In today’s borderless, global finance economy, mobility is not a plus — it is normal. The professionals no longer live in one geography or one nation; they pursue international opportunities, cross-border jobs, and international leadership positions. It is under these circumstances that CMA Certification has emerged as the unstated passport of the finance vagabonds — those who want to carry their know-how across country borders.

The CMA, or Certified Management Accountant, is a highly valued professional credential worldwide. With just 6–8 months of preparation time, students can equip themselves to pursue a career in India and globally with salary packages ranging from ₹8 LPA to ₹18 LPA. With its rigorous focus on management accounting, decision-making, and strategic business analysis, CMA is offering just the kind of talent that organisations need today.

Today, we are discussing why CMA Certification is so much a force to be reckoned with, its professional potential, global acceptability, benefits to professionals, and why finance candidates make it their golden ticket.

What is CMA Certification?

CMA Certification is a professional certification of the Institute of Management Accountants (IMA), USA, that is globally recognised. It attests to financial analysis ability, business acumen, decision-making ability, and management accounting ability. Unlike other accounting finance certifications, CMA combines technical knowledge with business know-how — a very practical approach to managing actual leadership.

Key Features of CMA Certification:

- Study Time: 6–8 months

- Career Prospect: India and worldwide in MNCs, consulting, Big 4, and corporate finance functions

- Salary Range: ₹8 LPA to ₹18 LPA for certified professionals

- International Recognition: Certified in 100+ countries

This combination of global acceptability, applicability, and high employer preference makes it one of the most sought-after finance professional certifications today.

CMA Certification Benefits: Why Professionals are Choosing It?

The advantage of CMA Certification is a hundredfold compared to an employment title. It’s global credibility and it proves that the person is leadership-ready.

1. Global Mobility

CMA experts can be deployed anywhere, ranging from the USA to the Middle East, Europe, and Asia. It offers finance vagabonds with the mobility to roam through geographies and industries.

2. Career Versatility

With a certified CMA, the contenders are not limited to traditional accounting. They can opt for careers in the area of:

- Financial Planning & Analysis

- Corporate Strategy

- Cost Management

- Internal Auditing

- Risk Management

- Business Consulting

3. High Earning Potential

Salary packages after acquiring CMA professional qualifications are considerably more than those without any certification. As per industry standards, CMA designation benefits include the average 60% salary increase with certification.

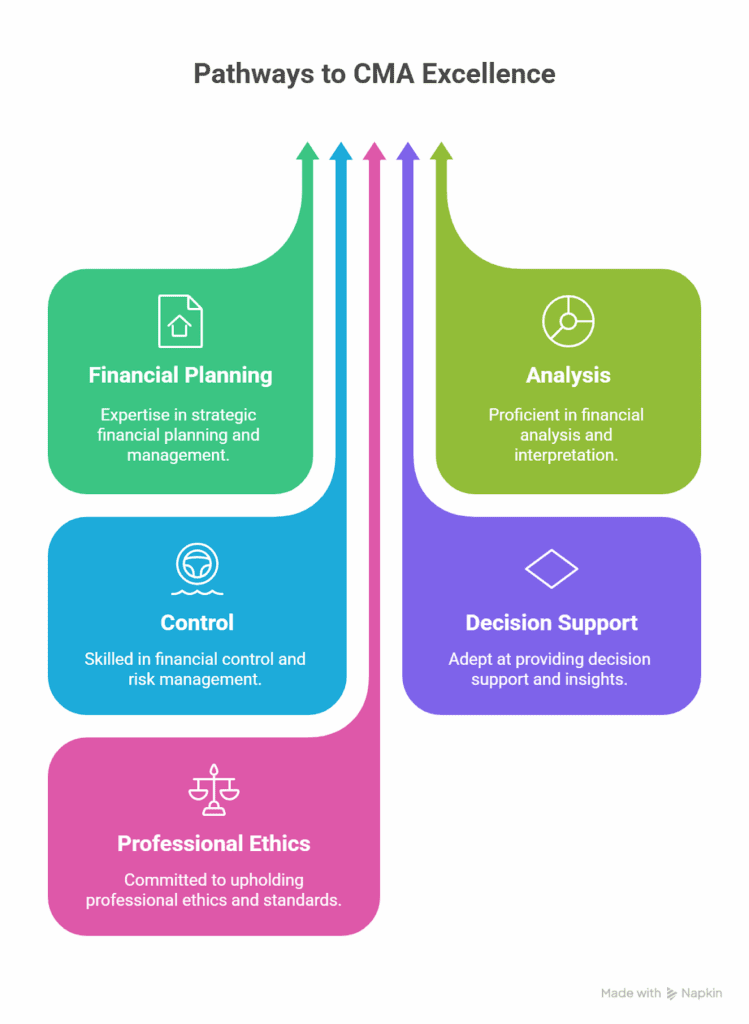

4. Strategic Decision-Making Skills

The CMA is concerned with developing leadership-capable competences. Concentrating on business analysis, financial planning, and performance management, the individuals develop competences to be able to make an immediate contribution to organisational strategy.

