Last updated on December 3rd, 2025 at 03:51 pm

Last Updated on 3 months ago by Imarticus Learning

If you’re exploring the ACCA course, one of your biggest questions is probably:

“What is the ACCA salary in India, and is it really worth it?”

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

Yes, the ACCA qualification can genuinely transform your career.

ACCA opens doors that most traditional accounting paths simply don’t. The good news? ACCA salaries in India have increased significantly over the last few years, particularly among Big 4 firms, multinational companies, and GCC markets, which are actively hiring ACCA talent.

In this guide, I’ll bring together the most reliable insights from leading salary reports to give you a clear breakdown of ACCA salary in India and across the world – covering freshers, experienced professionals, Big 4, city-wise trends, and international packages.

What is ACCA?

Whenever students ask me, “What is ACCA?” I always tell them this – ACCA is one of the few qualifications that truly prepares you for a global career in finance in the world of accounting, finance, audit, business, and even teaching.

ACCA is not just a qualification-it’s a launchpad. The Association of Chartered Certified Accountants (ACCA) is:

- Recognised in 180+ countries.

- Trusted by Big 4 firms, global banks, MNCs, FinTech companies, and consulting firms.

- A qualification that blends accounting, business, auditing, taxation, reporting, analytics, and leadership, which is exactly why ACCA salary in India has steadily risen as companies prioritise globally trained talent.

But more importantly, the ACCA course trains you to think like a modern finance professional – someone who can:

- Read the language of business.

- Apply international accounting standards.

- Lead audit and compliance processes.

- Evaluate financial health.

- Support strategic decision-making.

I’ve seen students – some with no commerce background – grow into confident professionals working across India and beyond, beginning their careers with a competitive ACCA salary in India and scaling up rapidly in global roles.

- India

- UAE

- UK

- Europe

- Singapore

- Canada

- Australia

That’s the kind of mobility ACCA offers. If you’re considering finance, accounting, or business as a career. Today, an ACCA member is valued for global recognition, international reporting knowledge, and strong risk and compliance expertise. That is exactly why companies now offer stronger compensation packages even at entry-level positions.

If you’re new to ACCA and want to understand how it really fits into your finance career, this video explains it clearly:

ACCA Salary Guide: Level-wise Breakdown

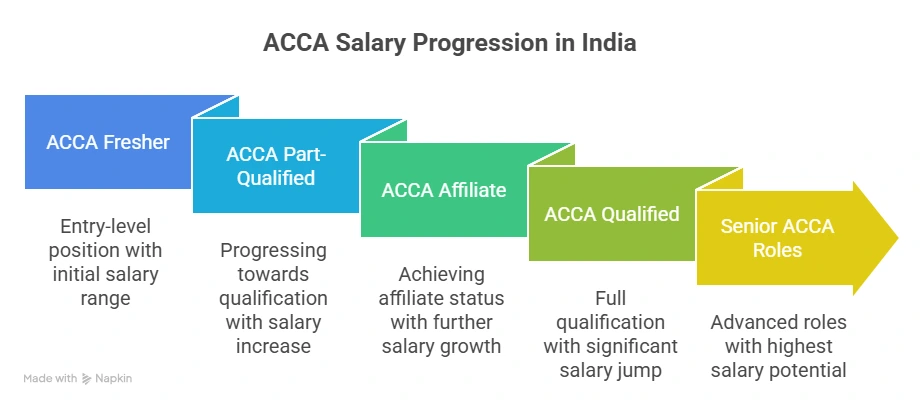

Before I show you the salary numbers, let me share something I’ve seen repeatedly. Salaries don’t just rise because you clear more papers – they rise because each ACCA subject you study adds a new layer of depth to your skillset. And this is exactly why the ACCA salary in India increases so predictably as you progress through the qualification.

When you’re learning the fundamentals at the Knowledge level, you build your base. As you move into skills-level subjects like Financial Reporting, Audit, and Taxation, the work you handle becomes more technical. And by the time you reach the Strategic Professional papers, you’re thinking at a management and decision-making level.

