Indian finance industry is gradually on the upsurge and greater professionals desire to establish prosperous finance career overseas. Best and most permanent qualification for the same is Chartered Financial Analyst (CFA) certification. You would probably be thinking how to become CFA in India, and the below guide contains all about eligibility, preparation for studies, fees, career benefit, and so on.

Understanding How to Become CFA in India?

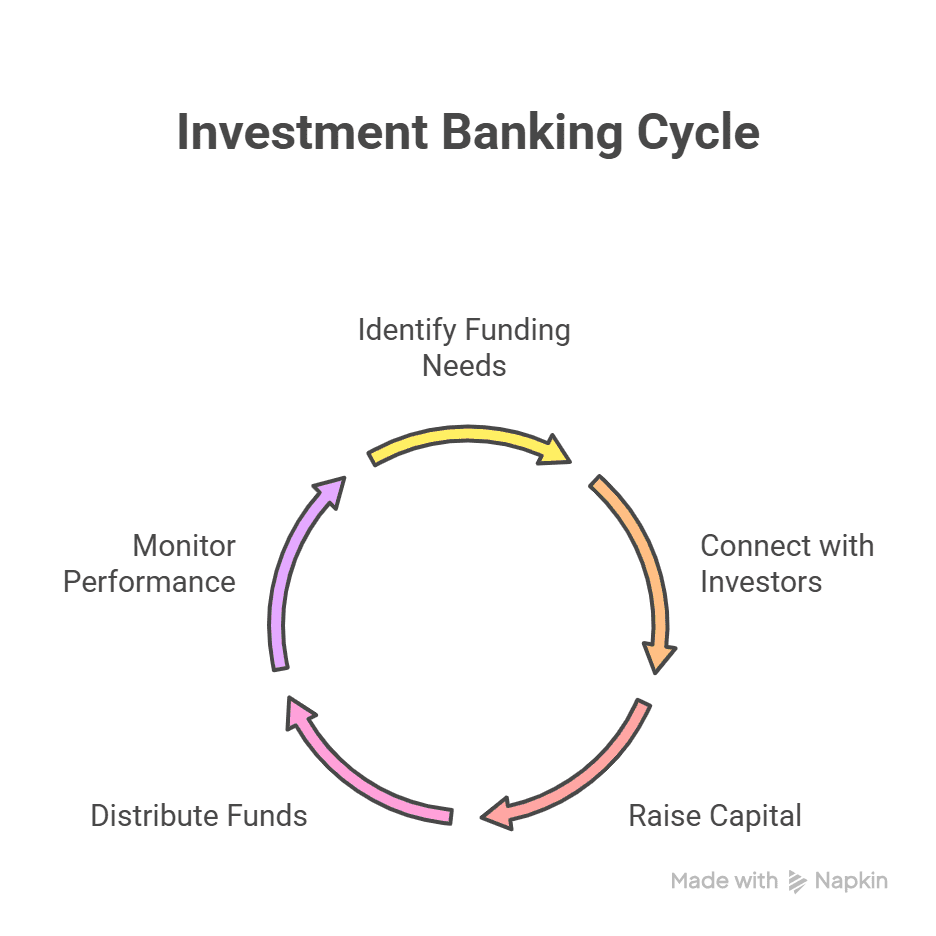

CFA program, held under the auspices of the CFA Institute, is considered globally as gold standard for investment analysis and portfolio management certification. CFA charter can be career-builder in a financial career for any Indian professional.

Responding to the question of how to become CFA in India, the candidates must pass three levels of exams (Level I, II, and III), obtain professional work experience, and become a member of CFA Institute. These are in sequence and are designed to test growing levels of information regarding financial analysis, portfolio management, ethics, and wealth planning.

CFA Eligibility Criteria in India

Before you start preparing for your CFA, you need to know about the eligibility requirements for CFA in India. These are the minimum requirements:

- You should have a bachelor’s degree or be in your final year of undergraduate studies.

- Or, you should have four years of professional and/or post-secondary work experience.

- You should have a passport.

It should be noted that English language proficiency and internet connectivity are the prerequisites of the computer-based mode of exam.

CFA Course Fees and Duration

Most of the applicants are interested to know CFA course fee and duration in India. The CFA program cost is different based on when you pay the exam fee.

- One-time Enrollment Fee: USD 350 (around INR 29,000)

- Early Registration Fee: USD 940 (around INR 78,000)

- Standard Registration Fee: USD 1,250 (around INR 1,03,000)

Each level takes serious study time of 300–400 hours. Depending on your speed of work, it will take 2.5 to 4 years to become a CFA charterholder.

