The ACCA vs MBA decision usually doesn’t begin with entrance exams, fees, or course brochures. It begins much earlier, at the moment you realise that business and finance are not one single career.

Two people working in the same company on the same floor can still live in completely different professional worlds. Where one spends the day understanding and analysing numbers, checking their accuracy, ensuring compliance, and protecting finances. The other spends the day making decisions, managing people, shaping strategy, and pushing growth.

Both are important. But they think differently. They work differently. And over time, they become very different professionals. This is the space where ACCA and MBA quietly exist.

When you observe real careers, the difference between ACCA and MBA doesn’t show up in textbooks. It shows up in everyday work. It shows up in whether your role revolves around closing books, analysing financial risk, maintaining standards, and building financial discipline, or around leading teams, making business calls, managing operations, and driving direction.

These aren’t small differences. They slowly shape how you see problems, how you add value, and how people define you professionally.

Because the real alignment isn’t academic. It’s about whether you enjoy precision or direction. Whether you prefer structure or strategy. Whether you feel energised by financial clarity or business leadership.

That’s also why questions like “Which is harder?” or “Which pays more?” never have a clean answer. Difficulty and salary feel different when the work itself feels right or wrong to you. A role that drains one person can excite another.

So in this comparison, I won’t be pushing you towards the ACCA Certification or MBA. I’ll help you recognise where you naturally belong.

Do you want to think like a finance expert?

Or do you want to think like a business leader?

Once you identify whether you think more like a finance expert or a business leader, your ACCA vs MBA decision becomes much clearer, helping you align your career path with your personal strengths.

ACCA Quick Fact:

ACCA is a professional qualification, not an academic degree. It is designed to build real-world finance capability, not just classroom knowledge.

Why ACCA vs MBA Is a Real Career Dilemma

For years, an MBA has been the default answer to career growth. If you wanted “better opportunities,” you did an MBA. If you wanted leadership roles, you did an MBA. If you wanted higher pay, again, an MBA.

But today’s career landscape is changing. Companies don’t just want generalists. They want professionals who can solve specific problems. Especially in finance, where accuracy, compliance, reporting standards, and financial strategy directly impact business survival.

That’s why ACCA has quietly become a powerful alternative. Students and professionals now stand at a crossroads of ACCA vs MBA:

- MBA offers breadth

- ACCA offers depth

MBA teaches you a little bit of everything: Marketing. Operations. Strategy. HR. Finance.

ACCA course subjects teaches you everything about: Accounting, Financial reporting, Audit, Taxation, Risk, Compliance, and Business finance.

So the question is simple: Do you want to know a little about many things?

Or become extremely strong in one of the most valuable business functions in the world?

This question becomes even more important in India, where:

- MBA seats are increasing every year.

- Quality varies drastically by college.

- ROI depends heavily on ranking.

While ACCA maintains a global standard, regardless of where you study. That’s why ACCA vs MBA is no longer about “degree vs course.” It’s about precision vs generalisation.

To help you see this comparison in action, here’s a video that breaks down both paths clearly, from cost and career options to global recognition and future opportunities:

What is ACCA

Before we go deeper into the comparison of ACCA vs MBA, let’s first understand what is ACCA, and what they actually do.

ACCA stands for the Association of Chartered Certified Accountants. It’s a globally recognised professional qualification in accounting and finance, with its headquarters in the UK.

In simple words, ACCA is designed for people who want to build a serious career in finance. It’s not just a course you study and forget. It’s a professional path that trains you to think, work, and grow like a finance expert. But ACCA is not a course in the traditional sense. It’s a professional pathway.

When you pursue ACCA, you are training to become a globally competent finance professional who understands:

- International accounting standards

- Financial reporting

- Audit and assurance

- Taxation

- Business strategy

- Ethics and governance

- Corporate finance

According to ACCA’s official framework, the qualification is built around knowledge, skills, and professional values. Which means you are not just learning concepts. You are learning how finance actually works inside companies.

Another powerful aspect of ACCA is the flexibility in ACCA course eligibility. You can:

- Start after 12th

- Start after graduation

- Study while working

- Progress at your own pace

- Build experience alongside exams.

