Finance credentials today travel faster than job titles. What used to be regional qualifications, the kind that stayed confined to one country’s accounting board, have turned into global currencies. And few have crossed that border as elegantly as the CMA USA.

What began as a professional designation for management accountants in the U.S. has turned into a worldwide standard for analytical thinking, business judgment, and ethical leadership.

But with that expansion came an interesting misconception: CMA eligibility is complicated, gated, or limited to a certain academic background.

It isn’t.

In fact, it’s one of the most inclusive finance credentials available today.

When students or professionals approach me with questions about eligibility, their doubts usually have less to do with policy and more to do with perception.

They think the CMA USA is a program designed for Americans, or that you need a finance degree even to be considered. Some even assume there’s an age barrier, that if you’ve crossed a certain point in your career, you’ve missed your chance.

In reality, the Institute of Management Accountants (IMA) built the CMA framework on flexibility. It was designed for people who are still becoming professionals

undergraduates, mid-career analysts, and even consultants shifting from operations into finance.

If you can demonstrate academic rigour, practical curiosity, and the willingness to commit to two exams, you already meet the spirit of the eligibility criteria.

In this piece, I’ll break down what that actually means in 2025: CMA Eligibility, the academic and professional requirements, the nuances of the CMA USA age limit, and how candidates in India and abroad can align their path to the global standards set by IMA.

What is CMA USA?

Whenever someone asks me what is CMA, really? I tell them it’s less of an exam and more of a mindset shift. It’s what happens when you stop looking at numbers as history and start reading them as strategy.

Certified Management Accountant or the CMA certification was born in boardrooms, not classrooms. Well, not literally, but here is what I mean.

Offered by the Institute of Management Accountants (IMA), the US CMA came from the need for finance professionals who could translate data into direction. Over time, that idea outgrew the U.S. and became a global qualification recognised in over 170 countries.

Today, when employers say they want a “CMA,” they’re not just hiring someone who knows accounting entries. They’re hiring someone who can forecast next quarter’s margins, question business models, and bring structure to decisions. It’s what makes the credential relevant from Mumbai to Dubai to New York.

Now, when it comes to CMA eligibility, people often expect rigid prerequisites. But that’s the beauty of this program: it was designed for accessibility. Whether you’re a finance graduate, an engineer who found joy in spreadsheets, or a mid-level professional looking for global recognition, the pathway stays open.

Now, if you’re caught between “should I or shouldn’t I” about the CMA, this quick watch breaks down what the US CMA can actually do for your career.

CMA USA Eligibility 2025: Who Can Apply?

For the CMA USA program eligibility in 2025, candidates should fulfil some academic, age, and professional requirements as provided by IMA. They are:

1. Academic Qualifications

To fulfil the CMA USA academic requirements, candidates should have:

- A Bachelor’s degree from a recognised institution (any stream)

- Or a qualification equivalent to a degree as recognised by the IMA (e.g., CA, CS, etc.)

The degree need not be in finance or accounting, but the candidate with it may find the subject more meaningful.

2. Age Requirements

No age limit is mentioned. However, the majority of the candidates start preparation either in the final year of graduation or after gaining some experience at work. The program is appropriate for the following individuals:

- Final-year undergraduate students

- Working professionals in finance and accounting

This makes the CMA USA age and education qualification convenient and flexible.

3. Membership with IMA

Prior to writing the exam, the student needs to become a member of the Institute of Management Accountants (IMA). This provides them with access to resources, a network, and official registration for the exam.

4. Two Years of Professional Experience

To receive the CMA credential (after writing the exams), candidates need to have two years of professional experience in either management accounting or financial management. This can be achieved:

- Before writing the exam

- Or within seven years post-clearing the exam

5. English Proficiency

Since the CMA USA examinations are conducted in English, one has to be well-versed in the language. While no official test is required, effective communication and reading skills are essential.

