Investment banking eligibility is one of those topics that often creates more anxiety than clarity. You might be in college, a few years into your career, or even thinking about a switch – and the question keeps coming up in different ways: am I qualified, did I choose the right path, or have I already missed my chance?

The confusion is understandable, because investment banking appears complex and exclusive from the outside, even though the reality is far more flexible than it’s made out to be. Unlike regulated professions, investment banking doesn’t follow a single academic formula.

What makes this even more confusing is the volume of conflicting advice online. Some sources make it sound like only graduates from elite colleges stand a chance. Others suggest that without a specific degree, your chances are close to zero. In reality, neither extreme is accurate.

Banks don’t hire based on labels alone – they hire based on whether you can contribute to deal execution, analysis, and client work from day one.

This is where the idea of investment banking qualification often gets misunderstood. There is no mandatory license or exam you must clear to be eligible in the traditional sense. Instead, banks look for a combination of education, technical skills, practical exposure, and mindset. If there’s a gap in any of these areas, that gap can usually be fixed, which is why many candidates turn to investment banking certification programs.

An investment banking certification doesn’t magically make someone eligible. What it does is far more practical: it helps convert academic knowledge into job-ready skills. For candidates from BCom, BBA, CA, engineering, or non-finance backgrounds, certifications often act as proof that they’ve learned financial modelling, valuation, capital markets, and deal processes the way banks actually use them. In a competitive hiring market, that signal matters.

In this guide, I’ll break down investment banking eligibility criteria in clear terms – who can apply, which investment banking qualifications matter most, and what you actually need to do to become an investment banker in today’s market.

Fact!

Many first-time applicants assume they’re too late for investment banking. In reality, for most candidates, investment banking eligibility is shaped by preparation choices made after graduation, not decisions made during college.

Understanding Investment Banking

Before talking about Investment Banking eligibility, it helps to understand what is investment banking and what the work actually involves.

Investment banking involves activities such as:

- Supporting mergers and acquisitions.

- Helping companies raise capital through equity or debt.

- Managing financial analysis, valuation, and transaction support.

- Ensuring smooth execution of deals and post-deal processes.

The table below shows how investment banking work translates into job roles:

| Investment Banking Activity | What Banks Expect From Candidates |

| Mergers & acquisitions support | Strong attention to detail and structured analysis |

| Capital raising (equity/debt) | Comfort with numbers and financial concepts |

| Financial analysis & valuation | Accuracy, Excel skills, and logical thinking |

| Transaction & deal execution | Ability to work under pressure and meet deadlines |

Investment banking job roles demand accuracy, commercial thinking, and the ability to work under pressure. That context explains why banks focus less on degrees alone and more on job readiness.

Understanding the nature of this work is important because it directly influences how recruiters judge investment banking eligibility at the entry level.

Before diving deeper into investment banking eligibility and qualifications, here’s a short video that clearly explains what investment banking is and what investment bankers actually do.

What Is Investment Banking Eligibility?

Investment banking eligibility refers to whether a candidate has the foundational education, skills, and preparation required to enter investment banking roles – especially at the entry level.

There is no official eligibility cutoff. Instead, recruiters assess:

- Your academic foundation and learning ability.

- Your comfort with numbers, finance, and structured thinking.

- Your exposure to banking tools, workflows, or simulations.

- Your readiness to handle real responsibilities from day one.

| Education Level | What This Means for Investment Banking Eligibility |

| After 10th | Too early for investment banking roles; focus on choosing the right stream and building strong academic foundations. |

| After 12th | Preparation stage: You can start learning finance basics, but roles typically require graduation. |

| Graduation (BCom / BBA / Engineering / Economics) | Entry-level eligibility is possible with the right skills, internships, or practical exposure. |

| Master’s (MBA / CA / CFA track) | Stronger eligibility when paired with role-specific skills and hands-on experience. |

Investment banking eligibility, therefore, is not something you either have or don’t have. It’s something that can be built deliberately over time through focused learning and practical exposure.

Fact!

Banks don’t use a single eligibility filter. Two candidates with the same degree can be treated very differently depending on skill readiness and practical exposure.

