If you’re planning to build a serious career in finance, investment banking, portfolio management, equity research, or risk management, chances are the CFA exam has already caught your attention. The CFA Program is one of the most respected paths you can take. It’s recognised globally, trusted by top financial institutions, and considered the gold standard for anyone who wants to master real-world finance.

But here’s something most students don’t realise at the beginning – The CFA is challenging, but it’s not impossible.

With the right preparation plan, the right study materials, guidance from the best CFA exam prep providers, and a clear understanding of how the exam actually works, clearing all three levels becomes far more manageable than it seems.

In this guide, I’ll break down everything you need to know, right from exam details, fees, topics, exam months, structure, and the best tips to prepare like a professional. Whether you’re just exploring or actively planning to register, this breakdown will help you understand exactly what to expect and how to prepare effectively.

Did You Know? Each CFA exam level is 4.5 hours long, split into two equal sessions – with an optional break in between.

Understanding CFA

A lot of students ask me, “What is CFA?, and Why is everyone in finance talking about it?” I can break it down in the simplest terms for everyone to understand it.

The CFA Course is offered by the CFA Institute and is designed for people who want to build real careers in investment analysis, portfolio management, wealth advisory, equity research, and all the big finance roles.

It is respected globally because the curriculum actually teaches what finance professionals use every day – ethics, financial analysis, valuation, risk management, and portfolio strategy. Nothing fancy. The CFA exam just tests real, practical skills employers value.

To earn the CFA charter, you need to clear all three levels, gain the required work experience, and follow strict ethical standards.

CFA Exam Eligibility

Another common question I get is, “Am I even eligible to take the CFA exam?”

Thankfully, the requirements are pretty straightforward.

You can take the CFA Level 1 exam if you meet any one of these:

- You’re in the final year of your bachelor’s degree.

- You’ve completed your bachelor’s degree.

- You have 4,000 hours of professional work experience, or

- You have a combination of education and experience that totals 4,000 hours.

That’s it. You don’t need a finance background, a master’s degree, or prior certifications. Just meet the minimum eligibility, and you’re good to go.

If you want a quick reality check about the CFA journey, the video above breaks down common myths, who can actually pursue the program, how to balance studies with life, and why failing once doesn’t stop your CFA path.

CFA Exam Structure

Understanding the CFA course syllabus and exam structure early helps you plan smarter. Each level follows a unique pattern:

| CFA Level | Format | Exam Duration |

| Level 1 | 180 multiple-choice questions | 4.5 hours (two sessions) |

| Level 2 | 88 vignettes + item-set questions | 4.5 hours (two sessions) |

| Level 3 | Essay-style constructed response + item sets | 4.5 hours |

Level 1 – The Foundation

CFA Level 1 exams focus on understanding basic financial concepts, ethics, and core analytical tools. It tests your recall, definitions, and introductory financial analysis skills while giving you exposure to all major CFA exam topics.

Level 2 – The Analyst’s Exam

CFA Level 2 moves into application-based learning. It tests you through case studies, valuations, and data-driven scenarios. This level demands stronger analytical ability, financial modelling skills, and accuracy in applying concepts to real-world situations.

Level 3 – The Portfolio Mastery Stage

CFA Level 3 emphasises portfolio management and wealth planning. It tests your ability to reason, structure answers logically, and make client-oriented investment decisions with the essay-style questions. It integrates everything learned across previous levels into practical portfolio strategies.

Did you know? All CFA exams are computer-based and held at approved global test centres. Paper-based exams were discontinued in 2021.

CFA Exam Months

Many students ask me, “When exactly can I take the CFA exam? Do I need to wait an entire year?”

The good news is – not anymore.

The CFA Institute now offers the exam multiple times a year, giving candidates far more flexibility than before. Here are the typical CFA exam months you can plan around:

- CFA Level 1: February, May, August, November.

- CFA Level 2: May, August, November.

- CFA Level 3: February, August.

This flexible schedule means you can plan your preparation, work commitments, and even retakes comfortably – without feeling locked into a single annual exam cycle.

