Just finished your BCom or almost there? You might be facing a question: What’s next?

Today’s job market isn’t what it used to be years ago. Companies are no longer just hiring based on degrees. They’re looking for people who’ve got the right skills, real-world knowledge, and the ability to hit the ground running.

That said, your BCom is a solid base. And if you’re eyeing a future in financial accounting, you’ve picked the right track. Financial accountant jobs are at the heart of every business. They’re all about keeping the books clean, helping teams make smart money moves, and making sure everything runs smoothly.

In this blog, I’ll break down the top job roles, the skills you need, where to apply, and how to grow in this field.

Financial Accountant Jobs You Can Apply to After BCom

Fresh out of college?

Don’t worry, there are plenty of finance jobs after BCom that are perfect for beginners.

More companies are tightening how they manage their finances. So, the demand for smart professionals who can handle numbers is only going up. Some great financial roles you can opt for after BCom are:

Financial Accountant

- What you’ll do: Prepare financial reports, ensure everything meets legal standards, and help analyse business performance.

- Skills you need: Accuracy, strong maths skills, and comfort with accounting software.

Auditor

- What you’ll do: Check if financial records are accurate and follow the rules.

- Skills you need: Eye for detail, an understanding of auditing standards, and high integrity.

Tax Consultant

- What you’ll do: Help individuals and businesses sort out their taxes.

- Skills you need: Updated knowledge of tax laws, logical thinking, and communication skills.

Financial Analyst

- What you’ll do: Study trends and data to help companies make investment and strategy decisions.

- Skills you need: Market research skills, Excel expertise, and confidence in numbers.

Management Accountant

- What you’ll do: Work on budgets, performance reports, and internal financial planning.

- Skills you need: Strategic thinking and familiarity with management reporting.

Credit Analyst

- What you’ll do: Check loan applications and assess financial risk.

- Skills you need: Analytical mindset and knowledge of financial software.

Here’s a quick look at some salary ranges for common roles:

| Job role | Average annual salary |

| Financial Analyst | INR 2.1 – 13 lakhs |

| Accounts Assistant | INR 1 – 4.4 lakhs |

| Money Manager | INR 0.2 – 12 lakhs |

| Senior Accountant | INR 2.2 – 9.5 lakhs |

| Personal Financial Consultant | INR 1.2 – 8.5 lakhs |

| Credit Analyst | INR 2.2 – 16 lakhs |

To succeed, taking up a professional financial accounting course through Imarticus Learning can make you job-ready after BCom

Where to Apply for Financial Accountant Jobs?

Once you know which roles suit you, the next step is figuring out where to send your CV. When it comes to jobs after BCom, the options are wide open. Here are some sectors worth checking out:

- Large corporations and MNCs

- Banks and financial institutions

- Public sector organisations

- Start-ups and mid-size firms

Top Companies that Hire for Financial Accounting Jobs

If you’re aiming high, there are some big names you can work towards. They offer strong salaries, global exposure, and solid growth opportunities. Here are a few:

