Last updated on November 14th, 2025 at 10:14 am

Are you wondering, “What is CMA?” Commerce and Finance graduates often ponder this as a career path. Certified Management Accountant (CMA) is a prominent accounting and finance career path. It is globally recognised and opens doors to dynamic, leadership-oriented roles and global career opportunities in the field of management accounting and financial management.

In this fast-paced global market, driven by the rise in unicorn startups and the tremendous growth of Big 4 Accountancy Firms, there is a surge in demand for qualified accounting, management, and financial professionals. Amidst this demand for qualified professionals, many are asking, ‘What is CMA and how can it propel my career?’

CMA is one such professional qualification that is emerging and gaining international recognition across the industry. This guide will explain why CMA is projected to be the top career choice in 2025, covering its syllabus, exam details, scope, and career path.

What is the full form of CMA?

The full form of CMA is Certified Management Accountant.

The CMA course has two variants. Recognised institutions offer both.

- IMA (Institute of Management Accountants) offers CMA in the US and has global recognition in over 150 countries.

- ICMAI (Institute of Cost Accountants of India) offers CMA in India with limited international exposure; however, it is recognised by IMA.

CMA was previously known as the Institute of Cost and Works Accountants (ICWA), which was offered by ICWAI. ICWAI is now renamed The ICMAI (Institute of Cost Accountants of India).

So, with these different forms, what exactly is CMA’s core function in the business world?” or “Beyond its organisational structure, what is CMA in terms of its practical application?” Let’s also address the fundamental question: What is CMA?

What is CMA?

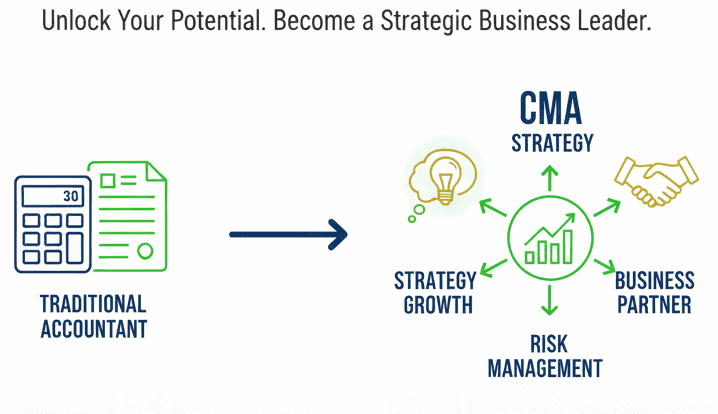

A CMA provides critical insights that drive profitability and sustainable growth within any organisation. CMAs are trained to analyse financial performance, predict scenarios, minimise risks, and help leadership teams to achieve operational efficiency and strategic business decisions.

What sets CMAs apart from other accountants is their focus on analysis and strategic influence. CMAs are trusted to shape the financial future of a business. As a CFA, their role carries significant analytical and strategic weight. Executive leadership, operational managers, and investors depend on their insights to make informed business decisions.

Imagine this: You’re planning a monthly household budget. You don’t just note how much you spent last month; you also decide, “If electricity bills rise, we’ll cut back on takeout. If there’s a bonus, we’ll save half and upgrade the fridge.” That’s what CMAs do for companies — they don’t stop at recording, they prepare for “what ifs.”

If you’re serious about CMA, here’s a bonus -Imarticus Learning is a Gold Learning Partner of IMA, which means you get official, trusted training with globally recognised guidance.

What is the CMA Course?

Having covered the basics, let’s explore in more detail: What is the CMA course, and how does it equip professionals for success?

CMA is a professional course offered by ICMAI to develop skilled professionals in the field of Cost and Management Accountancy and to perform exceptional service in the developing economy.

This often leads to the question: What is CMA offering that traditional paths might not? Careers in traditional financial fields like accounting, auditing, or taxation can become stagnant, with limited opportunities. The Certified Management Accountant (CMA) offers a fresh path with a highly recognised professional certification in the international market, equipping individuals with a comprehensive skill set to excel in management accounting, financial planning, decision analysis, and control.

In 2025, the demand for CMA professionals is soaring as companies need certified professionals for cost optimisation and improving operational efficiencies to maximise their profits in this emerging market.

Key Features of the CMA Program

When I look at the CMA (Certified Management Accountant, US CMA) credential, what stands out to me is how it’s designed to shape finance professionals into strategic leaders rather than just technical experts. When we consider these features, it becomes clear why many professionals are asking: What is CMA’s unique value proposition in today’s finance landscape?

