Last updated on October 31st, 2025 at 10:29 am

The ACCA subject list is a fascinating reflection of the changing world of finance, regulation, and business. While I haven’t sat the exams myself, my research has taken me deep into the heart of the syllabus, showing just how the qualification’s structure responds to real-world needs – and how it opens doors across the industry.

What makes the ACCA Certification unique is its practical orientation. You aren’t simply learning accounting entries; you’re learning how financial statements reveal business health, how taxation shapes policy, and how audit frameworks protect trust in organisations. Every topic reflects what top employers expect from finance professionals in today’s competitive, digitised economy.

If you’re thinking of a career in finance or accounting, ACCA (Association of Chartered Certified Accountants) is perhaps the best-known qualification globally. But come on – it isn’t a cakewalk! Understanding the ACCA subjects and the latest ACCA syllabus is your first step to boost your employability.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

Curious which ACCA papers are the toughest?

Which have the highest failure rates?

How can ACCA boost your career?

This guide weaves through all the major ACCA subjects and levels, packed with trends, news, and statistics to show why the curriculum is both relevant and future-proof.

ACCA Overview

Imagine sitting in a strategic planning meeting. Everyone has access to the financial statements. Most see numbers. An ACCA, however, identifies which divisions are underperforming, evaluates the impact of regulatory changes, and forecasts how strategic decisions will affect the company’s bottom line.

This is the ACCA edge: turning technical knowledge of accounting, audit, and tax into actionable insights that guide business strategy.

ACCA is a professional certification recognised in over 180 countries that demonstrates your expertise and understanding in the field of accounting, tax, reporting and finance. ACCA empowers you to build a global leadership career in finance with employment opportunities abroad and competitive salaries. It takes a duration of 2 to 4 years, based on your previous qualifications, to clear ACCA.

With over 13 exams spread over three levels, the ACCA course is demanding in terms of time and effort, particularly if you don’t approach your studies with the right strategy. There are multiple levels, exemptions, and optional papers to choose from.

From understanding the basics and mastering the core concepts at the Applied Knowledge level to tackling real and complex financial strategies at the Strategic Professional level, every stage of the ACCA course is designed to prepare and upgrade your financial expertise.

When everyone sees a spreadsheet full of transactions, an ACCA spots inconsistencies, ensures compliance, and safeguards the company’s reputation before a risk becomes a crisis.

👉 According to ACCA’s Global Talent Trends report, 85% of employers actively seek ACCA-qualified professionals because they blend analytical skill with ethical judgment – a rare and valuable mix.

What is ACCA

Before exploring the full spectrum of ACCA subjects, let’s first understand what is ACCA and why it holds such high regard among multinational corporations worldwide. The Association of Chartered Certified Accountants (ACCA) UK is the provider of ACCA, the world’s most trusted and respected certification in accounting, audit, tax and finance. ACCA-qualified professionals demonstrate a high-level expertise in financial management, business strategy, and corporate governance.

ACCA consists of a total of 13 papers. In which the candidates can choose two electives from a list of 4 papers.

Note: Regardless of how quickly students pass the exams with exemptions. Students are still required to complete 36 months of Practical Experience Requirement (PER).

Check whether you are eligible to apply for exemptions.

Use this ACCA Exemption Calculator.

ACCA Subject List

The ACCA qualification is a reflection of global finance itself – diverse, interconnected, and constantly evolving. Its subjects span taxation, audit, performance management, financial reporting, and leadership – the very competencies that define high-performing finance teams today.

Employers value ACCA professionals not just for their technical mastery but for their ability to connect the dots – to see how strategy, operations, and reporting all influence business success.

In short, the ACCA syllabus is built to create decision-makers, not just accountants. Let’s get a high-level overview of the ACCA subjects list across the different levels.