CFA Exam Preparation Strategies

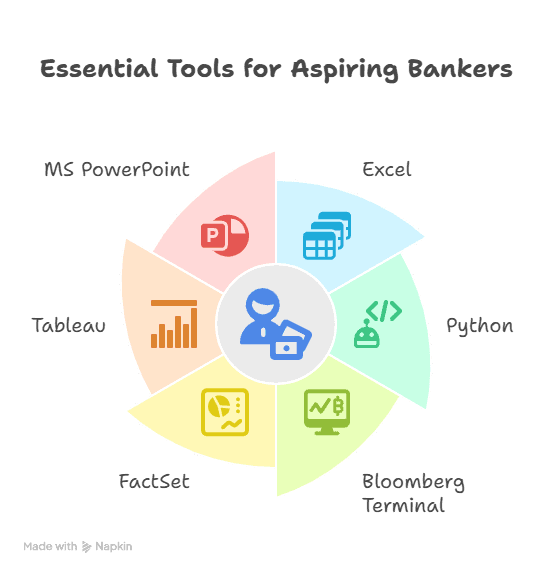

To clear the CFA exams, you need a good and strategic CFA plan of study for exam preparation. The below is how you can get maximum out of your study effort:

- Start preparing 6 months before the exam date.

- Utilize the CFA Institute study syllabus and practice tests.

- Utilize add-on prep firms like video lectures, question banks, and study calendars.

- Go to local CFA societies or study groups to keep you motivated.

Consistency is the name of the game. Plan so that you will have a work-study equilibrium.