- Morgan Stanley

- Boston Consulting Group

- Goldman Sachs

- Bain & Company

- JP Morgan Chase & Company

- McKinsey & Company

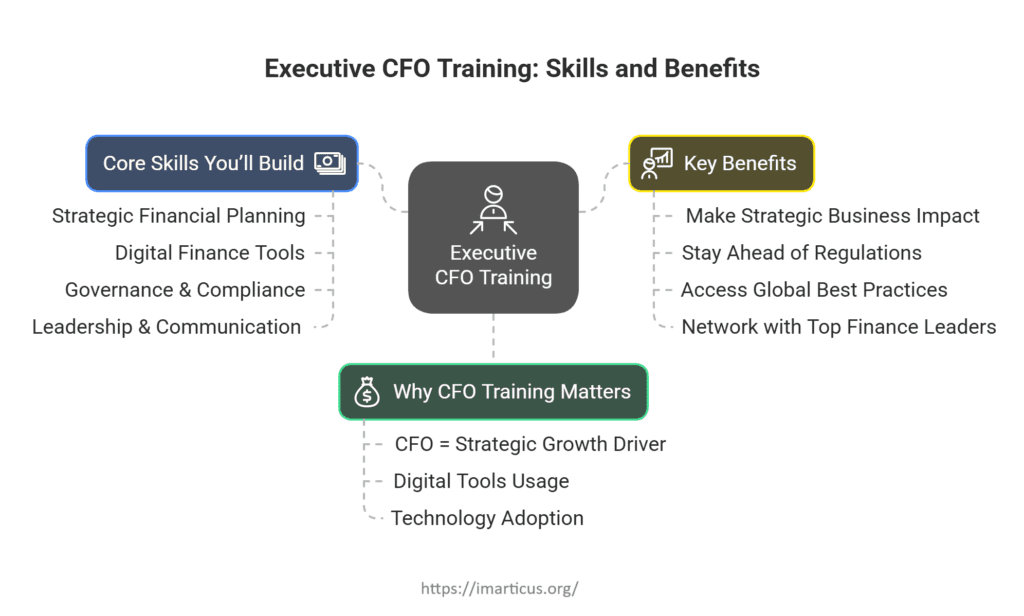

To crack a role in these firms, you’ll need more than just a BCom degree. A strong grip on accounting concepts, great communication skills, and the right certifications go a long way.

If you’re ready to level up, check out the applied finance programme by IIM Lucknow. It’s designed to bridge the gap between academics and real-world finance.

Gaining Practical Experience

Getting hands-on exposure while studying can fast-track your entry into financial accountant jobs. Here’s how to get that experience:

- Internships: A must for understanding how finance teams really work.

- Part-time roles: Even basic office jobs teach valuable lessons in managing time and tasks.

- Freelancing: Develops versatility by working with diverse clients.

How to Land a Job in Financial Accounting

Want to land your first role in this field? Focus on these basics:

- Strong resume: Add every skill, course, and small experience you have.

- Practical experience: Apply what you learn in live projects, internships, or simulations.

- Certifications: Go for short courses in taxation, investment banking, or accounting.

- Network with professionals: Join LinkedIn groups and talk to people already working in the field.

Best Certifications to Boost Your Career

A degree might get your foot in the door, but a certification can open it wider. Especially for financial accountant jobs, these credentials are worth considering:

| Certification | Eligibility | Career impact |

| CMA (Certified Management Accountant) | Graduate | Strong for budgeting, planning roles |

| CPA (Certified Public Accountant) | BCom or equivalent | Good for international financial jobs |

| ACCA (Association of Chartered Certified Accountants) | BCom or equivalent | Popular in global audit and finance |

| Financial Accounting and Management Program | BCom | Great for banking and finance careers |

Professional assistance in building your dream future

Conclusion

Financial accounting is a field where stability meets opportunity. As companies scale and finances become more complex, there’s a growing demand for people who can handle numbers smartly.

But to succeed, you’ll need more than theory. Keep learning, stay curious, and look for ways to apply your knowledge in real settings. That’s how you move from learning about financial accountant job descriptions to actually landing top roles.

If you’re ready to take that step, consider upskilling with a specialised finance programme. The right move today could shape your whole future.

Key Takeaways

Financial accountant jobs are perfect for BCom graduates starting out in finance. Popular roles include analyst, tax consultant, and auditor. Getting certified and gaining hands-on experience (like internships) boosts your chances and your salary.

FAQs

- Do I need a master’s degree to get into the financial accountant jobs?

No, it’s not necessary. Many employers prefer relevant certifications and real-world skills over a master’s degree.

- Can I work abroad with a BCom degree in finance?

Yes, but certifications like CPA or ACCA may be required based on the country. These open doors to international roles.

- How do I switch to financial accounting from a different background?

You can take beginner-friendly certification courses in accounting or tax. Start with internships or part-time jobs to gain confidence.

- Are there jobs after BCom in industries apart from banking?

Definitely. Healthcare, IT, consulting, and retail companies also hire financial accountants. Wherever there’s money flow, there’s accounting work.

- Can I get hired in the finance industry with no experience?

Yes. Start with roles like Accounts Assistant or Junior Accountant. Internships help build your base.

- Which software should I learn for financial accounting jobs?

Get comfortable with Excel, Tally, Zoho, Oracle, and SAP. Power BI is also a great add-on for data handling.

- What are the biggest challenges in financial accountant jobs?

Expect deadlines, data overload, and evolving regulations. But with the right mindset, it gets easier over time.