Most students don’t randomly wake up and decide to pursue the CFA or enrol in CFA classes. The thought usually begins somewhere in between – maybe during a finance lecture, while researching high-paying careers, or after seeing someone move into investment banking, portfolio management or global finance roles.

At first, the CFA certification sounds exciting. It sounds like the perfect step if you want a strong career in finance – global recognition, good roles and long-term growth. But once you open the syllabus and look at the exam structure, things start to feel very real. It’s not something you can finish with last-minute studying. This is usually when most students stop and think: Will I be able to manage CFA on my own, or should I join CFA classes?

If you’re serious about clearing CFA and building a strong career in finance, understanding how the right classes can support your preparation can make a bigger difference than you think. In this guide, I’ll walk you through everything you need to know about CFA classes – why they matter, who should consider them, what options are available and how to choose the right one for your goals.

Did you know?

CFA Classes are structured coaching programs that help students prepare for the Chartered Financial Analyst (CFA) exams through expert faculty guidance, study plans, mock tests and revision support.

What Are CFA Classes?

CFA classes are structured coaching programs that help students prepare for the Chartered Financial Analyst (CFA) exams through faculty guidance, study plans, mock tests and concept-based learning.

They are designed to help candidates:

- Understand the vast CFA course syllabus.

- Stay consistent with preparation.

- Practise exam-level questions

- Improve passing chances

Students can choose between classroom classes, online classes or hybrid learning formats depending on their schedule and learning style. Let’s have a look at the CFA Certification preparation:

| Factor | Details |

| Total CFA levels | 3 Levels |

| Study hours per level | 300-400 hours |

| Prep duration | 4-6 months per level |

| Best time to start | 6-9 months before exam |

| Pass strategy | Study + mocks + revision |

| Coaching benefit | Structure + consistency |

Also Read: What you should know about CFA eligibility.

Why CFA Classes Matter More Than You Think

A lot of students initially believe they can prepare for CFA on their own using CFA books and online resources. While self-study works for some, most candidates eventually realise that structured CFA classes make the journey much smoother. However, once they understand: What is CFA?, they realise the importance of classes.

The CFA course is known for:

- A vast and detailed syllabus

- Concept-heavy subjects

- Case-based questions

- Long preparation cycles

- Global competition

Without proper planning and guidance, it’s easy to feel overwhelmed.

This is where structured CFA coaching classes help. They provide:

- Clear study schedules

- Faculty guidance

- Doubt-solving sessions

- Mock tests and revision

- Exam strategy support

Instead of guessing what to study next, you follow a structured path. That alone reduces a lot of stress.

To help you understand a practical preparation approach, watch this detailed video on how to clear CFA Level 1. It covers effective study strategies, common mistakes students make and how to stay consistent throughout your preparation journey.

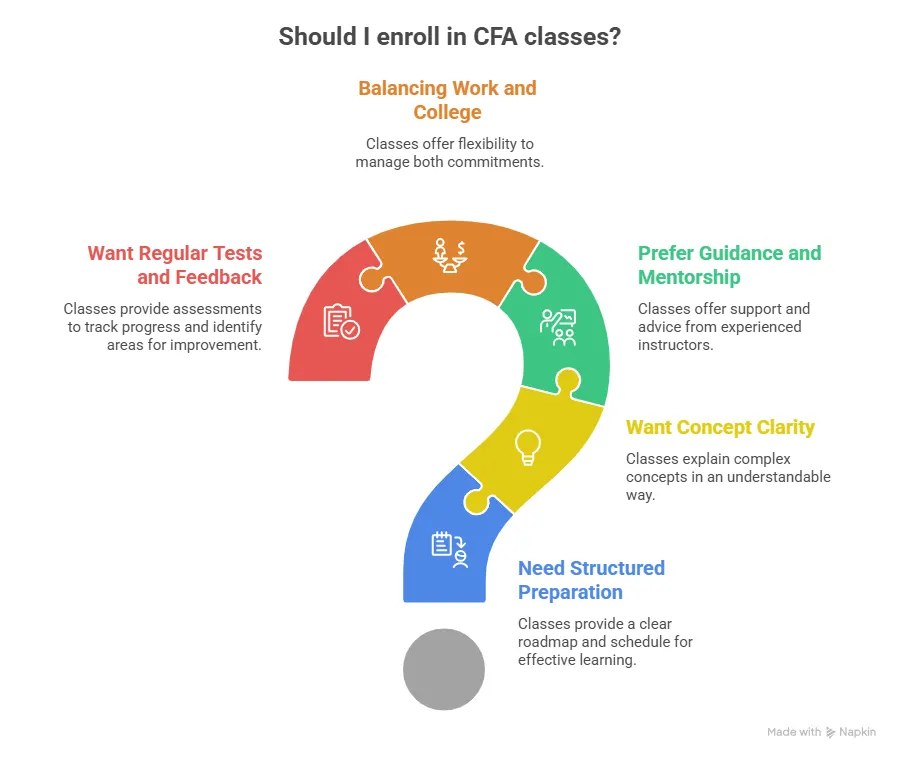

Who Should Consider CFA Classes?

Not everyone preparing for CFA has the same background. Some start CFA after BCom or graduation, others while working, and many even begin CFA after class 12 alongside their degree.

You should seriously consider joining CFA classes if you are:

- A BCom, BBA or finance student

- An MBA aspirant

- A finance or accounting working professional

- Planning a career in investment banking or portfolio management

- Switching into finance from another field

- Interested in global finance careers

Even students exploring CFA after class 12 start early with foundation preparation.

Good CFA prep classes help you build discipline and consistency – two things that matter more than intelligence in the CFA exam.