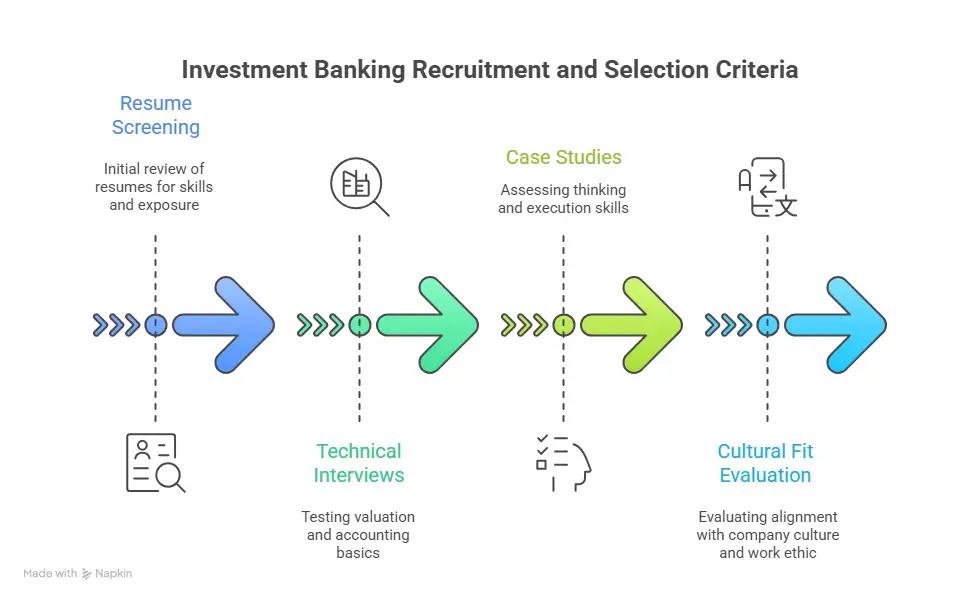

Investment Banking Qualifications: What Recruiters Actually Look For

Searches for the investment banking qualifications required are high because aspirants want clarity and certainty. The reality is that recruiters don’t look for one ideal qualification – they look for relevance.

Banks ask a simple question during hiring: Can this candidate understand the work quickly and execute accurately? That’s why educational background matters – but only to the extent that it supports job performance.

Before we go further into investment banking eligibility based on academic backgrounds, here’s a short video that breaks down how investment banking careers actually work – from what analysts do day-to-day to how teams operate:

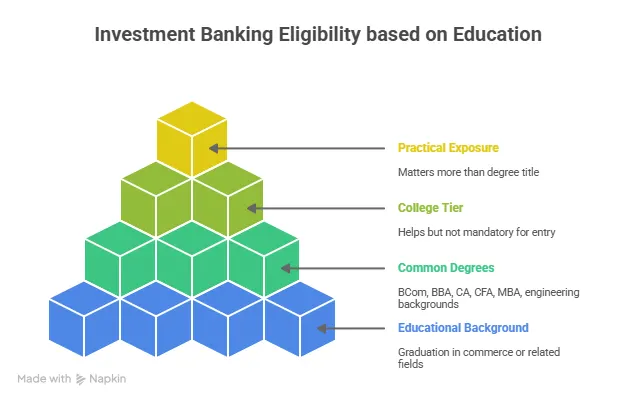

Common Educational Backgrounds in Investment Banking

Candidates entering an investment banking degree commonly come from:

- BCom, BBA, or BMS (Finance / Accounting) – These degrees offer early exposure to accounting, finance, and business fundamentals, which align well with banking roles.

- CA, CMA, CPA, or CFA tracks – These qualifications signal financial discipline and analytical ability, especially for transaction, valuation, or reporting-heavy roles.

- Engineering backgrounds – Engineers often excel in structured thinking, data analysis, and process-driven roles, particularly in analytics, operations, and modelling.

- MBA (Finance) – Often used for lateral or advanced entry, especially from well-recognised institutions.

What matters most is not the degree title, but how well your education prepares you to handle your job and aligns with real investment banking work. This is why investment banking eligibility is evaluated more as a capability profile than a qualification checklist.

