You finish school, and one question keeps coming back. Where do I begin if I want a serious career in finance? College is one route. A professional qualification is another. ACCA after 12th sits right at that decision point.

Think about how money moves in the real world. A small shop owner tracks daily sales and costs. A startup plans how to raise funds and manage cash flow. A large company studies profit, tax, and risk before making big decisions. Every one of these situations needs a professional who understands numbers, rules, and business choices. That is where ACCA Certification fits in.

When you look up what ACCA is, you are really asking what kind of professional you can become. ACCA trains you to read financial statements, plan budgets, check compliance, and guide business decisions. It is not just about learning formulas. It is about understanding how money decisions shape companies and careers.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

If you are someone who likes clarity, structure, and logic, this course feels natural. If you enjoy solving problems and working with numbers, you start to see patterns in accounts and reports. If you want a career that can take you across countries, this qualification gives you that mobility. ACCA after 12th gives you a path where your learning connects directly to real jobs. At this point, you have a clear sense of what ACCA after 12th represents. It is a global qualification. It is a practical learning journey that connects study with real work.

With this clarity, the next parts of the blog become easier to follow. You can now explore eligibility, duration, exams, and career outcomes with a clear picture of what you are working towards.

Understanding ACCA After 12th Before You Begin

When you think about building a career in finance right after school, one question usually comes first. What is ACCA and how does it shape your future?

ACCA is a global professional qualification in financial accounting. It trains you to understand how businesses manage money, make financial decisions, and stay compliant with laws. When you choose ACCA after 12th, you are stepping into a structured pathway that prepares you for roles in accounting, audit & taxation, and financial management across the world.

What You Study in ACCA

The ACCA course details is designed to help you move from basic concepts to advanced business decisions. You learn how money flows in a company and how to analyse it. Here is a simple view of the key areas covered.

| Area | What you learn in simple terms |

| Financial accounting | How to prepare company financial statements |

| Management accounting | How to control costs and plan budgets |

| Taxation | How individuals and companies pay taxes |

| Audit | How financial records are checked |

| Business strategy | How leaders make financial decisions |

This mix of subjects makes ACCA after 12th more than just an accounting course. It prepares you for real business situations.

How the ACCA Structure Works

The ACCA syllabus is divided into levels so that learning becomes easy and progressive. Each stage builds on the previous one.

| Level | What it focuses on | What you gain |

| Applied Knowledge | Basic accounting and business concepts | Strong foundation |

| Applied Skills | Core finance and taxation subjects | Practical skills |

| Strategic Professional | Advanced decision making and leadership | Professional expertise |

This step-by-step structure helps you grow your knowledge without feeling overwhelmed.

Why Students Choose ACCA After 12th

Students choose this path because it offers both flexibility and global exposure. Here are the main reasons students prefer ACCA after 12th:

- It is recognised in more than 180 countries.

- It allows multiple exam attempts every year.

- It focuses on practical knowledge, not just theory.

- It gives early entry into finance careers.

These features make it a strong option for students who want to start their professional journey early.

A simple, clear breakdown of the qualification helps you understand how each level builds your knowledge from basics to advanced business decisions. Knowing how the course is structured, what you study, and how the exams work gives you a strong foundation before you plan your journey ahead.

Can I Start ACCA After 12th?

When I first looked at ACCA after 12th, the biggest question in my head was simple. Can I start this course right after school, or do I need a degree first? The answer is yes. You can start ACCA after 12th. Many students in India and across the world begin their journey at this stage. The course has an entry pathway called Foundation in Accountancy (FIA). This route is made for students who have just finished school.

The idea is similar to learning to drive. You start with a learner’s license. You practise. Then you move to a full license. ACCA follows the same step-by-step growth. A student from commerce, science, or even arts can start. The only thing that changes is how much accounting you already know.

A few key facts make this decision easier to understand:

- ACCA is recognised in more than 180 countries

- It has more than 241,000 members globally

- Companies like Deloitte, EY, and KPMG hire ACCA professionals

These numbers show that this is not a small niche course. It is a global career track.