You’ll notice it yourself: the moment you move from Knowledge to Skills, the responsibilities you’re given start changing. Companies begin trusting you with more complex tasks, and that’s exactly why your salary grows in phases – and why the ACCA salary in India increases noticeably as you progress through the qualification.

Most candidates wonder – How much can an ACCA professional in India actually earn?

The table below reflects the progression I’ve observed across hundreds of students – from their first finance internship to senior-level managerial roles:

| Level | Yearly Salary (India) | Monthly Salary |

| ACCA Fresher | ₹4-6 LPA | ₹30,000-₹45,000 |

| ACCA Affiliate | ₹5-7.5 LPA | ₹40,000-₹60,000 |

| ACCA Part-Qualified | ₹3.6-6.5 LPA | ₹28,000-₹50,000 |

| ACCA Qualified | ₹7-15 LPA | ₹55,000-₹1.2L |

| Senior ACCA Roles | ₹18-30 LPA | ₹1.5L-₹2.5L |

Senior professionals in global roles or niche domains can cross 20 lakhs per annum and beyond.

What this tells you is simple: ACCA qualification rewards progress. Even before qualifying, part-qualified ACCA students start earning respectable salaries because employers value the consistency and discipline required to move through the exams. And once you’re fully qualified, the market opens up quickly – both in India and abroad.

If you’re planning to pursue ACCA alongside BCom, this detailed roadmap video will help you understand exactly how to structure your journey:

ACCA Salary in India

As you move through the qualification, you’ll also notice that some ACCA papers are tougher than others, especially at the Skills and Strategic Professional levels, and this difficulty is exactly why students who clear them are valued so highly in the job market. These advanced papers directly influence your earning potential, which is why ACCA salary in India tends to rise steadily as you progress through the levels.

Let me get straight to the number everyone wants:

To understand how an MCom and ACCA can work together to boost your finance career – from study plan to job prospects – here’s a video that lays out the full path:

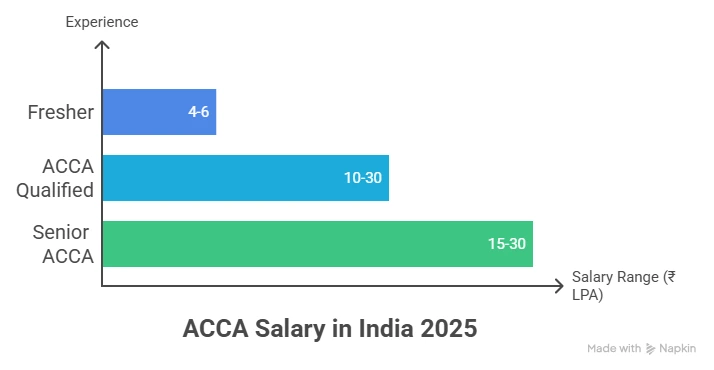

ACCA Average Salary in India

₹40,000-₹85,000 – This is what most candidates earn once they complete a significant portion of the qualification or become fully certified. This salary advantage also comes from the fact that the ACCA syllabus includes several demanding papers, especially at the higher levels, which directly contribute to stronger technical and analytical skills.

Highest ACCA Salary in India:

Senior ACCA professionals are currently earning ₹15-30 LPA as:

- Finance Managers

- FP&A Leads

- Internal Audit Managers

- Tax Managers

- Compliance Heads

That is why ACCA creates stronger job opportunities and faster career growth.

Quick ACCA Salary Facts

One thing I always remind students is this – your ACCA salary grows because the ACCA syllabus builds real, job-ready skills.

- ACCA freshers earn 40-60% more than non-certified candidates.

- Big 4 firms hire ACCA candidates for audit, tax, advisory & assurance.

- ACCA is recognised in countries like the UK, UAE, Canada, Australia, Singapore & Malaysia.

