Last updated on November 4th, 2025 at 11:32 am

Most people who search for ACCA course details expect a syllabus.

What they rarely expect is a professional philosophy.

After years of mentoring ACCA aspirants, I’ve realised that the qualification isn’t just a staircase of exams – it’s a curriculum built to rewire how you think about numbers, governance, and decision-making. Each paper doesn’t merely test content; it builds a behavioural skill that global finance quietly demands.

And that’s exactly why most summaries of the ACCA syllabus miss the point: they stop at “13 papers, 3 levels, and a professional ethics module.” What matters more is what these layers are trying to teach you about business reality.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

This breakdown isn’t another academic overview. It’s a functional interpretation of the ACCA pathway – how each level develops your decision logic, how the structure fits real-world finance workflows, and how you can use that knowledge to accelerate both exam performance and employability.

What Is the ACCA Qualification? And Why It Matters in 2025?

The Association of Chartered Certified Accountants (ACCA) is a globally recognised professional qualification that trains you in accounting, finance, taxation, auditing, business strategy, and ethics.

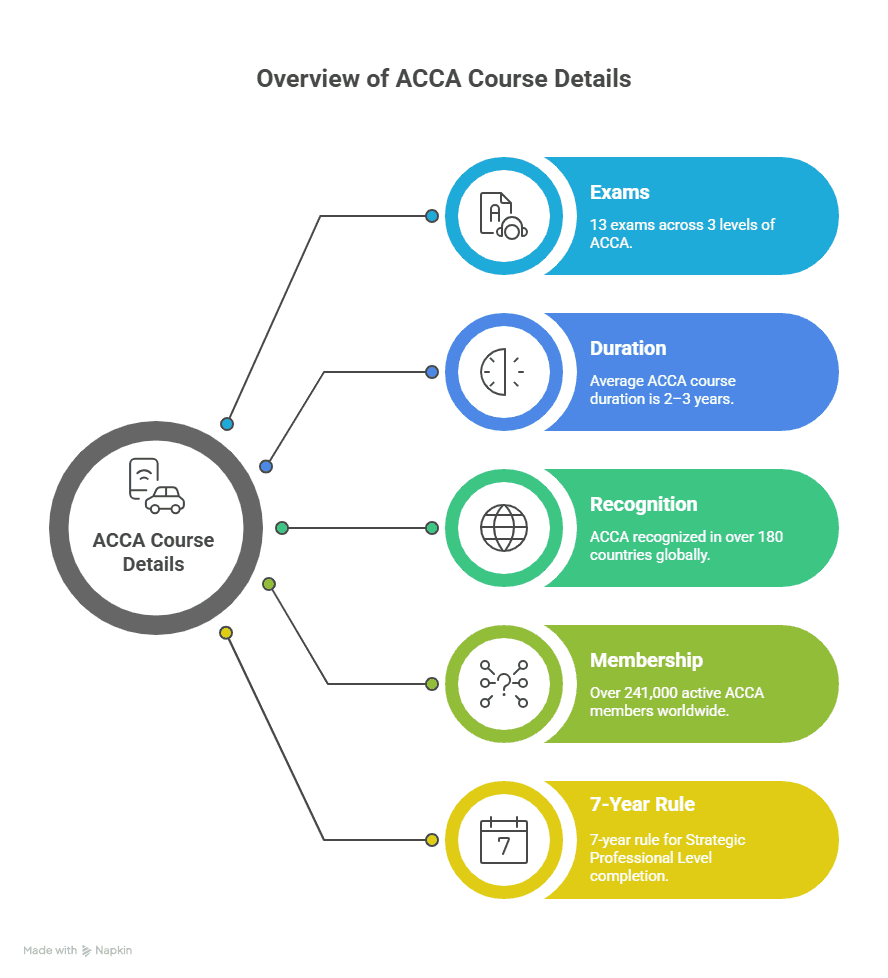

It’s accepted in 180+ countries and has over 241,000 members worldwide.