And once you complete ACCA, you are not limited to one country. ACCA is recognised in 180+ countries, making it one of the most mobile finance qualifications in the world.

Where ACCA really stands out is the clarity of career direction. It prepares you directly for roles like:

- Financial Accountant

- Auditor

- Management Accountant

- Tax Consultant

- Financial Analyst

- Finance Manager

- CFO (with experience)

To make the ACCA journey even clearer, here’s a helpful video that explains what ACCA really is, how the qualification works, and why it’s becoming such a strong choice for finance professionals:

What is an MBA

Now that we have understood what the ACCA syllabus offers, we should know the other side of our ACCA vs MBA comparison too. MBA stands for Master of Business Administration, which is an academic postgraduate degree that focuses on business leadership and management. An MBA is built to help you understand how an organisation functions as a whole:

- Marketing

- Operations

- Human resources

- Strategy

- Finance

- Leadership

It gives you a 360-degree view of business.

MBA programs are extremely popular because:

- They work across industries.

- They signal leadership potential.

- They are well known to recruiters.

- They provide networking opportunities.

But an MBA is fundamentally a generalist qualification.

Even if you choose an MBA in Finance, your exposure to finance is broader, more conceptual, and less technically detailed than ACCA.

Also Read: Is ACCA Tough? Clear Breakdown of Exam Difficulty and Format

ACCA vs MBA: The Core Difference

The MBA degree teaches you how to manage financial decisions. The ACCA course teaches you how to build, verify, report, and control them. Another difference is structure.

| Factor | ACCA | MBA |

| Study format | Modular | Full-time |

| Learning mode | Flexible | Campus-based |

| Duration | Exam-based, self-paced | Fixed (1-2 years) |

| Cost structure | Cost spread across levels | High investment |

| Recognition basis | Globally standardised qualification | Depends on college reputation |

| Career approach | Career-oriented from day one | Broader business exposure |

An MBA helps you become a business leader, whereas an ACCA helps you become a finance authority.

This is where the picture becomes very clear; both ACCA and MBA focus on completely different objectives. Your choice should be aligned with your career goals and preferences:

| MBA Focuses On | ACCA Focuses On |

| Leadership | Financial accuracy |

| Decision-making | Regulatory compliance |

| Strategy | International accounting standards |

| Team management | Financial risk |

| Business growth & management | Corporate financial health |

Think of it like this: An MBA helps you run the business, and an ACCA helps you protect and structure the business financially. In real-world companies:

- ACCA professionals ensure that direction is financially sound, compliant, and sustainable.

- MBA professionals often guide direction.

Both are important. But for anyone serious about finance, accounting, audit, or global financial roles, ACCA is far more direct and purpose-built.

And that’s what gives the ACCA qualification its quiet strength. It doesn’t try to be everything. It chooses to be exceptional at one thing: finance.

ACCA Quick Fact:

ACCA allows you to study while working and complete exams at your own pace, making it ideal for students who don’t want to pause their careers.

ACCA vs MBA: Course Duration and Study Pattern

This is where most students get their first reality check. An MBA asks you to pause your life for a while. ACCA fits into your life. Getting an understanding of the MBA and ACCA course details helps you plan your study routine effectively.

ACCA is flexible. You can study while working, take exams at your own pace, and build experience alongside learning.

An MBA is usually full-time. You quit your job, attend classes daily, and finish within a fixed timeline.

For many students and working professionals, this flexibility is not just convenient – it is powerful. You are not stepping out of your career to study. You are growing inside it.

| Aspect | ACCA | MBA |

| Nature | Professional qualification | Academic degree |

| Duration | 2-3 years on average (flexible pace) | 1-2 years (fixed) |

| Study Mode | Exam-based + Practical Experience Requirement | Classroom-based + projects |

| Entry point | After 12th or graduation | Only after graduation |

| Learning style | Technical, practical, job-aligned | Theoretical + managerial |

ACCA respects the fact that careers don’t need to pause to grow. MBA assumes you can afford a career break. For someone who wants financial independence early and steady career growth, ACCA naturally feels more practical.

You’re learning finance while actually working in finance. That creates faster confidence, better understanding, and stronger employability.

And then there’s another big advantage ACCA has over an MBA: ACCA exemptions.

