The recent COVID pandemic has harmed the GDPs and fiscal situations of countries across the globe. Financial analysts were the only ones that could help investors and companies to go through the challenges of the COVID pandemic. However, the COVID scenario in India is now under control and businesses have started their operations.

According to the latest financial analysis reports, the GDP and fiscal situation in India are back on track. 2021 has brought a new opportunity for businesses to generate huge revenue and gain returns on investment. Read on to know more about the current GDP and fiscal situation of India and how financial analysis helps.

Understanding GDP and fiscal situation

As a businessman or a financial analyst, you should be familiar with the terms like GDP and fiscal situation. GDP (Gross Domestic Product) refers to the market value of all the finished goods/services produced within the country. GDP is strictly applicable to the products and services produced within the borders of the country. The current GDP of a country is used by businesses and investors to make strategic decisions. GDP lets us know about the economy and producing capacity of the country.

Along with GDP, the fiscal situation of a country is also important in evaluating the economy. A strong fiscal position of a country is good for businesses and investors. If a country has its expenditures less than total revenue generated, it has a strong fiscal position.

If a country experiences a fiscal deficit (expenditures are more than revenue), it will also hamper the continuity of businesses.

If a country experiences a fiscal deficit (expenditures are more than revenue), it will also hamper the continuity of businesses.

GDP and fiscal position are important terms for a financial analyst to carry out the research process. If you are searching courses for financial analysts, you should have a prerequisite of GDP and fiscal position.

Current GDP and fiscal situation of India

For the first quarter of the 2021-22 financial year, the GDP in India has grown by 20.1%. The lockdown imposed by the government during the peak-COVID time severely affected the production of services and goods. Now, businesses and production houses are allowed to operate which has led to an increase in GDP for the first quarter. Construction and manufacturing sectors in India have shown the most growth in the first quarter of the 2021-22 financial year.

The revenue collection of the Indian government will also be better in 2021. High GST collections by the Indian government have narrowed the fiscal deficit. The fiscal deficit for the first four months of 2021 came to a nine-year low due to better revenue collection. All these details are closely studied by financial analysts. You can also search for courses for financial analysts and build a successful career.

Perfect course for financial analyst

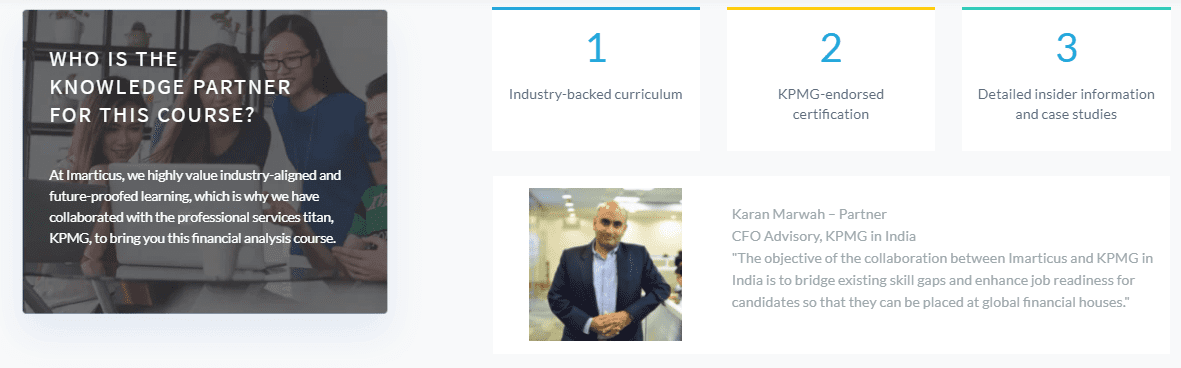

Among the many financial modeling courses in the market, Financial Analysis Prodegree offered by Imarticus Learning is the best. Its industry-oriented curriculum designed by KPMG makes it one of the best financial modeling courses in India. During the pro-degree program, you will work on six real-life projects to know more about industry practices.

It is a type of chartered financial analyst course that is self-paced and tech-aided. You will also be eligible for the placement assistance provided by Imarticus towards the end of the financial analysis course. Imarticus has successfully helped around 2400 enthusiasts to build their careers with their courses.

It is a type of chartered financial analyst course that is self-paced and tech-aided. You will also be eligible for the placement assistance provided by Imarticus towards the end of the financial analysis course. Imarticus has successfully helped around 2400 enthusiasts to build their careers with their courses.

Conclusion

A chartered financial analyst course can help you in knowing the techniques used in the industry to make better decisions. You can learn to evaluate businesses, investment ventures, and projects with a financial analysis course. Start your financial analysis course with Imarticus now!

This

This