Many students ask: ACCA or MBA? This video provides a clear comparison of both routes – take a look:

ACCA Starting Salary in India

If you’re just beginning your ACCA journey, here’s what you can expect: ₹30,000-₹45,000 per month, which comes to ₹4-6 LPA annually. This is the typical ACCA salary in India at the fresher level.

And here’s something many students don’t realise – your ACCA course eligibility often influences your starting salary too.

Students who begin ACCA right after 12th, or alongside BCom/BBA, usually enter the job market earlier. Those who start ACCA after gaining work experience or completing CA Inter (IPCC)/CA/MCom often negotiate better salaries because they bring both academic eligibility and practical exposure to the table.

Your internships, communication skills, and on-the-job experience add just as much value as the number of papers you’ve cleared – sometimes even more.

Professionals working in multinational corporations typically receive higher compensation packages than small or mid-sized firms.

Here’s a city-wise ACCA starting salary breakdown:

| City | Starting Salary (Monthly) |

| Bangalore | ₹35,000–₹50,000 |

| Mumbai | ₹33,000–₹48,000 |

| Delhi | ₹30,000–₹45,000 |

| Chennai | ₹28,000–₹42,000 |

| Hyderabad | ₹30,000–₹45,000 |

| Pune | ₹30,000–₹46,000 |

Bangalore and Mumbai tend to offer the highest starting packages due to higher MNC concentration.

If you’re still unsure whether ACCA is the right direction for your career, this video breaks it down:

ACCA Job Salary in India (Role-wise)

Not all ACCA careers look the same – and that’s actually one of the biggest advantages of this qualification. Because the ACCA course details cover everything from accounting and audit to financial management, taxation, reporting, and analytics, students naturally branch into different specialisations once they enter the job market.

Some discover they enjoy the structured nature of audit, others realise they have a strong analytical mindset suited for FP&A or business analysis, while many find tax or management accounting far more aligned with their strengths. Understanding role-wise salary expectations helps you decide which direction to grow in, because your first job often shapes both your career path and your long-term earning potential – and directly influences your ACCA salary in India.

Here’s what different roles typically pay ACCA candidates across India:

| Job Role | Salary Range |

| Accountant | ₹4.5-7 LPA |

| Auditor | ₹5-8 LPA |

| Tax Associate | ₹5-7 LPA |

| Financial Analyst | ₹5-10 LPA |

| Internal Auditor | ₹6-12 LPA |

| Management Accountant | ₹7-12 LPA |

| Finance Manager | ₹10-18 LPA |

| Business Analyst | ₹7-14 LPA |

| FP&A Analyst | ₹7-15 LPA |

New-age roles in risk management and global reporting are among the fastest-growing job opportunities for ACCA professionals.

What stands out here is the growth potential. Roles like FP&A, internal audit, and management accounting see some of the fastest jumps in compensation once you gain even 1 to 3 years of experience. If you choose your first role wisely, your ACCA journey becomes significantly more rewarding.

ACCA Salary in Big 4 (India)

Working with a Big 4 is a dream for many ACCA aspirants – and for good reason. The training, exposure, and credibility these firms provide can transform your career. Over the years, I’ve seen students who started their journey at a Big 4 rise rapidly in the industry, not just because of the salary, but because of the brand and the opportunities that follow, which is also why the ACCA salary in India tends to be higher for those who begin their career in these firms.

But it’s important to understand something honestly:

The ACCA course does come with its challenges – and that’s exactly why Big 4 firms value it so highly.

ACCA Skill and Professional levels feel intense. They require consistency, strong conceptual understanding, and practice with exam-style questions. But here’s the silver lining: these same challenges are what prepare you for Big 4 work – where deadlines are tight, client exposure is high, and analytical thinking is non-negotiable.

And because ACCA trains you to handle global standards and complex reporting scenarios, Big 4 hiring teams often prefer ACCA candidates for audit, risk, advisory, and assurance roles.

