Financial modeling is essential when building and running a company or any type of business. Financial management in many businesses relies heavily on the results obtained during this process, as analyzing the impact of different assumptions and assumptions allows critical decisions to be made about the strategy, growth, and capital management.

Using spreadsheets or similar tools allows us to detail historical performance, make forecasts, and analyze risks and returns under different sensitivity scenarios.

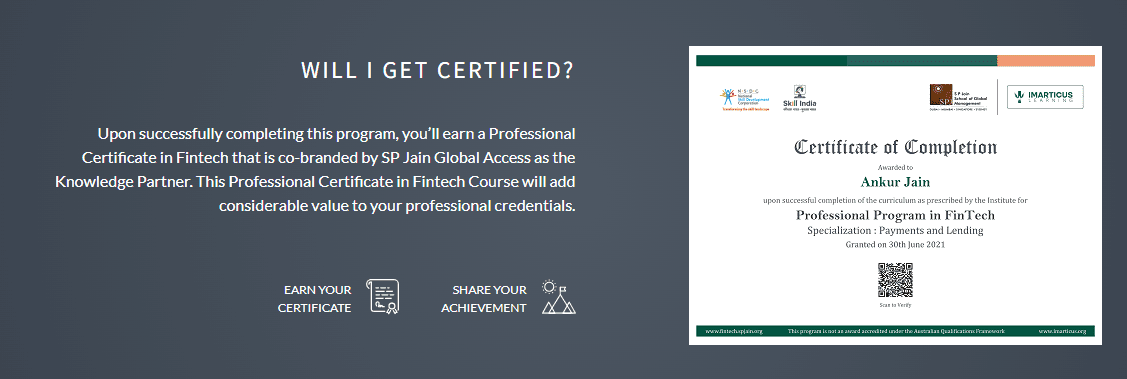

That is why in this article, we will give you a series of tips on financial modeling that may be useful if you are interested in the topic of financial modeling. We will give you tips on what we at Imarticus have identified as some of the best practices in financial modeling. These best practices are the basis on which we build our financial modeling courses in the FINANCIAL ANALYSIS PRODEGREE. We hope you find them useful.

- The first best practice is to use the right structure for the model. This is because it is always important to keep in mind that the model is a tool to achieve a goal and therefore the first decision before you start modeling is to determine which model structure will allow you to achieve that goal in the most efficient way.

- A general rule of thumb when deciding on the structure of the model is to keep it as simple as possible as long as it achieves the stated objective. As long as the model works well, it is always better to look for more simplicity. Simplicity is a recurring theme that we keep coming back to during the courses on financial modeling.

- Another rule of thumb is that the model should be modular. This means that it should have clearly defined modules or sections that flow in an organized way. It is important to keep in mind that a financial model tends to grow very quickly, and if it does not have a proper modular structure, it will be much more difficult to adapt and expand it.

Our recommendation then is to follow the steps described above to start structuring the model. Regarding the decision on how to organize it, we recommend using single-sheet models for simple and small models, and multi-sheet models for medium and large models.

If the model is very large, for example in the case of a multi-business company model, we recommend using a hybrid structure where a multi-sheet Excel file is used, but where each sheet is a one-sheet model in itself. The multi-ledger structure should be avoided as much as possible and only used in cases of extreme necessity.

Remember that working on a proper structure from the start saves time and avoids introducing errors when trying to restructure the model halfway through. We hope you find these best practices useful.

If you are interested in learning not only other financial modeling best practices but also how to become an expert in financial modeling. We suggest you take this financial analyst course. In addition to being industry-focused courses that will prepare you to be competitive in the working world, you will also be able to learn alongside experts in the field.

At the end of the course, you will be able to obtain a financial modeling certification endorsed by KPGM India and Imarticus. Having a certification with these prestigious names will surely make your career as a financial analyst take off. Stop hesitating, visit our Imarticus page to explore the Financial analysis Prodegree program, and let us know if you have any questions.

You must enroll in our

You must enroll in our