Last Updated on 3 months ago by Imarticus Learning

If you’re thinking about the CMA exam, chances are you’re not just chasing another certification; rather, you’re aiming for a career that demands sharper financial judgment and real business impact. The CMA isn’t tough because of two papers; it’s tough because it measures whether you can think like a management accountant who can influence decisions, not just report numbers.

People don’t pursue CMA because they want another set of letters after their name – they pursue it because they want to work beyond traditional accounting. Today’s businesses don’t just need number-crunchers; they need professionals who can interpret financial data, guide strategic decisions, and improve business performance across global markets. That’s exactly where the US CMA stands out.

The CMA examination is absolutely clearable – but only if you understand what the exam really tests and how to prepare the right way. That’s exactly why understanding the CMA exam details, requirements, pattern, windows, fees, and a smart prep plan isn’t optional – it’s your edge.

In this guide, I’ll walk you through everything clearly so you know what to expect and how to prepare with purpose, not guesswork.

Did you know? There are only two exams in the CMA course, and you can take them in any order based on what suits your schedule.

Understanding CMA

Students often ask me – What is CMA, and why does it matter so much. I tell them that the CMA certification is a globally recognised qualification offered by the IMA (Institute of Management Accountants, USA).

The US CMA course has become one of the fastest-growing finance qualifications because it blends accounting, analytics, and strategic management. Compared to traditional accounting courses, this course focuses on real business decisions.

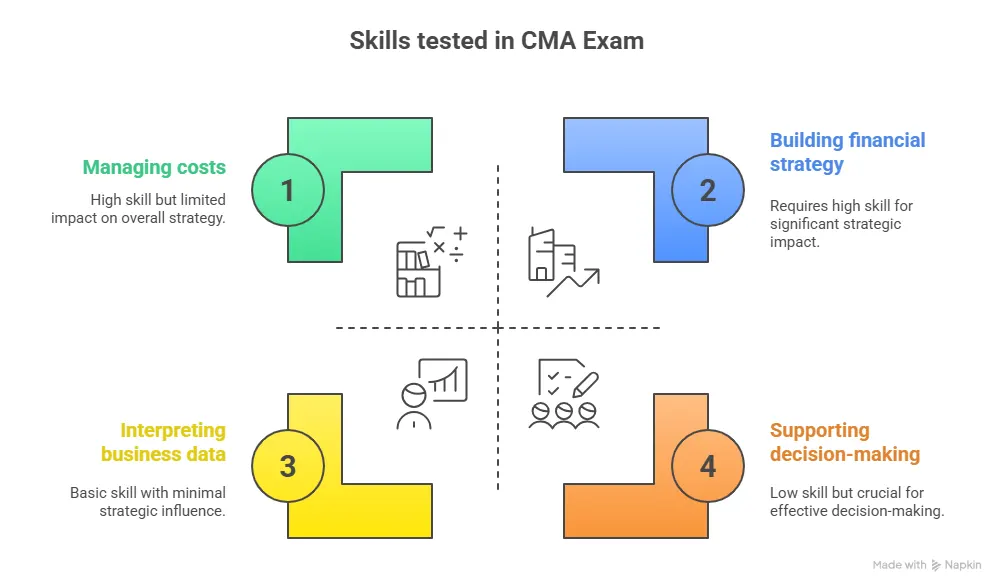

What you learn in the CMA course:

- Cost management

- Variance and profitability analysis

- Risk management

- Corporate finance

- Data-driven decision-making

- Strategic planning

In short, it turns you from someone who reports numbers into someone who drives decisions. And that’s why CMAs are in demand worldwide.

What Is the CMA Exam?

The CMA examination is a two-part professional qualification conducted by the Institute of Management Accountants (IMA). It validates your expertise in:

- Financial planning and analysis

- Cost management

- Internal controls

- Performance management

- Decision analysis for CMAs

- Strategic financial management

Most students underestimate how practical and dynamic the CMA course is. You’re not just preparing for an exam – you’re preparing for scenarios you’ll actually face in FP&A, costing, or business analytics roles.

Globally, recruiters view the CMA Certification Exam as a benchmark for finance professionals seeking to advance into advanced corporate roles.

If you’re questioning whether the CMA is truly worth the time, effort, and investment, this video breaks it down honestly. It looks at career outcomes, real-world value, and who benefits most from the CMA – helping you decide if this certification aligns with your long-term goals.

