Let’s be real, how to get into investment banking is one of the most searched career goals in finance.

Everyone wants the prestige, the salary, and the status. But few know what it actually takes. The path is steep, but if you play it right, it’s possible for anyone, even without an MBA or Ivy League degree.

In this post, we’ll give you a practical, no-jargon roadmap. No fluff. Just a clear plan for building your investment banking career path with the right tools: education, experience, skills, and smart decisions.

How to Get Into Investment Banking: Know the Career Ladder First

Before you chase roles or send CVs, you must understand how the investment banking career path actually works.

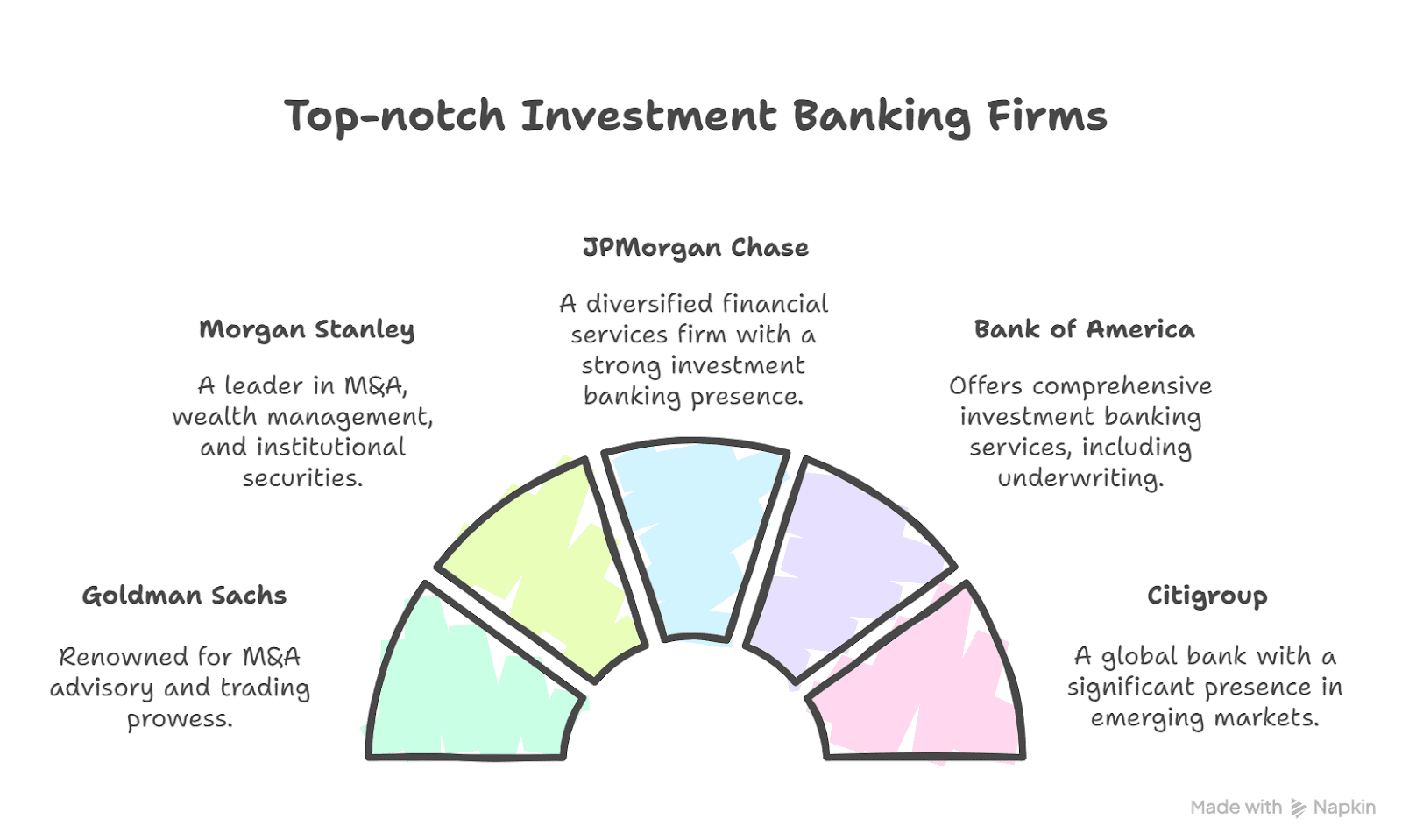

Investment banks offer advisory-based financial services to institutional investors, corporations, governments, and similar clients.