CFA Exam Registration Process

Most students wonder how the registration works. Here’s the good news – it’s simple and fully online.

Here’s the step-by-step registration process:

- Visit the CFA Institute Website – Create your CFA Institute account.

- Choose Your Exam Level & Window – Select the exam month (from the windows available for your level).

- Upload Eligibility Details – This includes your education or work experience.

- Pay the Exam Fee – Early registration saves the most, so register as soon as possible.

- Schedule Your Exam Slot – After payment, you can pick your exam day and time from the available test-centre options.

- And that’s it – your CFA journey officially begins.

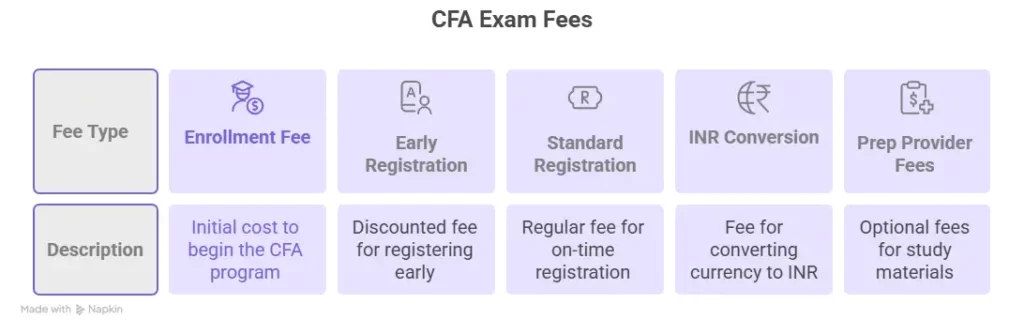

CFA Exams Cost

Students often ask me, “What would they spend on the CFA Fees?” And I totally understand the concern behind that question. Knowing the CFA Course Fees and Exam costs in advance helps you plan your budget and your preparation. The CFA exams cost depends on when you register:

- Early registration saves the most.

- Standard fees apply if you miss the early window.

- One-time enrollment fee for first-time Level 1 candidates.

The table below shows an overview of the CFA exam price:

| Fee Component | USD Amount (approx.) | INR Equivalent (₹) |

| One-time Enrollment Fee (first-time candidates) | USD 350 | ₹31,000-32,000 |

| Early Registration Fee (per level) | USD 990-1,090 | ₹88,000-98,000 |

| Standard Registration Fee (per level) | USD 1,290-1,390 | ₹1,15,000-1,25,000 |

| Rescheduling / Retake Fee (if applicable) | USD 250 | ₹ 22,000-23,000 |

Note – These INR equivalents are approximate. Actual INR cost will depend on the prevailing USD/INR exchange rate on the day of payment.

Here’s a fee breakdown for the CFA course at Imarticus:

| Fee Component | Typical Cost / Notes |

| Registration Fees | ₹10,000 |

| Course fee per level | ₹60,000-75,000 per level |

| What the fee covers (per level) | Study materials + prep courses + coaching through that level |

Note – The per-level fee is for the prep course/coaching offered by Imarticus, not the actual exam registration or exam-related fees.

Many candidates search for the CFA exam fees because budgeting is an important part of planning, especially across all three levels.

CFA Exam Topics

Across all levels, the CFA curriculum covers a wide range of concepts that finance professionals use every day. These topics build the exact skills needed for CFA certification career paths like investment banking, equity research, portfolio management, wealth advisory, risk analytics, and asset management. Whether you’re analysing financial statements, valuing companies, managing portfolios, or assessing market risks, the CFA exam topics are designed to prepare you for real-world responsibilities in these high-demand roles.

| CFA Topic | Level 1 Weight (%) | Level 2 Weight (%) | Level 3 Weight (%) |

| Ethics | ~15-20% | ~10-15% | ~10-15% |

| Quantitative Methods | ~6-9% | ~5-10% | ~0% not assigned for Level 3 |

| Economics | ~6-9% | ~5-10% | ~5-10% |

| Financial Statement Analysis | ~11-14% | ~10-15% | ~0% not assigned for Level 3 |

| Corporate Issuers | ~6-9% | ~5-10% | ~0% not assigned for Level 3 |

| Equity Investments | ~11-14% | ~10-15% | ~10-15% |

| Fixed Income | ~11-14% | ~10-15% | ~15-20% |

| Derivatives | ~5-8% | ~5-10% | ~5-10% |

| Alternative Investments | ~7-10% | ~5-10% | ~5-10% |

| Portfolio Management | ~8-12% | ~10-15% | ~30-35% |

Each level goes deeper:

- CFA Level 1 covers Concepts, Definitions & basics.

