If you’re looking into the CMA course fees, you’re probably wondering how much this prestigious finance qualification will set you back and, more importantly, whether it’s worth it. The Certified Management Accountant (CMA) course is one of the best investments you can make if you see yourself leading financial strategy, managing costs, or taking on senior leadership roles in finance.

When you first look at the CMA course fees, it might feel like a big number – and that’s completely normal. But what you may not realise yet is how that investment can multiply – not just in your salary, but in your confidence, career clarity, and global opportunities that follow. The truth? While the fees can feel like a significant upfront commitment, the career returns and global recognition often make it a game-changer.

This blog breaks down everything about CMA course fees in India for 2025, explores the return on investment, and unpacks career growth opportunities waiting at the end of the journey.

“The CMA deals with all the relevant areas of financial management and is a perfect complement to the strategic way we expect our professionals to perform.” – Stephen Cosgrove, CMA Vice President & Corporate Controller, Johnson & Johnson.

What is CMA?

Let’s start from the basics by understanding what is CMA. The CMA certification signals advanced abilities in financial accounting, enterprise finance, and strategic planning.

The Certified Management Accountant (CMA) is a globally recognised qualification that equips you with the skills to manage, analyse, and strategise business finances. It’s not just about crunching numbers – it’s about interpreting them to drive smarter decisions and stronger profits.

In India, the CMA course is offered by the Institute of Cost Accountants of India (ICMAI), and it’s considered one of the most powerful finance certifications for those aiming for leadership roles in corporate strategy, management accounting, and business finance.

The CMA trains you to be a strategist and a trusted advisor who plays a key role in shaping your company’s future profitability.

Why Choose the CMA Course in 2025?

Every year, thousands of commerce and finance students in India – and increasingly, working professionals, MBAs, and career-pivoters – choose CMA for one simple reason: it’s a ticket to modern, global, business-focused leadership.

Think of the CMA as your backstage pass to the world of strategic finance, opening doors not just in India, but across 170+ countries, from multinational corporations to fast-growing startups. It’s a qualification that speaks the universal language of business.

But the real magic isn’t just in the qualification. It’s in what the CMA trains you to do: think like a strategist, spot cost leaks before anyone else, guide corporate decisions, and become the go-to financial advisor in any organisation.

In a world where businesses don’t just need accountants but strategic thinkers who can drive growth, the CMA helps you stand out – not just for what you know, but for how you think, analyse, and lead. It’s more than a course; it’s a transformation that sets you apart in the global finance landscape.

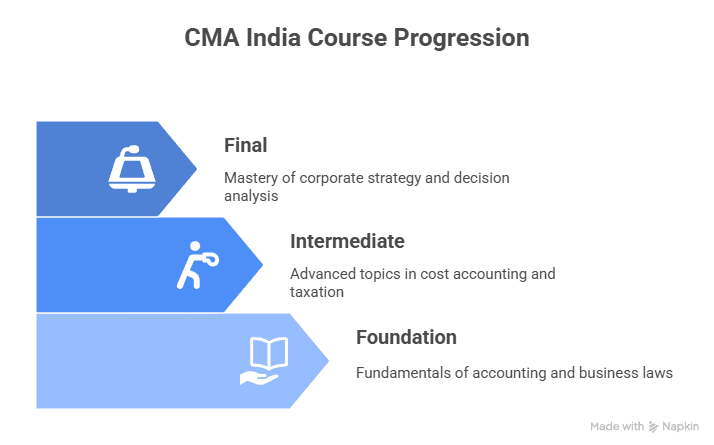

CMA Course Structure in India: Your Career Blueprint

The CMA in India, awarded by the Institute of Cost Accountants of India (ICMAI), unfolds in three key phases:

CMA Foundation: Your entry point into the world of business laws, accounting, and business mathematics.

CMA Intermediate: A deep dive into cost accounting, indirect taxation, operations management, and more – split into two groups.

CMA Final: This is where you transform from an analyst into a strategist, mastering financial reporting, corporate laws, and even electives for specialisation.

