Any milestone begins with knowing where to start. For anyone aspiring to become a Certified Management Accountant, the US CMA course subjects give you exactly that starting point. They shape not just how you prepare for the exam, but how you think as a finance leader. Too often, people jump into CMA prep without really understanding what the syllabus demands. You wouldn’t want such an approach because you want to be laser sharp in your preparation and get the subjects right from day one.

It is a certification with global recognition offered by the IMA. The curriculum covers the core areas of management accounting and finance that every business relies on. Right from budgeting and cost control to corporate finance and ethical decision-making, this certification tests you rigorously, which truly makes you a ‘numbers maverick’.

For someone preparing to become a CMA, these subjects are more than an exam checklist. They represent the skills you’ll use daily in senior finance roles. Like analysing numbers, guiding strategy, and helping companies make sound decisions and more.

In this guide, we will break down the entire CMA syllabus, explain why each subject is relevant, break down the requirements of the exam structure, and explore career options to pursue once you have completed each course.

What is the CMA Course?

The CMA (Certified Management Accountant) course is a qualification designated by the Institute of Management Accountants (IMA), USA, and recognised in over 170 countries. Unlike qualifications that lean heavily on taxation or auditing, CMA aims at planning, analysis, control, and decision-making.

CMA is designed for professionals with a desire to step away from generating numbers and instead interpret, analyse, and lead with numbers. This is why the CMA course subjects are centred around two enormous ideas: financial planning and strategic management. Collectively, they place you firmly in leadership roles in multinational corporations, large consulting firms, or institutions based on finance.

CMA Course Subjects Overview

The CMA exam is split into two parts. Each part has its own set of subjects, with weightages that reflect the importance of those skills in practice.

CMA Part 1: Financial Planning, Performance, and Analytics

This part focuses on the fundamentals of managing and analysing a company’s financial operations.

| Subject Area | Topics Covered | Weightage |

| External Financial Reporting Decisions | Principles of financial statements, recognition, measurement, disclosures | 15% |

| Planning, Budgeting, and Forecasting | Budgeting concepts, forecasting techniques, and variance analysis | 20% |

| Performance Management | KPIs, responsibility centres, cost and variance measures | 20% |

| Cost Management | Costing systems, allocation methods, and activity-based costing | 15% |

| Internal Controls | Governance, risk management, compliance frameworks | 15% |

| Technology and Analytics | Data analytics, financial modelling, and technology applications in finance | 15% |

CMA Part 2: Strategic Financial Management

This section pushes you into leadership territory, asking you to apply advanced financial concepts in real-world decision-making.

| Subject Area | Topics Covered | Weightage |

| Financial Statement Analysis | Ratio analysis, financial health indicators, and earnings quality | 20% |

| Corporate Finance | Capital structure, cost of capital, risk-return analysis | 20% |

| Decision Analysis | Pricing, capital budgeting, risk assessment, and investment planning | 25% |

| Risk Management | Hedging, insurance, enterprise risk strategies | 10% |

| Investment Decisions | Valuation models, mergers & acquisitions, security analysis | 10% |

| Professional Ethics | Compliance, corporate responsibility, ethical standards | 15% |

Collectively, these two parts cover everything from everyday financial planning to high-level strategy, storing the CMA course subjects, both indisputably broad and practical.

👉 Did you know? Over 70% of the CMA exam focuses on the practical application of concepts through real-world business scenarios. This is why mock exams and case studies are as important as studying theory.

Why the CMA Course Subjects Matter

👉 Fact: According to IMA’s 2023 report, CMA professionals earn on average 58% more than non-CMAs in similar roles, making it one of the most ROI-positive certifications in finance.

The CMA syllabus wasn’t designed in isolation – it reflects what businesses demand from finance professionals today. Here’s why these subjects are so valuable:

The CMA exam subjects cover fundamental concepts that are highly relevant to today’s business practices. Rather than graduating with a theoretical education, CMA students will graduate with essential financial management skills that will enable professionals to make empirical data-based decisions in complex business problems.

- Industry and Employment Relevance – The CMA certification syllabus is aligned with today’s most relevant critical trends in the areas of financial analytics, risk management & corporate finance, and employers will place a high value on it.

- Global Certification Recognition- Individuals who earn a CMA certification will have globally recognised international career opportunities that are typically in multinational corporations, financial firms & government agencies.

- Higher Earning Potential- CMA individuals earn 58% more vs. their non-certificated counterparts.

Are you still asking yourself whether CMA is the right certification for you? Check out our blog post on Is the CMA Certification Worth It?.

👉 Insight: The CMA syllabus is regularly updated to match the industry standards and reflect trends. For example, the inclusion of Technology & Analytics in Part 1 is a response to the growing demand for finance professionals skilled in data-driven decision-making.

