The landscape of financial markets has changed a lot over the years. Among all the financial markets, capital markets have seemingly become more complex. Most investors and corporate personnel aren’t even aware of the ever-changing capital markets.

As a result, young entrepreneurs suffer to bring long-term investment for their ventures. Investors that lack understanding of the capital markets fail to invest in profitable long-term securities. It is why we have come up with a capital markets training program to bridge the talent gap when it comes to capital markets. Let us see how our capital markets training program helps young entrepreneurs.

What is our capital markets training program?

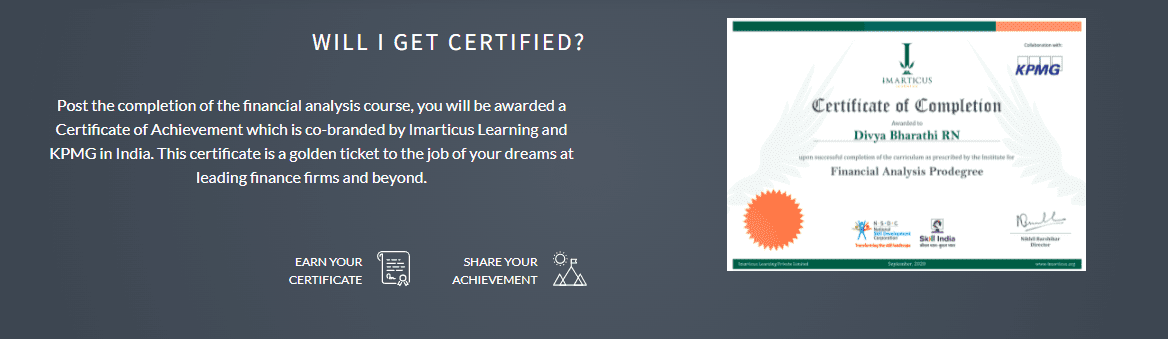

We at Imarticus Learning provide a financial services and capital markets course for young enthusiasts. Our management program in financial services and capital markets is endorsed by IIM Lucknow. IIM Lucknow is a renowned management institution in India and, you will get an industry-recognized certification.

The six-month-long IIM Lucknow course is drafted according to the new-age curriculum and covers the latest trends. You can secure a lucrative job role after completing the IIM Lucknow course. If you don’t want to ditch the idea of working for a company, our course will help you become a successful entrepreneur. Let us see how our capital market course is bridging the talent gap and creating next-gen entrepreneurs.

Pros of IIM Lucknow course in 2022

The benefits of joining our capital markets course in 2022 are as follows:

Learn about investment banking

If you are planning to become a successful entrepreneur, you should be aware of the investment banking landscape. Young entrepreneurs should know the value of due diligence before investing in an opportunity. You cannot invest in equity/security without any prior research. Our capital market course will help you learn financial valuation, equity research, structure finance, and much more by our capital markets course.

All these topics will help you know the research efforts required for making better investments. When dealing in bonds, shares, or any other long-term security, you need to know the past performance and current trends.

Financial valuation is another important concept for young entrepreneurs. When asking for funding, entrepreneurs need to present the correct valuation of their company. Based on the company valuation, equity and shares are sold. Our IIM Lucknow capital markets course will help you learn financial evaluation for a company or a financial instrument.

Learn about capital markets in detail

Our course will help you learn about different types of financial markets in detail. You will learn about various factors that affect the financial markets. When you work in capital markets, there are many compliance requirements to be followed. Our capital markets course will discuss the compliance status in capital markets.

You will also get to know about the risks encountered in the capital markets. Risk management is an important step for young entrepreneurs that want to excel in capital markets. If you can’t forecast market risks and eliminate them proactively, you might take a fall.

Learn about fintech by our capital markets course

The fintech revolution has now completely arrived in India at present. One can already see the shift of customers towards financial services aided by technology. The price of shares/bonds of fintech companies is also rising in recent years.

Our capital markets course can help young entrepreneurs understand the fintech sector. You will get an industry-oriented capital market certification at the end of the IIM Lucknow course. You will get to learn about capital markets from industry experts. You will also be introduced to capital market trends in 2022. Start your IIM Lucknow capital market course right away!

Create Networking

Create Networking  A financial market is bestowed with myriad opportunities for fresher and experienced candidates. From investment consultant to the budget analyst, the chances for growth are perpetual. Hence, a

A financial market is bestowed with myriad opportunities for fresher and experienced candidates. From investment consultant to the budget analyst, the chances for growth are perpetual. Hence, a