If you come from a commerce background like BCom, BBA, MCom, or similar degrees, you may already be eligible for exemptions in ACCA. That means:

- You skip certain foundation-level papers.

- You save time.

- You save exam fees.

- You reach the advanced levels faster.

In simple words, your previous education actually counts. Your journey becomes shorter and more efficient.

With an MBA, everyone starts at the same point. There are no academic exemptions. Whether you studied commerce or science, the duration and structure remain the same for all. That’s why ACCA feels more personalised and career-aligned, especially for commerce students.

So if you like structure, campus life, and an intense short-term academic environment, an MBA fits well. But if you want flexibility, career continuity, and a qualification that grows with your professional experience, ACCA exam naturally feels more practical.

This is why I say: MBA changes your direction, while ACCA strengthens your direction.

ACCA Quick Fact:

Commerce graduates (BCom, BBA, MCom, CA Inter, etc.) can get up to 9 paper exemptions, reducing both time and cost.

ACCA vs MBA: Cost and Return on Investment

This is where ACCA quietly becomes very strong. MBA fees vary massively. A top-tier MBA can cost as much as buying a small apartment. And unless you get into a top college, ROI becomes unpredictable.

ACCA course fees, on the other hand, are standardised globally. The qualification cost remains controlled, transparent, and far more affordable. Here’s a brief overview of ACCA fees:

| Component | Approximate Cost |

| Registration + Annual Subscription | ₹10,000 – 15,000 |

| Exam Fees (13 papers) | ₹1.5 – 2.5 lakhs (depending on pace & exam window) |

| Coaching & Training | ₹2 – 4 lakhs (varies by institute) |

| Total Approx Investment | ₹3.5 – 6.5 lakhs |

Now, I’ll show an approximate overview of MBA course fees:

| Type of MBA | Approximate Cost |

| Tier 1 Colleges (IIMs, ISB, Top Private) | ₹20 – 35 lakhs |

| Tier 2 Colleges | ₹10 – 20 lakhs |

| Average MBA Colleges | ₹5 – 10 lakhs |

Now comes the real question: What return are you getting on what you invest?

With ACCA, you get lower costs, global recognition, opportunities in direct finance roles, and faster financial stability. ACCA feels like a calculated financial decision. High-quality ACCA books make preparation simpler because they explain complex concepts in a practical, exam-focused way.

With an MBA, you have to bear much higher costs; the ROI is heavily dependent on the college brand, and your career direction still depends on specialisation and experience. An MBA often feels like a gamble on rankings and placements.

ACCA Insight:

ACCA typically costs 70-80% less than a full-time MBA, while still offering global career mobility in finance.

ACCA vs MBA Salary Comparison

Salary is where most comparisons become emotional. But smart career choices are made through consistency, not hype.

MBA salaries look impressive when you see average packages from top colleges. But in reality, MBA salaries vary wildly depending on:

- College ranking

- Specialisation

- Industry

- Location

The ACCA salary in India grows steadily because the qualification directly aligns with the finance roles that companies always need.

What matters more than starting salary is predictability. ACCA and MBA both offer lucrative salaries, but here’s how the salaries look for ACCA vs MBA at the same levels:

| Level | ACCA Salary (India) | MBA Salary (India) |

| Entry Level | ₹6 – 8 LPA | ₹4 – 7 LPA |

| Mid-Level (3-5 years) | ₹10 – 15 LPA | ₹8 – 14 LPA |

| Senior Level | ₹18 – 30+ LPA | ₹15 – 30+ LPA |

ACCA Salary Insights show that:

- Salary growth is skill-driven.

- Roles are finance-specific.

- Demand exists across industries.

With an MBA:

- Salary depends heavily on brand value.

- Growth depends on managerial success and job switches.

ACCA salaries rise because your technical value rises. MBA salaries rise because your managerial influence grows. Both paths can lead to high income. But ACCA offers a clearer, more stable financial progression in finance roles.

Did you know?

ACCA salaries grow with technical skill and experience, not college brand. This makes career progression more predictable.

ACCA vs MBA: Who Should Choose What?