Why Most Students Struggle to Clear CFA Without Coaching

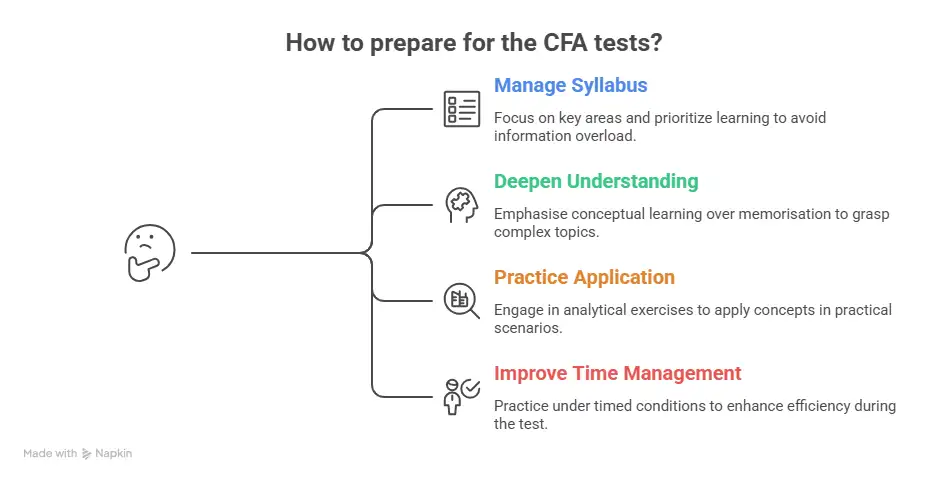

Many students start CFA preparation with full motivation, but lose direction after a few months. This usually happens because CFA is not just about studying hard – it’s about studying consistently and strategically.

Common challenges students face:

- Not knowing what to study first.

- Lack of a structured timetable

- Difficulty understanding complex topics

- No mock test practice

- Losing consistency after a few weeks

This is where structured CFA classes create a big difference. They provide a clear roadmap, regular testing and mentorship that keeps preparation on track. Students who follow structured guidance are far more likely to stay consistent and confident throughout the preparation cycle.

Also Read: CFA course details that every aspirant should know.

Types of CFA Classes Available Today

The good news is that there are multiple formats available today. You can choose based on your schedule and learning style.

Classroom CFA Classes – Traditional classroom coaching is still popular in cities like:

- CFA classes in Mumbai

- CFA classes in Pune

- CFA classes in Bangalore

- CFA classes in Delhi

- CFA classes in Ahmedabad

Many students prefer classroom programs for discipline and consistency.

CFA Online Classes – With technology improving, CFA online classes have become extremely popular. Many candidates now prefer online learning due to flexibility. If you search for the best CFA online classes, you’ll find many options offering live and recorded sessions.

Online learning is especially helpful if you’re:

- Working full-time

- Living in smaller cities

- Managing college alongside CFA

- Looking for weekend classes

Live + Recorded Hybrid Classes – Many institutes now offer hybrid CFA live classes where you attend live sessions and also get recordings for revision. Hybrid learning is becoming one of the most preferred formats for CFA preparation.

| Features | Classroom CFA Classes | Online CFA Classes | Live + Recorded Hybrid CFA Classes |

| Learning format | Face-to-face classroom learning | Fully online learning | Live classes with recorded access |

| Flexibility | Fixed schedule | Highly flexible | Flexible with revision access |

| Location requirement | Attend the physical centre | Learn from anywhere | Learn from anywhere |

| Faculty interaction | Direct in-person interaction | Live chat or session interaction | Live interaction + recordings |

| Recorded lectures | Usually not available | Available | Always available |

| Best suited for | Students needing discipline and structure | Working professionals & college students | Students needing flexibility + revision |

| Doubt solving | Immediate in class | During live sessions or forums | Live sessions + recorded review |

| Revision support | Classroom revision sessions | Recorded lecture revision | Strong revision through recordings |

| Peer learning | High peer interaction | Limited peer interaction | Moderate peer interaction |

| Study pace | Fixed pace | Self-paced | Balanced pace with flexibility |

To understand why so many students and working professionals choose this path, watch this video on why CFA is one of the best career moves in finance. It explains how the CFA charter adds credibility to your profile, improves career opportunities and helps you stand out in a competitive finance industry.

CFA Classes Fees

One of the first questions students ask before enrolling is simple: How much do CFA classes cost? The answer depends on the institute, level, and learning format. But having a rough idea of the CFA course fees helps you plan better.

| CFA Coaching Mode | Course Fee (Per Level) | Registration Fee |

| Classroom CFA Classes | ₹75,000 per level (Level 1, 2, 3) | ₹10,000 |

| Live Online CFA Classes | ₹60,000 per level (Level 1, 2, 3) | ₹10,000 |

Online CFA classes are often slightly more affordable than classroom coaching, while premium institutes with senior faculty may charge more.

When comparing fees, always check:

- Number of lecture hours

- Mock tests included

- CFA study material provided

- Revision sessions

- Faculty experience

- Doubt-solving support

The cheapest option isn’t always the best. Quality guidance saves time and reduces re-attempt risk.

Also Read: How to plan your CFA course duration wisely.

What to Expect in CFA Classes Level-Wise

Each CFA level requires a different preparation strategy. Good CFA course classes are designed accordingly.

CFA Level 1 Classes

CFA Level 1 classes focus on building strong fundamentals. Subjects include:

- Financial reporting

- Quantitative methods

- Economics

- Corporate finance

- Equity

- Ethics

Since Level 1 builds the base, structured CFA Level 1 online classes help you understand concepts clearly from the start. Starting strong at the CFA Level 1 exam makes Levels 2 and 3 easier.

CFA Level 2 Classes

Level 2 is considered more challenging because it focuses heavily on application. CFA Level 2 classes usually include:

- Case-based learning

- Valuation techniques

- Financial modelling basics

- Advanced portfolio concepts

At this stage, coaching becomes even more helpful.

CFA Level 3 Classes

CFA Level 3 classes focus on portfolio management and practical application. Key areas include:

- Portfolio strategy

- Wealth planning

- Case-based answers

- Essay-type questions

Since Level 3 requires structured answers, many candidates join specialised CFA Level 3 classes for guidance and answer-writing practice.

