Last Updated on 3 weeks ago by Imarticus Learning

CFA Jobs are not just roles on a job board. I’d rather call them decisions that shape how money moves across markets, how risks are managed, and how wealth is built over time. When you open a financial news app and see markets rise or fall, there are people behind those moves who read the signals early. Many of them are in CFA jobs.

Ask yourself a simple question. When you look at a company’s annual report, do you only see numbers or do you try to understand what those numbers mean for the future? That difference in thinking is what shapes CFA job roles.

Another question that many students have is about starting. Can you get work after clearing Level 1? The short answer is yes. Many entry roles begin with CFA Level 1 jobs and grow from there. These are the building blocks of jobs after CFA certification, and they help you move from theory to practice.

At its core, this path suits people who enjoy clarity in thinking. Over time, these habits build strong careers and open better CFA job opportunities. If you like solving problems, working with data, and making decisions that have real outcomes, this field gives you that space. This guide walks through CFA job opportunities, roles, and pay. It also covers jobs after CFA at each level and what to expect in India and abroad. The aim is simple. Make each path easy to see and easy to plan.

Did you know?

Globally, over 200,000 charterholders hold the CFA credential in 170 countries, with India rapidly becoming a powerhouse, ranking 3rd in CFA exam enrolment worldwide. (Source: Glassdoor)

Understanding the Foundation of the CFA Charter

Before we dive deeper into the ecosystem of CFA jobs in India, let’s unpack: what is CFA? and why it commands such reverence among investors, corporates, and regulators worldwide.

Put simply, the CFA is the gold standard for finance professionals committed to investment management, risk assessment, portfolio construction, and financial analysis. The CFA Institute tests your mastery over everything from quantitative analysis and asset valuation to ethics, portfolio strategy, and understanding how global markets move.

For those who earn it, career doors open to various coveted industry segments like

- Private Equity

- Asset Management

- Banking

- Consulting

- Wealth Management, etc.

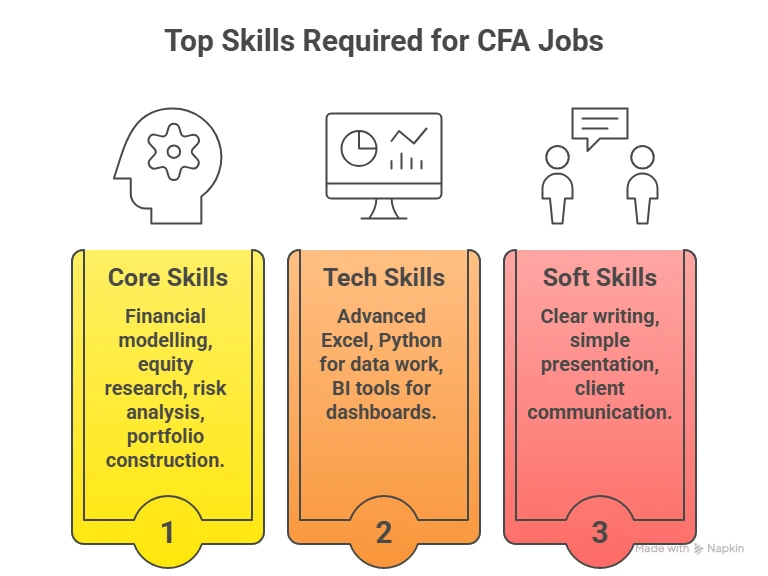

What You Learn in CFA

The CFA curriculum builds your thinking step by step. It trains you to move from theory to real decision-making.

Core subjects include:

- Financial analysis and reporting

- Equity and fixed income valuation

- Portfolio management and asset allocation

- Risk management and derivatives

- Ethics and professional standards

These are the core skills that define most CFA job roles and shape your CFA job profile in firms.