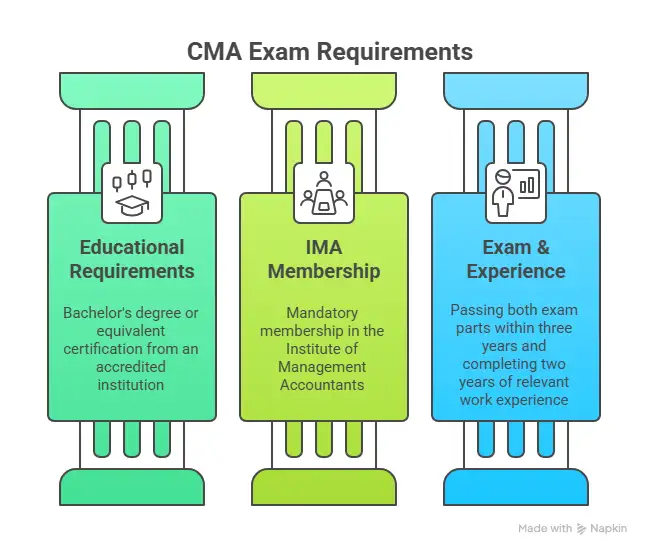

How to Become a CMA

Becoming a CMA is simpler than most aspirants think. Before registering for the CMA US exam, candidates must meet basic criteria for CMA eligibility. Here’s the process:

Meet CMA Eligibility Requirements

- Bachelor’s degree (any discipline) from an accredited institution

- Or an accepted equivalent professional certification

You can even start the CMA before completing your degree, as long as you finish it within 7 years.

Enrol with IMA (Institute of Management Accountants)

Mandatory IMA membership is required for CMA exam registration. Every candidate must register as an IMA member. This gives you:

- Access to resources

- Exam registration

- Student benefits

Join a Good Training Institute

A structured training program helps you master exam concepts and mock-based practice.

Prepare for Two Exams

Part 1: Financial Planning, Performance & Analytics

Part 2: Strategic Financial Management

Gain CMA Exam & Experience Requirements

- Pass both exam parts within three years.

- Get 2 Years of Relevant Work Experience. You need 2 years of work experience in finance or accounting, but you can complete it after passing the exam.

Think of the requirements as flexible – they’re meant to support your journey, not block it.

Maintain IMA Membership

Training institutes like Imarticus offer complete support on preparation, exam processes, and placements.

These are the formal certified management accountant exam requirements, but candidates who start early, even as students, gain a head start.

Did you know? You can start the CMA exam even before completing your graduation, as long as you meet the education requirements within the allowed time.

CMA Exam Fees

Let’s simplify the CMA course fees, because this is something students research endlessly:

CMA Exam Fees Breakdown

For Indian candidates, approximate costs are:

| Fee Type | Amount (Approx.) |

| IMA Membership | ₹16,000 – ₹20,000 |

| CMA Entrance Fee | ₹18,000 – ₹28,000 |

| CMA Exam Fee (per part) | ₹29,000 – ₹38,000 |

CMA exam fees have been standardised by reputed institutions conducting these examinations. A prospective candidate must be mindful of the exam fees being charged by the institution.

There’s no fixed last date for fee payment. You simply have to pay the exam fee before scheduling your test appointment.

Most candidates who struggle with the CMA exam don’t fail due to lack of effort, but because of unstructured preparation. The CMA is demanding, but not unmanageable. This video explains whether CMA is difficult, what the exam truly tests, and how students can prepare strategically to handle this challenging journey with confidence.

CMA Exam Pattern

Understanding the CMA exam pattern is half your battle won, as it clearly helps you design a high-precision study plan. The exam is designed to test applied knowledge – meaning you won’t just memorise theory; you’ll solve practical scenarios just like you would in a real company.

Part 1: Financial Planning, Performance, and Analytics

Part 1 is tougher for most students because it’s heavy on calculations. Topics include:

- Cost management

- Budgeting and forecasting

- Internal controls

- Performance management

- Technology and analytics

Part 2: Strategic Financial Management

Part 2 is more conceptual and strategy-driven. Topics include:

- Corporate finance

- Investment decisions

- Financial statement analysis

- Risk management

- Decision analysis for CMAs

- Professional ethics

The CMA exam model strongly leans toward practical, decision-oriented problem-solving – not theoretical memory work. Both parts test one core skill: Can you apply finance knowledge to real business decisions?

CMA Exam Structure & Format

This is one of the most commonly asked questions. The CMA exam format is globally uniform. There are only two exams in the CMA USA course.

Each exam is:

- 4 hours long

- 3 hours MCQs (100 questions)

- 1-hour essays (2 scenarios)

- You need to score at least 360 out of 500 to pass each part.

The US CMA question paper consistently tests real-world financial judgment rather than rote knowledge. It is designed to test your clarity, logic, and decision-making.