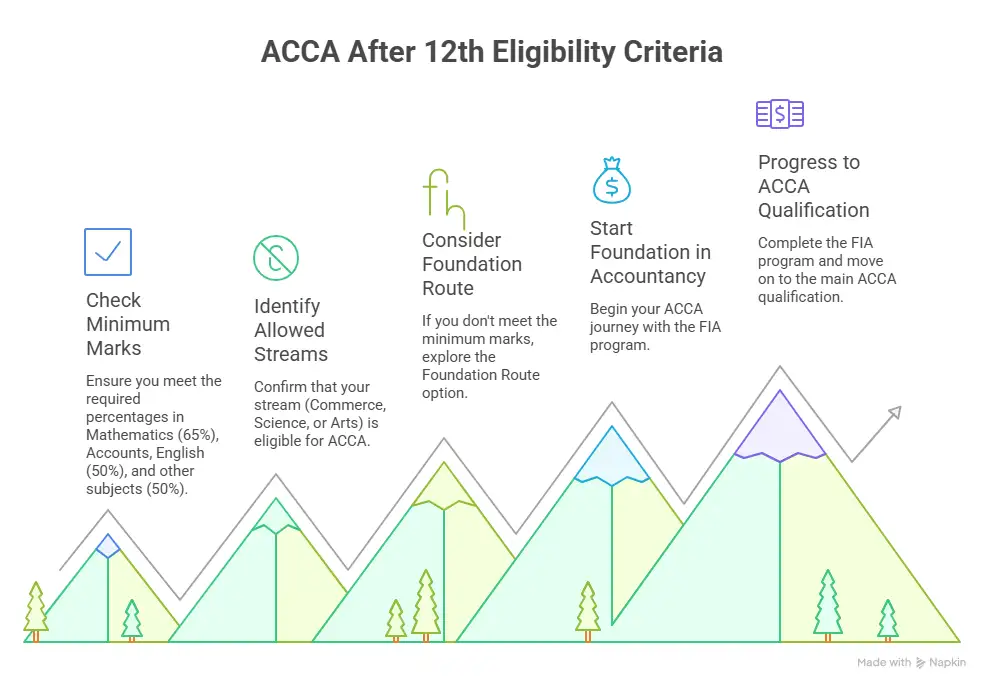

ACCA Eligibility After 12th

Before starting any course, I always like to check the entry rules. It saves time and confusion later. The ACCA eligibility after 12th is simple and clear. To start ACCA after 12th, you need:

- Minimum 65% in Accounts or Maths

- Minimum 50% in English

- Minimum 50% in other subjects

If you do not meet this, you can still enter through the Foundation route. This gives you the base knowledge, and then you move into the main ACCA papers. This means the answer to can we do ACCA after 12th is yes for most students. The course has flexible entry. For students who ask, “Can I do ACCA after 12th science?”, the answer is also yes. The only difference is that commerce students already know basic accounting. Science students will learn it from the start.

Also Read: Which ACCA Course Subjects are the Most Challenging?

Step-by-Step Roadmap to Start ACCA After 12th

Starting ACCA after 12th can feel confusing at first. So I like to break it into simple daily life steps. Think of it like joining a gym. You do not just walk in and lift heavy weights on day one. You follow a routine. Here is the step-by-step path.

Step 1: Register with ACCA

You create your student account on the official ACCA website.

Step 2: Choose your entry route

- Direct entry

- Foundation in Accountancy

Step 3: Start Applied Knowledge papers

These are beginner-level papers.

Step 4: Plan your study method

You can choose:

- Self study

- ACCA Coaching classes

- Online recorded lectures

Step 5: Book your exam

ACCA exams after 12th are conducted multiple times a year. You can choose a session that fits your preparation.

Step 6: Clear papers level by level

There are 13 papers in total. This is how to do ACCA after 12th in a clear and manageable way.

ACCA After 12th Commerce vs Science

This question comes up in almost every student group. To make it simple, let’s look at it like two people learning cricket. One has played in school before. One is new to the game. Both can become great players. The second person just needs a bit more practice in the beginning.