5. International Recognition

IMAs Certified Management Accountant title results in the title being recognized globally, conferring the certified practitioner a long-standing competitive advantage in the course of recruitment drives.

CMA Career Opportunities Across the Globe

Whereas discussing the career prospects in CMA, one has to highlight the versatility of the certification. It is equally valued by MNCs, corporates, and consultancy firms.

In India:

- Management accounting and corporate finance

- Back-office operations of US and European MNCs

- Big 4 firm advisory services

Abroad:

- Financial analyst roles in Fortune 500 organizations

- Consultancy firm strategic roles

- Management roles in manufacturing, technology, and healthcare

As globalisation and digitalisation intensify, CMA professionals are able to move into functions in which strategy and finance intersect and assist organisations to grow, scale up, and transform.

Certified Management Accountant Recognition: Why Employers Trust CMA

Today’s recruiters exercise prudence while taking hiring decisions. They require candidates who can contribute value from the very first day to their companies. The Certified Management Accountant designation is a seal of endorsement that guarantees recruiters technical competence, analytical minds, and strategic thinkers.

The employers value CMA professionals for:

- Their capability to analyze financial information in business context

- For being leadership-oriented decision-makers

- For responsiveness in the face of evolving regulatory environment

This renders CMA professionals most sought after in industries like banking, technology, consultancy, and manufacturing.

Imarticus Learning’s Role in CMA Certification Success

The US CMA program at Imarticus Learning is crafted under the mentorship of KPMG in India to stabilise academic education and industry expertise against each other. The team has maximised the preparation process among candidates with industry-specific case studies, live projects, and internship schemes.

What Makes Imarticus Learning Stand Out?

- Industry-Based Study Material: Closely put together by KPMG experts to cater to global finance needs

- Internship Exposure: Guest faculty exposure for industry readiness

- Joint Certification: Imarticus Learning + KPMG in India = strong brand credibility

- Special Study Guides: Access to study material for Surgent’s CMA (83% pass rate globally)

- Money-Back Guarantee: 50% fee rebate if exams not passed

- Pre-Placement Bootcamp: Resume creation, interview preparation, and job placement assurance

With IMA USA Gold Learning Partner, Imarticus is India’s first and only certified prep provider of the world’s top 5 finance certifications (CMA, CPA, CFA, FRM, ACCA).

CMA Certification vs Other Professional Qualifications

Comparing CMA certification with other certifications such as CPA, CFA, or ACCA, the benefits are evident:

- CMA vs CPA: CPA is US centered, whereas CMA is international oriented.

- CMA vs CFA: CFA is investment oriented, while CMA is broader with corporate finance and management accounting.

- CMA vs ACCA: CMA is quicker (6–8 months) in comparison to ACCA’s lengthy course duration.

For those who want international exposure and quicker professional opportunities, CMA is the correct choice to make.

Watch this video to know how you can grab a career opportunity in multinational companies with US CMA course degree

FAQs on CMA Certification

1. What is CMA Certification and which institution offers it?

It is a finance certification provided by the Institute of Management Accountants (IMA), USA).

2. How long should CMA be prepared?

For normal 6–8 months preparation with systematic learning.

3. What are the CMA designation benefits?

Improved growth in remuneration, global reputation, career designations as strategy, and other prospects in industries.

4. Does CMA allow me to work outside the country?

Yes, CMA provides career prospects in more than 100 nations, thus being one of the most sought-after international mobility certifications.

5. What are the salary ranges for CMA specialists?

Certified specialists earn ₹8 LPA to ₹18 LPA with much more on offer abroad.

6. Which industries recruit CMA-certified specialists?

IT, banking, consulting, manufacturing, FMCG, and healthcare are among the leading recruiters.

7. In what ways does Imarticus Learning support CMA candidates?

With Surgent study materials, sponsored KPMG case studies, internships, pre-placement boot camps, and a money-back guarantee.

Conclusion

The CMA Certification is now the nomad’s secret passport — for others who must live the international dream, dream leadership roles, and economic independence. With the eerie awareness, plenty of career prospects, and self-apparent salary benefits, CMA emerges as one of the most powerful finance certifications.

For Indian students, Imarticus Learning’s association with KPMG India merely makes it all that more profitable — training at global standards, actual practice, and 100% placement assistance.

If you’re willing to bring about a career quick start and unlock doors to international finance opportunities, CMA Certification is the pass you cannot afford to miss.