- CFA Level 2 focuses on Applications & valuation.

- CFA Level 3 tests Portfolio integration – Portfolio construction & decision-making.

These are also the essential areas to focus on when choosing your CFA exam study materials.

CFA Facts: CFA charterholders work in 160+ countries, making it one of the most globally portable finance qualifications.

Best CFA Exam Study Materials

Students often wonder what actually works for the right preparation. While there’s no correct answer, using a combination of the best CFA books can help in your journey. Choosing the right resources is half your success.

Here’s how to pick:

| Study Material | Best For | Why It Helps |

| CFA Institute Books | In-depth learning | Full explanations, detailed concepts, and official examples. |

| Schweser Notes | Fast revision | Concise summaries, structured theory, and quick revision support. |

| Wiley / Bloomberg Learning | Difficult topics | Simplifies complex areas like FRA, Derivatives, and Valuation. |

| CFA Exam Prep Courses (Imarticus Learning) | Mentorship & guided study | Live support, doubt-solving, structured plans, and expert faculty. |

| Question Banks & CFA Past Exams | Practice & exam readiness | Builds accuracy, improves speed, and reflects real exam difficulty. |

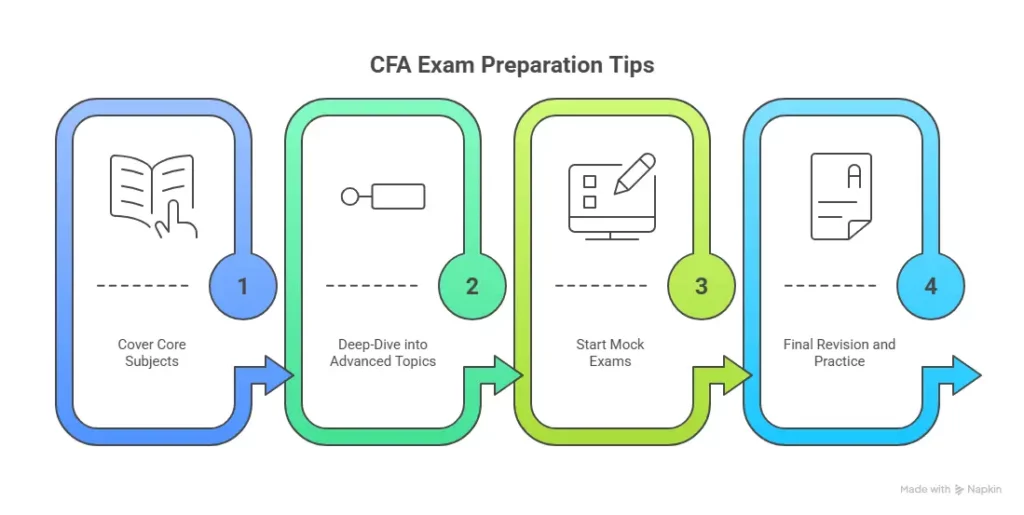

Best Tips to Prepare for the CFA Exam

Now that you are pretty aware of the CFA course details, it’s time to understand how successful students prepare for the CFA exams. Experts and successful CFA candidates agree on one thing: strategy matters as much as hard work.

Here are the most effective CFA exam tips, inspired by real analyst and portfolio manager insights:

1. Start Early With a Structured Plan – Most candidates prepare for 4-6 months per level. Break your study into weekly milestones.

