequently employ ACCA professionals to maintain and manage their finances, ensuring funding is spent correctly and accounted for. This role involves vectors of financial strategy and direction, but is further weighted by social obligations.

- Own Business: Many ACCAs utilise their financial abilities and pursue their businesses. This path offers an alternative vocational opportunity to be your boss, carries significant responsibility and high expectations.

Remember, whilst ACCA is a stepping stone to employment within the ‘Big 4’, it is equally an opportunity to follow a variety of career paths. In closing, don’t limit yourselves, but explore some alternative ACCA career paths to see where your qualification may take you on your journey.

Entering the Startup Ecosystem as an ACCA

The startup ecosystem is an exciting and energised space that offers the required unique skill set that ACCA professionals have. Most ACCA roles in the startup environment embody the nature of diverse, challenging yet rewarding, nurturing the opportunity for a successful ACCA payout outside of the traditional Big 4 offering. ACCA practitioners can assume several key roles in startups as follows:

- Financial Controller: An ACCA practitioner in this capacity will manage the whole of a startup’s financial activities, ensuring that all financial operations run smoothly and comply with regulations.

- Business Advisor: ACCA practitioners can act as business advisors by using their broad-based financial and business skills to provide strategic advice and guidance to startups that can help them through financial complexities and business challenges.

- Internal Auditor: An ACCA practitioner can act as the internal auditor, ensuring that a startup is complying with financial regulations and standards to mitigate risks.

The table below provides a summary of the key accountabilities and skills related to the ACCA roles we have discussed:

| Role | Accountabilities | Skills |

|---|---|---|

| Financial Controller | Managing financial operations, budgeting, and reporting | Financial management, strategic planning, and leadership |

| Business Advisor | Providing strategic business advice, financial planning | Business acumen, problem-solving, and communication |

| Internal Auditor | Ensuring compliance and risk management | Attentiveness, risk assessment, and integrity |

Pursuing an ACCA career in startups is about more than just crunching numbers. It is about being part of a team that builds something from the ground up, enjoying the thrills of entrepreneurship, and making an impact. It is about promoting an area of expertise to support the mission of the startup. Whether you are an ACCA graduate or an experienced practitioner, the startup world offers incredible opportunities and rewards for your career pathway!

Exploring the Road Less Travelled in Small and Medium-Sized Enterprises

Starting an ACCA career is by no means a straight path to the Big 4. SMEs have a lot to offer ACCA professionals.

In SMEs, employees are exposed to a broader range of responsibilities earlier than they would have been in a larger company. This is because smaller teams often require you to wear multiple hats! As an ACCA professional working for an SME, you will have:

- A wider range of tasks, skill-building and learning experiences outside of your area of expertise or practice.

- A much greater opportunity to contribute to the organisation because of the smaller teams in SMEs.

- Faster job progression – SMEs tend to work at a faster pace than larger entities.

Finally, given the flatter hierarchical structures at many SMEs, working relationships between employees and senior management tend to be closer. This can play an essential role in your future career, too, providing insights that may not be present at larger organisations!

There are also some disciplinary challenges with an ACCA career in another SME, including limited resources, unstructured or limited training programs, and heavier workloads. However, the potential opportunities for development, growth, and ability to have an impact is favourable to me as an ACCA professional.

Bottom line? If you are newly qualified or an ACCA member contemplating a career change, SMEs are an exciting alternative to consider. The road to success is not always the most walked-upon road.

Diversifying your ACCA career: Look beyond the Big 4

While you’ll often find an ACCA career will often land in the big four, you should take the opportunity to consider the range of jobs available to you; these fields include finance and banking, healthcare, and retail, to name a few. Your ACCA qualification allows access to a range of industry sectors.

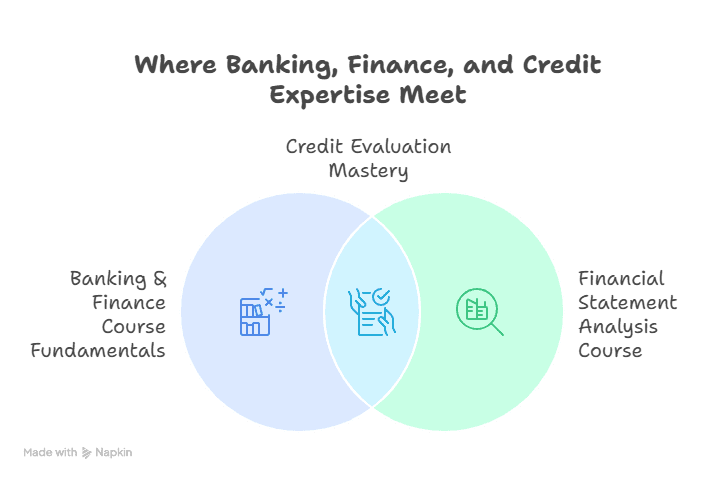

- Finance and Banking: With solid training and a strong background in financial management, ACCA is a highly regarded professional in the finance and banking industry. ACCA professionals are involved in a range of activities, including risk awareness, planning for capital purchases, and investment banking.