Also Read: Why pursuing CFA in Bangalore helps finance professionals.

CFA Classes in Major Indian Cities

Many students prefer location-based coaching. Let’s look at demand across cities.

CFA Classes in Mumbai

Mumbai has always been one of the top choices for CFA aspirants. As India’s financial capital, the city offers direct exposure to investment banks, asset management firms, research houses and global finance companies. This environment naturally attracts serious finance students.

Students in Mumbai often look for:

→Best CFA classes in Mumbai

→CFA Level 1 classes in Mumbai

→CFA coaching classes in Mumbai

Mumbai stands out in the peer group and networking opportunities. Many students also get internships and networking opportunities alongside their preparation, which adds real value to their CFA journey.

CFA Classes in Pune

Pune has quietly become one of India’s strongest education hubs. With a large student population and growing finance opportunities, the city has seen a steady rise in CFA aspirants over the years.

Popular searches here include:

→Best CFA classes in Pune

→CFA coaching classes in Pune

→CFA Level 1 classes in Pune

Many students in Pune start CFA alongside BCom, BBA or other finance degrees. This city offers a balanced environment of a serious academic culture without the fast pace of metro cities like Mumbai. Because of this, students often find it easier to maintain a consistent study routine and prepare for CFA alongside graduation.

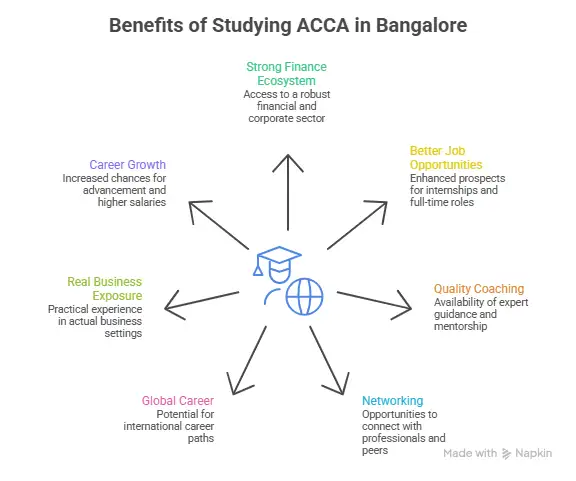

CFA Classes in Bangalore

Bangalore is widely known for tech and analytics, but it is also becoming a strong hub for finance and investment-related careers. With the presence of multinational companies, fintech firms and growing finance teams, interest in CFA has increased significantly.

Students frequently search for:

→CFA classes in Bangalore

→CFA Level 1 classes in Bangalore

→CFA coaching classes in Bangalore

A large number of working professionals in Bangalore pursue CFA to switch into core finance, investment roles or global finance positions. This is why weekend batches and online CFA classes are especially popular in the city. Many professionals balance demanding work schedules with structured CFA preparation.

Other Cities with Growing Demand

The demand for CFA classes is no longer limited to major metro cities. Students across India are now actively exploring finance careers and global certifications.

There is a rising demand for CFA coaching in cities like:

- Ahmedabad

- Surat

- Delhi

- Hyderabad

- Chennai

- Kolkata

- Vadodara

- Nagpur

In many of these cities, students prefer a mix of local coaching and online CFA classes. Online learning has made it possible to access top faculty without relocating to bigger cities. Even students from smaller towns are now preparing seriously for CFA and competing at a global level.

The trend is clear – CFA is no longer limited to a few metro cities. Aspirants from across India are taking it seriously, and with the right classes and consistency, location is no longer a barrier.

This video breaks down some of the most common CFA exam myths in 2025 and explains the reality behind them. From exam difficulty and passing rates to career opportunities and study strategies, it gives you a clearer picture of what to actually expect from the CFA journey.

CFA Online Classes vs Classroom Coaching

This is one of the biggest decisions students face. Both formats work – the right choice depends on your lifestyle.

| Factors | Choose CFA Online Classes If You | Choose Classroom CFA Classes If You |

| Work schedule | Are working full-time | Have a flexible student schedule |

| Study flexibility | Prefer flexible study timings | Prefer fixed and structured schedules |

| Learning style | Want recorded lectures for revision | Learn better with face-to-face teaching |

| Location | Live in smaller cities or remote areas | Stay in cities like Mumbai, Pune or Bangalore |

| Class timing | Need weekend or self-paced learning | Can attend regular classroom sessions |

| Discipline level | Can study independently with guidance | Need structured discipline and routine |

| Interaction | Comfortable with online interaction | Want peer competition and a classroom environment |

| Monitoring | Prefer self-paced progress | Need regular monitoring and supervision |

Many candidates today combine both: Live online sessions + recorded revision + self-study. That hybrid approach works extremely well.

Also Read: Everything you need to know before planning CFA in Delhi.

What Students Look For in the Best CFA Classes in India

Students searching for the best CFA classes in India usually compare three main factors:

- Faculty quality

- Results and reviews

- Support and mentorship

Good institutes offer:

- Structured learning plans

- Doubt-solving sessions

- Regular mock exams

- Performance tracking

- Career guidance

When looking for the best classes for CFA, focus on teaching quality and support rather than just brand name.

How CFA Coaching Classes Improve Your Passing Chances

Let’s be honest here. CFA is not impossible, but it is demanding. And most candidates who clear all levels successfully follow structured preparation.

Joining the right CFA coaching classes helps because:

- You follow a timetable.

- You don’t waste time figuring out what to study.

- Difficult concepts are explained clearly.

- Mock tests simulate real exam pressure.

- You stay consistent for months.

Consistency is the biggest success factor in CFA. Good classes help you maintain it.

Benefits of Joining CFA Classes Early

Starting early gives you a huge advantage. When you join CFA coaching classes early:

- Concepts feel easier

- Preparation feels less stressful.

