What is financial modeling? Financial modeling is a crucial tool for businesses and investors alike, providing a quantitative framework to evaluate financial performance and make informed decisions. By creating mathematical representations of financial situations, financial modeling enables forecasting, risk assessment, and strategic planning. They are powerful tools for business decisions.

The core financial modeling meaning generally refers to creating a data-driven financial model that lets you plug in assumptions about the future, maybe a new product launch or a shift in marketing strategy. By feeding these guesses into the model, you can see how they might impact the company’s bottom line and financial condition. Let us learn what is financial modeling.

What is Financial Modeling?

What is financial modeling? Financial modeling is like building a roadmap for your money. It’s a way to create forecasts that help you understand where your finances are headed. It helps you predict future financial outcomes based on different scenarios and variables.

What does a financial modeling course help you do? By using mathematical formulas and data analysis, financial modeling gives you insights into things like investment returns, business performance, and budgeting strategies.

So, what is financial modeling? It is like having a financial GPS that guides you through the twists and turns of economic decisions, helping you make smarter choices along the way. It is used by financial analysts to anticipate the impact of the internal and external factors on the company.

Understanding Financial Modeling and Valuation

Financial modeling and valuation might sound intimidating, but it’s essentially creating a path for the company’s financial future. What is included in financial modeling? It’s built with numbers and formulas.

Financial modeling is the art and science of building mathematical representations of financial situations. It’s a tool that enables individuals and organisations to make informed decisions by quantitatively analysing various aspects of their finances. From forecasting future cash flows to evaluating investment opportunities, financial modeling empowers stakeholders to understand the potential outcomes of their choices and to plan accordingly.

What is valuation? Valuation, on the other hand, is the process of determining the inherent value of assets, companies, or investments. It involves assessing factors such as cash flow, growth prospects, and risk to arrive at a fair and accurate valuation. Whether valuing a company for investment purposes, determining the value of a project, or assessing the worth of an asset, valuation is essential for making informed financial decisions.

Together, financial modeling and valuation form a powerful duo, enabling stakeholders to understand the financial implications of their decisions and evaluate opportunities with clarity and precision.

Use of Financial Planning

What is financial planning? Financial modeling is a powerful tool used in the business world to assess financial performance and make decisions. It builds a computerised representation of a company’s financial situation, often in the form of a spreadsheet. This takes into account various financial factors and forecasts future results based on historical data.

Economic indicators to industry-specific trends, understanding the external forces

It involves applying statistical analysis and forecasting techniques to interpret historical data and make predictions about the future.

What is financial modeling demand? Financial modeling demands a keen awareness of the broader economic and market factors that can impact financial outcomes.

Key strength of financial modeling lies in its versatility. Whether you’re evaluating a new business venture, assessing the value of a company, or optimising a portfolio of investments, financial models can be customised to address a wide range of financial questions and scenarios. As such, financial modeling requires a balance of technical expertise, critical thinking, and knowledge.

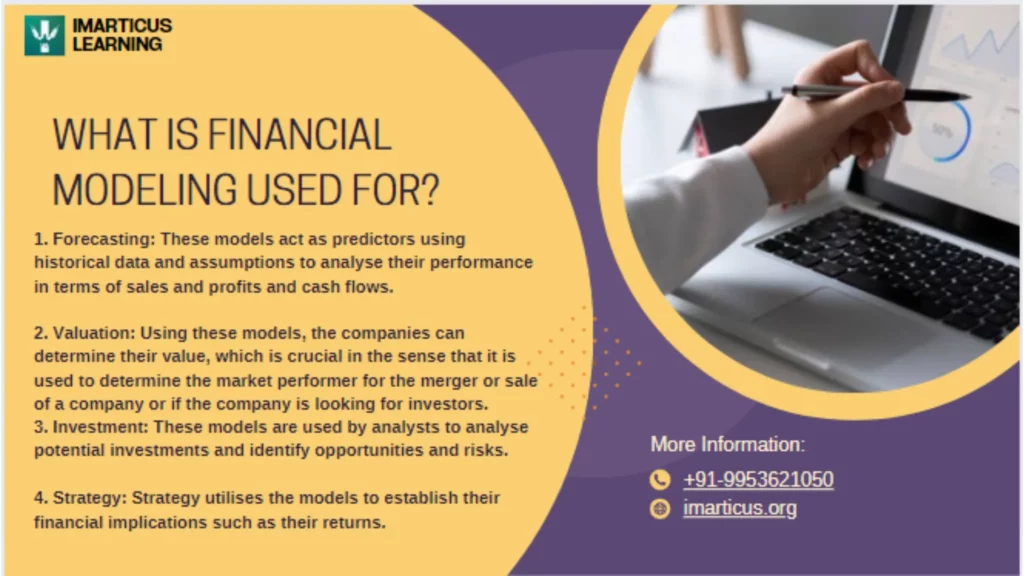

What Is Financial Modeling Used For?

Financial modeling has multiple applications in the business world. In summary, all these possibilities help a company to make informed and analytical financial decisions. These include the following possibilities: forecasting, valuation, investment, and strategy:

1. Forecasting: These models act as predictors using historical data and assumptions to analyse their performance in terms of sales and profits and cash flows.