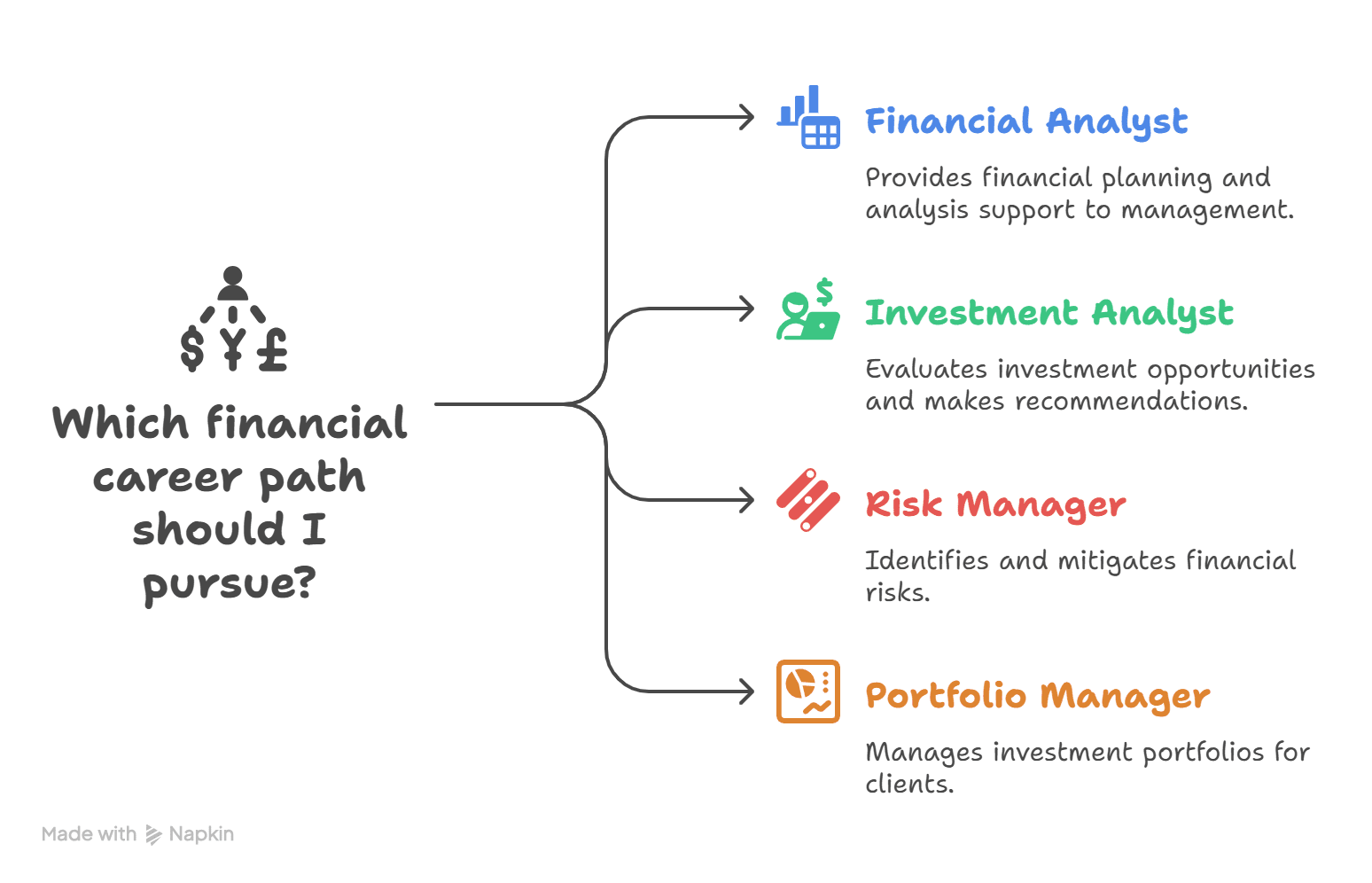

Career Opportunities and CFA Salary in India

CFA charterholder career path offers huge career opportunities in risk analysis, asset management, equity research, investment banks, and financial advisory.

With regard to CFA salary in India, fresh CFA charterholders will receive an average salary of INR 6–10 LPA which becomes double with experience. Senior experienced CFA professionals would command INR 20 LPA upwards in multinationals and investment banks, and

CFA and Other Best Finance Certifications

Although CFA is a high-class certification, it is always paired with other certifications. The most sought-after finance certifications for finance professionals are:

- Financial Risk Manager (FRM)

- Certified Financial Planner (CFP)

- Chartered Accountant (CA)

- Financial Modelling Certification

These modules develop complementary abilities in forecasting, tax planning, and risk management.