- Confidence improves

- You perform better in mocks.

- Interview readiness increases

Students who begin preparation 6 to 9 months before exams usually feel more confident.

If you’re wondering whether it’s realistically possible to clear CFA while working, this video explains a practical 2-hour-a-day study plan that helps working professionals stay consistent without burnout. It walks you through how to manage time effectively, build a daily routine and make steady progress even with a busy schedule.

CFA Classes for Working Professionals

Many working professionals pursue CFA to switch or grow in finance careers.

If you’re working full-time, the best option is:

- Weekend CFA classes

- Online CFA classes

- Recorded lecture access

- Structured study plans

Consistency matters more than study hours. Even 2-3 focused hours daily with proper coaching can deliver strong results.

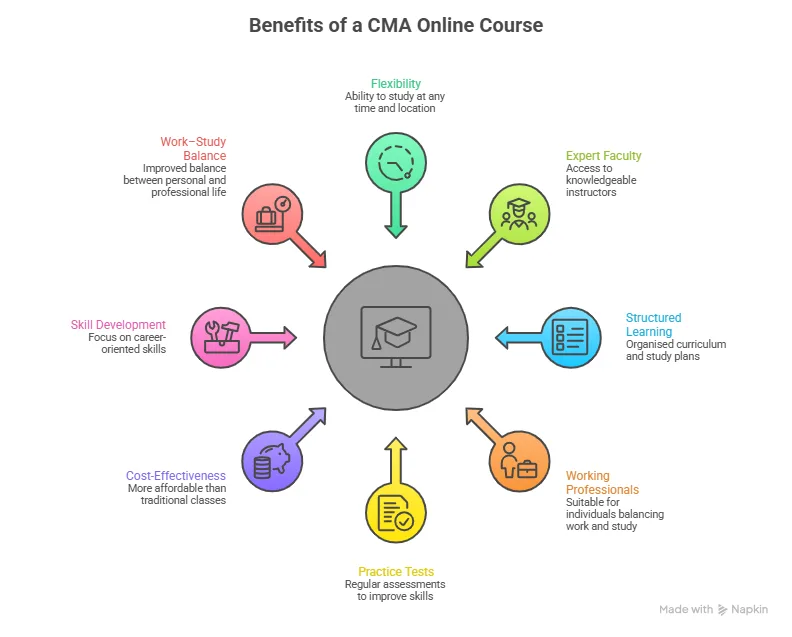

Are Free CFA Classes and Resources Enough?

You’ll find many CFA free online classes and YouTube lectures. They’re useful for:

- Basic understanding

- Topic revision

- Exploring CFA before enrolling

But relying only on free content can be risky because:

- No structured plan

- No mock CFA tests

- No mentorship

- No accountability

Most successful candidates use free resources as supplements, not replacements.

Also Read: How to prepare for CFA Level 1 Exams.

How to Stay Consistent During CFA Preparation

Joining CFA classes is just the first step. Staying consistent is what gets results. Simple tips:

| CFA Study Habit | Why It Matters |

| Follow a weekly study schedule | Keeps preparation organised and consistent |

| Revise regularly | Improves retention and concept clarity |

| Solve practice questions | Builds accuracy and exam confidence |

| Take mock tests seriously | Enhances time management and performance |

| Avoid last-minute cramming | Reduces stress and improves understanding |

CFA preparation is a marathon, not a sprint. Little daily progress leads to big results.

Is Joining CFA Classes Worth It?

If you’re serious about clearing CFA levels and building a finance career – yes. The right CFA classes:

| Benefits | How It Helps You |

| Save time | Follow a clear and structured study plan |

| Reduce confusion | Get expert guidance on difficult topics |

| Improve confidence | Regular practice and mock tests build confidence |

| Increase passing chances | Structured preparation improves exam readiness |

| Keep you disciplined | Fixed schedules help maintain consistency |

Think of coaching not as an expense, but as an investment in your career.

CFA Preparation Timeline With Coaching

If you’re joining CFA classes, here’s a realistic timeline most candidates follow:

| CFA Preparation Stage | Timeline |

| Concept learning | First 3-4 months |

| Practice questions | Next 2 months |

| Mock tests & revision | Last 1-2 months |

Most candidates spend 300-400 hours per level. With structured CFA coaching classes, this becomes much easier to manage.

This video explains how pursuing CFA can help you move towards ₹30 LPA investment banking and finance roles over time. It breaks down the skills you build through the CFA program, the kind of roles you can target after each level and how consistent preparation can position you for high-paying opportunities in the finance industry.

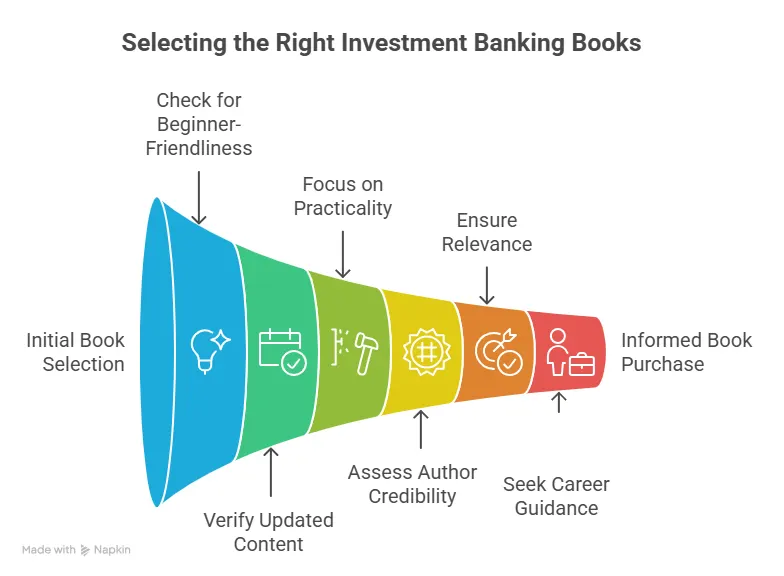

How to Choose the Best CFA Classes Near You

Search for “CFA classes near me”, and you’ll see hundreds of options. But not all coaching is equal. The right CFA classes should make your preparation structured, not stressful. Here’s how to choose wisely.