It’s not just book learning. The course is structured to build real-life skills, prepping you for boardroom decision analysis and strategic financial leadership from day one.

CMA Course Fees in India 2025: Level-wise Cost Breakdown

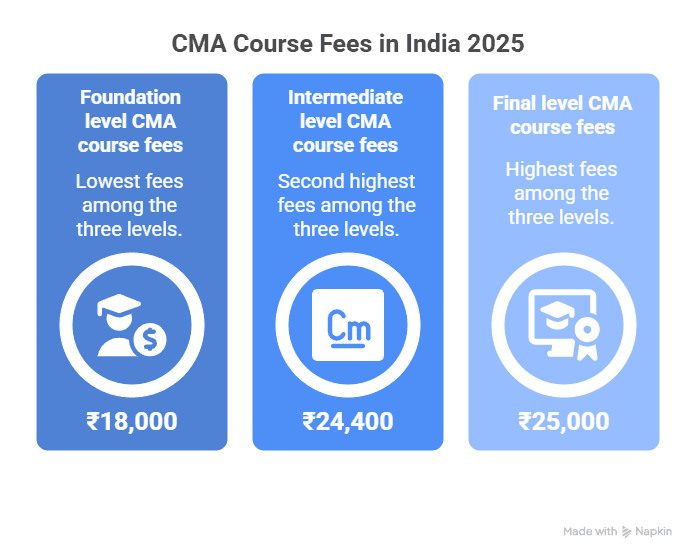

Let’s address the number one question: What exactly are the CMA course fees? Here’s the data, direct from ICMAI:

| Level | Registration Fee (INR) | Application Fee (INR) | Total (INR) |

| CMA Foundation | ₹6,000 | ₹12,000 | ₹18,000 |

| CMA Intermediate | ₹22,000 | ₹2,400 (both groups) | ₹24,400 |

| CMA Final | ₹25,000 | Included | ₹25,000 |

| Total | ₹67,400 |

These fees cover your core registration and exam applications. If you opt for coaching, study materials, or mock tests, factor in an additional ₹20,000–₹50,000 depending on your provider and how deep you want to go with your prep.

Real Example: The Actual Expenses

Take the case of Ankit, a CMA student from Delhi. Like many commerce graduates, he started his CMA journey with big dreams but a tight budget. His total outlay looked something like this – around ₹18,000 for Foundation, ₹24,400 for Intermediate, and ₹25,000 for Final, plus another ₹30,000 for coaching and test prep. It wasn’t an easy investment to make, but he viewed it as a step toward long-term growth.

Now, professionals with similar CMA credentials often start their careers at ₹7-8 LPA, especially when joining top consulting or finance firms – proof that the right investment in yourself really can pay off.

Torn between CMA (US) and an MBA? Before spending years and lakhs on an MBA, see why the CMA gives you faster ROI, global recognition, and leadership-ready skills – all in under a year.

🎥 Watch now to see how CMA (US) outpaces the MBA and how Imarticus Learning helps you get certified smarter and faster:

US CMA Course Fees: The Global Track

If your eyes are set globally, or you dream of working with MNCs, you may also be considering the US CMA from the Institute of Management Accountants (IMA).

| Fee Type | Student (USD) | Professional (USD) | Equivalent INR (Approx) |

| IMA Membership (per annum) | $49 | $295 | ₹4,000-₹24,000 |

| CMA Exam Entrance Fee | $225 | $300 | ₹18,000-₹24,000 |

| CMA Exam Fee (per part, two parts) | $370 x 2 | $495 x 2 | ₹60,000-₹82,000 |

| Total (full program) | $1,014 | $1,585 | ₹85,000-₹1.6 lakh |

Note – INR conversion mentioned is approximate and based on current exchange rates.

US CMA course fees cost between ₹1.2-₹2 lakh, including learning resources, significantly higher than the Indian CMA course fees, but with a global employer pull, a higher pass rate (45-50% vs 16-20% in CMA India), and exam flexibility.

Becoming a CMA instantly connects you to IMA’s powerful global network of over 1,40,000 accounting and finance professionals – a community that opens doors to international opportunities and lifelong career growth.