Here’s what ACCA professionals typically earn across the Big 4 firms in India:

| Big 4 Firm | Salary Range |

| Deloitte | ₹6.5-12 LPA |

| PwC | ₹7-14 LPA |

| EY | ₹6.5-13 LPA |

| KPMG | ₹6-12 LPA |

Big 4 hiring heavily favours ACCA because of the IFRS and audit focus. The real value of a Big 4 isn’t just the starting salary – it’s the learning curve. A year of experience in a Big 4 often equals two to three years of learning anywhere else. That’s why many ACCA students specifically target these firms to kick-start their careers.

Preparing for a Big 4 interview as an ACCA candidate? This video gives you practical strategies and tips to ace it:

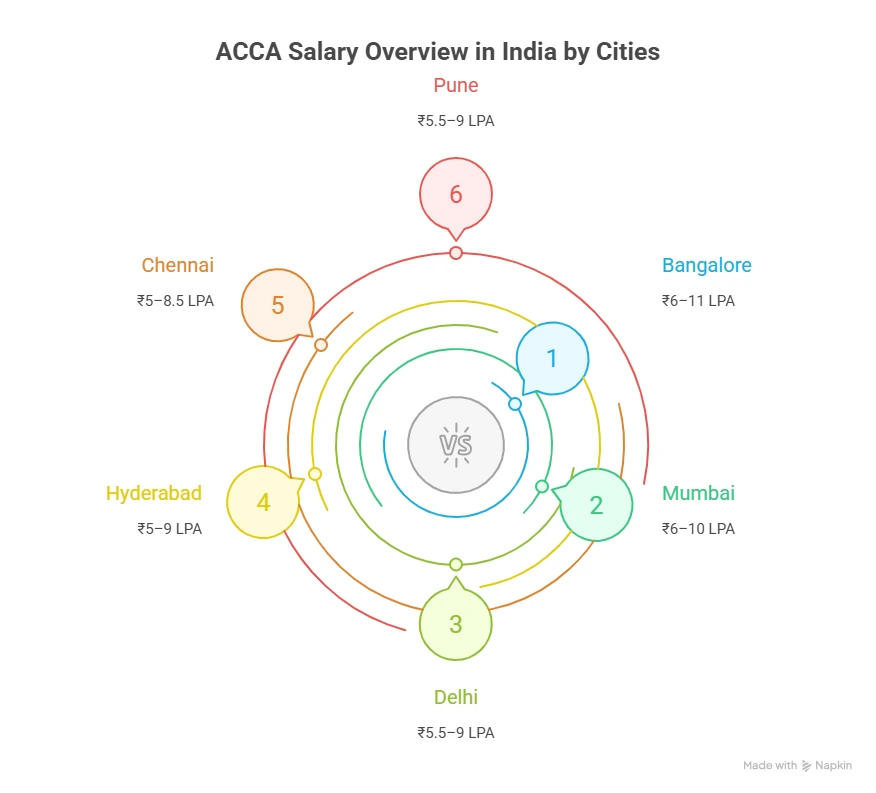

ACCA Salary City-Wise in India

Whenever students ask me, Which city gives the best ACCA salary? – I always tell them that salaries depend on the ecosystem around you. Some cities have Big 4 offices, some are dominated by GCCs, while others are hotspots for FinTechs and shared service centres. Naturally, this is why ACCA salary in India varies so much from one city to another.

