Taking your first step into the ruthless arena of finance starts with an über first step: nailing the investment banking interview. Cut-throat competition and shoot-from-the-hip expectations will have you primed to impress from question number one to handshake number one. In this guide, we will dissect the most sought-after interview questions of the investment bank, quiz you for customised finance job interview advice, show you how to write a winning investment banking resume, and guide you through steps to achieve success at finance placements.

This guide is your passport to success if you are a graduate or early career candidate looking for your dream job.

Understanding the Investment Banking Interview Process

The investment banking interview process typically follows a sequence of tough phases. The following can be expected:

- Application Screening: CV and cover letter screened for presentation and appropriateness.

- Aptitude or Online Tests: Tests of numeracy, verbal skill, and logical reasoning ability.

- First-Round Interviews: Technical questions as well as behaviour questions.

- Super Day or Final Round: A sequence of consecutive interviews with different team members, including senior bankers.

Interviewers want to see three things: advanced financial acumen, analytical thought, and culture fit. That is why every question in investment banking interviews is designed to test your crunch time capability.

Most Common Investment Banking Interview Questions (And How to Answer Them)

You will be asked a combination of technical, behavioural, and market questions. A few of the most common high-frequency ones are listed below:

Technical Questions

- Walk me through a DCF.

- How would you value a company with no revenues?

- What are the three statements and how are they related?

Pro Tip: Systematic frameworks. For instance, to delineate valuation, apply intrinsic (DCF) and relative (comps, precedent transactions) approaches.

Behavioural Questions

- Describe a story when you had to manage an awkward team member.

- Why do you wish to work as an investment banker?

Tip: Take on the use of the STAR method (Situation, Task, Action, Result) in giving brief, piercing, and effective answers.