CMA Exam Format and Passing Criteria

- CMA Course Details: Exam Format and Passing Criteria

The CMA exam subjects are divided into two exams (Part 1 &Part 2), which test candidates on advanced financial and strategic management concepts.

| Exam Details | Specifications |

| Exam Duration | Four hours per part |

| Total Marks | 500 per exam |

| Passing Score | 360 per exam |

| Question Format | 100 MCQs + 2 Essay Questions |

| Exam Windows | January-February, May-June, September-October |

The MCQs test conceptual clarity, while the essays push you to apply knowledge to business scenarios. For example, you might be asked to evaluate a budget proposal, analyse risk exposure, or justify an investment decision, all rooted in the CMA course subjects.

At Imarticus Learning, we make sure students are equipped to pass the exam with specific mentoring, doubt clearance sessions, & indicative mock tests that follow the structure of the actual exam.

For complete details on the CMA course and enrollment process, visit the Certified Management Accountant (CMA) program page.

👉 Quick Fact: Only around 45–50% of candidates pass each part of the CMA exam on their first attempt—highlighting the importance of structured preparation.

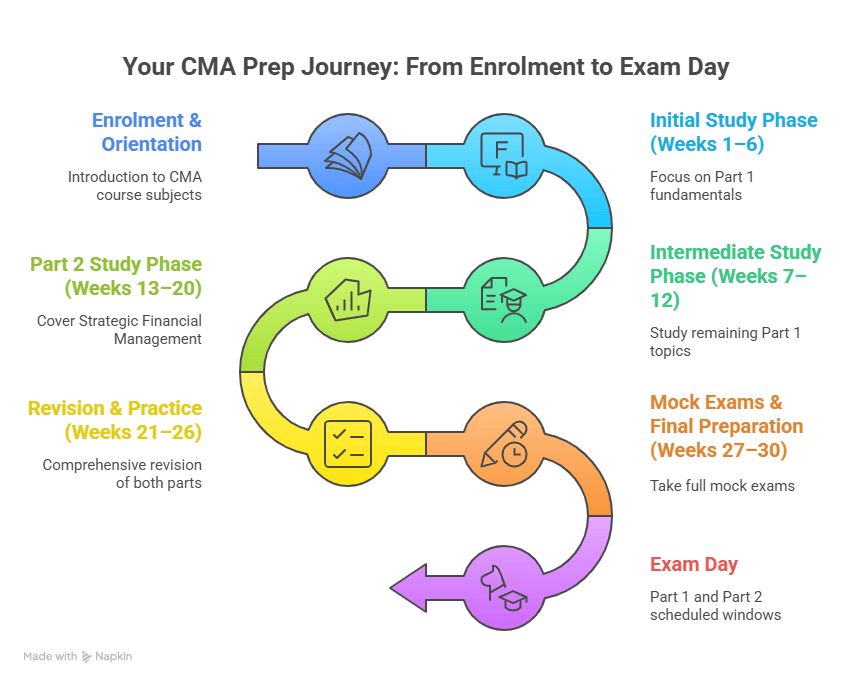

How to Prepare for CMA Course Subjects

CMA preparation asks for more than reading chapters and solving questions. The exam brings together knowledge, stamina, and clarity of thought. Successful individuals are adept at training their minds to deal with stress, making connections between ideas, and acting with accuracy.

CMA Study Material: How to Prepare for the Exam?

Success in CMA course subjects will rarely come from passive reading or cramming the last few days before the exam. Success will come from a preparation tool kit that matches the exam’s intensity. Oftentimes, the right study material will help structure your preparation, boost your confidence, and put you in a mental state that the exam will be looking for.

At Imarticus Learning, we have broken down the layered strategy to ensure every resource we provide has a purpose in your journey.

📌 Comprehensive CMA Study Material

Think of this as your foundation. The textbooks and concept guides give you the depth you need, while flashcards and MCQs keep your recall sharp. The practice tests, meanwhile, are where you test your stamina, exposing the little mistakes you wouldn’t notice while studying casually. And when you have video lectures led by CMA-certified faculty,

📌 Live Online Classes

With over 250 hours of live sessions, you get the kind of interactivity that makes tough topics less intimidating. Doubts don’t pile up; they’re solved on the spot. And with revision tools at hand, you keep looping back, reinforcing concepts until they’re second nature.

📌 Placement Assistance

CMA is a career pivot. That’s why the program doesn’t stop at exam prep. Resume-building workshops, mock interviews, and placement bootcamps with multinational companies are part of the design. It’s not about handing you a job but making you job-ready in a way that employers actually recognise.

📌 Money-Back Guarantee

One of the biggest worries students have is what if I don’t clear it? Imarticus reduces that anxiety with a 50% refund guarantee if you don’t pass. It signals confidence in their process, but more importantly, it gives you a safety net while you give the exam your best shot.

📌 Flexible Learning Options

Life doesn’t pause while you prepare. The course is structured over 6–8 months, with zero-cost EMI plans that make it easier to commit. It’s flexible enough to fit into the schedule of working professionals, yet structured enough to keep you moving steadily towards exam day.

CMA Study Resources

The right study material can make the difference between struggling and succeeding. Official IMA resources are a must, but many students also benefit from structured programs.

For instance, at Imarticus Learning, the CMA prep certificate includes:

- 250+ hours of guided classes with CMA-certified faculty.