Want to know how long the US CMA takes and what you’ll actually study? Take a look at our detailed guide on the US CMA Programme Duration, Fees & Syllabus – it breaks down everything you need to plan your journey confidently.

⚡Quick Summary: The CMA course fees in India range from ₹67,000 to ₹1.2 lakh (ICMAI) or ₹1.2-2 lakh for the US CMA, depending on registration timing, study materials, and coaching options.

Application Fees, Session Windows & Hidden Costs

Application windows: Indian CMA exams are conducted twice yearly – June and December.

US CMA windows are:

- Jan-Feb,

- May-June,

- Sept-Oct.

Extra costs: Paying late? Add ₹500-₹2,500. Need to re-sit an exam? Budget another ₹3,000-₹10,000 per subject. Coaching and mock tests range widely.

Materials: Some materials, such as study texts and institute journals, are included; others, like advanced revision kits or test series, are extra but often critical.

CMA India vs US CMA Course Fees

Choosing between CMA India and US CMA often comes down to your career goals – whether you’re aiming for strong local recognition or a globally mobile finance credential. Here’s a quick side-by-side comparison to help you decide which path fits your ambitions best:

| Feature | CMA (India) | CMA (US) |

| Exam Body | ICMAI | IMA |

| Levels | 3 | 2 |

| Total Fees | ₹67,000-₹1.2 Lakh | ₹1.2-₹2 Lakh |

| Average Salary | ₹7-10 LPA | ₹12-18 LPA |

Still wondering which one’s right for you? Our detailed guide on the US CMA vs the India CMA breaks down the differences in depth – from syllabus and exam structure to global recognition and career outcomes – so you can make an informed choice before enrolling.

Smart Tips to Plan Your CMA Course Fees

You don’t have to pay the full course fees all at once or alone. Here’s how to stretch your money wisely:

- Register early – save up to ₹10,000 with early-bird windows.

- Go digital – ICMAI’s e-study materials are cheaper and updated faster.

- Apply for student discounts or merit-based scholarships.

- Use Imarticus’s zero-cost EMI plan to spread the cost easily.

- Join peer groups for shared coaching and mock test resources.

Scholarships, Waivers, and Payment Flexibility

Yes, you can manage the costs!

Scholarships: ICMAI offers diversity, merit, and need-based scholarships for Indian CMA aspirants. US CMA candidates can apply for student discounts through IMA, reducing exam fees by 50% or more.

Instalment payments: Most leading coaching brands (including Imarticus) break fees into zero-cost or low-cost EMIs, so you can spread the financial bite over the year.

Employer support: Forward-thinking finance teams may partially/fully reimburse course or coaching fees if you sign a retention bond.

Not sure if you qualify yet? Check your eligibility before you spend a rupee on fees – this helpful breakdown explains exactly who can apply for CMA and will give you clarity on prerequisites, timelines and more.

“The CMA allows people to get a better job or a different job because it symbolises an element of proficiency, integrity, and competency in various areas important to the finance and business environment.” – Tony Caspio, Vice President, Strategic Programs & Global Equipment Supply Chain, Sealed Air Corporation.

What Do You Get for These Fees? ROI, Recognition & Career Value

The big question: “Is the investment really worth it?” Absolutely – and here’s why. When you invest in the CMA, you’re not just paying exam fees; you’re buying credibility, global recognition, and access to higher-paying opportunities across industries.

The CMA isn’t an expense – it’s an accelerator. It transforms how employers see you and how you see yourself – as a finance professional who can think strategically, lead confidently, and make data-driven business decisions that matter. In short, the CMA gives back far more than it costs – in salary growth, career stability, and international mobility.

CMA India salaries: On average, fresh CMAs earn ₹7-10 LPA, and experienced CMAs or those in urban hubs can reach ₹15-25 LPA or more, especially with consulting, MNCs, or leadership positions, and senior CMAs earn ₹20 LPA or more.