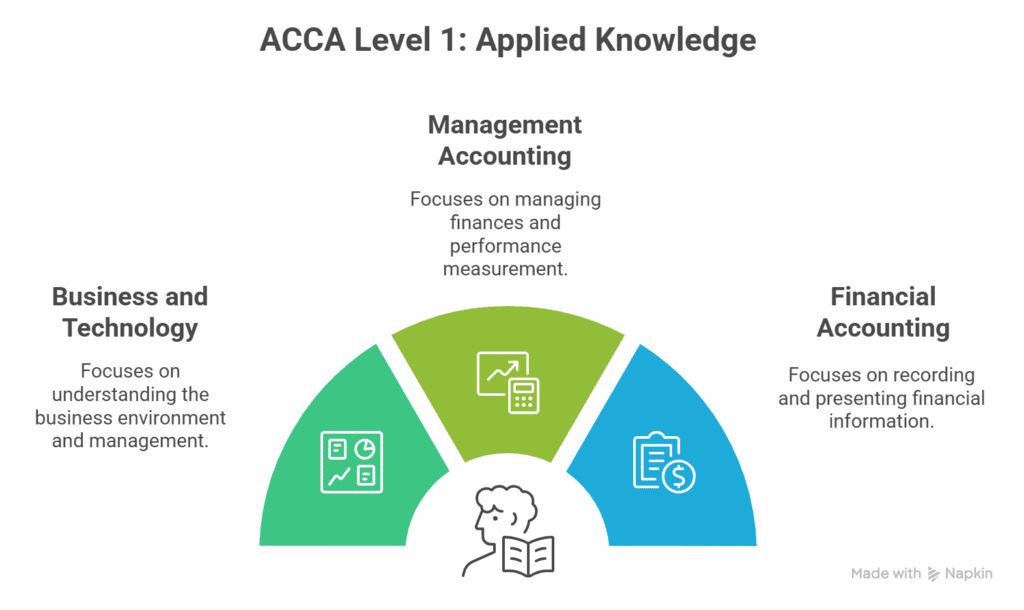

ACCA Level 1: Applied Knowledge

At the gateway to the ACCA qualification are the Applied Knowledge subjects, which cover the essential principles required for any finance professional. These form the base of financial literacy for students, and the skills are immediately useful in most business roles.

- Business and Technology – This focuses on developing an understanding of the business environment, management, and internal control.

- Management Accounting – This focuses on the techniques for managing finances, budgeting, costing, and performance measurement.

- Financial Accounting – This focuses on recording, processing, and presenting financial information, mainly in bookkeeping and financial statements.

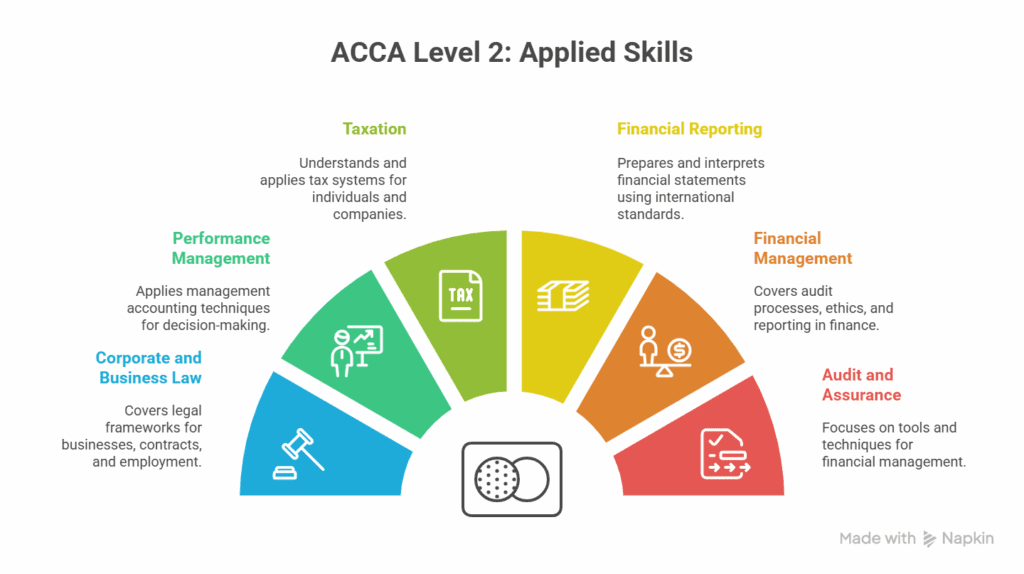

ACCA Level 2: Applied Skills

Once students are confident with the basics, the syllabus turns to Applied Skills – these are subjects every accountant needs to master, at a level equivalent to a UK bachelor’s degree. This level advances core ideas with more focus on applied concepts.

- Corporate and Business Law – This covers the legal framework relating to businesses, contracts, and employment.