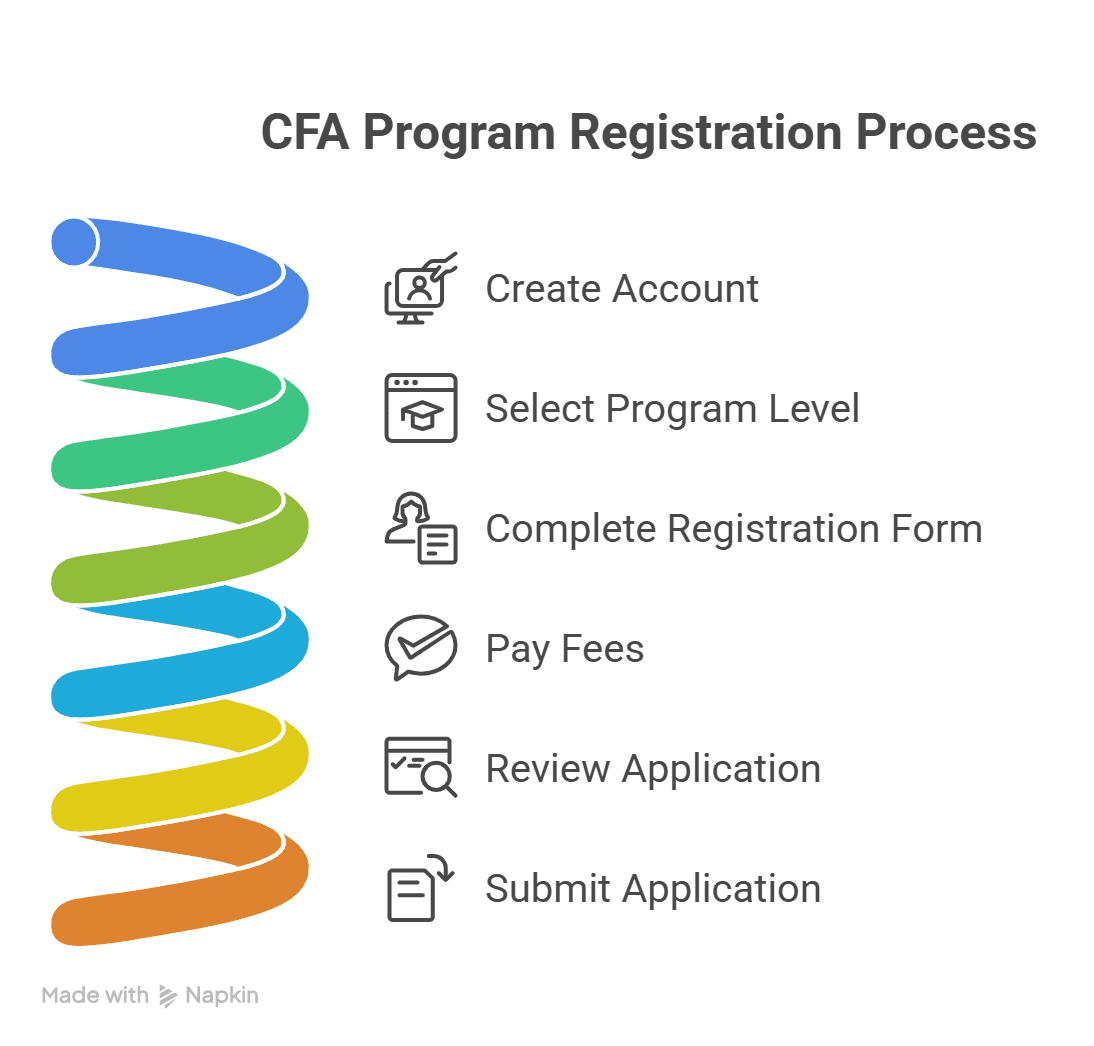

How to Become CFA in India: Step-by-Step Process?

The following is a step-by-step guide to becoming CFA in India:

- Check eligibility: Check if you are eligible to appear for Level I or II either through work experience or education.

- Online registration: Apply online for Level I via the CFA Institute website.

- Pay fees: Apply early and pay reduced fees.

- Begin preparation: Put in a minimum of 300 hours per level.

- Clear exams: Prepare and clear Level I, II, and III.

- Gain work experience: Obtain 4,000 hours of qualifying professional working experience.

- Apply for membership: Become a member of the CFA Institute and the CFA society within your location.

- Get charter: You’re now a CFA charterholder!

Why CFA is Ideal for Indian Finance Professionals?

Indian asset management firms, investment banks, and financial advisory firms have consistently high regard for the CFA certification. Here’s why it’s the best:

- Global recognition: Lukaed in more than 165 nations.

- Expert curriculum: Comprehensive study in valuation, financial reporting, and ethics.

- Career adaptability: Various career options in sell-side and buy-side professions.

- Professional values: Exhibits professionalism and devotion to employers.

FAQs

1. What is the first step in how to become CFA in India?

The first is to check your eligibility and register for the Level I exam on the official website of the CFA Institute.

2. What are the CFA eligibility criteria India-based students need to meet

The candidate must have four years of study and experience equivalent to a bachelor’s degree.

3. What is the CFA course fees and duration in India?

It is INR 1.5 to 2 lakhs per level, and the entire program can be of 4 years duration with a gap of 2.5 years.

4. How can I prepare effectively for the CFA exam?

Read CFA Institute study guides, mock papers practice, and study groups or classes for guidance.

5. What is the average CFA salary in India?

Indian freshers are paid INR 6–10 LPA, but experience holders can get more than INR 20 LPA.

6. Are there any scholarships available for CFA candidates in India?

Yes, the CFA Institute awards several merit, need, or academic affiliation-based scholarships.

7. What are some other best finance certifications to consider along with CFA?

FRM, CFP, CA, and financial model certifications are great complements to the CFA charter.

