So, you just finished your BCom and now you’re wondering, “What’s next?” If you’re aiming for high-paying investment banking jobs for freshers, you’re in the right place. The investment banking world is competitive, but the good news? You don’t need an MBA or CFA to break in. Many successful bankers started right after BCom!

But here’s the catch, the industry wants practical skills and real-world knowledge. That’s why a structured learning path can make all the difference. If you’re serious about making it, check out these investment banking courses to fast-track your journey.

Now, let’s get into the step-by-step guide on how you can land your first investment banking job after BCom.

Jobs After BCom: Why Investment Banking?

A BCom degree gives you a solid base in finance, but to land a high-paying job, you need specialised skills. Here’s why investment banking should be on your radar:

- Great Salary: Starting salaries are among the highest in the finance industry.

- Fast Career Growth: You can move up the ladder quickly with the right skills.

- Global Opportunities: Investment banks operate worldwide, so you have a chance to work abroad.

- Prestige: It’s one of the most respected career paths in finance.

Career Options After BCom

| Career Path | Role |

| Investment Banking | This involves assisting companies and governments in raising capital, mergers and acquisitions, and providing financial advisory services. |

| Financial Analyst | This role entails analysing financial data, creating financial models, and providing insights to support investment decisions. |

| Accounting | Accountants are responsible for maintaining financial records, preparing financial statements, and ensuring compliance with accounting regulations. |

| Tax Consultant | These professionals provide advice on tax laws, assist with tax planning, and ensure compliance with tax regulations. |

| Risk Management | This includes identifying, assessing, and mitigating financial risks for organisations. |

Clearly, investment banking pays the best among these options. But how do you get in? Keep reading.

How to Land an Investment Banking Job as a Fresher

1. Learn the Core Skills

Investment banking isn’t about textbook finance. You need to master:

- Financial Modeling: Building financial models in Excel.

- Valuation Techniques: DCF, Comps, and Precedent Transactions.

- M&A and IPOs: How companies raise capital and merge.

- Excel & PowerPoint: You’ll use these tools daily.

- Communication Skills: Pitching deals and networking.

Pro Tip: Start learning these now. Free resources on Investopedia and Corporate Finance Institute are great for getting jobs After BCom.

2. Take a Specialised Course

Self-learning is great, but structured programs get you job-ready faster. Top recruiters look for certifications that prove your expertise.

Consider enrolling in the Certified Investment Banking Operations Program to gain hands-on skills and placement support.

3. Build a Strong Resume

Your resume should highlight:

- Technical Skills (Financial modelling, valuation, Excel, etc.)

- Internships/Projects (Even unpaid internships count!)

- Certifications (CFA Level 1, NISM, investment banking courses)

- Soft Skills (Communication, analytical thinking)

4. Get an Internship

Most investment banks hire freshers from their internship pools. Apply to:

- Goldman Sachs

- JP Morgan

- Morgan Stanley

- Big 4 Firms (Deloitte, EY, KPMG, PwC)

- Boutique Investment Banks

Check LinkedIn Jobs and Naukri.com for openings.

Investment Banking Jobs: Where to Apply?

Here are some common investment banking jobs for freshers:

| Job Role | Description |

| Analyst | Handles financial models & reports |

| Associate | Manages client deals & transactions |

| Risk Analyst | Assesses financial risks |

| Equity Research Analyst | Analyses stocks & investments |

| M&A Analyst | Works on mergers & acquisitions |

Best Resources to Prepare

Free Learning Platforms

- Investopedia: Finance concepts & definitions.

- Wall Street Mojo: Financial modeling tutorials.

- Coursera: Free finance courses.

Must-Watch YouTube Videos

Imarticus Learning – Investment Banking Overview

How to Become an Investment Banker?

Common Mistakes Freshers Make When Applying

Many freshers struggle to land investment banking jobs for freshers because they overlook small but important details. Here are some common mistakes and how to avoid them:

- Generic Resumes: If your resume looks like everyone else’s, recruiters won’t notice you. Customise it for investment banking roles.

- Lack of Technical Skills: Knowing finance theories isn’t enough. You need to prove your skills in financial modelling, valuation, and Excel.

- Ignoring Networking: Many jobs aren’t even posted online. Connect with professionals on LinkedIn and attend finance events.