One of the most underrated features is how adaptable CMA is across industries. I’ve worked with manufacturing setups where cost control is king, and I’ve advised in tech companies where forecasting and scenario analysis matter more. The CMA toolkit is broad enough to make you valuable in both places. That kind of versatility is rare in finance qualifications, and it’s what makes this certification future-proof.

And then there’s the global respect. I like to compare it to having a “common business language.” Wherever you go, whether it’s a consulting firm in London, a tech company in Bangalore, or a bank in New York, the CMA designation signals that you’re not just another accountant, but someone who understands the wider game of business. This opens doors that you didn’t even know existed when you started.

Finally, job security doesn’t come from a piece of paper. It comes from being the kind of professional who is difficult to replace. CMA equips you by helping build a comprehensive mindset, like control, analysis, strategy, and ethics. It strengthens your personality to hold up under pressure, to adapt to change, and to keep adding value – something that the present-day employer seeks!

Here are some of the features of CMA I find most important:

Comprehensive & Strategic Curriculum

I see the CMA syllabus covering much more than traditional accounting. It combines areas like strategic planning, risk management, decision analysis, performance management, and advanced cost control. To me, this makes it clear that CMAs are trained to think beyond the numbers and contribute to business strategy.

Think of this like when you’re cooking dinner for friends, you are following a recipe; tasting, adjusting salt, deciding whether to add another side dish depending on how many guests show up, etc. Similarly, preparing for a CMA helps you learn how to constantly monitor, adjust, and align your actions with the bigger picture.

Global Recognition & Credibility

In my view, one of the biggest advantages of the CMA is its global reach. Since CMA is backed by IMA, USA, it is recognised in over 150 countries. This gives professionals the flexibility to pursue careers internationally.

Rigorous Examination Structure

I find the exam format particularly strong-it has two parts that test both multiple-choice knowledge and essay-based application. This balance ensures that candidates aren’t just memorising concepts but also demonstrating how to apply them in real business scenarios.

Ethics & Professional Standards

I like how the program builds in a strong focus on ethics. It reinforces that finance leaders need not only technical expertise but also integrity and accountability.

Hands-On, Real-World Case Studies

From my perspective, the inclusion of case studies is a standout feature. They give learners the chance to practise problem-solving in situations that mirror real corporate challenges.

Technology & Analytics Focus

I also notice that the CMA program keeps pace with modern finance by incorporating analytics, ERP systems, and tech-driven decision-making. That emphasis makes it highly relevant for today’s data-driven roles.

Internship & Industry Immersion Opportunities

I think it’s valuable that learners may gain access to internships with leading firms. This kind of exposure helps them bridge the gap between classroom learning and industry practice.

Money-Back Guarantee / Risk Mitigation

Another aspect I appreciate is how some providers reduce the financial risk of enrolment with refund or guarantee options if a learner doesn’t pass.

Placement & Career-Readiness Support

I see career services as a big plus. Resume workshops, interview preparation, and placement bootcamps make the program more practical and outcome-focused.

Flexible Scheduling & Exam Windows

Finally, I like that the CMA offers flexible exam windows-Jan–Feb, May–June, and Sept–Oct-allowing candidates to plan around their schedules and take the two parts in any order.

How CMA adds value to your career

When I think about the CMA, I don’t just see it as an exam or a certificate I hang on my wall. It is a passport that changed how I looked at business, finance, and even my own career choices. What sets the CMA apart, at least in my experience, is not one single feature but the way multiple dimensions of professional life come together under its umbrella.

For example, the earning potential isn’t just about the extra numbers on a payslip. It’s about the confidence you carry when you walk into a room and know you can argue a financial case backed by global best practices. That confidence almost always gets noticed, and it often translates into better pay.

I’ve seen colleagues without the credential doing the same work, yet the way a CMA articulates solutions makes decision-makers listen differently.

Leadership, too, is not promised on paper-it’s something you grow into. What the CMA does is nudge you out of the comfort zone of pure accounting and into conversations about performance, growth, and strategy.

You stop being the person who “closes the books” and start becoming the one who advises on what to do with the numbers. Over time, that shift is what places CMAs in senior management and leadership tracks across industries.

Strong Conceptual Learning

↓

Practical Application in Business Decisions

↓

Global Recognition and Career Opportunities

↓

Professional Resilience in Changing Markets

↓

Pathway to Strategic Leadership Roles

Is CMA Worth It?

After exploring its features and value, the ultimate question remains: What is CMA truly worth for your career? If you are passionate about costing, management, or auditing but do not want to create a career in the stereotypical Accountant Pathway, CMA is the best option for you. The value of the CMA lies in how closely it aligns with the realities of modern finance. It prepares you for roles where analysis, planning, and decision-making are central.

