Are you looking to gain a comprehensive understanding of financial planning and analysis? A course in 2022 may be perfect for you! This introductory guide will give you an overview of what you can expect from the system and help you decide if it is the right fit for your career goals. This course will teach you how to create effective financial plans and analyze financial data to make sound business decisions. If you want to start your career in finance, this course is a great place to start!

The basics of financial planning and analysis:

As you may know, financial planning and analysis (FP&A) is a process businesses use to decide where to allocate their resources. FP&A professionals must have a strong understanding of financial principles and accounting practices to make informed decisions.

This course will gain a comprehensive understanding of financial planning and analysis. You will learn how to create financial plans, analyze financial data, and make sound business decisions. This course is perfect for anyone looking to start or further their career in finance!

What is the scope of the financial planning and analysis course?

The scope of a financial planning and analysis course can be pretty vast. It can include topics like financial statement analysis, forecasting, and budgeting. The course might also touch on issues like risk management and investment analysis. Financial planning and analysis courses can be very beneficial for those looking to pursue a career in finance or accounting.

What are the benefits of financial planning and analysis courses?

Financial planning and analysis courses can provide you with the skills and knowledge necessary to manage your finances effectively. The ability to plan and analyze your financial situation can help you make informed decisions about your spending, saving, and investing.

In addition, financial planning and analysis courses can help you identify opportunities for improving your financial situation. By taking a financial planning and analysis course, you can learn how to create and maintain a budget, save money, reduce your debt, and invest in your future.

Financial planning and analysis courses can also help you develop risk management strategies. By learning about different types of risks, you can better protect your assets and minimize your financial losses.

Overall, taking a financial planning and analysis course can provide you with the tools and knowledge necessary to make strong financial decisions. If you are looking to improve your financial situation, a financial planning and analysis course may be right for you.

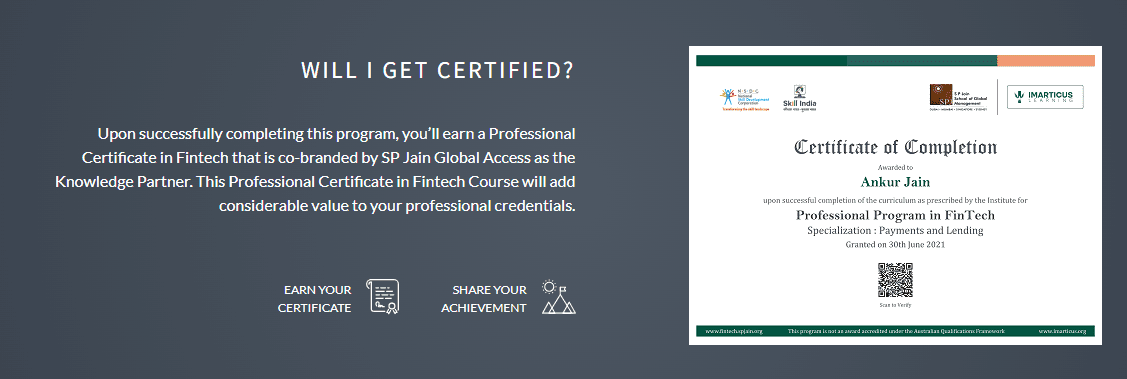

Discover Fintech courses with Imarticus Learning:

This course adds to your FinTech expertise through hands-on training from industry experts, real-world case studies, and projects that use technologies like Blockchain and Cloud Computing. Furthermore, it provides you with valuable interaction opportunities with FinTech sector leaders and entrepreneurs.

Course Benefits for Learners:

- Financial technology courses will educate students on applying machine learning algorithms and blockchain technology to their business needs, ensuring that they are well-equipped!

- The future of Fintech is bright, and students can stay up to date on the newest advances by attending networking events, job boards, or webinars.

- With this fantastic new resource, students will have access to some helpful tools that can assist them in finding their dream job after graduation!

The Final Word

The Final Word