Expect:

- Calculation-heavy MCQs

- Scenario-based essays

- Caselets that combine cost, finance, and analytics.

If you’ve practised enough mocks, the question pattern becomes predictable.

Since there are only two exam parts and flexible exam windows, the CMA course duration is typically between 6 to 9 months for candidates who follow a structured and consistent preparation plan.

CMA Exam Windows: When Can You Write the Exam?

The CMA US exam window follows a predictable cycle that repeats thrice every year:

- January-February

- May-June

- September-October

Candidates can schedule their attempt anytime within these windows through Prometric testing centres. These repeated cycles give you enough flexibility but also demand disciplined planning based on your job, college schedule, or study timeline.

You can take both parts in the same window or separate them – it’s entirely your call.

The CMA course exam details revolve around developing strategic and analytical capability. The US CMA course is shorter than most accounting programs and is designed for working professionals.

Did you know? The CMA exam doesn’t test how much you can memorise – it tests how well you can apply financial thinking to real business decisions.

How to Prepare for the CMA Exam

This is where most students go wrong – they study the CMA like an academic exam. It isn’t.

Start With Concepts, Not Questions – If your fundamentals are weak, the exam will feel unpredictable. Invest the first 4 to 6 weeks in strengthening costing, finance, analytics, and other core concepts.

Follow the CMA Exam Structure When Practising – Build stamina by simulating the real format:

- 100 MCQs in 3 hours

- 2 essays in 1 hour

These conditions prepare your mind for the 3 + 1 hour split.

Prioritise High-Impact Decision-Making Topics – These areas carry heavy weight and appear repeatedly:

- Capital budgeting

- Forecasting

- Working capital

- Variance analysis

- Break-even

- Risk analysis

Use Exam-Aligned, Reliable Resources – Unaligned or outdated material wastes time. Choose training programs that offer updated CMA syllabus coverage, guided learning, and mock exams aligned with the IMA exam pattern.

Follow a 12 to 16 Week Structured Prep Cycle – A proven approach many successful candidates follow:

- 10 weeks of learning

- 2 weeks of revision

- 2 weeks of mock exams

Learn CMA Exam Rules and Guidelines – You need to answer at least 50% of MCQs correctly to unlock the essay section. Essays demand both calculations and clear explanations.

Maintain Exam-Day Discipline

- Start with easier MCQs to build momentum.

- Don’t get stuck on tough questions.

- Use elimination techniques.

- Allocate ~30 minutes per essay scenario.

- Keep the last 20 minutes for review.

- A calm, structured approach scores better than aggressive guesswork.

US CMA Exam Tips

Here is some practical advice from CMA exam trends over the past few years:

- Don’t skip theory – ethics and controls are easy scoring areas.

- Learn to use financial calculators efficiently.

- Build familiarity with US GAAP applications.

- Use mocks to identify weak areas – not to boost confidence artificially.

- Keep your 3-month prep window sacred; consistency beats intensity.

The CMA exam is globally recognised and widely valued in FP&A, costing, corporate finance, and strategy roles. Before you decide on the CMA, this video offers a clear view of what preparation really involves and how the certification fits into long-term finance careers.

CMA Exam: Who Should Take This Certification?

The CMA exam isn’t meant for everyone – and that’s actually its biggest strength.

This certification is designed for people who don’t want to be limited to routine accounting work. It’s for those who want to understand how businesses really function behind the scenes, how decisions are made, and how financial insight turns into real business impact.

When comparing CMA vs CA, the key difference lies in focus – CA is compliance-driven, while CMA is built around management accounting, analytics, and strategic decision-making.

If you see yourself in any of the profiles below, the CMA is likely a very strong fit.

Finance Graduates Looking for Direction

Many finance graduates start their careers feeling unsure about their long-term path. You may understand accounting principles and finance theory, but you’re asking a bigger question:

How do I move into meaningful roles where my analysis actually matters?

The CMA helps bridge that gap. It takes what you learned academically and shows you how it’s used in budgeting, forecasting, investment decisions, and performance evaluation inside real organisations. For graduates who don’t want to remain stuck in entry-level reporting roles, CMA offers a clear, structured growth path.

Accounting Professionals Who Want to Move Beyond Compliance

If you’re already working in accounting, you’ve probably felt this at some point:

You prepare reports, close books, reconcile numbers – but you’re rarely part of strategic conversations.

The CMA changes that. It equips you with the tools to explain what the numbers mean, not just what they are. Many accounting professionals use CMA as a pivot – moving from pure compliance roles into FP&A, costing, internal consulting, COSO framework, and business-facing finance positions.

