If you’ve been exploring global finance careers, you’ve probably heard people say that the CMA certification is your passport to international opportunities. And honestly, that’s not an exaggeration. It isn’t about just recording numbers or closing books at month-end. Companies today want finance professionals who can analyse, interpret, and guide real business decisions – and that’s exactly the gap the certification fills.

When I first started looking into the certification, what stood out to me was how it shifts your mindset. Instead of simply explaining what happened in the past, you’re trained to shape what happens next – from budgeting and cost planning to performance strategy and financial leadership. That’s why employers around the world value CMAs so highly.

If you’re wondering how this certification can open doors in different countries, or how it compares in terms of career scope, salary, and job roles, don’t worry – this guide breaks it all down based on current global trends, not just theory.

Considering the US CMA certification? This quick video explains how it can boost your salary by 25-30%, fast-track your career in just 6-8 months, and why top global firms prefer them for senior roles.

What is CMA?

You’ll often hear this comparison:

Accountants explain the past. Certified Management Accountants influence the future.

If you’ve ever wondered what is CMA, simply put, it’s a credential designed to help professionals move from recording numbers to shaping business outcomes. The CMA certification isn’t just another accounting qualification – it’s engineered for global mobility. Unlike some regionally locked credentials, the IMA Certified Management Accountant certificate travels with you, recognised by employers who demand a strategic mindset and analytical rigour.

The IMA itself boasts more than 100,000 holders of this certification worldwide – a testament to CMA’s leap from niche credential to best-in-class global standard.

Imagine yourself sitting in a boardroom – not just presenting figures, but guiding discussions like:

Where should we invest next?

How do we optimise cost without hurting growth?

What pricing strategy will increase revenue and market share?

While others may see spreadsheets, a Certified Management Accountant sees direction, impact, and opportunity.

CMA identifies operational inefficiencies, anticipates regulatory changes, and steers the discussion toward both profitability and compliance. This unique lens makes them indispensable across continents – from North America’s high-powered finance hubs to the emerging markets of Asia and Africa.

Want to understand the subjects in detail? See the CMA course subjects list.

Why is CMA Gaining Global Recognition?

Let’s talk about why the CMA course is becoming such a sought-after credential worldwide. The finance world has changed a lot. It’s no longer enough to just record transactions or close the books every month. Companies now need people who can make sense of the numbers – people who can look at data, understand what it means for the business, and guide the next move. That’s exactly the strength this certification develops. It trains you to think beyond accounting and step into strategy. And that’s why employers across the world see Certified Management Accountants as future-focused finance leaders, not just number-crunchers.

Now, here’s what’s really contributing to its global rise:

International Curriculum: Unlike some national certifications, where local laws dominate the syllabus, the syllabus is standardised worldwide, with assessment and ethics benchmarks consistent across all countries. The CMA course syllabus is integrated with both US GAAP and IFRS, so CMAs are qualified to navigate diverse accounting standards wherever business takes them.

Consistent Criteria: No matter where you earn the credential, the global curriculum and evaluation standards remain the same, avoiding the regional revalidation that comes with many local certifications.

Employer Preference: In IMA’s recent survey, 82% of international consulting firms, multinationals, and banks favoured CMAs over non-certified counterparts, for their ability to blend financial acumen with management insight.

Career Examples and Real-World Impact

- Microsoft leverages CMAs for global finance decision-making.

- Unilever values CMAs in supply chain optimisation and foreign cost control.

- Top banks (HSBC, Standard Chartered) recruit CMAs for risk management and FP&A.

- Consulting giants like PwC and KPMG actively seek out CMAs in India, the Middle East, and beyond.

For a closer look at CMA course preparation, check out how to choose the best CMA review course.

CMA Scope Worldwide

Wondering where the CMA course can take you on your global finance journey? The great news is – the reach is truly international, and its value is skyrocketing in some of the world’s most dynamic markets. Whether you’re dreaming of leading finance teams, steering strategy, or making an impact in a fast-growing corporate landscape, the CMA stands as a powerful credential that opens doors everywhere.