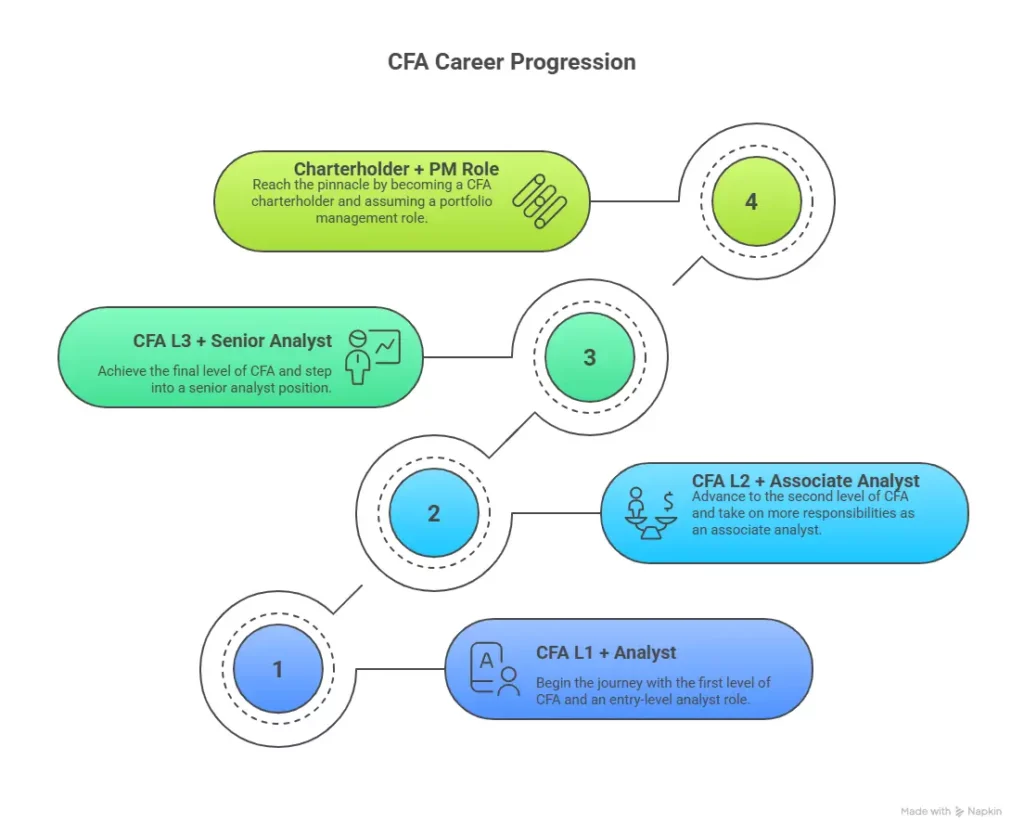

CFA Levels and What They Mean for Jobs

Each level changes the type of work you can do. This is how the journey maps to real roles across various CFA levels.

| CFA Level | What You Learn | Typical Job Entry |

| Level 1 | Basics of finance and markets | Entry CFA Level 1 jobs, like research or analyst support |

| Level 2 | Deep valuation and analysis | Core analyst roles and CFA Level 2 jobs |

| Level 3 | Portfolio and wealth strategy | Senior roles and CFA Level 3 jobs |

This is why many students ask, “Can I get a job with CFA Level 1?” The answer is yes, and each level further improves your CFA job opportunities. Jenny Johnson, the President and CEO of Franklin Templeton, encapsulated it best:

“You can hire people with an MBA, but you don’t necessarily know that one MBA is the same as another MBA. If you hire investment professionals with a CFA designation, you absolutely have confidence at the level of qualification.”

A career in finance often rewards those who can think clearly, act responsibly, and make decisions that stand the test of time. The CFA path supports this kind of growth by building strong analytical skills and ethical judgment.