- Performance Management – This covers applying management accounting techniques to quantitative and qualitative decision-making.

- Taxation – This covers understanding and applying tax systems for individuals and companies, where you can choose local variants like the UK, Malaysia, etc.

- Financial Reporting – This covers preparing and interpreting financial statements, applying international accounting standards.

- Financial Management – This covers understanding the audit process, ethical considerations, and reporting.

- Audit and Assurance – This covers the tools and techniques of financial management in the business context.

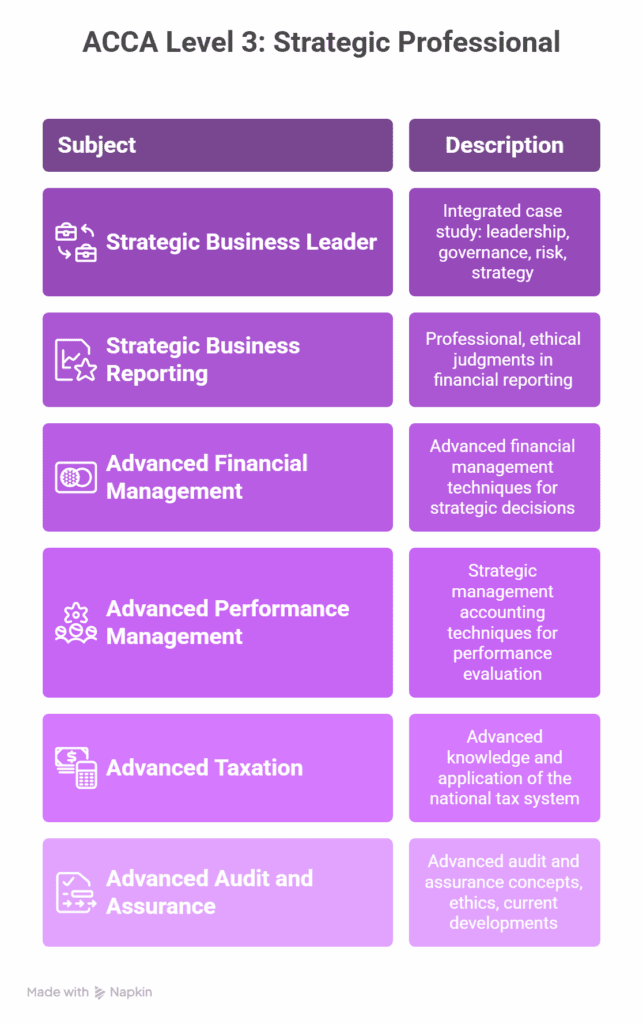

ACCA Level 3: Strategic Professional

At the top tier are Strategic Professional papers. These make the leap from technical skills to a strategic, consultative mindset. This is the most advanced level of ACCA, and for many, this is the most challenging but also the most rewarding stage of the ACCA journey.

Compulsory Subjects:

- Strategic Business Leader – This consists of an integrated case study focusing on leadership, governance, risk, and strategy.

- Strategic Business Reporting – This consists of professional and ethical judgments in financial reporting, focusing on the investor’s perspective.

Electives /Optional Subjects:

- Advanced Financial Management – This helps you specialise in the advanced application of financial management techniques for strategic decision-making.

- Advanced Performance Management – This helps you in applying strategic management accounting techniques to evaluate organisational performance.

- Advanced Taxation – This helps you gain advanced knowledge and application of the national tax system.

- Advanced Audit and Assurance – This helps you gain advanced concepts of audit and assurance, including ethics and current developments.

Quick Insight: The Strategic Professional level is where most students shift from learning “how” to learning “why,” a distinction that transforms your approach from accountant to advisor.

Each level demands a unique approach and difficulty level. The passing rates are generally higher for foundational levels. It decreases gradually as levels increase and subjects become more complex. It requires high-level skills like application, analysis, and professional judgment. Let’s explore each in greater detail!