Think of how you’d approach buying a new phone. You wouldn’t just look at the price tag; you’d compare features, durability, and resale value. A CMA’s role is similar — helping organisations look beyond cost and evaluate the long-term value of every decision.

Employers trust it because it signals readiness for responsibilities that go beyond recording transactions.

| Factor | Benefits CMA Gives in the Real World |

| Credibility | Recognised as a benchmark in management accounting and financial management worldwide. |

| Career Growth | Opens pathways to mid and senior-level roles in planning, analysis, and decision support. |

| Skill Development | Builds expertise in strategic thinking, problem-solving, and financial decision-making. |

| Practical Relevance | Curriculum closely aligned with business performance and management practices. |

| Global Recognition | Accepted across industries and countries, enhancing mobility and opportunities. |

| Return on Effort | A concentrated exam structure allows professionals to qualify in a shorter time frame. |

| Employer Demand | Companies actively seek CMAs for their ability to connect finance with strategy. |

A major reason the CMA is worth pursuing is credibility. A CMA credential reflects discipline, commitment, and the ability to apply knowledge in complex business environments. It shows that you have met rigorous global standards in management accounting and financial management.

CMAs often move into positions that involve planning, forecasting, and strategic support. These are roles with greater visibility and influence, and they often lead to faster progression within an organisation.

The curriculum is designed to sharpen problem-solving and critical thinking. Every concept is connected to improving performance, managing risk, or guiding long-term decisions. That makes the learning experience practical and relevant, rather than confined to academic theory.If you’re passionate about a career in management accounting, pursuing the US CMA is a powerful step.

Did you know?

The CMA doesn’t wait for complaints. It has the power to launch “market studies” – deep dives into entire sectors like mobile apps, care homes, or even the funeral industry! They’re like economic detectives, searching for hidden issues that stop competition from working fairly, even if no one has officially complained yet. If they find problems, they can demand changes!

CMA India vs US CMA

The Certified Management Accountant (CMA) India is offered by the ICMAI. It enables individuals to acquire expertise and skills in the domain of financial planning, analysis, control, decision-making, and professional ethics required to build a dynamic career in the field of cost and management accounting in India. It is recognised within India, some neighbouring countries, and the Middle East. It is highly recognised in the Indian government and the private sector, but is limited to global recognition.

The US CMA is offered by the IMA (Institute of Management Accountants). It enables individuals to gain expertise in the field of financial management and management accounting, to help professionals advance their careers internationally.

This professional certification is regarded as highly reputable in the field of management accounting. It is accepted in over 150 countries, making it the best choice for a career with global opportunities.

Other countries that offer CMA courses are Canada, Australia, the UAE and Saudi Arabia. These programs are local and usually country-specific with a domestic scope. The organising bodies have a Memorandum of Understanding (MoU) with the IMA USA.

You can opt for these CMA courses if you plan to work in that specific country; however, the US CMA offers global exposure and international mobility.

The following explains the difference between a US CMA and CMA India in a more easy-to-understand manner.

| Feature | US CMA | CMA India |

| Governing Body | Institute of Management Accountants (IMA), USA | Institute of Cost Accountants of India (ICAI) |

| Recognised In | 150+ countries | India, some neighbouring countries in Asia, the Middle East, and Canada. |

| Exam Structure | 2 Parts: Financial Planning & Strategic Financial Management | 3 Levels: Foundation, Intermediate, Final |

| Exam Mode | Online at Prometric centres globally | Pen-and-paper mode, biannual exams |

| Global Recognition | High; recognised in 150+ countries | Moderate, mainly India and some international presence |

| Average Salary | Around $107,817 (approx. INR 80-90 lakhs) | INR 6-12 lakhs per year |

| Duration to Complete | 6-18 months | 2-3 years generally; 3.5-4 years including internship |

| Work Experience | 2 years required, can be before or within 7 years after passing | 3 years mandatory, including 15 months internship |

| Pass Rate | Approx. 40-50% | Low, around 10-20% due to course difficulty |

| Focus Areas | Strategic and Financial Management | Cost management, taxation, and regulatory compliance |

| Ideal For | International careers, MNCs, strategic roles | Careers in the Indian market, regulatory compliance |

| Exam Cost | $1,000 – $2,500 | Approx. INR 50,000 – INR 100,000 |

| Continuing Education | 30 hours annually (including 2 hours ethics) | 20 hours annually |

| Job Profiles | Financial Analyst, CFO, Management Accountant | Cost Accountant, Auditor, Tax Consultant |

Candidates can choose between the Indian and the USA variant based on their career choices and interests. You can read the blog to decide which course is better for you: US CMA VS India CMA.