CFA Job Roles and Salaries

CFA job roles span many functions. You can study firms, build portfolios, test risk, or guide clients. Each CFA job role adds value to the system. Common CFA job titles and a short CFA job description for each are below:

- Financial Analyst: Studies data and builds valuation models

- Equity Research Analyst: Tracks sectors and writes investment notes

- Portfolio Manager: Allocates funds and manages risk

- Risk Consultant: Tests exposure and designs controls

- Investment Banker: Works on deals and capital raises

These are core CFA analyst jobs and advanced paths as you grow. The CFA job profile changes with each level. Your CFA job requirements expand with skill and experience.

Jobs after CFA Level 1

Picture yourself as an analyst at a global bank, and your CFA Level 1 is the keycard. Many CFA Level 1 jobs in India are entry roles in banks, rating firms, and consulting. Typical CFA Level 1 jobs include:

| Job Title | Avg Annual Salary | Typical Recruiters |

| Research Associate | ₹4 – 7.5 LPA | CRISIL, ICRA, HDFC AMC |

| Junior Analyst | ₹4.5 – 8 LPA | EY, Deloitte, Axis Bank |

| Risk Consultant | ₹4 – 6 LPA | KPMG, Genpact |

Jobs after CFA Level 2

This is where you’re trusted with deeper analytical responsibilities. You move into equity analysis, valuation, and credit. Typical CFA Level 2 jobs and CFA Level 2 jobs in India include:

| Job Title | Avg Annual Salary | Recruitment Focus |

| Equity Analyst | ₹8 – 14 LPA | Banks, Asset Management Firms |

| Credit Analyst | ₹7 – 13 LPA | Rating Agencies, NBFCs |

| Financial Consultant | ₹8 – 14 LPA | Consulting Giants |

City-wise CFA Level 2 Jobs Salary in India

The CFA Level 2 jobs salary in India ranges from ₹7-14 LPA for analysts and higher for niche roles. A quick view of city pay bands helps:

| City | Entry Range | Mid Level |

| Mumbai | ₹5 – 8 LPA | ₹12 – 25 LPA |

| Bangalore | ₹5 – 9 LPA | ₹12 – 22 LPA |

| Delhi NCR | ₹5 – 8 LPA | ₹10 – 20 LPA |

| Hyderabad | ₹4 – 7 LPA | ₹9 – 18 LPA |

These ranges reflect typical CFA jobs’ salaries across metros.

Jobs after CFA Level 3

Now, if Level 1 and 2 were your auditions, CFA Level 3 is your centre stage act- this level leads to leadership tracks. These are common CFA Level 3 jobs and jobs for CFA Level 3 candidates:

| Job Title | Avg Annual Salary | Who Hires |

| Portfolio Manager | ₹12 – 37 LPA | Blackrock, Aditya Birla Capital |

| Investment Banker | ₹15 – 48 LPA | Goldman Sachs, JP Morgan |

| Senior Analyst | ₹11 – 24 LPA | UBS, Fidelity, Motilal Oswal |

CFA Level 3 holders with 6-10 years’ experience routinely cross ₹35-50 LPA; the top 1% even breach the ₹1 crore threshold.

Did you know?

CFA Level 2 alumni command a 30% higher salary hike than industry peers from other backgrounds.

(Source: 300Hours)