Let’s take a closer look at how the CMA course is recognised across key regions, and why more and more employers worldwide are on the lookout for CMA-qualified professionals like you.

North America: US & Canada

The US and Canada lead in recognition, with top employers recruiting CMAs for senior and strategic finance functions. This strong demand translates into a clear salary premium and career mobility. CMAs often move into high-impact positions such as Senior Financial Analyst, Finance Manager, FP&A Specialist, and even CFO roles, reflecting the qualification’s high market value and industry trust.

Middle East & Gulf (UAE, Saudi Arabia, Qatar)

In recent years, Dubai, Saudi Arabia, and Qatar have really become strong hubs for CMA professionals. As these markets expand their financial services and strengthen corporate governance, the demand for skilled finance leaders is rising fast. In fact, some GCC regions have seen a 45% jump in CMA-qualified professionals year on year. And because companies are actively looking for people who can bring strategic and analytical thinking to the table, they often earn about 35-40% more than non-certified finance roles. It’s a market where the qualification genuinely pays off – both in career growth and compensation.

Asia-Pacific (India, Singapore, China)

China, Singapore, Malaysia, and India are now key players in the global talent landscape, with employers increasingly seeking professionals who can combine finance expertise with strategic insight. In India, especially, the momentum is hard to miss – there has been a 38% rise in CMA-specific job postings within just one year. This demand is coming from banks, IT companies, consulting firms, MNCs, and the Big 4, all of whom value CMAs for their ability to drive business performance and financial decision-making. It’s clear that the Certified Management Accountant is no longer a niche qualification – it’s becoming a mainstream requirement for future-ready finance roles. For detailed Indian salary insights, check the CMA salary in India 2025.

Europe & Africa

European multinationals and major banks are increasingly seeking the “edge” for strategic and leadership-oriented finance roles. Many finance teams now intentionally pair CMA certification with ACCA or CPA professionals to build strong, forward-looking leadership pipelines. In several cases, CMAs are valued as much as or even more than local qualifications in foreign countries, especially for roles tied to budgeting, performance strategy, and financial planning. At the same time, awareness is steadily rising across high-growth African economies, where companies are beginning to recognise the CMA certification as a pathway to building modern, globally aligned finance teams.

CMA Career Opportunities: Roles, Salaries & Growth

The CMA course is all about flexibility. Here’s where the CMA career stands out: data shows consistent, above-market pay and career mobility around the world. In India and the broader Asia-Pacific region, the numbers are climbing, while international postings provide even stronger earning potential.

| Career Path | Typical Roles | Salary Range |

| Corporate Finance | Finance Director, CFO, Financial Analyst | ₹6-40 LPA |

| Strategic Management | Strategy Consultant, Business Analyst | ₹8-35 LPA |

| Risk Management | Risk Analyst, Internal Auditor | ₹7-25 LPA |

| Financial Leadership | Finance Director, Controller | ₹35 LPA – ₹1.57 Crore+ |

| Consulting/Advisory | Management Consultant, Financial Consultant | ₹10-45 LPA |

Certified Management Accountants consistently report earning around 31% more than their non-certified counterparts – a bright spot for both career progression and job security. For more on salary expectations, see CMA salary.