Who Can Pursue CMA?

Now that we’ve established what is CMA and its benefits, let’s look at who can embark on this journey. What interests me the most about the CMA journey is that it doesn’t just test your knowledge; it shapes the way you think about business.

The most common question in the minds of aspirants is:

What is CMA?

What is the CMA course eligibility?

Who can apply for CMA?

What is the eligibility needed for CMA after class 12?

Honestly, it’s not easy when these questions buzz in your mind. So let’s get a clear picture of the eligibility criteria for CMA:

- Age Criteria: Candidates appearing for CMA have a minimum age limit of 18 years.

- Educational Qualifications: Bachelor’s degree from a recognised University, ideally in the field of accounting, finance, business, or a related field, accepted by IMA.

- Experience: You’ll also need at least 2 years of professional experience in management accounting or financial management.

Starting Your CMA Journey – Your Roadmap

No one is confident enough to clear the CMA Exam without following a proper pathway. It takes consistency, a rigorous study routine, strategy, patience, resilience and a clear approach. Many aspirants lose track, but with a strategic approach, the journey is less daunting and a lot more manageable.

- Enrol yourself in a CMA Prep Program: The first step in your journey is most crucial for your success.

- Build your Foundation: Dive deep into the core subjects by attending interactive lessons with dynamic content, quizzes, and exercises.

- Take the help of Live Expert Support: Clarify your doubts from live online classes or dedicated Q&A sessions with experienced instructors.

- Make use of Revision Support: Participate in intensive revision classes focusing on high-weightage topics, quick guides and personalised revision strategies.

- Practice Well: Access practice questions covering all exam topics and take simulated exams under timed conditions to be prepared.

- Register & Clear the CMA Exams: Get the IMA Membership, schedule the exam and successfully pass both parts to officially earn your prestigious US CMA credential.

- Attend Placement Bootcamp: Attend the Resume Building Workshops, grab networking opportunities to connect with recruiters and industry professionals to expand your career network, participate in mock interviews, and receive constructive feedback.

- Get Placed in Global Accounting Firms: Leverage your prep provider’s industry connections for opportunities with top firms.

If you’re looking to elevate your career beyond traditional accounting roles and truly drive an organisation’s success, understanding what is CMA and what it entails is your crucial first step.

CMA Course Duration

One can complete the US CMA Course in about 6 to 12 months for both parts.

A few factors that can reduce or increase the duration for certain candidates:

- Pace of study: Candidates who dedicate 12 to 15 hours per day to self-study or enrol themselves in a professional training institute can complete the course anywhere between a span of 6 to 8 months.

- Prior knowledge: Candidates who have qualified for ACCA or any other IMA (Institute of Management Accountants) recognised course with a similar background can also clear the exam in 6 to 9 months.

- Experience: Candidates with professional experience can complete the course in 6 to 9 months.

- Candidates qualifying for exemptions might have fewer subjects to prepare, which often reduces the study time and thus reduces the course duration.

CMA Exemptions

US CMA rarely offers exemptions. If you hold any professional degree with global recognition or from an organisation that has a collaboration with IMA, you might get a few exemptions. It rewards consistency, discipline, and practical application of concepts across finance, accounting, and strategy.

- Educational Qualifications: Candidates who hold a fully qualified ACCA(Association of Chartered Certified Accountants) credential are exempt from the CMA Exam’s educational qualification requirement.

- Membership: ICMAI CMA Members are exempt from holding an active Membership with IMA.

CMA Course Attempt Limits

- There is no maximum limit for attempts in the US CMA.

- You are required to pass both parts within three years of registration.

- You are required to follow a 30-day waiting period between two attempts.

- If you fail to clear both parts within the eligibility period, you are required to register again by paying the application fees.

US CMA Course Structure

The CMA curriculum tests your understanding and skills of financial and management accounting, preparing you for strategic and leadership roles.

CMA Syllabus – Part 1

CMA Part 1 consists of Financial Planning, Performance, and Analytics:

| Subjects | Weightage |

| External Financial Reporting Decisions | 15% |

| Planning, Budgeting and Forecasting | 20% |

| Performance Management | 20% |

| Cost Management | 15% |

| Internal Controls | 15% |

| Technology and Analytics | 15% |

CMA Syllabus – Part 2

CMA Part 2 consists of Strategic Financial Management:

| Subjects | Weightage |

| Financial Statement Analysis | 20% |

| Corporate Finance | 20% |

| Business Decision Analysis | 25% |

| Enterprise Risk Management | 10% |

| Capital Investment Decisions | 10% |

| Professional Ethics | 15% |

You can also read this blog to get a detailed insight into the CMA syllabus.