Here is a clear view.

| Stream | Starting Advantage | Initial Effort | Overall Difficulty |

| Commerce | Knows accounts basics | Lower | Moderate |

| Science | Strong maths logic | Medium | Moderate |

| Arts | Conceptual thinking | Medium | Moderate |

This shows that ACCA after 12th commerce gives a head start in accounting topics. But ACCA after 12th science gives strength in maths and logic. Both reach the same level in the end.

Also Read: How I Passed All My ACCA Exams on the First Try?

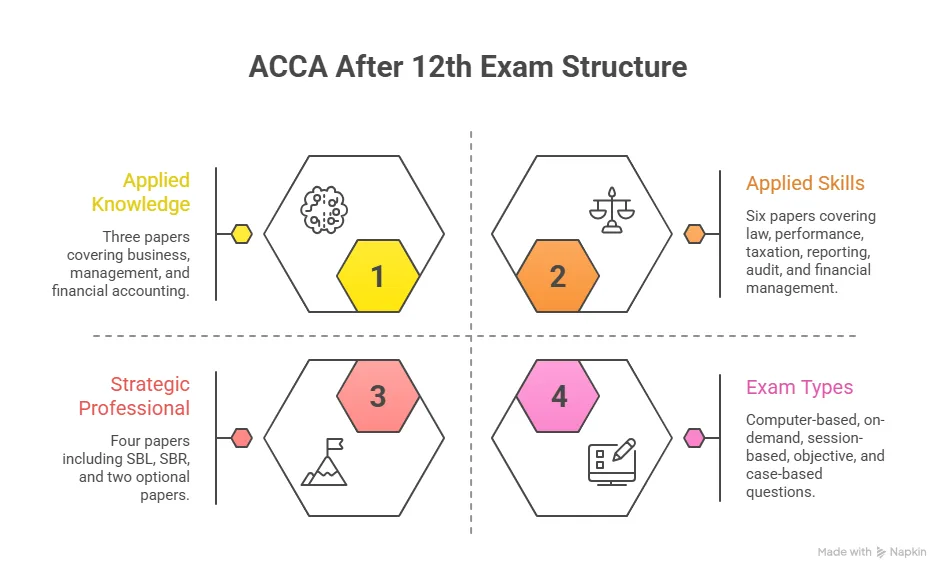

ACCA Course Details After 12th

To understand the course better, it helps to see the full structure. Before going into each paper, here is a simple table of the entire ACCA course after 12th.

| Level | Number of Papers | Focus Area |

| Applied Knowledge | 3 | Basics of accounting and business |

| Applied Skills | 6 | Core finance and taxation |

| Strategic Professional | 4 | Advanced finance and leadership |

This structure shows how the course grows step by step. It is similar to school classes. You start from the basics and move to advanced topics.

Also Read: How Globally Recognised Is the ACCA Qualification?

ACCA Exams After 12th Explained Simply

Students often feel stressed about exams. So I like to explain this in a simple way. ACCA exams after 12th are computer-based and are held four times a year. Exam months are:

- March

- June

- September

- December

This gives you four chances every year.

Each paper tests:

- Concepts

- Application

- Real business scenarios

This is useful because it prepares you for real jobs.

Is There an ACCA Entrance Exam after 12th

Many students search for the ACCA entrance exam after 12th or the ACCA entrance after 12th. There is no separate entrance exam for ACCA. You only need to meet the eligibility rules and register. If you do not meet the marks criteria, you can take the Foundation papers first.

A structured view of how the exams are organised can make preparation feel much more manageable. From the sequence of papers to the frequency of exam sessions, having a clear plan helps you decide how many subjects to attempt, when to revise, and how to pace your progress across levels so you stay consistent and exam-ready.

ACCA Course Duration After 12th

One of the most searched questions is about the ACCA duration after 12th. The ACCA course duration depends on how fast you clear exams. Here is a realistic timeline.

| Study Speed | Expected Duration |

| Fast track | 2 to 2.5 years |

| Normal pace | 3 to 4 years |

| Flexible pace | 4 to 5 years |

Many students complete the course in about 3 years. A student who plans well and gives 2 to 3 exams per attempt can complete faster.