Step 1: Understanding the Investment Banking Career Path

Before sending off applications, take a moment to learn how the investment banking career path really works.

The investment banking market grow steadily through 2025, with expectations of a continued annual increase through to 2030.

Here’s how it typically looks:

- Analyst

- Associate

- Vice President

- Director / Executive Director

- Managing Director

Each role comes with more responsibility and higher expectations. Recruiters now look beyond degrees. They want real skills, certifications, and experience. If you skip this foundation, you’ll lose to someone who didn’t.

Step 2: Start with Essential Finance Certifications

Degrees are helpful, but they’re not enough anymore. Today, recruiters want proof you can work in real banking environments. That’s where essential finance certifications give you the edge.

The Postgraduate Programme in Banking and Finance by Imarticus Learning is one of India’s most job-focused courses. It gives you practical experience and a direct route into the BFSI sector.

Step 3: How to Get Into Investment Banking Through Internships

Internships matter. A lot. Investment banking internships give you the real exposure hiring managers look for.

Here’s how to land them:

- Use your course network (Imarticus offers direct placement support)

- Contact alumni on LinkedIn

- Join internship portals and apply to firms too

- Attend campus hiring sessions

A strong internship on your CV, especially one supported by your course, shows you’re already in the game.

Step 4: Smart Finance Networking Strategies That Actually Work

Your skills matter, but who you know still helps. The right finance networking strategies can get you that call-back or referral.

Start with:

- Attending online finance webinars

- Joining LinkedIn groups and commenting on posts

- Reaching out to industry experts with thoughtful messages

- Engaging with your mentors and instructors during your course

Step 5: Top Interview Tips for Investment Bankers

Knowing your numbers isn’t enough. You need to perform confidently under pressure. These interview tips for investment bankers work:

- Master your personal pitch (education + interest + future goal)

- Review basic valuation methods (DCF, comps, etc.)

- Know how to read a balance sheet and an income statement

- Stay updated on deals, IPOs, and market movements

- Practice mock interviews (Imarticus Learning offers this in their prep module)

Being well-prepared gives you an edge that most candidates simply don’t have.

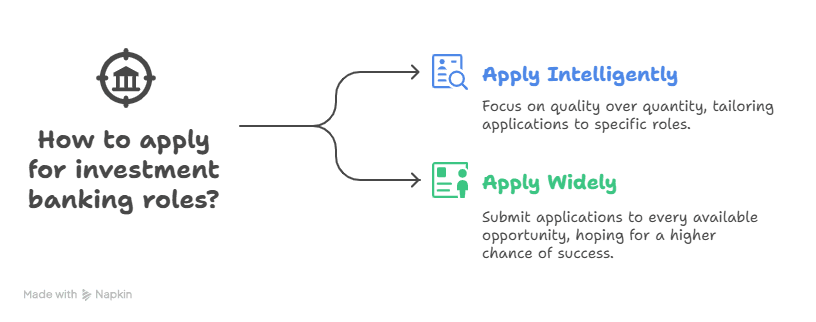

Step 6: Apply the Right Way to Entry-Level Roles

Don’t spray your CV everywhere. Focus your efforts.

- Start with analyst roles in credit, operations, or sales

- Use placement connections to reach top employers

- Tailor your CV to highlight projects, tools, and certifications

- Use keywords from the job description when applying

The goal isn’t to apply everywhere, it’s to apply smart.