Every city offers unique benefits when it comes to finance careers. Some offer aggressive, fast-paced markets, while others offer stable, long-term growth. To help you understand the landscape better, here’s a clear, city-wise view of what fresh ACCA candidates typically earn:

| City | ACCA Salary Range (Annual) |

| Bangalore | ₹6-11 LPA |

| Mumbai | ₹6-10 LPA |

| Delhi | ₹5.5-9 LPA |

| Chennai | ₹5-8.5 LPA |

| Hyderabad | ₹5-9 LPA |

| Kolkata | ₹4.8-7.5 LPA |

| Pune | ₹5.5-9 LPA |

| Ahmedabad | ₹4.5-7 LPA |

| Kochi | ₹4-7 LPA |

| Jaipur | ₹4-6.5 LPA |

| Gurgaon | ₹6-10 LPA |

| Noida | ₹5.5-9 LPA |

| Chandigarh | ₹4-7 LPA |

| Kerala | ₹3.8-7 LPA |

As you can see, Bangalore and Mumbai consistently offer higher starting packages – largely because of their dense corporate presence and international client exposure. But don’t underestimate Tier-2 cities like Kochi or Chennai; their finance and outsourcing ecosystem has grown rapidly, offering stable and rewarding entry-level roles.

Which Indian City Is Best for ACCA Placements?

One thing I’ve consistently noticed is that your ACCA placements often depend on where you complete your exams and where you begin your professional journey. The ACCA exams build your technical foundation, but it’s the job market around you that determines how quickly you can apply what you’ve learned and how competitive your ACCA salary in India will be in the early years.

An ACCA professional in India is trained to work with international standards, which gives them strong global recognition and makes them highly desirable for multinational corporations.

Every city has its strengths, but when it comes to ACCA placements, these cities stand out:

| City / Region | Why It’s a Strong Market for ACCA Professionals | Key Hiring Sectors |

| Bangalore | India’s tech and startup powerhouse; consistently high demand for ACCA talent due to rapid financial transformation across companies. | Big 4 firms, MNCs, shared service centres, FinTech companies. |

| Mumbai | The financial capital of the country is ideal for students aiming for high-growth finance and investment careers. | Investment banks, Audit firms, Corporate finance, Consulting firms. |

| Delhi NCR | A major hub for global organisations and consulting giants; excellent for strategic and analytical finance roles. | Internal audit, FP&A (Financial Planning & Analysis), Risk advisory. |

| Kochi / Trivandrum (Kerala) | A rapidly emerging finance and outsourcing destination with increasing international work exposure. | IT companies, outsourcing firms, and International audit outsourcing hubs. |

| Chennai | Known for stability and steady finance job growth – especially in shared services and outsourcing. | Shared service centres, Business process outsourcing, Audit & accounting KPO firms. |

If placements are your priority, Bangalore and Mumbai currently lead the ACCA recruitment landscape. These cities offer strong employer networks, faster career growth, and some of the highest ACCA salaries in India because they concentrate Big 4 firms, MNCs, and global capability centres.

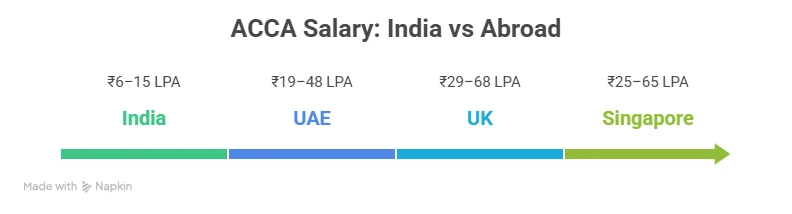

ACCA Salary Abroad

Now let’s step beyond India. One of the biggest advantages ACCA gives you is true global mobility. I’ve seen students move to Dubai within months of qualifying, get hired in London after just a couple of years of experience, or relocate to Singapore because their organisations needed IFRS-trained talent. And while ACCA salary in India offers a strong foundation to begin your career, international markets often amplify that growth even further because the ACCA curriculum is built around global accounting standards.

And here’s the interesting part:

The reason ACCA professionals fit so well into these international roles is that the ACCA course subjects themselves align directly with global job requirements. Employers abroad know that someone who has cleared these papers already understands IFRS, international audit standards, analytics, and business strategy.

That’s why ACCA salaries abroad are consistently higher than Indian packages – especially in audit, reporting, FP&A, and financial management roles.