CMA Exam Details

The CMA is built around decision-making, analysis, and strategy. This is unlike other accounting qualifications that focus heavily on rules and compliance.

This makes it highly relevant for professionals who want to move into roles where they influence business performance rather than simply report on it. The exam structure is straightforward, globally standardised, and flexible enough to fit the schedule of working professionals.

CMA Exam Pattern

The CMA Exam consists of 500 marks with a duration of 4 hours and is divided into two sections:

- 100 multiple-choice questions carry a 75% weightage.

- 2 Essay-based questions carry a 25% weightage.

- There is no negative marking for MCQs.

- To pass the CMA exams, candidates must score at least 360 out of 500 marks or 72%.

CMA Exam Schedule

The CMA exams are conducted in three testing windows across January-February, May-June and September-October. The exams are proctored online and administered through Prometric Testing Centres across India and worldwide.

Here’s a guide to help you crack the CMA USA certification.

CMA Registration

To take the CMA Exams, you need to first register with the organising institute of CMA.

ICMAI Registration for India

You need to register under ICMAI. The registration is valid for 7 years for Intermediate and Final. If you do not successfully clear the intermediate and final within this period, then you can apply for re-registration under the DE NOVO registration.

IMA (Institute of Management Accountants) Membership for US CMA

To be eligible for the CMA Course, it is mandatory to be an active member registered with IMA.

CMA Fees

Understanding the CMA fee structure is just as important as understanding the syllabus. The CMA journey involves two separate payments – one to Imarticus Learning for your training, and another to IMA USA, the official certifying body that conducts the global exams.

At Imarticus Learning, the CMA course study fee is ₹1,10,000, which covers comprehensive coaching, study material, and continuous exam support. What stands out is the 50% refund assurance – if a learner doesn’t pass even after two attempts, half the fee is returned. That level of confidence in outcomes speaks volumes about the programme’s effectiveness.

The second component is the IMA Board Fee, payable directly to IMA USA in USD, which includes the membership, entrance, and exam fees. As an Imarticus learner, you also receive an exclusive 30-40% discount on these fees, making the international certification far more affordable.

Note: Since IMA fees are charged in USD, the final amount may fluctuate slightly depending on the exchange rate.

A Lesser-known Fact About CMAs:

CMAs are your shield against deceptive deals, as a huge part of their mandate is direct consumer protection! They tackle unfair trading practices, misleading claims, and even aggressive sales tactics, which can hit everyday shoppers.

CMA Career Opportunities & Scope

A CMA certification, unlike other certifications, is a passport to versatile and high-impact career opportunities across the globe. Most people think CMA is just about crunching spreadsheets and minting money. But in reality, it is beyond that and opens doors to unimaginable opportunities like global recognition, diverse roles, high demand in India and even better pay.

Picture a family deciding on a vacation. You balance options — a short road trip that’s cheaper vs. an overseas holiday that’s pricier but memorable. You compare costs, benefits, and timing. In the same way, CMAs help businesses weigh choices and recommend the one that delivers the best value.

