In today’s rapidly evolving financial ecosystem, the demand for skilled banking professionals is growing faster than ever. If you’re a graduate looking to break into the sector or aiming to upskill for faster career progression… a Post Graduate Diploma in Banking and Finance might just be your smartest career move in 2025.

This course offers practical, job-focused learning… preparing you to handle modern banking roles, financial operations, customer engagement & compliance—all while aligning with real industry needs.

In this blog, we’ll break down the course structure, PGDBF course eligibility, career scope, salary prospects… & much more.

💼 What is a Post Graduate Diploma in Banking and Finance?

A Post Graduate Diploma in Banking and Finance (PGDBF) is a 6-12 month program designed to equip graduates with real-world banking, finance & risk management skills. Unlike generic MBA programs, this diploma is more focused, hands-on & placement-oriented.

This program combines academic knowledge with practical applications… making it one of the most job-oriented banking courses in India right now.

🔑 Key Highlights:

| Aspect | Details |

| Duration | 6–12 months (full-time or part-time options) |

| Format | Classroom, hybrid or online modes |

| Curriculum | Retail banking, financial markets, compliance, Excel |

| Outcome | Job-ready for BFSI sector |

| Extra support | Interview training, resume prep, career mentorship |

One popular alternative for those exploring finance-focused roles is the Postgraduate Financial Analysis Program by Imarticus, which blends finance fundamentals with modern tools & guaranteed placement support. You can watch this video to learn more.

PGDBF Course Eligibility Criteria

Before applying, let’s understand the PGDBF course eligibility in most institutes:

| Eligibility Parameter | Details |

| Educational Qualification | Graduation in any stream (Commerce preferred) |

| Age Limit (if any) | Usually 21–28 years (some courses are flexible) |

| Minimum Marks | 50–60% aggregate in graduation |

| Entrance/Assessment Test | Required by some institutes (basic aptitude) |

The PGDBF course eligibility makes it accessible for freshers from various academic backgrounds… as long as they’re willing to pursue a focused career in banking after PG diploma.

What You’ll Learn in a Banking and Finance Diploma After Graduation

The curriculum is specifically tailored for students who want a banking and finance diploma after graduation—making it both practical & fast-track.

| Core Modules | Skills Covered |

| Principles of Banking | Retail, digital & corporate banking basics |

| Financial Markets | Understanding debt, equity & forex markets |

| Regulatory Environment | RBI, SEBI, compliance & AML/KYC frameworks |

| Customer Service & Sales | Relationship management, client handling |

| Financial Products & Services | Mutual funds, loans, insurance, treasury |

| Excel & MIS Reporting | Basic modelling, dashboards, reporting |

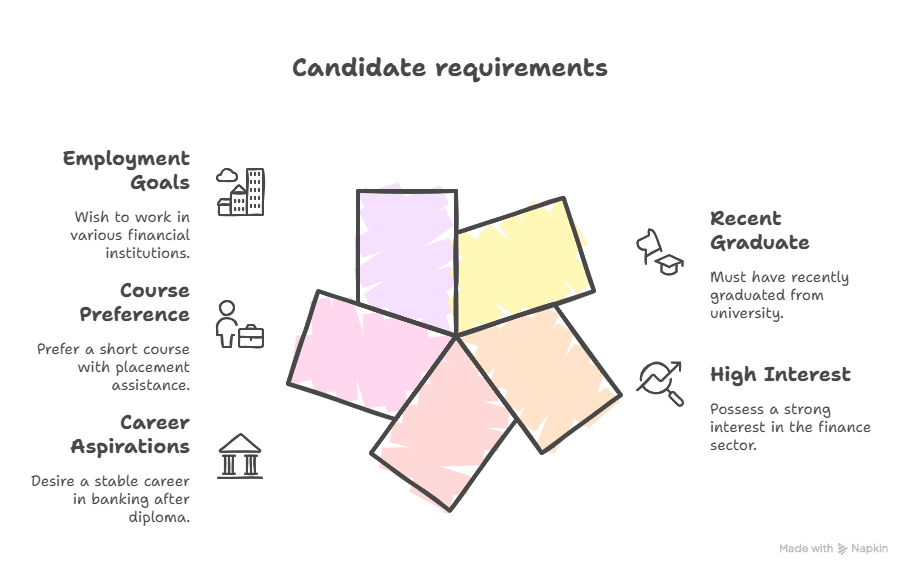

Who Should Consider This Course?

