Fraud has now become an indispensable concern in business and corporate entities. By 2020, more than 47% of US companies have experienced fraud. Another 35% were compelled to pay bribes to sustain the market.

Fraud is hence a widespread risk that needs robust methods to curb immediately. It not only harms business continuity but is largely responsible for ruining reputations. This is where internal control comes in. It minimises the risks of fraud and immediately mitigates any potential harm from the business.

In this article, we’ll learn about internal controls and how one can prevent them through robust fraud protection models. You’ll also understand the significance of B.Com in investment banking and how it would be efficient when it comes to fraud prevention.

What are Internal Controls in Accounting?

In simple terms, internal controls deal with looking after business policies and procedures. It helps to protect the organisation’s resources to detect and mitigate fraud and deficiency. It also ensures reliability and accuracy in accounting which makes data operatives easier. Finally, it plays a major role in compliance security and performance evaluation of the organisation to ensure a seamless business practice.

Not only this, but internal control is also responsible for judging the effectiveness of the organisation’s business practices. It includes five important components for this assessment- risk management, control environment, control activities, communication and monitoring and finally, information.

What are the 5 Pillars of Internal Control in Accounting?

Internal controls in accounting operate on five integral pillars that help to set the tone of the organisation. It creates a sense of control consciousness among the people. Here are the five pillars one should keep in mind before imposing internal control in accounting.

Risk Management: This is primarily the process of controlling and identifying the risks inside and outside the organisation. It is also a robust method to curb any upcoming risks and mitigate them to have an effective internal control system. This requires constant management and assessment of risks and evolving the business environment according to those risks.

Control Environment: This is primarily established by the administration of the organisation. They help in setting the tone of the institution and help to establish a controlling consciousness. It depends on these few factors. They are:

- Ethical values and integrity.

- Competence and commitment.

- Operating style and leadership ideologies.

- Assigning authority and responsibility.

- Development among the people.

Control Activities: These are policies and procedures that ensure management directives are carried out efficiently. They help to ensure necessary actions are taken to address and mitigate risks aligning with the objectives of the business entities. They occur throughout the organisation at every level to modify the functions according to the situation. It includes a wide range of activities like approvals, authorisations, reconciliation, verifications and reviewing the operating performances.

Communication and Monitoring: in this case, all the personnel of the organisation must receive a clear message from the top management to mitigate any misinterpretation. Other than this, the internal control systems should be monitored with scrutiny to assess the system’s performance quality over time. This would include regular management and supervisory activities which will improve the internal control system performance significantly.

Information: To run a smooth internal control system, pertinent information should be identified, communicated and captured properly. This would enable the people to carry on with their responsibilities properly and would ensure minimal amounts of risks within the organisation.

Types of Fraud

Fraud or corporate fraud deals with illegal and deceptive actions committed by both internal and external perpetrators for their own gains. Unlike mistakes, frauds generally involve intentional malicious acts. It can not only harm the organisation but is equally harmful to various customers, employees, partners, creditors and investors.

Here are some examples of frauds bordering on asset misappropriation, corruption and financial statements.

Corruption

This type of fraud primarily involves employees exploiting their position to influence business transactions to reap personal benefits. Extortion, Bribery and conflict of interest are one of the common types of corporate fraud.

Misappropriation

Also known as insider fraud, this is primarily committed by a director of the company or an outside third-party vendor. This fraud adheres to stealing cash before recording it in the company accounting books. The common types of asset misappropriation fraud are:

- Stealing company data, business assets and intellectual property.

- Implementing a ghost employee and creating false invoices.

- Making false reimbursement claims.

- Stealing various non-cash assets.

Financial Statement Fraud

In this case, employees or management tend to create fictitious revenues and hide liabilities. The main goal here is to paint a false picture of the financial performance of the organisation and boost the company’s market value to attract new investors.

It is one of the least common types of fraud but attracts the most attention during its occurrence.

5 Ways of Protection Against Fraud in Accounting

Internal control improvement holds the key to preventing fraud in the world of accounting. Here are some ways one can prevent fraud. They are:

Ethics and Conduct

ACFE has ruled that a robust code of conduct is the pinnacle of good fraud control management. It sets the tone of the organisation and maps out the appropriate behaviours. It also helps to safeguard company reputations and avoid legal litigation.

Internal Reporting System

A strong internal reporting system like a confidential hotline or an internal website or portal can help in curbing fraudulent activities. The system should be completely anonymous so that whistleblowers do not hesitate to report any suspicious activities to employers.

Duty Segregation

Duty segregation or separation of duties is also a crucial form of internal control that reduces fraud risks. It loosely translates to not burdening one person with multiple duties to increase fraudulence in the organisation.

Internal and External Audits

Solid internal and external audits are also a viable method to curb the risk of fraud. Management reviews and evaluations by an impartial external auditor would bring objectivity to the procedure and make the internal controls of the organisation much more robust. However, both external and internal auditors should work hand in hand to analyse any fraudulent situations and make appropriate changes to policies and procedures.