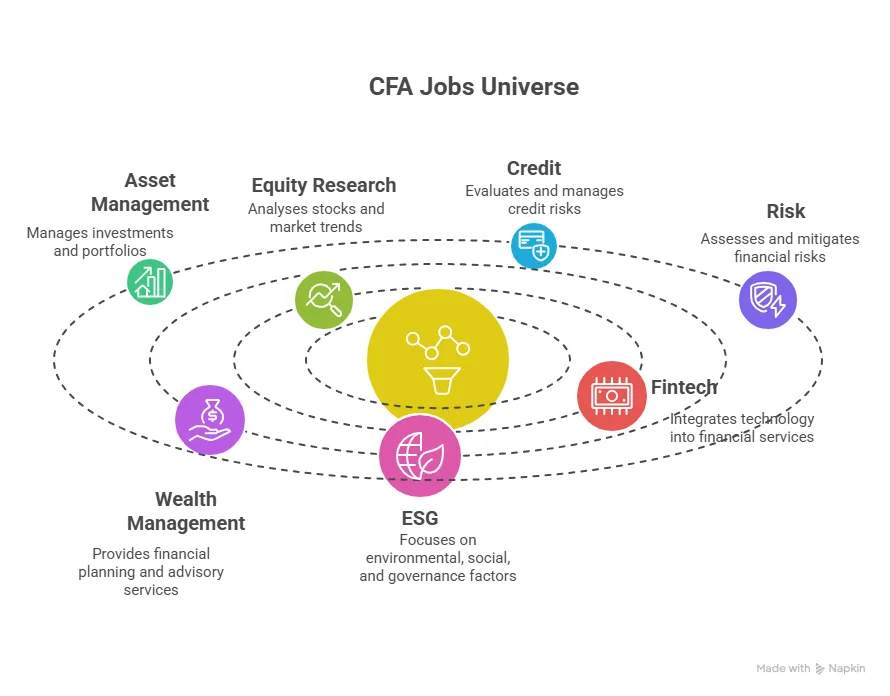

CFA Jobs in Different Sectors

When I talk to candidates about CFA jobs, I often tell them that their charter doesn’t lock them into one lane; it opens several highways. Some take the analytical road to become equity research analysts, others steer toward portfolio management, and a growing number venture into fintech or ESG investing.

In this section, let’s map CFA salary and how the CFA fits into different industries, and what kind of growth stories are unfolding within each.

| Sector | Role Overview | Typical Salary | Top Employers |

| Investment Banking | Guide IPOs, M&As, fundraising, and strategic advisory. These are high-impact CFA job roles with strong decision-making exposure. | ₹12 – 48 LPA | Goldman Sachs, Citi, Morgan Stanley |

| Asset & Wealth Management | Manage large portfolios including mutual funds, pension assets, and sovereign funds. Performance directly shapes investor wealth. | ₹10 – 35 LPA (Senior PMs ₹40LPA+) | HDFC AMC, BlackRock, Fidelity |

| Fintech & Alternative Investments | Work in fintech and startup ecosystems, analysing risk and building investment strategies. Expanding scope of CFA jobs in India and global markets. | ₹12 – 30 LPA | Upstox, Zerodha, Pine Labs |

| Consulting & Risk Management | Focus on valuation, due diligence, and risk audits. Strong analytical thinking and advisory expertise required. | ₹10 – 30 LPA | BCG, Bain, KPMG |

Top Recruiters for CFA Jobs

Charterholders can work seamlessly from London to New York, from Singapore to Dubai. Here are some companies offering strong CFA job roles across banking, asset management, and consulting. And almost all of them are industry titans!

- Investment Banks: Goldman Sachs, JP Morgan, Morgan Stanley, Barclays

- Asset Management: BlackRock, HDFC AMC, Fidelity, State Street, Axis MF

- Consulting: McKinsey, Bain, BCG

- Credit Rating: CRISIL, ICRA, Moody’s, S&P

- Private Equity and Hedge Funds: KKR, Temasek, Sequoia, Citadel

Recruiters look for ethics and strong analysis. The charter signals both. It helps you get calls for CFA job vacancies across teams.

Also Read: Turn Big Data Skills Into High-Impact CFA Roles in Finance

Role-wise Pay and Growth

If you’re exploring CFA Jobs, one of the first questions on your mind is probably: “What can I realistically earn?” along with how different CFA job roles influence your pay and growth. This table breaks down salaries across key roles in CFA Jobs, helping you understand not just what each position pays, but the value each role contributes to organisations and markets:

| Job Role | Entry-Level Salary | Senior-Level Salary | Typical Employers |

| Financial Analyst | ₹5 – 8 LPA | ₹11 – 19 LPA | Asset Management Firms, Banks |

| Portfolio Manager | ₹12 – 20 LPA | ₹25 – 50 LPA+ | Mutual Funds, Hedge Funds, Pension Funds |

| Investment Banker | ₹14 – 25 LPA | ₹35 – 48 LPA+ | Investment Banks, MNCs |

| Risk Consultant | ₹6 – 10 LPA | ₹12 – 16 LPA | Consulting Firms, Banks, Corporations |

