Have you ever found yourself fascinated by market trends, financial reports, or the inner workings of businesses… only to second-guess your career aspirations… because you don’t have a finance degree? You’re not alone. In fact, this is a common worry among many professionals and fresh graduates from non-finance backgrounds.

The good news? You can become a financial analyst without holding a traditional finance degree. Yes, really.

Thanks to the evolving nature of today’s job market, where skills & practical knowledge often matter more than just academic credentials, breaking into finance without a degree in the subject is not only possible — it’s more common than you might think.

Let’s dig into how you can navigate this journey, the skills needed for financial analysis, alternative routes to gain credibility, & the best financial analyst certification programs that open the right doors.

What Does a Financial Analyst Actually Do?

A Financial Analyst evaluates economic data, market trends, & company financials to guide investment or business decisions. Their insights help businesses manage resources, minimise risk & maximise profit. Analysts work in banks, investment firms, corporations, start-ups & government bodies.

But don’t let the job title intimidate you. If you’re comfortable with numbers, enjoy strategic thinking & can interpret data logically — this could be the right fit for you, regardless of your degree.

Here’s a simplified breakdown of what this role entails:

| Responsibility | Details |

| Data Interpretation | Analysing income statements, balance sheets & market trends |

| Forecasting | Projecting future financial performance using various models |

| Reporting | Preparing clear summaries for stakeholders or senior management |

| Investment Analysis | Evaluating potential investment opportunities |

| Risk Management | Identifying risks & proposing mitigation strategies |

Is a Finance Degree Necessary?

Let’s be clear — a degree in finance can give you an initial boost. It provides a foundational understanding of accounting, economics, & capital markets. However, it’s not mandatory for pursuing a financial analyst career path.

Many employers today value practical skills, certifications, & relevant experience more than the specific subject of your undergraduate degree. In fact, professionals from fields like engineering, mathematics, physics, IT, or even psychology have transitioned successfully into finance roles.

Breaking Into Finance Without a Degree in Finance

Here’s the real question — how can you go from a non-finance background to analysing financials for a living?

The answer lies in three pillars:

- Learn the skills needed for financial analysis

- Get the right credentials

- Build hands-on experience

Let’s walk through each.

Skills Needed for Financial Analysis

Regardless of your educational background, there are a few must-have competencies if you want to succeed in this field. Here’s a rundown of the core skills needed for financial analysis:

| Skill Area | Explanation |

| Analytical Thinking | Ability to derive meaning from financial numbers, trends & scenarios |

| Microsoft Excel | Proficiency with spreadsheets, formulas, pivot tables & basic modelling |

| Accounting Principles | Understanding concepts like revenue, expenses, depreciation, and equity |

| Financial Modelling | Building models to evaluate business & investment scenarios |

| Communication | Presenting insights in a clear, structured & non-technical manner |

| Market Awareness | Keeping up with industry developments & global financial news |

These skills can be developed through online courses, YouTube tutorials, or through structured learning platforms like Imarticus Learning’s Postgraduate Financial Analysis Program.

Alternative Qualifications for Finance Careers

Don’t have a degree in finance? No worries. There are several alternative qualifications for finance careers that are well-respected in the industry.

| Credential | Why It Matters |

| CFA (Chartered Financial Analyst) | A prestigious, in-depth global certification ideal for investment roles |

| Financial Modelling Certifications | Teaches you how to build valuation models used across finance |

| FMVA (Financial Modelling & Valuation Analyst) by CFI | Focuses on practical applications in Excel & analysis |

| Imarticus Financial Analysis Program | Short-term, industry-focused training with placement support |

These are just some of the financial analyst certification programs that give you hands-on tools & recognised credentials that hiring managers value.

Your Financial Analyst Career Path: A Non-Traditional Journey

The journey might be different for you — and that’s perfectly fine. Here’s a practical roadmap to help you build a strong financial analyst career path without needing a finance degree:

| Step | Action Plan |

| Understand Financial Basics | Learn accounting, ratios, Excel, & basic economic indicators |

| Choose a Certification | Select from industry-aligned financial analyst certification programs |

| Build a Portfolio | Create mock reports, valuation models, and dashboard presentations |

| Apply for Internships | Even short-term projects help in gaining credibility |

| Network Strategically | Engage with finance professionals on LinkedIn, attend webinars & meetups |

| Stay Updated | Follow news on Bloomberg, Moneycontrol, or Economic Times regularly |

Want to explore how financial markets play into this? Don’t miss this blog on Financial Market Functions — it’s a solid foundation builder.

Top Finance Jobs Without a Finance Degree

You might be wondering, “Okay, but what are my options if I don’t have a finance degree?” Well, here’s a look at viable finance jobs without a finance degree that you can pursue:

| Job Role | Core Skills Needed |

| Junior Financial Analyst | Excel, basic finance, reporting |

| Business Analyst (Finance) | Data interpretation, KPIs, business acumen |

| Risk Management Associate | Risk tools, financial metrics, scenario planning |

| Operations Analyst | Process optimisation, reporting & compliance tracking |

| Data Analyst (Finance Domain) | SQL, Tableau/Power BI, finance-specific KPIs |

Most of these roles can serve as stepping stones in becoming a financial analyst eventually.