Fact!

Investment banking teams are often academically mixed. It’s common to see commerce graduates, engineers, and chartered accountants working on the same deal.

What Qualification Is Required for an Investment Banker?

A common question is: What qualifications are required for an investment banker?

The honest answer is – there is no mandatory qualification, either traditionally or in modern hiring patterns. Banks care far more about:

- Whether you understand financial concepts clearly.

- Whether you can work confidently with numbers and data.

- Whether you can handle real banking tasks under time pressure.

From a hiring perspective, investment banking eligibility often comes down to how quickly a candidate can add value in real workflows. This practical focus is also why investment banking salary levels tend to reward performance and responsibility rather than degrees alone.

In short, degrees may open doors and help you get noticed, but skills and execution are what ultimately secure roles and drive career growth.

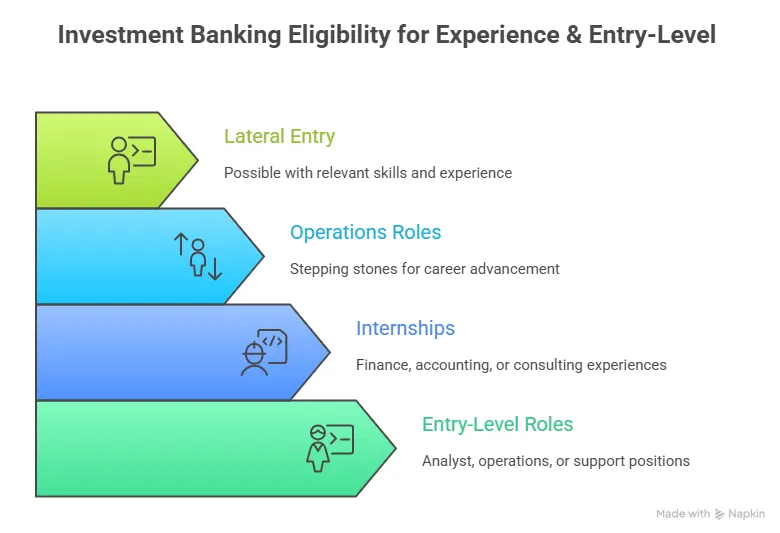

Investment Banking Qualifications Required at Entry Level

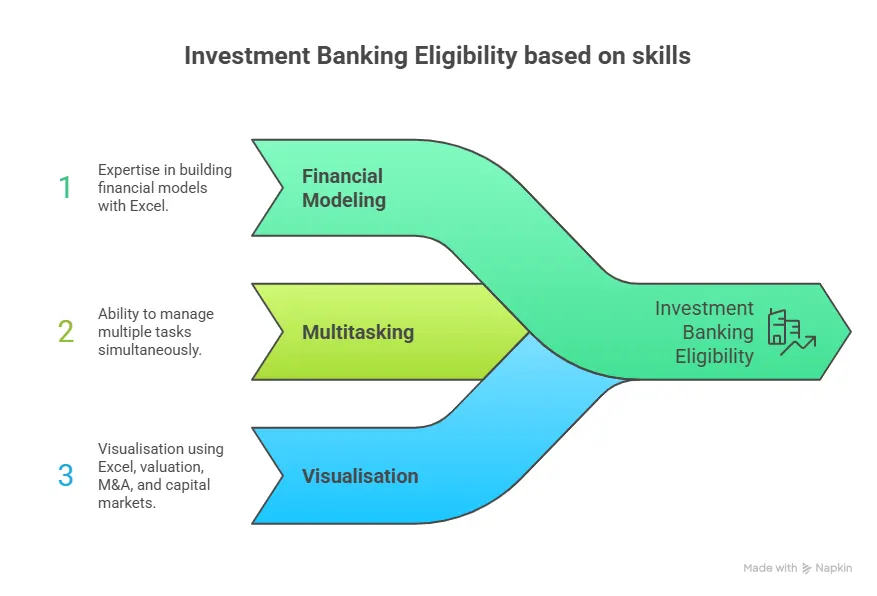

At the entry level, the investment banking qualifications required are practical rather than academic.