Here is a country-wise table summarising international ACCA salary ranges across top markets:

| Country | Salary Range (in INR per year) | Career Insights (Based on Industry Experience) |

| United Kingdom (UK – outside London) | ₹29-58 LPA | Strong demand for audit, IFRS, and financial reporting professionals. Excellent start for those aiming for long-term UK careers. |

| United Kingdom (London) | ₹36-68 LPA | Higher pay due to global HQs, consulting firms, and investment companies concentrated in London. |

| UAE / Dubai | ₹19-48 LPA | One of the most popular destinations for ACCA professionals, with tax-free income and fast career progression. |

| Qatar | ₹15-45 LPA | Attractive packages and steady demand in audit, assurance, and government-linked entities. |

| Saudi Arabia | ₹12-40 LPA | Growing financial reforms and high hiring activity in compliance, audit, and internal control roles. |

| Malaysia | ₹10-30 LPA | Increasingly becoming a shared-services and regional finance hub for many global companies. |

| Ireland | ₹25-55 LPA | Preferred by many ACCA students due to smooth work visa pathways and strong accounting demand. |

| Switzerland | ₹60 LPA – ₹1.2 Crore per annum | One of the highest-paying finance markets, ideal for senior audit, risk, and finance leadership roles. |

| Germany | ₹35-70 LPA | Strong market for IFRS-focused roles and multinational finance teams. |

| Singapore | ₹25-65 LPA | Highly competitive, but excellent for long-term growth in FP&A, audit, and regulatory roles. |

| Canada | ₹28-50 LPA | Ideal for ACCA professionals targeting audit, banking, or corporate finance roles; stable migration pathway. |

| Australia | ₹30-55 LPA | High-quality work environment with strong demand for management accounting and financial analysis. |

| USA | ₹35-75 LPA | Strong packages in Big 4, advisory, and financial reporting compliance roles. |

This table alone tells you why ACCA is such a powerful qualification. Your earning potential multiplies once you step into global markets. And the best part? Many professionals complete most papers in India affordably, and then move abroad for higher-paying roles – making ACCA an incredibly high-ROI qualification.

Many professionals first build strong foundations in India and later use additional certifications and experience to move into global roles.

At the same time, it’s important to remember that ACCA salary in India remains highly competitive when adjusted for cost of living, career growth, and the sheer number of Big 4, GCCs, and MNCs operating here. For many students, India becomes the perfect place to start their ACCA journey, gain experience, and then decide whether they want to explore global opportunities later.

ACCA Salary Insights – What You Should Know

Before we dive deeper, here’s an important ACCA salary insight I’ve seen play out again and again – your earning potential in ACCA will grow with your skillset, attitude, and willingness to learn, not just the certificate. And yes – ACCA can genuinely change your career, if you treat it seriously.

- ACCA demand in India, especially in the Big 4, keeps rising every year – and that’s one of the biggest reasons ACCA salaries in India have seen steady growth across roles and industries.

- ACCA qualified professionals earn 50-120% more than part-qualified or non-certified candidates.

- ACCA is one of the fastest pathways to global accounting careers.

- Even freshers get opportunities across audit, taxation, management accounting, and risk.

- ACCA doesn’t make you successful by itself. But it gives you a stronger start and a wider career path than almost any other accounting qualification.

Want a clear comparison of how much ACCA and CA professionals earn in India and abroad? Watch this video for a detailed breakdown:

How Imarticus Learning Supports Your ACCA Journey

One thing I’ve learned after mentoring countless ACCA aspirants is this: Your training partner can shape your entire ACCA experience – from how confidently you learn the ACCA syllabus to how quickly you land your first job and start earning a competitive ACCA salary in India.

That’s exactly where Imarticus Learning stands out. Over the years, I’ve seen students transform from unsure beginners to confident finance professionals because they had the right guidance at every step.