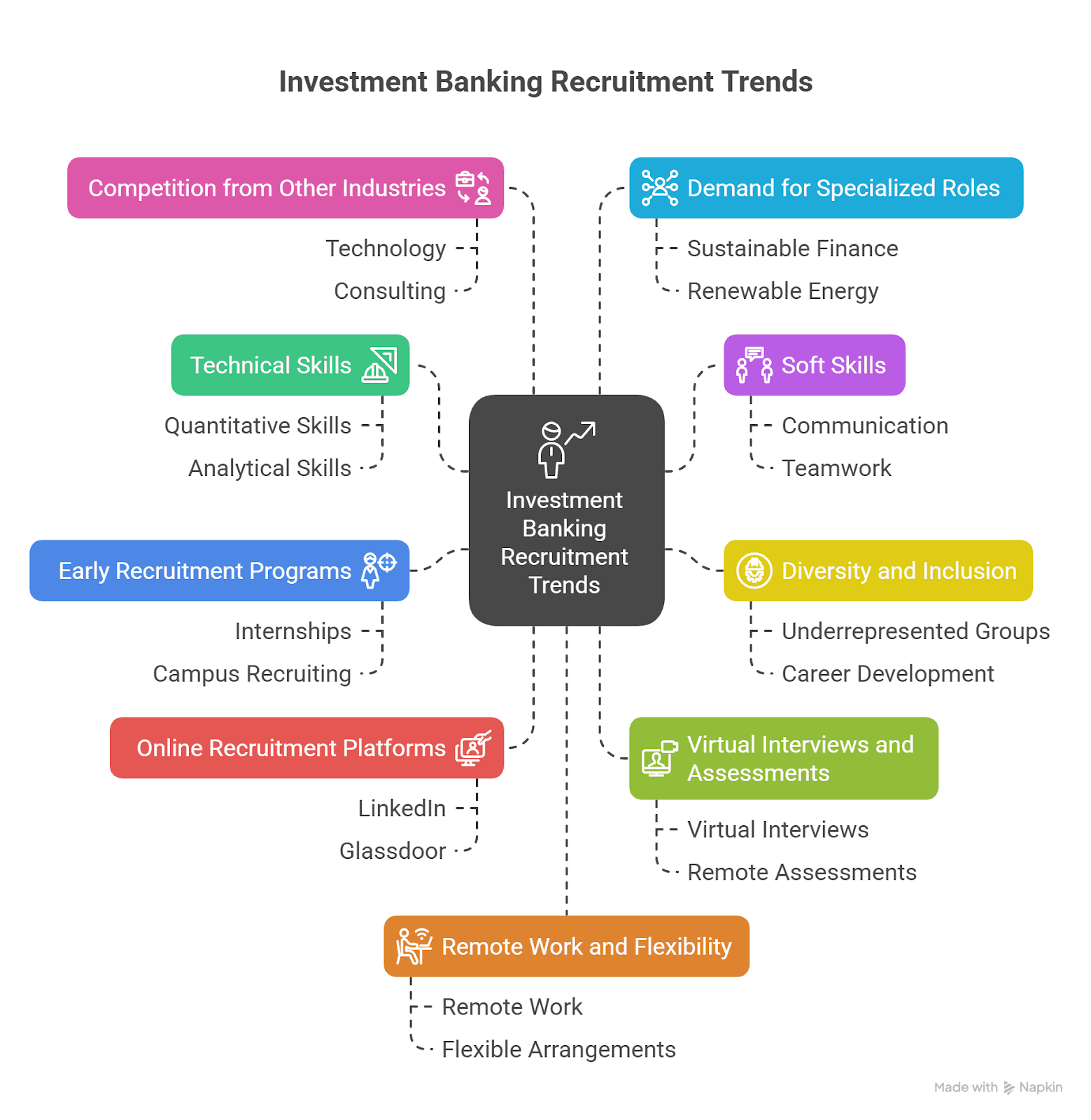

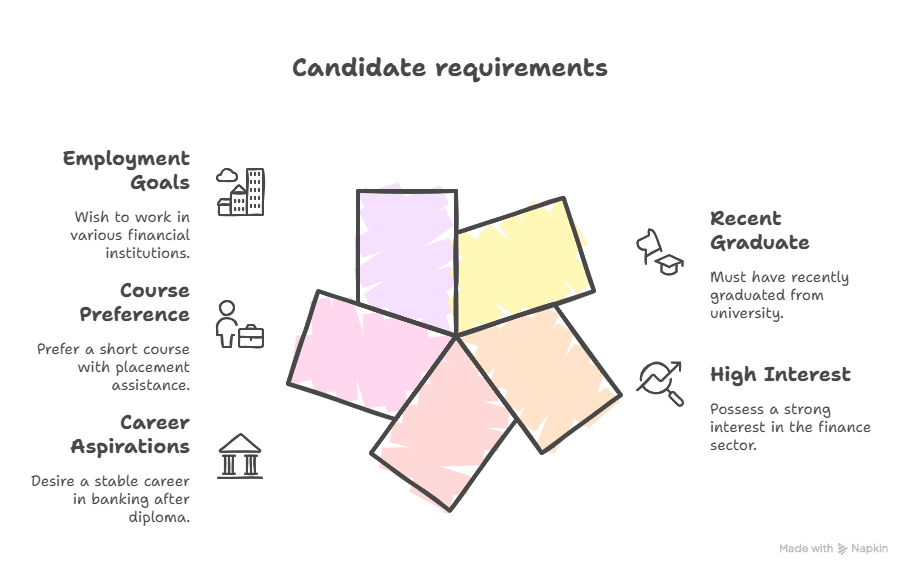

Considering Alternatives: Imarticus’ Certified Investment Banking Operations Professional

If you are new to the world of finance professionals and wish to be sure of a spot in hugely rewarding career paths without having to invest years in the CFA process, then Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) programme is a perfect stepping stone.