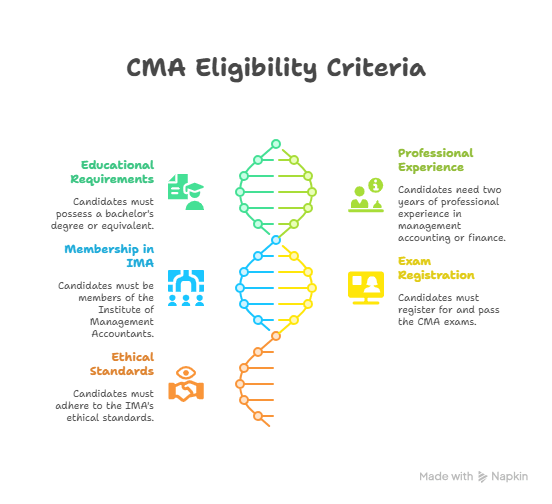

Below is a visual overview of the US CMA Eligibility requirements, each of which we will discuss in the blog ahead in detail.

US CMA Exam Requirements

After fulfilling the eligibility requirements, you need to fulfil the US CMA exam requirements:

- Become. IMA member

- Enrol in the CMA program and remit the examination fees

- Select an approved study partner such as Imarticus

- Reschedule and appear for Part 1 and Part 2 examinations

Part 1 and Part 2 are each four hours long and consist of:

- 100 multiple-choice questions (MCQs)

- 2 essay questions

Check the Content Specifications Guidelines issued by IMA for comprehensive coverage of the examinations.

CMA USA Eligibility 2025: Complete Breakdown

The eligibility criteria for CMA USA revolve around three primary pillars: academic qualification, professional experience, and IMA membership.

1. Educational Qualification

To meet the CMA eligibility requirements, candidates must possess a bachelor’s degree in any field from an accredited institution. The IMA does not restrict degrees to commerce or finance backgrounds, which makes the course inclusive for candidates from science, arts, or engineering streams.

However, students with commerce or management backgrounds should take preparatory training to bridge gaps in finance concepts.

2. Work Experience Requirement

IMA requires candidates to have at least two years of continuous work experience in management accounting, auditing, financial analysis, or budgeting.

This experience can be completed before or within 7 years after passing the CMA USA exam.

Eligible Job Roles Include:

- Financial Analyst

- Cost Accountant

- Internal Auditor

- Budget Analyst

- Corporate Finance Executive

- Corporate Accountant

3. IMA Membership Requirement

To enrol for CMA USA, you must become a member of IMA. This membership unlocks:

- Official exam registration

- Access to IMA learning resources

- Entry into the CMA candidate program

There are different membership categories:

| Membership Type | Target Group | Approx. Annual Fee |

| Professional | Working professionals | $280 |

| Student | Full-time students | $45 |

| Academic | Professors or educators | $150 |

CMA USA Age and Education Criteria Simplified

The CMA USA isn’t built on complicated prerequisites; it’s built on common sense.

If you look closely, every eligibility rule has one purpose: to ensure that whoever takes this exam can think like a management accountant: with structure, accountability, and a sense of financial cause and effect.

That’s why CMA USA eligibility feels less like a checklist and more like a framework for readiness. Here’s what it really takes to qualify in 2025:

| Aspect | Requirement | How It Plays Out in Real Terms |

| Age | No official age limit | Whether you’re finishing college or shifting careers, you can begin anytime. |

| Education | Bachelor’s degree (any stream) from an accredited university | The course doesn’t favour one background; it’s designed for anyone comfortable with numbers and logic. |

| Students in the Final Year | Eligible to appear for exams before graduation | Many aspirants start early to fast-track their careers. Certification follows after completing their degree. |

| Work Experience | 2 years in management or financial accounting (before or within 7 years post-exam) | CMA doesn’t just test theory; this step ensures you’ve applied it in practice. |

| IMA Membership | Mandatory before registration | This links you directly to IMA’s official resources, community, and exam access. |

US CMA Eligibility for Indian Students

India has quietly become the backbone of the global CMA talent pipeline. Every year, thousands of Indian finance graduates enter the U.S. CMA ecosystem, not because the rules are lenient, but because the qualification aligns perfectly with how India’s commerce education system is structured.

Most Indian degrees already build the analytical foundation that the CMA USA tests for: management accounting, business economics, and financial reporting. So, when it comes to US CMA eligibility for Indian students, the process isn’t a new obstacle; it’s a matter of documenting what you already possess in a format the Institute of Management Accountants (IMA) recognises.

Indian professionals and students often ask, “Who can apply for CMA USA in India?” The answer is simple:

- Graduates of any stream are eligible.