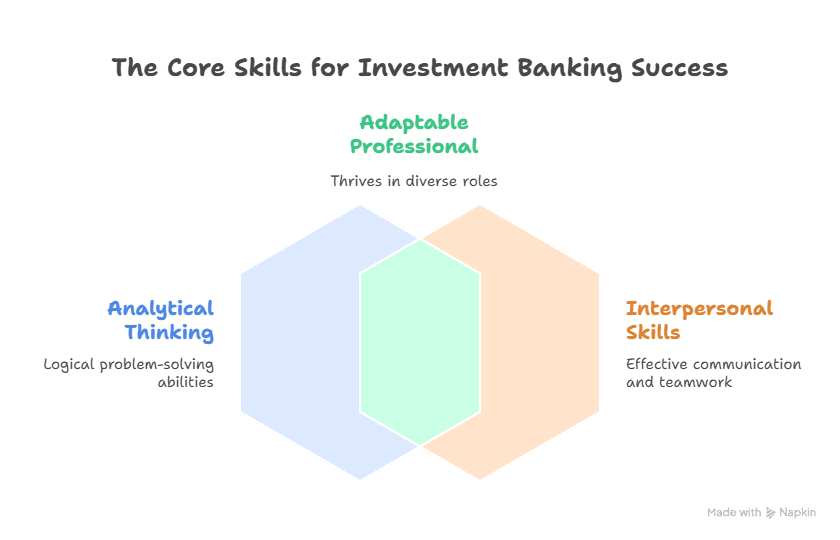

Even after landing your first role, learning must continue. Topics like AML, KYC, and regulatory finance help you move up faster. Other than academic qualifications, they require a good combination of analytical and interpersonal experiences.

The skill set needed usually depends on the target job. To cite an example, brokers should have extraordinary sales skills, and equity analysts must have a keen analytical mind and good communication skills.

Why Imarticus Learning Is Your Gateway to a Job in Finance

The Postgraduate Programme in Banking and Finance from Imarticus Learning covers these through its modules and job-prep immersion phase. Learning doesn’t stop at certification; it’s your long-term asset.

Register for the Postgraduate Programme in Banking and Finance by Imarticus Learning, get certified, trained, and placed in just 3 months. Start your career with top retail banks and financial services firms. Step into entry-level roles offering salary packages of up to ₹6 LPA. Fast-track your journey in just three months.

Complete two months of interactive online training, followed by a one-month intensive Job:

- Prep through the Imarticus Learning Immersion experience.

- Engage in real-world simulations, roleplays, and case studies.

- Build skills in sales, customer service, communication, and banking operations.

- Earn an ₹8,000 Imarticus Banking Fellowship upon successful completion of the course.

Gain a certified qualification in Banking and Finance, backed by a curriculum crafted by professionals with over 20 years of industry experience. Open doors to various career paths, including Retail Banking, Credit Management, and Banking Operations.

Start your journey with India’s top-rated certification course. Assured placement, ₹8,000 fellowship, expert-led training, and real-world simulations.

Register Now!

FAQ

1. How do you get into investment banking without an MBA?

You can do it with a finance degree and a certified course like Imarticus’ postgraduate programme. An MBA is not mandatory.

2. What are the best finance networking strategies for students?

Start with LinkedIn, webinars, and alumni events. Use your course contacts too.

3. Do you need to do investment banking internships?

Absolutely. They make you familiarse yourself with the business and make your CV look impressive.

4. What are some of the job positions I would be able to secure after doing the Imarticus programme?

Retail bank analyst, credit officer, bank operations manager, and so on.

5. What are the effective interview tips for being an investment banker?

Keep cool, study the basics of finance, track the market, and do a mock interview.

6. What is the value of necessary finance certifications?

This certification indicate that you are employment-seeking and have an interest in the profession.

7. Can the non-finance graduates take this route?

Yes, in case you take a job-oriented course such as that of Imarticus Learning.

The Final Words

Entering investment banking has nothing to do with luck, but rather hard work, proper advice, and decisions. It allows you to have an upper hand in knowing how to enter investment banking, no matter whether you are a new starter or a career switcher.

Whether it comes to developing your skills with the help of critical finance certifications or intelligently employing finance networking tools and passing interviews successfully, every step counts.

In case you are looking to kick-start your investment banking career at an early stage, considering the Postgraduate Programme in Banking and Finance by Imarticus Learning will see you through all you need: actual training, placement, and guidance by professionals.

You are not only getting ready to take a job when you have well-organised learning coupled with industry exposure, but indeed you are beginning your long career.

Sign up today and get a head start on becoming a competitive, job-ready professional in investment banking.