2. Valuation: Using these models, the companies can determine their value, which is crucial in the sense that it is used to determine the market performer for the merger or sale of a company or if the company is looking for investors.

3. Investment: These models are used by analysts to analyse potential investments and identify opportunities and risks.

4. Strategy: Strategy utilises the models to establish their financial implications such as their returns.

Financial Modeling Illustrations

What is financial modeling and its illustrations? Financial modeling is one of the most highly valued, but least understood, skills in financial analysis. What is financial modeling? The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results.

Financial modeling is a tool used across various industries to analyse, forecast, and make strategic decisions. Here are some practical examples showcasing how financial modeling is applied in real-world scenarios:

Startup Valuation

Imagine you are a venture capitalist evaluating a startup for investment. Financial modeling can help you estimate the company’s future cash flows, assess its growth potential, and determine its valuation. By projecting revenues, expenses, and funding requirements, you can make informed decisions about whether to invest and at what valuation.

Real Estate Investment Analysis

What is financial modeling? Suppose you are considering purchasing a commercial property as an investment. What does financial modeling do? It can assist you in evaluating the property’s potential ROI, taking factors such as operating cost, property appreciation, rental income, operating expenses and financing costs. By building a cash flow model, you can determine whether the investment aligns with your financial goals and risk tolerance.

Merger and Acquisition Analysis

In the context of M&A transactions, financial modeling is used to assess the financial impact of potential mergers, acquisitions, or divestitures. By combining financial statements of the target company with projections of synergies and integration costs, estimate the potential value creation or dilution resulting from the transaction. This financial analysis informs negotiation strategies and helps stakeholders understand the implications of the deal.

Budgeting and Forecasting

What is financial modeling? For businesses of all sizes, financial modeling plays a crucial role in budgeting and forecasting processes. By creating detailed financial models that project revenues, expenses, and cash flows, companies can set realistic financial goals, allocate resources effectively and monitor performance against targets. Financial modeling enables businesses to adapt to changing market conditions, identify potential risks, and make proactive adjustments to their strategies.

These examples illustrate the versatility and importance of financial modeling in guiding decision-making and driving business success.

What is Corporate Modeling?

It involves using data and analytical tools to forecast financial outcomes, analyse risks, and evaluate strategic alternatives. Corporate modeling helps businesses understand how various factors such as sales growth, expenses, and capital investments will impact their financial performance over time. By building models that simulate different scenarios and assumptions, companies can anticipate potential challenges and opportunities, allowing for proactive decision-making.

One of the important aspects of corporate modeling includes financial statements. Corporate modeling helps businesses understand how various factors such as sales growth, expenses, and capital investments will impact their financial performance over time. By building models that simulate different scenarios and assumptions, companies can anticipate potential challenges and opportunities, allowing for proactive decision-making.

You can check out how to predict an organisation’s income statements, balance sheets and cash flow statements with the three-statement financial model.

What is Financial Modeling Course?

Financial modeling is the process of constructing a digital representation of a company’s financial performance. This model factors in income statements, balance sheets, and cash flow statements, allowing for forecasts and scenario planning. Financial modeling courses break down this process into manageable steps. Participants learn how to use spreadsheet software, typically Excel, to build formulas, create charts, and automate calculations.

These courses cater to a wide range of professionals. Finance analysts and aspiring analysts form a core group, but anyone involved in financial planning or decision-making can benefit. Business owners, entrepreneurs, and even non-finance professionals seeking career advancement can find value in understanding financial modeling fundamentals.

Wrapping Up

Mastering financial modeling is essential for anyone looking to navigate the complexities of modern finance with confidence. Whether you’re making investment decisions, managing corporate finances, or planning for the future, the ability to harness the power of financial models is a valuable skill that can drive informed decision-making and unlock new opportunities. Whether you’re a seasoned financial analyst or a novice investor, dive into the world of financial modeling and equip yourself with the tools you need to excel.

Wish to master financial modeling? Enrol in the Post Graduate Program in Financial Analysis to become a financial modeling expert. This program will teach you everything you need to become a financial analyst.

Contact us today!

FAQ’s

Financial modeling is a process of creating mathematical representations of financial situations to analyse and forecast outcomes. It is crucial because it helps individuals and businesses make informed decisions by quantitatively evaluating various financial scenarios, such as investments, budgeting, and strategic planning.

To excel in financial modeling, individuals need a solid understanding of accounting principles, proficiency in spreadsheet software like Excel, and knowledge of statistical analysis and financial concepts. Strong critical thinking and problem-solving skills are also essential for interpreting data and making sound financial decisions.

Financial modeling can be applied across various industries, including finance, consulting, real estate, and technology. In finance, it’s used for valuing assets, assessing investment opportunities, and managing risk. In consulting, it helps analyse business performance and develop strategic recommendations. In real estate, it’s utilised for property valuation and investment analysis. In technology, it aids in forecasting revenues and assessing startup valuations.

Some common challenges in financial modeling include data quality issues, uncertainty about future variables, and the complexity of modeling certain financial instruments or scenarios. Ensuring the accuracy of inputs, dealing with nonlinear relationships, and managing model complexity while maintaining transparency and usability are ongoing challenges for financial modelers.