- Textbooks, MCQs, flashcards, and video lectures tailored to the syllabus.

- Pre-placement bootcamps to help students transition into global roles after certification.

- Mock exams that replicate the actual testing experience.

- Surgent US CMA’s study material, which is recognised as a top content provider by IMA US.

The idea isn’t just to pass but to master the CMA course subjects in a way that makes you job-ready.

Who Should Pursue the CMA Certification?

The CMA isn’t just for one type of professional. It’s a flexible qualification that fits into different career paths:

- Finance graduates who want to fast-track into high-growth roles

- Accounting professionals seeking a shift from compliance to strategy

- MBA students adding a global credential to their profile

- Working professionals looking for international opportunities in finance

If your ambition is to move beyond reporting numbers to influencing business outcomes, the CMA course subjects are designed for you.

👉 Career Tip: CMA is not limited to finance majors. Even engineers, MBAs, and professionals from other backgrounds pursue CMA to pivot into finance leadership roles.

Career Opportunities After CMA

Mastering the CMA course subjects prepares you for a wide range of roles, including:

- Financial Analyst – interpreting financial data for decisions

- Management Accountant – planning, budgeting, and cost control

- Risk Manager – identifying and mitigating corporate risks

- Treasury Manager – handling corporate cash flow and investments

- Corporate Controller – overseeing internal reporting and compliance

- Chief Financial Officer (CFO) – leading financial strategy at the highest level

Multinational corporations, consulting firms, the Big Four audit and accounting firms, and government agencies comprise the range of employers. The demand for CMAs continues to rise as businesses operate in a more complicated financial environment. Future employers will require people with the technical and strategic knowledge and skills needed to add value to the business in the financial functions.

👉 Fact: Nearly 80% of CMAs end up in management roles within 2 years of certification—proof of its strong career acceleration.

FAQs about the US CMA Course Subjects

If you are considering taking the CMA exam and have an inordinate number of questions surrounding the CMA course subjects, exam structure, preparation, or career opportunities, read below. We answer some of the most frequently asked questions to help you proceed through your CMA journey with confidence and understanding.

What are the CMA course subjects?

The CMA course subjects are split into two parts. Part 1 is about financial planning, reporting, performance management, cost management, and analytics, which are part of daily finance work. Part 2 covers corporate finance, investment choices, strategy, and ethics that prepare candidates for leadership positions where finance decisions impact an organisation’s results.

How many exams are there?

To become a CMA, you must complete two examinations, one for each part of the reading syllabus. Each exam has 100 multiple-choice questions and two essay scenarios to assess your understanding of the material. Together, the two exams assess whether, as a candidate, you can apply both your technical skill and strategic thought to the role of a financial manager.

What is the passing score?

To pass each CMA examination, a score of at least 360 out of 500 is required. This is to demonstrate your achievement in understanding the main subject matter and applying those concepts to finance and management in practice. Besides having subject matter knowledge, you will need to practice answering CMA exam-type questions in a timed manner to be successful.

How long does it take to complete the CMA?

Most candidates complete the CMA within 6-8 months of consistent preparation. Though working professionals may take longer, depending on schedules. The actual time depends on your ability to quickly cover the CMA curriculum. A structured study plan can significantly shorten your overall preparation time.

What is the best way to prepare?

The best preparation technique for the US CMA is a balanced combination of studying, practice and mock tests. The focus primarily should be on mastery of high-weightage areas such as decision analysis and corporate finance, while simultaneously practising essay-style questions. Finding a formal program which includes expert help and support allows for support through guided lectures, mock exams and placement assistance.

Wrapping Up

The subjects covered in the CMA course are a deliberate sequence that mirrors the transition of a finance professional. The first part positions you in the practices of reporting, planning, and cost control, the domains that keep an organisation in equilibrium. The second part takes your thinking out with considerations around investment, long-term health of the organisation, and the ethical weight in choices. Together, they present a transition from the operational perspective to the strategic perspective.

What makes the design effective is its reflection of the realities of business. A financial analyst who cannot articulate conclusions from a budget or forecast has functionality that is as limited as a strategist who cannot discern the signals buried in financial statements. The CMA syllabus mandates that you learn to do both, as that duality is the difference between someone who is just good with numbers and someone who can lead using them.

The exam format, which blends multiple-choice questions and paragraphs, fosters that balance of abilities. You’re assessed on whether you know the answer, but you are also assessed on whether you can share it in a clearly communicated, logical, and structured way. As a practice, that is the most highly coveted skill by companies — the ability to turn data into relevant and suggestive information.

In the end, mastering the CMA course subjects is less about earning a certificate and more about acquiring a way of thinking. Once, if you’ve worked through the connections between reporting, risk, and strategy, you’ll start seeing patterns in business problems that others miss. That perspective shapes the way you approach every financial challenge that comes your way.

👉 For anyone serious about mastering the CMA course subjects, guidance matters as much as grit. The US CMA Course by Imarticus Learning gives you both classroom knowledge and professional clarity.