Real-World Tips to Make the Switch

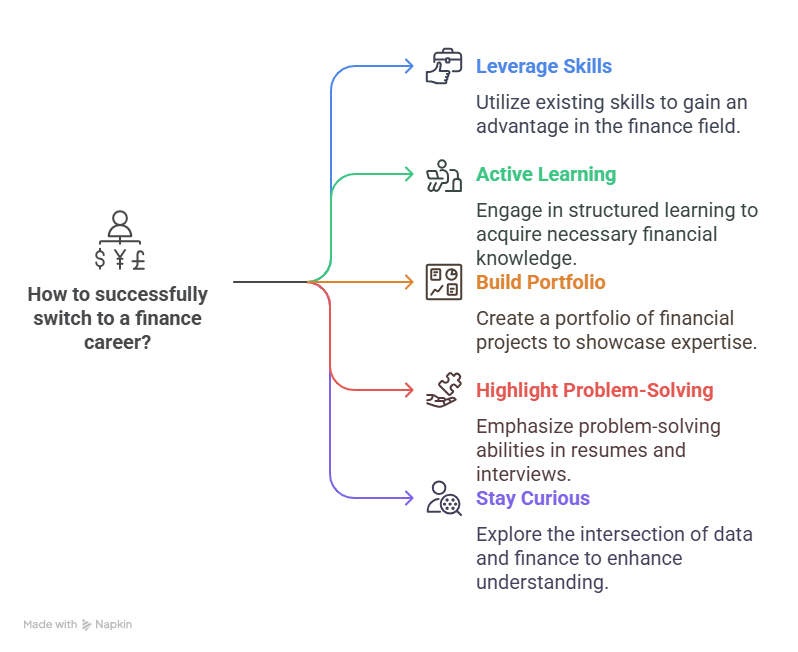

If you’re serious about breaking into finance without a degree, here are some practical, no-fluff strategies:

- Leverage What You Know

Have a background in coding, maths, research, or marketing? Use those transferable skills to your advantage. - Start Learning Actively

Platforms like Coursera, Udemy, & Imarticus offer beginner-friendly content to get started fast. - Work on Case Studies

Build a personal portfolio of financial models, analysis reports & dashboards. You can even volunteer for start-ups to gain experience. - Showcase Problem-Solving

In interviews or resumes, highlight your ability to analyse data, solve real-world business problems, & communicate clearly. - Stay Curious

This blog on Exploratory Data Analysis shows how data & finance intersect. Understanding this link adds value to your profile.

Recommended Learning Path: Step-by-Step

Here’s a sample timeline if you’re starting from scratch:

| Timeframe | Learning Milestone |

| Week 1–2 | Learn financial statements, Excel basics, and terminology |

| Week 3–6 | Take up a short course on accounting or valuation modelling |

| Week 7–12 | Join a comprehensive program like the PG Financial Analysis Program |

| Month 4–5 | Build your resume with mock projects or freelance gigs |

| Month 6–8 | Apply for entry-level roles, internships, or remote analyst jobs |

Need help picking a course? Read this Beginner’s Guide to Choosing the Best Financial Analysis Course.

FAQs

1. Can I pursue a financial analyst career path without a finance degree?

Yes… many professionals explore the financial analyst career path with degrees in economics, engineering, or even humanities… it’s all about the right skills & mindset.

2. What are some common finance jobs without a finance degree?

There are plenty… junior analyst, operations associate, risk assistant, or even business analyst roles fall under finance jobs without a finance degree.

3. Is becoming a financial analyst possible after studying something else?

Definitely… becoming a financial analyst doesn’t always require a finance degree… with dedication, training & exposure, it’s totally doable.

4. What are alternative qualifications for finance careers?

Great question… alternative qualifications for finance careers include CFA, FMVA, Excel & modelling bootcamps… or postgraduate programs focused on real-world finance skills.

5. What are the must-have skills needed for financial analysis?

To thrive in this field… you’ll need skills needed for financial analysis like Excel, data interpretation, accounting basics & a sharp eye for detail.

6. How do I start breaking into finance without a degree?

Start small… explore free resources, build a portfolio, take a few certifications… breaking into finance without a degree is all about initiative & persistence.

7. Are financial analyst certification programs actually helpful?

Oh yes… financial analyst certification programs can fast-track your journey… they show recruiters that you’re serious & job-ready.

8. Do companies hire people for finance jobs without a finance degree?

Absolutely… companies value skills & attitude… not just degrees… that’s why finance jobs without a finance degree are very much within reach.

Final Thoughts

So, can you become a financial analyst without a finance degree?A Financial Analyst evaluates economic data, market trends, & company financials to guide investment or business decisions. Their insights help businesses manage resources, minimise risk & maximise profit. Analysts work in banks, investment firms, corporations, start-ups & government bodies.

But don’t let the job title intimidate you. If you’re comfortable with numbers, enjoy strategic thinking & can interpret data logically — this could be the right fit for you, regardless of your degree.

Yes, you absolutely can.

Today, it’s not about where you started, but where you’re heading. The finance industry is vast, dynamic, & increasingly open to professionals with diverse backgrounds. If you’re willing to learn the skills needed for financial analysis, pursue credible financial analyst certification programs, and stay committed — your degree (or lack thereof) won’t hold you back.

All you need is clarity, confidence & the right roadmap.

If you’re ready to make the leap, explore the Postgraduate Financial Analysis Program by Imarticus. It’s designed for aspiring analysts just like you — offering real-world skills, industry mentors & a placement-driven approach.