Before exploring the full spectrum of ACCA subjects, let’s first understand what is ACCA and why it holds such high regard among multinational corporations worldwide.

In India, it’s gaining massive traction because Big 4 firms and global MNCs now prefer ACCA-qualified professionals for international reporting and compliance roles.

The beauty of the ACCA course lies in how it blends academic rigour with real-world adaptability. Unlike many regional accounting degrees that stay confined to one jurisdiction, ACCA’s framework mirrors the language of global business – International Financial Reporting Standards (IFRS).

So, whether you’re interpreting a balance sheet in London or auditing a firm in Dubai, the principles remain the same. Think of it as learning the “universal grammar” of accounting. Once you know it, you can converse fluently in finance anywhere in the world.

This video explains the ACCA Course Details comprehensively.

The ACCA Course Details: Structure, 3 Levels, 13 Papers, One Global Standard

If you’ve ever wondered how the ACCA qualification manages to produce accountants who can speak the language of business anywhere in the world, the secret lies in its structure. The ACCA course details are designed like a staircase: each step strengthens your financial foundation while preparing you for strategic leadership. Across three levels and 13 papers, ACCA ensures you evolve from student to strategist, from record-keeper to decision-maker.

Before diving into the ACCA syllabus itself, picture the journey as a well-engineered building:

- The Applied Knowledge level forms the foundation, where you learn how financial data is created and managed.

- The Applied Skills level builds the structure – teaching you how to interpret, analyse, and regulate that data.

- Finally, the Strategic Professional level adds the top floors – where financial insight meets executive judgment.

Each of these levels reflects the real-world progression of an accountant’s career. At the beginning, you’re learning how businesses work. In the middle, you’re applying why they work. And at the end, you’re shaping where they go next.

To put it in perspective, over 240,000 ACCA members and 590,000 students follow this very structure globally. Whether you’re studying in Mumbai or Manchester, the same syllabus, same ethics module, and same exam standards apply. This consistency is what makes ACCA stand apart: it’s not just an exam system; it’s a global benchmark of competence.

Here’s a quick way to visualise the journey:

Each level builds not just on technical skill, but analytical maturity.

| Level | No. of Exams | Focus Area |

| Applied Knowledge | 3 | Accounting fundamentals, business technology, and management accounting |

| Applied Skills | 6 | Law, taxation, financial reporting, audit, performance management, and financial management |

| Strategic Professional | 4 | Leadership, strategy, and advanced technical papers (two compulsory + two optional) |

By the time you reach the Strategic Professional stage, you’ll be solving business cases the way CFOs and audit partners do.

ACCA Course Duration and Eligibility

ACCA understands that many of its learners are juggling university, work commitments, or even professional transitions. That’s why it offers flexibility at every step, from when you start to how fast you move through its 13 exams.

On average, most students complete ACCA in 2 to 3 years, but that’s just the median. You could sprint through in under two years if you study full-time, or stretch it to four if you’re balancing work and family. There’s no expiry date on ambition, and ACCA’s modular structure respects that.

What’s more, ACCA exams are conducted four times a year: March, June, September, and December- giving students ample flexibility to plan and progress. This quarterly rhythm means you don’t lose momentum, and you can re-strategise after every session if needed.

Eligibility Criteria:

- Minimum qualification: 10+2 with English and Mathematics

- For graduates (especially B.Com, BBA, or CA Inter students), direct entry with paper exemptions is possible.

- Working professionals can pursue it alongside a job.

| Existing Qualification | Possible ACCA Exemptions |

| 12th Commerce | No exemption |

| B.Com / BBA | 3–4 papers |

| CA Inter | Up to 6 papers |

| CA Qualified | Up to 9 papers |

Check your ACCA Exemptions with this calculator here:

https://www.accaglobal.com/in/en/help/exemptions-calculator.html

ACCA Course Syllabus: A Deep Dive into Each Level

Unlike most courses that dump theory, ACCA builds competence step by step.

Here’s how each level shapes your understanding.