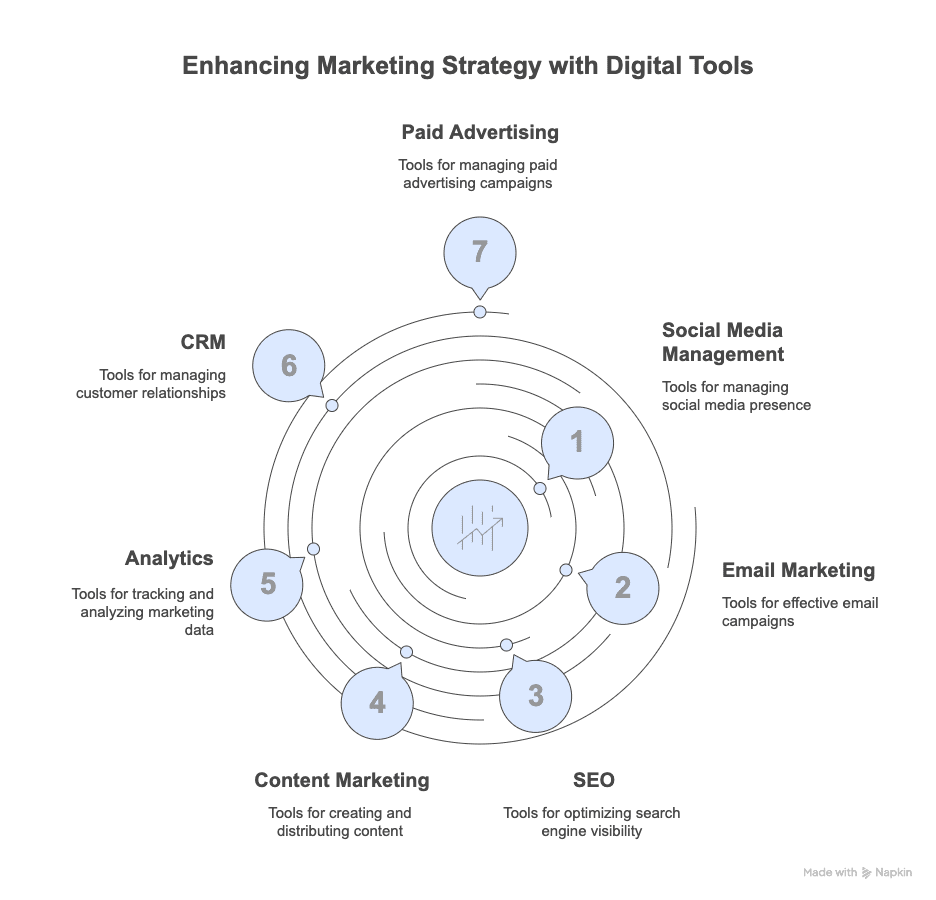

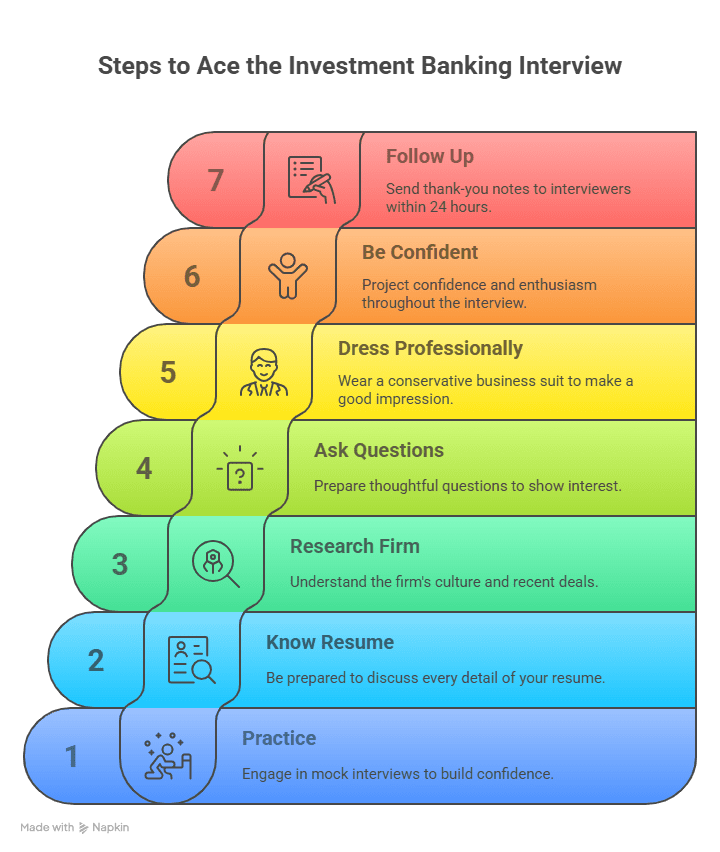

Finance Job Interview Tips That Work

Below are tested finance interview tricks embraced by professionals who have coached thousands of career seekers to interview successfully for top IB jobs:

- Know Your Resume Inside Out

Everything and anything put on it can be requested to justify—so be certain in giving the reason and background behind each line.

- Read Financial News Carefully

Keep current on IPOs, mergers, rate increases, and worldwide market trends.

- Mock Interviews

Practice mock interviews with a friend or guide. Emphasize delivery and confidence.

- Mastery of Mental Math

Unorthodox mental math is required in technical rounds—if the position involves equity research or financial modeling.

- Dress the Part

Impressions are everything. Dress professionally, formal wear unless otherwise specified.

How to Create a Winning Resume for Investment Banking

Here’s how to make it a winner:

| Key Element | Description |

| Quantified Achievements | Include results with numbers — e.g., “Saved 20% operational costs via financial audit” |

| Action-Oriented Verbs | Use words like “analysed”, “executed”, “developed”, “valued” |

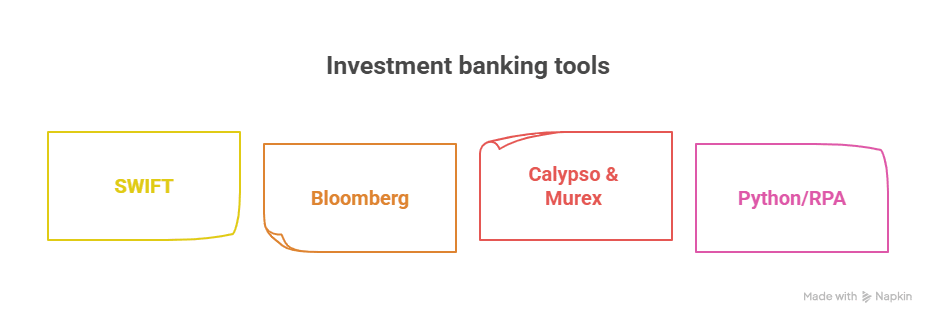

| Technical Tools | Highlight Excel, PowerPoint, Bloomberg, VBA, Python, if applicable |

| Certifications | List relevant courses like CFA Level 1 or CIBOP™ |

Bonus Tip: Utilise a clean, one-page design and customise your resume for each opportunity.