ACCA Subjects: Complete List

The syllabus isn’t just an academic menu – it’s a signal to the industry about the skills that matter now and in the coming decade. Here’s a simple breakdown of the current papers and levels as of 2025:

| Level | Paper Name | Abbreviation/Code |

| Applied Knowledge | Business and Technology | BT (F1) |

| Applied Knowledge | Management Accounting | MA (F2) |

| Applied Knowledge | Financial Accounting | FA (F3) |

| Applied Skills | Corporate and Business Law | LW (F4) |

| Applied Skills | Performance Management | PM (F5) |

| Applied Skills | Taxation | TX (F6) |

| Applied Skills | Financial Reporting | FR (F7) |

| Applied Skills | Audit and Assurance | AA (F8) |

| Applied Skills | Financial Management | FM (F9) |

| Strategic Professional – Essentials | Strategic Business Leader | SBL |

| Strategic Professional – Essentials | Strategic Business Reporting | SBR |

| Strategic Professional – Options | Advanced Financial Management | AFM |

| Strategic Professional – Options | Advanced Performance Management | APM |

| Strategic Professional – Options | Advanced Taxation | ATX |

| Strategic Professional – Options | Advanced Audit and Assurance | AAA |

Students typically complete 13 papers – three at Knowledge level, six at Skills, and four at Strategic Professional (two Essentials, two Options). Some exemptions apply, depending on previous qualifications.

Did you know?

The ACCA Council has currently stopped taking paper-based exams, and all exams are conducted computer-based/ online in testing or remote centres.

ACCA Updates in 2025

The ACCA council keeps their curriculum up to date in line with industry requirements. The ACCA syllabus for 2025 has the three-tiered exam structure with a few revisions and additions.

Applied Knowledge Level changes

Financial Accounting (FA) has a few syllabus changes; Management Accounting (MA) syllabus remains unchanged, with some changes in the learning outcomes which apply from September 2025 until June 2026.

Applied Skills Level changes

The Corporate and Business Law (LW-ENG / LW-GLO), Taxation (TX-UK) and Financial Reporting (FR) syllabi have been changed; the syllabi for Performance Management (PM) and Audit and Assurance (AA) remain the same with a few changes in their learning outcomes, which apply from September 2025 until June 2026.

Strategic Professional Level changes

Strategic Business Reporting (SBR-INT /SBR-IRL) and Advanced Taxation (ATX-UK) have a few changes in their syllabus. While there are no significant changes to the syllabus in Strategic Business Leader (SBL), Advanced Performance Management (APM), and Advanced Audit & Assurance (AAA-INT/ AAA-UK), some of their learning outcomes have been changed, which apply from September 2025 until June 2026.

The ACCA Council has announced a latest update for the 2027 Exam with Future ACCA Qualification by redesigning their existing curriculum into four levels – Foundations, Knowledge, Expertise, and Strategic.

Foundation entry routes remain open, with the qualification accessible to those without prior degrees.

Electives have been refocused with a restructuring aligned with evolving industry needs like AI, digital finance, technology, data science, and sustainability, in reporting now features in optional Strategic Professional modules.

The goal is to help students experience more integrated assessments focused on real-world skills in professional judgement and analytical reasoning, and prepare them for leadership roles.

Note: Students need to use up-to-date study materials from the official site or from ACCA Global’s Gold Approved Learning Partner when preparing for their exam.

An Overview Of The ACCA Papers

While every student’s experience may vary, global pass rates consistently show that papers like Strategic Business Leader (SBL), Strategic Business Reporting (SBR), Advanced Audit and Assurance (AAA), Advanced Financial Management (AFM), and Performance Management (PM) are among the most challenging subjects.

These subjects not only require memorisation of the core concepts and basic principles, but also deep analytical thinking ability for applying to case studies and professional scenarios. Understanding the difficulty level of each ACCA subject helps you plan your time better and focus on studying and take efforts where they matter most.

Top 3 Most Difficult ACCA Papers

Students often find these subjects quite difficult in terms of passing due to the high-level skills required for the practical application of complex concepts.

- Strategic Business Leader (SBL) – This paper demands high analytical and problem-solving abilities, requiring you to demonstrate high analytical and problem-solving abilities to solve the real-world application of case studies.

- Advanced Audit and Assurance (AAA) – This paper demands high technical knowledge of auditing and writing skills for the analysis of complicated scenarios like high-level auditing strategies and risk management.

- Performance Management (PM) – This paper demands a deep understanding of costing techniques and financial management, and applying financial management principles to practical situations.

ACCA papers do not just test your domain knowledge but also the practical skills that you will require to showcase yourself as an ACCA professional. The difficulty level in each paper depends on the learning outcomes and the pattern of the questions.