Documentation

Documentation helps to reduce fraud because of its reliability and visibility. This makes it easier to make various transactions seamlessly and maintains transparency. Other ways to use documentation to prevent fraudulence are:

- Using ‘deposit only’ stamps for incoming checks.

- Not using a signature stamp.

- Requiring two or more signatures on the check to withdraw a specific amount.

- Listing all checks on a long before handing them to authorised personnel.

- Requiring the supervisors to approve employee timesheets before processing payroll.

- Examining all cancelled checks to ensure that third parties are legitimately recognised.

Conclusion

Preventing fraudulence might be a challenge. However, maintaining a robust internal system is extremely important when it comes to maintaining the integrity and reputation of the organisation.

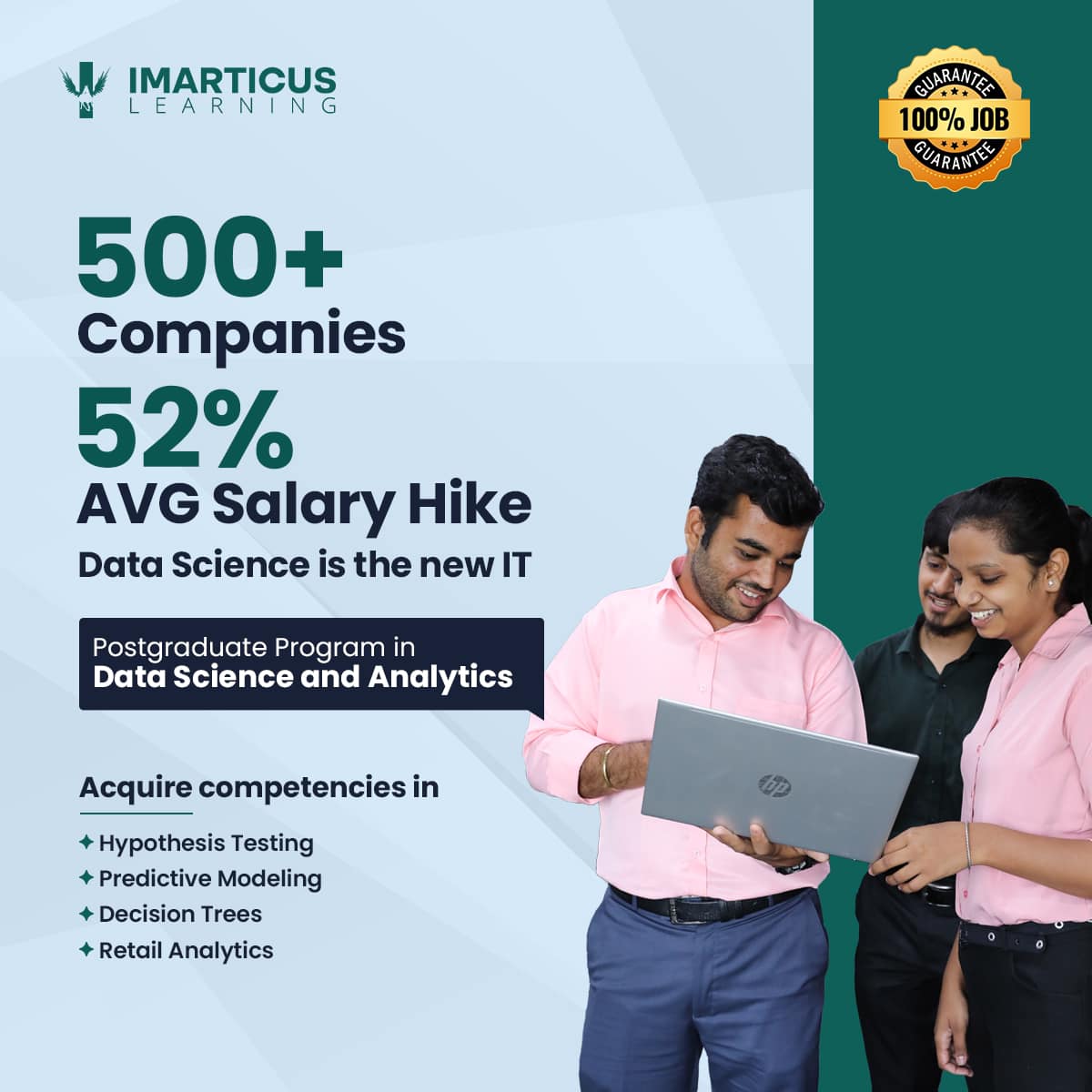

If you are wondering about various career options after 12th, check out Imarticus Learning’s B.Com course from Rathinam College of Arts and Science. You would be guided to your path of financial brilliance and pursue your dream career to do B.Com in Investment Banking.

To know more, check out the website right away!