- Institutes can initiate final year students.

- Working professionals aspiring for an international career in accountancy or finance.

As job opportunities increase from MNCs, CMA course eligibility in India has witnessed increased interest from:

- B.Finance, BBA, and MBA students

- CA/CS hopefuls aspiring for international exposure

- Working professionals aspiring for a promotion or international career opportunities

- Education Requirements for Indian Students

Indian aspirants don’t need to worry about a “different rulebook.”

If you hold a bachelor’s degree from a UGC-recognised university, you already meet the foundational educational criteria.

However, because the Institute of Management Accountants (IMA) is based in the United States, they need formal verification that your Indian degree aligns with the U.S. bachelor’s equivalency standard. That’s where WES (World Education Services) or an IMA-approved evaluation agency comes in.

| Requirement | Details for Indian Candidates | Purpose |

| Degree Recognition | Bachelor’s degree in any stream (Commerce, Business, Accounting, Economics, or equivalent) from a UGC-approved Indian university | Establishes academic eligibility |

| Transcript Evaluation | Done through WES or other IMA-recognised credential evaluators like ECE or SpanTran | Confirms equivalence to a U.S. bachelor’s degree |

| Language Requirement | No separate IELTS/TOEFL required – Indian degrees are automatically accepted as proof of English proficiency | Simplifies documentation |

| Final-Year Students | Students in the final year of their degree may attempt the exam; certification is issued after graduation + work experience | Encourages early starters |

- What Indian Students Typically Submit

To register for the CMA USA exam as an Indian student, you’ll need:

- Official degree certificate (or final-year proof of enrollment).

- Academic transcripts issued by your university.

- Credential evaluation report (from WES, ECE, or IMA-approved agency).

- A government ID for identity verification (passport preferred).

- IMA membership and CMA program registration confirmation.

Most IMA-approved evaluation agencies have now digitised the process. You can submit your transcripts directly from your university or in sealed envelopes, depending on their policy.

(Note: IMA no longer accepts self-attested or photocopied transcripts.)

- Work Experience Pathways for Indian Candidates

Here’s where many Indian students get confused. You can attempt both CMA exam parts without prior work experience, but to get certified, you must complete two years of professional experience in management accounting or financial management roles.

This experience can come from:

- Public accounting firms or Big 4s (like Deloitte, KPMG, PwC, EY)

- Corporate finance roles in MNCs or Indian conglomerates

- Roles like Financial Analyst, Cost Accountant, Budget Analyst, Internal Auditor, or FP&A Associate

If you’re working in India, you can get your supervisor or HR department to verify your role using the IMA experience verification form. That’s all the documentation required.

- Why Indian Students Have an Advantage

Most Indian finance graduates have already studied cost accounting, management accounting, and basic financial reporting during their degrees. This makes the CMA USA syllabus, especially Part 1 (Financial Planning, Performance, and Analytics), much easier to grasp.

Moreover, the global demand for CMAs in India has surged, particularly in finance transformation, FP&A, and data-driven decision-making roles. The following companies have been known to hire US CMAs directly from India for global finance positions.:

- Amazon

- Accenture

- Deloitte

- IBM

Summary: CMA USA Eligibility for Indian Students

This table will help you summarise the eligibility for Indian students.

| Criteria | Indian-Specific Guideline | Verification Method |

| Education | Bachelor’s from a UGC-recognised university (any stream) | WES / ECE / IMA-approved evaluation |

| Work Experience | 2 years in accounting, finance, or management roles | IMA work verification form |

| Language | Automatically accepted for Indian degrees | No test required |

| Final-Year Eligibility | Yes, can attempt exams before completing graduation | Submit proof of enrollment |

| IMA Membership | Mandatory before exam registration | Join via IMA official site |

| Global Relevance | Recognised in 170+ countries | Valid for global placements |

Let’s take an example:

Suppose Aditi, a B.Com graduate from Delhi University, wants to pursue CMA USA.

She doesn’t need to redo her degree or take any English test.

She only needs to:

- Apply to WES for her degree equivalence.

- Register as an IMA member.

- Enrol in the CMA program through a verified training partner such as Imarticus Learning.

- Appear for Part 1 and Part 2 exams while in her final semester.

