A financial analyst is one of the most prestigious career options in the financial services industry. Given the growing importance of data and the need to analyze it for obtaining valuable information, there is an unprecedented need for professionals who can deal with data. The role of a financial analyst is diverse and requires high analytical skills along with good quantitative acumen.

The job entails gathering data, organizing it, conducting a thorough analysis, making predictions based on the analysis and developing recommendations. There is a high demand for financial analyst courses given the value it adds in terms of providing relevant industry-specific knowledge and practical exposure to the work. The role of a financial analyst is held in high regard given the value it adds to the organization.

A financial analyst is responsible for gathering vital information about the industry and creating strategies to grow the business, they have a huge role to play in an organization’s decision-making process. They are also responsible for talking with various stakeholders to the company and make the required analysis. Let’s delve deeper into some of the most exciting benefits of being a financial analyst.

Benefits of being a Financial analyst

People working in the capacity of a financial analyst are responsible for unleashing actual insights about the company’s financial performance and overall outlook; they help to find out the driving factors that are helping with the growth of an organisation. This helps them obtain in-depth industry knowledge and can open new opportunities for them.

The role of a financial analyst is very dynamic and multi-faceted. It also involves meeting with various stakeholders to the business. This can help you expand your professional network and also help you develop personal connections that can be leveraged later if you might need any assistance in the future.

The financial analyst job is considered among the most rewarding career opportunities. The remuneration offered to a financial analyst is usually higher than what other professionals might get at the same level. In addition to the fixed remuneration, financial analysts are also entitled to a decent bonus and commission.

The demand for financial analyst professionals is growing in double digits and has a plethora of opportunities for people who want to pursue a career in finance. In addition to the finance sector, financial analysts are also needed in other industries that rely on using data science to grow their businesses.

Financial analysts have a steep learning curve and require being up to date with new information. This helps you build your knowledge base and makes you better prepared for future job roles. It also keeps you updated with the new economic activities and technological changes in the domain.

Given the nature of the job of financial analysts, job security is an added advantage. Financial analysts are highly skilled professionals who have access to crucial company information. The sophisticated nature of this role makes analysts less-prone to job loss in uncertain times. It is also difficult and expensive for the company to hire a new professional in a short period.

One of the best things about being a financial analyst is the work-life balance that you get. People in the finance industry often complain about the absence of work-life balance. Investment bankers earn more but at a much higher personal cost, they work at least 70-80 hours per week. However, the role of a financial analyst only demands normal business hours.

Working in the capacity of a financial analyst for an organization has numerous benefits. From work-life balance to crucial company information it has a whole lot to offer that other jobs normally do not. It is also among the most rewarding career opportunities.

Also Read: Future of Financial Analyst In India

If you decide to

If you decide to  Organizations prefer candidates who are really strong in

Organizations prefer candidates who are really strong in

Commerce graduates can also pursue a career in Forensic Accounting with a

Commerce graduates can also pursue a career in Forensic Accounting with a

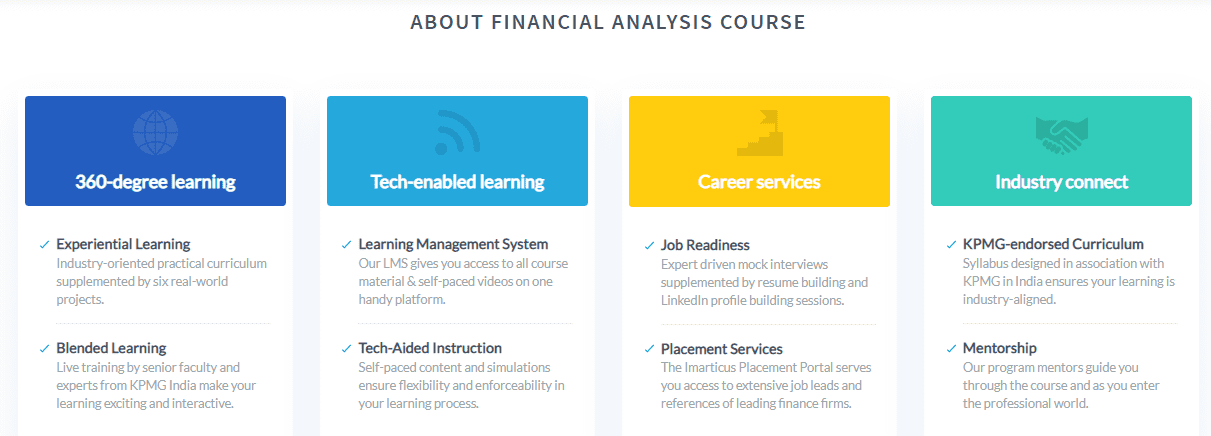

At Imarticus, we empower students with

At Imarticus, we empower students with