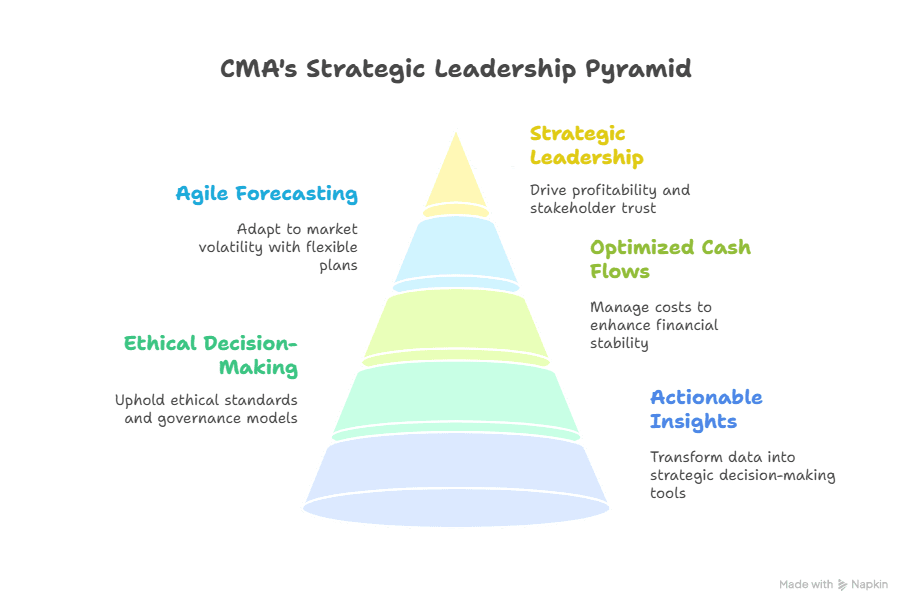

If you’re considering becoming a CMA, you’re already thinking beyond bookkeeping to business strategy.

The Certified Management Accountant title means you can read between the lines and navigate the ship.

This blog covers CMA qualifications, a usable CMA exam study guide, the nuts and bolts of becoming a Certified Management Accountant, CMA certification career advantages, and the variety of global CMA career opportunities—all in plain human terms.

Why the CMA is Significant in 2025

Finance requires strategists, not number-crunching jocks. Recent IMA salary survey results indicate that CMAs are more likely to receive faster promotions and higher total compensation than non-CMAs.

That says it all about the career benefit of CMA certification—more pay, more responsibility, and real business clout.

The CMA would be most accurately described as a “T-shaped” credential. Advanced accounting and analytics constitute the vertical bar. Strategic, tech and ESG savvy constitute the horizontal bar. Most companies desire both.

CMA Eligibility Requirements

Before rushing out and spending cash on books, check these boxes:

Education: You can give the CMA exam with 10+2, but to get the certification, you will require a degree from a recognised university

Membership: Membership with the Institute of Management Accountants (IMA).

Experience: Two consecutive years in management accounting or financial management.

Ethics: A promise to the IMA’s Statement of Ethical Professional Practice.

Tip: Still a student? You can sit the exams early and provide evidence later—just within the IMA’s time frames.

CMA Exam Preparation Guide

A practical CMA exam prep guide helps you learn efficiently

- Back-plan on exam day. Choose a window, and divide weekly goals.

- Mix learning modes. Live classes (e.g., Imarticus Learning), video classes, question banks and flashcards.

- Take a minimum of three timed mocks for every section.

- Monitor weak spots. Maintain an “error log” and focus on difficult areas weekly.

- Get a community behind you. Study groups and forums keep you on your toes.

Adaptive learning hack: Utilise platforms that automatically vary the difficulty of questions based on how you do. They are time-saving and show blind spots at light speed.

Is CMA US Difficult? | Quick 3-Minute Breakdown

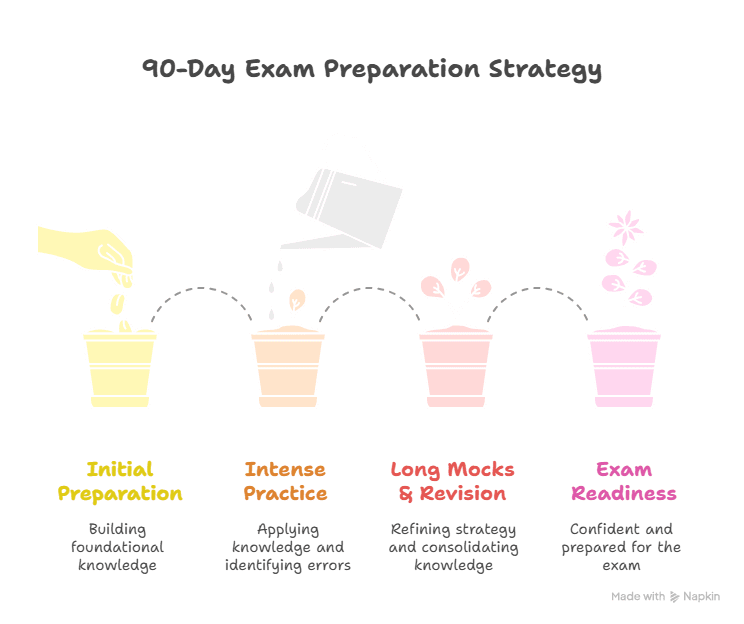

The 90-Day CMA Sprint Plan (New Approach)

Divide your prep into three coordinated sprints:

- Days 1–30: Frameworks and concepts. Produce mind maps and formulae sheets.