Recruiters expect candidates to demonstrate:

- Basic accounting knowledge and the ability to read financial statements.

- Working familiarity with Excel and data handling.

- An understanding of capital markets, transactions, or deal flow.

- Strong attention to detail and execution discipline.

Candidates who rely only on academic theory often struggle to meet these expectations. This is why many aspirants choose short, role-focused programs that teach how investment banking actually functions on the job.

At this stage, investment banking eligibility is closely tied to execution ability rather than academic depth.

Do you know?

Performance-based roles tend to reward responsibility faster than credentials. This is why investment banking salary growth is closely tied to execution quality, not degrees.

Investment Banker Course Eligibility: Who Can Apply?

When it comes to investment banker course eligibility, most industry-aligned programs are intentionally designed to be accessible.

Typically, they are open to:

- Fresh graduates

- Final-year students

- CA, CMA, CPA aspirants

- Engineers transitioning into finance.

- Early-career professionals

The real requirement is not prior deal experience, but a willingness to learn, practice, and build job-ready investment banking skills.

Investment Banking Eligibility Criteria by Education Background

Investment Banking Eligibility often varies depending on background – but it’s not permanent. With the right preparation, many non-ideal profiles become competitive.

| Education Background | Eligible for Entry-Level IB Roles |

| BCom / BBA (Finance, Accounting) | ✅ |

| BCom / BBA (General) | ❌ |

| CA (Qualified / Semi-qualified) | ❌ |

| MBA (Finance – Tier 1) | ✅ |

| MBA (Finance – Tier 2 / 3) | ❌ |

| Engineering (Any Stream) | ❌ |

| Economics / Statistics | ❌ |

| Commerce + IB Certification | ✅ |

| Non-finance Degree (Arts / Science) | ❌ |

This table reflects direct eligibility without additional preparation. With focused training or certification, many candidates move from not eligible to interview-ready within months.

Did you know?

Many investment banking courses are intentionally open to non-finance backgrounds because banks themselves train people on systems, but expect core skills upfront.

Investment Banker Eligibility in India

When it comes to investment banker eligibility in India, competition is intense – but expectations are fairly clear once you understand how hiring actually works. Indian investment banking roles often support global investment banks and financial institutions, which means recruiters are focused on consistency, accuracy, and readiness rather than just academic credentials.

In the Indian market, investment banking eligibility is strongly influenced by how well candidates adapt to global processes and offshore delivery standards. Indian recruiters typically look for:

- Strong accounting and finance fundamentals, especially the ability to understand financial statements and transactions.

- Exposure to global banking processes, including how deals, trades, and reporting workflows operate across markets.

- Readiness to perform from the first day on the job, with minimal hand-holding.

Many aspirants assume that clearing investment banking exams alone is enough to meet these expectations. While exams and certifications can help build knowledge, they carry the most value when paired with practical exposure and applied skills. In practice, candidates who can demonstrate hands-on understanding of banking workflows often stand out more than those relying on academic scores alone.

Because of this, skill-based preparation frequently matters more than the degree you hold or the college you attended – especially in India’s highly competitive investment banking job market.

Did you know?

A significant portion of investment banking roles in India support global markets, which is why familiarity with international processes often outweighs local degrees.