2. Prioritise High-Weight Topics – Areas like FRA, Equity, and Fixed Income carry huge weight – focus heavily on them.

3. Practice More Than You Read – CFA exam prep is 70% practice. Use Question banks, end-of-chapter problems, and mock tests.

4. Learn Efficiently (Not Just More) – Condense notes, use summary sheets, and review formulas regularly.

5. Strengthen Ethics Thoroughly – Ethics performs a tie-breaker role – don’t underestimate it.

6. Simulate Exam-like Conditions – Take full mock exams to build stamina for the 4.5-hour exam.

7. Maintain Consistency – Keep your momentum steady, as consistency beats last-minute cramming.

CFA Exam Difficulty & Pass Rates

Let’s be honest – the CFA exam is challenging. But the difficulty does not mean the exam is complicated.

Here’s the real picture:

- CFA Level 1 pass rates usually range around 22-30%.

- CFA Level 2 pass rates are around 40%.

- CFA Level 3 pass rates are slightly higher, often 40-50%.

The difficulty doesn’t come from tricky questions – it comes from the volume of concepts you need to master and the discipline required to stay consistent.

Most candidates fail because they:

- Don’t follow a fixed study plan,

- Rely only on reading, not practice,

- Underestimate Ethics,

- Skip mocks,

- Start studying too late.

Even though the pass rates are high, with the right preparation strategy and training, clearing each level on the first attempt is absolutely possible.

Is the CFA Exam Worth It?

Yes, the CFA designation is one of the most powerful career accelerators globally. Clearing the CFA course acts as a gateway to global finance and is beneficial if you want a career in:

- Equity Research

- Investment Banking

- Portfolio Management

- Wealth Management

- Risk Analytics

It signals expertise, commitment, and professionalism – qualities every finance employer looks for today. And yes, the CFA exam can feel overwhelming in the beginning, but once you understand the structure, plan your preparation properly, and stay consistent, it becomes far more manageable than it appears.

Another thing students often ask me is about the CFA salary in India. While salaries vary based on your role and experience, CFA candidates and charterholders generally earn significantly higher than the average finance graduate. Many entry-level roles start with competitive packages, and as you gain experience, CFA-qualified professionals often move into high-paying roles in equity research, investment banking, portfolio management, and risk analytics.

In simple terms: the CFA is not just a certification – it’s a long-term investment in a career that grows with you. If you also want a quick breakdown of the salaries and roles you can expect after each CFA level, this short video explains it clearly and helps you understand the real career outcomes of the CFA journey.

Did You Know? CFA exams use multiple psychometric methods, including Minimum Passing Score (MPS) and equating, to ensure fair scoring across all exam sessions.

Why Choose Imarticus Learning for the CFA Exam?

A lot of students ask me, “There are so many platforms out there – should I prepare for the CFA exam with one of them?”

And honestly, the answer is simple: Imarticus makes the CFA journey easier, structured, and far more guided.

Here’s why:

- Expert-Led Training With Industry Faculty – At Imarticus, you’re not just learning from trainers – you’re learning from real finance professionals. Many of them are ex-analysts and domain experts who’ve worked with the exact concepts you study for the CFA exam. They bring real-world examples into every session, which makes understanding complex topics a lot easier.

- Live Doubt-Solving & Mentorship – Instead of figuring everything out on your own, you get continuous academic support. You can clarify doubts instantly, attend dedicated doubt-clearing sessions, and even get one-on-one guidance whenever you need it.

- Complete Level-Wise Support – Each level of the CFA program demands a different kind of preparation. Imarticus guides you through all three – whether it’s building your foundation for Level 1, tackling valuation-heavy concepts in Level 2, or mastering portfolio strategy for Level 3. Your entire journey is mapped out clearly.

- Flexible Learning Options (Online + Classroom) – Whether you’re a student, a working professional, or someone balancing both, the classes are designed to fit your schedule. You can choose online flexibility or a classroom experience based on what works best for you.

- CFA-Aligned Study Materials & Practice Questions – The materials are designed to simplify complex topics like FRA, derivatives, and portfolio management – topics candidates usually find difficult.