CMA Salary in India & Abroad

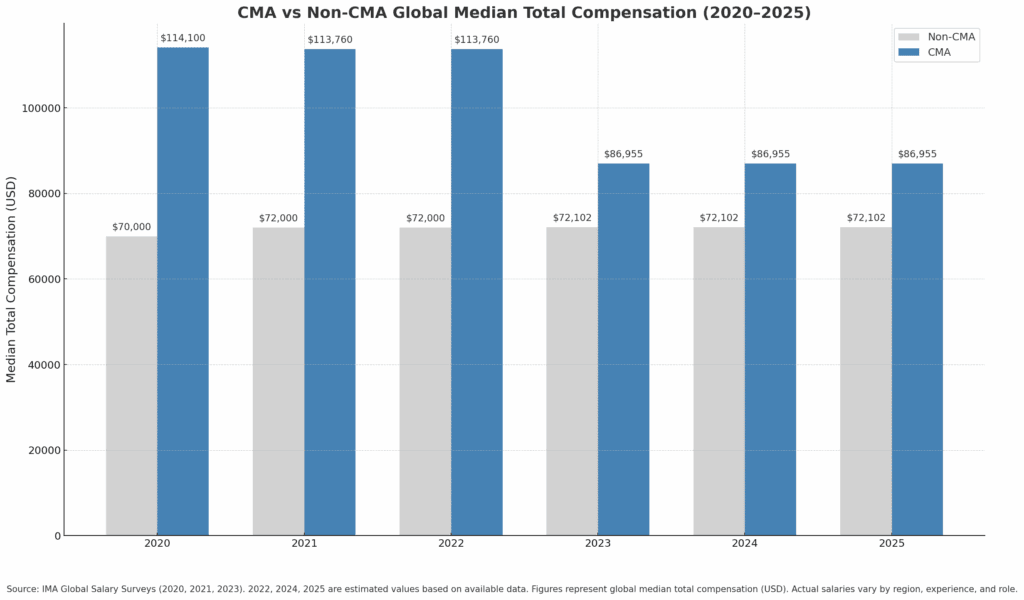

CMAs get a lucrative salary in India, ranging from:

- ₹4-10 LPA for freshers and entry-level professionals, while top-ranking candidates can get ₹17-26 LPA.

- Mid-senior level salary ranges from ₹7-12 LPA and can be higher based on experience.

- Senior professionals earn between ₹15-20 LPA on average, while experienced professionals earn beyond ₹50 LPA-1 crore per annum.

- Entry-level CMAs in the USA earn between ₹40 and ₹ 60 LPA. The average salary for an experienced CMA in the USA ranges between ₹85 LPA and ₹ 1.1 crores.

CMA Job Roles

A CMA qualification unlocks the door to versatile career opportunities. The CMA offers opportunities in accounting, financial management, planning, analytics, information systems, and even consulting. With experience, CMAs can advance to senior leadership positions in various industries.

Some prominent job roles where CMAs work are:

- Costing Manager – ₹8-21 LPA

- Financial Manager – ₹14-21 LPA

- Cost Accountant – ₹2-15 LPA

- Finance and Accounts MIS – ₹17-22 LPA

- Corporate Financial Consultant – ₹2-22 LPA

- Director of Finance and Operations – ₹32 LPA – 1.1 Crore per annum

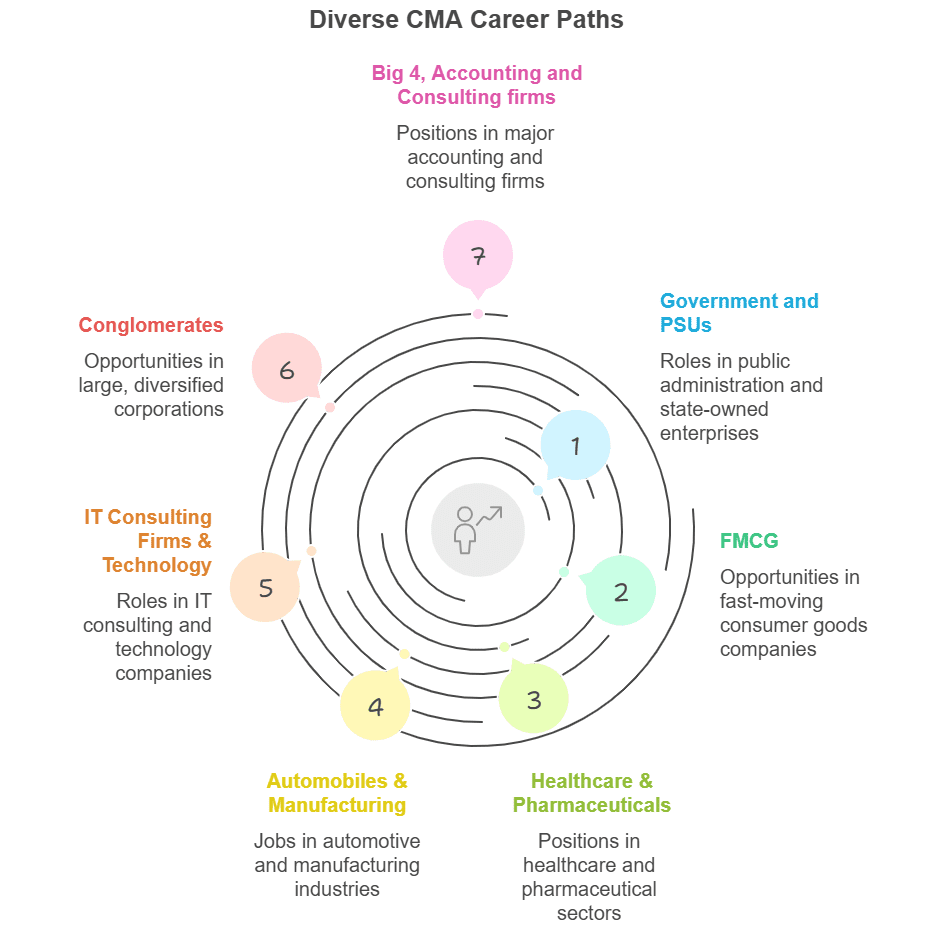

Industries where CMAs are in demand

When you’re looking at your career path, it’s quite obvious to wonder if you’re choosing the right specialisation. Will it limit you? Will it open doors?