- Complete 2 years of finance work (say, as a financial analyst).

Once she meets all those criteria, she officially earns her CMA USA certification, globally recognised and professionally respected.

How Long Does It Take to Become a CMA?

If you’ve ever tried planning for a marathon, you know it’s not the distance that’s tricky; it’s the pacing. The same logic applies to the CMA USA Eligibility journey.

While the exam is just two parts, the preparation and certification process involves multiple moving pieces: study time, exam windows, credential evaluations, and work experience verification.

On average, it takes 6–9 months of consistent preparation to pass both exam parts, but the total journey from registration to certification can stretch to 12–18 months, depending on your schedule, background, and study strategy. You can aid this journey by preparing with the best CMA review courses, the CMA Handbook, and top study materials provided by approved study partners.

Breaking Down the CMA USA Timeline

| Stage | Avg. Time Required | What Happens Here |

| Step 1: Registration + IMA Membership | 1–2 weeks | Apply for IMA membership, enrol in the CMA program, and get your IMA ID. |

| Step 2: Credential Evaluation | 2–6 weeks | If you hold a non-U.S. degree (e.g., an Indian B.Com), get it evaluated through WES or ECE. |

| Step 3: CMA Exam Preparation | 3–6 months per part | Study for Part 1 (Financial Planning) and Part 2 (Strategic Financial Management). Most learners attempt one part at a time. |

| Step 4: Appear for Exams | 1–2 months | Choose from three global testing windows: Jan–Feb, May–Jun, or Sep–Oct. |

| Step 5: Experience Completion | 0–24 months (parallel or post-exam) | Gain 2 years of relevant work experience to qualify for the CMA certificate. |

CMA USA Exam Windows and Registration Deadlines 2025

One of the most practical aspects of cracking the CMA USA exam is its flexibility. Instead of fixed annual dates, the IMA offers three global exam windows every year, allowing students and professionals to schedule their attempts around academic or work commitments.

In 2025, the available testing periods are:

| Exam Window | Testing Months | Registration Deadline | Ideal Time to Begin Preparation |

| Window 1 | January – February | December 15, 2024 | September 2024 |

| Window 2 | May – June | April 15, 2025 | January 2025 |

| Window 3 | September – October | August 15, 2025 | May 2025 |

Each window stays open for roughly two months, and exam slots fill up quickly, especially for international test centres. That’s why booking early is non-negotiable.

Registration typically closes one month before the exam window begins, but waiting until the last minute is risky. It’s best to finalise your slot once you’re 70–80% through your preparation.

A smart way to plan your journey is to treat each exam window like a “goalpost”, align your study calendar backwards from the window you aim for. For instance, if you’re targeting the May–June window, your ideal start date is January, giving you a comfortable four-month runway for one part. And as you plan the timelines, knowing the step-by-step breakdown of CMA course details makes the path clearer.

This strategic alignment ensures you’re never rushed and that your CMA USA exam registration syncs perfectly with your study rhythm.

Who Should Apply for CMA USA?

If you’re considering who can apply for CMA USA, the perfect candidates are:

- Students pursuing or completing graduation in commerce, finance, or business administration who want a career that crosses borders.

- Accounting and finance professionals aiming to deepen their technical and managerial expertise and transition into strategic roles.

- Corporate analysts, auditors, or consultants seeking credibility in global markets.

- Entrepreneurs and business owners who want sharper financial control and decision-making skills to scale efficiently.

The Pros and Challenges of Pursuing CMA USA

No global qualification is without its tests, and that’s what gives the CMA its worth. Here’s a realistic look at the pros and challenges so you can weigh your decision confidently:

| Aspect | Pros | Challenges |

| Global Recognition | Recognised in over 170+ countries, the CMA USA opens doors to multinational companies, consulting firms, and Big 4s. | Competing with global peers means maintaining consistency and commitment across time zones and career demands. |

| Career Acceleration | CMAs often move into managerial or leadership roles faster due to their decision-oriented training. | Requires balancing professional commitments with study schedules, especially for working professionals. |

| Versatility | The qualification spans finance, analytics, and business strategy, valuable across industries like tech, manufacturing, consulting, and FMCG. | You need strong conceptual clarity; rote learning won’t help. The exam tests applied business reasoning. |

| Earning Potential | According to the IMA Global Salary Survey, CMAs earn 21% more globally than their non-certified peers. | Initial costs (exam, membership, and training) can feel heavy without a structured plan or employer support. |

| Time Efficiency | You can complete the certification in 12–18 months, unlike multi-year local alternatives. | Compressed timelines mean disciplined, consistent preparation is essential. |