If you want to run the financial engine, choose ACCA and if you want to run the organisation, choose MBA. If your dream career sits inside finance, ACCA feels less like an option and more like a natural decision. Here’s a short table that helps you understand what you should choose between ACCA vs MBA based on your traits:

| Factor | ACCA | MBA |

| Career in accounting, auditing, taxation, or finance | ✅ | ❌ |

| General business leadership roles | ❌ | ✅ |

| Enjoy structure, logic, and financial problem-solving | ✅ | ❌ |

| International career opportunities | ✅ | ✅ |

| Exposure to multiple business domains | ❌ | ✅ |

| Globally standardised qualification | ✅ | ❌ |

| Targeting consulting, strategy, marketing, or operations | ❌ | ✅ |

| Prefer predictable career growth with strong ROI and lower financial risk | ✅ | ❌ |

| Ready for a high investment and competitive environment | ❌ | ✅ |

| See yourself as a future finance leader or CFO | ✅ | ❌ |

When comparing ACCA vs MBA, the right choice depends on whether you want to specialise deeply in finance and accounting or build a broader career in business and management.

Did you know?

ACCA professionals are hired by Big 4 firms, multinational corporations, global banks, and shared service centres worldwide.

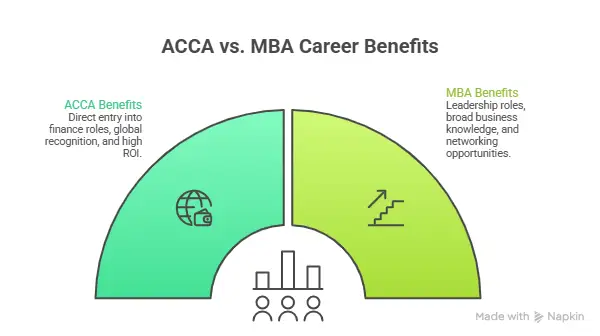

ACCA vs MBA Career Opportunities

ACCA vs MBA career opportunities differ mainly in focus and take you in very different directions.

Career Opportunities After ACCA

One of the most underrated strengths of an ACCA career is how clear the direction is. You don’t finish ACCA and wonder, Now what? You already know where you fit in the financial ecosystem.

ACCA prepares you for roles that every company needs, in every country, in every industry. Once you complete ACCA, you can work in areas like:

- Financial Accounting & Reporting

- Audit & Assurance

- Taxation & Compliance

- Corporate Finance

- Risk Management

- Management Accounting

- Financial Planning & Analysis

- Finance Leadership Roles Over Time

You’re not trained to assist finance teams, but to lead, take control and be the finance team. ACCA moves you deeper into the world of finance, numbers, and financial decision-making and prepares you for specialised ACCA jobs.

Big firms, especially the Big 4 (Deloitte, PwC, EY, KPMG), actively hire ACCA professionals because they trust the qualification’s global standard. Multinational companies, global shared service centres, consulting firms, and financial institutions value ACCA because it ensures technical accuracy and professional ethics. Each of the ACCA papers is designed to build real-world finance and accounting skills, not just exam knowledge.

And there’s something quietly powerful about that. When companies look for ACCA professionals, they are not looking for potential. They are looking for capability. Your career grows from Junior Accountant → Senior Accountant → Finance Manager → Financial Controller → CFO.

Few qualifications offer that kind of clarity, where you benefit from your experience and skills, as if they are compounding.

Career Opportunities After MBA

MBA opens a very different kind of door. Instead of specialising deeply in one function, an MBA exposes you to many:

- Marketing

- Operations

- HR

- Strategy

- Finance

- Consulting

- General Management

After an MBA, common roles include:

- Business Analyst

- Management Consultant

- Marketing Manager

- Operations Manager

- Strategy Associate

- Finance Manager (more managerial, less technical)

MBA careers are broader and more flexible. But they are also less predictable. Two MBA graduates can have completely different outcomes depending on:

- The college they studied in

- The network they built

- Their internship exposure

- Their communication and leadership skills

An MBA doesn’t promise you a specific role. It offers a platform. What you build on it depends heavily on you and your environment. That’s not a weakness. But it’s a different kind of career risk. ACCA gives direction. An MBA gives possibilities.