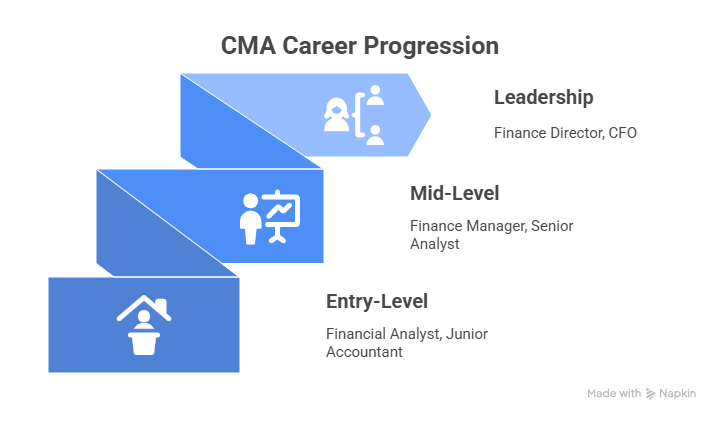

Salary Growth Over a Typical CMA Career

So, what does a CMA career actually look like in terms of growth and role progression? And the salary growth? It moves in step with these increased responsibilities and impact. The path turns you from an analyst into a trusted business advisor and eventually a strategic leader. Each step opens doors to more influence, bigger challenges, and greater rewards – making it one of the most fulfilling career paths in finance.

| Experience | Career Stage | Typical Range |

| 0-2 years | Entry | ₹3-5 LPA |

| 3-7 years | Strategist/Mid-Level | ₹8-15 LPA |

| 8+ years | Manager/Business Leader | ₹15-30 LPA+ |

| 12+ years | Director/CFO/Executive Director | ₹20-35 LPA+ |

By year 2-4, most proactive certified professionals cross the ₹1 lakh per month (₹12 LPA) threshold in India, especially with top employers and analytics skills.

Industry Demand and Growing Sectors

The world of finance is evolving, and the demand for skilled Certified Management Accountants is growing in tandem across a variety of industries. Whether it’s strategising for clients in consulting firms or optimising costs in manufacturing plants, CMAs bring valuable expertise that companies crave to stay competitive and agile.

Here’s a quick look at how CMA professionals are valued across key sectors today:

| Industry | Average Salary | Rationale for Demand |

| Consulting | ₹7-20 LPA | High analysis, client strategy focus |

| Banking & BFSI | ₹8-25 LPA | Risk, compliance, FP&A, decision tools |

| Tech & IT | ₹6-18 LPA | Data analytics, transformation projects |

| Manufacturing | ₹6-15 LPA | Cost control, process optimisation |

| e-Commerce | ₹5-12 LPA | Dynamic pricing, business growth |

The data speaks volumes: The credential is not just recognised worldwide – it’s rewarded, with real pay and career acceleration, by the most progressive employers. The credential unlocks careers in every major business and finance hub, giving you the practical expertise and analytical power modern companies need most.

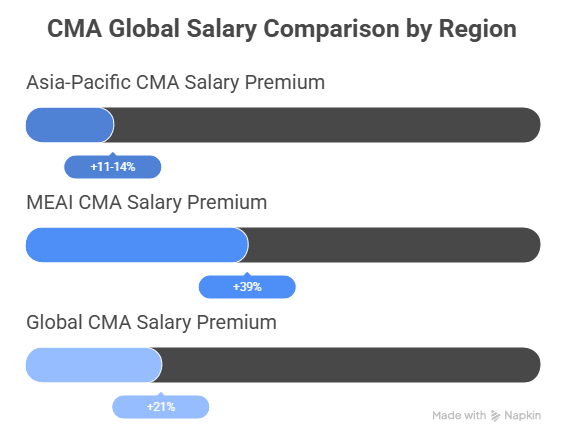

International Reach and Market Premiums

CMA credentials command regional premiums. Asian and Middle Eastern CMAs enjoy salary increases up to 120% above the market. Across emerging markets, Certified Management Accountants consistently report higher earnings, ranging from approximately 10-15% in Asia-Pacific to 35-40% in the Middle East, Africa, and India, compared to non-certified professionals. (IMA Global Survey)

Global banking institutions, including HSBC and Standard Chartered, actively recruit CMAs for risk and strategic analysis in their international operations.