Also Read: How to Become a CFA Charterholder with a Clear Step-by-Step Roadmap

CFA Jobs vs Jobs By Other Finance Certifications

When it comes to building a career in finance, the choices can be overwhelming – MBA, CA, CPA, FRM, or CFA. I often get asked by students and professionals, “Which one gives me the edge?” From my years mentoring candidates, here’s what I tell them: each credential has its own strengths, but the CFA stands out for its global recognition, investment-focused rigour, and ethical grounding. This is why it leads to strong and diverse CFA job opportunities across markets.

| Differentiator / Feature | CFA | MBA | CA | CPA | FRM |

| Global Recognition | ✅ | ✅ | ❌ | ❌ | ✅ |

| Finance Focused | ✅ | ✅ | ❌ | ✅ | ✅ |

| Accounting Focused | ❌ | ❌ | ✅ | ✅ | ❌ |

| Quantitative Skills Required | ✅ | ✅ | ✅ | ✅ | ✅ |

| Strategic/Leadership Skills | ❌ | ✅ | ❌ | ❌ | ❌ |

| Exam Difficulty Level | ✅ | ❌ | ✅ | ✅ | ✅ |

| Job Opportunities in Investment Banking | ✅ | ✅ | ❌ | ❌ | ✅ |

| Job Opportunities in Corporate Finance | ✅ | ✅ | ✅ | ✅ | ✅ |

| Job Opportunities in Risk Management | ❌ | ❌ | ❌ | ❌ | ✅ |

| Global Mobility | ✅ | ✅ | ❌ | ❌ | ✅ |

Here is a video that breaks down the differences between CFA and MBA. It explores what each qualification offers, CFA career prospects, CFA salary potential, and which one is better suited to your aspirations.

CFA Job Opportunities in India

India offers a wide spread of CFA job opportunities across metros and growing hubs. The mix includes banks, asset managers, fintech firms, and consulting houses. A clear view of cities helps you plan where to start and how to grow in CFA jobs in India.

CFA Jobs in Mumbai

Mumbai is the main hub for markets. You will see roles in trading, asset management, and research. Many CFA jobs in Mumbai sit close to the action in capital markets. Pay ranges are strong due to deal flow and fund size, and the learning curve is steep from day one.

For those starting, there is a clear entry path:

- CFA fresher jobs in Mumbai are commonly found in research support, data analysis, and junior risk roles across brokerages and AMCs.

- CFA Level 1 jobs in Mumbai include analyst trainee positions in investment banks, credit rating firms, and portfolio support teams.

- CFA Level 1 fresher jobs in Mumbai often begin with valuation work, market tracking, and building basic financial models.

CFA Jobs in Delhi

Delhi and NCR host large banks, consulting firms, and corporate headquarters. Many CFA jobs in Delhi focus on corporate finance, credit analysis, and advisory mandates where decision-making and client interaction go hand in hand. For those entering the field, there are clear starting points:

- CFA level 1 jobs in Delhi are available in credit rating agencies, consulting firms, and bank advisory teams.

- Entry roles often include financial analysis, due diligence support, and building credit models.

- The CFA job scope in Delhi NCR spans investment banking, risk consulting, and corporate finance roles.

- Many firms here hire regularly, improving overall CFA job prospects in India for candidates targeting advisory and consulting pathways.

This mix of corporate exposure and consulting work makes Delhi a strong base for candidates who want strategic and client-facing CFA careers.