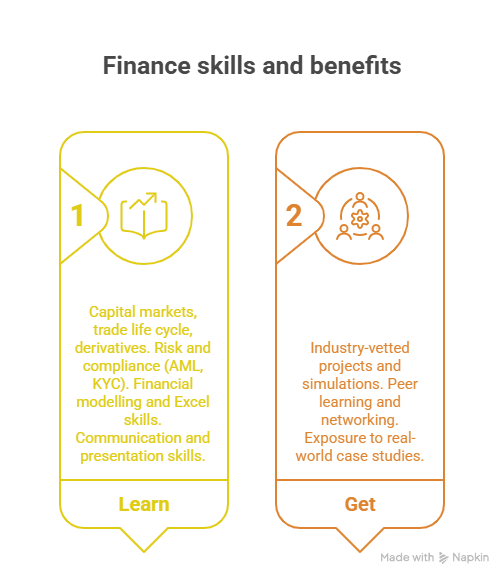

How the CIBOP Program Can Give You a Competitive Edge?

The Imarticus Learning Certified Investment Banking Operations Professional (CIBOP™) program is a champion. It gives students industry-sponsored on-the-job training and project work that placement managers adore.

CIBOP™ Key Stats:

- 100% Job Guarantee

- 60% Average Salary Increase

- 7 Interview Guarantees

- 1000+ Recruitment Partners

- ₹4 LPA Avg. Salary | Up to ₹9 LPA

- 1200+ Batches Completed

- 50,000+ Students Impacted

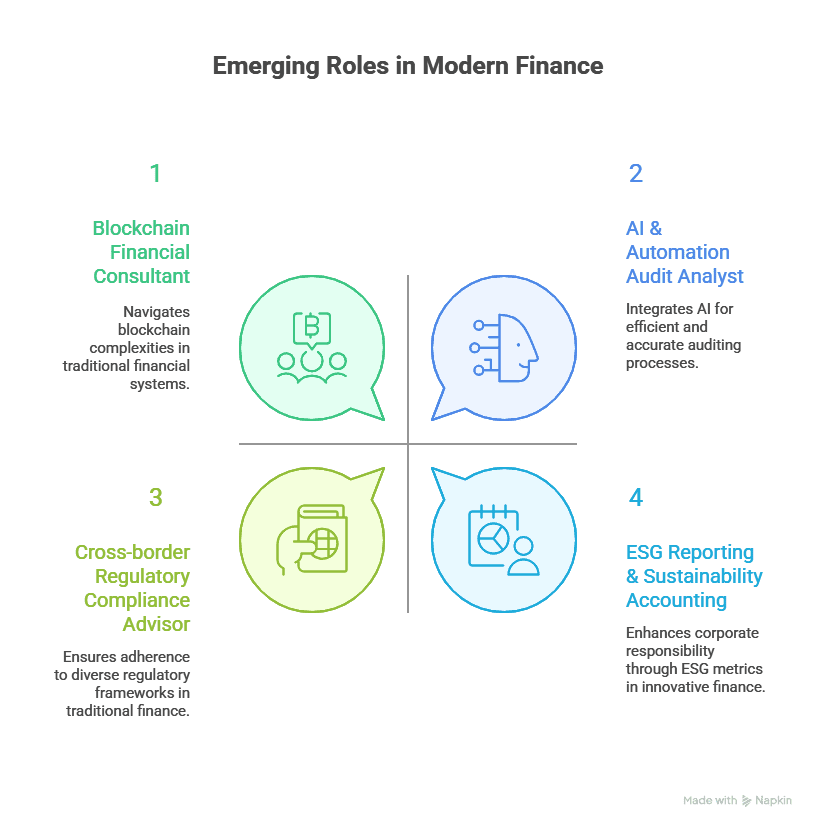

By pointing out situations in day-to-day life such as anti-money laundering, settlements in trade, and risk of compliance, the course increases work-readiness for highly sought-after jobs such as:

- Investment Banking Associate

- KYC Analyst

- Client Onboarding Associate

- Regulatory Reporting Analyst

- Collateral Management Analyst

Building Interview Confidence with Projects and Simulations

Recruiters seek candidates who appear extremely confident with day-to-day usage. CIBOP™ learners rehearse exercises such as:

- Money Laundering Schemes

- Trade-Based Compliance

- Mitigation of Risk in Ethical Banking

These practice exercises hone your industry acumen, so you’ll be interview-ready.