1. Applied Knowledge Level

This is your foundation: the ABCs of business and finance.

| Subject | Focus |

| Business & Technology (BT) | How businesses operate, the role of technology, and governance principles |

| Management Accounting (MA) | Costing, decision-making, and performance metrics |

| Financial Accounting (FA) | Recording, processing, and summarising financial transactions |

💡 Example: Think of this level as learning how the engine of a business works before you drive the car.

2. Applied Skills Level

Now comes the muscle: you learn to analyse and interpret numbers.

| Subject | Core Learning |

| Corporate & Business Law (LW) | Legal framework and governance |

| Performance Management (PM) | Using KPIs to assess efficiency |

| Taxation (TX) | Direct and indirect taxes (India, UK, etc.) |

| Financial Reporting (FR) | IFRS, financial statements, group accounts |

| Audit & Assurance (AA) | Internal controls, audit evidence, risk |

| Financial Management (FM) | Capital budgeting, investment, and working capital management |

3. Strategic Professional Level

This is where you transform from accountant to strategist.

| Subject | Description |

| Strategic Business Leader (SBL) | Integrated case study simulating board-level decisions |

| Strategic Business Reporting (SBR) | Advanced financial reporting and ethics |

| Optional Papers (Choose 2) | Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Audit & Assurance (AAA), Advanced Taxation (ATX) |

ACCA Exam Pattern and Flexibility

Whenever students come to me asking about ACCA course details, the first thing I clarify is how the exams actually work, how often they happen, how flexible they are, and what kind of questions to expect. Understanding this early helps you plan your preparation realistically, rather than feeling overwhelmed later.

The ACCA qualification is divided into three levels: Applied Knowledge, Applied Skills, and Strategic Professional, with a total of 13 papers. Each level builds on the previous one, taking you from the fundamentals of accounting and business to advanced topics like strategic reporting and leadership.

Watch this video to understand the full ACCA Exam Pattern in detail:

One of the things I genuinely appreciate about ACCA is its exam flexibility. Exams are held four times a year, and you can choose how many papers to attempt in each sitting. Some of my students take one exam at a time to focus deeply on each subject, while others attempt two or three together to move faster. It completely depends on your study routine and other commitments.

| Level | Type | Duration |

| Applied Knowledge | Objective-based | 2 hours |

| Applied Skills | Objective + case-based | 3 hours |

| Strategic Professional | Scenario-based | 3–4 hours |

Another practical detail I always highlight is that the Applied Knowledge exams are computer-based and available on demand, meaning you don’t have to wait for a fixed exam window: you can book them whenever you’re ready. This is especially useful if you’re just starting your ACCA journey and want to maintain momentum.

Also, you only need 50% marks to pass each paper, and there’s no limit on the number of attempts. This takes a lot of pressure off because it lets you progress at your own pace, without the fear of a single failed attempt slowing you down.

🧠 Did you know? ACCA Global pass rates range between 35% and 80%

Career Opportunities After ACCA

When people talk about career opportunities after ACCA, they usually list job titles. But the truth is — ACCA doesn’t just decide where you work, it shapes how you fit into the financial ecosystem.

In 2025, finance is no longer a single lane. It’s a network where roles overlap between data, sustainability, compliance, and strategy. And this is exactly where ACCA-qualified professionals thrive. Their training in reporting, analysis, and ethics gives them a language that both CFOs and CEOs understand – they don’t just “close books,” they connect the dots between operations and outcomes.

You’ll now find ACCA professionals in places you wouldn’t expect ten years ago:

- Leading data-driven audit automation teams at Deloitte,

- Designing fintech risk models for neobanks,

- Handling carbon accounting for sustainability-driven corporations, and

- Advising cross-border M&A transactions from India to the Middle East.