This program is ideal if you:

- Have recently graduated (BCom, BBA, BA, BSc, or even BTech)

- Are a fresher with zero experience but high interest in finance

- Want a stable & structured career in banking after PG diploma

- Prefer a short-term course that includes placement assistance

- Wish to work in banks, NBFCs, fintech firms, or financial startups

In fact, many candidates also use this as a stepping stone to explore careers in M&A, risk, or investment roles. Here’s a helpful blog on Mergers and Acquisitions Careers for CA Graduates to see how your journey might evolve.

Career Scope After Completing PGDBF in 2025

Once you complete your post graduate diploma in banking and finance, you’re ready to enter a wide array of roles across the BFSI (Banking, Financial Services & Insurance) domain.

| Role | Sector | Salary (INR/Year) |

| Relationship Manager | Retail/Private Banks | 3.5–6 LPA |

| Credit Analyst | NBFCs, Lending firms | 4–8 LPA |

| Operations Executive | Banks, Fintech | 3–5 LPA |

| Risk & Compliance Analyst | BFSI & Regulatory firms | 4–7 LPA |

| Wealth Management Associate | Financial Planning Firms | 4–9 LPA |

Depending on the program, many institutes also offer 100% placement assistance, making it one of the most job-oriented banking courses currently available in India.

Why Choose a PG Diploma Over a Full MBA?

Wondering whether to go for a full-fledged MBA or a post graduate diploma in banking and finance? Here’s a quick comparison:

| Factor | MBA in Finance | PG Diploma in Banking & Finance |

| Duration | 2 years | 6–12 months |

| Cost | ₹10–25 lakhs | ₹1–2 lakhs |

| Focus | Broad, general management | Focused, banking-specific |

| Entry Barrier | Competitive entrance exams | Moderate (sometimes only aptitude test) |

| Placement Speed | Longer wait | Faster placement cycles |

For many, a banking and finance diploma after graduation is a faster, more affordable, & highly relevant way to start working in the BFSI sector.

Why Job-Oriented Banking Courses Matter in 2025

In 2025, banks & financial institutions aren’t just hiring based on degrees—they’re looking for skill-ready talent.

That’s why job-oriented banking courses are gaining momentum. They prioritise:

- Real-time simulations

- Industry projects

- Resume & interview support

- Case studies aligned to actual banking roles

Courses that also offer modules in Excel, Power BI, compliance tools… & CRM software make you truly market-ready.

Best Banking Diploma Courses in India (What to Look For)

Not all courses are created equal. To identify the best banking diploma courses in India, check for the following:

| Criteria | What to Look For |

| Industry Tie-ups | Access to real recruiters & hiring partners |

| Updated Curriculum | Modules on modern banking tools & regulations |

| Practical Learning | Projects, simulations, case studies |

| Placement Support | Minimum 3–5 interview opportunities |

| Mentorship & Career Guidance | Access to expert guidance & coaching |

The Postgraduate Banking and Finance Program by Imarticus ticks most of these boxes—making it a top choice among serious finance aspirants in India.

FAQs

1. What is the PGDBF course eligibility?

Graduation in any stream… some ask for 50–60% marks.

2. Is PGDBF a good choice after college?

Yes, it’s a smart step for career-ready training.

3. What makes banking and finance diploma after graduation useful?

It’s quick, job-focused… & fits freshers perfectly.

4. Are job-oriented banking courses better than MBAs?

For fast job roles… yes, they’re more focused.

5. What is the career in banking after PG diploma like?

Stable, growing… with roles in sales, risk, ops & more.

6. Which are the best banking diploma courses in India?

Ones with industry tie-ups… updated tools… & placement support.

7. Can I pursue banking and finance diploma after graduation online?

Yes, many offer hybrid or remote models now.

8. Will job-oriented banking courses help in private banks?

Definitely—they teach practical tools banks use daily.

Final Thoughts: Should You Take the Leap?

Choosing a post graduate diploma in banking and finance can be a transformative decision. Whether you’re seeking your first job… or switching careers, this course offers practical skills, placement support & strong industry relevance.

It’s ideal for:

✅ Graduates wanting a specialised, short-term course

✅ Professionals reskilling for the BFSI sector

✅ Freshers struggling to get interviews in core finance roles

✅ Candidates preparing for banking certification exams

If you’re confused between options or don’t know where to start, this career in finance blog breaks down various entry points… so you can choose what fits your goals.

In 2025, the demand for future-ready finance professionals will only grow.

And the best way to stand out? Choose from the best banking diploma courses in India that offer relevance, skills… & real job outcomes.

Because in banking, knowing the theory is good—but knowing how to apply it is what gets you hired.