Here’s a global Comparison of salaries region-wise:

| Region | Mean Base | Median Total | Key Takeaway |

| Americas | $129,961 | $153,874 | Highest global salaries |

| Asia-Pacific | $36,985 | $44,548 | Fastest growth in demand and salary acceleration |

| Middle East/India | $32,878 | $39,583 | Strong regional premium, rising fast |

| Europe | $104,369 | $124,024 | Top-tier finance hub, sought for analysis roles |

Certified Management Accountants in Asia, the Middle East, and India often see regional premiums (35–40% boosts) over their non-certified peers.

If you’re still weighing whether this certification is the right move for you, explore whether the CMA certification is worth it to understand its long-term impact on career growth, salary, and global opportunities.

Skills That Make CMAs Stand Out

To truly stand out as a CMA, you’ll need more than the credential – you’ll need a sharp set of business skills. Discover the top 10 skills every CMA must have and ensure you’re ready for the strategic finance roles employers are actively hiring for.

Certified Management Accountants are not just spreadsheet experts. Their training equips them for:

- Strategic financial planning and business performance analysis.

- Deep expertise in risk assessment and management.

- Advanced cost accounting and operational controls.

- Effective communication and collaboration with leadership.

- Turning raw numbers into business-shaping decisions through decision-making facilitation.

These skills, bundled into the certification, are cited as top priorities by global recruiters. As automation spreads, CMAs’ blend of analytical rigour and business judgment remains in the highest demand – no AI or software can replicate strategic insight.

Dive deeper into “Decision Analysis: How CMAs contribute to effective management”.

CMA Exam and Curriculum: Built for World-Ready Finance

The exam is administered primarily in English, but the IMA offers study guides in Chinese, Japanese, and Arabic languages – affirming its international focus. The curriculum covers global accounting standards, allowing holders to be productive across geographies without retraining or additional licensing.

No regional relicensing is required, making the CMA course perfectly suited for cross-border job mobility, a distinct advantage over region-specific certifications. Explore the best CMA study materials 2025.

If you’re curious about what it takes to earn the CMA certification and how much it might cost to invest in your global finance future, check out the CMA course fees to get a clear picture.

How to Maximise Your CMA for Global Mobility

CMAs don’t just “earn more” – they earn differently. The certificate signals a leap from support roles to decision-making. Factors influencing salary benchmarks in vibrant finance economies include:

- Experience and cross-functional exposure

- Hands-on tech skills and data analytics tools (Power BI, Tableau, SAP)

- Leadership and the ability to translate numbers into actionable insights

- International assignments or IFRS/US GAAP experience.

Succeeding with this certification worldwide takes more than the credential:

- Local Knowledge: Pair your CMA certification with an understanding of domestic financial constraints to get deeper expertise and cross-functional business projects early in your career..

- Industry Focus: Specialise your skills in high-growth sectors like tech, banking, fintech or manufacturing within your own country.

- Language Skills: Getting fluent in foreign languages increases your hiring potential overseas.

- IMA Networking: Connect with IMA chapters in your area to tap into local job opportunities.

Proactively upskilling in these areas ensures that the certification opens doors globally. So the earning potential is absolutely there – the key is building strong analytical and leadership skills and moving into strategic finance roles over time.

Planning where to leverage your credentials? Understanding the difference between the US CMA vs the Indian CMA programs can give you a real edge.

Curious about how much you can really earn as a CMA in India versus the USA? This video breaks down the earning potential.

CMA vs Other Global Certifications

Let’s clarify how the CMA course stands out among popular alternatives like ACCA, CFA, and CPA:

| Certification | Global Reach | Key Focus | Best-Suited Roles | Median Duration | Typical Industry Preference |

| CMA (by IMA, US) | 170+ countries | Cost control, management accounting, strategic finance | FP&A, CFO, Corporate Finance, Business Analysis | 6-18 months | MNCs, BFSI, Consulting, Tech |

| ACCA | 180+ countries | Audit, tax, and financial reporting | Audit, Tax, Statutory Reporting | 2-3 years | Audit, Public Accounting |

| CFA | Global, esp. finance | Investment analysis, asset management | Investment banking, Equity Analyst | 2-4 years | Funds, Asset Management |

| CPA | Mostly the US, recognised globally | Public accounting, regulatory, and auditing | Audit, Controller, Consultancy | 1-2 years | Accounting & Audit Firms |