How Many Exemptions for ACCA After 12th

Students also ask how many exemptions for ACCA after 12th. The answer is simple. Students who join ACCA after 12th usually get no exemptions. ACCA exemptions are mostly given to:

- BCom graduates

- CA students

- Other professional courses

So after school, you will normally complete all 13 papers.

ACCA Exemptions based on Qualifications

| Qualification | Typical Exemptions | Papers Exempted | What It Means for You |

| 12th (Commerce/Science/Arts) | No exemptions | 0 papers | You start from the first level (Applied Knowledge) |

| B.Com (General) | Up to 4 papers | BT, MA, FA, LW | You start directly from the Applied Skills level |

| B.Com (Accounting & Finance specialisation) | Up to 5-6 papers | BT, MA, FA, LW, PM, TX (varies) | You enter mid Applied Skills level |

| BBA / BMS (Finance) | Up to 3-4 papers | BT, MA, FA, LW | Similar entry as B.Com general |

| CA Foundation (India) | No exemptions | 0 papers | You begin from Applied Knowledge |

| CA Intermediate (Group 1 cleared) | Up to 5-6 papers | BT, MA, FA, LW, PM, TX | You start at advanced Applied Skills papers |

| CA Intermediate (Both groups cleared) | Up to 7-8 papers | BT, MA, FA, LW, PM, TX, FR, FM | You move close to the Strategic Professional level |

| CA Final (Qualified CA) | Up to 9 papers | All Applied Knowledge + Applied Skills | You only need to complete the Strategic Professional level |

| MBA (Finance) | Up to 3-5 papers | BT, MA, FA, LW, PM | Depends on the subjects studied |

Did you know?

The ACCA pass rate for many papers is around 40% to 50%. (Source: ACCA)

ACCA Course Fees after 12th in India

Before committing to any long-term course, I always look at the total cost. It helps me plan better and avoid surprises. The total cost of ACCA after 12th is made up of different parts. It is not a single fee. It includes registration, exam fees, and study support. Here is a simple breakdown to understand the ACCA course details after 12th from a cost point of view.

| Cost Component | Approx Cost (INR) |

| Registration fee | ₹7,000 to 9,000 |

| Annual subscription | ₹10,000 to 12,000 |

| Exam fees per paper | ₹9,000 to 15,000 |

| Coaching fees | ₹1,00,000 to 2,50,000 |

The full cost for the ACCA course after 12th commerce in India usually falls between ₹2.5 lakh and 4.5 lakh, depending on the study method. This range can change based on coaching choice and the number of attempts.

Also Read: How to Prepare for ACCA Exam Online?

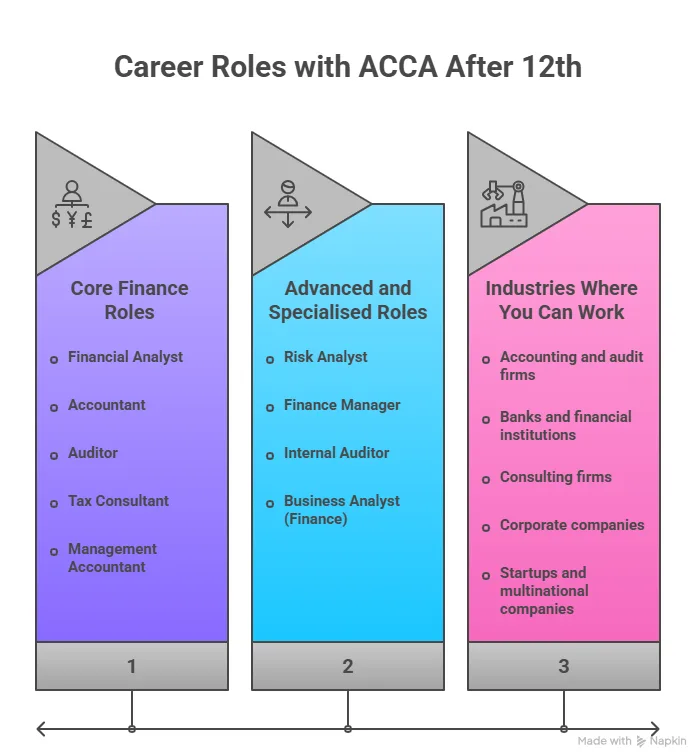

Career Scope and Salary after ACCA

Once you understand cost, you want to know what comes after the course. That is where the ACCA career scope becomes important. ACCA after 12th opens doors to global finance roles. Companies across the world recognise the qualification.