- Days 31–60: Intense daily practice sets, weekly mock tests, speedy feedback loops.

- Days 61–90: Long mocks, review of errors, speedy fact revision.

Steps to Become a Certified Management Accountant

- Verify CMA eligibility criteria and become an IMA member.

- Enrol and pay Part 1 and Part 2 fees.

- Utilise a CMA exam study guide in organising study blocks, mocks, and revisions.

- Pass both parts within three years from the date of registration.

- Record and complete two years of qualifying work experience.

- Maintain CPE credits each year to retain the credential in force.

Time & Task Snapshot

| Step | What You Do | Typical Timeframe | Cost (Indicative) | Evidence Needed |

| 1 | Join IMA & verify eligibility | 1–2 weeks | USD 260–295 (membership) | Degree/professional credential |

| 2 | Pay entrance + exam fees | 1 week | USD ~1,000–1,500 total | Receipts for payment |

| 3 | Study for Part 1 & Part 2 | 6–12 months total | Course/material fees vary | Study logs and mock scores (self) |

| 4 | Take the exams (4 hours each) | 2 exam windows | Included in exam fees | Pearson VUE score reports |

| 5 | Gain two years’ experience | Before/after exams | N/A | Employer verification letters |

| 6 | Submit application for certification | 2–4 weeks processing | N/A | Completed IMA application |

| 7 | Maintain CPE | Ongoing (annual) | Varies (courses, events) | CPE completion records |

Career Benefits of CMA Certification

Career advantages of CMA certification are:

- Strategic contribution: You influence budgets, long-term strategy, and cross-functional initiatives.

- Mobility: Transitions between roles—FP&A, strategy, risk, ESG, and digital transformation.

- Future-proofing: Where automation handles the drudgery in accounting, CMAs handle the interpretation, insight and change management.

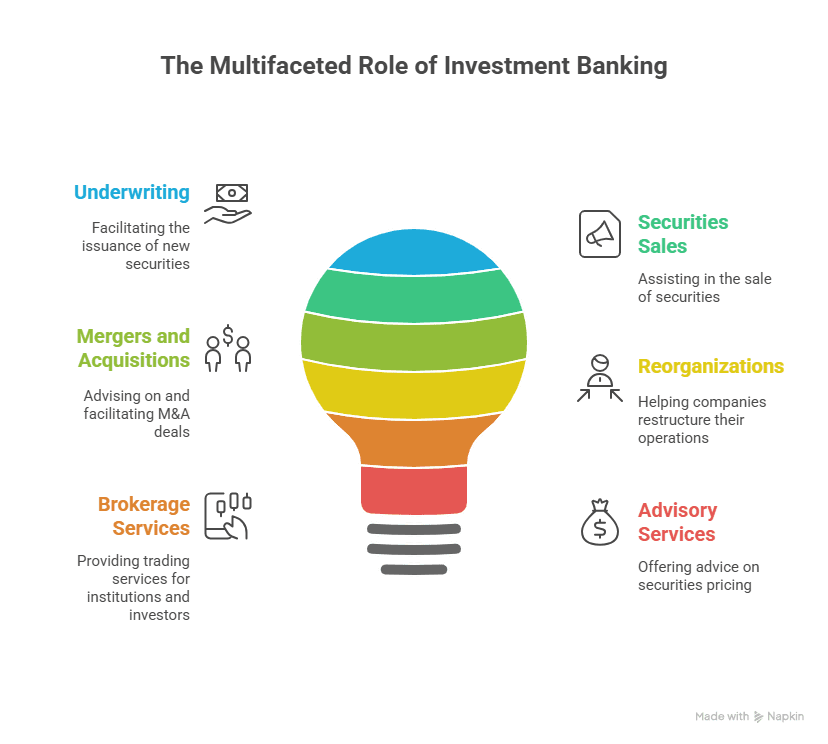

Global CMA Career Opportunities

The certification is recognised in 178 countries. You can target roles like:

- Finance & Strategy: FP&A Analyst, Business Strategy Manager, Corporate Controller.

- Risk & Governance: Risk Manager, ESG Reporting Lead, Compliance Analyst.

- Consulting & Tech: Finance Transformation Consultant, Data Analytics Lead.

The demand is increasing in North America, the Middle East, India, the UK and Southeast Asia as organisations look for finance specialists with the ability to align numbers with strategy.

FAQs

1. What are the eligibility requirements to become a CMA?

A bachelor’s degree (or equivalent credential), IMA membership and two years’ relevant experience.

2. How many sections does the CMA exam have?

Two: Section 1 (Financial Planning, Performance & Analytics) and Section 2 (Strategic Financial Management).

3. How do I become a full-time CMA?

Plan in sprints, study weekends/evenings, and employ adaptive learning tools for productivity.

4. What is the worldwide pass rate?

Generally, 40–50%. It indicates just how challenging and widespread the exam is.

5. How much time do I have to pass both sections?

Three years following your entry into the CMA program.

Conclusion

The US CMA is much more than a certification; it is a route to your high-level finance career in the realm of global finance.

Key Takeaways

- Become a CMA: satisfy eligibility conditions, study wisely, pass two parts, and get two years’ experience.

- CMA eligibility conditions are straightforward—ensure you have them in place well in advance to avoid disappointment.

- The career advantages are worth the investment in credentials, leading to better career opportunities worldwide as a CMA.

Time to make that leap from “finance enthusiast” to “global strategy expert” qualified?

Enrol for the Imarticus Learning CMA certification program today in collaboration with KPMG in India.