What’s really cool about the CMA is that it’s not just about one narrow lane. You can think of it like gaining a universal translator in the language of business strategy. Suddenly, you’re not just understanding one industry; you’re equipped to dive into the strategic financial challenges of practically any sector that sparks your interest.

If you wish to work in the fast-paced world of consumer goods, the precision of healthcare, the innovation of tech, or even the broad scope of government, your CMA skills become your passport. You’re no longer limited to one particular industry.

It’s about empowering you to pick your adventure, knowing you can contribute meaningfully wherever you choose to lead.

- Government and PSUs

- FMCG

- Healthcare & Pharmaceuticals

- Automobiles & Manufacturing

- IT Consulting Firms & Technology

- Conglomerates

- Big 4, Accounting and Consulting firms

Top Companies Hiring CMAs

CMAs are in huge demand across various industries. Companies actively recruit CMAs to drive business growth. Here’s a list of companies that hire CMA professionals:

- KPMG, Deloitte, PwC, EY,

- ONGC, GAIL, Indian Oil,

- Infosys, Wipro, TCS,

- BCG, Grant Thornton, Amazon, Microsoft,

- HUL, Nestle, Mahindra and Mahindra, Tata Motors,

- Genpact, Crisil, Barclays, MSCI, and many others.

Both ICMAI and IMA (Institute of Management Accountants) have a career partnership and networking events where they offer placement services with top companies.

If you’re still wondering, “Is CMA worth it?” Have a look at this video explaining CMA Career Benefits & Opportunities.

Interesting Fact!

According to the IMA, salary surveys show that younger professionals (aged under 30) get higher pay on earning a CMA, indicating its power to significantly accelerate career growth.

CMA vs CA vs ACCA vs CPA – Which Should You Choose?

Isn’t it challenging to choose the right accounting certification? This overview will help you visualise a clear picture.

Now you must be wondering, and as you should, that there are all these wide ranges of certifications available. All have their reputation, their pros and cons, their credibility. How do I know CMA is best suited for me? Let us explain with the help of this grid.

✅ = Strongly aligns / clear advantage

❌ = Not a primary feature / weaker fit

| Differentiator | CMA (US) | CA (India) | ACCA (UK) | CPA (US) |

| Shortest average completion time | ✅ | ❌ | ❌ | ✅ |

| Best suited for corporate/industry finance | ✅ | ✅ | ✅ | ✅ |

| Minimal mandatory articleship/training | ✅ | ❌ | ✅ | ✅ |

| Strong management accounting & FP&A focus | ✅ | ❌ | ✅ | ❌ |

| Global recognition across 100+ countries | ✅ | ❌ | ✅ | ✅ |

| Curriculum aligned with US & IFRS standards. | ✅ | ❌ | ✅ | ✅ |

| Flexible exam windows (computer-based) | ✅ | ❌ | ✅ | ✅ |

| Best fit for working professionals | ✅ | ❌ | ✅ | ✅ |

| Balanced difficulty vs. reward ratio | ✅ | ❌ | ✅ | ✅ |

| Higher salary uplift for FP&A roles | ✅ | ❌ | ✅ | ✅ |

| Lower attrition/dropout compared to CA. | ✅ | ❌ | ✅ | ✅ |

| Direct corporate entry without audit focus | ✅ | ❌ | ✅ | ✅ |

| Strong integration of analytics & decision support | ✅ | ❌ | ✅ | ✅ |

| Reciprocity with CPA and other bodies | ✅ | ❌ | ✅ | ✅ |

| Employer sponsorships are common in MNCs | ✅ | ❌ | ✅ | ✅ |

| Suited for career switchers (non-commerce) | ✅ | ❌ | ✅ | ✅ |

| Cost-to-benefit ROI is favourable globally. | ✅ | ✅ | ❌ | ❌ |

| Easier retake and scheduling flexibility | ✅ | ❌ | ✅ | ✅ |

| Ethics, risk & control emphasis embedded | ✅ | ✅ | ✅ | ✅ |

| Smooth transition pathway to CPA later | ✅ | ❌ | ✅ | ✅ |

What are the Benefits of CMA?