(Source)

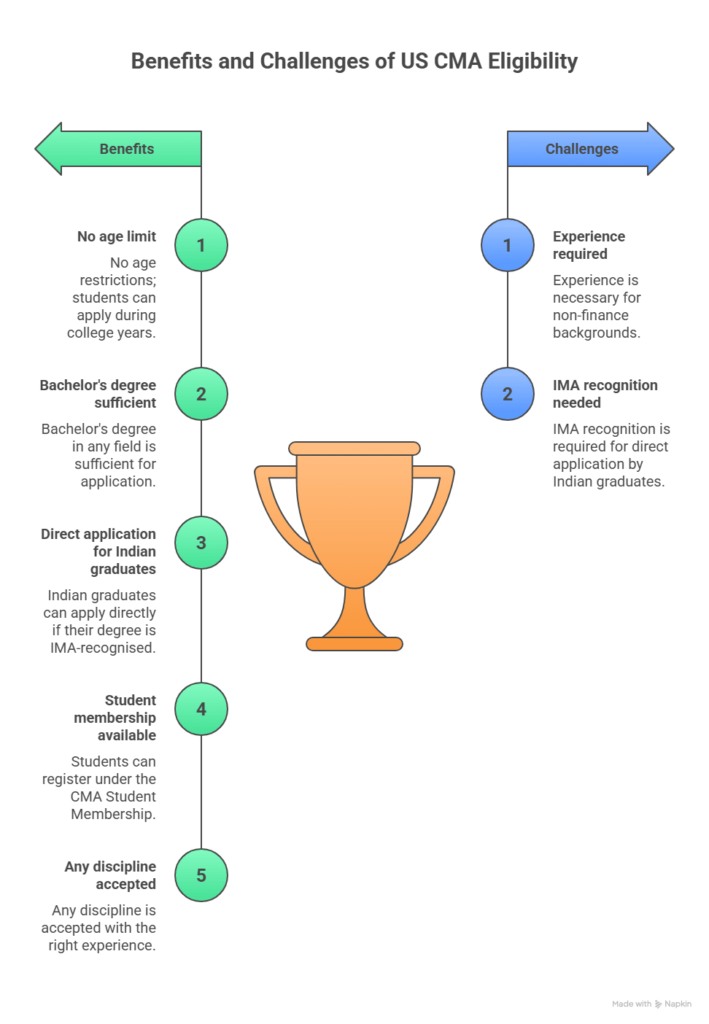

Here is a visual representation of the CMA benefits against the challenges that one may face:

Why Choose Imarticus Learning for Your CMA USA Journey

Meeting the CMA eligibility criteria is one thing, but mastering the exam with confidence is another. The right learning partner doesn’t just teach you accounting concepts; it builds your professional judgment, pace, and precision, the three traits that define successful CMAs.

That’s where Imarticus Learning stands apart. As an IMA Gold Learning Partner, Imarticus operates at the highest global standard set for training providers of the US CMA Course, ensuring your learning path mirrors international expectations and also guide you on sure shot ways to become a CMA.

What sets it apart isn’t the promise of passing, it’s the structure that guarantees readiness.

1. Guaranteed Outcome Framework

Imarticus is one of the very few institutes offering a Money-Back Guarantee if you don’t clear all exams. That level of confidence only comes when the system is proven, from instructor quality to curriculum depth. Every module is benchmarked against IMA’s learning outcomes and powered by Surgent Learning, one of the world’s most adaptive CMA prep engines.

2. Gold Learning Partner Status

Being an IMA Gold Partner isn’t a label; it’s a compliance mark earned through rigorous audits of student outcomes, faculty expertise, and content alignment. This ensures your learning hours, mock exams, and test simulations meet the same quality standards that IMA expects globally.