Investment Banker Job Qualifications vs Skills

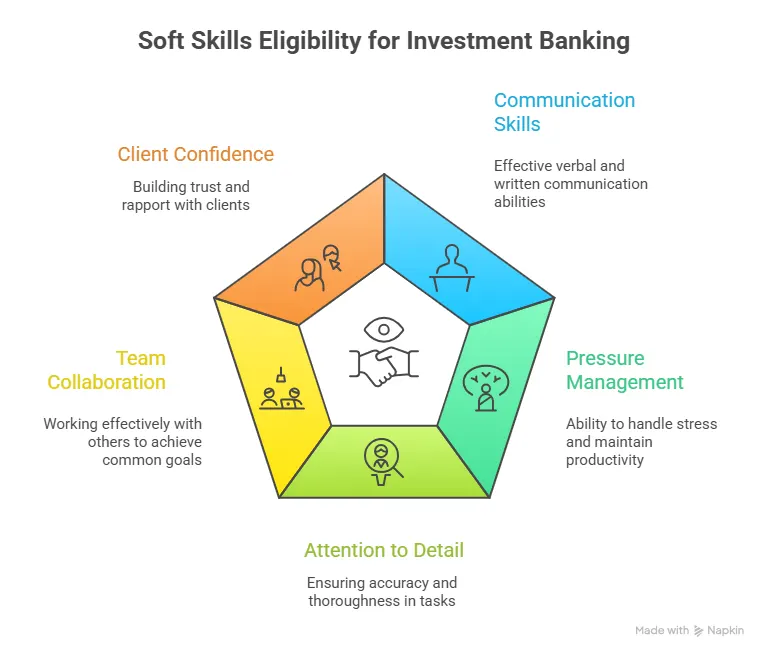

Many candidates mix up investment banker job qualifications with real skills – and that’s where a lot of good profiles lose out. Degrees and certifications can help your resume get shortlisted, but they’re rarely what decides whether you get hired or succeed once you’re in. Most banks assume that tools can be taught and systems can be learned, especially at the beginning of an investment banking career.

What recruiters really care about is how you think and how you perform when the pressure is on. They want to see whether you can stay accurate with numbers, follow processes carefully, and make sound investment decisions when timelines are tight.

In reality, banks evaluate candidates for:

- Logical, structured thinking – being able to break down complex information and work through it step by step.

- Accuracy under pressure – delivering clean, error-free work even when deadlines are tough.

- Financial judgement – understanding what the numbers actually mean in a real business or transaction context.

This is why hands-on exposure, simulations, and practical training carry significant weight and play such a big role in hiring decisions. Candidates who’ve worked through real banking scenarios tend to settle in faster and perform better from day one, giving them a clear edge over those who rely only on qualifications.

What to Do to Become an Investment Banker

If you’re genuinely thinking about how to become an investment banker, it helps to step away from the noise and focus on what actually works in the real hiring market. There isn’t a single shortcut or some quick crash course or credential – but there is a clear, practical path that most people who break into the field end up following.

At its core, becoming an investment banker is really about getting the fundamentals in place, building skills you’ll actually use on the job, and applying them with purpose. It’s not about trying to do everything at once. It’s about focusing on the right things, in the right order. The steps below reflect what people who successfully enter investment banking usually prioritise, rather than the generic advice you’ll find everywhere online.

| Step | What You Need to Do | Why It Matters |

| Build accounting and finance fundamentals | Learn financial statements, accounting basics, and corporate finance concepts | This is the language of investment banking; without it, nothing else works |

| Learn Excel and financial analysis | Master Excel, financial modelling basics, and data handling | Most entry-level work happens in Excel -speed and accuracy matter |

| Understand real banking workflows | Learn how deals move from pitch to execution, including M&A and capital markets processes | Banks hire people who understand how work actually gets done |

| Prepare for role-specific interviews | Practice accounting, valuation, and scenario-based interview questions | Interviews test practical thinking, not just qualifications |

| Apply strategically to entry roles | Target analyst, operations, or support roles aligned with your skill level | Smart role selection improves your chances of getting in |

| Stay focused and consistent | Avoid jumping between unrelated courses or goals | Focused preparation beats scattered effort every time |

Here’s a short video that gives a practical overview of investment banking careers and what recruiters look for. It’s especially useful if you’re trying to understand what actually matters when preparing for roles in this field after getting an understanding of investment banking eligibility:

Why Choose Imarticus Learning for Your Investment Banking Preparation

For many aspirants, the challenge with investment banking eligibility isn’t ambition – it’s the gap between academic learning and what banks actually expect on the job. This is where Imarticus Learning positions itself differently.

The Investment Banking Certification is a practical pathway for candidates who want to build job-ready investment banking skills and improve their eligibility. Here’s why it matters for aspirants preparing for investment banking roles:

- Designed to bridge the gap between academic knowledge and real investment banking work, especially for candidates evaluating their eligibility.

- Focuses on actual investment banking operations and workflows, rather than generic finance theory.