Whenever I evaluate a professional certification, I like to weigh it against three things: career outcomes, global mobility, and return on investment. The CMA, in my opinion, checks all three boxes.

First, the career impact is undeniable. CMAs are positioned for roles that go beyond accounting-think financial strategy, risk management, business analysis, and leadership positions. That versatility makes the credential far more valuable than a qualification that limits you to traditional bookkeeping or compliance work.

Second, the global recognition of the CMA across 150+ countries makes it especially worthwhile. It allows professionals to build careers in whichever country they wish to, freeing them from the boundaries of geography. For someone aiming to build an international career, work with multinational companies or explore opportunities abroad, that’s a huge advantage.

Finally, when I look at the return on investment, the numbers speak for themselves. CMAs typically earn a significant premium over their non-certified peers, and the certification itself can be completed in a relatively short period compared to other finance qualifications. That means the payback period-both in terms of time and money-is much shorter.

So, is CMA worth it? Absolutely yes!.

Why Choose CMA Certification?

The CMA is a globally recognised certification with a strong earning potential. The CMA isn’t just a certification but an investment in your future. With average salaries of $100,000–$125,000 in the US and ₹6-25 LPA in India, and even higher for top experienced professionals.

It builds your ability to analyse numbers and connect them with decisions, and decisions with growth. That’s exactly why the CMA is more than a certification; it’s proof that you can lead with insight and make an impact on a global scale.

If you are still not clear about what is CMA? This US CMA course guide can help you get a detailed insight into why it’s the right career choice for you.

FAQs About CMA Course

Here are a few frequently asked questions about the CMA course.

What is a CMA qualification?

CMA is a globally recognised professional certification in accounting offered by the IMA (Institute of Management Accountants), which opens global career opportunities with high pay.

What is the CMA salary in India?

CMAs in India have a higher salary, with freshers drawing ₹4-26 LPA, ₹7-50 LPA for mid-level professionals and ₹15 LPA to 1 crore per annum for senior professionals.

What are the salary ranges for a CMA in India and abroad?

The salary range for CMA in India starts from ₹4 LPA for freshers up to ₹1 crore per annum for senior executives. At the same time, the salary range for a CMA in the USA is between ₹40 LPA to 1.1 crore per annum.

What is the CMA exam pattern?

The CMA exam is a total of 4 hours, which consists of 2 parts for a total of 500 marks per part. The exam is conducted in an online proctored format.

What is CMA eligibility?

Candidates who hold a Bachelor’s degree and have 2 years of work experience in financial and management accounting can pursue the CMA.

What are the specific subjects and exam pattern for CMA India and the US?

CMA India is a comprehensive course distributed across three levels that focuses on basic foundational subjects of cost accounting, and also covers financial accounting, business laws, direct and indirect taxation, management accounting, cost auditing, ethics, and corporate governance in-depth.

US CMA comprises two parts that emphasise financial planning, performance management, internal controls, corporate finance and decision analysis skills for a global aspect.

What is the paper pattern for CMA US?

The US CMA exam includes two parts for a total of 4 hours per part, with each part having 100 MCQs and two essay-based questions.

What is CMA Inter?

CMA Inter or CMA Intermediate is the second level of CMA. This level builds on the knowledge gained and deepens understanding, and emphasises application skills through the subjects. Candidates who have completed the CMA Foundation or a Bachelor’s Degree are eligible for this level.

What are CMA and CPA?

CMA is a Certified Management Accountant who primarily works in the corporate finance sector, and CPA stands for Certified Public Accountant who works in the public accounting role.

What is the difference between CA and CMA?

CA is a chartered accountant who works predominantly in the field of accounting, taxation and auditing. CMA is a certified management accountant who works primarily in cost accounting, financial accounting, management and risk analytics.

Your Next Steps

Ultimately, understanding what is CMA is the first step towards a strategic and globally recognised career in finance. CMA isn’t just another certification. It’s a career passport giving you the confidence to walk into interviews, global recognition to stand out, and the skills to shape financial strategies that create a lasting impact in the business world.

So if you’re asking yourself, “Is CMA really worth it?” the answer lies in your ambition. If you want to secure a job, any degree might get you one. But if you want to create a strategic career with global opportunities, CMA could be your game-changer.

At Imarticus, we offer extensive and outcome-focused training customised to your needs, networking events, immersion, industry collaborations, and a lot more to equip you with employable skills and the confidence to work in the corporate and business world. Are you ready to begin your career with the US CMA certification from IMA’s Gold Learning Partner? Enol now!