- Poor Interview Prep: Investment banking interviews test both technical and behavioural skills. Practice case studies and mock interviews beforehand.

- Applying Without Internships: Even a short internship at a small firm can set you apart from other freshers.

Top Investment Banks Hiring Freshers

If you’re looking for investment banking jobs for freshers, here are some of the top firms that hire BCom graduates:

Bulge Bracket Banks (Global Giants)

- Goldman Sachs

- JP Morgan

- Morgan Stanley

- Citi

- Bank of America Merrill Lynch

Mid-Tier & Boutique Investment Banks (Easier to Get Into)

- Avendus Capital

- Edelweiss Financial Services

- Motilal Oswal Investment Banking

- JM Financial

- ICICI Securities

Pro Tip: Apply to boutique investment banks first. They’re easier to break into and give you experience before moving to bigger firms.

How to Prepare for an Investment Banking Interview

Investment banking interviews are tough. They typically include:

1. Technical Questions

- How do you value a company?

- Explain the DCF method.

- What happens to a company’s financials if depreciation increases?

2. Behavioral Questions

- Why do you want to work in investment banking?

- Describe a time you handled pressure.

- Tell us about a financial project you worked on.

3. Case Studies & Problem-Solving

- You might be given a company and asked how you’d value it.

- You may need to analyse financial statements and suggest M&A strategies.

Pro Tip: Prepare with resources like Wall Street Prep and practice mock interviews with peers.

What to Do If You Don’t Get an Investment Banking Job Immediately

Not everyone lands an investment banking job on the first attempt. But don’t worry, there are alternative paths:

1. Join a Financial Consulting Firm

Many consulting firms handle M&A advisory and valuation work similar to investment banks.

2. Start in a Corporate Finance Role

Companies like Reliance, Tata, and Infosys hire finance grads for in-house corporate finance teams.

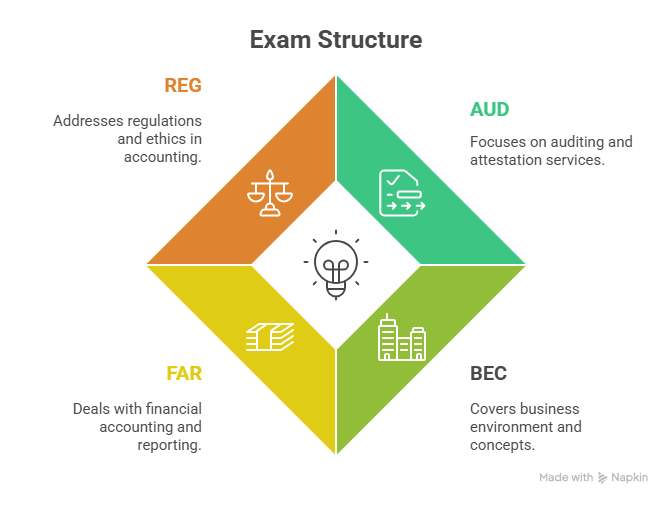

3. Get Additional Certifications

If you need a stronger profile, consider taking the Certified Investment Banking Operations Program or clearing CFA Level 1.

4. Reapply After Gaining Experience

Work in audit, risk management, or equity research, and reapply to investment banks after 1-2 years.

Final Thoughts

Investment banking is tough to crack, but with the right skills and strong preparation, you can land your dream job. Take action today, learn core skills, enrol in investment banking courses, and apply for internships.

If you’re serious about breaking into this field, check out the Certified Investment Banking Operations Program to boost your chances. Good luck!

FAQs

Can I get investment banking jobs after BCom?

Yes! Many investment banks hire BCom graduates, especially if you have financial modelling, valuation, and Excel skills.

What is the salary of a fresher in investment banking?

Starting salaries for jobs After BCom in investment banking range from 6-12 LPA, depending on skills and company.

Do I need an MBA for investment banking?

No, but an MBA can help for senior roles. Freshers can enter through investment banking courses and internships.

Where can I apply for investment banking jobs for freshers?

Check LinkedIn, Naukri.com, and company career pages for openings when it comes to investment banking jobs for freshers.

Which is the best certification for investment banking?

The Certified Investment Banking Operations Program is highly recommended to easily get investment banking jobs for freshers.

Is CFA better than investment banking courses?

CFA is broader. Investment banking courses focus on job-specific skills, making them faster and more practical.