While managers debate numbers, an ACCA predicts cash flow challenges, evaluates investment decisions, and guides the board toward smarter financial strategies.

Frequently Asked Questions About ACCA Subjects

Let’s look at some of the frequently asked questions about the ACCA subjects.

Are there 17 exams in ACCA?

According to the current syllabus, there are 13 papers in ACCA til June 2026. The 13 exams are held across 3 levels of ACCA- Applied Knowledge, Applied Skills and Strategic Professional.

What are the 13 papers of ACCA?

The 13 papers of ACCA are:

- Applied Knowledge – Business and Technology (BT), Management Accounting (MA) and Financial Accounting (FA).

- Applied Skills – Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Financial Management (FM), and Audit & Assurance (AA).

- Strategic Professional – Strategic Business Leader (SBL), Strategic Business Reporting (SBR) – mandatory, and two optional papers from Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), and Advanced Audit and Assurance (AAA).

Is ACCA tougher than CA?

While ACCA and CA are both challenging in terms of subjects and technical difficulty. ACCA offers a flexible structure with a higher passing rate as compared to CA, making it more manageable. ACCA exams are held more frequently than CA, making it easier to pass quickly. ACCA is considered easier than CA in terms of structure and flexibility.

Can I skip ACCA papers?

Exemptions are a great way to accelerate your ACCA journey if you have prior qualifications recognised by the ACCA Council. These qualifications are not automatically applied, and one must apply for exemptions by paying a specific fee per examination.

What qualification is required for ACCA exemptions?

Usually, candidates with qualifications higher than 10+2 are eligible for certain exemptions.

- Commerce Graduates and Postgraduates (BCom, BBA, MCom and MBA) qualified candidates are exempt from up to 5 papers in the Applied Knowledge / Applied Skills Level.

- CA Inter/ IPCC qualified candidates are exempt from 6 or more on particular papers.

- Qualified CA candidates are exempt from 9 papers.

- MSc in Accounting candidates from recognised Universities are exempt from 4 papers.

Can I finish ACCA in 1 year?

Yes, you can finish ACCA in 1 year by opting for exemptions and clearing all the exams in the first attempt. However, this is challenging and might require a rigorous study routine and time management skills, along with prior experience in the industry.

Is ACCA without maths?

Yes, you do not require advanced mathematics knowledge for ACCA. However, there are a few entry-level requirements where you need to have mathematics at your 10+2 level. As ACCA focuses on high-level accounting and application skills, a basic understanding of arithmetic and algebra concepts is enough.

Which ACCA subject should I try first?

Begin with BT, MA, and FA in the Applied Knowledge level for a solid base. You need to begin with the foundation level and take the easiest subject according to your interest level and strengths to cover the syllabus efficiently.

Key Takeaways

- The list of ACCA subjects comprises 13 papers in three levels.

- SBL, AAA, and PM are the most challenging ACCA exams.

- Past paper practice and a planned study schedule are essential to pass hard papers.

- ACCA is recognised in India, with leading firms recruiting ACCA-qualified staff.

- The ACCA syllabus 2025 is changing with an emphasis on digital finance and sustainability.

Next Steps Towards Your ACCA Journey

ACCA is challenging, but mastering its subjects builds strong technical knowledge and enhances your employability, which makes it extremely rewarding. Even though there are a few difficult subjects, proper training and guidance, strategic planning, focused study tactics, and maximising available materials can really drive up your probability of success.

The ACCA subject list is so much more than “just” an exam set. Each paper opens a new window into the finance profession’s present and future. UK finance surveys forecast that by 2030, more than half of all accountants will need advanced digital and sustainability skills as standard. The ACCA qualification already builds this in, with a syllabus that feels both practical and visionary.

Whether for those considering the ACCA route or simply wanting to understand how finance education meets the tides of technology, sustainability, and globalisation, this subject list is a signpost to both industry needs and personal career progression. And as the world keeps changing, so will the skills mapped out in the next iteration of the ACCA syllabus – making it one of the most flexible, future-proof qualifications in global finance.

Imarticus Learning offers ACCA in collaboration with KPMG in India, leads the way to global career prospects. Should you commit yourself to bettering your profession in finance and accountancy, acquiring mastery in ACCA’s list of subjects is your way forward to prosperity!