Here’s what makes their ACCA support system so effective:

- Expert ACCA faculty (industry practitioners + exam specialists) – At Imarticus, you learn from people who’ve actually worked in the industry – qualified ACCA mentors and exam-focused trainers who know exactly how the papers are tested. Their teaching is practical, clear, and designed to build strong conceptual understanding.

- Live online classes tailored to all learning levels – Whether you’re at the Knowledge level or preparing for Professional papers, the classes are structured to fit your routine. With live sessions, flexible timings, and real-time doubt clearing, staying consistent becomes much easier.

- Placement support with top hiring partners – Imarticus’ industry network opens real doors for ACCA students. You get resume help, interview training, Big 4 preparation, and access to hiring drives – many students land roles even before they complete all their papers. This early start often gives them a strong edge in their career, especially because the entry-level ACCA salary in India is already competitive compared to most finance qualifications.

- Doubt-solving + mentorship support – ACCA can feel overwhelming, but you’re never on your own. You get one-on-one mentorship, regular doubt-solving sessions, exam strategy guidance, and study planners that keep you on track – support that genuinely improves first-attempt pass rates.

- Exam-oriented training that helps students clear papers smoothly – From Kaplan content to mock tests, revision kits, and progress trackers, every resource is designed to help you understand the exam pattern and walk into your papers with confidence.

- A Guided, Structured Learning Path – No more confusion about paper order, exemptions, or exam timelines. Imarticus helps you plan your entire ACCA journey with a personalised roadmap that keeps everything simple, efficient, and aligned with your career goals.

If you want structured guidance and a clear path, they’re a reliable choice.

Key TakeAways

The growth of ACCA salaries in India is driven by:

- Rising presence of multinational corporations.

- Global reporting standards.

- Demand for skilled tax consultants.

- Expansion of risk management roles.

Whether you start with entry-level positions or move into leadership, ACCA offers excellent job opportunities, strong global recognition, and salaries that can cross 20 lakhs with the right experience.

FAQs About ACCA Salary in India

Before students begin their ACCA journey, the most common questions I hear are always about salaries, growth, and long-term earning potential. And it’s completely natural – you want to know what your future might look like before you invest your time and effort. So here are a few frequently asked questions about ACCA salary in India to give you complete clarity.

Can an ACCA earn ₹1 crore?

Yes – absolutely. An ACCA professional in India crossed the ₹1 crore mark, especially those working in:

- Senior audit roles in the UAE.

- FP&A and financial controller roles in Singapore.

- Senior advisory or consulting roles in the UK.

- Director-level positions in Big 4 firms.

- CFO/Finance head roles in India.

While this level isn’t achieved in the first few years, it becomes realistic with the right mix of experience, international exposure, and specialised expertise. In fact, many professionals who begin with a solid ACCA salary in India eventually scale up to these high-earning global leadership roles.

Who earns more, CA or ACCA?

In India, CAs often earn more at the entry level due to their expertise in Indian laws. However, ACCA salary in India is competitive in Big 4 firms and MNCs, and globally, ACCA professionals tend to earn more thanks to their IFRS and international finance focus. At Imarticus Learning, we guide students to choose the right path based on their career goals.

Is ACCA in demand in India?

Yes, the demand for ACCA in India has grown sharply over the last five years.

Top companies hiring ACCA include:

- Big 4 firms

- Global Capability Centres (GCCs)

- Shared service centres

- IT and consulting firms

- FinTech companies

- Outsourcing and audit support firms

With India becoming an IFRS-aligned economy and multinational companies expanding here, ACCA demand is at its highest level yet.

Who is the highest-paid ACCA?

The highest-paid ACCA professionals usually work in senior audit & advisory roles in Big 4, finance leadership roles (CFO, Director of Finance, Financial Controller), consulting roles in the UK, UAE, Singapore, or Europe, risk, compliance, and regulatory reporting roles at global banks. While the ACCA salary in India itself can be very strong at senior levels, it’s these international and leadership roles that unlock the highest earning potential for ACCA professionals worldwide.