US CMA salaries: The IMA’s 2023 report shows US CMAs earn 24% more than their non-certified peers. The international acceptance often means salary offers of ₹12-18 LPA for candidates with strong communication and analytical skills.

Average salaries: Fresh Indian CMAs earn ₹7-10 LPA; seasoned professionals can command ₹15-25 LPA or more. US CMAs typically enjoy a salary bump of 58% over non-certified peers.

“While the highest CTC has been recorded at ₹19.7 LPA, the average package for CMA qualified students was around ₹10 LPA.” – ICMAI Placement Report, 2023

Career acceleration: Nearly 80% of CMAs move into management roles within two years of qualifying, according to industry stats.

Future-proof skills: The CMA is regularly updated with the recent inclusion of analytics & technology modules and gives you practical leadership, not just accounting theory.

Want to dive deeper into what CMAs actually earn in India? Take a look at this detailed salary guide about

CMA Salary in India: How Much Can Certified Management Accountants Earn in 2025.

Where CMAs Work

A 2024 LinkedIn review showed CMAs (India/US) thriving in EY, KPMG, HUL, ITC, Amazon, and even startups – doing everything from corporate strategy and risk roles to financial control. The versatility of the CMA is its real USP. Some top employers include: EY, KPMG, Deloitte, HUL, ITC, Amazon, PwC, and high-growth startups.

Career Outcomes

80% job placement: Nearly four out of five Imarticus CMA graduates land interviews in global finance, FMCG, or consulting companies within six months.

Roles: Think Financial Analyst, Cost Manager, Risk Analyst, Corporate Treasurer, and even CFO. The Big Four, major banks, advisory firms, and Indian unicorns all aggressively hire CMAs.

Global mobility: US CMA, in particular, allows Indian professionals to shift to Singapore, the Middle East, Europe, or the US with minimal credential hurdles.

💡 Key Takeaways:

- CMA course fees in India 2025: ₹67,000-₹1.2 lakh

- US CMA course fees: ₹1.2-₹2 lakh

- Average CMA salary in India: ₹7-10 LPA

- ROI: Up to 58% higher salary vs non-certified peers

According to the IMA 2023 Salary Survey, professionals with a CMA earn approximately 21% higher median total compensation than those without the certification – a clear indication that the CMA pays off, literally.

How Imarticus Learning Helps You Ace the CMA

Let’s talk preparation, because passing CMA isn’t just about paying the fees – it’s nailing the exam, getting job-ready, and feeling confident every step of the way.

Imarticus US CMA in collaboration with KPMG Features:

- 250+ live faculty-led training hours by industry leaders and CMA-holders.

- Full suite of CMA-approved study materials, including Surgent CMA resources, mock tests, and flashcards.

- Structured doubt clearance with guaranteed mentor access.

- Resume and interview prep bootcamps, with direct links to MNC recruiters.

- Zero-cost EMI payment plans and a money-back guarantee if you don’t pass.

- Placement bootcamps and ongoing skill workshops.

Confused between CMA (US) and CPA (US)? You’re not alone – both are powerful global credentials, but the right one depends on where you see your career going. This video breaks it all down for you: from job roles and salaries in Canada to which one fits better for Big 4 firms or corporate finance.

FAQs About CMA Course Fees

Got questions about CMA course fees before you take the plunge? You’re not alone – from payment flexibility to eligibility and employer support, these are some of the most common doubts future CMAs have. Whether you’re curious about upfront costs, scholarships, or how to make the CMA journey smoother and more affordable, here’s a quick, frequently asked questions guide to help you plan smart and invest confidently in your finance career.

How much does the CMA course cost in India?

The total CMA course fees in India usually range from ₹1.2-₹1.8 lakhs, depending on how you plan your journey. If you go the self-study route, the costs are lower, but enrolling with a premium institute like Imarticus Learning gives you expert guidance, mock tests, and real-world prep support that make every rupee worth it.

Do I need to pay all CMA course fees upfront?

Not always, you don’t have to pay all your CMA course fees upfront. Imarticus Learning offer flexible EMI and instalment options that make your journey easier on the wallet. This way, you can focus on mastering the syllabus, not stressing over the payment schedule.