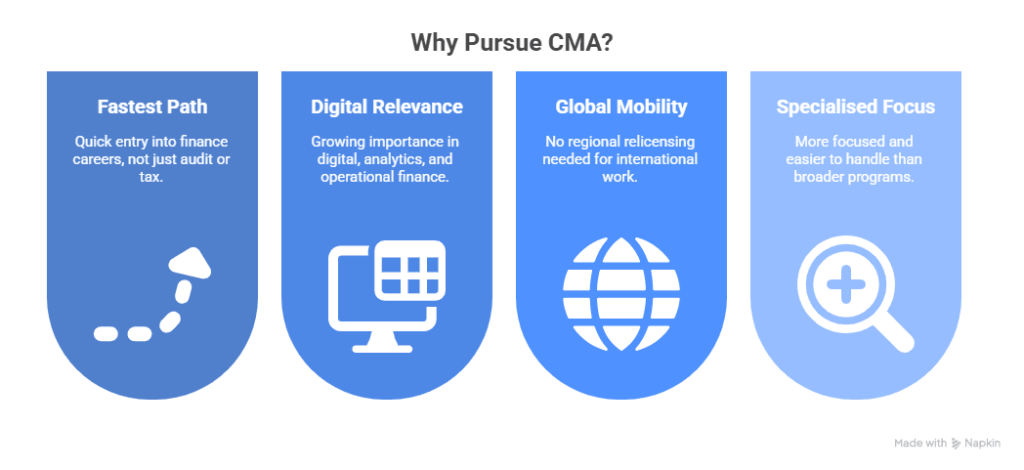

Why Choose CMA?

If you’re aiming for a finance career that goes beyond just crunching numbers, the CMA is your fast-track ticket. It opens doors to high-impact roles in business and industry, not just traditional audit or tax functions. You’re trained to think strategically, influence decisions, and drive business performance – skills that employers actively seek.

The CMA certification is also increasingly relevant in today’s digital world. With businesses leaning on data analytics, operational finance, and technology-driven decision-making, Certified Management Accountants are perfectly positioned to bridge the gap between numbers and strategy.

And if you’ve ever dreamed of working abroad or with global companies, the CMA gives you mobility without the headache of regional relicensing. Whether it’s North America, the Middle East, or Asia, your credential travels with you – recognised and respected by employers worldwide.

Compared to broader programs like ACCA or CA, the CMA course is more specialised, manageable, and focused on strategic finance roles – making it a smart, targeted investment in your career.

Elevate Your CMA Journey

Think of this as more than just CMA coaching. It’s like having a guided path into the world of global finance.

You’re not sitting and memorising formulas on your own. You learn through live discussions, real business examples, and case studies that make you think like someone already working in a finance team. When you hit a tough topic, you have mentors who actually explain it – not just read slides. And when exam pressure kicks in, there’s structure, mock tests, and someone checking in to make sure you don’t fall off track.

You’ll spend over 250 hours engaged in industry-focused, expert-led classes where the learning is hands-on and practical. It’s learning that prepares you to not just pass exams but to confidently analyse, decide, and lead from day one. Mock exams and practice assignments build your confidence and sharpen your skills, making sure you’re ready for the moments that count.

But the journey doesn’t end with passing the CMA exams. The real journey starts after it. That’s where career support comes in, right from resume polishing, interview preparation, and guidance on which roles to target based on your strengths. You learn how to speak confidently about your skills, not just list them.

Ready to start your global finance journey with expert guidance and real-world experience? Learn more about the CMA certification program offered in collaboration with KPMG in India and take the first step towards transforming your career.

FAQs About CMA Global Recognition

When you’re considering the CMA certification, it’s natural to have questions about how it’s viewed across different countries and industries. Here are a few frequently asked questions around CMA’s global recognition, how it compares internationally, licensing requirements, and the practical benefits you can expect as a global finance professional.