Also Read: ACCA vs CFA: Which Qualification Fits Your Career Goals Better

ACCA vs MBA: Global Recognition and Mobility

This is where ACCA quietly becomes very powerful. ACCA is not tied to one country’s education system.

It is tied to international finance standards. Companies need people who understand money deeply. People who can read financial statements with confidence, ensure compliance, manage risk, and guide businesses with accuracy. That level of trust doesn’t come from surface knowledge. It comes from technical expertise. That’s what ACCA gives you.

With ACCA, you are trained in:

- IFRS

- Global auditing practices

- International financial reporting

- Universal ethics and governance

That means your skillset travels with you. You don’t have to reprove your worth in a new country. Your qualification already speaks the language global employers understand and value.

ACCA is recognised in over 180 countries. That is not just a number. It’s career freedom. An MBA, on the other hand, is usually region-dependent. An MBA from a top global school travels well, but from an average college, it mostly stays local.

So if international mobility matters to you, ACCA is a passport with strong recognition, and an MBA is a visa that depends on where you got it from. One moves with you. The other stays attached to its brand. And in today’s global job market, that difference is everything.

ACCA Fact:

ACCA builds expertise in financial reporting, audit, tax, ethics, and risk – the backbone of financial decision-making.

ACCA vs MBA: Skills Developed

This is where the personality of each qualification really shows. ACCA builds you from the inside out as a finance professional. It doesn’t just teach you what finance is. It teaches you how finance works in the real world. With ACCA, you develop:

- Deep understanding of financial reporting and accounting standards

- Strong auditing and compliance knowledge

- Tax planning and regulatory expertise

- Risk assessment and internal control skills

- Corporate finance and business analysis capability

- Ethical judgment in financial decision-making

You become someone companies trust with their numbers, reports, and financial integrity. When your ACCA coaching is backed by global standards and real industry exposure, your learning automatically becomes more practical and meaningful.

MBA, on the other hand, builds you as a decision-maker and manager. With an MBA, you develop:

- Leadership and people management skills

- Strategic thinking

- Business communication

- Problem-solving across departments

- Market and operations understanding

- Business planning and execution

You become someone who can run teams, guide strategy, and manage organisations.

So the difference is very natural: ACCA makes you financially powerful. An MBA makes you managerially powerful. Neither is wrong. But if your heart is in finance, accuracy, reporting, analysis, and financial strategy, ACCA gives you sharper tools.

ACCA vs MBA in India: Market Demand & Trends

India’s job market is changing as companies are becoming more global, compliance-driven, and finance-focused. That’s creating a steady demand for professionals who understand international accounting standards and corporate finance deeply. This is where ACCA quietly fits very well.

| Factor | ACCA | MBA |

| Demand in finance & accounting roles | ✅ | ❌ |

| Demand across industries (general roles) | ❌ | ✅ |

| Recognition by Big 4 firms | ✅ | ✅ |

| Global job mobility | ✅ | ❌ |

| Cost vs salary return (ROI) | ✅ | ❌ |

| Technical finance depth | ✅ | ❌ |

| Leadership & general management | ❌ | ✅ |

| Consistency in career outcomes | ✅ | ❌ |

What this shows is simple: India doesn’t just need managers. It needs finance specialists who can operate at global standards.

An MBA will always have demand. But that demand is uneven. It depends on:

- College reputation

- Industry cycles

- Competition levels

ACCA demand is more stable because every company needs:

- Accountants

- Financial compliance

- Accurate finance reporting

- Financial control

That creates long-term relevance. And that’s why, in today’s Indian market, ACCA quietly feels like the safer, sharper, and more career-focused choice for anyone who is serious about finance.

Why Choose Imarticus Learning for ACCA

Choosing ACCA is a big step. But choosing the right place to prepare for it matters just as much. ACCA isn’t easy. It needs discipline, structure, and the right guidance. That’s where Imarticus Learning really helps.

Imarticus doesn’t treat the ACCA program like just another coaching program. It treats it like a career journey. The focus isn’t only on clearing exams, but on preparing you for real roles in finance.

One of the biggest strengths is its industry connection with KPMG. This means what you learn is closely aligned with how global firms actually work. You don’t just study theory; you understand how finance, audits, and compliance function in real companies.