- Healthcare: The healthcare industry similarly has full-time and employed ACCA professionals, as the financial management activities emphasise understanding financial consequences when it comes to budgeting, financial reporting, and the ability to develop long-term strategies.

- Retail and FMCG: As an ACCA professional in this space, you are ideally suited for taking advantage of opportunities for accumulating, interpreting and understanding roles involving supply chain cost data, and the development of pricing and revenue growth plans.

- Technology: The tech industry is characterised by risk-taking and disruptiveness, driving positive change in a fast-moving world. ACCA professionals can find roles in technology companies using skills in financial modelling, business analysis, and advisory strategies.

- Government and non-profit: Many ACCA professionals contribute to the public sector or charitable organisations by providing a mark of integrity and credibility, as well as developing business processes and policies, such as producing budget forecasts for government departments and all forms of public funds.

The above list reveals that there is a range of sectors with different ACCA opportunities, allowing you to develop your career path according to your interest, focus or desired outcome. Always remember, your career as an ACCA professional is not limited to the Big Four; however, as a qualified professional with skills and knowledge, you will have a meaningful career in any sector. Enjoy the flexibility that your ACCA qualification provides, and embrace the opportunities that await you. Who knows, your new ACCA career journey could be just around the corner.

Check out the new opportunities available in finance and accounting as part of our ACCA Certification course at Imarticus Learning. The ACCA Certification course builds the knowledge and skills necessary for a successful ACCA career. It aligns well with the purpose of this blog on professional development in the finance industry, and we love providing our readers with the experience. This course covers a wide range of material while building a solid foundation in financial management, taxation, auditing, and much more. ACCA Certification grants candidates global possibilities as it is recognised in over 180 countries. Thus, whether you are an aspiring accountant or an accountant wanting to level up in your career, the ACCA Certification can serve as a significant career milestone. So make the smart move towards a fruitful ACCA career, and create new professional opportunities with us at Imarticus Learning.

Frequently Asked Questions

What is an ACCA Career?

An ACCA career is defined as a professional journey pursued by individuals who have received the ACCA (Association of Chartered Certified Accountants) qualification. This qualification is globally recognised and opens new doors to opportunities in many roles related to finance or accounting at many organisations worldwide. Not only that, but it does not limit you to just the traditional path at the Big 4 accounting firms, and there’s also a wide array of alternative pathways.

Can I skip the traditional Big 4 pathway in my ACCA Career?

While many qualified ACCA professionals tend to start at the Big 4 accounting firms, that is not the only route available to you. You may want to consider whether opportunities in banking, insurance, public sector, corporate finance or even charity work, are more appealing options. You may also wish to look at academic or consulting roles. Just keep in mind that your ACCA qualification provides useful transferable skills for a wide array of jobs to go beyond the Big 4.

What are the possible advantages of taking an alternative route in my ACCA Career?

There are many advantages to taking an alternative route in your ACCA Career. The alternative pathway allows you to not only avoid the pressure cooker environments often associated with the Big 4 firms, but also achieve a better work-life balance. This alternative route also allows for a different set of experiences and skills, which could potentially benefit you when considering future career progression. It may also afford you opportunities for work within areas that are in better alignment with your interests or long-term career objectives.

What is the job outlook for those who choose an alternative ACCA Career?

The job outlook for those who choose an alternative ACCA Career is strong, and, considering the demand for ACCA qualified professionals spans numerous sectors outside of just the Big 4. In other words, the diversity of skills and knowledge obtained through an ACCA qualification prepares people to transition between different roles or different sectors, and having the ability to pivot between different options gives a good indication of job security and long-term career prospects.

If I skip the Big Four route initially, can I work there later in my ACCA Career?

Yes, you can! Ultimately, pursuing an alternative pathway first does not prevent you from working with one of the Big 4 firms at a later stage in your ACCA Career. The experience you will gain working in an alternative role may afford you a much more diverse experience that will make you a more appealing candidate when you decide to move. Your wider breadth of knowledge and diversity will put you in a position to distinguish yourself.