An ACCA qualification opens doors across industries like consulting, audit, fintech, and corporate finance.

| Role | Typical Salary Range (India) | Global Salary Range |

| Financial Analyst | ₹6–10 LPA | £35,000–£55,000 |

| Management Accountant | ₹8–15 LPA | £45,000–£65,000 |

| Audit Associate | ₹6–12 LPA | £40,000–£60,000 |

| Finance Manager | ₹12–25 LPA | £60,000–£90,000 |

| CFO (10+ yrs exp.) | ₹45L–₹1Cr+ | £100,000+ |

(Source: Glassdoor India, Payscale)

If you’re comparing finance certifications and wondering which one offers better long-term ROI, you might also want to check out the ACCA salary in India – It gives a clear idea of how another global qualification stacks up against the CFA in terms of pay and growth potential.

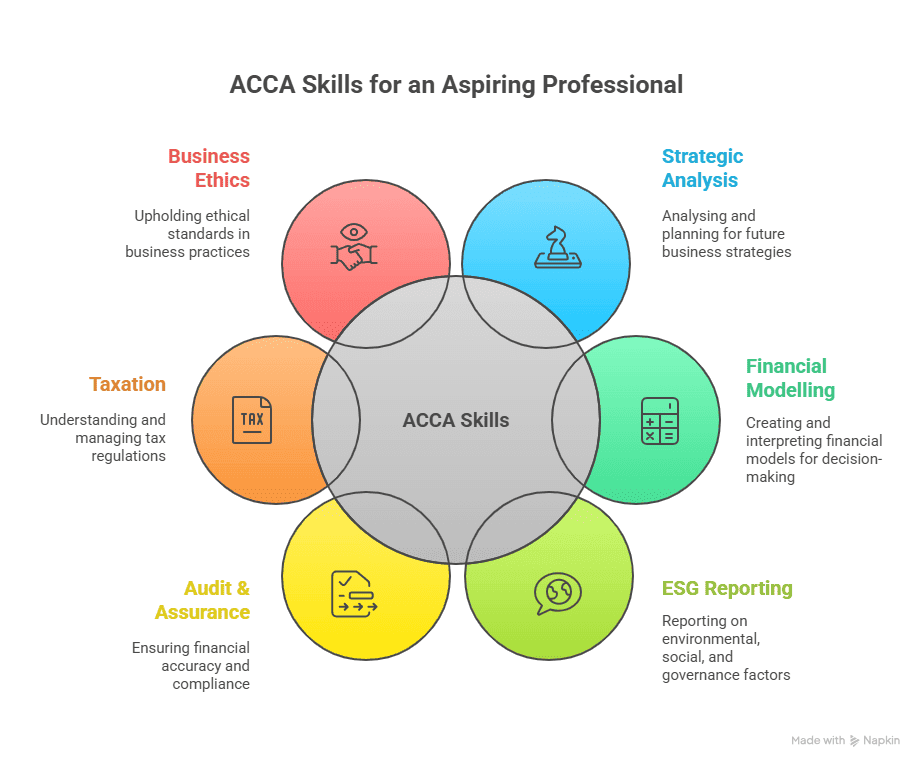

Beyond Numbers: Skills ACCA Builds That Others Miss

If I had to define what truly separates an ACCA-qualified professional from the rest, I wouldn’t start with accounting standards; I’d start with pattern recognition.

Because that’s what ACCA really teaches you: to see systems, not silos.

While most finance programs teach you how to record information, the ACCA course details teach you how to interpret it: how tax, ethics, data, and strategy influence each other in real business ecosystems. That’s what makes ACCA professionals invaluable in boardrooms; they don’t just know the numbers; they understand the storylines those numbers tell.

Here’s what that looks like in the modern workplace:

- Strategic Agility, Not Just Strategic Thinking:

The ACCA curriculum doesn’t give you static frameworks; it trains you to move between them. Whether it’s evaluating a merger or adapting a company’s reporting to new IFRS updates, you learn to make judgment calls under changing conditions; something AI still can’t replicate.

- Decision Literacy:

Most people see finance as record-keeping. ACCA flips that: it’s decision architecture. The emphasis on case-based exams means you learn why decisions succeed or fail, not just how they’re booked. That’s why ACCA professionals tend to become sounding boards for CEOs rather than back-office accountants.