Smart Strategies for Finance Placements

Securing placements into finance careers at great companies is a matter of being ready and visible. Here’s how:

- Use Your Network

Alumni networks, mentors, and LinkedIn will lead you to warm leads.

- Show Certifications

Employers will place more value on job guarantee-backed certifications such as CIBOP™ than on bland MBAs.

- Practice Personal Pitch Decks

Pitch yourself as a brand. Use slide decks to tell your achievements, initiatives, and objectives.

- Always be Interview-ready

Placement calls can come without warning. Pre-suit, materials, and pitch in advance.

Mistakes to Avoid During the Interview

Rehearse repeating as much as you shouldn’t repeat when you rehearse repeating what you must repeat.

- Don’t Ask Technical Questions

If in doubt, let them know that and ask to follow up on them.

- Don’t Chat Excessively

Be neat and concise with answers.

- Don’t Undersell Soft Skills

Numbers aren’t everything — communication, ethics, and teamwork do count.

- Don’t Miss Company Research

Know their recent deals, revenues, customers, and CEOs.

FAQs

1. What are the most critical phases of an investment banking interview process?

The process usually consists of CV screening, online behavioral and technical interviewing, and an aptitude test followed by a final round of interviews popularly referred to as “Super Day,” where interviewees have consecutive interviews with several senior bankers.

2. What type of questions do investment banking interviews usually consist of?

Be on the lookout for a mix of technical finance questions (i.e., DCF, valuation methods), behavioural STAR questions, and market or economic scenario questions to test your knowledge and thinking.

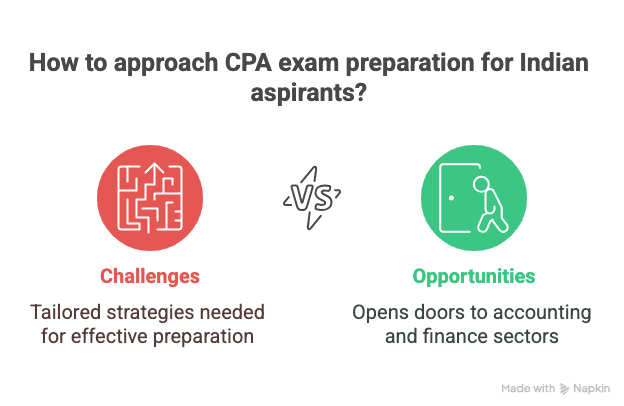

3. How do I prepare for technical investment banking interview questions?

Refreshes knowledge of the financial modelling fundamentals, principles of accounting, methods of valuation such as DCF and comparables, and mental maths proficiency. Take a structured course like CIBOP™ to get exposed to experiential learning.

4. How does one make a resume look good for investment banking interviews?

Use action verbs, quantify your contribution, list the relevant certifications like CFA or CIBOP™, and emphasize technical tools like Excel, VBA, and Bloomberg. Dress your resume down to one crisp, well-fitted page.

5. Are the soft skills useful in investment banking interviews?

Yes. Communication, team work, ethics, and leadership are tested with commonality along with the finance knowledge. The candidate possessing good hard and soft skills is noticed during placements.

6. What is the CIBOP program and how can it assist in interviews?

Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) offers 100% job assurance, live projects, mock interviews, and industry training that prepares candidate profiles for real investment banking operation roles.

7. What are some common mistakes to be avoided in finance interviews?

Do not be too long-winded, under-prepare for the company, fail to mention soft skills, or make technical shots. Remain calm, brief, and in times of doubt, state your willingness to follow up after researching.

Conclusion

Memorisation isn’t the key to acing all investment banking interview questions. It’s more about understanding what the interviewer truly desires — clarity, credibility, business sense, and preparedness. With the proper attitude, mock drilling techniques, a street-smart investment banking resume, and instruction from a program such as CIBOP™, your path to finance placements becomes not just feasible but worthy. So go ahead and make your dream of being a part of a world-class investment bank or finance firm today. Upskill, get set, and make your mark.