CFA Jobs in Chennai

CFA jobs in Chennai span asset servicing, fund accounting, and reporting for global funds. The city has a strong base of shared service centres and global asset managers, which creates steady demand for finance professionals with strong process and analysis skills. For candidates at the start of their journey, Chennai offers clear entry routes:

- CFA level 1 jobs in Chennai are common in fund accounting, reconciliation, and portfolio reporting teams.

- Entry roles include valuation support, fund accounting and NAV calculations, and performance analysis for global portfolios.

- Many CFA fresher jobs in India are concentrated in Chennai’s global service centres and fund administration firms.

CFA Jobs in Hyderabad

Hyderabad has a strong tech and analytics base, which makes it a growing hub for finance roles. For candidates starting, there are clear entry pathways:

- CFA jobs in India for freshers in Hyderabad include roles in financial analysis, reporting, and risk analytics within MNC service centres.

- Freshers often begin with data-driven roles such as valuation support, portfolio analytics, and performance reporting.

- Strong demand from fintech startups and analytics firms that need finance professionals who understand data.

Other Best Cities for CFA jobs

The best cities for CFA jobs in India are Mumbai, Bangalore, Delhi NCR, and Hyderabad. Alongside these hubs, several other cities also offer strong opportunities depending on your preferred role, industry, and growth path.

Here’s how some of the key locations compare:

- CFA jobs in Gurgaon: Gurgaon hosts many global banks, consulting firms, and global capability centres. Roles here focus on advisory, risk consulting, and corporate finance with strong client exposure.

- CFA jobs in Pune: Pune has a large base of MNC back offices and analytics centres. Many roles involve financial modelling, valuation support, and portfolio reporting for global clients.

- CFA jobs in Kolkata: Kolkata offers growing opportunities in broking houses, NBFCs, and regional research firms. Roles often focus on equity research, credit analysis, and trading support.

- CFA jobs in Bangalore: Bangalore blends finance with technology. Many roles sit at the intersection of fintech, analytics, and risk, making it a strong choice for candidates who want tech-driven finance careers.

- CFA jobs in Ahmedabad: Ahmedabad has a strong base of financial institutions, broking firms, and NBFCs. Roles here include credit analysis, portfolio management support, and SME lending analytics.

Each of these cities offers a different mix of exposure, pace, and specialisation. Choosing the right location can shape your early learning, the kind of deals or portfolios you handle, and how quickly you grow into higher responsibility roles.

Also Read: 5 Must-know Things About CFA

CFA Job Opportunities Abroad

Global markets open doors for CFA jobs abroad in North America, Europe, and Asia. The charter is recognised across regions.

CFA Job Opportunities in USA

There are many CFA job opportunities in USA across buy-side and sell-side firms, with strong demand in asset management, investment banking, and research teams. The US market offers depth, scale, and exposure to global capital flows, making it one of the most sought-after destinations for finance professionals.

For candidates at different stages, the opportunities vary:

- CFA fresher jobs in USA are often available through internships, trainee analyst roles, and research support positions in banks and asset management firms.

- CFA level 2 jobs in USA include equity research analyst, credit analyst, and risk specialist roles in large financial institutions.

- CFA jobs in NYC are among the most competitive and high-paying, with Wall Street firms offering roles in investment banking, hedge funds, and asset management.

- Other cities like Chicago, Boston, and San Francisco also offer strong opportunities across trading, quant, and portfolio management. Chicago hosts large asset managers. CFA jobs in Chicago include portfolio and risk roles.

The US continues to offer one of the widest and most rewarding ecosystems for building long-term CFA careers.

CFA Jobs in Dubai

CFA jobs in Dubai focus on private wealth, family offices, and regional investment funds. The city acts as a gateway to Middle East capital markets, with strong demand for professionals who can manage portfolios, structure investments, and advise high-net-worth (HNI) clients. For those starting, there are clear entry pathways:

- CFA fresher jobs in Dubai are available in junior research, portfolio support, and client servicing roles within private banks and family offices.

- Entry roles often include performance tracking, market research, and assisting senior advisors with client portfolios.