Here are common job roles after completing the course.

- Financial analyst

- Auditor

- Tax consultant

- Risk analyst

- Management accountant

Here is a practical range of ACCA salary in India across common career roles:

| Job Role | Entry Level Salary (0-2 years) | Mid-Level Salary (3-5 years) | Experienced Salary (6+ years) |

| Financial Analyst | ₹5 – 8 LPA | ₹8 – 14 LPA | ₹14 – 22 LPA |

| Auditor | ₹4.5 – 7 LPA | ₹7 – 12 LPA | ₹12 – 20 LPA |

| Tax Consultant | ₹5 – 7 LPA | ₹7 – 13 LPA | ₹13 – 20 LPA |

| Risk Analyst | ₹6 – 9 LPA | ₹9 – 15 LPA | ₹15 – 24 LPA |

| Management Accountant | ₹5 – 8 LPA | ₹8 – 14 LPA | ₹14 – 22 LPA |

In global markets, ACCA professionals can earn higher packages depending on location.

Global opportunities with ACCA

ACCA is not limited to India. It is a global qualification. ACCA members work in countries like:

- UK

- UAE

- Singapore

- Canada

- Australia

Many international companies prefer ACCA for roles in audit, consulting, and finance. This means that when I choose ACCA after 12th, I am not just choosing a local career. I am choosing a global one.

Also Read: Simplifying the ACCA Qualification for Aspiring Accountants

ACCA vs Other Finance Courses

Students often compare ACCA with CA, CMA, and MBA. Here is a simple understanding of ACCA vs CA and other qualifications.

| Course | Duration | Global recognition | Flexibility |

| ACCA | 2.5 to 4 years | High | High |

| CA | 4.5 to 5 years | Medium | Low |

| CMA | 3 to 4 years | Medium | Medium |

| MBA | 2 years | Medium | High |

This table shows how ACCA after 12th fits well for students who want flexibility and global exposure.

A clear look at where the ACCA qualification can take you in India helps you plan your next step with confidence. Understanding salary ranges, growth timelines, and industry demand gives you a practical view of how your career can evolve over the next few years.

Decision framework to choose ACCA after 12th

Before starting, I like to ask myself a few simple questions. This helps me know if my plan is realistic.

Ask yourself these questions

- Do I enjoy working with numbers?

- Do I want a global career?

- Can I study consistently for 2 to 3 hours daily?

- Am I comfortable with English-based exams?

If the answer to most of these is yes, then ACCA after 12th is a strong fit.

A Realistic 3 Year Roadmap To Complete ACCA

Many students ask how to finish ACCA after 12th in a focused way. A clear plan makes the journey easier. I like to break the course into a simple 3-year timeline. This gives enough time to learn, revise, and attempt exams without stress. Here is a practical roadmap based on a normal study pace.

| Year | Focus | Papers |

| Year 1 | Basics and foundation | 3 to 4 papers |

| Year 2 | Core finance subjects | 4 to 5 papers |

| Year 3 | Advanced level and options | 4 papers |

This plan fits well with the average ACCA duration after 12th of about 3 to 4 years. A student who studies consistently can complete the course in this time without burnout.

Also Read: Boost Your Accounting Career with the Benefits of an ACCA Qualification

Why Choose Imarticus Learning for Your ACCA Journey

When you prepare for ACCA after 12th, the quality of your learning partner can directly shape your results. The right support system makes it easier to understand concepts, stay consistent with exams, and move into real finance roles with confidence. Imarticus Learning has designed its ACCA Program preparation to connect academic preparation with real industry exposure, so students can learn, practise, and transition into careers with clarity.