- Mock Exams, Test Series & Performance Tracking – The best way to crack the CFA exam is to practise exactly how you’ll be tested. Imarticus gives you full-length mock exams that mirror the real CFA pattern. You also get detailed performance reports so you know exactly where to improve before the big day.

In short, if you want guidance, structure, discipline, and expert mentorship – not just study material – Imarticus is one of the strongest partners you can choose for your CFA course.

Imarticus Learning, in collaboration with KPMG in India, is supported with additional credibility, expertise, and industry relevance and provides a structured CFA preparation journey designed for guaranteed success.

FAQ’s About CFA Exam

Before we wrap up, here are some of the most frequently asked questions students ask me about the CFA exam. If you’re still unsure about anything – from eligibility to preparation – these answers will clear things up.

What are the CFA exam details I should know before registering?

The CFA exam is divided into three levels, each focusing on different areas of finance – from foundational concepts to advanced portfolio management. You must clear Levels 1, 2, and 3 sequentially, with each exam offered during specific exam months throughout the year.

Who is eligible for the CFA exam?

You can take the CFA Level 1 exam if you are in the final year of your bachelor’s degree, have already completed your degree, or have at least 4,000 hours of professional work experience. You can also qualify with a mix of education and work experience that adds up to those 4,000 hours. And honestly, you don’t need to be from finance at all – students from any background can start the CFA journey as long as they meet one of these simple requirements. To take the Level 2 and 3 exams, previous levels should be cleared successfully.

What is the total cost of the CFA?

In Indian currency, the total cost comes to roughly ₹30,000-32,000 for the enrollment fee and anywhere between ₹90,000-1,25,000 per level for the registration. And if you choose to prepare with a structured coaching provider like Imarticus Learning, you can expect an additional ₹60,000-75,000 per level for the classes, study materials, and guided support, which honestly makes the preparation a lot smoother.

What are the best CFA exam prep materials to study from?

Most candidates use CFA Institute Books (official curriculum), Schweser Notes for fast revision, Wiley or Bloomberg for clarity on tough topics, and Mock tests combined with CFA past exams for practice. Students who prefer structured learning often choose Imarticus Learning, which offers curated CFA exam prep materials, live sessions, practice questions, and mentorship.

Are CFA past exams available for practice?

Yes. The CFA Institute provides mock exams, practice questions, and topic tests within the candidate portal. They don’t release full past exams, but their official mocks closely reflect the exam pattern and difficulty level.

What is the CFA exam structure like for all three levels?

The CFA exam structure varies by level:

- CFA Level 1: 180 multiple-choice questions

- CFA Level 2: Vignette-based item sets

- CFA Level 3: Essay-style constructed responses + item sets

Each level is 4.5 hours long, split into two sessions and tests deeper conceptual understanding as you progress.

How many hours should I study for the CFA exam?

Most candidates usually spend 300+ hours studying per level. It is recommended to stay consistent over months rather than last-minute cramming – a structured study plan and regular practice are key to clearing the exam.

Does the CFA program exam guarantee a job?

The CFA exam does not guarantee a job, but it significantly strengthens your profile. With the right practical skills, networking, and guidance from platforms like Imarticus Learning, it opens doors to global roles in investment banking, asset management, risk analytics, and equity research.

Wrapping Up Your CFA Exam Preparation

The CFA exam is challenging, but it rewards disciplined, consistent learners. With the right guidance and structured preparation, clearing all three levels becomes completely achievable. Thousands of students clear it every year – not because they’re geniuses, but because they follow the right approach, use the right CFA exam prep materials, and stay committed throughout the journey.

If you’re looking for structured coaching, expert mentorship, live doubt-solving, or guided study plans, the CFA course at Imarticus Learning in collaboration with KPMG in India is designed exactly for that. They help you study smarter, stay consistent, and build the skills you need not just to pass the exam – but to thrive in your finance career.

If you’re serious about building a global finance career, the CFA charter is one of the strongest investments you can make in yourself. Your CFA journey starts with one decision – and you’re already halfway there by reading this guide. Keep going, stay consistent, and you’ll get there.