Working Analysts Ready for the Next Step

Analysts often do the hardest work – building models, analysing trends, and preparing insights – yet may feel invisible in decision-making rooms.

CMA exam strengthens exactly the skills that elevate analysts:

- decision analysis

- performance management

- financial storytelling

- strategic evaluation

It helps analysts transition from “supporting decisions” to influencing decisions, which is what leads to faster career progression and leadership opportunities.

Professionals Targeting FP&A, Costing, or Strategic Finance

If your career goals include:

- FP&A roles

- Cost management

- Business analytics

- Strategic finance

Then CMA is almost tailor-made for you. The range of CMA jobs spans across FP&A, costing, corporate finance, analytics, and leadership-track finance roles in both Indian and global organisations.

The CMA exam mirrors the kind of thinking required in these roles – evaluating alternatives, managing costs, forecasting outcomes, and advising leadership. It’s one of the few finance certifications that consistently aligns with how these roles function in real companies.

Did You Know? Essay questions in the CMA exam test how you think and explain decisions, not just your final answer.

What Roles Does the CMA Actually Lead To?

This is where the CMA certification truly stands apart. The certification doesn’t just add a title to your resume – it changes the kind of roles you’re considered for.

Common Career Outcomes After CMA

CMAs are frequently hired or promoted into roles such as:

- Financial Analyst – analysing performance, budgets, and business trends

- Cost Accountant – managing cost structures and profitability

- FP&A Manager – driving forecasts, budgets, and strategic planning

- Finance Manager – overseeing financial operations and decision support

- Controller – managing financial reporting, controls, and internal processes

- Business Analyst – linking data, finance, and strategy

CMA salary in India reflects strong growth for professionals with experience. CMA is often a stepping stone toward CFO-track leadership roles, where financial judgment, strategic insight, and business understanding matter more than technical accounting alone.

The Bigger Picture

At its core, the CMA isn’t about becoming “more technical.” It’s about becoming more valuable to a business. If you want a career where:

- Your analysis influences decisions.

- Your opinion is heard in leadership discussions.

- Your work shapes business outcomes.

Then the CMA exam isn’t just worth considering – it’s a logical next step.

Is the CMA Exam Worth It?

Absolutely – if you approach it with clarity and discipline. The CMA USA exam is rigorous but fair, testing practical skills across CMA course subjects such as cost management, budgeting and forecasting, financial planning and analysis, corporate finance, risk management, and decision analysis. It rewards professionals who can think strategically, analyse decisions, and guide business performance. With the right preparation model and exam-specific strategy, clearing this credential within 6 to 9 months is achievable.

The CMA isn’t just an exam; it’s a career accelerator that opens doors across India, the UAE, the US, the UK, and Asia. If you want a career in FP&A, costing, strategy, corporate finance, or even business analytics. Then, yes, CMA is one of the smartest investments you can make.

It’s globally recognised, industry-relevant, and laser-focused on decision-making skills that companies desperately need.

Many CMA candidates clear the exam while working full-time, because the syllabus is compact and designed for professionals.

Why Many CMA Aspirants Choose Imarticus

If you speak to people who’ve already attempted the CMA exam, you’ll hear this again and again:

The syllabus isn’t impossible, but the exam can feel unpredictable if your preparation isn’t structured.

That’s where the right guidance starts to matter.

Imarticus doesn’t position the CMA course as just another accounting course. It approaches the CMA exam the way candidates experience it in real life – as a decision-making exam that rewards clarity, application, and calm execution.

Preparation That Matches How the CMA Exam Actually Works

One of the biggest mistakes candidates make is studying too much and practising too little in the right way. At Imarticus, learning is designed around how the CMA exam tests you – not how textbooks explain concepts. Classes focus on:

- understanding why a decision is correct

- recognising patterns in exam questions

- applying concepts across different scenarios

This helps students stop memorising and start thinking the way the exam expects.

A Clear Study Path

CMA preparation can easily feel overwhelming if you’re balancing college, work, or both. What Imarticus provides is clarity – a clear idea of:

- What to study

- When to study it

- How much is “enough”

With a structured study plan, regular checkpoints, and guided revision, students don’t feel lost or unsure about their progress. You always know where you stand.

Faculty Who Explain Concepts Clearly

Good CMA faculty don’t just know the syllabus – they know where students usually get stuck. Imarticus’ trainers focus on breaking down complex topics in a way that feels practical, not academic.

Instead of long explanations, you’ll often hear:

Here’s how the exam looks at this or This is why this option works better in real business situations.

That shift in thinking makes a huge difference.