Here are the key features that make Imarticus Learning a strong choice for ACCA preparation:

- Gold Status ACCA Learning Partner: Imarticus Learning is recognised as a Gold Approved Learning Partner by ACCA UK. This ensures the teaching quality, student support, and academic delivery meet global ACCA standards.

- Training in collaboration with KPMG in India: The programme is built in collaboration with KPMG in India. This brings real-world case studies, practical business exposure, and applied finance insights into your preparation.

- Joint certification with KPMG in India: Along with your ACCA qualification, you receive a joint certification that adds value to your professional profile and strengthens your resume for employers.

- Internship opportunities with KPMG in India: High-performing students get access to internship opportunities with KPMG in India, giving them direct exposure to industry work environments.

- Kaplan powered study material: The programme includes official Kaplan content, which is one of the most trusted ACCA study resources globally, including books, practice papers, and revision tools.

- Placement and internship assurance support: Imarticus Learning offers strong placement or internship support and structured career readiness training to help students move into finance roles after key ACCA levels.

- Pass assurance and money-back support at a professional level: The programme includes a money-back assurance if professional-level ACCA exams are not cleared, reflecting confidence in the academic structure and student support.

FAQs on ACCA After 12th

When you plan a professional course early, a few doubts about eligibility, difficulty, timelines, and career outcomes often come up while exploring ACCA after 12th. This section brings clear, simple answers to the most frequently asked questions that help you move forward with confidence.

Can I take ACCA after 12th?

Yes, you can start ACCA after 12th if you meet the basic eligibility marks or use the foundation route. This allows me to enter the course directly after school and build my finance career step by step. Many students in India choose structured coaching from Imarticus Learning to stay on track with study plans and exam preparation.

Is ACCA very difficult?

The difficulty level of ACCA after 12th depends on my preparation and consistency. The exams test understanding and application of concepts, so regular practice makes a big difference. With proper study planning and guidance from institutes like Imarticus Learning, many students clear papers steadily.

Can I finish ACCA in 3 months?

It is not possible to complete ACCA after 12th in 3 months because the course has multiple levels and exams. A realistic timeline is 2.5 to 4 years, depending on the number of papers you attempt each year. A fast-track plan with strong study discipline can help complete it on the shorter side of this range.

Which is easier, MBA or ACCA?

The ease of ACCA after 12th compared to MBA depends on my interest and career goals. ACCA focuses on finance and accounting concepts, while MBA covers management and business topics. If you enjoy numbers and financial analysis, ACCA will feel more natural to study.

What if I fail an ACCA exam?

If you fail a paper in ACCA after 12th, you can attempt the exam again in the next available session. ACCA conducts exams multiple times a year, so you do not have to wait long. With support from Imarticus Learning, you can review weak areas and prepare better for the next attempt.

Is ACCA harder than CA?

The level of ACCA after 12th and CA is different in structure and exam style. ACCA focuses on global accounting standards and application-based questions. CA has a different format from national regulations. The difficulty depends on my study style and comfort with the syllabus.

Can I pursue ACCA after 12th or graduation?

Yes. Students can start ACCA after Class 12 through the foundation route or directly after graduation. Commerce and finance graduates may also get paper exemptions. Most students complete ACCA in 2 to 3 years, depending on how many papers they attempt per session, exemptions availed and consistency in preparation.

Take the First Step Towards ACCA After 12th

Choosing ACCA after 12th is a clear step into a global finance career. The course gives structure, flexibility, and a strong career scope. It fits both commerce and science students. The path becomes simple when you break it into small steps, like eligibility, study plan, exam schedule, and career goal.

The journey needs steady effort. A daily study habit and a clear exam plan make a big difference. The course rewards consistency more than speed. Each level builds real skills in finance, tax, audit, and business decisions. These skills stay useful for life and work. The cost and duration are practical for most students in India. The return on investment is strong when you look at the starting salary and long-term growth. The option to work in global markets adds even more value. If you want a guided path, structured coaching can help me stay on track. The ACCA Course prep offered by Imarticus Learning offers study plans, doubt support, and mock exams that match the ACCA pattern. This can help me move through the levels with clarity and confidence.