- Exposure to international clients and global asset classes builds strong early career experience.

CFA Jobs in Singapore

CFA jobs in Singapore cover funds, trading desks, and wealth management, with the city acting as a major gateway to Asia’s capital markets. Many global asset managers and private banks operate here. There is a steady range of opportunities for candidates at different stages:

- CFA level 1 jobs in Singapore are commonly found in fund operations, research support, and portfolio analytics teams within global banks and asset managers.

- CFA fresher jobs in Singapore are available in junior analyst, data analysis, and client reporting roles across wealth management and fund administration firms.

- Freshers gain exposure to international portfolios, cross-border investments, and multi-asset strategies from early in their careers.

As you gain experience, roles expand into portfolio management, trading strategy, and private wealth advisory. This mix of global exposure, strong financial infrastructure, and access to Asian markets makes Singapore one of the most attractive destinations for long-term CFA careers.

Other Sought-after Countries for CFA Jobs

Beyond the major global hubs, several other regions also offer strong and specialised CFA career opportunities. Each location has its own focus areas and industry strengths.

- CFA jobs in Australia: Sydney and Melbourne are key financial centres. Roles focus on wealth management, superannuation funds, and asset management for both retail and institutional clients.

- CFA jobs in Germany: Frankfurt is Europe’s banking hub. Roles here focus on credit risk, regulatory analysis, and corporate finance within major banks.

- CFA jobs Hong Kong: Hong Kong acts as a gateway to Asian capital markets. Opportunities include trading, equity research, and hedge fund roles.

- CFA jobs in Canada: Canada offers strong demand in pension funds, insurance asset management, and institutional investing, with clear entry pathways through CFA Level 1 jobs in Canada, making it a stable long-term market for CFA professionals.

Global Salary Comparison for CFA Jobs:

A quick snapshot of how CFA Jobs are valued across major global markets, highlighting how role, region, and experience shape earning potential.

| Role | India | USA | Singapore |

| Analyst | ₹6 – 12 LPA | $70k – 110k | SGD 60k – 95k |

| Portfolio Manager | ₹20 – 50 LPA | $100k – 180k | SGD 120k – 220k |

| Credit Analyst | ₹7 – 14 LPA | $75k – 120k | SGD 70k – 110k |

| Risk Manager | ₹10 – 22 LPA | $95k – 150k | SGD 110k – 170k |

| Investment Banker | ₹15 – 40 LPA | $110k – 190k | SGD 130k – 220k |

Also Read: Top Roles You Can Land with a CFA Certification

Why Imarticus Learning Stands Out for CFA Preparation

Preparing for the CFA exams is not only about clearing three levels. It is about building real skills that translate into strong CFA Jobs and long-term growth in finance. The right learning partner helps you move from concepts to application and career outcomes. This is where Imarticus Learning brings a structured, industry-aligned approach to CFA Course preparation.

Key Features of Imarticus Learning’s CFA Program prep:

- Industry-Led Training with KPMG in India Collaboration: The program is delivered in collaboration with KPMG in India, ensuring exposure to real-world finance use cases and industry-aligned learning.

- CFA Institute Approved Prep Provider: Imarticus Learning is a recognised CFA Institute Prep Provider, which ensures the curriculum is aligned with the official syllabus and updated regularly.

- Kaplan Schweser Study Material Access: Learners receive trusted Kaplan Schweser study resources, which are widely used by global CFA candidates for structured preparation.

- Mock Tests and Exam-Focused Practice: Practice tests and exam simulation tools help candidates assess readiness and improve performance before the actual CFA exams.

- Flexible Learning with Classroom and Centre-Based Options: The program offers in-person sessions and centre-based learning, allowing candidates to choose a format that suits their schedule.

- Affordable Fee Structure with EMI Options: Flexible payment plans and a level-wise fee structure make it easier to manage costs across the CFA journey.