- Covers trade lifecycles, transaction support, compliance processes, and global banking operations used by leading financial institutions.

- Helps candidates from commerce, finance, engineering, and non-finance backgrounds build role-relevant skills.

- Emphasises execution accuracy, process understanding, and job readiness, which are critical in entry-level investment banking roles.

- Structured to convert learning into practical skills that recruiters recognise during hiring.

- Particularly useful for aspirants who don’t fit the traditional ideal profile but want to build investment banking eligibility through focused preparation.

FAQs About Investment Banking Eligibility

If you’re unsure whether you meet investment banking eligibility criteria, these frequently asked questions clear up the most common concerns.

Who is eligible for investment banking?

Anyone with a strong foundation in finance, accounting, or analytical skills can become eligible for investment banking. There is no fixed academic requirement. Commerce students, finance graduates, engineers, and career switchers can all enter investment banking if they build the right skills and job readiness.

How to qualify for investment banking?

To qualify for investment banking roles, you need:

- Basic accounting and financial knowledge.

- Comfort with numbers and Excel.

- Understanding of how investment banking roles actually work.

- Practical exposure through internships, training, or certification.

Can I become an investment banker after engineering?

Yes, absolutely. Engineers succeed in investment banking when they:

- Transition early into finance concepts.

- Build valuation and Excel skills.

- Demonstrate analytical problem-solving.

Many banks value engineers for their structured thinking, especially in analytics, operations, and modelling roles.

Does investment banking require maths?

Yes, but far less than people fear. It’s more about accuracy and logic than formulas. Advanced mathematics is not required. You need:

- Comfort with numbers

- Logical reasoning

- Basic arithmetic, percentages, and ratios.

Who can become an investment banker?

If you’re wondering who can become an investment banker, the answer is broader than many expect.

- Commerce students already have a strong foundation.

- Finance graduates align naturally with analyst roles.

- Engineers bring analytical strength and structure.

- Career switchers succeed with focused preparation.

Eligibility depends more on preparation than background.

Is an MBA or a CA better for investment banking?

Neither MBA nor CA is strictly better – it depends on the role you’re targeting.

- MBA (Finance) is often useful for front-office and leadership roles.

- CA provides strong accounting and financial depth, useful in transaction and analytical roles.

Both paths work when combined with practical investment banking skills.

Is CFA or CA better for investment banking?

CFA and CA can both support an investment banking career, but neither guarantees entry.

- CFA focuses on investment analysis and markets.

- CA focuses on accounting, auditing, and finance.

Banks care more about how well you can apply knowledge on the job.

Is CFA compulsory for investment banking?

No, CFA is not compulsory for investment banking. While it can certainly help deepen your understanding of finance and markets, banks don’t treat it as a mandatory requirement. Many people working in investment banking today don’t hold a CFA charter. What matters more is whether you can apply financial concepts in real situations and handle the work that comes with the role.

Do I need to clear investment banking exams to be eligible?

There is no mandatory investment banking exam. Exams and certifications can help build knowledge, but eligibility depends more on practical skills and readiness to perform on the job. In practice, employers focus more on job readiness and applied skills, which is why some candidates choose structured, role-focused training through providers like Imarticus Learning to build practical investment banking capabilities with dedicated training courses instead of long certification paths.

Investment Banking Eligibility Is More Flexible Than You Think

Most people who eventually make it into investment banking didn’t start with a perfect profile. Many had doubts about their degree, their background, or whether they were already late to the process. What helped them move forward wasn’t a checklist or a shortcut – it was deciding to work with what they had and improve it step by step.

Investment banking doesn’t follow a single, fixed entry path. People enter from different backgrounds, at different stages, and for different roles. This way, investment banking eligibility is less about where you start and more about how intentionally you prepare. What actually matters more over time is whether you understand what the work involves and whether you’re willing to build the skills it requires.

If this career is something you’re genuinely considering, don’t wait to feel fully eligible before you start. Take an honest look at where you are today, focus on the most important gaps, and work on them consistently. Progress in investment banking usually comes from steady effort, not perfect timing.

With the right preparation and a bit of patience, investment banking certification can start to feel less intimidating and much more achievable.