3. Real-World Career Readiness

Every CMA student at Imarticus gets hands-on industry experience through internships with KPMG and other leading firms. This bridges the gap between exam theory and actual financial problem-solving, an advantage that most training providers overlook. These internships aren’t just resume fillers; they demonstrate your ability to apply management accounting principles in real business contexts, a critical differentiator in placements.

4. One-on-One Mentorship from Industry Experts

The CMA curriculum is vast, and every learner has a different starting point. That’s why Imarticus assigns personal mentors, all of whom are qualified CMAs, CAs, or CPAs themselves. This ensures your doubts are addressed in context, not in theory.

5. Placement-Driven Learning

Imarticus’ ecosystem extends beyond training. With dedicated placement assistance, resume-building workshops, and mock interviews, the transition from CMA certification to your first role becomes structured. The institute’s alumni footprint across Big 4s, global consulting firms, and multinational corporations stands as evidence.

FAQs About CMA USA Eligibility

Still have questions about the CMA eligibility criteria and how it applies to your profile? This section clears the air. From academic prerequisites to work experience and age requirements, here are answers to the most frequently asked questions students have before registering for the CMA USA exam.

Is CMA easier than CA?

CMA Eligibility criteria are simpler than CA because you only need a bachelor’s degree and IMA membership to apply. However, the exam focus is conceptual and analytical, not lengthy like CA. Students who enrol with Imarticus Learning get structured mentorship to complete CMA within a year, whereas CA can span 4–5 years.

What are the CMA course fees?

Total CMA USA course fees range from ₹1.5 lakh to ₹2.2 lakh, depending on membership type and training partner. These fees cover IMA registration, exam charges, and coaching. Imarticus Learning offers flexible EMI options and money-back guarantees to ensure CMA Eligibility remains affordable.

Can I give CMA after 12th?

You can start preparing for the US CMA after 12th, but official CMA Eligibility requires a bachelor’s degree to earn the credential. Many students join Imarticus Learning during college so that they’re exam-ready as soon as they graduate.

Who is qualified for CMA?

Anyone meeting the CMA Eligibility criteria, a bachelor’s degree from a recognised institution and two years of relevant experience, qualifies. Indian students from BCom, BBA, and MBA backgrounds fit perfectly.

What is the CMA salary?

CMA-certified professionals in India earn around ₹8-10 LPA on average, while global median salaries cross $80,000. Holding CMA Eligibility not only boosts pay but also qualifies you for roles with performance bonuses and stock options.

Is CMA higher than MBA?

Both CMA and MBA serve different purposes. CMA Eligibility represents technical mastery in management accounting, whereas MBA focuses on business breadth. Many professionals combine the two for maximum career impact.

Can CMA earn 1 crore?

Yes, senior finance leaders with CMA Eligibility in multinationals and consulting often cross ₹1 crore CTC through bonuses and profit-sharing. Roles like CFO or Head of FP&A command that range.

Which type of degree is CMA?

CMA is not an academic degree but a professional certification. Your CMA Eligibility depends on holding a bachelor’s degree and meeting IMA experience requirements. It is globally equivalent to a master’s level credential in financial management.

Is CMA losing value?

Not at all. CMA Eligibility has grown sharply since the digital finance transformation accelerated post-2020. Companies now seek CMA-qualified leaders for automation and data-governance projects.

Will CMA be replaced by AI?

AI may handle repetitive tasks, but CMA Eligibility equips you to interpret and strategise using AI outputs. Imarticus Learning’s CMA program already integrates AI and analytics modules to keep graduates future-ready.

Your Next Step After Meeting the US CMA Eligibility Criteria

Every professional milestone begins with clarity: knowing where you stand, what qualifies you, and how far your effort can take you. The US CMA eligibility framework is precisely that checkpoint. It helps you see whether your academic foundation, work exposure, and intent align with what the global finance ecosystem demands.

The CMA USA qualification goes beyond exams and certificates. It trains you to interpret numbers with purpose, connect data with strategy, and make financial decisions that influence business outcomes. Once you’ve mapped your eligibility, the next question isn’t if you should pursue it; it’s how you’ll make it count.

If you’ve been exploring the CMA USA path this year, think of this as your starting line. Begin your journey with the CMA Course prep offered by Imarticus Learning and take your first step towards a global career built on skill, credibility, and confidence.