- Sustainability Fluency:

ESG isn’t a side note anymore; it’s a new financial grammar. The fact that ACCA integrated sustainability concepts early on shows foresight. Today, graduates who can connect financial materiality with environmental and social outcomes are redefining corporate accountability from within.

- Interdisciplinary Intelligence:

The future CFO won’t be an accountant: they’ll be a systems thinker. And that’s where ACCA quietly leads. Its syllabus sits at the intersection of finance, technology, and ethics; a rare mix that helps professionals stay employable even as automation reshapes roles.

Example: ACCA now integrates ESG principles into the curriculum, reflecting global demand for ethical, sustainable finance leaders.

Future of ACCA in 2025 and Beyond

If there’s one thing the last decade has taught the finance world, it’s that transformation doesn’t always mean replacement; it often means refinement. The role of finance professionals is expanding into spaces that didn’t even exist a few years ago.

What’s remarkable is how the ACCA course balances global standards with regional adaptability. For instance, a student in India learns to interpret IFRS with the same rigour as one in London, but through case studies that reflect local markets and emerging economies. This dual approach: global framework, contextual understanding, is what keeps the qualification future-proof.

Industry data backs this up. According to the ACCA Global Talent Trends 2025, over 74% of employers now see ACCA-qualified professionals as “future-fit” because of their multidisciplinary training in finance, governance, and technology. Companies like HSBC, Unilever, and PwC are even integrating ACCA modules into internal upskilling programs, treating the curriculum as a benchmark for financial maturity.

Automation, AI, and sustainability are transforming finance roles. ACCA’s syllabus has already been adapted by introducing digital audit, analytics, and strategic business leadership modules.

By 2030, 70% of finance functions will use AI in reporting – ACCA-qualified professionals are being trained for exactly that world. (Source)

Key Takeaways and Free ACCA Resources to Help You Prepare

If you’ve made it this far, you already understand that the ACCA course isn’t just another professional qualification; it’s a roadmap that turns curiosity into expertise and discipline into global opportunity. But before you dive into preparation, let’s distil what really matters from everything we’ve explored.

- ACCA is globally recognised and accepted in 180+ countries.

- It comprises 13 exams over three levels.

- Average completion time: 2–3 years.

- Huge career scope in Big 4 and MNCs.

- Flexible exam structure and online learning options.

- Excellent ROI – starting salaries ₹6-8L, scaling up to ₹1Cr+.

Free and Trusted ACCA Preparation Resources

Here’s a curated list of credible tools and study aids – not the usual “exam dumps,” but real resources that deepen your understanding of the ACCA course details:

- ACCA Practice Platform – Official mock exams and CBE-style question banks to simulate real exam environments.

- ACCA Learning Hub – Free CPD and micro-certification courses designed by ACCA for continuous upskilling.

- ACCA Study Support Resources – Official and community-driven platforms to make your preparation more efficient and exam-ready.

Preparing for the ACCA course can feel like charting a global journey, and every traveller needs the right map. In the short video below, we break down the most effective study support resources, from official ACCA tools to community-driven platforms, so you can learn smarter, stay consistent, and actually enjoy the process.

Why Imarticus Learning Stands Out for ACCA Prep

A well-structured approach transforms that chaos into progress. It’s not about rushing through the ACCA subject list – it’s about sequencing them smartly. Some learners thrive with a mentor-driven setup that mirrors how finance professionals actually think and work. That’s why I often point students toward the ACCA in collaboration with KPMG in India, offered by Imarticus Learning.

- Gold / Approved Learning Partner Status

Imarticus is recognised as an approved preparation partner for the ACCA qualification. This means its curriculum, materials and teaching approach align with ACCA’s global standards. - Industry Collaboration with KPMG in India

The collaboration between Imarticus and KPMG in India brings real-world case studies and exposure to the ACCA prep. It’s not just exam prep – it gives you insight into how top finance firms operate, which helps you apply ACCA knowledge more meaningfully. - Kaplan-Powered Study Material

Imarticus uses ACCA-approved content via Kaplan, meaning students get materials built for success, not just tuition. Having such curated resources reduces wasted preparation time and ensures you’re studying what matters. - Pass Guarantee / Placement Assurance

Imarticus offers strong support: e.g., a money-back guarantee if professional-level ACCA exams aren’t cleared, as well as strong placement or internship commitments post certain levels. - Structured Learning & Flexibility

The programme blends live classes, recorded sessions, doubt-clearing, and mentoring, suited for full-time students and working professionals alike. They map the ACCA course details (levels, papers, duration) into a manageable timeline.