FAQs About CFA Jobs

When you explore finance careers, questions around roles, salaries, and growth often come up at every stage of the journey. This quick guide answers the most frequently asked questions about CFA Jobs so you can make informed decisions with clarity and confidence.

What kind of jobs does a CFA get?

A CFA can move into research, asset management, risk, consulting, and banking. Most people begin with analyst work and then move to portfolio or advisory roles as they gain experience. These CFA Jobs include equity research, credit analysis, portfolio management, and investment banking. Many learners also prepare with Imarticus Learning to add practical projects and improve their profile before they apply.

Can CFA get a job in RBI?

Yes. The Reserve Bank of India hires for research, supervision, and risk roles. A CFA can apply through exams and specialist hiring tracks. These CFA Jobs in RBI value strong analysis, ethics, and macro understanding. Courses and case studies from Imarticus Learning can help you show applied skills in interviews.

Who earns more CFA or a CA?

Pay depends on the role and industry. In investment roles and asset management, a CFA can earn more at mid and senior levels. In audit and compliance tracks, a CA may earn more early on. Over time, both paths can reach strong pay bands. For CFA Jobs, the upside comes from portfolio size, performance bonus, and client mandates. Many professionals also combine CA and CFA that span finance and compliance.

How much does a CFA earn per month?

Monthly pay varies by city, role, and level. Entry analysts may earn ₹40,000 to ₹80,000 per month. Mid-level roles can reach ₹1.2 to 2.5 lakh per month. Senior roles can cross ₹4 lakh per month plus bonus. A structured learning path with Imarticus Learning can help you reach higher bands faster by adding modelling and research projects.

What is the CFA Level 1 salary?

Level 1 roles are entry roles in research, risk, and operations. Typical pay ranges from ₹4 to ₹8 LPA depending on city and firm. These CFA Jobs include research associate, junior analyst, and risk support. Imarticus Learning offers guided projects that help you present real work to recruiters.

Which is more valuable, CFA or MBA?

The CFA is deep in investment and markets. An MBA is broad in management and strategy. For market roles and asset management, the CFA has a strong edge. For consulting and leadership tracks, an MBA helps. Many firms hire both for CFA Jobs in investment teams and for MBA roles in strategy. Some candidates even combine both over time.

What are normal job packages after CFA Level 3?

After Level 3 and a few years of experience, packages move up to ₹20 to ₹50 LPA and higher in top firms. Roles include portfolio manager, senior analyst, and investment banker. These CFA Jobs also include bonuses linked to fund performance and deal value. If you work on large portfolios or deals, total pay can rise fast.

Is CFA a good choice for a career? How much time does it take to clear the CFA?

Yes. The CFA is a strong path for anyone who enjoys markets, data, and long-term thinking. Most people clear all three levels in two to four years with steady study and work experience. These CFA Jobs reward patience, ethics, and clear analysis. With a clear plan and guided prep from Imarticus Learning, many candidates manage both study and work with ease.

Plan Your Roadmap for CFA Jobs Now

CFA Jobs open doors to a wide and meaningful career path. You now have a clear picture of roles, salary bands, cities, and global options. You also know how Level 1, Level 2, and Level 3 change your scope and pay. The path is simple to see. Learn the concepts. Build proof of work. Apply with focus. Grow with each role and explore more CFA job opportunities as you progress.

If you keep your steps small and steady, your profile will become strong. Over time, your work can grow into portfolio and advisory roles. This is how many people build strong CFA jobs in India and abroad, starting from CFA Level 1 jobs and moving toward senior roles.

It also helps to learn with guidance. A program that adds projects, mock interviews, and placement support can speed up your start. The CFA Program prep with Imarticus Learning is one such path. It can help you turn study into real work samples and move closer to the roles you want, at your own pace and comfort, while preparing you for CFA job vacancies and improving your CFA job profile.

Stay consistent. Keep your work simple and clear. Let your ideas show through your models and notes. With time, your effort compounds and your options expand.