What is the first salary of an ACCA?

Most ACCA freshers in India start with a monthly package of ₹30,000–₹45,000, which works out to about ₹4-6 LPA. In metro cities like Bangalore or Mumbai, the ACCA salary in India can go even higher – often touching ₹50,000 per month – thanks to stronger MNC presence and greater international client exposure.

Who earns more ACCA or an MBA?

The comparison depends on the MBA: A tier-1 MBA (IIM/ISB) will typically earn more than ACCA. A general MBA from a mid-tier college usually earns less than ACCA professionals working in Big 4, MNCs, and GCCs. In global markets (UK, UAE, Singapore), ACCA salaries are often higher than general MBA salaries because companies value IFRS, audit, and reporting skills.

Does ACCA salary increase after clearing each level?

Yes. ACCA salaries rise noticeably as you move from Knowledge → Skills → Professional level. Each stage adds more technical depth, making you eligible for specialised and better-paying roles. Many students see a 20-40% jump after clearing major Skills or Professional papers. At Imarticus Learning, students get structured guidance, exam-focused training, and mentor support that helps them clear papers faster – which means they advance through levels more efficiently and unlock higher salary slabs earlier in their career.

Do Big 4 firms pay more to ACCA-qualified professionals?

Generally, yes. Big 4 firms offer ₹6-14 LPA to ACCA candidates based on their level and interview performance. ACCA-qualified professionals with IFRS expertise often receive higher packages because their skillset aligns directly with audit, assurance, and advisory work. Students who train with Imarticus Learning often secure better starting packages because they receive structured exam preparation, placement assistance, resume-building support, and interview training that helps them stand out in competitive hiring processes – especially in Big 4 firms, GCCs, and MNC finance teams.

Do ACCA candidates earn more with work experience?

Absolutely. After 1-3 years of experience, ACCA candidates often witness their salaries grow from ₹6-8 LPA to ₹10-15 LPA. Experience in audit, FP&A, or management accounting accelerates career growth significantly.

Is ACCA worth it for freshers in India in terms of salary?

Yes. ACCA freshers earn 40-60% more than general BCom/MCom candidates because they enter the workforce with global accounting knowledge, IFRS training, and stronger analytical skills. Even at the starting level, ACCA provides a higher salary baseline.

Does location affect ACCA salary in India?

Yes, ACCA salaries vary by city. Metro cities like Bangalore, Mumbai, Gurgaon, Hyderabad, Pune offer higher packages – often ₹6-11 LPA, due to multinational companies, Big 4 firms, startups, and GCCs operating there. Tier-2 cities offer slightly lower but stable salary ranges.

Can ACCA professionals earn in dollars while working in India?

Yes. Many ACCA candidates working in Big 4 offshore teams, GCCs, outsourcing firms, and international audit support roles receive client-linked compensation or foreign currency incentives. Some firms also offer hybrid or remote international roles.

Does risk management pay more?

Yes. ACCA roles in risk management, compliance, and governance are among the highest-paying today.

ACCA Salary in India: High-Paying Career Path

The rise in ACCA salary in India is no coincidence – it reflects how rapidly organisations are shifting towards global accounting standards, international reporting frameworks, and cross-border finance roles.

Whether it’s the Big 4, multinational companies, GCCs, or high-growth startups, employers today actively seek ACCA professionals for their global perspective and practical skill set.

For freshers, ACCA opens the door to stable, well-paying roles. For experienced professionals, it creates a pathway to leadership positions in finance, audit, advisory, FP&A, and compliance. And for those looking abroad, ACCA offers some of the strongest global salary potential in the world of finance.

And if you’re serious about building a career in finance, my advice is simple: Start early. Stay consistent. Learn deeply. And choose the right guidance. Take the first step today. Join the ACCA course and build the global career you deserve.

It can scan, diagnose, and attempt to correct the

damaged files whenever corruption occurs.