Blockchain technology has certainly caught the attention of different industry sectors especially the bitcoin sector. It is a game changer in the functioning of business and also aids in enabling innovation to evolve at a rapid pace. Which is why most companies are now adopting blockchain technology.

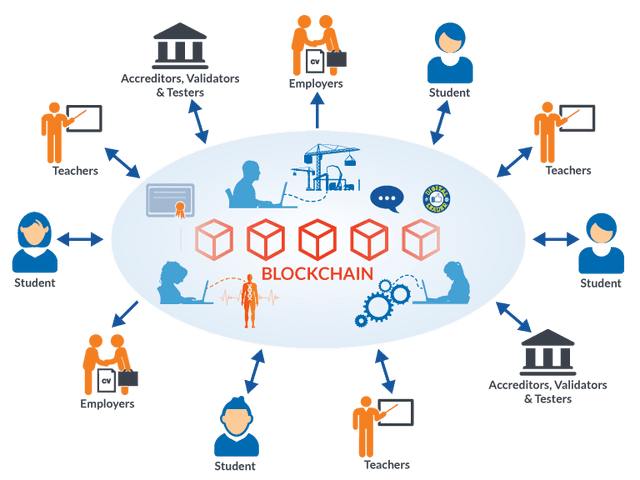

With the use of technology at the forefront, industries across are seeing a rise in the use of blockchain business models. Companies are now looking at decentralizing problems, the way they are perceived and the unique ways to solve them. Organizations are now trying to get the Blockchain technology to adapt to their mainstream implementations.

What is the need for a blockchain business model

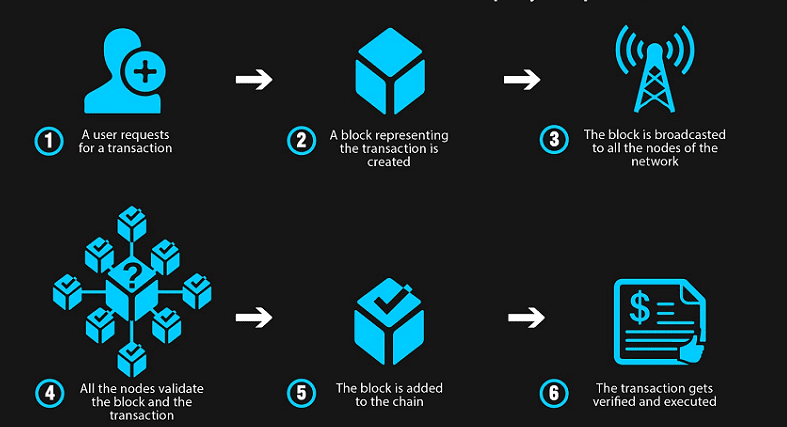

Blockchain in itself is a business model with which businesses can turn their processes into a decentralization platform to alter the way their system works. Implementing a blockchain business model in an organization could change the entity, flow of transactions, profits, turnovers and ensures growth in the right direction.

From the advent of Bitcoin, blockchain based business models have been constantly used, modified and improved to suit the needs of the business. Blockchain business ideas must work at both macro and micro levels that will benefit the end users and the employees of the company.

With the blockchain business model, there is no need for a centralized authority. So the business model becomes a lucrative one with no stakeholders involved. Anyone helping and inputting in the blockchain gets rewarded for their contribution, depending on the contribution.

Bitcoin helps the miners to earn a profit by making their contribution to decoding the algorithm at any stage. This kind of model helps every person or institution contributing to the model to make some profit. Now that we have gained a basic understanding of how the blockchain business model works, let’s see some popular ones that function in the sectors:

- Token Economy – Utility Token Business Models

Loads of startups, e-commerce sites and business use this model where the businesses hold some of the utility tokens and release the remaining for the functioning of networks. The profit is made when the value of the utility token changes. The utility tokens have got variables assigned to them and examples are BANKEX tokens, EDU token, and even Ripple.

2. Blockchain as a service business model ( BaaS)

This model aims at providing an ecosystem for other businesses to manage their existing blockchain system. Within this system, companies can test, research and experiment to decentralize their functions. Microsoft (Azure), Amazon (AWS) are examples that use this system and the startups, companies don’t have to worry about how their blockchain works and focus on their core business. This model also eliminates the need for hardware.

3. Block-based Software Products

Since its inception in 2009, older conglomerates also have the need to adapt their businesses to the blockchain technology. The easiest way for corporates to do this is to buy a blockchain solution and collaborate it with their existing system. This gives a chance to blockchain companies to create solutions and sell them to bigger giants. This is a lucrative option as it will give a profit up front and also a chance to develop solutions for support after implementation. Lack of talent in the market could also be a reason to buy a blockchain based software product that fits the requirement and saves the hassle of recruiting and training staff.

Since its inception, blockchain technology has been creating waves with almost every industry trying to implement it. Studies and surveys reveal that most companies would have adopted technology in a couple of years. Participants enrolling in the Fintech course will benefit from the knowledge given during the sessions about the functioning of these business model.