About the Postgraduate Financial Analysis Program

CIBOP is a Postgraduate Financial Analysis Programme that converts 3-year experience alumni into high-paying finance careers in leading global organizations. It offers:

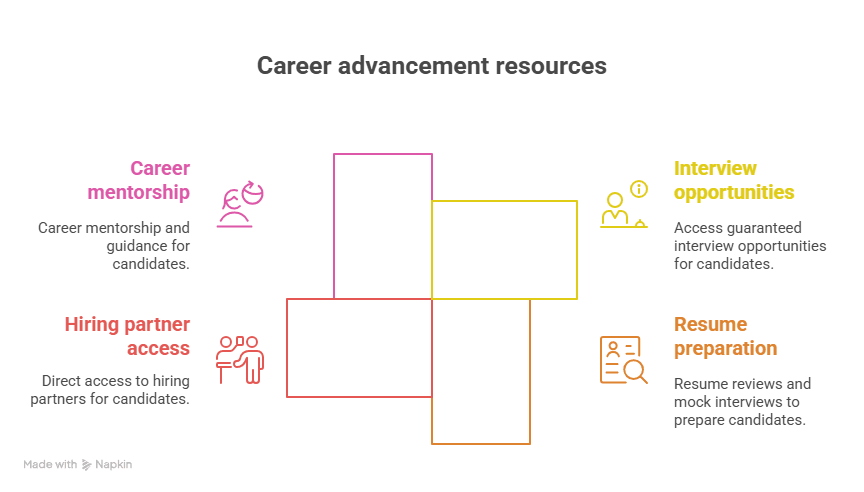

- 100% Job Guarantee with 7 interview assurances

- Weekday (4-month) and weekend (8-month) classroom or flexible learning

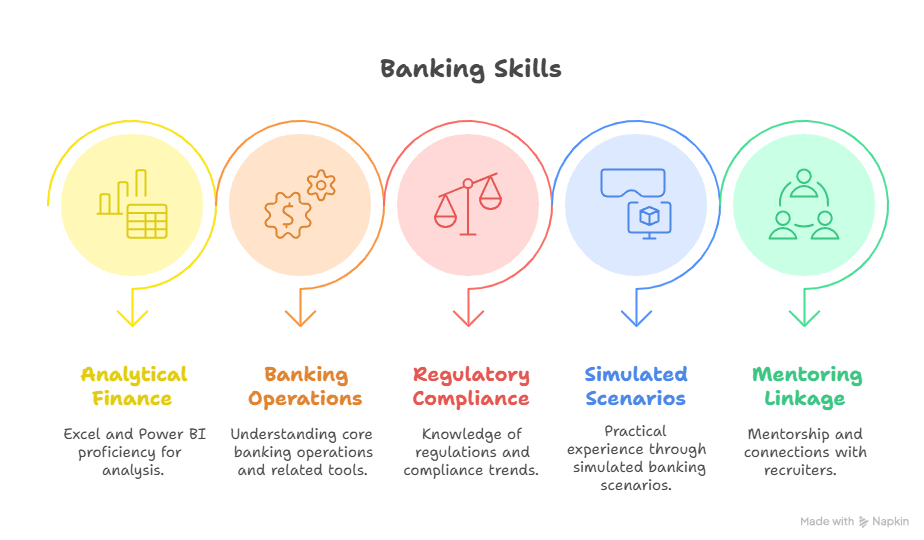

- Equity research, valuation, financial modeling, and master-level Excel for finance – intense skills

- Personal branding, LinkedIn coaching, and access to 500+ hiring partners

Where Our Alumni Work:

UBS, BNP Paribas, Bank of America, Capgemini, Citibank, Genpact, Goldman Sachs, J.P. Morgan, Morgan Stanley, and RBS.

Best Education Provider in Finance for 30th Elets World Education Summit 2024, the program fills the skill gap and is actually a catapult to high-growth career.

Conclusion

So, CFA in India, how do I? It’s a diligent, disciplined procedure that involves hard work, discipline, and dedication for several years. But then it’s one of the brightest moves you ever make in your finance life. If you go for a chance at CFA immediately or begin with a vocation-industry-ploshing, job-guaranteed course like Imarticus Learning’s Postgraduate Financial Analysis Program, the world and its world of finance promises are yours for the taking.

Select the course best suited to your career and aspirations—and on to a finance career on a global stage.