Is CMA easier than CA?

Yes, the CMA course is generally considered more manageable than CA. CA has a broader syllabus and a longer exam cycle, while the CMA is focused on management accounting, financial planning, and business strategy. However, “easier” still depends on your comfort with analytical and case-based problem solving – CMA is intensive, but far more structured and predictable than CA.

What is the CMA salary?

Your salary as a CMA depends heavily on your role, company, and how quickly you grow. Freshers typically start around ₹6-12 LPA. As you move into roles like Senior Analyst, FP&A, or Finance Manager, the range usually moves to ₹12-28 LPA. With experience, CMAs often step into leadership positions like Controller, FP&A Lead, or Finance Director, where compensation can go from ₹30 LPA to even ₹1 crore+, especially when bonuses and performance incentives come into play. In short, your growth is tied to your ability to drive business performance.

Is CMA or CFA better?

They point to two different careers, so the “better” one depends on what you want to do every day. Choose CMA if you see yourself working within companies – driving budgeting, financial planning, decision support, costing, operations, and business strategy. Choose CFA if your interest is in financial markets – investment banking, equity research, portfolio management, or wealth management. Both are strong qualifications, but the right one is the one aligned with your career path – not the one that just sounds more popular.

Can a CMA earn ₹1 crore?

Yes, but it happens with experience, not right after qualification. The CMA opens the door to roles where finance professionals move beyond accounting and start influencing business decisions. When CMAs grow into positions like Finance Manager, FP&A Lead, Controller, or eventually Finance Director/CFO in MNCs or high-growth companies, total compensation can cross the ₹1 crore mark.

Is the CMA recognised in Europe, Asia, and the Middle East?

Yes, especially in MNCs and international banks. CMA’s focus on management accounting and strategy sets it apart – increasingly valued alongside or above local credentials in these regions.

Will CMA mobility help with career moves abroad?

Absolutely. Because the CMA is built on global curriculum standards and does not require regional revalidation, it’s accepted in major hiring markets worldwide. Combine it with local language skills or domain mastery for even greater portability.

Do CMAs earn more?

Yes. CMA-certified professionals globally command salary premiums (21-58%+) over non-certified accountants. In fast-growing markets, the premium is even higher.

Can I switch sectors or climb faster as a CMA?

Definitely. CMA-trained pros transition more easily from accounting to roles in analytics, consulting, risk, or the C-suite, due to their broad business impact.

How many times can I attempt the CMA exam?

There’s no strict limit on the number of attempts for the CMA exam. You are allowed to retake the exam as many times as needed to pass. Most candidates take 2-3 attempts per part, depending on their preparation. At Imarticus Learning, we guide you with structured study plans, mock tests, and expert mentorship to maximise your chances of clearing each part in the first attempt, saving both time and effort.

References

- https://www.ambitionbox.com/profile/director-finance-salary/mumbai-location

- https://www.ambitionbox.com/profile/cfo-salary

- https://www.glassdoor.co.in/Salaries/strategy-consultant-salary-SRCH_KO0%2C19.htm

- https://www.glassdoor.co.in/Salaries/senior-strategy-consultant-salary-SRCH_KO0%2C26.htm

- https://www.glassdoor.co.in/Salaries/risk-analyst-salary-SRCH_KO0%2C12.htm

Unlocking Global Opportunities with CMA

CMA’s international recognition, consistently high salary premiums, and increasingly strong demand mean that career mobility is within reach for those who earn the credential. Firms worldwide – from tech giants to banks and consultancies – are on the lookout for CMAs who can steer strategy, control risk, and drive performance.

With the right training, local knowledge, and commitment to continuous learning, a CMA certification opens new vistas – not just for your job title, but for your global career ambitions.

Ready to take your career worldwide? Imarticus Learning empowers future CMAs with the hands-on skills, mentorship, and international exposure that global finance leaders demand today.