Is the US CMA more expensive than the Indian CMA?

Yes, the US CMA course fees might cost a bit more – usually around 1.5 to 2 times higher – but the payoff is worth it. You gain global recognition, a streamlined exam structure, and access to higher-paying international roles. You’re not just paying more – you’re investing smarter in a globally respected career.

Does the CMA course fee include study materials?

When you register with IMA, you’ll get official digital study materials. But Imarticus Learning takes it a step further – offering upgraded content, mock exams, and one-on-one mentorship designed to help you actually master the concepts and pass with confidence.

Do you have to be a commerce graduate to do CMA?

Not at all! You don’t need to be a commerce graduate to pursue the CMA – engineers, science grads, arts students, and MBAs are all welcome as long as you’ve completed your 10+2 and graduation. In fact, many CMA rankers come from non-commerce backgrounds. With Imarticus Learning’s structured CMA training, even career switchers find it easy to build a strong finance foundation and excel in the exams.

What happens if I fail a subject?

If you fail a subject, don’t worry – you only need to pay the re-application fee for that specific paper, usually around ₹1,200-3,000, not the entire CMA course fees again. It’s designed to keep your progress on track without burning a hole in your pocket.

Is the CMA course fee refundable if I fail or reschedule?

No, the CMA exam fees are non-refundable – but here’s the good part: you only need to reapply for the specific part you missed. With Imarticus Learning’s guidance, most students clear the CMA on their first try and save on repeat costs.

How can I reduce my CMA course fees?

Start early, apply for IMA scholarships, and go digital to cut down on extra costs. You can also save more by joining Imarticus Learning’s bundled programs that include everything – classes, materials, mentorship, and support – at one smart price.

Is there any scholarship or financial aid for CMA students?

Yes! IMA offers scholarships that can reduce your CMA fees by up to 70%, and Imarticus Learning helps eligible students apply for them successfully. It’s a great way to make your CMA journey more affordable without compromising on quality learning or career outcomes.

Do employers sponsor CMA?

Yes, more and more employers are stepping up to sponsor the CMA today. Leading MNCs, finance firms, and even tech giants often reimburse part or even the entire course fee for professionals pursuing the US CMA. It’s their way of investing in skilled finance talent that brings real value to the business.

Is the CMA worth the money?

Absolutely. CMA-certified professionals earn around 21% more than non-CMAs (according to IMA’s 2023 survey), and that premium only grows with experience. The ROI is undeniable – your investment in the CMA pays off quickly through better roles, global exposure, and faster career growth.

References

- https://icmai.co.in/upload/Students/E-Bulletin/Intermediate-Vol2-No10-Dec2017.pdf

- https://icmai-wirc.in/wp-content/uploads/2025/03/ICMAI-WIRC-CMA-Vidyarthi-March-25-Gudhi-Padwa-special-Edition.pdf

- https://in.imanet.org/press-releases/2023/december/imas-2023-global-salary-survey-reports-rising-salaries-job-opportunities-and-satisfaction-among-cmas

Wrapping Up: Is the CMA Course Fee Worth the Investment?

Choosing CMA isn’t just about the fees – it’s about building a strong career, future-ready skills, and global recognition.

If you’re ready for:

- Leading business decisions, not just executing them.

- International job opportunities across sectors.

- An average salary bump of over 58% compared to peers.

- Flexible, professional training that fits real working lives.

Every rupee you invest in CMA with Imarticus Learning quickly pays off through global recognition and career growth. At Imarticus Learning India, our CMA course fees are structured to be affordable without compromising on quality. With expert guidance, easy EMI options, and placement support, we make pursuing CMA in India simple and globally recognised.

Don’t let fees hold you back – every rupee you invest in the CMA builds a foundation for a decade of growth. At Imarticus Learning, we’ve seen it first-hand: learners who once hesitated now lead finance teams across Big 4s and MNCs. Still have questions? Imarticus counsellors will walk you through every stage – eligibility, fees, career mapping, and more. Take action today and make “CMA” the three letters that drive your career forward.