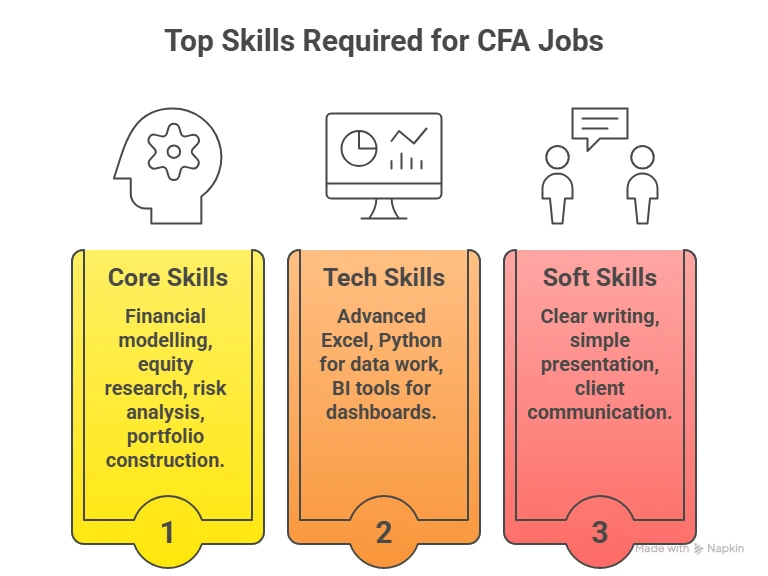

Check Faculty Experience

Good faculty can simplify complex topics like derivatives, portfolio management and fixed income.

Before enrolling, check:

- Teaching experience

- Student reviews

- Demo lectures

- Industry background

Strong faculty = faster concept clarity.

Look for Structured Study Plans

The CFA syllabus is vast. Random studying rarely works.

The best classes for CFA offer:

- Weekly schedules

- Topic-wise coverage

- Revision plans

- Mock test calendars

This keeps you consistent and prevents last-minute panic.

Mock Tests and Practice Support

Mock exams are critical. Choose a CFA Institute that provides:

- Chapter-wise tests

- Full-length mock exams

- Performance analysis

- Exam strategy sessions

Practice improves accuracy and time management.

Doubt Solving and Mentorship

Many students struggle not with studying, but with staying consistent. Good coaching institutes offer:

- Doubt-solving sessions

- Mentorship support

- Performance tracking

- Study guidance

This extra support makes a big difference.

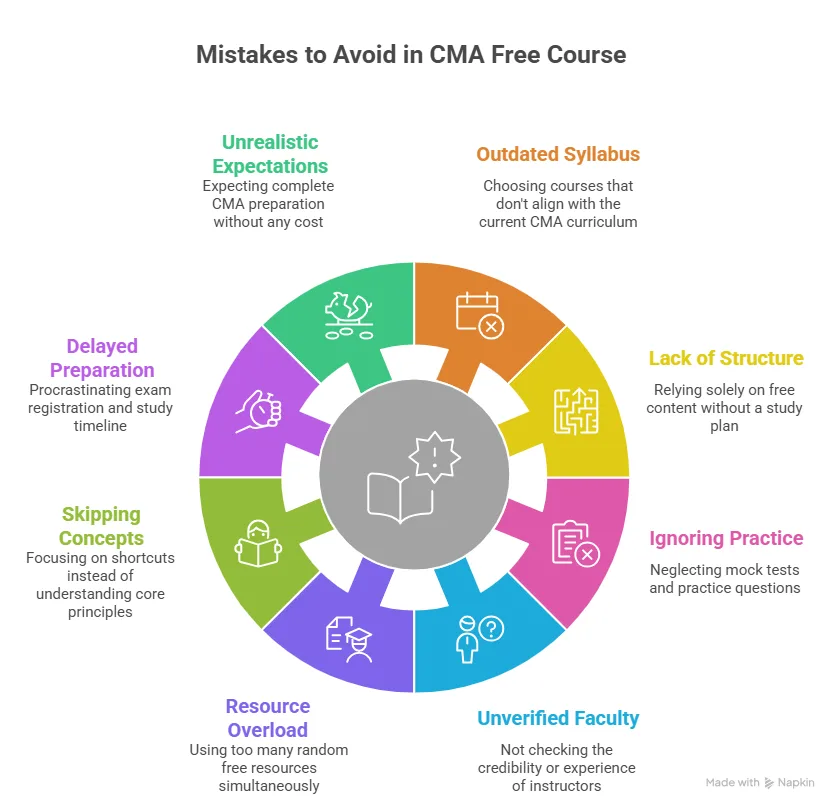

Mistakes Students Make While Choosing CFA Classes

Most students make similar mistakes when selecting coaching.

| Mistakes to Avoid | Why You Should Avoid It |

| Choosing only based on low fees | Low cost may compromise teaching quality and support |

| Joining without demo classes | Demo sessions help evaluate teaching style and clarity |

| Ignoring faculty quality | Strong faculty ensures better concept understanding |

| Relying only on recorded lectures | Lack of live interaction can slow learning |

| Not checking mock test support | Mock tests are essential for exam readiness |

| Following friends blindly | Choose classes based on your own learning needs |

The best CFA classes for you are the ones that match your learning style and schedule.

Also Read: CFA vs CPA – which finance certification is better for your finance career?