Imarticus is also a Gold Approved Learning Partner of ACCA, which shows that its teaching quality and learning standards are recognised globally, not just locally.

With Kaplan-powered ACCA study material, you get:

- Structured books

- Real exam-style questions

- Mock tests

- Clear performance tracking

So you always know where you stand.

What students appreciate most is the clarity Imarticus brings to the entire ACCA journey. And the support doesn’t end with exams. Imarticus walks with you beyond the classroom. From resume building and interview preparation to placement guidance, everything is designed to help you step into the finance industry with confidence, not confusion.

In simple words, Imarticus gives direction to your ACCA journey. And when it comes to ACCA, having that direction makes all the difference.

FAQs About ACCA vs MBA

Choosing between ACCA and MBA can feel confusing because both are great options. One takes you into finance, the other into business leadership. The right choice isn’t about popularity, it’s about what suits you and the kind of career you want to build. These frequently asked questions will help you clear your doubts.

Is ACCA better than an MBA?

It depends on your career goal and preferences. For finance, accounting, audit, or taxation roles, ACCA is usually the better choice because it is specialised and globally recognised. With structured training and career support from Imarticus Learning, ACCA also becomes a more practical and career-focused path. For general management and leadership roles, an MBA fits better.

Can ACCA replace an MBA?

For finance-focused careers, yes. ACCA often carries more professional value than an MBA because it proves technical competence in finance. Many ACCA professionals move into leadership roles without needing an MBA.

Is ACCA harder than an MBA?

ACCA is more technically demanding. It tests a deep understanding of finance and accounting concepts. MBA is challenging in a different way, focusing more on projects, presentations, teamwork, and decision-making.

Which has better global recognition, ACCA or MBA?

ACCA has stronger global professional recognition, especially in finance and accounting roles. It is accepted in over 180 countries. MBA recognition depends heavily on the reputation of the college you attend.

Can I do ACCA after an MBA?

Yes. Many professionals do ACCA after an MBA to strengthen their technical finance skills and improve career credibility in accounting and finance roles.

Can I do an MBA after ACCA?

Absolutely. ACCA gives you a strong finance foundation that can make you a powerful MBA candidate, especially for finance, strategy, or leadership roles.

Which is more affordable: ACCA or MBA?

ACCA is far more affordable. MBA programs, especially good ones, can be very expensive. ACCA offers a better cost-to-career return for finance professionals.

Which one gives faster career stability?

ACCA usually offers quicker career stability in finance because it leads directly into in-demand roles like accountant, auditor, analyst, and finance executive.

Can ACCA professionals become CFOs?

Yes. Many CFOs globally hold ACCA or similar professional accounting qualifications. ACCA builds the exact financial expertise required for senior leadership roles.

Should I go for MBA or ACCA?

It depends on what kind of career you want. If you are interested in finance, accounting, audit, taxation, and corporate reporting, ACCA is the better choice because it is specialised, globally recognised, and gives you a clear career path. If you are more interested in business leadership, strategy, consulting, or managing teams, then an MBA is more suitable.

ACCA or MBA: which is better for your career?

When you really step back from the comparison of ACCA vs MBA and look at both options, the answer becomes quite simple. ACCA and MBA are not trying to do the same thing. They are meant for different kinds of journeys. An MBA is for people who want a broad view of business and see themselves moving into general management and leadership roles. ACCA is for people who want to build a solid, specialised career in finance. And right now, specialisation has real power.

With ACCA, you’re building skills that travel across industries and countries. You’re building a profile that grows stronger with experience. And you’re doing it without putting your life on pause or taking on massive financial pressure.

An MBA can still be a great option if you love strategy, people management, and business leadership. But if your heart is in finance, numbers, and financial decision-making, ACCA feels more natural. More direct. More honest with who you are.

So the real question is not ACCA vs MBA Which is better? rather it’s Which one fits you better? If you see yourself as a finance professional first, ACCA is the smarter choice. It gives you clarity, confidence, and a career that grows with you.

And if you want to take that step with proper guidance, structure, and industry support, starting your ACCA journey with the right training partner matters. Explore the ACCA course that doesn’t just help you clear exams, but helps you build a real career. Because when your foundation is strong, everything you build on it becomes stronger too.