Mock Exams

Mocks aren’t just about checking your score – they’re about learning how you think under pressure. At Imarticus, mock exams are treated as learning tools.

Through detailed feedback and performance tracking, students start to see:

- Which topics cost them marks?

- where time slips away.

- How small mistakes add up.

That awareness is often what turns a borderline attempt into a confident pass.

Support That Goes Beyond Just Clearing the Exam

For many aspirants, CMA is part of a bigger plan – better roles, better pay, better career direction. Imarticus supports that larger picture by helping students with:

- CMA registration and exam scheduling.

- clarity on exam windows and fees.

- Career guidance once exams are done.

This end-to-end support reduces stress and lets students focus on what actually matters: preparing well.

In Simple Terms, the CMA exam is absolutely clearable. But it’s much easier when:

- Your preparation is structured.

- Your doubts are addressed early.

- Your practice mirrors the real exam.

That’s why many CMA aspirants choose Imarticus – not because it promises shortcuts, but because it provides clarity, consistency, and confidence throughout the journey.

And when the exam day arrives, that confidence matters more than anything else.

The CMA exam gives you three exam windows every year, making it one of the most flexible global finance certifications.

FAQs About the CMA Exam

If you’re considering the CMA exam, it’s natural to have questions. Below are answers to some of the most frequently asked questions that students ask before they begin.

What is the CMA exam form and the last date for registration?

The CMA exam form is completed online through the IMA portal after becoming an IMA member.

There is no fixed exam form last date. However, you must:

- Pay the exam fee.

- Register for the exam.

- Schedule your test appointment before the exam window closes.

Early registration is recommended to secure preferred exam slots.

What are the CMA exam fees and total cost in India?

The CMA exam fees typically include:

- IMA membership fee

- CMA entrance fee

- CMA exam fee (per part)

For Indian candidates, the total CMA cost usually ranges between ₹1.2 to 1.5 lakhs, depending on student or professional membership and the number of exam parts attempted.

Can I really pass the CMA exam on my first attempt?

Yes, many candidates do clear the CMA exam on their first attempt. The key difference is preparation style. Those who focus on understanding concepts, practise exam-style questions, and give enough time to revision and mock exams tend to perform much better than those who rely only on question banks.

Is the CMA exam very difficult? Is CMA tougher than CA?

The CMA exam is challenging, but in a different way.

CA focuses heavily on statutory law, taxation, and compliance.

CMA focuses on analytics, business decisions, and financial strategy.

Many candidates find CMA more manageable because:

- It has only two exams.

- The syllabus is application-based.

- There is no article-ship requirement.

With structured preparation, many students clear the CMA on their first attempt.

How many hours are required to pass the CMA exam?

On average, candidates spend 150-170 hours per exam part, which is 300-350 hours total.

The actual number of hours required depends on your background in accounting or finance. Candidates studying with structured programs, such as those offered by Imarticus Learning, often find it easier to stay consistent and exam-ready within this time frame.

Is the CMA exam more practical or theoretical?

The CMA exam is far more practical than theoretical. While you do need to understand concepts, the exam mainly tests how you apply them in real business situations – through scenarios, case-based questions, and decision-making problems.

Do I need a strong accounting background to clear the CMA exam?

A basic understanding of accounting helps, but you don’t need to be an expert before you start. Many candidates come from finance, commerce, or even non-accounting backgrounds. The CMA syllabus is structured in a way that builds concepts gradually, especially if you follow a guided preparation approach.

Is the CMA exam something I can manage alongside a job or college?

Yes, many candidates prepare for CMA while working full-time or studying in college. The CMA exam is designed with working professionals in mind, which is why it has flexible exam windows and a relatively compact syllabus. What matters most isn’t the number of hours you study each day, but having a realistic plan you can stick to consistently.

Take the CMA Exam With Confidence

If you’ve made it this far, you’re probably not just exploring the CMA exam out of curiosity. You’re thinking about where your finance career is headed – and whether this qualification fits into that bigger picture.

That’s exactly how CMA should be approached.

The CMA isn’t something you should rush into, and it isn’t something you should attempt blindly. It works best when you understand what it demands, how it fits into your current commitments, and what kind of preparation will actually help you stay consistent over time. When that clarity is in place, the journey feels far more manageable.

You don’t need to have every detail planned from day one. What helps is a realistic study plan, steady progress, and guidance that keeps you from constantly second-guessing your approach.

If you’re considering the CMA course and want to understand what preparation could look like for you – based on your background, schedule, and career goals – it may help to speak with someone who has guided many candidates through the same decisions.

The CMA exam is demanding – but approached the right way, it can be a very rewarding step forward in your career.