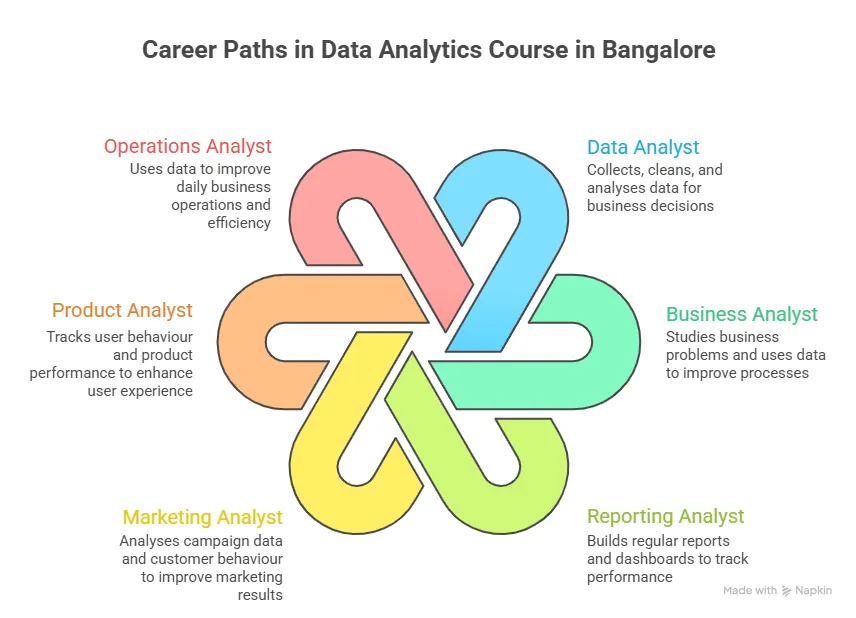

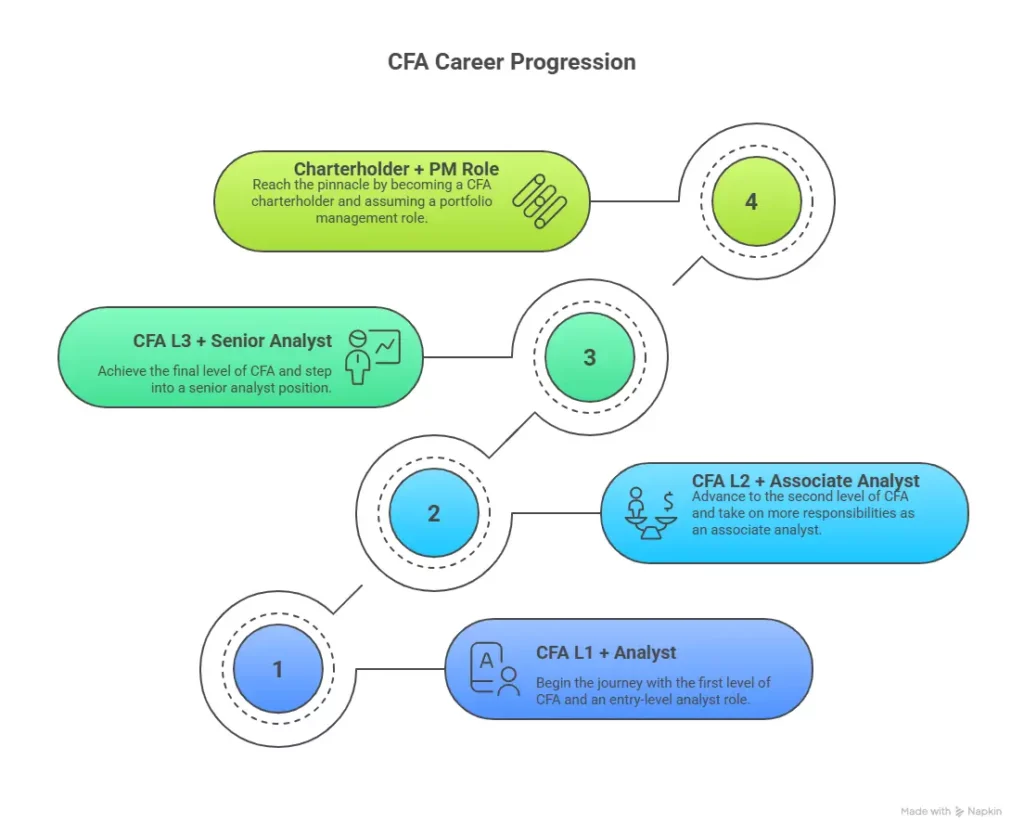

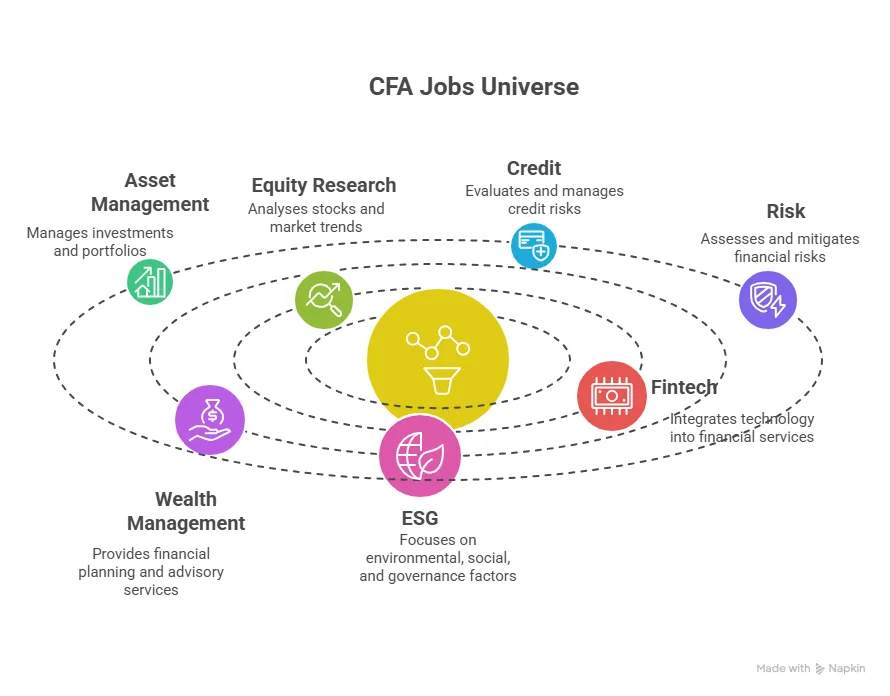

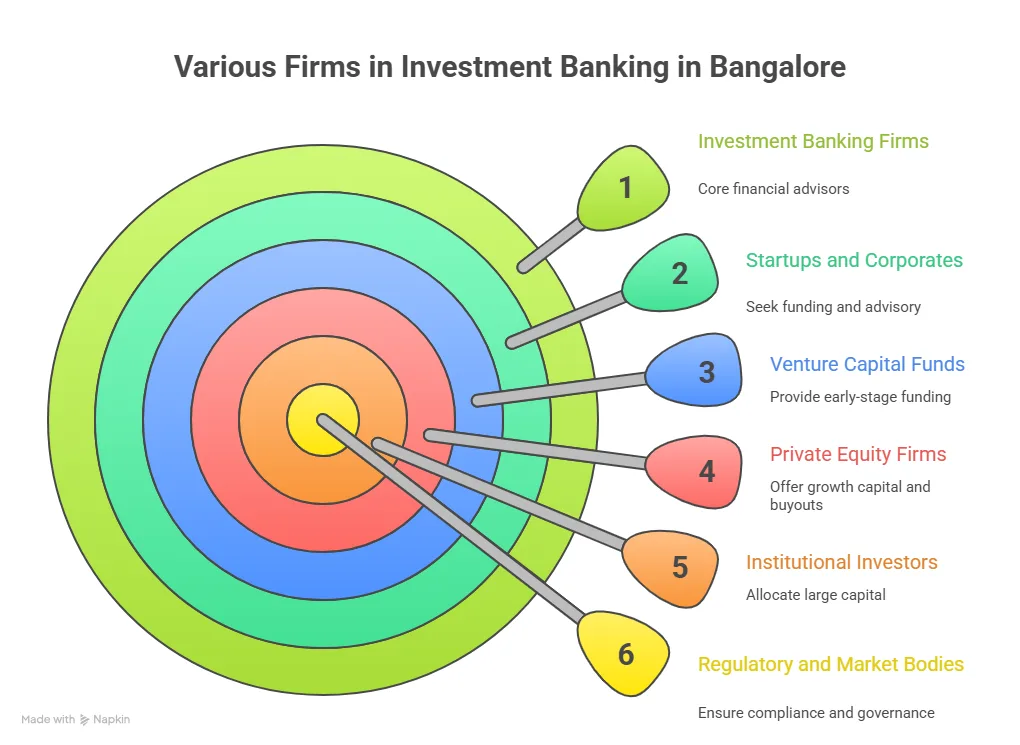

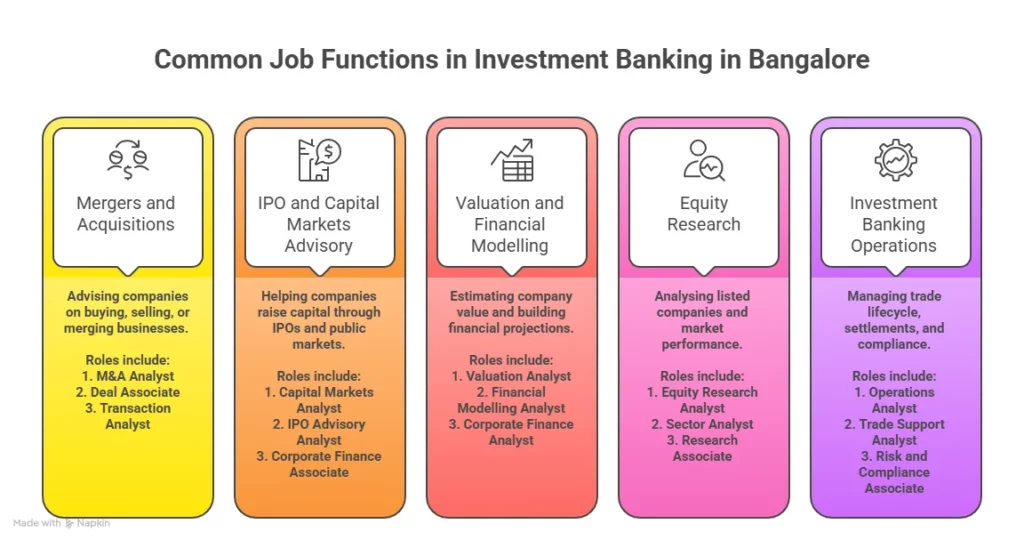

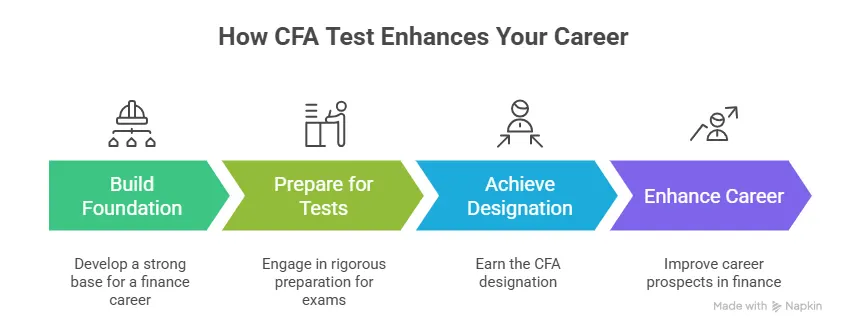

Career Opportunities After Completing CFA

Students join CFA exam classes with one goal in mind – building strong CFA careers. Once you clear the CFA levels, career opportunities open across multiple domains.

| Role | Where You Can Work |

| Investment Analyst | Asset management firms |

| Equity Research Analyst | Brokerage & research firms |

| Portfolio Manager | Wealth management companies |

| Financial Analyst | Corporates & MNCs |

| Risk Analyst | Banks & financial institutions |

| Investment Banking Analyst | IB & advisory firms |

The CFA charter is globally recognised, which means career options are not limited to India.