FAQs on ACCA Course Details

Choosing a global qualification like ACCA comes with its fair share of curiosity. These frequently asked questions break down the ACCA course details, not as a checklist, but as insights from real academic and professional experience.

What is the breakdown of the ACCA?

The ACCA course details outline a clear three-level structure – Applied Knowledge (3 papers), Applied Skills (6 papers), and Strategic Professional (4 papers) – making a total of 13 exams. Each level deepens your understanding of finance, accounting, and strategic decision-making. At Imarticus Learning, we help students build a structured path through these levels, focusing on progression and conceptual clarity rather than cramming.

What are the details of the ACCA course?

The ACCA course comprises 13 subjects covering key areas like accounting, finance, auditing, taxation, business strategy, and ethics. Exams are held four times a year, offering flexibility for working professionals or full-time students. On average, the qualification can be completed in 2-3 years. Through Imarticus Learning’s guided mentorship, students follow a study plan that balances technical skills with analytical and strategic thinking – exactly what modern finance roles demand.

What is the 7-year rule in ACCA?

Under the ACCA course details, the 7-year rule applies to the Strategic Professional level. Once a student clears their first Strategic paper, they must complete the remaining exams within seven years. This ensures your knowledge stays current with global accounting standards.

What are the 9 papers of ACCA?

The first nine exams under the ACCA course cover the Applied Knowledge and Applied Skills levels. These include foundational subjects such as Business Technology (BT), Management Accounting (MA), Financial Accounting (FA), Corporate and Business Law (LW), and Financial Management (FM). At Imarticus Learning, our faculty connects each paper’s concepts to real business scenarios, helping learners understand applications beyond textbooks.

Can ACCA earn 1 crore?

Yes. Senior ACCA professionals in India, particularly those in multinational roles or CFO positions, can earn ₹1 crore+ annually, especially after 10-12 years of experience.

What is the hardest subject in ACCA?

Strategic Business Reporting (SBR) and Advanced Audit & Assurance (AAA) are considered the toughest due to their analytical and judgment-heavy nature.

Can a weak student crack ACCA?

Absolutely. The ACCA course rewards consistency and clarity, not memorisation. Even students with average academic backgrounds succeed when guided with the right approach. Imarticus Learning’s mentor-led programs focus on conceptual understanding and weekly progress tracking, helping every learner build the confidence to pass, one paper at a time.

Which are the 3 toughest exams in the world?

CA, CFA, and ACCA are often ranked among the top three toughest finance exams globally due to their conceptual depth and duration.

What is the easiest subject in ACCA?

Most students find Business & Technology (BT) and Financial Accounting (FA) relatively easier, as they focus on core understanding rather than interpretation.

Why ACCA Is the Smartest Bet for the Future Accountant

Here’s the thing – accounting is no longer about “ticking boxes” or “closing books.” It’s about making sense of a world run by data, ethics, and strategy.

The ACCA qualification gives you that lens – to not just work in finance, but to lead through finance.

Whether you’re a student eyeing international exposure or a professional looking for upward mobility, the ACCA course details tell a story of transformation – from learner to global finance leader.

So if you’ve been contemplating a career move that transcends borders, think of ACCA as your passport – stamped not just with global recognition, but with the skillset of the future. Because the hardest part of ACCA isn’t the syllabus, it’s starting with structure.

Explore how Imarticus Learning’s offering of ACCA in collaboration with KPMG in India simplifies the ACCA course details into a clear, achievable plan designed by mentors who’ve guided hundreds on the same journey.