What Salary Can You Expect After CFA?

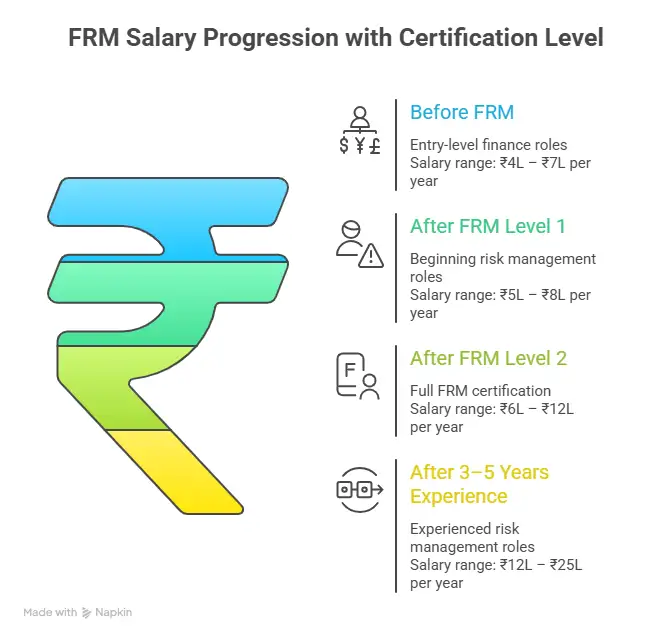

The CFA salary in India depends on the CFA level cleared, experience, skills, and your location.

| Experience Level | Average Salary |

| CFA Level 1 cleared | ₹5 – 8 LPA |

| CFA Level 2 cleared | ₹8 – 15 LPA |

| CFA Charterholder | ₹15 – 35 LPA+ |

Top roles in portfolio management and investment banking can go significantly higher. This is one reason demand for CFA classes in Mumbai, Pune, and Bangalore continues to grow.

If you’re curious about how salaries typically progress after clearing each level, this video explains the salary scope after CFA Levels 1, 2 and 3 clearly and realistically. It covers what kind of roles you can expect, how compensation increases with experience and how the CFA charter can boost your long-term career growth.

Why Choose Imarticus Learning for CFA Classes

When you’re preparing for something as demanding as the CFA program, the institute you choose plays a big role in how smooth – or stressful – your journey feels. Many students today look for coaching that goes beyond just lectures and actually supports them through the entire preparation process.

This is where Imarticus Learning stands out for many CFA aspirants across India.

Why students prefer Imarticus Learning:

- One of the biggest advantages is that the program is designed with a strong industry focus.

- You get access to the official course material from Kaplan Schweser.

- India’s first and only approved prep provider for the top 5 accounting and financial certifications.

- Dual teacher support model with faculty and mentor for one-to-one support.

- Pre-placement bootcamp after successfully clearing the CFA Level 1.

- Industry-led program with a joint certification with KPMG in India.

FAQs About CFA Classes

Before joining CFA classes, most students have practical questions about preparation time, coaching effectiveness, online learning and career outcomes. Here are some of the frequently asked questions asked by CFA aspirants to help you make a more confident and informed decision.

Is CFA worth it in 2026?

Yes, and demand is growing rapidly. With global finance roles expanding and Indian finance professionals moving into international markets, CFA continues to be one of the most respected finance certifications. It is especially valuable for careers in Investment banking, Portfolio management, Equity research, Wealth management, and Global finance roles. This rising demand is one reason searches for the best CFA classes in India continue to grow every year.

Do CFA classes guarantee success?

No coaching can guarantee passing. But the right CFA classes, like Imarticus Learning, significantly improve your chances. They help you stay disciplined, cover the syllabus on time, practise consistently, avoid common mistakes, and stay motivated. Your effort, combined with the right guidance, gives you results.

Are CFA classes necessary to clear the exam?

No, it is not mandatory, but extremely helpful. Many candidates clear CFA with coaching because structured learning and mock tests improve preparation and confidence.

What should I look for before joining CFA classes?

Before enrolling, check faculty experience, demo lectures, mock test support, student reviews and structured study plans. Choosing classes based on teaching quality and support is more important than choosing based only on fees.

Which city has the best CFA classes in India?

Major cities like Mumbai, Pune, Bangalore, Delhi and Ahmedabad have strong CFA coaching options. However, online CFA classes with Imarticus Learning now allow students to learn from anywhere.

How many months are needed for CFA preparation?

Most candidates prepare for 4 to 6 months per level. With proper CFA classes and consistent study, this timeline becomes manageable.

Are CFA online classes effective?

Yes. Good online CFA classes provide live lectures, recordings, mock tests and doubt solving. Many working professionals prefer this flexible format.

Can I prepare for CFA while working full-time?

Absolutely. Many candidates prepare with weekend or evening CFA classes. Consistency matters more than daily study hours.

Choose the Right CFA Classes For Success

Preparing for CFA is a serious commitment. But with the right guidance, it becomes far more manageable. Good CFA classes don’t just teach concepts. They help you stay disciplined, practise regularly and build confidence for the exam.

Whether you choose the best classes for CFA in Mumbai, Pune, Bangalore or online, choose your learning format, focus on quality teaching, structured preparation and strong mock test support. Start early. Stay consistent. Trust the process. That’s how most successful CFA candidates clear all levels and move into high-growth finance careers.

Choosing the right CFA classes can shape your preparation and confidence. Explore a structured CFA course, and make your journey smoother.